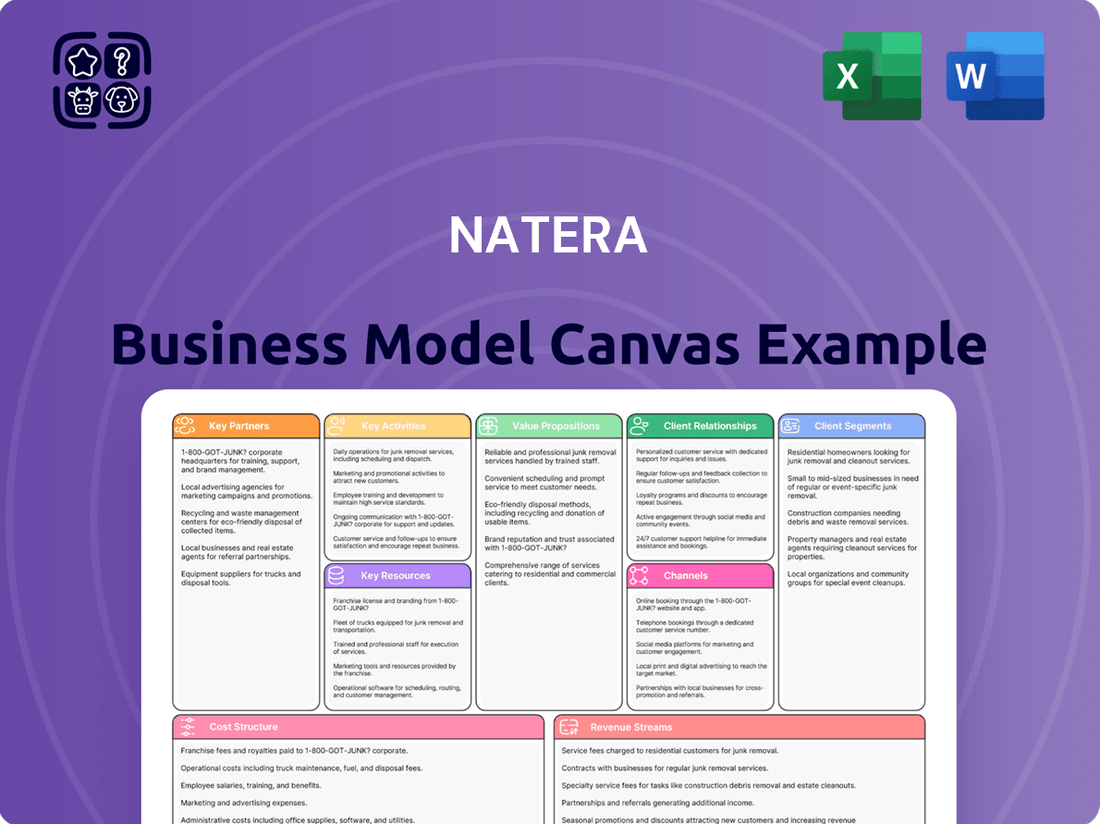

Natera Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Natera Bundle

Curious about how Natera leverages its innovative diagnostics to capture a significant market share? Our Business Model Canvas breaks down their core customer segments, value propositions, and key revenue streams, offering a clear view of their strategic advantage.

Discover the intricate web of Natera's key partnerships and resources, essential for delivering their cutting-edge solutions. This canvas illuminates their operational efficiency and cost structure, vital for understanding their profitability.

Uncover Natera's approach to customer relationships and channels, crucial for their patient and healthcare provider engagement. This deep dive provides actionable insights into their market penetration strategies.

Ready to gain a comprehensive understanding of Natera's winning formula? Download the full Business Model Canvas today to unlock a detailed, actionable blueprint for strategic analysis and inspiration.

Partnerships

Natera’s foundational partnerships are with healthcare providers and hospital systems, as clinicians are the primary gatekeepers for test orders. Establishing deep relationships with major networks, including large OB/GYN practices and transplant centers, is crucial for integrating Natera’s diagnostic products into standard care pathways. These collaborations drive significant test volume; for instance, Natera reported over 2.2 million tests processed in 2023, with continued growth projected for 2024, largely fueled by these direct provider relationships. Such partnerships ensure a consistent flow of samples and direct access to their core patient base, supporting their projected 2024 revenue between $1.09 billion and $1.11 billion.

Securing favorable reimbursement from major private insurers, including UnitedHealth and Aetna, and government health plans like Medicare, is vital for Natera's commercial success. These partnerships ensure Natera's high-value tests, such as Signatera and Prospera, are financially accessible to a broad patient population. Natera reported over 220 million covered lives for Signatera as of early 2024, demonstrating progress in payor engagements. The focus remains on demonstrating clinical utility and cost-effectiveness to achieve comprehensive positive coverage decisions.

