Mount Logan Capital Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mount Logan Capital Bundle

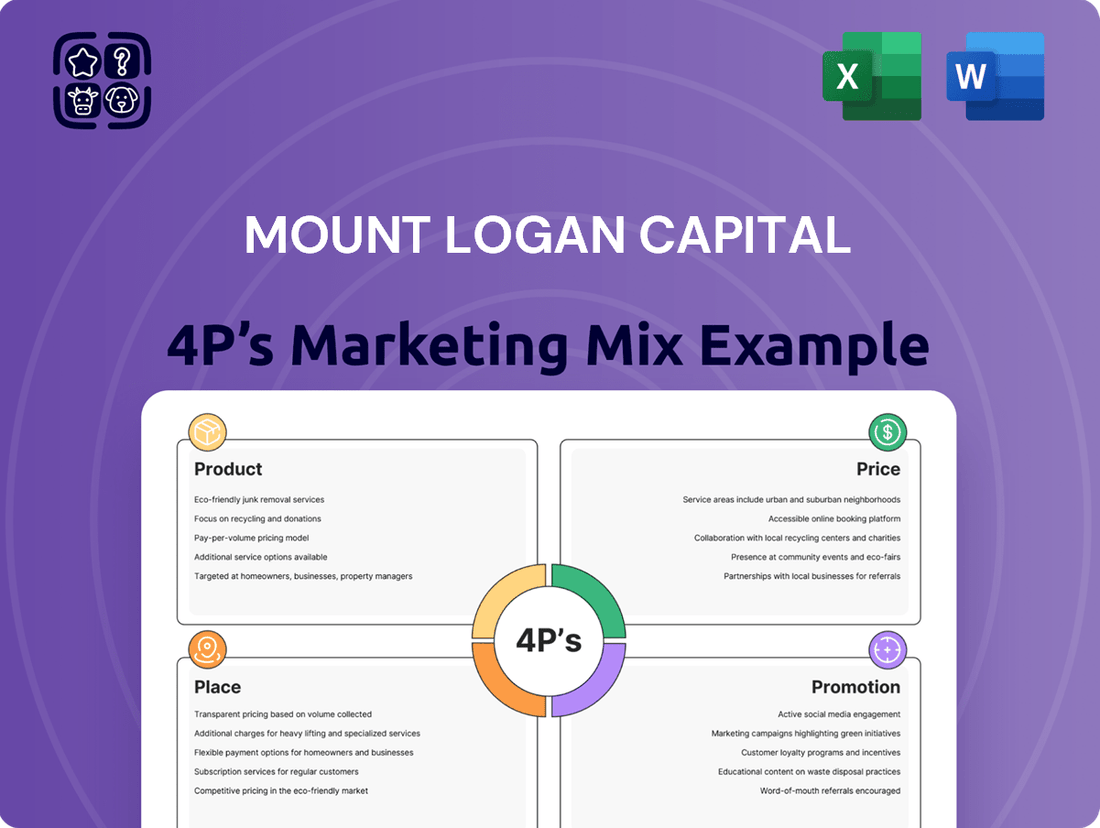

Mount Logan Capital's marketing strategy is a carefully orchestrated blend of innovation and market understanding. Their product offerings are designed to meet specific financial needs, while their pricing structures are competitive yet reflect the value provided. Understanding their distribution channels and promotional activities is key to grasping their market penetration.

Go beyond this snapshot—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Mount Logan Capital. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Mount Logan Capital offers a diverse portfolio of investment products, including privately negotiated debt, equity, and real estate opportunities. These alternative asset exposures are tailored for institutional and high-net-worth investors. For instance, as of the first quarter of 2024, the company reported total assets under management of $1.4 billion, demonstrating significant scale in its diverse offerings.

The company's strategic advantage is built upon its deep expertise in identifying and actively managing investments across a wide array of private and public credit markets. This allows them to navigate complex financial landscapes and source unique opportunities. Their success in 2023 saw them deploy over $300 million in new capital across their credit strategies.

Mount Logan Capital's Specialized Credit Solutions are centered on providing tailored financing through avenues like leveraged loans and opportunistic credit funds. This focus directly addresses market gaps where traditional lending is less active.

