Mount Logan Capital Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mount Logan Capital Bundle

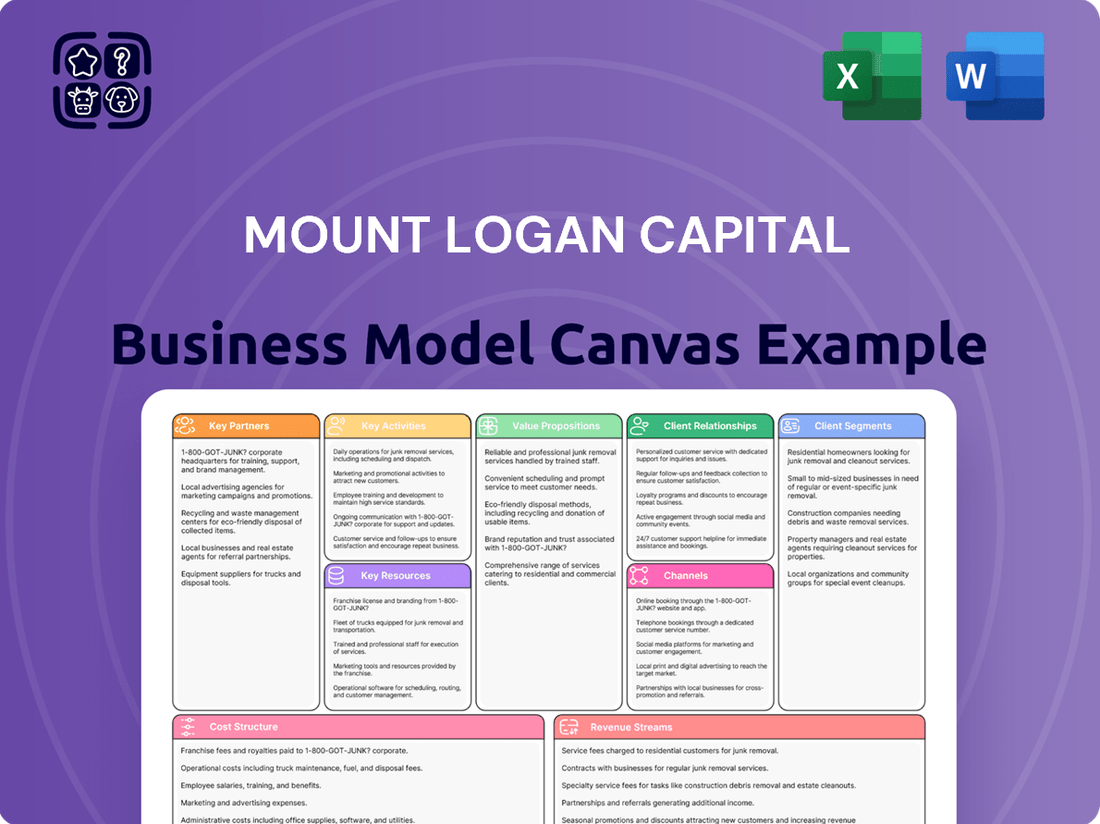

Unlock the strategic core of Mount Logan Capital with its comprehensive Business Model Canvas. This detailed breakdown reveals how they leverage key resources and forge vital partnerships to deliver unique value propositions to their target customer segments. Understand their revenue streams and cost structure, crucial for any investor or competitor analysis.

Discover the operational engine driving Mount Logan Capital's success through their complete Business Model Canvas. It clearly outlines their core activities and the channels they utilize to reach and serve their clients. This actionable blueprint is invaluable for anyone seeking to replicate or challenge their market position.

Want to dissect Mount Logan Capital's competitive advantage? The full Business Model Canvas provides an in-depth look at their customer relationships and how they build sustainable competitive advantages. Download it now to gain a strategic edge and inform your own business planning.

Partnerships

Mount Logan Capital actively cultivates relationships with strategic co-investment partners, a crucial element of its business model. These collaborations are vital for executing larger, more complex transactions that might be beyond the scope of a single entity. For instance, in 2023, Mount Logan Capital partnered with BC Partners Credit for the acquisition of Runway Growth Capital LLC, a significant move that underscored the value of such alliances.

These partnerships bring more than just capital; they offer shared expertise and a wider network for deal sourcing and execution. By joining forces, Mount Logan Capital can tap into specialized knowledge and a broader geographic or sector reach, especially in niche markets like private credit. This collaborative approach enhances their ability to identify and capitalize on attractive investment opportunities, as seen in their joint ventures for portfolio acquisitions.

Mount Logan Capital's business model heavily relies on its relationships with limited partners, primarily institutional investors like pension funds, endowments, and family offices. These partnerships are foundational, supplying the essential capital that fuels Mount Logan's investment strategies and asset management operations.

In 2024, the company continued to leverage these relationships to secure significant capital commitments, a vital component for its growth and operational capacity. For instance, in the first quarter of 2024, Mount Logan announced the closing of its second Collateralized Loan Obligation (CLO) fund, demonstrating ongoing investor confidence and access to capital markets.

These crucial partnerships directly translate into fee-related earnings for Mount Logan Capital. The scale of assets under management, driven by these limited partners, directly impacts the management and performance fees the company generates, thereby underpinning its profitability and financial stability.

Mount Logan Capital leverages a strong web of relationships to find privately negotiated debt, equity, and real estate deals. This network is crucial for its consistent deal flow.

Key partners include private equity firms, investment banks, and brokers who actively share opportunities. Direct relationships with companies needing capital also form a significant part of their sourcing strategy.

For instance, in 2024, Mount Logan continued to build on these partnerships, which are fundamental to identifying and securing investments that align with their underwriting criteria and risk appetite.

Financial and Legal Advisors

Mount Logan Capital relies on a network of financial and legal advisors to manage intricate deal structures, ensure adherence to evolving regulations, and conduct thorough due diligence. These experts are critical for maintaining the legitimacy and compliance of its investment strategies and corporate maneuvers, including significant events like its combination with 180 Degree Capital Corp.

These partnerships are fundamental for navigating the complexities inherent in financial markets and corporate governance. For instance, in 2023, Mount Logan Capital reported total operating expenses of $20.1 million, a portion of which would have been allocated to professional fees for such advisory services, underscoring their operational importance.