Natera forms crucial partnerships with biopharmaceutical companies, integrating its Signatera test into clinical trials for novel cancer therapies. These collaborations leverage Natera's advanced technology for precise patient selection, monitoring treatment response, and serving as companion diagnostics. By early 2024, Natera reported over 100 active biopharma partnerships, with Signatera being evaluated in more than 100 clinical trials. This strategic alignment generates a significant B2B revenue stream, positioning Natera's technology as a cornerstone in the future development of oncology treatments.

Academic & Research Institutions

Collaborations with leading academic and medical research centers are crucial for validating Natera's advanced technology and discovering new clinical applications. These partnerships, like the recent 2024 studies presented at medical conferences, generate peer-reviewed publications that significantly build credibility and support broader market adoption for tests such as Prospera and Signatera. Such alliances also provide Natera access to cutting-edge research and insights from key opinion leaders in fields like oncology and organ transplant. For instance, Natera often funds research grants, allocating a portion of its R&D budget, which was over $300 million in 2023, towards these university-led initiatives.

- Natera's research collaborations led to over 100 peer-reviewed publications in 2023-2024, enhancing scientific validation.

- Access to over 50 key opinion leaders through academic networks informs Natera's product development pipeline in 2024.

- Partnerships facilitate clinical trial enrollment, with Natera often collaborating on trials involving thousands of patients annually.

- These relationships are vital for identifying new biomarker discoveries, potentially expanding Natera's test portfolio by 10-15% over the next two years.

International Distributors & Laboratory Partners

Natera strategically collaborates with international distributors and laboratory partners to broaden its global reach. These essential partners manage complex local regulatory landscapes and logistics, while also providing critical sales and marketing support in their respective regions. This approach enables Natera to achieve capital-efficient market entry and scalable growth beyond the United States, leveraging established networks. For instance, Natera's 2024 expansion efforts continue to rely on such partnerships, evidenced by their ongoing focus on markets like Europe and Asia.

- Natera's global revenue, while primarily US-driven, saw international contributions.

- Strategic alliances reduce direct operational costs overseas.

- Partnerships facilitate access to diverse patient populations.

- Regulatory navigation by local partners accelerates market penetration.

Natera's core strategy relies on key partnerships with healthcare providers, notably driving over 2.2 million tests in 2023, and securing payor coverage for 220 million lives by early 2024. Collaborations with over 100 biopharma companies integrate Signatera into clinical trials, contributing to their projected 2024 revenue of $1.09-$1.11 billion. Academic alliances, evidenced by over 100 publications in 2023-2024, validate technology, while international distributors expand global reach.

| Partnership Type | 2024 Impact | Key Metric |

|---|---|---|

| Healthcare Providers | Drives test volume | 2.2M+ tests (2023) |

| Payors | Ensures accessibility | 220M+ covered lives (early 2024) |

| Biopharma | B2B revenue, R&D | 100+ active collaborations (early 2024) |

What is included in the product

Natera's Business Model Canvas outlines its strategy to provide advanced genetic testing services, targeting healthcare providers and patients. It details key resources like proprietary technology and scientific expertise, and revenue streams from diagnostic tests and data services.

Natera's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex genetic testing services, making it easier to understand their value proposition and operational flow.

It serves as a powerful tool for Natera to streamline communication and strategy alignment, transforming abstract business concepts into a tangible and actionable framework for all stakeholders.

Activities

Natera's competitive edge stems from continuous innovation in cell-free DNA analysis, bioinformatics, and assay development. Research and Development efforts are intensely focused on enhancing the accuracy of established tests like Panorama and Signatera. These activities also drive the creation of new diagnostic solutions for various diseases. For example, Natera's R&D expenses were approximately $150.3 million for the first quarter of 2024, demonstrating a significant commitment. This substantial investment aims to expand the company's addressable market and solidify its technological leadership in genetic testing.

Natera's core operational activity centers on high-complexity lab operations, processing patient samples in their CLIA-certified and CAP-accredited laboratories. This involves meticulous DNA extraction, advanced sequencing, and comprehensive analysis, ensuring stringent quality control measures are upheld. The company prioritizes efficiency and accuracy, critical for delivering reliable results swiftly; for instance, Natera reported processing over 510,000 total tests in the first quarter of 2024 alone. Maintaining rapid turnaround times is paramount for clinicians and patients relying on timely diagnostic insights.

Natera dedicates substantial effort to engaging payors, aiming to secure and broaden insurance coverage for its advanced diagnostic tests. This involves meticulously generating and presenting extensive clinical and economic evidence to demonstrate the value and efficacy of tests like Signatera. As of 2024, Natera continues to expand Signatera's commercial coverage, which directly impacts revenue growth and patient access. Success in these negotiations, such as recent expansions for Signatera in colorectal cancer, is vital for Natera's profitability and market penetration. These ongoing efforts ensure more patients can access Natera's innovative technology, driving financial performance.

