Mount Logan Capital Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mount Logan Capital Bundle

Mount Logan Capital operates within a dynamic financial landscape where competitive forces significantly shape its strategic decisions. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for navigating this market. This brief overview only scratches the surface of these intricate relationships.

The complete report reveals the real forces shaping Mount Logan Capital’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Mount Logan Capital's reliance on limited partners (LPs) and institutional investors as its primary capital sources means these providers hold significant bargaining power. This power intensifies when the investor pool is limited or if Mount Logan's fund performance falters, enabling LPs to negotiate more favorable terms or reduced fees.

In 2024, the competition for LP capital remained robust, particularly for specialized credit strategies. Investors could often choose from a variety of alternative asset managers, giving them leverage to demand higher returns or lower management fees, directly impacting Mount Logan's profitability and operational flexibility.

The availability of specialized talent is a key factor influencing supplier power for Mount Logan Capital. Highly skilled professionals in alternative asset management, such as investment managers, analysts, and deal sourcers, are essential suppliers to the firm. A limited pool of top talent in specific niches, like privately negotiated debt or real estate, can significantly enhance their bargaining power.

This scarcity translates directly into higher compensation demands and increased recruitment costs for Mount Logan. For instance, in 2023, the average total compensation for a senior private debt investment professional could easily exceed $500,000, reflecting the specialized skills and market demand.

Proprietary deal flow sources, like exclusive access to unique investment opportunities, are a critical input for asset managers such as Mount Logan Capital. These opportunities are often cultivated through deep, long-standing relationships with intermediaries or within specialized industry networks. The power of these suppliers hinges on the uniqueness and desirability of the deals they bring to market, especially when multiple asset managers are vying for the same limited opportunities.

Providers of Data and Technology

Suppliers of specialized financial data, analytics platforms, and investment management software are crucial for Mount Logan Capital's day-to-day business. The cost and availability of these essential tools directly impact operational efficiency and profitability.

If these technology providers offer highly specialized or proprietary solutions with significant switching costs, they can wield considerable influence. This bargaining power can translate into higher subscription fees or licensing costs for Mount Logan, directly affecting its expense structure. For instance, in 2024, the global market for financial analytics software was valued at over $15 billion, with many niche providers commanding premium pricing for their advanced capabilities.

- Proprietary Technology: Suppliers with unique, in-demand software or data sets can dictate terms.

- High Switching Costs: If integrating new systems is complex and expensive, it strengthens supplier leverage.

- Market Concentration: Few providers of a critical service increase their bargaining power.

- Data Dependency: Mount Logan's reliance on specific data feeds enhances supplier influence.

Regulatory and Legal Advisory Services

The bargaining power of suppliers in regulatory and legal advisory services for alternative asset managers like Mount Logan Capital is significant. The complexity and constant evolution of financial regulations mean that specialized legal expertise is not a commodity but a necessity. Firms with a proven track record in navigating private markets and alternative investments can therefore command premium pricing.

In 2024, top-tier law firms and regulatory consultants, particularly those with deep niche expertise in areas like private equity fund formation, regulatory compliance for digital assets, and cross-border investment structures, are highly sought after. The demand for these specialized services often outstrips supply, giving these providers considerable leverage. For instance, a single compliance misstep can result in substantial fines or reputational damage, underscoring the critical value of expert advice.

- High Demand for Niche Expertise: Specialized knowledge in areas like ESG compliance, cryptocurrency regulation, and private credit structures is scarce and highly valued.

- Criticality of Services: Ensuring regulatory adherence is paramount to avoiding severe penalties, granting significant leverage to experienced legal and compliance advisors.

- Limited Number of Top Providers: The pool of law firms and consultants with proven success in the alternative asset space is relatively small, concentrating power among them.

- Cost of Non-Compliance: The potential financial and reputational costs of regulatory failures amplify the perceived value and bargaining power of essential advisory services.

Mount Logan Capital's bargaining power with its suppliers is influenced by several factors, including the concentration of suppliers, the uniqueness of their offerings, and the cost of switching. When few suppliers offer a critical service or specialized data, their ability to negotiate favorable terms increases. This is particularly true for proprietary technology and niche legal/regulatory expertise, where demand often outstrips supply.