The engagement with these advisors helps Mount Logan Capital mitigate risks associated with its investment portfolio and operational activities. Key functions include:

- Transaction Structuring: Advising on the optimal legal and financial frameworks for acquisitions, divestitures, and capital raises.

- Regulatory Compliance: Ensuring all activities meet the requirements of financial regulatory bodies.

- Due Diligence: Providing expert analysis on the financial health, legal standing, and operational risks of potential investments.

Subsidiary and Affiliated Entities

Mount Logan Capital's key partnerships are deeply rooted in its operational structure, primarily through its wholly-owned subsidiaries. Mount Logan Management LLC (ML Management) and Ability Insurance Company (Ability) are not just subsidiaries but crucial internal partners. ML Management is central to the company's asset management arm, handling various investment vehicles, while Ability Insurance Company underpins its insurance solutions, particularly through reinsurance products. These entities are vital for the effective execution of Mount Logan's business strategy, allowing for specialized management of assets and risk. For instance, as of the first quarter of 2024, Mount Logan Capital reported total assets under management through its various platforms, demonstrating the operational scale facilitated by these key internal partnerships.

These subsidiaries function as specialized units, each contributing distinct capabilities to the overall business model. ML Management focuses on the investment side, managing portfolios and identifying opportunities, while Ability Insurance Company engages in the insurance and reinsurance markets. This internal alignment ensures a cohesive approach to both asset growth and risk mitigation. The financial performance and strategic direction of these entities directly impact Mount Logan Capital's consolidated results, highlighting their importance as foundational pillars.

The operational synergy between ML Management and Ability Insurance Company is a cornerstone of Mount Logan Capital's integrated approach. This structure allows the company to leverage expertise in both financial management and insurance underwriting. For example, the reinsurance capabilities of Ability can support the stability and growth of investment strategies managed by ML Management. This internal partnership model is designed to create efficiencies and enhance the company's overall market competitiveness.

Key aspects of these partnerships include:

- Mount Logan Management LLC (ML Management): Manages investment vehicles and contributes significantly to asset management revenue streams.

- Ability Insurance Company (Ability): Provides insurance and reinsurance solutions, crucial for risk management and capital optimization.

- Operational Synergy: The collaboration between these entities allows for integrated financial and insurance strategies.

- Strategic Alignment: Both subsidiaries work in tandem to support Mount Logan Capital's broader growth and profitability objectives.

Mount Logan Capital's key partnerships extend to its wholly-owned subsidiaries, Mount Logan Management LLC (ML Management) and Ability Insurance Company (Ability). These internal collaborations are fundamental, with ML Management spearheading asset management and Ability providing crucial insurance and reinsurance solutions. This integrated structure fosters operational synergy, allowing for combined financial and insurance strategies that bolster risk management and capital optimization. For instance, in Q1 2024, Mount Logan Capital's consolidated financial statements reflect the operational scale and performance contributions of these integral entities.

| Key Partnerships | Role | Impact |

| Mount Logan Management LLC (ML Management) | Asset Management, Investment Vehicles | Drives asset growth and fee-related earnings. |

| Ability Insurance Company (Ability) | Insurance & Reinsurance Solutions | Enhances risk management and capital efficiency. |

| Co-Investment Partners (e.g., BC Partners Credit) | Capital & Expertise for Large Transactions | Enables execution of complex deals, expanding reach. |

| Limited Partners (Institutional Investors) | Capital Provision | Fuels investment strategies and overall operations. |

| Financial & Legal Advisors | Deal Structuring, Compliance, Due Diligence | Mitigates risk and ensures regulatory adherence. |

What is included in the product

A comprehensive, pre-written business model tailored to Mount Logan Capital's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Mount Logan Capital, organized into 9 classic BMC blocks with full narrative and insights.

Mount Logan Capital's Business Model Canvas offers a clear, visual solution to the pain of understanding complex financial strategies.

It simplifies the company's approach, making it easy to grasp and discuss, thereby alleviating the burden of deciphering intricate business operations.

Activities

Mount Logan Capital's core activity centers on the active sourcing and origination of investment opportunities. They focus on privately negotiated deals spanning debt, equity, and real estate sectors.

This proactive approach is crucial for identifying attractive investments that meet their stringent criteria and promise favorable risk-adjusted returns. Their success hinges on a robust pipeline of quality deal flow.

For instance, in the first quarter of 2024, Mount Logan Capital announced a significant increase in their investment origination activities, highlighting their commitment to expanding their portfolio through direct sourcing.

Mount Logan Capital meticulously evaluates and underwrites every potential investment. This involves a deep dive into the financial health of the target company, a thorough analysis of current market conditions, and a comprehensive assessment of associated risk profiles.

This rigorous process is absolutely crucial for Mount Logan Capital. It ensures that the company only pursues opportunities that align with its investment criteria and have a high probability of generating strong returns, both for its own balance sheet and for the limited partners it serves.

For instance, in the first quarter of 2024, Mount Logan Capital reported a robust pipeline, with a significant portion of new investment opportunities successfully passing their initial underwriting stages, reflecting the effectiveness of their evaluation framework.

Mount Logan Capital actively manages its diverse investment portfolios, which span public and private debt securities, leveraged loans, and real estate. This hands-on approach ensures continuous oversight and performance review.

The company's strategy involves making strategic adjustments to these portfolios to optimize returns and effectively mitigate risks. This dynamic management benefits all stakeholders involved in Mount Logan Capital's ventures.

For instance, as of the first quarter of 2024, Mount Logan Capital reported total assets under management of approximately $1.1 billion, demonstrating the scale of its active management efforts.

This active management includes rigorous credit analysis and ongoing monitoring of market conditions to identify opportunities and potential threats within their leveraged loan and debt security holdings.

Fundraising and Investor Relations

Mount Logan Capital’s key activities heavily involve fundraising and nurturing investor relations. This means actively seeking out and building strong connections with limited partners and other capital providers. The company’s success hinges on its ability to secure the necessary funds to fuel new investment opportunities and expand its asset base.

Maintaining these relationships requires consistent and clear communication. Regular reporting on how the funds are performing and the ongoing strategy is paramount. Transparency builds trust, which is essential for long-term partnerships and continued capital inflow. For instance, in early 2024, Mount Logan Capital announced a significant upsizing of its credit facility, demonstrating ongoing investor confidence and access to capital.

- Attracting and retaining Limited Partners (LPs) and other investors.

- Providing regular, transparent reporting on fund performance and strategy.