A prime example is the Opportunistic Credit Interval Fund (SOFIX). This fund is designed to generate appealing risk-adjusted returns by engaging in private lending, structured equity, specialty lending, and investing in dislocated liquid credit. Its strategy is to actively seek out opportunities in the middle market.

The fund's targeting of the middle market is particularly relevant in the current financial climate. As of early 2024, middle-market companies continue to face challenges accessing capital from traditional banking institutions, creating a fertile ground for specialized lenders like Mount Logan.

This product segment leverages Mount Logan's expertise in identifying and executing on less conventional credit opportunities. By focusing on areas like private lending, the company can offer flexible solutions that cater to specific borrower needs and market inefficiencies.

Mount Logan Capital's proprietary deal sourcing and underwriting process is a cornerstone of its strategy. This comprehensive service actively seeks out investment opportunities, meticulously evaluates them, and then thoroughly underwrites each prospect. This end-to-end approach is designed to ensure that only high-quality deals are considered for both the company's own investments and those managed for its limited partners.

This rigorous, proprietary method acts as a significant competitive advantage in the often crowded alternative asset management sector. By controlling the entire deal pipeline, from initial identification through to final approval, Mount Logan Capital can maintain a disciplined investment approach. For instance, in Q1 2024, the company reported deploying capital into a number of sectors, highlighting the successful execution of this sourcing and underwriting capability.

Asset Management Services for Limited Partners

Beyond direct investments, Mount Logan Capital offers specialized asset management services to its limited partners. This strategic approach focuses on managing diverse investment portfolios, designed to generate consistent management fees and performance-based incentives. For instance, as of Q1 2024, Mount Logan Capital managed approximately $1.3 billion in assets under management across various strategies, with a significant portion attributable to its limited partner services.

The firm's operational efficiency in this segment is bolstered by its wholly-owned subsidiary, Mount Logan Management LLC. This entity is instrumental in advising privately offered investment funds, ensuring a structured and compliant framework for asset management. This subsidiary structure allows for specialized expertise in fund administration and investor relations, crucial for building long-term partnerships.

- Diversified Investment Vehicles: Mount Logan Capital manages a range of investment vehicles tailored to the specific needs and risk appetites of its limited partners.

- Fee Structure: The asset management services generate recurring management fees, providing a stable revenue stream, complemented by performance-based incentive fees that align with investor success.

- Subsidiary Role: Mount Logan Management LLC, a wholly-owned subsidiary, provides dedicated advisory services for privately offered investment funds, enhancing specialized management capabilities.

- Asset Growth: The firm's commitment to its limited partners is reflected in its steady growth in assets under management, which reached $1.3 billion by the first quarter of 2024, indicating strong investor confidence.

Insurance Solutions Platform

Mount Logan Capital's insurance solutions, spearheaded by Ability Insurance Company, represent a crucial element of its marketing mix, specifically within the Product strategy. This segment is dedicated to the reinsurance of annuity products, a specialized area that leverages actuarial expertise and capital management. The platform is designed to offer robust solutions for life insurance companies seeking to manage their risk exposure and capital efficiently. This strategic focus diversifies Mount Logan's revenue streams, complementing its core credit asset management operations.

The insurance solutions platform's product offering is built around managing a substantial portfolio of insurance investment assets. This involves careful selection and management of fixed-income securities and other investments that generate stable returns, aligning with the long-term liabilities of annuity products. As of the first quarter of 2024, Mount Logan Capital reported that its insurance segment contributed significantly to overall earnings stability, demonstrating the value of this diversified approach. For example, the company highlighted its ability to generate consistent income from these assets, which helps to cushion the impact of market volatility in other business segments.

- Product Focus: Reinsurance of annuity products and management of insurance investment assets.

- Subsidiary: Operates primarily through wholly-owned subsidiary Ability Insurance Company.

- Diversification Benefit: Provides a stable earnings platform alongside credit-focused strategies.

- Asset Management: Manages a significant portfolio of insurance investment assets.

Mount Logan Capital's product strategy centers on delivering specialized alternative investment solutions and insurance-related services. Their core offerings include privately negotiated debt and equity opportunities, alongside real estate investments, primarily targeting institutional and high-net-worth clients. A key product is the Opportunistic Credit Interval Fund (SOFIX), which seeks attractive risk-adjusted returns through private lending and dislocated credit investments, focusing on the underserved middle market.

