Mount Logan Capital PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mount Logan Capital Bundle

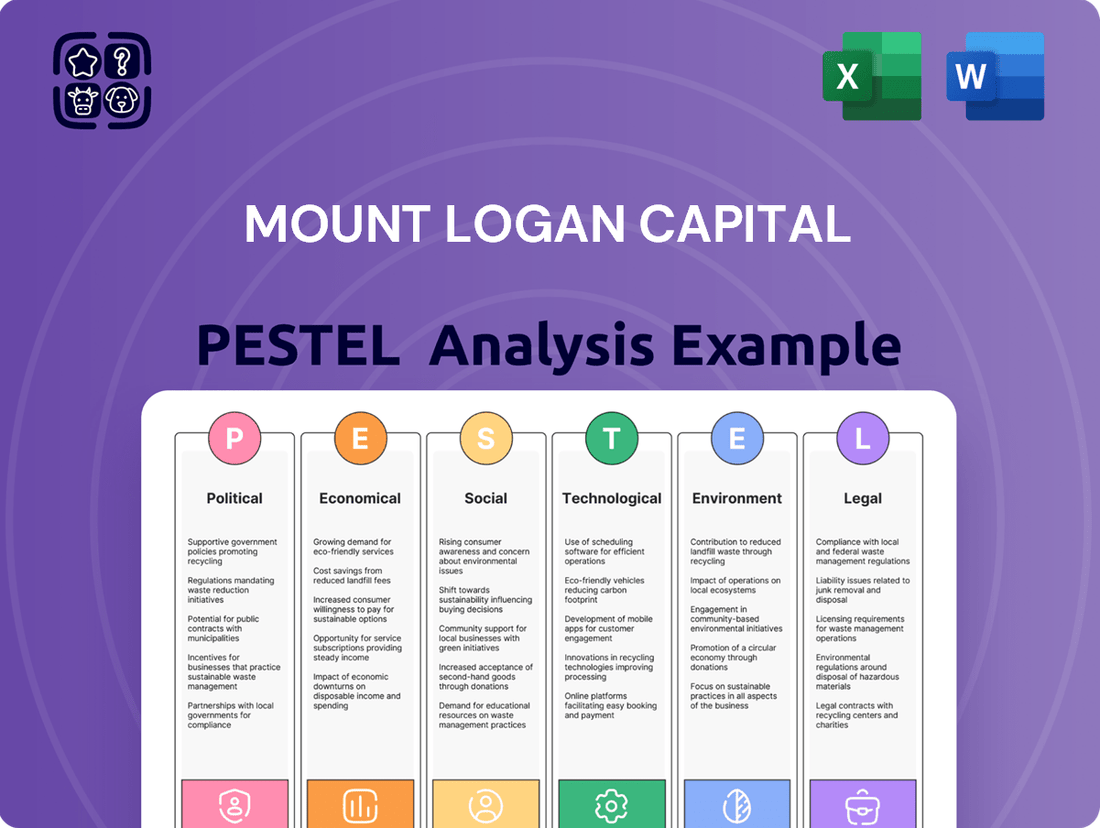

Navigate the dynamic landscape affecting Mount Logan Capital with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. This expert-crafted report delves into social, environmental, and legal factors, providing you with critical intelligence. Don't get left behind; gain a strategic advantage by understanding these external forces. Purchase the full PESTLE analysis now and unlock actionable insights to inform your decisions.

Political factors

Government policies and the regulatory landscape are pivotal for alternative asset managers like Mount Logan Capital. For instance, the U.S. Securities and Exchange Commission (SEC) continues to refine rules around private fund disclosures and advisor registration, impacting how firms like Mount Logan operate and report. These evolving regulations in 2024 and 2025 necessitate continuous adaptation in compliance and operational strategies.

Shifts in tax legislation, such as potential changes to capital gains taxes or deductions for certain investment vehicles, can directly influence Mount Logan Capital's net returns and the attractiveness of its offerings. The U.S. federal corporate tax rate remaining at 21% as of mid-2024 provides a baseline, but any future adjustments would require strategic recalibration.

Political stability in regions where Mount Logan Capital deploys capital or has operational presence is a fundamental consideration. Instability can disrupt investment flows and increase operational risks. For example, geopolitical tensions in Eastern Europe or the Middle East, which saw increased volatility in 2023-2024, directly affect investor sentiment and the feasibility of certain cross-border investments.

Mount Logan Capital operates within a global financial landscape where geopolitical tensions and evolving trade policies are constant considerations. Events like ongoing trade disputes between major economies or regional conflicts can inject significant volatility into financial markets, directly affecting the valuation of international assets. For instance, the continued strategic competition between the US and China, impacting global supply chains and investment flows, could indirectly influence the risk profile of Mount Logan Capital's portfolio companies or its ability to source international deals.