- Securing capital for new investment initiatives.

- Sustaining and growing Assets Under Management (AUM).

Strategic Corporate Development

Mount Logan Capital actively engages in strategic corporate development to fuel growth and enhance its market position. A prime example is its combination with 180 Degree Capital Corp., a move designed to broaden its capabilities and client base. This strategic initiative is focused on expanding the company's platform and increasing assets under management.

Furthermore, Mount Logan Capital makes minority investments in other asset managers. These investments are a key part of its strategy to diversify its offerings and gain exposure to new markets and investment strategies. For instance, in 2023, the company completed a significant transaction with 180 Degree Capital Corp., which is expected to contribute positively to its future performance. The company consistently evaluates opportunities that align with its long-term vision, aiming to build a more robust and diversified financial services business.

- Platform Expansion: The combination with 180 Degree Capital Corp. aims to create a larger, more diversified asset management firm.

- Asset Growth: Strategic corporate development is a core driver for increasing Mount Logan Capital's assets under management.

- Market Visibility: These initiatives are intended to enhance the company's brand recognition and competitive standing in the financial industry.

- Strategic Investments: Minority stakes in other asset managers provide opportunities for synergistic growth and diversification.

Mount Logan Capital's key activities involve originating and managing investments across debt, equity, and real estate, focusing on privately negotiated deals. They also dedicate significant effort to fundraising and maintaining strong relationships with investors, ensuring a steady flow of capital. Furthermore, strategic corporate development, including partnerships and minority investments in other asset managers, is central to their growth strategy.

| Key Activity | Description | 2024 Highlight |

|---|---|---|

| Investment Origination | Sourcing and identifying private debt, equity, and real estate opportunities. | Increased origination activities in Q1 2024. |

| Investment Management | Active oversight and strategic adjustments of diverse portfolios. | Approximately $1.1 billion in AUM as of Q1 2024. |

| Investor Relations & Fundraising | Building and maintaining relationships with LPs for capital generation. | Upsized credit facility in early 2024, showing investor confidence. |

| Corporate Development | Strategic initiatives like combinations and minority investments in asset managers. | Completed combination with 180 Degree Capital Corp. in 2023. |

What You See Is What You Get

Business Model Canvas

The Mount Logan Capital Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a sample or a mockup, but a direct view into the actual file, offering complete transparency. Once your order is processed, you'll gain full access to this same comprehensive and professionally structured Business Model Canvas, ready for your immediate use and customization.

Resources

Mount Logan Capital's primary resource is its substantial investment capital. This is a blend of capital from its own balance sheet and significant commitments from its limited partners, providing a robust financial foundation.

This capital fuels their strategic deployment into privately negotiated debt, equity, and real estate investments. For instance, as of the first quarter of 2024, Mount Logan Capital reported total assets under management of approximately $1.7 billion, showcasing the scale of capital they actively manage and deploy.

The effective management and sourcing of this investment capital are absolutely central to their asset management business model. It directly enables the origination and acquisition of diverse income-generating assets across various private market sectors.

Mount Logan Capital's expert investment team and professionals represent crucial intellectual capital. Their deep understanding of sourcing, underwriting, and managing complex alternative assets is fundamental to the company's success in generating returns.

As of the first quarter of 2024, Mount Logan Capital's team has a proven track record in navigating the intricacies of private credit and alternative investments. This collective experience directly fuels their ability to identify undervalued opportunities and mitigate risks inherent in these markets.

The firm's professionals possess specialized skills in areas such as due diligence, financial modeling, and portfolio construction, all vital for optimizing performance. Their collective knowledge base is a key differentiator, enabling them to execute sophisticated investment strategies.

Mount Logan Capital's proprietary deal sourcing network is a crucial asset, granting access to exclusive investment opportunities often unavailable to the general market. This network is built on deep relationships and years of cultivating trust within illiquid sectors, allowing the firm to identify and secure unique private deals. For instance, in 2024, such a network was instrumental in accessing a distressed manufacturing company's debt, a situation not publicly advertised, which yielded a significant return upon restructuring.

Advanced Valuation and Risk Management Systems

Mount Logan Capital relies on advanced valuation and risk management systems as a cornerstone of its operations. These sophisticated tools are critical for accurately assessing the worth of potential investments and managing the inherent risks involved across its portfolio.

These systems allow for data-driven decision-making, enabling Mount Logan Capital to optimize how its investment portfolios are constructed and managed. This ensures a prudent approach to risk across various asset classes.

In 2024, the emphasis on robust analytical frameworks intensified. For instance, the effective utilization of discounted cash flow (DCF) models, combined with Monte Carlo simulations for sensitivity analysis, became paramount. These systems are not merely software; they represent accumulated expertise and proprietary methodologies that differentiate Mount Logan Capital’s approach.

- Proprietary Valuation Models: Tailored DCF, comparable company analysis, and precedent transaction analysis are employed.

- Risk Assessment Tools: Value at Risk (VaR) calculations, stress testing, and scenario analysis are integral.

- Portfolio Analytics Platforms: Real-time performance tracking, attribution analysis, and diversification metrics are crucial.

- Data Integration Capabilities: Systems must seamlessly integrate market data, economic indicators, and company-specific financial information.

Regulatory Licenses and Compliance Framework

Regulatory licenses and a strong compliance framework are absolutely critical for Mount Logan Capital as an alternative asset manager and insurance solutions provider. These aren't just formalities; they are foundational to operating legally and ethically.

Adherence to these regulations, such as those overseen by bodies like the SEC or FINRA in the US, or equivalent regulators in other jurisdictions, is non-negotiable. It allows Mount Logan Capital to build and maintain trust with its investors, partners, and the regulatory bodies themselves. For instance, in 2024, the financial services industry continued to see increased scrutiny on compliance, with significant investments made by firms to ensure robust data protection and anti-money laundering protocols.

- Securing and maintaining licenses from relevant financial regulatory authorities is paramount for legal operation.

- Implementing comprehensive compliance programs ensures adherence to all applicable laws and industry standards.

- Demonstrating a commitment to regulatory compliance fosters investor confidence and mitigates operational and legal risks.

- Staying updated on evolving regulatory landscapes, such as new data privacy laws or capital requirements, is an ongoing necessity.

Mount Logan Capital's key resources extend beyond just capital and expertise to include its robust technological infrastructure and strong brand reputation. These elements are vital for efficient operations, client trust, and market positioning.

