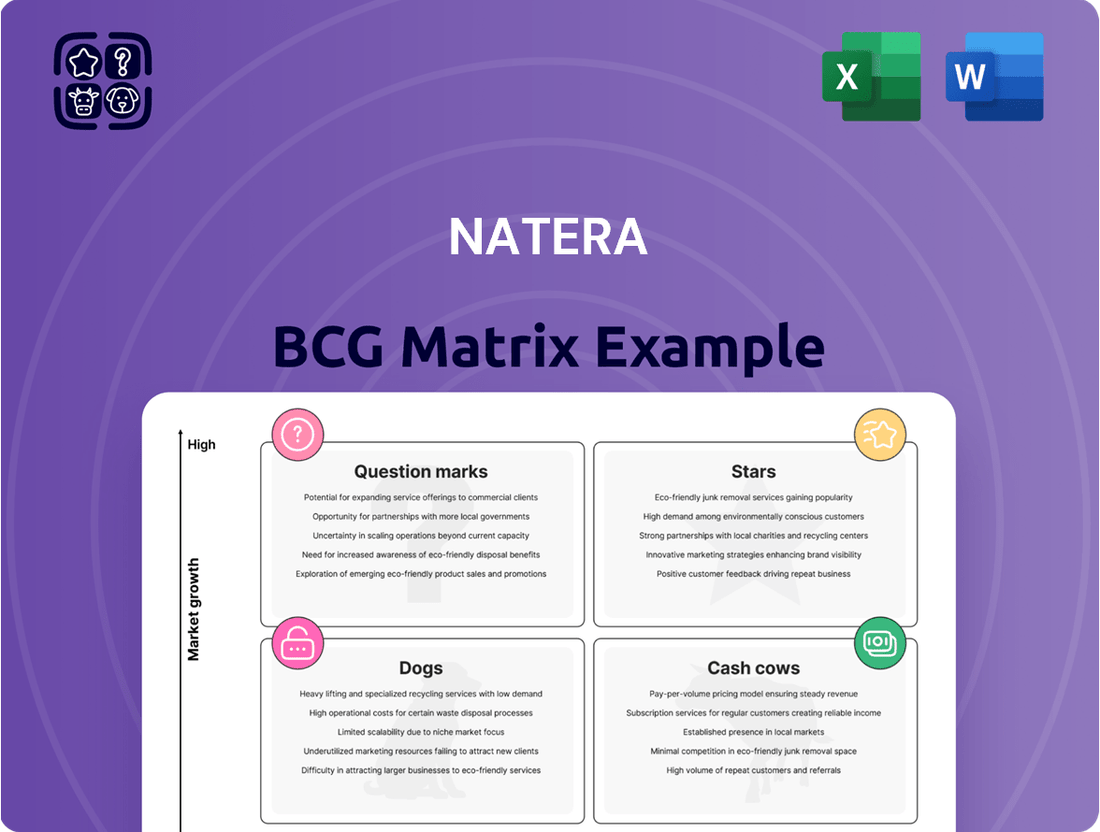

Natera Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Natera Bundle

Natera's BCG Matrix offers a glimpse into its product portfolio's competitive landscape. Explore how its tests fare in the market – are they Stars, or Dogs? See the potential of its offerings, mapped visually. Understand the strategic implications for each product category. This preview is just the beginning. Get the full BCG Matrix report for a deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Signatera is Natera's personalized molecular residual disease (MRD) test, a pivotal growth engine. Test volumes saw substantial increases, boosted by expanded Medicare coverage. For example, in 2024, Natera's revenue grew significantly, with Signatera contributing a large portion. This growth reflects Signatera's increasing adoption and impact.

Prospera is Natera's test to assess organ transplant rejection risk. It's shown strong performance in kidney and heart transplant studies. In 2024, Natera reported Prospera contributed significantly to its transplant rejection monitoring revenue. Medicare covers Prospera, boosting its accessibility for patients. This coverage helps drive adoption and revenue growth.

Natera's oncology portfolio is a star, with substantial growth in testing volume. This growth indicates strong market adoption and expansion potential. The company's Signatera test, for example, saw a 68% increase in volume in 2024. This growth is fueled by the increasing demand for personalized cancer care. The oncology market is a high-growth area for Natera.

Strong Revenue Growth

Natera shines as a "Star" due to its robust revenue expansion. In 2024, the company showcased impressive growth, and projections for 2025 continue this positive trend. This highlights Natera's strong market position and effective strategies. The continuous revenue increase signifies sustained demand for their products.