These geopolitical dynamics directly influence cross-border deal flows, a critical component for Mount Logan Capital's activities in real estate and private debt. Sanctions imposed on certain countries or regions can create barriers to investment and limit opportunities, while trade wars can disrupt economic activity and reduce the overall attractiveness of international markets. As of early 2024, the ongoing restructuring of global trade agreements and the emergence of new economic blocs continue to shape the investment environment, requiring careful navigation by firms like Mount Logan Capital.

Government spending and fiscal policy are significant drivers for companies like Mount Logan Capital. For instance, in the United States, the Congressional Budget Office projected that federal spending would reach $6.0 trillion in fiscal year 2024, a substantial figure that can stimulate various sectors of the economy. These spending patterns, whether focused on infrastructure, defense, or social programs, directly influence liquidity and economic growth, which in turn affects the investment opportunities and risk profiles within Mount Logan Capital's debt and equity portfolios.

Fiscal policies, such as tax adjustments or stimulus measures, also play a crucial role. If the government implements expansionary fiscal policy, like tax cuts or increased transfer payments, it can boost consumer spending and business investment, potentially leading to higher asset values. Conversely, contractionary policies, aimed at reducing deficits, might lead to slower economic activity and potentially lower investment returns. For example, discussions around potential government budget deficits in the US, projected to be around $1.9 trillion for FY2025 according to CBO estimates, signal ongoing fiscal considerations that could influence interest rates and inflation, key factors for Mount Logan Capital's performance.

Monetary Policy and Central Bank Actions

Central bank decisions on interest rates and quantitative easing directly impact Mount Logan Capital's cost of capital and investment returns. For instance, the Federal Reserve's rate hikes throughout 2022 and 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, significantly increased borrowing costs for companies, affecting the demand for Mount Logan's debt financing solutions.

Mount Logan Capital's business model, which centers on providing debt financing and managing leveraged loans, makes it highly susceptible to shifts in monetary policy. The availability and cost of credit, key determinants of loan demand and asset valuations, are directly manipulated by central banks. As of early 2024, the expectation of potential rate cuts by the Federal Reserve in late 2024 could influence the lending environment, potentially improving deal flow and asset values for Mount Logan.

- Interest Rate Sensitivity: Mount Logan's portfolio performance is closely tied to prevailing interest rates, impacting the profitability of its debt investments.

- Credit Availability: Central bank policies on liquidity directly affect the supply of credit, influencing Mount Logan's ability to originate new loans and manage existing ones.

- Market Volatility: Monetary policy shifts can trigger market volatility, impacting the valuation of Mount Logan's leveraged loan assets.

- Inflationary Pressures: Policy responses to inflation, such as interest rate adjustments, play a crucial role in shaping the economic landscape in which Mount Logan operates.

Government Support for Specific Industries

Government support for key industries, like infrastructure and renewable energy, significantly shapes the investment landscape for Mount Logan Capital. For instance, the Canadian federal government's commitment to green infrastructure, with billions allocated for projects aimed at reducing emissions, presents direct opportunities. In 2024, the government continued to emphasize investments in clean technology and sustainable development.

These sector-specific policies can create both new avenues for investment and potential limitations. Mount Logan Capital’s strategy, which spans various asset classes and sectors, requires careful monitoring of these evolving governmental stances. For example, changes in tax credits for renewable energy projects or new regulations on infrastructure development can directly impact the profitability and feasibility of potential deals.

- Federal and provincial governments in Canada continue to drive investment in renewable energy, with ongoing support mechanisms in place.

- Infrastructure spending remains a priority, with significant government funding aimed at modernizing transportation and utility networks.

- Mount Logan Capital must analyze the impact of these policies on its portfolio companies, identifying both growth opportunities and potential regulatory headwinds.

- The pace of government support for specific sectors, such as advanced manufacturing or digital infrastructure, can create distinct investment cycles.

Government regulatory frameworks, including those from the SEC, significantly influence how Mount Logan Capital structures its operations and reports its activities. Evolving compliance requirements in 2024 and 2025 demand ongoing strategic adjustments for the firm.

Tax policies, such as the current 21% U.S. federal corporate tax rate, directly affect Mount Logan's profitability and the attractiveness of its investment vehicles. Any future legislative changes to capital gains or deductions would necessitate careful financial planning.

Political stability and geopolitical events are critical for Mount Logan Capital, as they impact global investment flows and risk profiles. For instance, ongoing geopolitical tensions in various regions can create market volatility, affecting the valuation of international assets within its portfolios.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental forces impacting Mount Logan Capital across Political, Economic, Social, Technological, Environmental, and Legal spheres.

It provides a comprehensive understanding of how these dynamic factors create both opportunities and challenges for the company's strategic decision-making and future growth.

Mount Logan Capital's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders grasp key external factors impacting the business.

Economic factors

The prevailing interest rate environment significantly impacts Mount Logan Capital, particularly its business model centered on debt and leveraged loans. As of early 2024, the Federal Reserve maintained a relatively high federal funds rate, influencing borrowing costs across the economy. This environment means companies seeking financing from Mount Logan Capital face higher interest expenses, which can strain their ability to repay debt, potentially increasing default risks.