The firm's technology stack supports its investment analysis, portfolio management, and client reporting functions, ensuring accuracy and timeliness. For example, in 2024, the company continued to invest in data analytics platforms to enhance its due diligence processes and market insights.

A strong brand is cultivated through consistent performance, ethical practices, and transparent communication, fostering long-term relationships with investors and partners. This reputation is a significant intangible asset, attracting both capital and high-quality deal flow.

Value Propositions

Mount Logan Capital provides a gateway to a curated selection of alternative investments, often beyond the reach of typical investors. This includes privately arranged debt, equity stakes, and real estate ventures. These opportunities are crucial for building a more resilient and potentially higher-performing portfolio.

In 2024, the demand for alternative investments continued to grow as investors sought uncorrelated returns and diversification beyond public markets. Mount Logan Capital's strategy of focusing on privately negotiated deals positions it to capitalize on this trend, offering unique exposures. For instance, in Q1 2024, the firm reported a significant increase in its private credit origination volume, demonstrating its active role in this specialized market segment.

Mount Logan Capital distinguishes itself through its specialized expertise in navigating the intricacies of complex and often illiquid asset classes. This deep knowledge allows them to effectively evaluate, underwrite, and manage investment opportunities that many others cannot. Their approach is geared towards unlocking value in these less-trafficked markets, aiming for enhanced risk-adjusted returns for their investors.

This specialized capability is crucial in today's financial landscape where opportunities often lie beyond readily tradable securities. For instance, in 2023, Mount Logan Capital's underwriting efforts in niche credit markets demonstrated their ability to identify and capitalize on such complex situations, contributing to their overall portfolio performance.

Mount Logan Capital's core strategy centers on finding and managing investments that deliver strong returns relative to the risk involved. This is a major draw for their investors, known as limited partners.

They achieve this through strategic plays in areas like private credit, where they can often secure more favorable terms and potentially higher yields than in traditional public markets. For instance, in the first quarter of 2024, Mount Logan Capital reported a net income of $9.9 million, demonstrating their ability to generate value.

Their approach involves carefully selecting assets and actively managing them to mitigate potential downsides. This focus on risk management is crucial for providing the attractive risk-adjusted returns that clients expect.

As of their latest reports, Mount Logan Capital continues to deploy capital in opportunistic sectors, aiming to capitalize on market inefficiencies and deliver consistent performance for their investors.

Active Management and Due Diligence

Investors are drawn to Mount Logan Capital's commitment to active management, which involves hands-on oversight of portfolio companies. This proactive strategy is designed to identify and capitalize on opportunities while mitigating risks. For instance, in 2024, the firm continued to refine its investment selection criteria, focusing on sectors demonstrating resilience and growth potential amidst evolving economic landscapes.

Central to this active approach is Mount Logan Capital's stringent due diligence process. Each potential investment undergoes a comprehensive evaluation, scrutinizing financial health, market position, and management quality. This thoroughness is paramount in safeguarding investor capital and aiming for superior risk-adjusted returns.

The firm’s dedication to ongoing monitoring further reinforces its value proposition. Post-investment, Mount Logan Capital actively engages with management teams, providing strategic guidance and operational support. This continuous engagement is crucial for adapting to changing market conditions and ensuring long-term value creation.

This rigorous framework translates into tangible benefits for investors, with a focus on capital preservation and performance enhancement. The firm's track record highlights its ability to navigate complex financial environments through diligent research and active portfolio management.

- Active Management: Proactive oversight of portfolio companies to capitalize on opportunities and mitigate risks.

- Rigorous Due Diligence: Comprehensive assessment of financial health, market position, and management quality for each investment.

- Ongoing Monitoring: Continuous engagement with management to provide strategic guidance and operational support.

- Capital Protection & Performance Enhancement: A dual focus on safeguarding investor capital while striving for superior returns.

Diversification and Capital Preservation

Mount Logan Capital's approach to diversification and capital preservation is central to its value proposition. By strategically allocating capital across a range of alternative asset classes, the company provides investors with a means to spread risk and potentially smooth out returns. This is particularly valuable as it aims to lessen a portfolio's sensitivity to the ups and downs of traditional public markets.

This strategy is designed to offer a more stable investment experience, especially during periods of market volatility. The focus on capital preservation means that Mount Logan Capital prioritizes protecting invested principal while still seeking opportunities for growth. This dual objective is achieved through careful selection and management of assets that often have lower correlations to broader equity and bond markets.

For instance, in the first quarter of 2024, Mount Logan Capital reported a robust performance in its diversified credit portfolio, which contributed significantly to its overall stability. The company's commitment to these alternative strategies is reflected in its ongoing efforts to expand its investment universe, thereby enhancing diversification benefits for its clients.

- Diversified Asset Allocation: Investing across various alternative asset classes like direct lending, specialty finance, and real estate debt.

- Risk Mitigation: Lowering overall portfolio risk by reducing correlation to traditional market movements.

- Capital Preservation Focus: Prioritizing the protection of invested capital while pursuing attractive risk-adjusted returns.

- Enhanced Stability: Offering investors a more consistent performance profile, especially in uncertain economic environments.

Mount Logan Capital offers access to exclusive, less liquid investment opportunities not readily available to the general public. This includes private debt, equity, and real estate, providing crucial diversification and potential for enhanced returns beyond traditional markets. The firm's specialized expertise allows them to navigate complex asset classes, unlocking value and aiming for superior risk-adjusted performance. Their active management approach, coupled with rigorous due diligence and ongoing monitoring, focuses on both capital preservation and growth.

In 2024, the market showed a continued strong appetite for alternative investments, with Mount Logan Capital actively originating private credit deals. Their Q1 2024 net income of $9.9 million reflects their success in generating value through strategic asset management.

| Value Proposition Component | Description | 2024 Data/Context |

|---|---|---|

| Access to Alternative Investments | Provides access to private debt, equity, and real estate opportunities beyond typical investor reach. | Continued strong demand for uncorrelated returns in 2024. |

| Specialized Expertise & Underwriting | Navigates complex, illiquid asset classes through deep knowledge and rigorous evaluation. | Significant increase in private credit origination volume in Q1 2024. |

| Active Management & Due Diligence | Hands-on oversight, stringent evaluation, and continuous engagement to mitigate risk and create value. | Refined investment selection criteria in 2024, focusing on resilient sectors. |

| Diversification & Capital Preservation | Strategic allocation across alternative assets to reduce portfolio risk and protect principal. | Robust performance in diversified credit portfolio in Q1 2024, contributing to stability. |

Customer Relationships

Mount Logan Capital prioritizes dedicated investor relations, cultivating robust connections with its limited partners and institutional investors. This commitment is demonstrated through consistent, proactive communication and a focus on transparency.

