Mitsubishi HC Capital PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mitsubishi HC Capital Bundle

Uncover the intricate web of external forces shaping Mitsubishi HC Capital's trajectory. Our PESTLE analysis delves into political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a crucial understanding of these dynamics to refine your strategic planning.

Arm yourself with actionable intelligence on the macro-environmental factors influencing Mitsubishi HC Capital. From navigating international trade policies to adapting to evolving consumer behaviors, our comprehensive report provides the insights you need to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now to secure your competitive advantage.

Political factors

Mitsubishi HC Capital navigates a complex web of government financial regulations, including those concerning lending practices, capital adequacy ratios, and overall financial stability. For instance, in 2024, many jurisdictions are reinforcing capital requirements for financial institutions to withstand economic shocks, potentially increasing compliance burdens.

Shifts in these regulatory landscapes, such as the push for enhanced sustainable finance frameworks or more stringent anti-money laundering protocols, can significantly alter Mitsubishi HC Capital's operating expenses and necessitate strategic adjustments. The global trend towards greater transparency in financial reporting, seen in evolving IFRS standards, directly impacts how the company must present its financial health.

Furthermore, the political stability of the markets where Mitsubishi HC Capital operates plays a crucial role in shaping investment confidence and the efficiency of international transactions. Countries with stable political environments, evidenced by consistent policy implementation and low geopolitical risk, generally offer a more predictable operating environment for multinational financial services firms.

Mitsubishi HC Capital's global leasing operations are directly influenced by international trade policies and geopolitical shifts. For instance, changes in trade agreements, like potential renegotiations of existing pacts or the imposition of new tariffs, can significantly alter the cost and availability of leased assets across borders. This directly impacts their supply chain for equipment and machinery used in global leasing portfolios.

Rising protectionism, evident in various economic blocs in 2024 and projected into 2025, poses a challenge by potentially restricting cross-border capital flows and increasing the complexity of international financing. This can lead to higher operational costs and reduced flexibility in structuring deals for multinational clients.

Geopolitical tensions in key regions where Mitsubishi HC Capital has substantial investments or operational presence can create market instability. For example, heightened tensions in East Asia or ongoing conflicts in Eastern Europe could affect asset values, currency exchange rates, and the overall economic stability of those markets, impacting the company's risk assessment and investment strategies.

The company must continually monitor and adapt to evolving trade landscapes, such as the ongoing adjustments within global supply chains post-pandemic and the strategic economic realignments between major trading partners. These dynamics directly shape the demand for leasing services and the risk profile of cross-border transactions in 2024 and beyond.

Government fiscal policies, such as changes in taxation and public spending, alongside central bank monetary policies like interest rate adjustments, significantly shape the cost of capital and the overall demand for financial services. For instance, the anticipation of a cautious stance on rate cuts by the U.S. Federal Reserve and Bank of Canada through 2025 will directly influence Mitsubishi HC Capital's lending and leasing rates, affecting profitability.

Furthermore, policy shifts, such as potential modifications to bonus depreciation rules in major economies, can materially impact the investment decisions of Mitsubishi HC Capital's clients concerning new equipment acquisitions, thereby influencing the company's leasing and financing volumes.

Support for Green and Sustainable Initiatives

Governments worldwide are increasingly prioritizing sustainability and decarbonization, creating a fertile ground for companies like Mitsubishi HC Capital that focus on green financing. This political emphasis translates into tangible opportunities for the company to expand its offerings in sectors crucial for environmental transition.

Direct government incentives, subsidies, and regulatory mandates aimed at promoting renewable energy projects and the widespread adoption of electric vehicles are significant drivers. For instance, many nations have set ambitious targets for renewable energy deployment, with policies like tax credits and feed-in tariffs directly stimulating investment in solar, wind, and other clean energy sources. The International Energy Agency (IEA) reported in its 2024 outlook that global investment in clean energy is projected to reach new highs, underscoring the policy-driven growth in this area. These initiatives create a strong demand for specialized financial solutions, such as leasing and lending for green assets, which Mitsubishi HC Capital is well-positioned to provide.

- Green Financing Growth: Political drive for decarbonization fuels demand for sustainable financial products.

- Government Incentives: Subsidies and tax credits for renewables and EVs directly boost financing needs.

- Policy Alignment: Mitsubishi HC Capital's focus on green assets matches governmental sustainability agendas.