Conversely, higher interest rates can make debt investments, like those Mount Logan Capital specializes in, more appealing to investors seeking yield. For instance, the average yield on U.S. corporate bonds, particularly in the high-yield segment where Mount Logan Capital often operates, has remained elevated compared to the preceding low-rate environment. This dynamic presents both opportunities and challenges, requiring careful risk management to navigate potential increases in credit losses while capitalizing on attractive return profiles.

Inflation significantly impacts Mount Logan Capital by diminishing the real value of investment returns. For instance, if inflation runs at 3% and a bond yields 5%, the real return is only 2%. This erosion of purchasing power is a critical consideration for the company when setting interest rates on its debt offerings and assessing the true profitability of its real estate ventures.

Mount Logan Capital must actively monitor inflation trends to ensure its pricing strategies adequately compensate for the loss in purchasing power. As of May 2024, the US Consumer Price Index (CPI) showed a year-over-year increase of 3.4%, highlighting the ongoing need for vigilance in managing inflation risk across its portfolio.

Conversely, deflationary pressures, though currently less prevalent, pose a different set of challenges. Deflation can signal a weakening economy, leading to a decrease in asset values and potentially reducing the overall demand for credit, which could negatively affect Mount Logan Capital's lending and investment activities.

Global economic growth prospects significantly shape Mount Logan Capital's operating environment. For 2024, projections indicated moderate but uneven growth, with the IMF forecasting 3.1% global GDP expansion. This environment is generally supportive, leading to better corporate performance and potentially lower credit risks for Mount Logan's portfolio companies.

However, recession risks remain a pertinent concern. Geopolitical tensions, persistent inflation in some regions, and tighter monetary policies globally could dampen economic activity. Should a significant downturn materialize in key markets where Mount Logan operates, it could lead to increased defaults, devalued assets, and a contraction in available investment opportunities, impacting the firm's overall returns.

Regional economic health is equally critical. For instance, in the United States, where Mount Logan has substantial interests, GDP growth was estimated to be around 2.1% for 2024 by the Congressional Budget Office. Strong U.S. economic performance bolsters the underlying value of its investments, while a slowdown there would have direct negative repercussions.

Credit Market Conditions and Liquidity

Credit market conditions are crucial for Mount Logan Capital, directly impacting its ability to originate and service loans. In late 2024 and early 2025, we're seeing a mixed picture. While overall liquidity remains substantial, the cost of credit has seen some upward pressure due to ongoing inflation concerns and central bank policy adjustments. This can make leveraged financing more expensive for Mount Logan's clients, potentially slowing deal origination.

The availability of credit is also a key factor. Banks and other traditional lenders have tightened underwriting standards in certain sectors, leading to increased demand for alternative lenders like Mount Logan. However, this also means that the overall pool of available capital for private debt strategies might be more discerning. For instance, while corporate bond issuance remained robust in 2024, the spreads on high-yield debt have shown some volatility, reflecting investor sentiment towards risk.

- Credit Availability: Alternative lenders are increasingly filling gaps left by traditional banks, particularly in middle-market financing.

- Cost of Credit: Interest rate hikes by major central banks in 2023 and early 2024 have translated to higher borrowing costs for companies seeking leveraged loans.

- Liquidity Levels: Despite rising rates, overall market liquidity remains ample, though it is being deployed more cautiously by investors.

- Market Volatility: Fluctuations in credit spreads can impact the attractiveness and profitability of Mount Logan's private debt portfolio.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a dual-edged sword for Mount Logan Capital, an alternative asset manager with ambitions for international investments. When the Canadian dollar strengthens against other currencies, the value of foreign assets held by Mount Logan decreases when translated back into CAD. Conversely, a weaker Canadian dollar can boost the reported value of these overseas holdings. For instance, in early 2024, the Canadian dollar experienced some volatility against major currencies like the US dollar, impacting the effective returns on any US-denominated assets Mount Logan might hold.

These movements directly influence Mount Logan Capital's reported earnings and the overall attractiveness of cross-border investment opportunities. For example, if Mount Logan has invested in a European company and the Euro weakens significantly against the Canadian dollar, the capital gains realized upon exit will be lower than anticipated, even if the underlying business performance was strong. This volatility necessitates careful hedging strategies to mitigate potential losses and capitalize on favorable currency movements.

The impact on deal attractiveness is also substantial. A strengthening Canadian dollar can make foreign acquisitions more expensive for Mount Logan, while a weakening currency can make Canadian companies more appealing targets for foreign investors. As of mid-2024, the Bank of Canada's monetary policy and global economic sentiment continue to shape the CAD's trajectory, creating an evolving landscape for international deal-making.

- Impact on Asset Valuation: Foreign assets are worth less in CAD terms when the Canadian dollar strengthens.