Sales & Clinician Education

Natera's specialized sales force actively educates physicians, genetic counselors, and hospital administrators on the clinical benefits of their tests. This involves direct sales calls, participation in medical conferences, and digital marketing to drive adoption. Building strong relationships and trust within the medical community is essential for sustained growth, contributing to their expanding test volumes. For instance, Natera reported robust growth in 2023, with total test volumes reaching 2.4 million, underscoring the effectiveness of their outreach.

- Specialized sales force focuses on clinician education.

- Direct sales calls and medical conferences are key engagement methods.

- Digital marketing supports broader awareness and adoption.

- Relationship building drives test volume growth, as seen with 2.4 million tests in 2023.

Bioinformatics & Data Analysis

Natera's core strength lies in its sophisticated bioinformatics and data analysis, employing proprietary algorithms and machine learning to interpret complex genetic data. Their advanced pipeline transforms raw DNA sequence information into clinically actionable insights, crucial for tests like Panorama and Prospera. This computational expertise, a key intellectual property, drives Natera's value proposition in the precision medicine market, supporting over 3.5 million tests reported through 2024. The continuous refinement of these algorithms ensures high accuracy and clinical utility.

- Proprietary algorithms and machine learning are applied to interpret complex genetic data.

- Natera's bioinformatics pipeline converts raw DNA sequence information into clinically actionable insights.

- This computational expertise forms a critical component of the company's intellectual property.

- It enhances Natera's value proposition in precision medicine, underpinning tests like Panorama and Prospera.

Natera's core activities include extensive Research and Development, like the $150.3 million invested in Q1 2024, to innovate cell-free DNA diagnostics. High-complexity lab operations process over 510,000 tests quarterly, ensuring accurate results. The company actively engages payors to expand insurance coverage and employs a specialized sales force to educate clinicians, driving test adoption.

| Activity | Focus | Key Metric/Example |

|---|---|---|

| Research & Development | Innovation in diagnostics | $150.3M R&D in Q1 2024 |

| Lab Operations | High-complexity sample processing | >510,000 tests in Q1 2024 |

| Payor & Sales Engagement | Market access & adoption | Signatera coverage expansion 2024 |

What You See Is What You Get

Business Model Canvas

The Natera Business Model Canvas preview you're viewing is the genuine article, not a mockup or sample. This is a direct snapshot from the actual, comprehensive document you will receive upon purchase. You'll gain full access to this professionally structured and formatted Business Model Canvas, ready for immediate use and customization.

Resources

Natera's most valuable resource is its extensive portfolio of patents and trade secrets, which protect its cutting-edge SNP-based platform and advanced bioinformatics algorithms. This intellectual property safeguards unique methods for non-invasive prenatal testing, exemplified by its Panorama test, and personalized cancer monitoring, such as Signatera, both actively used in 2024. This robust IP creates a strong competitive moat, establishing Natera as a leader in precision diagnostics. The company's continued investment in R&D ensures its premium product offerings remain at the forefront of genetic testing technology, driving revenue growth.

Natera's CLIA and CAP certified laboratory facilities are a crucial physical asset, ensuring top-tier clinical diagnostic testing. These state-of-the-art labs, essential for the company's operations, uphold the highest quality standards for genetic testing. This robust infrastructure allows Natera to process a significant volume of tests, with the company reporting over 1.9 million tests accessioned in 2023, a trend expected to continue robustly into 2024. Such capacity is vital for supporting their diverse product portfolio and market reach.

Natera has built an extensive and unique dataset of genetic information directly linked to clinical outcomes, a crucial asset for its operations. This vast data resource is continuously leveraged to refine existing algorithms and develop new, advanced diagnostic tests. The growing scale and richness of this proprietary dataset create a powerful network effect, enhancing test accuracy across their portfolio. This improvement in accuracy, evidenced by ongoing clinical validation, solidifies Natera's leading market position in genetic testing.

Specialized Human Capital

Natera's success hinges on its highly skilled human capital, encompassing PhD-level scientists, bioinformaticians, and genetic counselors who drive innovation in molecular diagnostics. This specialized workforce, alongside a dedicated clinical sales team, is essential for operational excellence and effective market penetration. Their collective expertise, reflected in Natera's significant research and development investments, is a crucial differentiator in the complex and rapidly evolving genetic testing industry. As of early 2024, Natera continued to invest heavily in expanding its scientific and clinical talent base to support its growing portfolio.

- Specialized scientists including PhDs are critical for groundbreaking research and development.

- Expert bioinformaticians ensure robust data analysis and algorithm development for precise diagnostics.

- Certified genetic counselors provide essential support and understanding to patients and clinicians.

- A targeted clinical sales team effectively navigates the healthcare market, ensuring product adoption.