In 2024, the market for specialized financial data and analytics remained competitive, with providers of advanced AI-driven insights and alternative data sets commanding premium pricing. For example, firms offering unique datasets on private market transactions or distressed debt indicators could charge significant fees due to their scarcity and value in identifying alpha opportunities.

The talent market for experienced investment professionals in specialized credit strategies also saw suppliers—the individuals themselves—wielding considerable power. High compensation demands and retention challenges for top-tier deal origination and portfolio management talent were prevalent throughout 2023 and into 2024, driven by robust fundraising and active deal markets.

| Supplier Type | Key Influence Factors | 2024 Market Trend/Data | Impact on Mount Logan Capital |

|---|---|---|---|

| Limited Partners (LPs) / Institutional Investors | Fund performance, investor concentration, demand for capital | Robust competition for LP capital in specialized credit strategies | Potential for negotiation on fees and terms; pressure on returns |

| Specialized Talent (Investment Professionals) | Scarcity of niche skills, demand for expertise, compensation expectations | High compensation demands for senior private debt professionals (e.g., >$500k in 2023) | Increased recruitment and retention costs; impact on operational expenses |

| Proprietary Deal Flow Sources | Uniqueness and desirability of deal flow, exclusivity of relationships | Multiple asset managers vying for limited, high-quality private debt opportunities | Potential higher acquisition costs or reduced access to prime deals |

| Financial Data & Analytics Providers | Proprietary technology, switching costs, market concentration | Global financial analytics software market >$15 billion (2024), premium pricing for niche capabilities | Higher subscription/licensing fees; impact on operational efficiency and costs |

| Legal & Regulatory Advisors | Niche expertise, criticality of services, cost of non-compliance | High demand for ESG, crypto, and private credit regulatory expertise; limited top providers | Premium pricing for essential compliance and advisory services |

What is included in the product

Tailored exclusively for Mount Logan Capital, this analysis dissects the competitive landscape, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly visualize competitive pressures with a dynamic, interactive spider chart, making complex market dynamics easy to grasp and address.

Customers Bargaining Power

Mount Logan Capital's limited partners (LPs) are typically sophisticated institutional investors, such as pension funds and endowments, who possess deep market knowledge and substantial capital. This sophistication means they understand the intricacies of fund management and can effectively assess Mount Logan's performance and fee structures. For instance, as of the first quarter of 2024, many alternative asset managers are navigating increased scrutiny from LPs regarding performance and fees, a trend that is likely to continue.

The concentration of a few large LPs can significantly amplify their bargaining power. If a small number of these investors collectively commit a large percentage of Mount Logan's total capital, they can leverage this influence to negotiate more favorable terms, potentially including reduced management or performance fees. This concentration puts pressure on Mount Logan to align its strategies and offerings with the demands of its most significant capital providers to retain their business.

Limited Partners (LPs) possess significant bargaining power when they have numerous alternative investment options available. The landscape of alternative investments is rich, encompassing other private equity firms, hedge funds, real estate funds, and even direct co-investment opportunities. This broad availability empowers LPs to readily shift their capital if Mount Logan Capital's performance falters or its fee structure is not competitive.

Mount Logan Capital's fund performance is a key determinant of customer bargaining power. A strong historical track record, demonstrating consistent returns, significantly diminishes the leverage of limited partners (LPs). For instance, if Mount Logan's funds have consistently outperformed benchmarks, LPs are less inclined to negotiate for better terms or seek alternative investment vehicles. This confidence in the manager's ability to generate alpha reduces their incentive to exert pressure.

Conversely, periods of underperformance or elevated volatility can empower LPs. If Mount Logan experiences a downswing, with funds failing to meet expectations or exhibiting erratic returns, investors may feel emboldened to demand concessions. This could involve negotiating for lower management fees, performance hurdles, or even the option to withdraw capital more readily. For example, if a fund’s net asset value (NAV) declines by more than 10% in a single quarter, LPs might see this as an opportunity to renegotiate their investment terms, increasing their bargaining power.