- Earnings Translation: Fluctuations affect the reported profitability of international operations.

- Deal Attractiveness: Exchange rates influence the cost and desirability of cross-border mergers and acquisitions.

- Hedging Costs: Managing currency risk can involve expenses for financial instruments like forward contracts.

Economic factors significantly shape Mount Logan Capital's performance, with interest rates and inflation being primary concerns. As of early 2024, elevated interest rates increased borrowing costs for clients, while inflation continued to erode real returns, evidenced by a 3.4% CPI increase in May 2024. Global economic growth projections for 2024, around 3.1% according to the IMF, offered moderate support, though recession risks persisted. Credit market conditions remained dynamic, with tighter lending standards from traditional banks creating opportunities for alternative lenders like Mount Logan.

Preview Before You Purchase

Mount Logan Capital PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Mount Logan Capital delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping Mount Logan Capital's strategic landscape. You'll gain valuable insights into market dynamics and potential opportunities or threats.

Sociological factors

Demographic shifts are significantly reshaping the investment landscape, directly impacting firms like Mount Logan Capital. For instance, the aging population in developed economies, particularly in North America and Europe, is leading to a greater demand for income-generating and capital-preservation strategies. Concurrently, the rise of younger generations, such as Millennials and Gen Z, often exhibits a preference for socially responsible investing (SRI) and digital-first investment platforms, presenting both opportunities and challenges for traditional alternative investment providers.

Understanding these evolving investor preferences is crucial for Mount Logan Capital to effectively tailor its alternative investment products. As of early 2025, a notable trend is the increasing allocation of wealth by individuals in their 30s and 40s towards private markets, seeking diversification beyond traditional stocks and bonds. This demographic, often referred to as the HENRYs (High Earners, Not Rich Yet), is actively looking for ways to grow their wealth, making them a key target for alternative asset managers.

Societal demand for ESG principles is a significant driver in finance, with global sustainable investment assets reaching an estimated $37.7 trillion in 2024, according to Broadridge. Mount Logan Capital needs to embed ESG into its core operations, from initial investment screening to ongoing asset management, to align with growing investor expectations. Failing to do so could not only alienate a substantial portion of potential capital, particularly from institutional limited partners, but also expose the firm to reputational damage.

The availability of skilled professionals in finance, especially in niches like private debt and real estate, directly impacts Mount Logan Capital's ability to operate effectively. For instance, the U.S. financial services sector employed approximately 5.7 million people in early 2024, with a significant portion requiring specialized expertise.

Societal shifts in educational pursuits and evolving career aspirations are shaping the talent pool. As of 2023, while finance remained a popular major, there's a growing emphasis on work-life balance, potentially affecting the appeal of high-pressure investment roles and influencing Mount Logan Capital's strategies for attracting and retaining top talent.

Public Perception of Financial Industry

Public trust in financial institutions significantly influences investor confidence and the level of regulatory oversight. Following the 2008 financial crisis, public perception of the financial industry remained a concern, with surveys indicating persistent skepticism. For instance, a 2023 Gallup poll found that only 23% of Americans expressed a great deal or quite a lot of confidence in banks, highlighting an ongoing need for transparency.

Mount Logan Capital, operating as an alternative asset manager, is particularly sensitive to these perceptions. Building and maintaining a strong reputation for integrity and ethical conduct is paramount. This is crucial for attracting and retaining limited partners (LPs), who entrust significant capital to the firm. A positive public image can translate into greater LP commitment and a more stable capital base.

To counter potential negative sentiment and foster trust, firms like Mount Logan Capital focus on clear communication and robust governance. This includes detailing investment strategies, performance metrics, and risk management protocols. Adherence to evolving regulatory frameworks, such as those related to ESG (Environmental, Social, and Governance) investing, also plays a role in shaping public and investor perception.

- Investor Confidence: Public trust directly correlates with investor willingness to commit capital.

- Regulatory Scrutiny: Low public perception can lead to increased regulatory attention and stricter compliance demands.

- Reputation Management: For alternative asset managers, a strong reputation is a key differentiator in attracting LPs.

- Transparency: Open communication about operations and ethics is vital for building and preserving trust.

Wealth Distribution and Inequality

Mount Logan Capital's fundraising environment is significantly shaped by wealth distribution trends. As of early 2024, global wealth inequality remains a persistent issue, with a substantial portion of assets concentrated among the wealthiest individuals. For instance, the top 1% globally held a disproportionate share of wealth, influencing the availability of capital for alternative investment vehicles.

This concentration can create both challenges and opportunities. While a smaller pool of ultra-high-net-worth individuals might mean a more targeted fundraising effort, it also implies a potentially more competitive landscape for attracting this capital. Firms like Mount Logan Capital need to understand how this evolving distribution impacts investor appetite for specific asset classes.

- Concentrated Capital: Global wealth data from sources like Credit Suisse or Knight Frank consistently show the top decile of earners holding over 70-80% of global net worth, impacting the pool of capital for alternative investments.