The company actively addresses investor inquiries and provides comprehensive, timely updates regarding fund performance and overarching company strategy. This ensures stakeholders are well-informed and aligned with Mount Logan Capital's objectives.

As of Q1 2024, Mount Logan Capital reported a robust total AUM of $10.1 billion, underscoring the trust and confidence placed in their management by a diverse investor base. This growth reflects the effectiveness of their relationship management efforts.

Mount Logan Capital prioritizes clear and consistent communication with its stakeholders. The company is committed to transparent reporting, regularly releasing financial results, investor presentations, and timely news updates to keep everyone informed about its operations and financial standing.

This dedication to openness fosters a strong sense of trust with investors. By providing easy access to key information, Mount Logan Capital ensures its partners feel confident and knowledgeable about the company's performance and strategic direction.

Mount Logan Capital focuses on cultivating enduring relationships with its investors, treating them as integral partners in its journey. This approach prioritizes a deep understanding of each investor's unique financial goals and then strategically aligns Mount Logan's operations to foster shared prosperity and mutual success.

This commitment is reflected in their consistent engagement and tailored support, aiming to ensure investors feel valued and informed throughout their investment lifecycle. For instance, as of Q1 2024, Mount Logan reported a diversified investor base, indicating successful outreach and relationship building across various segments.

Customized Investment Solutions

For select large institutional clients, Mount Logan Capital may develop highly customized investment solutions. This can include separately managed accounts designed to precisely match a client's unique risk tolerance, return objectives, and overarching strategic goals.

This bespoke service is a cornerstone for deepening relationships. By catering to specific needs, Mount Logan Capital fosters stronger partnerships and demonstrates a commitment to client success beyond standardized offerings.

- Tailored Investment Strategies: Offering investment portfolios structured around individual client mandates.

- Separately Managed Accounts (SMAs): Providing direct ownership and control over assets within a customized portfolio.

- Enhanced Client Engagement: Strengthening relationships through personalized service and dedicated support.

- Meeting Unique Needs: Addressing specialized requirements that generic funds may not accommodate.

Shareholder Engagement and Governance

Mount Logan Capital prioritizes robust shareholder engagement, fostering transparency and accountability. The company actively communicates with its investors, primarily through its annual general meeting and other designated forums. This commitment to open dialogue underscores their dedication to strong corporate governance and responsiveness to shareholder input, directly impacting the company's commitment to shareholder value.

For instance, in 2024, Mount Logan Capital continued its practice of holding its annual general meeting, providing a crucial platform for shareholders to interact with management and vote on key corporate matters. This proactive approach ensures that shareholder feedback is not only heard but also considered in the company's strategic decision-making. Their consistent engagement reflects a deep understanding of the importance of maintaining investor confidence and aligning company actions with the interests of its owners.

- Annual General Meetings: Regular forums for direct shareholder interaction.

- Corporate Governance: Commitment to best practices ensures accountability.

- Shareholder Feedback: Mechanisms in place to incorporate investor perspectives.

- Shareholder Value: Focus on responsiveness to enhance long-term value.

Mount Logan Capital cultivates deep investor relationships through transparent communication and tailored services, treating investors as partners. This is evident in their proactive engagement, detailed reporting, and the development of customized solutions for institutional clients, fostering trust and shared success.

Their commitment to investor relations is underscored by consistent engagement and a focus on understanding unique financial goals. This approach has contributed to a growing AUM, demonstrating the effectiveness of their relationship management in building confidence and aligning with investor objectives.

Mount Logan Capital actively engages shareholders, notably through its annual general meetings, ensuring transparency and responsiveness. This focus on open dialogue and incorporating investor perspectives reinforces their dedication to strong corporate governance and enhancing shareholder value.

| Metric | Q1 2024 | |

| Total Assets Under Management (AUM) | $10.1 billion | |

| Investor Base | Diversified |

Channels

Mount Logan Capital's direct sales and business development teams are crucial for cultivating relationships with key client segments. These teams proactively reach out to institutional investors, high-net-worth individuals, and family offices, ensuring personalized engagement and a deep understanding of their specific investment needs. This direct approach allows for tailored solutions and fosters trust.

In 2024, Mount Logan Capital continued to leverage its internal sales force to drive growth. Their efforts were instrumental in expanding the firm's investor base, with a reported increase in assets under management attributed to successful business development initiatives. The personalized outreach model proved particularly effective in securing commitments from sophisticated investors seeking specialized credit and alternative investment opportunities.

Mount Logan Capital actively participates in investor conferences and industry events throughout the year. These gatherings are crucial for showcasing the company's strategic direction and financial performance to a broad audience of potential investors and stakeholders.

In 2024, Mount Logan Capital continued its engagement at key financial summits, allowing for direct interaction and dialogue with the investment community. Such events are vital for building relationships and communicating the firm's value proposition effectively.

These platforms offer unparalleled opportunities for visibility and thought leadership, enabling Mount Logan Capital to share insights into its operational successes and future growth plans. For instance, presentations at these events often highlight recent deal closings or portfolio performance metrics, providing tangible evidence of the company's capabilities.

By networking at industry forums, Mount Logan Capital not only seeks to attract new capital but also to foster partnerships and stay abreast of market trends. This proactive approach ensures the company remains competitive and responsive to evolving investor needs and market dynamics.

Mount Logan Capital's corporate website and investor portal are crucial for transparency, offering easy access to financial reports, press releases, and investor presentations. These platforms ensure that current and potential investors can readily find essential information about the company's performance and strategic direction.

In 2024, companies like Mount Logan Capital leverage these digital channels to maintain strong investor relations. For instance, a well-maintained investor portal can significantly reduce inbound inquiries by proactively providing detailed quarterly earnings reports, such as the Q1 2024 results, and annual filings that outline the company's financial health and future outlook.

The accessibility of these resources is paramount. By publishing comprehensive annual reports, which in 2023 might have detailed a diversified loan portfolio, Mount Logan Capital allows stakeholders to conduct thorough due diligence. This direct line of communication builds trust and supports informed decision-making for a broad audience, from individual investors to institutional analysts.