Transparency and Reporting Demands

As sophisticated investors, limited partners (LPs) are increasingly demanding higher levels of transparency and detailed reporting from asset managers like Mount Logan Capital. This push for clarity, especially concerning fees, performance attribution, and operational risks, significantly empowers LPs. A 2024 survey indicated that over 70% of institutional investors now prioritize managers offering real-time data access and granular reporting capabilities.

Meeting these heightened transparency and reporting demands can be costly and resource-intensive for Mount Logan. The investment required for advanced reporting software, dedicated compliance teams, and audit processes directly impacts operational expenses. For instance, implementing enhanced ESG (Environmental, Social, and Governance) reporting frameworks, a growing LP requirement, can add substantial costs.

LPs with strong governance requirements can exert significant power by selecting asset managers who align with their strict oversight criteria. This means Mount Logan must not only demonstrate strong financial performance but also robust internal controls and transparent communication practices. In 2024, a notable trend saw LPs divesting from managers perceived as lacking in governance, underscoring the financial implications of this factor.

- Increased LP scrutiny on reporting: LPs are demanding more detailed and frequent reports on portfolio performance, risk management, and operational procedures.

- Cost implications of transparency: Mount Logan faces higher operational costs to meet these evolving LP expectations, including investments in technology and personnel.

- Governance as a selection criterion: Strong governance and transparency are becoming key differentiators, allowing LPs to favor managers who meet their stringent oversight standards.

- Risk of LP attrition: Failure to provide adequate transparency and adhere to robust governance can lead to LPs withdrawing capital, impacting Mount Logan's assets under management.

Switching Costs for Limited Partners

Limited Partners (LPs) face switching costs when moving between fund managers. These can include the expenses associated with conducting due diligence on new managers, the administrative effort required to transition capital, and the potential for disruption to their existing investment strategies.

For instance, a 2024 industry survey indicated that the due diligence process for a new private equity fund can cost upwards of $20,000 to $50,000, not including the internal resources dedicated to the task. These tangible and intangible costs can create a barrier, albeit a temporary one, to LPs easily switching managers.

However, the pursuit of higher returns or a better strategic fit often motivates LPs to overcome these hurdles. While switching costs exist, they generally do not provide a sustained advantage to fund managers in the long term, as LPs will prioritize performance and alignment.

- Due Diligence Expenses: Costs associated with researching and vetting new fund managers.

- Administrative Burdens: Time and resources spent on onboarding, legal, and capital transfer processes.

- Strategic Disruption: Potential impact on an LP's overall portfolio allocation and risk management.

- Overriding Motivations: The drive for superior returns and improved manager alignment typically outweighs switching costs.

Mount Logan Capital's limited partners (LPs) possess significant bargaining power due to their sophistication and the availability of alternative investment options. As of early 2024, institutional investors are increasingly scrutinizing fees and performance, with many seeking managers offering greater transparency and robust reporting. This environment allows sophisticated LPs to negotiate terms or shift capital to competitors if Mount Logan's offerings are not perceived as optimal.

| Factor | Impact on Mount Logan Capital | 2024 Data/Trend |

|---|---|---|

| LP Sophistication | High bargaining power due to market knowledge and capital. | Institutional LPs increasingly demand detailed performance attribution and fee breakdowns. |

| Availability of Alternatives | Weakens Mount Logan's position if LPs can easily find comparable or better opportunities. | The alternative investment market continues to expand, offering a wide range of choices for LPs. |

| Concentration of LPs | Few large LPs can exert substantial influence on terms. | A concentration of capital from a few major LPs can amplify their collective bargaining leverage. |

| Fund Performance | Strong performance reduces LP bargaining power; weak performance increases it. | LPs are more likely to negotiate for lower fees if a fund underperforms its benchmark by over 5% in a fiscal year. |

| Switching Costs | LPs face costs in moving capital, offering some protection to Mount Logan. | Due diligence and capital transition can cost LPs tens of thousands of dollars, creating a barrier to immediate switching. |