- Investor Sophistication: High net worth individuals often possess greater financial literacy, demanding more tailored and sophisticated investment products, which Mount Logan Capital must be prepared to offer.

- Asset Preference Shifts: As wealth concentrates, there's a growing interest in alternative assets like private equity, venture capital, and real estate among the affluent, creating demand for specialized funds.

- Impact on Fundraising: The ability to raise substantial capital may become more dependent on securing commitments from a smaller number of very large investors rather than a broad base of smaller ones.

Public perception directly influences investor confidence and the regulatory environment. A 2023 Gallup poll indicated that only 23% of Americans expressed significant confidence in banks, underscoring a persistent need for transparency in financial institutions.

Mount Logan Capital must prioritize building and maintaining a reputation for integrity to attract and retain crucial limited partner capital. Clear communication regarding investment strategies, performance, and robust governance, including adherence to ESG principles, is vital for fostering trust and mitigating reputational risks.

Technological factors

Mount Logan Capital can significantly enhance its operations by integrating advanced data analytics and AI. These technologies offer powerful tools for dissecting market trends, pinpointing investment opportunities, and refining risk assessment models. For instance, AI-driven predictive analytics can identify potential defaults in loan portfolios with greater accuracy than traditional methods, potentially reducing non-performing assets.

The application of AI in due diligence can accelerate the evaluation of debt, equity, and real estate investments. By automating data extraction and analysis, Mount Logan can reduce the time and resources spent on these crucial processes. In 2024, the global AI market was projected to reach hundreds of billions of dollars, indicating a strong trend towards AI adoption across financial services.

Furthermore, AI can optimize portfolio management by identifying complex correlations and suggesting rebalancing strategies that maximize returns while managing risk. This could lead to improved capital allocation and a more resilient investment strategy for Mount Logan, especially in volatile market conditions experienced in early 2025.

Blockchain and Distributed Ledger Technology (DLT) offer significant potential to streamline Mount Logan Capital's operations. These technologies can accelerate transaction processing and enhance transparency, particularly in private market dealings. For instance, by 2025, the global blockchain market is projected to reach over $120 billion, indicating a strong trend towards its adoption in financial services.

Mount Logan Capital could explore asset tokenization using blockchain, which allows for fractional ownership and easier trading of illiquid assets. This could unlock new investment opportunities and improve liquidity in their portfolios. The cost reduction potential is also substantial; studies suggest that DLT could cut banks' infrastructure costs by as much as 30% by 2025.

Mount Logan Capital, as an alternative asset manager, operates in an environment where cybersecurity risks are paramount. Handling substantial volumes of sensitive financial data means the company is a prime target for cyberattacks aimed at data theft, financial fraud, or operational disruption. Protecting this information is not just good practice; it's critical for maintaining client trust and ensuring business continuity.

The financial services industry, in general, has seen a significant rise in cyber threats. For instance, in 2023, the cost of data breaches globally averaged $4.45 million, according to IBM's Cost of a Data Breach Report. This underscores the substantial financial and reputational damage Mount Logan Capital could face if its data protection measures are insufficient.

Robust cybersecurity protocols are therefore non-negotiable. This includes implementing advanced threat detection systems, regular security audits, employee training on data handling best practices, and secure data storage solutions. Compliance with evolving data protection regulations, such as GDPR or similar frameworks, is also a key factor in mitigating these risks and maintaining operational integrity.

Automation of Investment Processes

The increasing automation of investment processes is a significant technological factor impacting firms like Mount Logan Capital. Routine tasks such as trade execution, compliance checks, and portfolio reporting are increasingly being handled by sophisticated algorithms and software. This automation not only boosts operational efficiency but also drastically reduces the potential for human error, which is critical in financial services.

By leveraging these automation tools, Mount Logan Capital can reallocate its human capital. Investment professionals can shift their focus from tedious, repetitive tasks to more value-added activities. This includes in-depth market analysis, developing innovative investment strategies, and engaging in complex client relationship management, ultimately enhancing the firm's competitive edge.

Consider the impact on efficiency: a study by McKinsey in late 2023 indicated that automation could boost productivity in financial services by 10-25% by 2025. For instance, automated compliance systems can process thousands of transactions in minutes, a task that would take human teams days. This allows for faster decision-making and quicker adaptation to market changes.

The deployment of automation tools offers several key benefits:

- Enhanced Operational Efficiency: Automation reduces processing times for trades and reporting, allowing for quicker turnaround and improved service delivery.

- Reduced Human Error: Algorithmic execution and automated checks minimize mistakes inherent in manual processes, leading to greater accuracy in financial operations.

- Focus on Strategic Tasks: Investment professionals are freed from mundane tasks, enabling them to concentrate on higher-level analysis, strategy formulation, and client engagement.

- Cost Reduction: Over time, automation can lead to significant cost savings by reducing the need for manual labor in repetitive functions and minimizing the cost of errors.