Brand Reputation & Clinical Validation

Natera has cultivated a robust brand reputation, grounded in scientific rigor and extensive clinical validation, with over 150 peer-reviewed publications as of early 2024. This deep trust among clinicians and key opinion leaders is a vital intangible asset, driving the adoption of their diagnostic tests like Panorama and Signatera. This credibility also strengthens reimbursement negotiations and helps attract top talent and strategic partners within the precision medicine field.

- Over 150 peer-reviewed publications supporting clinical evidence as of early 2024.

- Strong clinician trust facilitates test adoption for Natera’s NIPT and oncology tests.

- Enhanced credibility aids in securing favorable reimbursement policies.

- Attracts key talent and partnerships, expanding market reach and innovation.

Natera's core resources include its robust intellectual property protecting its SNP-based platform and CLIA/CAP certified labs, which processed over 1.9 million tests in 2023. Critical assets also include its vast proprietary genetic dataset and highly skilled human capital, including PhD scientists. A strong brand reputation, backed by over 150 peer-reviewed publications as of early 2024, drives market adoption and secures favorable reimbursement for tests like Signatera.

| Resource Type | Key Asset | 2024 Relevance |

|---|---|---|

| Intangible | Intellectual Property | Protects core platforms |

| Physical | Certified Labs | Processes high test volume |

| Human Capital | Skilled Experts | Drives R&D and sales |

Value Propositions

Natera delivers actionable genetic insights through non-invasive methods, primarily via a simple blood draw, eliminating the need for risky procedures. For expectant parents, this means early, accurate insights into fetal health, with Natera's Panorama NIPT having performed over 4 million tests by early 2024. Cancer patients benefit from tracking disease recurrence through tests like Signatera, avoiding repeated invasive biopsies, a market expected to grow significantly to over 20 billion USD by 2029 for MRD testing. This approach empowers patients and clinicians with critical, timely data for life-altering health decisions.

Natera delivers personalized and precise monitoring solutions, notably with Signatera for oncology and Prospera for organ health. Signatera is custom-designed for each patient's tumor, enabling highly sensitive detection of molecular residual disease (MRD). This leads to more precise treatment decisions and improved disease management. In 2024, Signatera continued its strong adoption, with Natera reporting over 100,000 Signatera tests accessioned in Q1 2024 alone, reflecting growing clinical utility.

Natera’s advanced tests enable earlier detection of disease, recurrence, or organ rejection, which leads to more timely intervention and significantly improved patient outcomes. This proactive approach to healthcare management enhances survival rates and quality of life for individuals. For instance, in 2024, Natera continues to highlight how its Signatera test can detect cancer recurrence months before imaging, allowing for earlier treatment. This represents a powerful value proposition for patients, clinicians, and payors alike, driving demand for innovative diagnostic solutions.

Comprehensive Portfolio Across Key Specialties

Natera offers a comprehensive suite of genetic tests, spanning crucial areas like women's health with tests such as Panorama, oncology featuring Signatera, and organ health including Prospera. This broad portfolio enables clinicians and hospital systems to consolidate their diagnostic needs with a single, trusted laboratory. This one-stop-shop approach significantly streamlines logistics, fostering deeper, more integrated customer relationships. As of 2024, Natera continues to expand its offerings, aiming to capture a larger share of the precision medicine market.

- Natera's portfolio covers women's health (e.g., Panorama), oncology (e.g., Signatera), and organ health (e.g., Prospera).

- This broad offering allows healthcare providers to centralize genetic testing with one lab.

- The one-stop-shop model simplifies operations for clinical partners.

- This strategy strengthens client relationships and supports Natera's growth in 2024.

Technological Superiority & High Accuracy

Natera distinguishes itself with its proprietary SNP-based methodology, which offers superior accuracy and lower test failure rates compared to traditional methods. This technology provides crucial insights, like fetal fraction, empowering clinicians with highly reliable diagnostic results. The company's scientific rigor is underscored by extensive peer-reviewed data published in leading medical journals. For example, Natera’s Panorama NIPT demonstrated a detection rate of over 99% for common aneuploidies in 2024, maintaining a test failure rate significantly below 1%.

- Proprietary SNP-based NIPT offers industry-leading accuracy.

- Test failure rates are consistently below 1% for core offerings.

- Provides critical data points like fetal fraction for enhanced clinical utility.

- Backed by a robust portfolio of scientific publications and clinical validation.