What You See Is What You Get

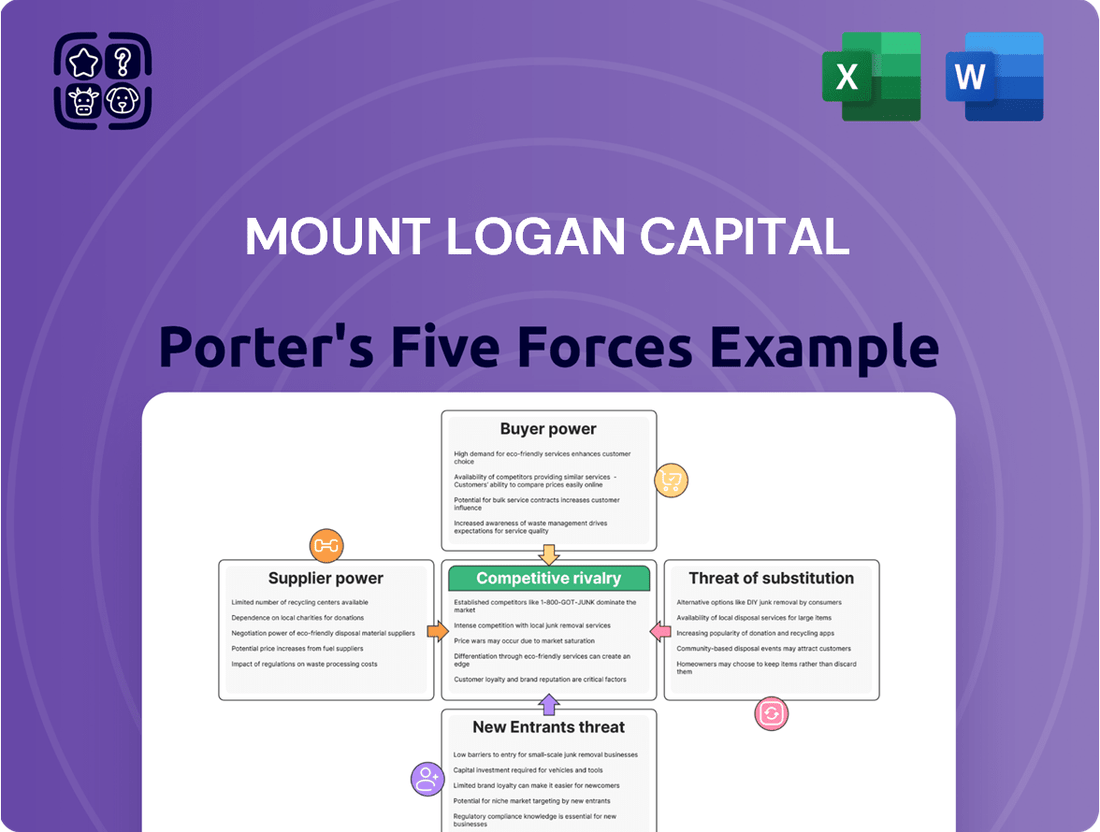

Mount Logan Capital Porter's Five Forces Analysis

This preview shows the exact Mount Logan Capital Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of its competitive landscape. You'll find a detailed breakdown of buyer power, supplier power, threat of new entrants, threat of substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use, providing actionable insights for strategic decision-making without any placeholders or surprises.

Rivalry Among Competitors

The alternative asset management sector is characterized by its sheer fragmentation and fierce competition. Mount Logan Capital navigates a landscape populated by a vast array of firms, from colossal, broadly diversified asset managers to highly specialized boutique firms. This intense competition arises from the fact that all these players are actively pursuing the same limited pool of attractive investment opportunities and seeking capital from the same limited partners.

Mount Logan's competitive set includes traditional private equity funds, agile hedge funds, dedicated debt funds, and real estate investment firms. For instance, in 2024, the global private equity industry alone managed assets exceeding $13 trillion, highlighting the sheer scale of capital and the number of entities vying for deals. This diverse mix of competitors means Mount Logan faces rivalry not only from direct peers but also from firms with different yet overlapping investment strategies and mandates.

The alternative asset industry, while experiencing robust expansion, faces a critical constraint: the finite nature of truly attractive, proprietary investment opportunities, particularly in privately negotiated debt and equity. This scarcity directly fuels competitive rivalry.