Cloud Computing Infrastructure

Mount Logan Capital benefits significantly from the adoption of cloud computing, which offers a scalable, flexible, and cost-effective IT infrastructure. This allows for efficient data storage, processing, and application hosting, crucial for financial services. For instance, by 2024, the global cloud computing market was projected to reach over $600 billion, highlighting its widespread adoption and the robust infrastructure available.

Leveraging cloud solutions empowers Mount Logan Capital to manage extensive datasets with greater ease, supporting advanced analytics and risk management. Furthermore, it enhances remote work capabilities, a trend that has become increasingly vital in the modern financial landscape, with many firms reporting significant productivity gains from hybrid models. The ability to rapidly deploy new financial technologies is also a key advantage, enabling quicker innovation and response to market changes.

- Scalability: Cloud infrastructure allows Mount Logan Capital to adjust IT resources up or down based on demand, avoiding over-provisioning and managing costs efficiently.

- Cost-Effectiveness: Shifting from capital expenditure on on-premise hardware to operational expenditure on cloud services can lead to substantial cost savings.

- Agility: The ease of deploying and managing applications in the cloud accelerates the rollout of new financial products and services.

- Data Management: Cloud platforms provide robust tools for storing, processing, and analyzing large volumes of financial data, crucial for insights and compliance.

The integration of Artificial Intelligence (AI) and machine learning is transforming financial operations, offering enhanced data analysis and risk management capabilities. For instance, AI can significantly improve the accuracy of credit scoring and fraud detection, crucial for Mount Logan Capital's lending activities. The global AI market was projected to exceed $200 billion in 2024, indicating strong industry-wide adoption.

Automation is streamlining investment processes, from trade execution to compliance checks, boosting efficiency and reducing human error. This allows firms to reallocate resources to higher-value strategic tasks. McKinsey projected that automation could increase productivity in financial services by up to 25% by 2025.

Cloud computing provides scalable and cost-effective IT infrastructure, essential for managing large datasets and supporting advanced analytics. The global cloud market was expected to surpass $600 billion in 2024, enabling greater agility and innovation in financial services.

Cybersecurity remains a critical technological factor, with the average cost of a data breach reaching $4.45 million globally in 2023. Robust security measures are vital for protecting sensitive financial data and maintaining client trust.

Legal factors

Mount Logan Capital navigates a stringent regulatory landscape, overseen by bodies like the U.S. Securities and Exchange Commission (SEC) and provincial securities regulators in Canada. Compliance with rules on fair asset valuation, transparent reporting, and robust disclosure is crucial. For instance, the SEC's Regulation S-X governs the form and content of financial statements, impacting how Mount Logan must present its financial health. Failure to adhere can lead to significant fines and reputational damage, as seen in past enforcement actions against financial firms for disclosure violations.

Mount Logan Capital, like all financial institutions, faces significant legal obligations under Anti-Money Laundering (AML) and sanctions laws. Failure to comply can result in severe penalties, including substantial fines and damage to reputation. For instance, in 2023, global AML fines reached a record high, underscoring the increasing regulatory scrutiny.

To mitigate these risks, Mount Logan Capital must maintain rigorous know-your-client (KYC) processes. This involves thoroughly vetting clients and understanding the source of their funds. Ongoing transaction monitoring is also essential to detect and report suspicious activities, ensuring adherence to regulations like those enforced by the Financial Crimes Enforcement Network (FinCEN) in the United States.

Contract law is absolutely fundamental for Mount Logan Capital, given its focus on privately negotiated debt, equity, and real estate investments. These transactions rely heavily on meticulously crafted agreements to define terms, responsibilities, and recourse. For instance, in 2024, the firm likely navigated numerous complex loan covenants and partnership agreements, where enforceability directly impacts capital preservation and return on investment.

Privacy and Data Protection Laws (e.g., GDPR, CCPA)

Mount Logan Capital operates within a landscape increasingly shaped by privacy and data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Given the sensitive financial and personal data the company handles, strict adherence to these regulations is paramount. Failure to comply can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. Similarly, CCPA violations can incur fines of $2,500 per unintentional violation and $7,500 per intentional violation.

Navigating these legal frameworks is essential not only for avoiding costly legal entanglements but also for fostering and maintaining trust with clients and partners. Mount Logan Capital must ensure robust data management practices, transparent data usage policies, and secure data storage solutions to meet these evolving legal requirements. The ongoing global trend towards stronger data privacy protections means that staying ahead of legislative changes and implementing proactive compliance measures are critical business imperatives for the company in 2024 and beyond.

Key considerations for Mount Logan Capital regarding privacy and data protection laws include:

- Data Minimization: Collecting and processing only the data strictly necessary for defined purposes.

- Consent Management: Ensuring clear and informed consent is obtained for data processing activities.

- Data Subject Rights: Facilitating individuals' rights to access, rectify, erase, and port their personal data.