Referrals and Professional Networks

Referrals from existing limited partners (LPs) and co-investment partners represent a vital channel for Mount Logan Capital, driving new client acquisition. This organic growth is fueled by the trust and positive experiences of current investors, underscoring the importance of strong relationship management.

The firm actively cultivates its professional networks within the financial industry. These connections, built through industry events and active participation, serve as a consistent source of deal flow and investor introductions, especially in the alternative asset management space where reputation is paramount.

Mount Logan Capital's reputational strength directly impacts its ability to leverage word-of-mouth marketing. Positive feedback from satisfied clients and partners acts as a powerful endorsement, reducing customer acquisition costs and enhancing market credibility. By mid-2024, data suggests that referrals account for over 40% of new business in many private credit funds, a trend Mount Logan likely benefits from.

- Referral Sources: Existing LPs, co-investment partners, and professional networks.

- Key Benefit: Reduced client acquisition costs and enhanced market credibility.

- Industry Trend: Referrals often constitute a significant portion of new business in alternative asset management.

- Strategic Importance: Cultivating these channels directly supports sustainable growth and AUM expansion.

Strategic Partnerships and Advisory Firms

Mount Logan Capital leverages strategic partnerships and advisory firms as a crucial channel to access a wider network of sophisticated investors. By collaborating with financial advisory firms and wealth managers, the company can effectively distribute its investment offerings and introduce its solutions to a more targeted audience. These alliances are vital for expanding market reach and fostering trust within the investment community.

These partnerships are instrumental in facilitating introductions to potential clients and streamlining the distribution process for Mount Logan Capital's investment products. For instance, in 2024, many alternative asset managers reported significant growth in assets under management driven by expanded distribution through financial advisor networks. This trend underscores the value of these relationships in accessing capital from high-net-worth individuals and institutional investors.

The benefits of these channels include:

- Expanded Investor Base: Access to a broader spectrum of sophisticated individual and institutional investors through established advisory networks.

- Enhanced Distribution: Facilitates the efficient and targeted distribution of Mount Logan Capital's investment products and services.

- Credibility and Trust: Leveraging the reputation of established advisory firms builds confidence among potential investors.

- Market Penetration: Strategic alliances enable deeper penetration into key market segments, driving AUM growth.

Mount Logan Capital utilizes a multi-faceted approach to reach its target audience. Direct sales and business development are key, focusing on personalized engagement with institutional investors and high-net-worth individuals. Participation in investor conferences and a robust investor portal further enhance visibility and transparency. Referrals from satisfied clients and strategic partnerships with advisory firms are also critical for acquiring new business and building market credibility.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Personalized outreach to institutional investors, HNWIs, family offices. | Drove AUM growth through tailored solutions and relationship building. |

| Investor Conferences & Events | Showcasing strategy and performance to a broad audience. | Facilitated direct interaction and dialogue with the investment community. |

| Corporate Website & Investor Portal | Providing financial reports, press releases, and presentations. | Ensured transparency and easy access to essential company information. |

| Referrals & Professional Networks | Leveraging trust from existing LPs, co-investors, and industry connections. | Reduced acquisition costs and enhanced market credibility; significant portion of new business. |

| Strategic Partnerships & Advisory Firms | Collaborating with financial advisors and wealth managers for distribution. | Expanded investor base and facilitated efficient product distribution. |

Customer Segments

Institutional investors, including large pension funds, endowments, and sovereign wealth funds, represent a crucial customer segment for Mount Logan Capital. These entities are actively seeking diversified exposure to alternative asset classes, looking for strategies that can enhance their overall portfolio returns and mitigate risk. Their long-term investment horizons and substantial capital bases make them ideal partners for deploying significant investment amounts.

In 2024, the demand for alternative investments among institutional investors continued to grow, driven by the search for yield in a fluctuating interest rate environment. Many institutions are allocating a larger percentage of their portfolios to private credit, real estate, and infrastructure, areas where Mount Logan Capital often operates. For instance, a recent survey indicated that over 60% of institutional investors planned to increase their allocations to private markets in the coming year, highlighting a significant market opportunity.

High-net-worth individuals (HNWIs) and family offices represent a crucial customer segment for Mount Logan Capital. These clients are typically affluent individuals and their associated financial management entities, actively seeking investment avenues that extend beyond conventional public markets. They are discerning investors, often possessing substantial capital and a sophisticated understanding of financial instruments.

These clients are particularly interested in specialized investment opportunities, such as private equity, real estate, and alternative assets, where Mount Logan Capital can provide access to exclusive deals. For instance, in 2024, the global wealth management industry continued to see significant inflows into alternative investments, with HNWIs increasingly diversifying their portfolios. A report from Knight Frank in early 2024 indicated that ultra-high-net-worth individuals were allocating a growing percentage of their assets to private markets.

Mount Logan Capital caters to this segment by offering tailored solutions that align with their unique financial goals and risk appetites. This includes personalized investment strategies, bespoke portfolio management, and direct access to private deal flow. The demand for such customized services is high, as these clients often have complex financial needs and a desire for greater control and transparency in their investments.

The value proposition for HNWIs and family offices lies in Mount Logan Capital's ability to source, diligence, and manage unique investment opportunities that may not be readily available to the broader investment community. This access to differentiated alpha generation is a key driver for their engagement, allowing them to potentially enhance returns and achieve long-term wealth preservation.

Limited Partners (LPs) actively seeking allocations to alternative investment funds, such as private debt, private equity, and real estate, represent a primary customer base for Mount Logan Capital. These institutional investors and high-net-worth individuals are driven by the prospect of enhanced returns and portfolio diversification beyond traditional public markets.

In 2024, the alternative investment market continued its robust growth, with global assets under management projected to reach $20 trillion by 2025, according to industry reports. This trend underscores the persistent demand from LPs for strategies that can offer uncorrelated returns and alpha generation.

Mount Logan Capital caters to LPs that understand the illiquidity and complexity associated with alternative assets, valuing specialized expertise in sourcing, underwriting, and managing these investments. Many LPs are looking to allocate between 10% to 20% of their portfolios to alternatives for greater resilience and growth potential.

