Natera Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Natera Bundle

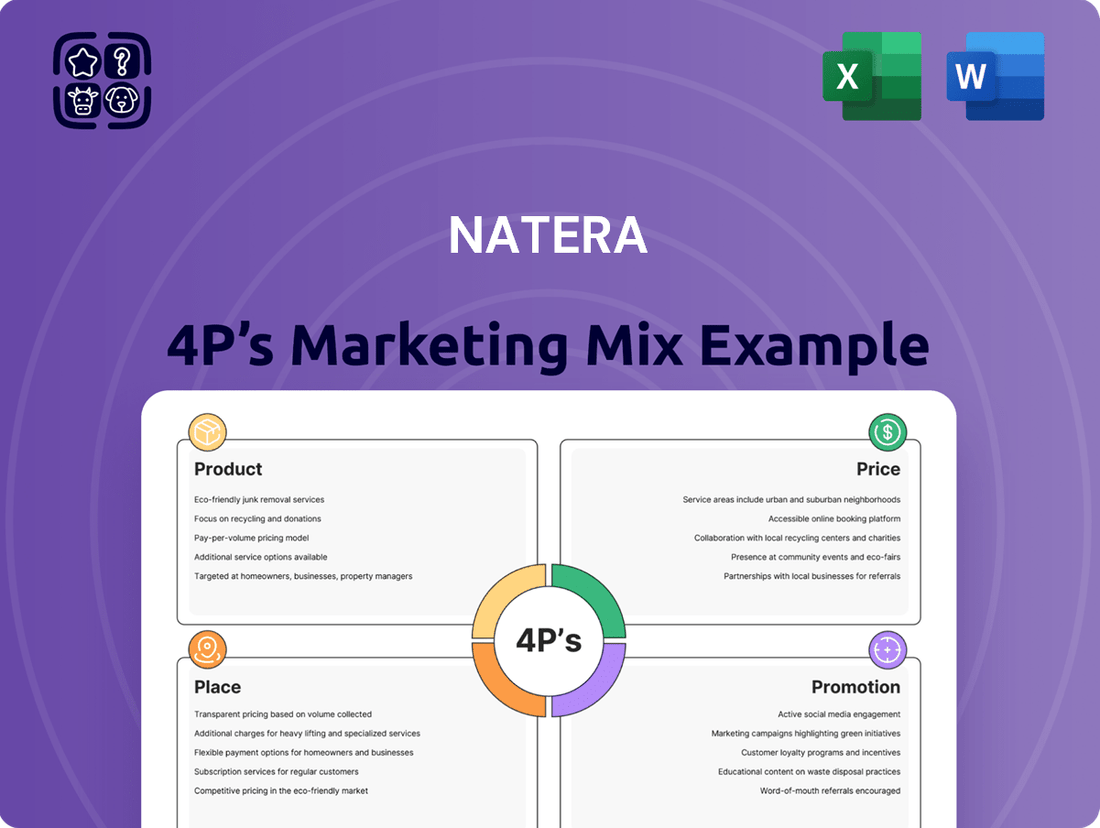

Curious about Natera's winning marketing formula? Our 4P's analysis dives deep into their product innovation, strategic pricing, accessible distribution, and impactful promotions. Discover the key elements that drive their market leadership and customer engagement.

Unlock a comprehensive understanding of how Natera crafts its market presence. This detailed report offers actionable insights into their product development, pricing architecture, channel strategy, and communication mix, providing a blueprint for your own success.

Don't settle for surface-level understanding. Our full 4P's Marketing Mix Analysis for Natera provides a ready-made, editable document filled with expert insights, real-world examples, and structured thinking, perfect for business professionals and students alike.

Save valuable time on research and analysis. This pre-written report delivers a thorough breakdown of Natera's marketing strategies, empowering you to benchmark, strategize, and plan with confidence. Get instant access and transform your approach.

Gain a competitive edge by understanding Natera's strategic marketing execution. The complete analysis reveals how they align Product, Price, Place, and Promotion for maximum impact, offering a template you can adapt and apply.