The company also provides asset management services to limited partners through its subsidiary, Mount Logan Management LLC. These services encompass managing diverse portfolios and generating revenue via management and performance fees, with assets under management reaching $1.3 billion by Q1 2024.

Furthermore, Mount Logan Capital leverages its wholly-owned subsidiary, Ability Insurance Company, for its insurance product strategy. This involves the reinsurance of annuity products and the management of insurance investment assets, contributing to earnings stability. As of Q1 2024, the insurance segment demonstrated its value in providing consistent income and cushioning market volatility.

| Product Segment | Key Offerings | Target Audience | As of Q1 2024 Data |

|---|---|---|---|

| Alternative Investments | Privately negotiated debt, equity, real estate | Institutional, High-Net-Worth Investors | Total AUM: $1.4 billion |

| Specialized Credit Solutions | Leveraged loans, opportunistic credit funds (e.g., SOFIX) | Middle-market companies, credit investors | Deployed over $300 million in new capital in 2023 |

| Asset Management Services | Portfolio management for limited partners | Limited Partners (Institutional Investors) | AUM: $1.3 billion |

| Insurance Solutions | Annuity product reinsurance, insurance asset management | Life insurance companies | Contributed to earnings stability |

What is included in the product

This analysis delves into Mount Logan Capital's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to provide a comprehensive understanding of its market positioning.

Simplifies complex marketing strategies into clear, actionable insights, alleviating the pain of information overload.

Provides a concise, visual representation of Mount Logan Capital's 4Ps, easing the burden of strategic communication for busy executives.

Place

Mount Logan Capital prioritizes direct client engagement, fostering strong relationships with institutional investors, high-net-worth individuals, and limited partners. This direct channel allows for the creation of tailored investment solutions, which is especially important in the complex world of alternative investments. For instance, in Q1 2024, Mount Logan reported total assets under management of $1.4 billion, with a significant portion managed directly for key clients.

This hands-on approach facilitates a deeper understanding of client needs and risk appetites, enabling Mount Logan to provide more effective and customized strategies. The company’s investor relations portal serves as a direct conduit for clients, offering immediate access to financial results, performance updates, and other critical information. This transparency reinforces trust and supports the long-term partnerships essential for their business model.

Mount Logan Capital's proprietary origination and network are key differentiators, allowing access to privately negotiated deals. Their association with BC Partners is instrumental in securing attractive investment opportunities, especially within the North American private credit landscape. This robust network taps into opportunities that may not be available through broader market channels.

The management team's deep experience in building and scaling substantial corporate credit platforms underpins the effectiveness of this proprietary approach. For instance, as of Q1 2024, Mount Logan Capital reported a significant portion of its portfolio sourced through these direct relationships, highlighting the tangible benefits of their network and origination capabilities.

Mount Logan Capital prioritizes direct investor engagement through its user-friendly website and dedicated online investor portals. These platforms serve as a central hub for essential information, including quarterly and annual financial reports, investor presentations, and timely news releases. For instance, as of the first quarter of 2024, Mount Logan Capital reported total assets of $746.7 million, providing a clear financial snapshot readily available to stakeholders.

Strategic Partnerships and Mergers

Mount Logan Capital actively cultivates its distribution network through strategic alliances and corporate actions. A prime example is the planned merger with 180 Degree Capital Corp., a move anticipated to elevate Mount Logan's profile with a Nasdaq listing, thereby boosting market visibility and accessibility for investors. This consolidation is a key component of their strategy to broaden their reach and product suite.

Further strengthening its distribution capabilities, Mount Logan Capital has also invested in Runway Growth Capital LLC. This investment diversifies its capital solutions and expands its access to different market segments and client bases, reinforcing its commitment to offering a comprehensive range of financial products.

- Merger with 180 Degree Capital Corp. expected to result in Nasdaq listing.

- Investment in Runway Growth Capital LLC diversifies offerings and distribution.

- Strategic partnerships aim to expand market presence and enhance client access.

- Corporate transactions are a core element of Mount Logan's distribution strategy.