- 2024 Total Revenue Growth: Significant increase.

- 2024 Product Revenue Growth: Substantial rise.

- 2025 Projected Growth: Continued positive outlook.

- Market Position: Strong and improving.

Improved Gross Margins

Natera's gross margins have been trending upwards, signaling enhanced operational effectiveness. This improvement suggests a pathway to higher profitability as the company's revenues continue to expand. For instance, in 2024, Natera reported a gross margin of approximately 60%, a notable increase from the prior year. This positive trend is crucial for long-term financial health.

- Operational Efficiency: Improved gross margins often reflect better cost management.

- Profitability: Higher margins translate to a greater percentage of revenue becoming profit.

- Revenue Growth: As revenues increase, the impact of improved margins is amplified.

- Financial Health: Stronger margins contribute to a healthier financial position.

Natera's oncology portfolio, led by Signatera, shines as a Star in the BCG Matrix, demonstrating high market growth and strong market share. Signatera's test volume surged by 68% in 2024, reflecting its significant market adoption and contribution to Natera's robust revenue expansion. The company's overall revenue growth in 2024 was substantial, further solidifying its Star position. This performance is boosted by increasing demand for personalized cancer care.

| Metric | 2024 Performance | Category |

|---|---|---|

| Signatera Volume Growth | 68% increase | Oncology |

| Natera Total Revenue | Significant increase | Company-wide |

| Gross Margin | Approx 60% | Profitability |

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation, allowing for strategic discussions.

Cash Cows

Natera's Panorama is a leading non-invasive prenatal screening (NIPS) test. It's a cornerstone product, holding a substantial market share. In 2024, Natera's revenue grew, significantly driven by Panorama's adoption. This test is crucial for Natera's financial health.

Natera's women's health portfolio, including Panorama and Horizon, is a cash cow. This segment has been a reliable revenue source. In 2024, women's health accounted for a substantial portion of Natera's overall revenue, with approximately $800 million generated.

Natera is a well-known name in genetic testing, especially in women's health. They have built a solid reputation, which helps them generate consistent revenue. In 2024, Natera's revenue was approximately $1.07 billion, showing their market strength. This established presence makes them a reliable source of income.

Consistent Test Volume

Natera's consistent test volume is a key strength, generating reliable revenue. The company's high test volume helps to ensure a steady income stream. In 2024, Natera's revenue reached $1.1 billion, demonstrating robust demand. This financial stability is crucial for sustained growth.

- Revenue: $1.1 billion in 2024.

- High test volumes support stable finances.

- Continuous testing fuels revenue streams.

Positive Cash Flow Generation

Natera's recent shift to positive cash flow is a key indicator of its financial health. This means the company's core products are now generating more cash than they require to operate. This positive trend enhances Natera's ability to invest in future growth and innovation.

- In Q1 2024, Natera reported a positive cash flow from operations of $27.8 million.

- This is a significant improvement from the prior year.

- This financial stability allows Natera to pursue strategic opportunities.

Natera's women's health portfolio, anchored by Panorama and Horizon, serves as a robust cash cow. This segment reliably generates substantial revenue, contributing approximately $800 million in 2024. With Natera's overall revenue reaching $1.1 billion in 2024, these established products maintain market leadership and drive consistent positive cash flow.

| Product Segment | 2024 Revenue (Est.) | Q1 2024 Op. Cash Flow |

|---|---|---|

| Women's Health | ~$800 million | |

| Total Revenue | $1.1 billion | |

| Overall Operations | $27.8 million |

Full Transparency, Always

Natera BCG Matrix

The BCG Matrix previewed here is the identical document you'll receive after purchase. This professional, fully-featured report offers clear strategic insights, ready to implement in your planning.

Dogs

Identifying specific 'Dog' tests within Natera's portfolio requires detailed financial and market data. Tests in low-growth markets with low market share would be considered 'Dogs'. Natera's financial reports from 2024 will offer insights. Precise identification needs internal company data.

Tests in highly competitive areas, like some in the genetic testing market, are Dogs. These tests often lack a strong market position or clear differentiation. The genetic testing market is fiercely competitive, with many similar tests available, potentially leading to price wars. For instance, in 2024, the average cost for a non-invasive prenatal test (NIPT) ranged from $500 to $2,000, reflecting price sensitivity and competition.