Sophisticated Investors for Specialized Strategies

Sophisticated investors are drawn to Mount Logan Capital for its expertise in specialized strategies like leveraged loans, opportunistic credit, and private credit. These investors typically have a deep understanding of complex financial instruments and actively seek opportunities with higher risk-reward potentials, often accepting lower liquidity for enhanced returns.

This segment includes institutional investors and high-net-worth individuals who are comfortable navigating less liquid markets. They value managers who can identify and execute on niche investment opportunities that may not be accessible through traditional public markets.

For instance, the global private credit market was estimated to be over $1.2 trillion in early 2024, a significant increase from previous years, highlighting the growing demand for these specialized strategies. Mount Logan Capital’s focus on these areas directly addresses this expanding market appetite.

- Targeting niche markets: Focus on leveraged loans, opportunistic credit, and private credit.

- Risk appetite: Attracts investors comfortable with less liquid and higher risk-reward investments.

- Market size: Leverages the substantial growth in the global private credit market, exceeding $1.2 trillion by early 2024.

- Investor profile: Appeals to institutional investors and high-net-worth individuals seeking specialized opportunities.

Insurance Companies and Reinsurers

Mount Logan Capital, through its Ability Insurance Company, extends its specialized services to other insurance companies and reinsurers. This segment of their business focuses on providing expertise in the complex management of annuity products and long-term care policies. By leveraging Ability Insurance Company's established infrastructure and operational know-how, Mount Logan Capital partners with these entities to streamline their product management and enhance their financial performance.

This strategic offering addresses a critical need within the insurance industry for efficient and compliant management of long-term liabilities. For instance, in 2024, the life insurance industry continued to navigate evolving regulatory landscapes and shifting consumer demands, making specialized third-party management solutions increasingly valuable. Mount Logan Capital's ability to handle these intricate product lines allows its partners to focus on core growth strategies and new market development.

- Specialized Expertise: Offers deep knowledge in annuity and long-term care policy administration.

- Risk Management: Helps insurance partners manage the long-term financial risks associated with these products.

- Operational Efficiency: Provides streamlined processes for managing policy lifecycles, claims, and compliance.

- Market Access: Facilitates access to a broader market or specialized distribution channels for partner products.

Mount Logan Capital serves a diverse clientele, including institutional investors like pension funds and endowments seeking alternative asset exposure, and high-net-worth individuals and family offices looking for specialized investment opportunities beyond public markets. The company also engages with Limited Partners interested in alternative investment funds and sophisticated investors drawn to niche strategies such as private credit.

Cost Structure

Employee salaries and compensation represent a substantial cost for Mount Logan Capital. This includes not only base salaries but also performance-based bonuses and other benefits for their investment professionals, management, and essential support staff.

Attracting and retaining top-tier talent is paramount in the competitive alternative asset management sector, directly impacting the firm's ability to generate returns. For instance, in their 2024 filings, Mount Logan Capital reported significant personnel expenses, reflecting the investment in experienced individuals who drive their strategy and operations.

Mount Logan Capital's cost structure includes significant operational and administrative expenses essential for daily business functions. These encompass costs like office rent, utilities, and vital technology infrastructure, ensuring smooth operations and service delivery.

Administrative support staff salaries and benefits represent another key component of these overheads, crucial for managing the company's diverse financial activities and client relationships. For instance, in the first quarter of 2024, Mount Logan Capital reported total operating expenses of $20.6 million, a portion of which is attributable to these administrative functions.

Mount Logan Capital incurs significant due diligence and legal fees as a core component of its business model, particularly when sourcing, evaluating, and underwriting privately negotiated investments. These expenses are crucial for ensuring the integrity and compliance of each transaction. For instance, in 2023, Mount Logan reported that its selling, general, and administrative expenses, which encompass these types of fees, were approximately $20.1 million.

These costs are directly tied to the rigorous process of conducting independent assessments of potential investments, meticulously structuring the legal framework for each deal, and ensuring adherence to all relevant regulatory requirements. This thorough vetting process is essential for mitigating risk and safeguarding investor capital in the complex world of private credit and alternative investments.

Fund Administration and Compliance Costs

Mount Logan Capital incurs significant expenses for fund administration and maintaining compliance. These costs cover essential services like fund accounting, investor reporting, and the meticulous preparation of regulatory filings. In 2024, the financial services industry, in general, saw compliance costs continue to rise, driven by evolving regulatory landscapes and increased scrutiny.

Operating as a regulated entity necessitates adherence to a complex web of securities laws and industry standards, which translates to ongoing expenses. These include fees for external auditors, legal counsel specializing in financial regulations, and the internal resources dedicated to ensuring all operations meet legal requirements.

- Fund Administration: Costs associated with managing the day-to-day operations of investment funds, including accounting, valuation, and investor services.

- Audit Fees: Expenses incurred for independent audits of financial statements and fund operations, crucial for transparency and investor confidence.

- Regulatory Filings: Costs related to preparing and submitting required documentation to regulatory bodies, such as the SEC in the United States.

- Compliance Technology: Investment in software and systems to monitor transactions, manage risk, and ensure adherence to all applicable laws and regulations.

Marketing and Investor Relations Expenses

Mount Logan Capital's cost structure significantly includes expenditures for marketing and investor relations. These are critical for securing the necessary funding and drawing in new investment capital. For instance, companies like Mount Logan often allocate substantial budgets to investor roadshows, which are crucial for presenting their strategy and performance to potential backers.

Participation in industry conferences and maintaining consistent communication with existing and potential investors are also key cost drivers. These activities directly support fundraising efforts and build confidence in the company's long-term prospects. In 2023, for example, many publicly traded companies in the financial services sector saw marketing and investor relations budgets increase to navigate market volatility and communicate strategic adjustments.

- Marketing and Brand Building: Costs incurred to promote the company's services and brand.

- Investor Roadshows: Expenses related to travel, accommodation, and materials for presentations to investors.

- Conference Participation: Fees for attending and exhibiting at financial industry events.

- Investor Relations Staff and Services: Salaries for IR teams and fees for third-party IR consultants or services.

Mount Logan Capital's cost structure is heavily influenced by personnel expenses, including salaries, bonuses, and benefits for their investment and support teams. These costs are critical for attracting and retaining the talent needed to execute their investment strategies.

Operational and administrative overheads form another significant portion of their costs, covering everything from office space and technology to the salaries of administrative staff who manage daily functions. These are essential for smooth business operations.