- Market Expansion: Supportive policies enable the company to tap into rapidly growing green sectors.

Corporate Governance and Transparency Demands

Political landscapes globally are increasingly emphasizing robust corporate governance and transparency. This heightened scrutiny translates into potential new regulations concerning financial disclosures, audit practices, and board diversity mandates. For instance, recent years have seen a push for greater independent oversight on corporate boards, a trend likely to continue into 2024 and 2025.

Mitsubishi HC Capital is proactively addressing these evolving political pressures. Their strategic focus on strengthening the independence and objectivity of their Board of Directors and its various committees demonstrates an alignment with these governance demands. Furthermore, the company’s commitment to transparent financial reporting, including detailed disclosures on executive compensation and risk management, positions them favorably amidst this regulatory evolution.

- Increased Regulatory Focus: Expect stricter rules on board independence and financial reporting in key markets during 2024-2025.

- Board Composition: A growing political emphasis on gender and experience diversity within corporate boards is anticipated.

- Transparency Reporting: Companies will likely face pressure to provide more granular data on ESG performance and supply chain ethics.

- Shareholder Activism: Politically influenced shareholder proposals regarding governance practices are expected to rise.

Political stability is paramount for Mitsubishi HC Capital's international operations, influencing investor confidence and transaction efficiency. Regions with consistent policy and low geopolitical risk provide a more predictable environment for global financial services firms, as seen in 2024.

Trade policies and geopolitical shifts directly impact cross-border leasing, with protectionist trends in 2024 and 2025 potentially restricting capital flows and increasing operational costs for multinational clients.

Government fiscal and monetary policies, such as anticipated cautious interest rate adjustments by major central banks through 2025, directly influence Mitsubishi HC Capital's cost of capital and demand for its services.

Governments are increasingly prioritizing decarbonization, creating opportunities for Mitsubishi HC Capital in green financing, supported by incentives for renewables and EVs, a trend expected to continue through 2025.

What is included in the product

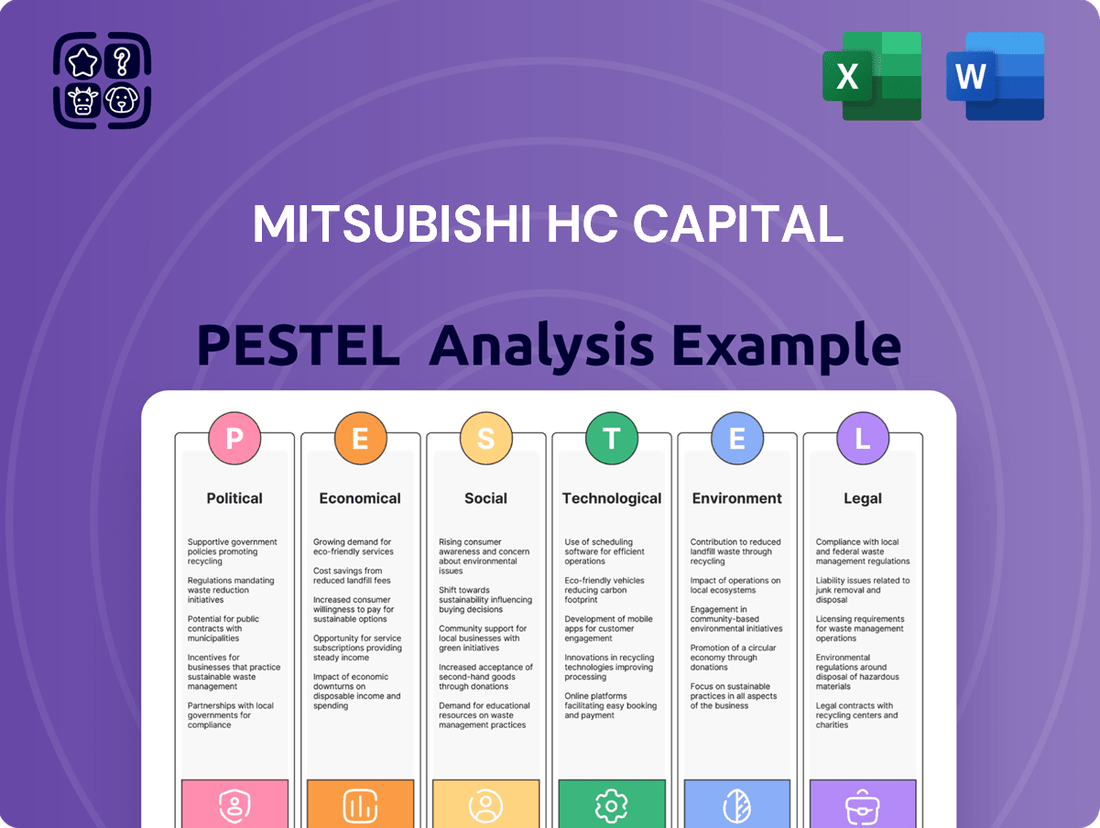

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Mitsubishi HC Capital, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats for the company.