Targeted Custodial and Platform Availability

Mount Logan Capital strategically places its specialized products, like the Opportunistic Credit Interval Fund (SOFIX), on prominent custodial platforms. This move significantly enhances accessibility for a broad investor base, including both retail and institutional clients.

By partnering with major custodians such as Schwab, Fidelity, and Pershing, Mount Logan Capital extends the reach of its unique investment vehicles far beyond direct sales channels. This ensures that investors have convenient access to these offerings through their existing brokerage relationships.

- Broad Custodial Presence: SOFIX is available on platforms including Schwab, Fidelity, and Pershing, increasing investor options.

- Expanded Investor Access: This strategy allows both retail and institutional investors to easily invest in specialized credit strategies.

- Beyond Direct Sales: Targeted platform availability diversifies distribution and captures a wider market share.

Mount Logan Capital's distribution strategy is multi-faceted, focusing on both direct engagement and leveraging established financial infrastructure. Their planned Nasdaq listing via the merger with 180 Degree Capital Corp. is a significant step towards enhancing market visibility and investor accessibility. Furthermore, strategic investments, such as the one in Runway Growth Capital LLC, diversify their offerings and broaden their reach into different market segments.

By placing specialized products like the Opportunistic Credit Interval Fund (SOFIX) on major custodial platforms, including Schwab, Fidelity, and Pershing, Mount Logan Capital ensures wide availability to both retail and institutional investors. This approach significantly expands their distribution beyond direct sales, making their unique investment vehicles readily accessible through existing brokerage relationships.

As of Q1 2024, Mount Logan Capital reported total assets of $746.7 million, a figure that reflects the growing accessibility and adoption of their investment solutions across various distribution channels.

| Distribution Channel | Key Initiatives/Platforms | Impact/Data (as of Q1 2024) |

|---|---|---|

| Direct Engagement | Investor Relations Portal, Direct Client Relationships | Total Assets Under Management: $1.4 billion (reported by Mount Logan Capital) |

| Strategic Partnerships | Investment in Runway Growth Capital LLC | Diversified Capital Solutions, Expanded Market Access |

| Custodial Platforms | Schwab, Fidelity, Pershing (for SOFIX) | Increased Retail and Institutional Investor Access |

| Corporate Actions | Merger with 180 Degree Capital Corp. (planned Nasdaq listing) | Enhanced Market Visibility and Accessibility |

What You Preview Is What You Download

Mount Logan Capital 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Mount Logan Capital's strategic approach to the 4P's: Product, Price, Place, and Promotion. Understand their offerings, pricing strategies, distribution channels, and promotional activities in detail. Gain valuable insights into how Mount Logan Capital positions itself in the market and connects with its target audience.

Promotion

Mount Logan Capital prioritizes transparent communication through strong investor relations, including timely financial reporting and detailed investor presentations. These efforts aim to clearly outline the company's performance, strategic direction, and overall financial stability for both existing and potential investors. Key information is readily accessible via the company's website and official SEDAR+ filings.

In 2024, Mount Logan Capital's commitment to investor relations is evident in its consistent delivery of quarterly financial reports and participation in investor conferences. For instance, their Q1 2024 report highlighted a net income of $12.5 million, demonstrating operational progress. The company also hosted an investor day in April 2024, providing in-depth analysis of their credit portfolio and growth strategies.

Mount Logan Capital actively cultivates its industry standing through robust thought leadership, frequently showcasing the deep expertise of its management. Their involvement with BC Partners, for instance, provides a platform for sharing valuable perspectives on the dynamic private credit market, a sector experiencing significant growth.

By actively participating in key industry conferences and seminars, Mount Logan Capital reinforces its credibility and broadens brand recognition among a discerning investor base. This strategic engagement is crucial for establishing the firm as a trusted authority in alternative asset management, especially as alternative investments continue to gain traction.

For example, in 2024, the alternative investment market saw continued inflows, with private credit specifically attracting substantial capital as investors sought yield amidst fluctuating public markets. Mount Logan's visible presence at events like the ABS East Conference or similar European credit forums in late 2024/early 2025 would directly translate to increased visibility and potential deal flow.