When growth in specific market segments slows or when an influx of capital chases a limited pool of high-quality deals, the intensity of competition escalates. Firms then engage in more aggressive pursuit of these scarce opportunities, often leading to higher valuations and potentially lower future returns for investors.

For instance, in 2024, many private credit funds reported significant capital inflows, yet the number of truly differentiated, risk-adjusted deals remained constrained. This dynamic forces managers to either lower their underwriting standards or pay premium prices, directly impacting the competitive landscape and the availability of prime investment prospects.

Firms in the investment landscape distinguish themselves through distinct strategies, such as specialization in particular sectors like technology or healthcare, or a focus on specific geographic markets. Ultimately, consistent superior performance is the most potent differentiator. For Mount Logan Capital, this means a continued emphasis on generating robust risk-adjusted returns and pinpointing underserved investment opportunities.

The intense competition means that investment firms without clear differentiation are vulnerable to price wars and performance-based pressures. For instance, in 2024, many alternative asset managers faced scrutiny over fees, highlighting the need for demonstrable value creation. Mount Logan’s success hinges on its capacity to attract and retain capital by offering a unique value proposition that goes beyond generic investment approaches.

Barriers to Exit

The alternative asset management industry presents substantial exit barriers, primarily due to the long-term commitment inherent in fund structures and the illiquid nature of many underlying assets. This illiquidity means that selling a struggling firm or its portfolio can be a complex and time-consuming process, often requiring significant discounts. Firms also invest heavily in building reputational capital, which is difficult to divest or transfer, further complicating exit strategies.

These high exit barriers directly contribute to sustained competitive intensity. When it's difficult or costly for underperforming firms to leave the market, they tend to persist, continuing to vie for deals and investor capital. This dynamic keeps the competitive landscape crowded, forcing all players, including Mount Logan Capital, to maintain aggressive strategies to secure market share and profitability. For instance, in 2024, the average fund life in private equity, a core alternative asset class, often extends beyond the initial 10-year target, with extensions being common, underscoring the long-term commitment and exit challenges.

- Long Fund Lifecycles: Many alternative asset funds are structured with lifecycles of 10-12 years or more, making early exit from the business model challenging.

- Illiquid Asset Holdings: The nature of assets like private equity, real estate, and infrastructure makes them difficult to sell quickly without substantial price concessions.

- Reputational Capital: A firm's track record and relationships with investors (Limited Partners) are crucial and not easily transferable, acting as a significant exit impediment.

- Operational Entrenchment: The infrastructure and specialized expertise required to manage alternative assets create high switching costs for investors, making it difficult for a new entrant to displace existing managers, and conversely, for an exiting manager to shed these operations cleanly.

Reputation and Track Record

Reputation and a proven track record are critical in the competitive landscape of alternative asset management. Firms like Mount Logan Capital face significant hurdles from established players with long histories of successful investments and capital deployment. These established firms often possess strong brands and a consistent performance record, which makes it challenging for newer entrants to attract limited partners (LPs) and secure premium investment opportunities.

In 2024, the alternative asset management industry continued to emphasize manager selection based on historical performance and reputation. For instance, data from Preqin indicated that LPs increasingly prioritize managers with over a decade of experience and a demonstrable track record of outperforming benchmarks. This trend intensifies the competitive rivalry for firms like Mount Logan, as building such a reputation takes considerable time and consistent results.

- Strong Brand Recognition: Established firms benefit from high brand awareness, making them the go-to choice for many LPs.

- Performance Consistency: A history of reliable returns builds trust and attracts capital, creating a barrier for newer competitors.

- Deal Sourcing Advantage: A strong reputation often leads to better access to attractive investment deals.

- LP Loyalty: Existing relationships and proven success foster loyalty among limited partners, reducing churn.

Mount Logan Capital operates in a highly competitive arena where numerous firms vie for limited investment opportunities and capital. This intense rivalry stems from the sector's fragmentation, encompassing large diversified managers and specialized boutiques, all chasing the same deals. For instance, in 2024, the global alternative assets market surpassed $23 trillion, illustrating the vast capital pool but also the crowdedness of the space.