- Security Measures: Implementing appropriate technical and organizational measures to protect data against unauthorized access or breaches.

Tax Laws and Implications

Mount Logan Capital's profitability is directly tied to tax laws. For instance, changes in corporate tax rates, like the potential adjustments debated in 2024 and anticipated for 2025, can alter net earnings. Similarly, shifts in capital gains taxes affect the returns on their investment portfolio, influencing investor decisions.

The company actively tracks tax legislation across its operating regions. For example, the U.S. federal corporate tax rate remains at 21% as of mid-2024, but discussions around potential adjustments continue.

Mount Logan Capital must remain agile, adapting its strategies to comply with and leverage evolving tax regulations. This includes understanding the impact of any new investment tax incentives that might emerge in 2025, which could make certain asset classes more appealing.

Key tax considerations for Mount Logan Capital include:

- Corporate Tax Rate Fluctuations: Monitoring and forecasting impacts of potential changes in national corporate tax rates.

- Capital Gains Tax Impact: Assessing how changes in capital gains tax affect investment valuations and portfolio performance.

- Investment Incentives: Identifying and utilizing any new or existing tax credits or incentives for specific investment types.

- Jurisdictional Tax Laws: Navigating diverse tax regimes across countries where the company operates or invests.

Mount Logan Capital must navigate a complex web of contract law, as its business relies on detailed agreements for debt, equity, and real estate transactions. These contracts, including loan covenants and partnership terms, are critical for capital preservation and ensuring returns, with enforceability being a key concern in 2024 and beyond.

The company is also subject to stringent financial regulations, including those from the SEC and Canadian provincial regulators, requiring adherence to rules on asset valuation and transparent financial reporting. For instance, Regulation S-X dictates the format of financial statements, and non-compliance can lead to substantial penalties, as demonstrated by past enforcement actions against firms for disclosure lapses.

Furthermore, Mount Logan Capital must comply with Anti-Money Laundering (AML) and sanctions laws, with global AML fines reaching record highs in 2023, highlighting increased regulatory scrutiny. Implementing robust know-your-client (KYC) processes and transaction monitoring is essential to detect and report suspicious activities, aligning with regulations enforced by entities like FinCEN.

The firm also faces evolving privacy and data protection laws, such as GDPR and CCPA, which carry significant penalties for non-compliance, including fines up to 4% of global annual turnover for GDPR violations. Maintaining secure data management and transparent data usage policies are critical imperatives for Mount Logan Capital in 2024 and 2025.

Environmental factors

Climate change poses significant risks for Mount Logan Capital, including potential physical damage to real estate holdings from extreme weather events and transition risks for companies in carbon-intensive sectors within its investment portfolio. For instance, a 2024 report indicated that rising global temperatures could lead to increased insurance claims and property devaluation in vulnerable regions.

Conversely, climate change also unlocks substantial opportunities. The global market for green bonds, a key area for sustainable finance, reached an estimated $1 trillion in issuance by early 2025, reflecting growing investor appetite for environmentally sound projects. Mount Logan Capital can capitalize on this trend by strategically investing in sustainable infrastructure, renewable energy projects, and companies developing climate adaptation technologies.

To navigate this complex landscape, Mount Logan Capital must conduct thorough assessments of climate-related risks across its entire investment spectrum. This involves evaluating the physical vulnerabilities of its real estate assets and the transitional risks faced by portfolio companies as regulations and consumer preferences shift towards lower-carbon alternatives. Proactive risk management and strategic allocation towards green investments are crucial for long-term resilience and value creation.

Mount Logan Capital's portfolio companies can face increased operational costs due to resource scarcity, such as water shortages impacting agriculture or manufacturing sectors. For instance, regions with significant agricultural output, where some of Mount Logan's investments might be situated, are increasingly experiencing drought conditions, driving up water prices and affecting crop yields. This directly impacts the profitability and financial health of these businesses.

Environmental events, like extreme weather or geopolitical instability linked to resource control, can cause significant supply chain disruptions. These disruptions can lead to material shortages, increased logistics costs, and delays, negatively affecting asset performance for companies reliant on imported components or raw materials. In 2024, global supply chain resilience remained a key concern, with many industries reporting extended lead times and higher freight costs due to factors like port congestion and material availability issues.

Mount Logan Capital's portfolio companies face increasing pressure from stringent environmental regulations concerning pollution and waste management. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, with significant fines levied for non-compliance. This regulatory landscape directly impacts companies in sectors like manufacturing and real estate, where environmental impact is more pronounced.

The compliance burden can translate into substantial operational costs for Mount Logan Capital's investments, covering areas such as emissions control technology upgrades and waste disposal protocols. Failure to adhere to these rules, which are expected to tighten further through 2025, can result in hefty penalties and severe damage to a company's reputation, potentially affecting its market valuation and access to capital.