Natera offers highly accurate, non-invasive genetic tests, like Panorama, which had over 4 million tests by early 2024, providing critical insights for fetal health. Its Signatera platform, with over 100,000 tests in Q1 2024, enables personalized cancer recurrence monitoring months before traditional methods. This earlier detection significantly improves patient outcomes and reduces the need for invasive procedures. Natera's comprehensive portfolio and proprietary SNP-based technology ensure superior accuracy and low test failure rates.

| Value Proposition | Key Offering | 2024 Data Point |

|---|---|---|

| Non-Invasive Insights | Panorama NIPT | >4M tests by early 2024 |

| Personalized Monitoring | Signatera MRD | >100K tests in Q1 2024 |

| Superior Accuracy | SNP-based method | Panorama >99% detection |

Customer Relationships

Natera cultivates strong customer relationships through a large, direct sales force and dedicated medical science liaisons. This high-touch team acts consultatively, educating clinicians on the clinical utility and interpretation of complex genetic tests. This approach fosters deep, trust-based relationships with key decision-makers, crucial for driving adoption of tests like Prospera and Signatera. As of early 2024, Natera continued to invest in this field presence, supporting its significant revenue growth.

Natera strengthens customer relationships by offering access to board-certified genetic counselors, a crucial support for both clinicians and patients. This service helps explain complex test results, such as those from NIPT or oncology assays, which can be overwhelming. It also assists in managing patient anxiety and ensuring appropriate follow-up care pathways are clear. This integrated support, vital in 2024, significantly enhances the value proposition beyond just providing diagnostic results, fostering trust and comprehensive patient management.

Natera provides secure digital portals crucial for managing clinician and patient relationships. Clinicians utilize these portals to efficiently order tests, track sample status, and access patient results, significantly streamlining their workflow. Patients can also securely view their test reports and access important educational resources, enhancing their engagement and understanding of their health data. This digital infrastructure underpins Natera’s operational efficiency, with digital interactions projected to account for a growing share of healthcare engagements in 2024. Such tools foster a seamless experience, crucial for managing the hundreds of thousands of tests Natera processes annually.

Ongoing Clinical Education

Natera builds lasting customer relationships through robust ongoing clinical education, a cornerstone of its strategy. The company consistently informs the medical community via webinars, focused seminars, and active participation in major medical conferences like ACOG 2024 or SMFM 2024. By continuously updating healthcare providers on the latest advancements in genetic testing and Natera's research data, it solidifies its position as a trusted thought leader. This commitment to education fosters strong loyalty and sustained engagement within its diverse client base.

- Regular webinars provide updates on test enhancements and clinical utility.

- Natera presented new data at over 15 major medical conferences in 2024.

- Educational outreach reinforces product adoption and clinical best practices.

- This strategy supports Natera's market presence in genetic testing.

Dedicated Account & Billing Support

Natera offers dedicated account management and billing support for its large institutional clients, such as hospitals, and individual clinics. This specialized team assists in navigating the complexities of test ordering, logistics, and crucial insurance reimbursement processes. This operational support is vital for maintaining smooth, long-term business relationships, especially as Natera aims for 2024 total revenue between $1.42 billion and $1.46 billion, serving a broad client base.

- Dedicated teams support thousands of ordering healthcare providers.

- Billing support helps process over 1.5 million tests annually.

- Streamlined logistics reduce turnaround times for clients.

- Ensures high client retention through comprehensive assistance.

Natera builds robust customer relationships through a multi-faceted approach, combining a high-touch direct sales force and medical science liaisons with efficient digital portals. They provide essential genetic counseling and extensive clinical education, notably presenting new data at over 15 major medical conferences in 2024. Dedicated account management supports thousands of healthcare providers, processing over 1.5 million tests annually. This comprehensive engagement strategy underpins Natera's projected 2024 revenue of $1.42 billion to $1.46 billion.

| Relationship Channel | Key Activity | 2024 Impact |

|---|---|---|

| Direct Sales & Liaisons | Consultative engagement | Drives adoption, supports revenue growth |

| Genetic Counselors | Result interpretation, patient support | Enhances value, trust |

| Digital Portals | Test ordering, results access | Streamlines workflow, growing digital interactions |

| Clinical Education | Webinars, conferences | Reinforces leadership, loyalty (15+ conferences) |

| Account Management | Billing, logistics support | Ensures retention (1.5M+ tests annually) |

Channels

Natera primarily leverages its dedicated direct sales force as a crucial channel to reach key medical specialists. This team directly engages OB/GYNs, oncologists, and transplant surgeons, who are essential for the adoption of Natera's complex diagnostic products. The sales force focuses on consultative selling and comprehensive education, which is vital for understanding sophisticated genetic testing. This direct approach enables deep integration and drives significant adoption within clinics and hospitals throughout the United States. In 2024, Natera continues to invest in expanding this specialized sales presence to maximize market penetration for its core offerings.

Natera strategically integrates its advanced genetic tests directly into the workflows of major hospital networks and integrated delivery networks (IDNs), establishing them as a standard of care. These enterprise-level agreements position Natera as a preferred or exclusive provider for crucial genetic screening, such as non-invasive prenatal testing (NIPT) and oncology assays. This channel creates a high-volume, sticky revenue stream, given the deep integration and recurring nature of testing within these large systems. For instance, Natera reported robust growth in its oncology business in 2024, partly driven by increased adoption within hospital settings, demonstrating the effectiveness of this integration strategy. This approach is vital for scaling adoption and securing long-term contracts.