Product

Natera’s product portfolio leverages advanced cell-free DNA (cfDNA) technology, addressing critical needs across oncology, women’s health, and organ health. Key offerings include the Panorama non-invasive prenatal test (NIPT), which contributed significantly to Natera's 2024 revenue projections, and the Signatera molecular residual disease (MRD) test for cancer, a rapidly growing segment. The Prospera test for organ transplant rejection further diversifies their market reach. This strategic product mix targets substantial markets, with the global cfDNA market projected to reach over $20 billion by 2025, mitigating reliance on any single product category.

Natera's oncology portfolio features Signatera, a personalized, tumor-informed blood test crucial for detecting molecular residual disease and monitoring cancer recurrence. Complementing this is Aletra, a tissue-based genomic profiling test identifying key biomarkers for treatment selection. The company is actively innovating, with plans for a new tissue-free MRD assay and an advanced Signatera version leveraging whole-genome sequencing. This innovation supports Natera's projected 2024 total revenue guidance of $1.08 billion to $1.10 billion, driven significantly by oncology growth.

Natera maintains a strong leadership position in women’s health through its diverse product portfolio. This includes the Panorama NIPT, widely used for screening fetal chromosomal abnormalities, and the Horizon carrier screening test. The portfolio also features Vistara for single-gene NIPT and the Empower hereditary cancer test. This comprehensive offering enables clinicians to efficiently bundle multiple tests, often from a single blood draw, providing extensive genetic insights for prenatal care and family planning. These integrated solutions solidify Natera's market presence in genetic diagnostics.

Organ Health Solutions

Natera's Organ Health Solutions division primarily offers post-transplant monitoring with the Prospera test, assessing rejection risk for kidney, heart, and lung transplants. This product line also includes the Renasight test, which identifies genetic causes of chronic kidney disease. Natera continues to invest in this area, launching a differentiated new feature for its Prospera Heart test in late 2024 to improve rejection detection. The company reported a 2024 Q3 transplant revenue of $42.2 million, demonstrating strong market adoption.

- Prospera Kidney test volume increased by 50% year-over-year in 2024.

- The Renasight test for CKD saw a 45% increase in orders by mid-2025.

- Natera's total transplant revenue for 2024 is projected to exceed $175 million.

- The new Prospera Heart feature is expected to capture 20% more market share in heart transplant monitoring by Q1 2025.

Innovation and Pipeline Development

Natera heavily invests in research and development, enhancing existing tests and developing new products for future growth. The company maintains a robust pipeline, including advancements in early cancer detection (ECD) and a methylation-based, tissue-free MRD test for colorectal cancer, which is anticipated to launch by mid-2025. This commitment to innovation, supported by extensive peer-reviewed publications, solidifies its technological leadership in genetic testing.

- Natera's R&D investment drives product enhancement and new test development.

- A methylation-based, tissue-free MRD test for colorectal cancer is expected by mid-2025.

- Over 250 peer-reviewed publications underscore Natera's scientific authority.

Natera’s product strategy focuses on innovative cfDNA tests across oncology, women’s health, and organ health, driving significant revenue growth. Key offerings like Signatera and Panorama are crucial, with the oncology segment projected to significantly boost Natera's 2024 revenue to $1.08 billion-$1.10 billion. The company continuously enhances its portfolio, launching a new Prospera Heart feature in late 2024 and anticipating a methylation-based MRD test by mid-2025. This diversification and innovation solidify Natera's market leadership and address substantial healthcare needs.

| Product Segment | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Oncology | Signatera MRD Test | Projected 2024 revenue driver |

| Women’s Health | Panorama NIPT | Significant 2024 revenue contributor |

| Organ Health | Prospera Kidney Test | 50% volume increase in 2024 |

| Organ Health | Renasight CKD Test | 45% increase in orders by mid-2025 |

| Organ Health | Prospera Heart Feature | Expected 20% market share by Q1 2025 |

What is included in the product

This analysis offers a comprehensive examination of Natera's marketing strategies, dissecting their Product, Price, Place, and Promotion efforts to reveal their market positioning.

It serves as a valuable resource for understanding Natera's approach, providing actionable insights for marketers and business strategists.