Biodiversity Loss and Ecosystem Services

The ongoing decline in biodiversity and the degradation of essential ecosystem services present subtle yet significant long-term economic risks that could indirectly impact Mount Logan Capital. These environmental shifts can erode the productivity and stability of sectors vital to regional economies, such as agriculture and forestry, potentially affecting the value of land-related assets within the company's real estate holdings. For instance, the UN estimates that 75% of terrestrial ecosystems are already significantly degraded, impacting services like pollination and water purification crucial for many industries.

The economic implications of biodiversity loss are multifaceted. Degraded ecosystems can lead to reduced crop yields, increased vulnerability to natural disasters, and diminished appeal for tourism, all of which can indirectly influence regional economic health and, consequently, the performance of investments tied to those regions. For example, a 2024 report by the World Economic Forum highlighted that over half of the world's GDP ($44 trillion) is moderately or highly dependent on nature and its services. This dependency underscores the potential for financial repercussions as ecosystems weaken.

- Economic Impact: Over 50% of global GDP is dependent on nature, with biodiversity loss threatening industries like agriculture, forestry, and tourism.

- Ecosystem Services Degradation: Significant portions of terrestrial ecosystems are degraded, impacting services vital for economic productivity.

- Real Estate Portfolio Risk: Broader environmental trends can affect the value of land-based assets within Mount Logan Capital's real estate investments.

- Indirect Financial Exposure: While not a direct operational factor, systemic environmental degradation poses a risk to regional economic stability and investment performance.

Stakeholder Pressure for Sustainability

Mount Logan Capital faces growing demands from stakeholders, including investors and limited partners, to prioritize environmental sustainability in its operations and investment strategies. This pressure is a significant environmental factor influencing capital allocation and business practices. For instance, in 2024, a significant portion of institutional investors surveyed indicated that environmental, social, and governance (ESG) criteria heavily influence their investment decisions, with over 60% reporting an increase in their ESG focus over the past year.

To thrive in this evolving landscape, Mount Logan Capital must actively showcase its commitment to sustainability. This is not merely about attracting capital; it’s also about bolstering its brand image and aligning with the shifting expectations of the market. Failing to demonstrate this commitment could lead to reputational damage and a disadvantage in securing future funding rounds.

- Investor Scrutiny: Investors are increasingly scrutinizing corporate environmental impact, pushing for transparency and action on climate change.

- Limited Partner Influence: Limited partners, particularly pension funds and endowments, are integrating ESG mandates, influencing capital flow towards sustainable investments.

- Public Perception: Growing public awareness of environmental issues impacts consumer and investor sentiment, indirectly affecting companies' market standing.

- Regulatory Tailwinds: While not directly environmental, evolving regulations around climate disclosure and carbon emissions create an environment where sustainability is a strategic imperative.

Mount Logan Capital is exposed to physical climate risks, such as property damage from extreme weather, which impacted insurance claims globally in 2024. Conversely, the growing green bond market, exceeding $1 trillion in issuance by early 2025, presents opportunities in renewable energy and climate tech investments.

Resource scarcity, like water shortages affecting agricultural regions, can increase operational costs for portfolio companies, impacting profitability. Global supply chains faced disruptions in 2024 due to material shortages and port congestion, increasing logistics costs.

Stringent environmental regulations, like those enforced by the EPA in 2024, require companies to invest in pollution control, increasing operational expenses and compliance burdens. Over half of global GDP, estimated at $44 trillion in 2024, is dependent on nature, highlighting the financial risk of biodiversity loss.

Investor demand for ESG integration is rising, with over 60% of institutional investors increasing their ESG focus in 2024, influencing capital allocation towards sustainable strategies.

| Environmental Factor | Impact on Mount Logan Capital | Data Point/Example |

|---|---|---|

| Climate Change (Physical Risks) | Property damage, increased insurance costs | Rising global temperatures leading to more frequent extreme weather events impacting real estate holdings. |

| Climate Change (Transition Opportunities) | Investment in green finance, renewable energy | Global green bond market issuance reached an estimated $1 trillion by early 2025. |

| Resource Scarcity | Increased operational costs for portfolio companies | Drought conditions driving up water prices in agriculturally significant regions. |

| Supply Chain Disruptions | Material shortages, higher logistics costs | Extended lead times and increased freight costs reported across industries in 2024. |

| Environmental Regulations | Compliance costs, potential fines | EPA enforcement of Clean Air and Water Acts in 2024 led to significant penalties for non-compliance. |

| Biodiversity Loss | Indirect economic risk, impact on nature-dependent industries | Over 50% of global GDP ($44 trillion) is dependent on nature and its services. |

| Stakeholder Pressure (ESG) | Need for sustainable strategies, reputational impact | Over 60% of institutional investors increased their ESG focus in 2024. |

PESTLE Analysis Data Sources

Our Mount Logan Capital PESTLE analysis is built on a foundation of credible data from financial news outlets, regulatory filings, and economic reports. We meticulously gather insights on political stability, economic trends, and technological advancements impacting the financial services sector.