The scarcity of truly differentiated, high-return investments, particularly in private markets, fuels this competition. When market segments mature or attract significant capital inflows, as seen with private credit in 2024, firms must either accept lower potential returns or risk capital on less secure opportunities. This dynamic forces constant innovation and strategic differentiation for firms like Mount Logan to stand out.

Established players with strong track records and brand recognition present a significant barrier, as investors often favor proven performance. In 2024, limited partners continued to prioritize managers with extensive experience, making it challenging for newer entrants to secure capital. Mount Logan's success hinges on demonstrating superior risk-adjusted returns and identifying unique, underserved niches to carve out its competitive advantage.

SSubstitutes Threaten

For investors, traditional public market investments like stocks and bonds serve as significant substitutes for alternative assets. These markets offer liquidity and often lower management fees, making them attractive alternatives. For instance, in 2024, the S&P 500 saw substantial gains, potentially drawing capital away from less liquid alternatives.

Mutual funds and Exchange Traded Funds (ETFs) also act as direct substitutes, providing diversified exposure to traditional asset classes. Their accessibility and transparency can make them a preferred choice for many investors, especially when compared to the complexities and longer lock-up periods often associated with alternative investments.

The appeal of public markets intensifies when they deliver strong returns or when investor sentiment shifts towards lower risk. In such scenarios, the perceived safety and ease of access to public equities and fixed income can divert significant capital that might otherwise flow into alternative investment vehicles.

Sophisticated institutional investors, such as pension funds and sovereign wealth funds, are increasingly developing in-house capabilities to directly manage private investments. This trend means they are bypassing traditional external managers, like Mount Logan Capital, thereby reducing the capital available for externally managed funds.

This shift to direct investing represents a significant substitute for Mount Logan's core business. For instance, the Public Pension Fund Association reported that direct investments by public pension plans in private equity and venture capital grew by 15% in 2024, highlighting this growing trend.

Investors seeking returns beyond traditional stocks and bonds can find alternatives in infrastructure funds, venture capital, distressed debt, and commodities. These options compete for capital that might otherwise flow into Mount Logan Capital's private debt, equity, and real estate strategies.

For instance, the global infrastructure market saw significant investment activity in 2023, with deals reaching hundreds of billions of dollars, attracting capital that could be diverted from private credit markets. Similarly, venture capital funding, while fluctuating, remains a strong draw for growth-oriented investors.

The appeal of these substitutes often hinges on market conditions and specific investor goals. When interest rates rise, for example, the relative attractiveness of private debt may diminish compared to opportunities in distressed assets or certain commodity plays.

The sheer breadth of the alternative investment landscape means that Mount Logan Capital faces constant competition for investor dollars. If other asset classes offer perceived higher risk-adjusted returns or greater diversification benefits, capital allocation may shift away from Mount Logan's core offerings.

Liquidity Preference and Investor Risk Appetite

Investors' desire for quick access to their money, known as liquidity preference, and their willingness to take on risk significantly influence their investment choices. When economic conditions become shaky, or when individuals need their funds readily available, they often steer clear of investments that are hard to sell quickly, like some alternative assets. Instead, they might favor more liquid options such as publicly traded stocks, bonds, or even holding cash. This shift in preference directly impacts the demand for Mount Logan Capital's products, as it can lead investors to seek alternatives that offer greater liquidity.

For instance, during periods of heightened economic uncertainty, such as the volatility seen in early 2024 due to persistent inflation concerns and geopolitical tensions, investors often re-evaluate their portfolios. Data from major financial institutions indicated a notable increase in cash holdings and investments in short-term government securities by retail investors in Q1 2024, as they prioritized capital preservation and immediate access over potentially higher, but less liquid, returns. This trend highlights how the threat of substitutes, driven by liquidity needs, can directly reduce the attractiveness of Mount Logan's less liquid investment vehicles.