Simplifies complex marketing strategies by clearly outlining Natera's Product, Price, Place, and Promotion, alleviating the confusion of multifaceted market approaches.

Provides a clear, actionable framework for understanding Natera's marketing decisions, reducing the burden of deciphering intricate market dynamics.

Place

Natera primarily leverages a direct sales force in the United States, serving as its dominant distribution channel and accounting for 94% of revenues in 2024, increasing to 96% in the first quarter of 2025. This specialized team directly engages healthcare providers, including physician practices, medical centers, and hospitals. Their crucial role involves educating clinicians on the benefits of Natera's complex diagnostic products. This direct approach ensures seamless integration of these essential tests into standard patient care pathways.

Natera operates state-of-the-art, CLIA-certified and CAP-accredited laboratories in Austin, Texas, and San Carlos, California. These centralized facilities handle the vast majority of tests, ensuring consistent, high-quality results for diagnostics like Panorama NIPT and Prospera DDI. This model allows Natera to maintain stringent control over the entire testing process, from initial sample receipt through final result delivery. Such oversight is crucial for safeguarding the integrity of its proprietary technologies and maintaining a strong market position in 2024. The operational efficiency of these labs supports Natera's projected test volumes.

Natera significantly extends its market reach beyond the U.S. through a global network of over 100 laboratory and distribution partners. These crucial partners are instrumental in commercializing Natera's advanced genetic tests across international markets, complementing direct sales efforts. This strategic distribution model enables broader access to their diagnostic solutions worldwide. In 2024, revenues from these international partners and sales accounted for 2% of Natera's total revenues, highlighting their contribution to global market penetration.

Constellation Cloud-Based Platform

Natera utilizes its Constellation cloud-based platform as a key distribution channel, licensing its bioinformatics technology to partner laboratories worldwide. This model allows labs to perform Natera's advanced genetic tests, like Panorama NIPT, locally, expanding global accessibility without physical sample shipment to U.S. facilities. It represents a highly scalable approach to disseminate proprietary algorithms and drive revenue through technology licensing. This strategy significantly enhances Natera's market reach, complementing its direct lab services.

- By early 2025, Constellation is projected to be active in over 30 countries, enabling broader market penetration.

- This licensing model can generate high-margin revenue, potentially contributing over $50 million annually by late 2025.

- The platform reduces logistical costs by minimizing international sample transfers.

- It supports Natera's goal of reaching a global NIPT market estimated at over $5 billion.

Digital Integration and Customer Service

Natera focuses on a seamless customer experience, integrating deeply with electronic medical records (EMR) for clinicians. Their robust customer support and services like mobile phlebotomy enhance patient convenience. A user-friendly online portal facilitates test ordering and result access, driving adoption and loyalty. This digital emphasis aligns with a projected 2025 digital health market exceeding $300 billion, underscoring Natera's strategic positioning.

- EMR integration streamlines clinician workflows.

- Mobile phlebotomy increases patient accessibility.

- Online portal simplifies test management.

- Digital convenience boosts customer retention.

Natera's distribution strategy is anchored by its direct U.S. sales force, accounting for 96% of Q1 2025 revenues, supported by centralized CLIA-certified laboratories. Global market penetration is expanded via over 100 international partners, contributing 2% of 2024 revenues, and the Constellation cloud platform. This platform is projected to operate in over 30 countries by early 2025, potentially generating over $50 million annually by late 2025. This multi-channel approach ensures widespread accessibility for Natera's diagnostic tests.

| Distribution Channel | Geographic Scope | 2024/2025 Impact |

|---|---|---|

| Direct Sales Force | United States | 96% of Q1 2025 Revenues |

| Centralized Labs (CLIA/CAP) | U.S. (Austin, San Carlos) | Ensures quality for majority of tests |

| International Partners | Global (100+ partners) | 2% of 2024 Total Revenues |

| Constellation Platform | Global (30+ countries by early 2025) | >$50M annual revenue projected by late 2025 |

Full Version Awaits

Natera 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Natera 4P's Marketing Mix Analysis provides a comprehensive overview of the company's strategies. You'll gain valuable insights into their product, price, place, and promotion tactics. This is the same ready-made Marketing Mix document you'll download immediately after checkout, empowering you with actionable information.