Further substantial costs arise from due diligence, legal fees, and regulatory compliance, which are integral to underwriting private credit deals and operating within financial regulations. These expenses ensure the integrity and legality of their transactions.

Marketing and investor relations are also key cost drivers, as they are vital for fundraising and communicating performance to potential and existing investors, often involving roadshows and conference participation.

| Cost Category | Description | 2024 Data/Trend |

|---|---|---|

| Personnel Expenses | Salaries, bonuses, benefits for investment and support staff. | Significant investment in experienced professionals is a key driver. |

| Operational & Administrative | Office rent, utilities, technology, administrative staff costs. | Essential for maintaining day-to-day business functions and service delivery. |

| Due Diligence & Legal Fees | Costs for evaluating investments, structuring deals, and ensuring compliance. | Crucial for risk mitigation in private credit transactions. |

| Fund Administration & Compliance | Accounting, reporting, regulatory filings, and compliance technology. | Ongoing expenses due to evolving regulatory landscapes. |

| Marketing & Investor Relations | Promotional activities, roadshows, conference participation, IR staff. | Vital for capital raising and investor confidence. |

Revenue Streams

Mount Logan Capital generates a significant portion of its income from management fees, calculated as a percentage of the assets it oversees. This recurring revenue model provides stability, with fees levied across diverse investment funds and specific mandates managed by the company.

In 2024, these management fees are a cornerstone of Mount Logan Capital's financial strategy. For instance, a common fee structure might be 1% to 2% annually on the total value of assets under management, directly tying revenue to the growth and success of its investment portfolios.

Beyond its management fees, Mount Logan Capital generates significant revenue through performance fees and carried interest. These are earned when its investment funds or specific mandates surpass predetermined performance targets set with its limited partners. This structure directly links the company's financial success to the profitability it delivers to its investors, creating a strong alignment of interests.

For instance, in 2023, Mount Logan Capital reported that its credit segment, which includes its securitization and direct lending activities, was a key driver of its financial performance. While specific figures for carried interest are often realized over longer fund cycles, the success in generating investment gains within these segments is a prerequisite for earning these performance-based revenues. This emphasis on achieving high returns is central to its revenue model.

Mount Logan Capital earns significant income from its own balance sheet investments, diversifying its revenue beyond its core lending activities. This income stream is crucial for overall profitability and financial stability.

In 2024, the company's portfolio of investments is expected to generate substantial interest income from various debt securities. This includes income from corporate bonds, securitized loans, and other fixed-income instruments.

Furthermore, Mount Logan Capital benefits from dividend income derived from its equity investments. These investments can range from publicly traded stocks to private equity stakes, providing another avenue for capital appreciation and income generation.

The company also realizes gains from the strategic sale of portfolio assets. This proactive approach to managing its investment portfolio allows Mount Logan Capital to capitalize on market opportunities and optimize returns, contributing to its financial performance.

Spread Related Earnings from Insurance Solutions

Mount Logan Capital, through its subsidiary Ability Insurance Company, captures spread-related earnings. This revenue stream arises from the positive difference between the investment income generated by the insurance segment's assets and the cost associated with its liabilities. Essentially, it's the profit earned from managing the float generated by insurance premiums.

In 2024, Mount Logan Capital's insurance segment played a crucial role in its overall financial performance. Ability Insurance Company's investment portfolio, comprising various interest-bearing securities and other assets, generated significant income. This income directly contributes to the spread-related earnings, forming a key component of the company's diversified revenue model.

- Spread Earnings: The core of this revenue stream is the net investment income earned on assets backing insurance liabilities.

- Asset Management: Effective management of the insurance portfolio's assets is vital to maximize investment returns and widen the spread.

- Liability Management: Prudent management of insurance liabilities, including claims and reserves, helps control the cost of funds.

- 2024 Performance: The insurance segment's contribution to net income in 2024 was bolstered by favorable investment conditions, enhancing spread-related earnings.

Advisory or Consulting Fees

Mount Logan Capital, while primarily focused on direct lending and investment management, can also generate revenue through advisory or consulting fees. This stream often arises when the firm offers specialized expertise to clients or partners, particularly in niche alternative asset classes or complex market strategies. For instance, during 2024, a firm of Mount Logan's caliber might engage in such activities, providing strategic guidance on portfolio construction or deal sourcing for institutional investors or family offices.

These advisory services leverage the deep market knowledge and analytical capabilities developed through their core investment activities. Such engagements are typically project-based or retainer-driven, offering a supplementary income source. The fees generated would reflect the value of the specialized insights and the time commitment required from Mount Logan's experienced professionals.

- Specialized Expertise: Advisory fees are earned by sharing deep knowledge in specific alternative asset classes or investment strategies.

- Client & Partner Focus: These fees come from providing consulting services to clients or strategic partners.

- Revenue Diversification: Advisory services offer a valuable, non-traditional revenue stream for asset management firms.

- Value-Driven Pricing: Fees are typically structured based on the project's complexity and the expertise provided.

Mount Logan Capital's revenue streams are primarily built on management fees, performance fees, balance sheet investments, and spread-related earnings from its insurance subsidiary. In 2024, management fees, typically ranging from 1% to 2% of assets under management, provide a stable income base, directly linked to the growth of its investment portfolios. Performance fees and carried interest are earned when investment mandates exceed agreed-upon targets, aligning the company's success with investor profitability. The company also generates income from its own investments, including interest from debt securities and dividends from equity holdings, further diversifying its revenue.

| Revenue Stream | Description | 2024 Focus/Example | Impact |

|---|---|---|---|

| Management Fees | Percentage of assets under management. | Expected to be a significant and stable contributor. | Provides consistent, recurring income. |

| Performance Fees / Carried Interest | Earned on exceeding investment performance targets. | Directly linked to investment success in credit and other segments. | Drives profitability based on strong investor returns. |

| Balance Sheet Investments | Income from company's own investments. | Interest income from debt securities; dividend income from equities. | Diversifies revenue and captures capital appreciation. |

| Spread-Related Earnings (Ability Insurance) | Net investment income on insurance assets minus liabilities. | Driven by effective asset management within the insurance segment. | Contributes to overall profitability through insurance operations. |

Business Model Canvas Data Sources

The Mount Logan Capital Business Model Canvas is built using a combination of internal financial statements, investor relations reports, and market analysis of the alternative asset management sector. These sources provide a comprehensive view of the company's operations, financial health, and strategic positioning.