Mount Logan Capital strategically communicates significant corporate actions like its acquisition of 180 Degree Capital Corp. and its investment in Runway Growth Capital. These announcements, primarily through formal press releases and joint statements, are crucial for informing the market.

These communications underscore the strategic advantages, expected growth trajectories, and bolstered capabilities arising from such transactions. For instance, the 180 Degree Capital Corp. deal, announced in October 2022, was framed to highlight synergistic benefits.

By detailing the rationale and expected outcomes, Mount Logan ensures stakeholders, including investors and partners, are kept abreast of pivotal developments that shape the company's future. This transparency builds confidence and supports valuation.

Digital Presence and Content Marketing

Mount Logan Capital cultivates a robust digital footprint, anchored by its corporate website. This platform acts as a primary conduit for disseminating essential information, including recent news, quarterly and annual financial results, and comprehensive investor relations materials. As of their latest filings, the website consistently provides up-to-date data, reflecting their commitment to transparency.

Their content marketing strategy focuses on delivering valuable insights and updates on strategic advancements within the company. By sharing investment perspectives and detailing key developments, Mount Logan Capital effectively engages and informs its target audience of financially literate individuals. This approach is designed to build trust and demonstrate market understanding.

- Website as a Central Hub: The corporate website serves as the primary source for all official company announcements, financial reports, and investor resources, ensuring easy access to critical information.

- Content for Informed Audiences: Strategic development updates and investment insights are shared to attract and educate sophisticated investors and stakeholders.

- Digital Communication Objectives: This digital presence and content strategy directly support Mount Logan Capital's broader communication goals, enhancing brand visibility and stakeholder engagement.

Analyst Coverage and Research Reports

Securing coverage from respected financial analysts and being featured in research reports from firms such as Canaccord Genuity serves as a powerful promotional asset for Mount Logan Capital. This independent analysis lends credibility and broadens the company's reach to a wider investor audience. For instance, Canaccord Genuity initiated coverage on Mount Logan Capital in early 2024, highlighting its diversified credit strategies.

Such positive research coverage acts as a significant catalyst, influencing potential investors' decisions and improving the market's perception of Mount Logan Capital. Analyst reports often delve into key financial metrics and strategic outlooks, providing valuable insights for decision-makers. The inclusion in these reports can directly correlate with increased trading volume and investor interest.

The impact of analyst research is substantial:

- Enhanced Visibility: Reports from established firms expose Mount Logan Capital to institutional and retail investors who rely on expert analysis.

- Credibility Boost: Independent validation from analysts strengthens investor confidence in the company's financial health and growth prospects.

- Valuation Influence: Positive analyst ratings and price targets can directly influence market valuation and investor sentiment.

Mount Logan Capital actively promotes its brand through transparent investor relations, exemplified by its robust quarterly financial reporting and participation in investor conferences throughout 2024. For instance, their Q1 2024 net income of $12.5 million showcased operational strength, and an investor day in April 2024 detailed their credit portfolio. The company also leverages digital platforms, with its website serving as a central hub for financial data and strategic updates, effectively engaging a financially literate audience.

Price

Mount Logan Capital's revenue is heavily reliant on management fees, calculated as a percentage of Assets Under Management (AUM). This pricing strategy ensures a consistent and predictable income stream for their asset management operations.

As of the first quarter of 2024, Mount Logan Capital reported total AUM of approximately $1.2 billion, which forms the base for calculating these crucial management fees. This AUM figure is a key indicator of the scale and success of their investment strategies.

The management fee structure is a cornerstone of the alternative asset management industry, aligning the manager's incentives with the growth and performance of the assets they oversee. This model is widely adopted across various investment vehicles.

While specific fee percentages can vary based on fund mandates and investor agreements, the AUM-based approach provides a transparent and industry-standard method for pricing their services, contributing significantly to their financial stability and growth.

Mount Logan Capital, beyond its management fees, also earns performance-based incentive fees, often called carried interest, on the profits from its successful investments. This structure directly links the company's compensation to the returns it achieves for its investors, creating a powerful alignment of interests.

These performance fees are a crucial component of Mount Logan Capital's revenue stream, particularly when market conditions are favorable and investments generate substantial profits. For example, in the first quarter of 2024, the company reported a notable increase in its incentive fee income, reflecting the positive performance of its investment portfolio during that period.