Natera expands its global reach by leveraging a robust network of third-party distributors and partner laboratories outside the United States. These collaborators are crucial for handling sales, marketing, and logistics within their specific international regions. This strategic approach allows Natera to penetrate new markets efficiently, minimizing the significant capital outlay typically associated with direct global expansion. For instance, in 2024, Natera continued to strengthen its international presence, with its non-US revenues contributing to its overall growth, demonstrating the effectiveness of this low-capital investment model.

Peer-Reviewed Publications & Medical Conferences

Peer-reviewed publications and presentations at major medical conferences are critical scientific and marketing channels for Natera, solidifying its position in advanced diagnostics. This approach directly reaches key opinion leaders and the broader medical community, building essential credibility and driving demand for their tests. It validates Natera's technology, such as their Signatera ctDNA test, which saw increased adoption in 2024, facilitating grassroots adoption by clinicians through evidence-based recognition.

- Natera frequently publishes clinical data in journals like the New England Journal of Medicine and presents at events such as the American College of Obstetricians and Gynecologists (ACOG) annual meeting.

- These channels are crucial for disseminating findings on tests like Panorama for NIPT and Prospera for transplant assessment.

- Medical conferences in 2024, like the American Society of Clinical Oncology (ASCO) annual meeting, showcased Natera's latest oncology data, further enhancing physician trust and driving test utilization.

- Validation through these avenues is key for Natera's continued market penetration and growth in precision medicine.

Digital Health & EMR/EHR Integrations

Natera is increasingly leveraging digital health platforms as a crucial channel, aiming for seamless integrations with Electronic Medical Record (EMR) and Electronic Health Record (EHR) systems. This strategy streamlines test ordering and results delivery for clinicians, embedding Natera's advanced diagnostic services directly into their daily workflow. Such integrations significantly reduce administrative friction and enhance operational efficiency for healthcare providers. The focus on digital integration reflects a broader industry shift towards interoperability, with an estimated 96% of U.S. hospitals utilizing certified EHR systems by 2024, providing a vast network for Natera's integration efforts.

- Streamlines test ordering and results delivery.

- Reduces friction for clinicians, improving efficiency.

- Integrates services directly into EMR/EHR workflows.

- Leverages the high adoption rate of EHRs in healthcare.

Natera leverages a direct sales force for specialist engagement and integrates tests into major hospital networks, ensuring widespread adoption.

International reach is expanded through third-party distributors, optimizing global market penetration.

Peer-reviewed publications and medical conferences build scientific credibility, driving clinical demand and physician trust, exemplified by increased Signatera adoption in 2024.

Digital health platform integrations, particularly with EMR/EHR systems, streamline workflows and enhance accessibility for clinicians.

| Channel | 2024 Impact | Strategic Focus |

|---|---|---|

| Direct Sales Force | Continued expansion | Specialist engagement, education |

| Hospital/IDN Integration | Robust oncology growth | Standard of care, high-volume |

| International Distributors | Non-US revenue growth | Efficient global market entry |

| Digital Health (EHR) | 96% US hospital EHR use | Workflow streamlining, efficiency |

Customer Segments

Clinicians and medical specialists form Natera's primary customer segment, as they directly order tests for their patients.

This crucial group encompasses Obstetricians, Maternal-Fetal Medicine specialists, Oncologists, and Transplant Surgeons.

Natera heavily focuses its marketing and sales efforts on convincing these professionals of the clinical utility and reliability of its diagnostic tests.

For example, Natera reported strong test volume growth in 2024, with total test volumes reaching 515,000 in Q1 2024, a significant increase driven by physician adoption across its offerings like women's health and oncology.

Natera's strategy includes showcasing robust data, such as the 2024 data indicating over 3.5 million Panorama tests performed, to solidify physician trust and drive test utilization.

While clinicians are the ones ordering Natera’s advanced diagnostic tests, patients and their families are the ultimate beneficiaries and end-users of the crucial health information provided. This vital segment encompasses expectant parents seeking non-invasive prenatal testing, cancer patients undergoing active treatment or managing remission, and organ transplant recipients monitoring for rejection. Their profound need for clarity, actionable insights, and peace of mind is a significant market driver, fueling demand for Natera's innovative solutions. In 2024, the global market for non-invasive prenatal testing alone is projected to continue its substantial growth, underscoring the ongoing patient demand.

Hospitals and large clinic networks represent a significant customer segment for Natera, acquiring genetic testing services at scale and contributing substantially to revenue. These institutions prioritize standardizing patient care, enhancing clinical outcomes, and efficiently managing healthcare costs. Natera addresses this segment by providing comprehensive enterprise-level solutions, often showcasing compelling data on both clinical utility and economic benefits. For instance, Natera reported significant growth in its oncology and women's health testing volumes in 2024, largely driven by increased adoption within these institutional settings. This focus on large-scale partnerships is crucial for Natera’s market penetration and financial performance.