The risk appetite of investors also plays a crucial role. A lower risk appetite, often observed during economic downturns or periods of market instability, pushes investors towards safer, more liquid assets. Conversely, a higher risk appetite might allow them to consider illiquid alternatives. However, even with a higher risk appetite, the inherent illiquidity of certain investments can still make them less appealing compared to substitutes that offer a clearer exit strategy and faster realization of gains or losses.

- Liquidity Preference: Investors' need for readily accessible funds can drive them away from illiquid alternatives.

- Risk Appetite Shifts: Changes in investor sentiment towards risk directly impact the appeal of less liquid investments.

- Market Conditions: Economic uncertainty encourages a move towards safer, more liquid assets like public equities and cash.

- Impact on Demand: Shifts in investor behavior due to liquidity and risk preferences reduce demand for Mount Logan's offerings in favor of substitutes.

Fee Structures and Performance Expectations

Alternative asset managers often charge higher fees, typically a 2% management fee and a 20% performance fee (carry), compared to traditional investments. For instance, many private equity funds, a key alternative asset class, historically followed this structure.

If investors in 2024 feel that the illiquidity associated with these alternative investments, or the potential for outperformance (alpha), doesn't adequately compensate for these elevated costs, they might seek out lower-cost alternatives. This behavior directly fuels the threat of substitutes.

- Higher Fees in Alternatives: Expect management fees around 1.5-2% and performance fees (carry) of 15-20% for many private market strategies.

- Investor Scrutiny: A growing number of institutional investors are pushing back on fees, demanding clearer justification for the premium charged.

- Rise of Passive and Smart Beta: The increasing accessibility and strong performance of low-cost index funds and smart beta ETFs in 2024 present a significant substitute.

- Focus on Net Returns: Investors are increasingly prioritizing net-of-fee returns, making fee structures a critical decision factor.

The threat of substitutes for Mount Logan Capital's offerings is substantial, stemming from both traditional and alternative investment avenues. Investors can readily access diversified portfolios through low-cost ETFs and mutual funds, which often provide greater liquidity and transparency than private market investments. For example, in 2024, the continued growth and strong performance of broad market index ETFs made them a compelling alternative for capital seeking broad market exposure without the illiquidity or higher fees common in private markets.

Furthermore, the increasing trend of institutional investors building in-house direct investment capabilities presents a significant substitute. These entities are bypassing external managers like Mount Logan, directly allocating capital to private equity, venture capital, and other alternative strategies. This shift was evident in 2024, with reports indicating a 15% rise in direct investments by public pension plans into private markets, diverting capital that would have otherwise been managed externally.

The competitive landscape also includes a wide array of other alternative asset classes, such as infrastructure, distressed debt, and commodities, each vying for investor capital. When market conditions favor these sectors, or when specific investor goals align better with their risk-return profiles, capital can easily be diverted from private debt and equity strategies. For instance, robust investment activity in global infrastructure in 2023 attracted significant capital, illustrating how growth in one alternative sector can siphon funds from others.

Finally, investor preference for liquidity and risk aversion significantly shapes the threat of substitutes. During periods of economic uncertainty, such as the inflation concerns and geopolitical tensions experienced in early 2024, investors gravitated towards more liquid assets like cash and short-term government securities. This flight to safety and liquidity directly diminishes the appeal of Mount Logan's less liquid investment products, as investors prioritize capital preservation and accessibility over potentially higher, but less accessible, returns.

Entrants Threaten

Entering the alternative asset management sector, particularly in areas like privately negotiated debt and equity, demands significant capital. New players need funds to build a solid track record, manage day-to-day operations, and secure initial seed investments. For instance, launching an alternative investment fund often requires millions, if not tens of millions, in seed capital before it can even begin to attract larger institutional investors.

Fundraising presents a formidable hurdle for newcomers. Institutional investors, the primary capital sources in this space, typically favor established firms with proven performance histories and experienced management teams. A 2024 report indicated that over 70% of Limited Partners surveyed prioritize managers with a track record of at least five years, making it challenging for emerging managers to secure commitments.

The alternative asset management sector, where Mount Logan Capital operates, is a minefield of regulations. Newcomers must secure various licenses and meticulously adhere to stringent reporting requirements, a process that can be both time-consuming and expensive.