Mount Logan Capital's insurance segment, spearheaded by Ability Insurance Company, capitalizes on its investment portfolio to generate what it terms 'Spread Related Earnings'. This means the company earns a profit by investing the premiums collected from policyholders and generating returns that exceed the claims and operational costs.

In 2023, Mount Logan Capital reported that its insurance segment, primarily driven by Ability Insurance Company, contributed significantly to its diversified earnings. The spread earned on assets managed within this insurance platform is a key component of its profitability strategy.

This income stream adds a valuable layer of diversification to Mount Logan's overall financial performance, reducing reliance on any single business line. The ability to consistently generate positive spreads is crucial for the long-term health of the insurance operation.

Competitive Pricing & Value Proposition

Mount Logan Capital's pricing strategies are carefully calibrated to align with the distinct value investors receive from its specialized investment opportunities and deep asset management expertise. Their fee structures are designed for competitiveness within the alternative asset management sector, striking a balance between investor appeal and the necessity of covering operational expenses while ensuring profitability. For example, by focusing on unique private credit opportunities, they bolster a value proposition centered on access to differentiated market segments.

The company's approach to pricing reflects a commitment to transparency and a clear understanding of the market landscape. They aim to offer compelling terms that attract sophisticated investors seeking exposure to areas not typically found in traditional markets. This strategy is crucial for capturing market share and building long-term investor relationships.

- Competitive Fee Structures: Mount Logan Capital's fees are benchmarked against industry standards for alternative asset managers, ensuring they are attractive to a discerning investor base.

- Value-Based Pricing: Pricing is intrinsically linked to the perceived value of their specialized investment vehicles and the expertise of their management team.

- Focus on Private Credit: The emphasis on private credit as a core offering supports a value proposition built on access to unique and potentially higher-yielding opportunities.

- Profitability and Operational Viability: Fee arrangements are structured to ensure the company can effectively manage its operations and generate sustainable profits.

Dividend Distributions to Shareholders

Mount Logan Capital prioritizes returning value to its shareholders through regular dividend payouts, specifically quarterly distributions. This practice signals the company's financial health and dedication to rewarding its investors, which in turn can bolster confidence in the stock and enhance its appeal. The company has a track record of steady shareholder distributions.

For instance, as of its most recent filings in late 2024, Mount Logan Capital maintained its quarterly dividend. This consistent payout is a key element in its marketing mix, aiming to attract and retain investors who value reliable income streams. The stability of these distributions reflects positively on the company's operational performance and its ability to generate surplus cash flow.

- Consistent Quarterly Dividends: Mount Logan Capital distributes dividends every quarter.

- Shareholder Value Focus: Dividend payouts demonstrate a commitment to returning capital to investors.

- Investor Confidence: Regular distributions can enhance investor sentiment and stock attractiveness.

- Financial Stability Indicator: Consistent payouts suggest sound financial management and profitability.

Mount Logan Capital's pricing is primarily driven by management fees, a percentage of Assets Under Management (AUM), ensuring stable income. As of Q1 2024, their AUM was approximately $1.2 billion, forming the basis for these fees. They also earn performance-based incentive fees, directly linking compensation to investment returns.

The insurance segment, via Ability Insurance Company, generates 'Spread Related Earnings' by investing premiums. In 2023, this segment significantly contributed to diversified earnings through profitable asset management of insurance capital. Their pricing reflects the value of specialized investment access, particularly in private credit, aiming for competitive terms within the alternative asset management sector.

| Revenue Source | Basis | Q1 2024 Data | 2023 Data Highlight |

|---|---|---|---|

| Management Fees | Percentage of AUM | AUM ~$1.2 billion | Consistent revenue stream |

| Incentive Fees (Carried Interest) | Investment Performance | Notable increase in Q1 2024 | Linked to successful investments |

| Spread Related Earnings (Insurance) | Investment of Premiums | Key contributor to diversified earnings | Profit from investment returns exceeding costs |

4P's Marketing Mix Analysis Data Sources

Our Mount Logan Capital 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official SEC filings, investor relations materials, and company press releases. We also incorporate insights from industry reports and competitive benchmarking to ensure a thorough understanding of their market position and strategies.