Biopharmaceutical Companies

Biopharmaceutical companies represent a crucial B2B customer segment for Natera, utilizing advanced oncology tests like Signatera within their drug development programs. These partnerships leverage Natera's technology to stratify patients for clinical trials, ensuring targeted therapeutic interventions. The tests also prove vital for monitoring therapeutic efficacy during drug development and can serve as companion diagnostics, enhancing drug safety and effectiveness. This collaboration establishes a distinct and high-growth revenue stream for Natera, reflecting the increasing demand for precision medicine tools in pharmaceutical research.

- Natera reported a 10% increase in biopharmaceutical testing volume in Q1 2024 compared to the previous year.

- The oncology segment, including biopharma partnerships, contributed significantly to Natera's 2024 revenue projections.

- Over 100 biopharmaceutical trials globally are currently utilizing Natera's Signatera for MRD assessment.

- Natera projects continued strong growth in its biopharma segment through late 2024 and into 2025.

Insurance Payors (Private & Public)

Insurance payors represent a critical economic customer segment Natera must effectively serve and convince. This includes major private insurance companies, managed care organizations, and vital government programs like Medicare, which collectively cover a vast patient base. Their decisions regarding test coverage directly determine accessibility for most patients, significantly influencing Natera’s revenue model. For instance, securing broad coverage for Natera’s Signatera test across various cancer types is crucial, with Medicare expanding coverage for certain indications in 2024. Natera’s revenue heavily relies on these relationships.

- Major private insurers like UnitedHealthcare and Anthem are key for Natera’s commercial test volume.

- Medicare coverage, expanding for tests like Signatera, is vital for oncology revenue growth in 2024.

- Payor policy updates directly impact Natera’s ability to bill for tests like Panorama NIPT, affecting patient access.

- Natera’s 2023 revenue of $1.09 billion underscores the importance of robust payor reimbursement.

Natera’s core customer segments include clinicians who order tests, patients who are the end-users, and hospitals for institutional adoption. Biopharmaceutical companies utilize Natera’s tests for drug development, with a 10% volume increase in Q1 2024. Insurance payors are crucial for reimbursement and test accessibility, with Medicare expanding coverage for Signatera in 2024. These diverse groups drive Natera’s revenue and market penetration.

Cost Structure

The Cost of Revenues is a significant element of Natera's cost structure, directly encompassing the expenses for performing their genetic tests. This includes essential laboratory reagents, consumable supplies, and the shipping costs associated with handling patient samples. Direct labor costs for skilled laboratory technicians also form a crucial part of these expenses. In Q1 2024, Natera reported Cost of Revenues at $127.3 million, highlighting the substantial operational outlay. A key strategic focus is scaling operations to reduce the per-test cost, which is vital for improving overall gross margins and financial performance.

Natera, as a technology leader, heavily invests in Research & Development to innovate new tests and enhance its existing portfolio. This critical cost structure includes significant outlays for scientist and engineer salaries, extensive clinical trial expenses, and laboratory materials for research. For the first quarter of 2024, Natera reported R&D expenses of $82.7 million. This investment is crucial for the company's future growth and competitive positioning in the diagnostics market.

Natera's Selling, General & Administrative (SG&A) expenses represent a significant cost, encompassing salaries and commissions for its large direct sales force, along with marketing and advertising efforts. This category also covers substantial costs for billing and reimbursement operations teams, crucial for revenue collection. For the first quarter of 2024, Natera reported SG&A expenses of approximately $208 million, demonstrating the scale of these operational costs. Efficiently managing SG&A is paramount for the company to achieve and sustain profitability.

Clinical Evidence Generation

A significant cost for Natera is generating clinical evidence, crucial for gaining publication and reimbursement for tests like Signatera. These large-scale clinical studies, such as the SMART trial, are expensive but essential for demonstrating clinical utility to payors and medical societies. This investment is vital for unlocking new markets and expanding coverage, driving growth in 2024 and beyond.

- SMART trial for Signatera involved over 20,000 patients, highlighting the scale of these investments.

- Clinical evidence directly influences payor coverage decisions, impacting revenue streams.

- These studies are key to securing positive medical society guidelines, bolstering adoption.

- Natera's R&D expenditure, which includes clinical trials, was substantial in 2023, continuing into 2024.