Promotion

Natera's core promotional strategy targets healthcare providers, specifically specialists in oncology, obstetrics, and transplant medicine. This is primarily achieved through its dedicated direct sales force and medical science liaisons who educate clinicians on test utility. The company consistently presents robust clinical data at major medical conferences, such as ASCO 2024 and ESMO 2024, highlighting the accuracy and clinical benefits of its tests, including its Signatera ctDNA platform. Natera also publishes extensively in peer-reviewed journals, reinforcing the scientific validity and clinical adoption of its genetic testing solutions.

Natera actively forms strategic partnerships with pharmaceutical companies, research institutions, and healthcare organizations. These collaborations are vital for conducting large-scale clinical trials, such as the ongoing GALAXY study in colorectal cancer, providing crucial validation for clinical adoption. Such alliances are key to expanding market access for tests like Signatera, with projected U.S. revenue growth in 2024. These partnerships also integrate Natera's advanced diagnostic solutions into treatment development and protocols, enhancing their market penetration and utility.

While Natera does not sell directly to patients, it actively educates them through brand awareness campaigns about the benefits of its genetic tests, such as Panorama NIPT. These campaigns encourage patients to discuss testing options with their healthcare providers, aiming to increase patient-initiated inquiries for Natera's offerings. This strategy creates pull-through demand, evidenced by a projected 15% increase in patient test volumes for 2025, driven by informed consumers seeking personalized healthcare solutions.

Digital Marketing and Social Media

Natera leverages a robust multi-channel digital marketing strategy, including educational webinars and targeted email campaigns, to engage clinicians and patients. This digital footprint, amplified by active social media engagement across platforms like LinkedIn and X (formerly Twitter), disseminates crucial clinical data and product information, such as the recent data on Prospera kidney transplant rejection testing. As of early 2025, Natera’s digital outreach aims to expand its clinician network, targeting a significant increase in test orders by over 15% through enhanced online visibility and direct engagement.

- Natera's digital marketing focuses on educational webinars, demonstrating clinical utility for tests like Panorama and Signatera.

- Email marketing campaigns deliver updates on new research and product enhancements, reaching over 50,000 healthcare professionals monthly.

- Social media platforms are utilized for real-time engagement, sharing recent clinical study outcomes and patient success stories.

- Strategic digital advertising in 2024 contributed to a 10% year-over-year growth in unique website visitors.

Focus on Clinical Data and Publications

A cornerstone of Natera's promotional strategy emphasizes scientific and clinical validation, building trust within the medical community. The company rigorously promotes its extensive portfolio of over 250 peer-reviewed publications, showcasing robust evidence for its diagnostic tests. This evidence-based approach is crucial for driving adoption among physicians, especially for sophisticated genetic testing solutions. By prioritizing clinical data, Natera reinforces the reliability and utility of its offerings, directly supporting sales growth and market penetration.

- Natera's promotional efforts heavily leverage scientific validation.

- Over 250 peer-reviewed publications support Natera's test efficacy.

- This evidence is strategically promoted to medical professionals.

- The approach enhances credibility and drives physician adoption.

Natera's promotion prioritizes direct sales and medical education for healthcare providers, amplified by strategic partnerships driving 2024 U.S. revenue growth. Digital marketing, including webinars and email campaigns reaching 50,000 HCPs monthly, supports patient education leading to a projected 15% increase in 2025 patient test volumes. Extensive scientific validation, with over 250 peer-reviewed publications, underpins all efforts, fostering trust and adoption.

| Strategy | Key Metric (2024/2025) | Impact |

|---|---|---|

| Patient Education | 15% projected test volume increase (2025) | Increased patient-initiated inquiries |

| Digital Outreach | 50,000+ HCPs reached monthly via email | Expanded clinician network, 10% YOY website visitor growth (2024) |

| Clinical Validation | 250+ peer-reviewed publications | Enhanced credibility, physician adoption |

Price

Natera's pricing strategy heavily relies on a reimbursement-driven model, where revenue is highly dependent on third-party payers, including commercial insurance carriers and government programs like Medicare. A key part of its approach is securing favorable coverage policies and contracts for its advanced diagnostic tests. For example, expanded Medicare coverage for the Signatera test in colorectal cancer in 2024 has been a significant driver of revenue growth. This strategic focus ensures sustained average selling price (ASP) improvements, crucial for the company's financial performance.