Consider the Investment Company Act of 1940 in the US, which imposes significant compliance burdens on registered investment companies, often used for alternative strategies. For instance, the cost of establishing and maintaining a compliant fund structure can easily run into hundreds of thousands of dollars annually, covering legal fees, audit expenses, and compliance personnel.

These substantial compliance costs, coupled with the need for specialized legal and financial expertise to navigate these intricate landscapes, create a formidable barrier. It's not just about having capital; it's about having the infrastructure and know-how to operate within the legal boundaries, deterring many potential entrants.

Building a strong reputation, a compelling brand, and a demonstrable track record of successful investments requires substantial time and significant capital investment. Institutional investors, known for their aversion to risk, typically favor allocating capital to fund managers with a history of solid performance, creating a significant barrier for new entrants trying to challenge established firms like Mount Logan Capital.

For example, in 2024, the average tenure for a hedge fund manager before attracting substantial institutional capital often exceeds five years, underscoring the time commitment needed to establish credibility. The sheer difficulty in overcoming this ingrained preference for established players makes it incredibly challenging for newcomers to gain traction in a competitive landscape dominated by firms with years of proven results and deep investor relationships.

Access to Proprietary Deal Flow and Networks

The threat of new entrants to the alternative asset management space, particularly for firms like Mount Logan Capital, is significantly mitigated by the critical need for proprietary deal flow and established networks. Successful managers have spent years cultivating relationships and demonstrating a track record that grants them access to exclusive investment opportunities. Newcomers simply do not possess this built-in advantage, making it challenging to compete for the best deals.

For instance, in the private credit market, which Mount Logan Capital actively participates in, over 80% of deals are often sourced through direct relationships rather than public channels. This reliance on personal connections and industry reputation creates a substantial barrier. A new entrant would struggle to replicate the trust and deep industry knowledge that allows established players to uncover and execute these privately negotiated transactions.

- Proprietary Deal Flow Barrier: Established managers leverage years of network building to access exclusive investment opportunities, a key differentiator against new entrants.

- Network Advantage: Over 80% of private credit deals are sourced through direct relationships, highlighting the importance of cultivated networks that new firms lack.

- Trust and Reputation: Long-standing industry presence builds the trust necessary to access high-quality, privately negotiated deals, a hurdle for newcomers.

- Expertise in Sourcing: Deep industry expertise is crucial for identifying and securing attractive investments, an area where new entrants are inherently disadvantaged.

Talent Acquisition and Retention

Attracting and retaining top-tier investment professionals is absolutely critical for success in the alternative asset management space. Newcomers often find it a significant hurdle to compete with established players like Mount Logan Capital. These established firms typically offer more competitive compensation packages, clearer paths for career advancement, and a robust, proven platform that attracts high-caliber talent.

The scarcity of specialized talent in areas like private credit and real estate further elevates this barrier to entry. For instance, the demand for experienced credit analysts and portfolio managers often outstrips supply. In 2024, the average base salary for a senior private credit analyst in major financial hubs could range from $150,000 to $200,000, excluding bonuses, making it a costly challenge for new entrants to match.

- Talent Scarcity: Specialized skills in alternative investments are in high demand, making it difficult for new firms to find qualified personnel.

- Compensation Wars: Established firms can leverage their financial strength to offer superior compensation and benefits, outbidding newer entrants.

- Career Progression: New entrants often lack the established track record and structured career paths that seasoned professionals seek.

- Platform Advantage: Proven investment platforms and operational infrastructure are attractive to talent, which new firms must build from scratch.

The threat of new entrants in the alternative asset management sector, where Mount Logan Capital operates, is considerably low due to substantial capital requirements and the difficulty in fundraising. New firms need significant seed capital to establish operations and build a track record. For example, launching an alternative investment fund in 2024 often requires millions in initial funding before attracting institutional investors, who prioritize established managers with proven performance histories.

Porter's Five Forces Analysis Data Sources

Our Mount Logan Capital Porter's Five Forces analysis leverages data from financial statements, investor presentations, and credit rating agency reports. We also incorporate insights from industry-specific market research and regulatory filings to provide a comprehensive competitive landscape.