Provides a concise version of the Mitsubishi HC Capital PESTLE Analysis that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting the company.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of the political, economic, social, technological, environmental, and legal landscape for Mitsubishi HC Capital.

Economic factors

Changes in global interest rates directly influence Mitsubishi HC Capital's borrowing expenses and the profitability of its leasing and financing operations. For instance, in the fiscal year ending March 2025, the company reported a notable increase in its interest-bearing debt, which means its exposure to interest rate shifts is significant.

A scenario of rising interest rates, as seen in various global economies throughout 2024 and projected into 2025, typically leads to higher funding costs for Mitsubishi HC Capital. This can put pressure on its profit margins, particularly for longer-term leasing contracts where fixed rates might have been set when borrowing costs were lower.

Conversely, periods of lower interest rates can stimulate demand for new financing and leasing agreements as borrowing becomes more attractive for businesses. However, these lower rates can also compress the returns Mitsubishi HC Capital earns on its investments and financial assets, creating a delicate balancing act for profitability.

The company's financial performance for FY2025, which showed increased revenues and operating income, was achieved alongside this rising interest-bearing debt. This highlights the ongoing challenge of managing funding costs in an environment where interest rate dynamics can quickly impact overall financial health and strategic planning.

The global economic outlook significantly impacts Mitsubishi HC Capital's core businesses. A robust global economy, with projections for continued, albeit moderate, growth in 2025, generally boosts demand for equipment leasing and financial services as businesses invest and expand. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, with a similar pace anticipated for 2025, signaling a supportive environment for capital expenditures.

However, recession risks remain a persistent concern. Should a global downturn materialize, companies might scale back on capital spending, directly reducing demand for leasing solutions and potentially increasing credit risk for Mitsubishi HC Capital. For example, a significant slowdown in major economies like the US or Europe could trigger a contraction in equipment financing volumes, as seen during past economic contractions.

Economic slowdowns also present challenges in asset utilization and recovery. During recessions, leased equipment may be returned prematurely or its resale value diminished, impacting profitability. Conversely, periods of economic expansion, such as the anticipated 2025 growth, tend to stimulate higher volumes of new business and investment, improving asset turnover and financial performance for the company.

Persistent high inflation significantly impacts Mitsubishi HC Capital by diminishing the real value of future lease payments and increasing the cost of acquiring new assets. For instance, if inflation remains elevated in 2024, the profitability of existing long-term leasing contracts could be squeezed, as the fixed payments received would represent less purchasing power. This also complicates the forecasting of residual values for leased assets, a critical component in valuation models.

While the outlook for 2025 suggests a moderation in inflation, with many economic forecasts anticipating a decline from 2024 peaks, the lingering effects of past inflation can still influence asset valuations. For example, if 2024 saw inflation averaging around 3-4% in key operating regions, the discount rates used in discounted cash flow (DCF) analyses for asset valuations would be higher, leading to lower present values. The expectation of lower inflation in 2025, perhaps closer to central bank targets of 2%, would generally support asset valuations by reducing discount rates and improving predictability.

Currency Exchange Rate Volatility

Mitsubishi HC Capital, as a global financial services firm, faces inherent risks from currency exchange rate volatility, especially concerning its international business activities. Fluctuations in currency values can significantly alter the reported worth of overseas assets, debts, and profits when converted back to its reporting currency, the Japanese Yen. For instance, during the first half of fiscal year 2024 (April-September 2024), a weaker Yen against major currencies like the US Dollar and Euro can boost Yen-denominated earnings from overseas operations, while a stronger Yen would have the opposite effect. This dynamic directly impacts the translation of foreign subsidiary financial statements into consolidated results.