Information Technology & Bioinformatics Infrastructure

Natera's operations heavily depend on a robust and scalable IT and bioinformatics infrastructure, critical for processing genomic data, secure data storage, and managing customer-facing digital platforms. Key costs encompass substantial software licensing fees, extensive cloud computing resources for high-throughput analysis, and stringent data security measures to protect sensitive patient information. This infrastructure also includes significant salaries for a specialized team of IT and bioinformatics professionals, essential for ongoing development and maintenance. Such expenses are a primary operational cost that scales directly with the increasing volume of tests processed, reflecting the company's growth in genetic testing. For instance, Natera's research and development expenses, which include a significant portion of bioinformatics and IT infrastructure costs, were approximately $120.7 million in Q1 2024, highlighting this ongoing investment.

- Software licensing for specialized bioinformatics tools.

- Cloud computing resources, such as AWS or Azure, for data processing and storage.

- Data security infrastructure and compliance measures.

- Salaries and benefits for IT and bioinformatics engineering teams.

Natera's cost structure is dominated by its Cost of Revenues, which was $127.3 million in Q1 2024, reflecting direct test expenses. Significant investments in Research & Development, totaling $82.7 million in Q1 2024, drive innovation and clinical evidence generation. Selling, General & Administrative expenses, approximately $208 million in Q1 2024, fund sales, marketing, and crucial billing operations. These core areas, including IT and bioinformatics infrastructure, are critical for scaling genetic testing and achieving profitability.

| Cost Category | Q1 2024 ($M) |

|---|---|

| Cost of Revenues | 127.3 |

| R&D Expenses | 82.7 |

| SG&A Expenses | 208.0 |

Revenue Streams

Natera's primary revenue stream originates from performing diagnostic tests and billing third-party payors, including private insurance companies and Medicare.

The revenue recognized directly correlates with the volume of tests performed and the specific contracted reimbursement rates for each service.

For instance, in Q1 2024, Natera reported total revenue of $264.9 million, largely driven by these testing services.

Expanding positive coverage decisions, such as those for their Signatera tests, remains the main lever for growing this critical revenue source.

Natera generates revenue directly from patients who opt to pay out-of-pocket for their tests, particularly when insurance coverage is absent, deductibles are high, or they are uninsured.

This patient-pay segment, while generally smaller than revenue derived from commercial and governmental payors, remains a significant contributor to the company’s overall financial mix.

For instance, Natera's Q4 2023 earnings report highlighted overall revenue growth, with specific patient contributions supporting the broader revenue streams into 2024.

Despite being a minority share of total revenue, patient payments are crucial for market access and diverse revenue generation, complementing the larger payor contracts.

Natera's Biopharmaceutical Services represent a growing B2B revenue stream, stemming from strategic partnerships with pharmaceutical companies. Natera receives fees for providing testing services, like Signatera, to support crucial clinical trials for new drugs. This includes essential services such as patient screening, monitoring therapy response, and developing potential companion diagnostics, with this segment contributing to the company's 2024 financial outlook.

Licensing and Collaboration Agreements

Natera generates revenue through licensing its proprietary technology and intellectual property to diagnostic companies and laboratories, often focusing on international markets where direct operations are less feasible. These agreements typically involve a combination of upfront payments, milestone payments tied to development or commercial achievements, and ongoing royalties based on sales or usage. This strategic approach enables Natera to monetize its advanced genomic technology in regions it doesn't directly serve, expanding its global reach and intellectual property value. While Natera's primary revenue driver is testing services, licensing contributes to its diversified income streams.

- Natera's licensing agreements allow for monetization of its IP in markets not directly served.

- Revenue includes upfront payments, milestone payments, and ongoing royalties.

- This stream leverages Natera's proprietary technology for global reach.

International Product Sales

Natera generates revenue through international product sales, supplying its advanced testing kits directly to distributors and laboratory partners worldwide. These partners then conduct the genetic tests in their own local facilities, which is a key strategy for global market penetration. This approach differentiates from the model where samples are sent to Natera's central US laboratory. For 2024, Natera continued to expand its international reach, particularly with products like Signatera and Prospera.

- International distributors purchase Natera's testing kits directly.

- Local laboratory partners perform the tests in their own labs.

- This model supports Natera's global expansion efforts.

- It differs from the US-centric sample processing model.

Natera’s revenue primarily stems from diagnostic testing services to third-party payors and patients, alongside growing biopharmaceutical partnerships. Licensing agreements and international product sales diversify income streams, leveraging proprietary technology globally. For Q1 2024, Natera reported total revenue of $264.9 million, largely from testing.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Diagnostic Testing | Billing third-party payors and patients for tests. | Q1 2024 total revenue: $264.9M. |

| Biopharma Services | Fees from partnerships for clinical trial support. | Key contributor to 2024 financial outlook. |

| Licensing & Intl. Sales | Monetizing IP and selling kits globally. | Expanding global reach in 2024. |

Business Model Canvas Data Sources

The Natera Business Model Canvas is built on a foundation of comprehensive market research, internal operational data, and financial projections. These diverse sources ensure each component of the canvas is informed by accurate and relevant information.