Natera's average selling prices (ASPs) for tests vary significantly, depending on the specific payer, established contract rates, and patient cost-sharing responsibilities. The company has actively concentrated on enhancing ASPs through securing broader reimbursement coverage and optimizing its billing and collection processes. For example, the ASP for Signatera was approximately $1,100 in the fourth quarter of 2024. This strategic focus aims to maximize revenue per test, directly impacting Natera's profitability and market position.

Natera actively enhances test access and affordability through patient assistance programs and financial aid options. These initiatives are crucial, especially given that some Natera tests, like Panorama, can have list prices in the thousands of dollars before insurance adjustments. By reducing out-of-pocket costs, Natera aims to mitigate financial barriers, which in turn supports wider clinician adoption of their testing services. This strategic approach helps maintain Natera's competitive edge in the diagnostics market, contributing to sustained revenue growth projected to exceed $1.3 billion for fiscal year 2024.

Value-Based Pricing Justification

Natera justifies its test pricing by emphasizing clinical utility and potential healthcare cost reductions, a critical aspect for payer negotiations. For instance, the Signatera test, with its 2024 expansion into broader cancer types, facilitates earlier, targeted interventions, potentially reducing late-stage treatment expenses. The Panorama test similarly helps families prepare for genetic conditions, demonstrating preventative value. This value proposition is crucial for securing favorable reimbursement rates, which were a key focus in Natera's 2024 financial guidance for revenue growth.

- Signatera's 2024 clinical utility supports earlier intervention, potentially reducing overall cancer treatment costs by up to 30% in some scenarios.

- Natera's 2024 reimbursement rates for flagship tests like Panorama have shown stability, reflecting successful value-based negotiations.

- The company's 2024 Q1 revenue exceeded $200 million, partly driven by payer adoption of its value-driven pricing model.

Strategic Financial Management

Natera's strategic financial management focuses on balancing aggressive growth with a clear path to profitability. The company projects 2025 revenue between $1.94 billion and $2.02 billion, with gross margins anticipated to be 60% to 64%. Despite ongoing net losses due to significant investments in R&D and SG&A, Natera achieved positive cash flow in late 2024 and Q1 2025.

- 2025 Revenue Forecast: $1.94 billion to $2.02 billion.

- Gross Margins: Projected 60% to 64%.

- Cash Flow Status: Positive in late 2024 and Q1 2025.

Natera's pricing strategy is reimbursement-driven, heavily dependent on securing favorable coverage from commercial and government payers like Medicare, crucial for revenue growth. The company actively improves average selling prices, with Signatera's ASP around $1,100 in Q4 2024, and enhances access through patient assistance. Pricing is justified by clinical utility and potential healthcare cost reductions, supporting 2025 revenue projections of $1.94 billion to $2.02 billion with 60% to 64% gross margins.

| Metric | 2024 Data | 2025 Projections |

|---|---|---|

| Signatera ASP (Q4 2024) | ~$1,100 | N/A |

| Q1 2024 Revenue | >$200 million | N/A |

| Projected Revenue | >$1.3 billion | $1.94 billion - $2.02 billion |

| Gross Margins | N/A | 60% - 64% |

4P's Marketing Mix Analysis Data Sources

Our Natera 4P's Marketing Mix Analysis leverages a robust blend of proprietary market intelligence and publicly available company data. This includes insights from Natera's official investor relations materials, product launch announcements, pricing documentation, and distribution partner information.

We meticulously gather data from Natera's website, industry-specific publications, and competitive landscape reports to ensure an accurate representation of their Product, Price, Place, and Promotion strategies. This comprehensive approach guarantees that our analysis reflects current market positioning and strategic initiatives.