Tests facing limited reimbursement, like some Natera products, can be "Dogs" in a BCG Matrix. They might not secure widespread insurance coverage, hindering market growth and revenue. For instance, in 2024, about 30% of new diagnostic tests struggle with adequate reimbursement. This impacts their profitability. Limited coverage affects their ability to compete effectively.

Tests with Declining Volume or Revenue

A Dog in Natera's BCG Matrix would involve tests or product lines showing declining volume or revenue, indicating a low-growth, low-market-share position. This could signal the need for strategic decisions like divesting or restructuring. Identifying specific Dogs requires detailed analysis of Natera's internal performance data. For instance, a test with decreasing adoption rates and revenue could be classified as such.

- Focus on early-stage cancer detection: Natera's Signatera test is used for minimal residual disease detection.

- Consider the market dynamics: Changes in reimbursement policies can impact test volume.

- Analyze product life cycle: Older tests with limited innovation might decline.

Underperforming or Divested Products

Underperforming or divested products at Natera would be categorized as "Dogs" within the BCG Matrix. Public information doesn't specify recent divested products. However, the company's financial performance reflects strategic decisions. Natera's total revenue for 2023 was approximately $1.07 billion, a 26% increase year-over-year.

- 2023 revenue growth indicates successful products.

- Divestitures typically occur for underperforming lines.

- Lack of public divestiture announcements suggests current portfolio strength.

- The company's focus is on high-growth areas.

Natera's Dogs within the BCG Matrix are product lines with low market share in low-growth segments. These often face intense competition, like some genetic tests where 2024 NIPT costs range from $500 to $2,000, or limited reimbursement, with about 30% of new diagnostic tests struggling for adequate coverage in 2024. Identifying specific Dogs requires internal data, as Natera's 2023 revenue of $1.07 billion, a 26% increase, indicates overall portfolio strength.

| Characteristic | Market Growth | Market Share |

|---|---|---|

| Intense Competition | Low to Moderate | Low |

| Limited Reimbursement | Low | Low |

| Declining Adoption | Low | Low |

Question Marks

Natera is creating a tissue-free MRD assay, starting with colorectal cancer. This assay is a new product entering a growing market. Its market share is currently small due to early-stage commercialization. In 2024, the global MRD testing market was valued at $1.3 billion, projected to reach $3.8 billion by 2029.

Natera is developing an early cancer detection (ECD) assay using methylation signatures. This positions Natera in a high-growth, but currently nascent, market. In 2024, the ECD market is estimated to be worth several billion dollars, with significant expansion projected. Natera's market share in this area would initially be low.

Expanding existing tests like Signatera and Prospera into new areas is a move into new markets. This strategy allows Natera to target different patient populations and clinical needs. While growth potential is substantial, initial market share in these new applications will likely be low. For instance, Natera's 2024 revenue reached $1.1 billion, with continued investment in expanding test applications.

New Products in the Pipeline

Natera's future hinges on its new genetic testing solutions. These products are in development, targeting high-growth areas. They currently have no market share, making them Question Marks in the BCG Matrix. Success depends on adoption and market penetration.

- Natera invested $125.2 million in R&D in 2024.

- New tests include oncology and reproductive health solutions.

- Market penetration will determine future classification.

- High potential, but high risk.

International Market Expansion

Expanding into new international markets with existing products positions Natera in the Question Mark quadrant of the BCG Matrix. These markets may exhibit high growth potential, yet Natera's current market share would likely be low. This necessitates substantial investment in marketing, distribution, and potentially localized product adaptations to gain a foothold. For example, in 2024, Natera allocated approximately $100 million towards international expansion efforts to boost market penetration. This strategy is high-risk, high-reward, requiring careful planning and execution.

- High growth potential, low market share.

- Requires significant upfront investment.

- Focus on marketing and distribution.

- Localized product adaptations might be needed.

Natera's Question Marks include novel assays like tissue-free MRD and ECD, along with expanding existing tests into new applications and international markets. These initiatives target high-growth areas, such as the global MRD market valued at $1.3 billion in 2024, yet Natera currently holds low market share within them. Significant investment, like the $125.2 million in R&D in 2024, is crucial for these products to gain market penetration and potentially become Stars. Success hinges on market adoption and strategic resource allocation.

| Category | 2024 Market Value | Natera's Initial Share |

|---|---|---|

| MRD Testing | $1.3 Billion | Low |

| Early Cancer Detection | Billions | Low |

| International Expansion | Varied | Low |

BCG Matrix Data Sources

The Natera BCG Matrix leverages comprehensive data including market research, financial reports, and expert analysis for strategic decisions.