The company's broad geographical diversification of earnings sources acts as a natural hedge against the most extreme currency impacts. By operating in numerous markets, Mitsubishi HC Capital can often offset losses in one region due to currency movements with gains in another. However, substantial and rapid shifts in major currency pairs, such as the USD/JPY or EUR/JPY, can still create considerable short-term financial statement distortions. For example, if the Yen strengthens by 5% against the US Dollar, the value of U.S. dollar-denominated assets and earnings would decrease when translated into Yen.

Mitsubishi HC Capital's financial performance is directly tied to these currency movements. Consider the impact on its leasing and credit businesses. If a significant portion of its assets are financed in Japanese Yen but generate revenue in US Dollars, a strengthening Yen would reduce the Yen equivalent of those dollar revenues, impacting profitability. Conversely, a weakening Yen would inflate the Yen value of dollar-denominated income. The company's hedging strategies, employed to mitigate these risks, also come with their own costs and complexities.

- Exposure to Major Currencies: Mitsubishi HC Capital's global operations expose it to significant currency fluctuations, particularly against the US Dollar and Euro, which are key currencies for its overseas earnings.

- Impact on Financial Reporting: Changes in exchange rates directly affect the translation of foreign subsidiary financial statements, impacting reported asset values, liabilities, and profitability in its consolidated Yen-based accounts.

- Geographic Diversification as a Mitigant: The company's wide geographical spread of operations helps to cushion the blow of currency volatility by balancing gains and losses across different currency markets.

- Fiscal Year 2024 Context: During the first half of fiscal year 2024, the performance of Mitsubishi HC Capital was influenced by the prevailing exchange rates, with a weaker Yen generally benefiting its translated overseas profits.

Availability of Credit and Capital Market Conditions

The availability of credit from traditional banking institutions and the overall health of capital markets are crucial for Mitsubishi HC Capital's operational funding and growth strategies. When bank lending becomes more restrictive, especially for small and medium-sized enterprises, it opens doors for alternative financiers like Mitsubishi HC Capital to step in and fill the funding gap. This dynamic can lead to increased demand for their leasing and financing solutions.

Mitsubishi HC Capital has proactively managed its funding by diversifying its sources beyond traditional bank loans. This strategy includes leveraging public markets through various bond issuances across different geographical regions. For instance, in fiscal year 2023, the company issued yen-denominated bonds and also secured funding through overseas markets, demonstrating a commitment to broadening its financial base and reducing reliance on any single funding channel.

- 2024/2025 Credit Availability: Global central banks have maintained relatively stable interest rates through early 2025, though concerns about inflation persist, potentially leading to cautious lending practices from banks.

- Capital Market Diversification: Mitsubishi HC Capital's fiscal year 2023 financial reports indicate successful public debt issuances in Japan, the United States, and Europe, totaling billions of dollars, which strengthens its liquidity position.

- Opportunity in Tightening Credit: As some traditional lenders become more selective, non-bank financial institutions like Mitsubishi HC Capital are well-positioned to capture market share by offering flexible financing to businesses that might otherwise struggle to obtain capital.

- Funding Cost Management: While capital markets offer access to funds, their volatility means Mitsubishi HC Capital must continually monitor interest rate movements and market sentiment to optimize the cost of its financing.

Economic factors significantly shape Mitsubishi HC Capital's operational landscape. Fluctuations in global interest rates directly impact borrowing costs and profitability, with rising rates in 2024 and projected into 2025 increasing funding expenses.

The overall global economic outlook, with moderate growth anticipated for 2025, generally supports demand for leasing and financing, though recession risks remain a concern. Persistent inflation, while expected to moderate in 2025, continues to affect asset valuations and the real value of lease payments.

Currency exchange rate volatility, particularly against the US Dollar and Euro, impacts the translation of overseas earnings, though geographic diversification offers some mitigation. The availability and cost of credit from capital markets are crucial, with Mitsubishi HC Capital diversifying funding sources through bond issuances.

| Economic Factor | 2024/2025 Trend/Impact | Mitsubishi HC Capital Relevance |

| Interest Rates | Generally rising through 2024, stabilizing with potential for moderation in 2025. | Increases borrowing costs, impacts leasing yields. FY2025 debt levels highlight sensitivity. |

| Global Growth | Projected moderate global growth of ~3.2% for 2024 and similar for 2025. | Boosts demand for equipment leasing and financing as businesses invest. |

| Inflation | Elevated in 2024, expected to moderate towards 2% targets in 2025. | Reduces real value of future lease payments; higher discount rates for asset valuation. |

| Currency Exchange Rates | USD/JPY and EUR/JPY volatility impacting translated earnings. Weaker Yen benefited H1 FY2024 overseas profits. | Affects reported value of foreign assets, liabilities, and profits. Diversification provides some hedge. |

| Credit Availability | Cautious lending practices due to inflation concerns, but capital markets remain accessible. | Company diversifies funding via bond issuances (e.g., FY2023 Yen, USD, EUR bonds) to ensure liquidity. |

Preview the Actual Deliverable

Mitsubishi HC Capital PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details a comprehensive PESTLE analysis for Mitsubishi HC Capital, covering Political, Economic, Social, Technological, Legal, and Environmental factors. This in-depth analysis will equip you with crucial insights into the market landscape affecting the company.

Sociological factors

Consumer and business preferences are shifting, moving away from outright ownership towards more flexible financial arrangements. This evolution is evident in the growing interest in subscription services and outcomes-based solutions, which directly influence the demand for traditional leasing and installment sales. For instance, the global subscription economy was projected to reach over $1.5 trillion by 2025, indicating a significant shift in how consumers and businesses access goods and services.

Mitsubishi HC Capital's ability to cater to these changing demands is paramount. By focusing on customized financial solutions, the company can better align with market needs. This includes adapting to the increasing demand for rental equipment, a sector that saw significant growth, with the global equipment rental market valued at approximately $115 billion in 2023 and anticipated to expand further.

Demographic shifts are a significant factor, with the global population getting older. In 2024, approximately 1 in 9 people worldwide were aged 65 and over, a figure projected to rise significantly. This aging trend directly fuels a growing demand for healthcare services and related infrastructure.

This increasing healthcare demand presents a clear opportunity for Mitsubishi HC Capital. The company is well-positioned to offer specialized financing for essential medical equipment, the construction or expansion of healthcare facilities, and various healthcare-related services. For instance, the global medical equipment market was valued at over $500 billion in 2023 and is expected to grow substantially.

The availability of skilled talent, especially in areas like digital transformation (DX) and sustainability, is a critical sociological factor influencing Mitsubishi HC Capital's capacity for innovation and strategic execution. A significant portion of the global workforce, estimated to be over 50% by some projections for 2025, will require reskilling or upskilling to adapt to technological advancements, highlighting a broad challenge.

Mitsubishi HC Capital recognizes this and is actively investing in improving internal DX literacy, a move supported by the fact that companies with higher digital maturity often report stronger financial performance. Addressing potential skill gaps through robust training and talent development programs is therefore essential for the company to maintain its competitive advantage in the dynamic financial sector.

Increased Emphasis on ESG and Social Responsibility

Societal expectations are increasingly shaping business practices, with a significant focus on Environmental, Social, and Governance (ESG) factors. Investors and consumers alike are scrutinizing companies' commitments to sustainability and ethical operations. For Mitsubishi HC Capital, this translates into a heightened responsibility to demonstrate robust ESG performance, influencing both its reputation and access to capital.

The company's active engagement in sustainable finance and its dedication to fostering diversity and respecting human rights are direct responses to these growing societal demands. These initiatives are not merely compliance measures but are integral to building trust and long-term value. For instance, Mitsubishi HC Capital's participation in initiatives like the UN Principles for Responsible Investment (PRI) underscores its commitment to integrating ESG considerations into its investment strategies.

Mitsubishi HC Capital's efforts in community engagement further solidify its social responsibility. By supporting local communities and engaging in philanthropic activities, the company aligns its operations with broader social well-being. This approach is critical in a landscape where corporate citizenship is as important as financial returns.

- Growing Investor Demand: Global ESG assets under management are projected to reach $50 trillion by 2025, highlighting the financial imperative for companies like Mitsubishi HC Capital to prioritize ESG.

- Reputational Impact: Strong ESG performance can enhance brand image and customer loyalty, while poor performance can lead to significant reputational damage.

- Human Rights Focus: Mitsubishi HC Capital's commitment to upholding human rights throughout its value chain is a key component of its social license to operate.

- Diversity and Inclusion: Embracing diversity within its workforce and leadership is crucial for innovation and reflecting the broader societal makeup.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, creating a significant demand for infrastructure development, real estate, and improved mobility solutions. As of 2024, projections indicate that over 60% of the world's population lives in urban areas, a figure expected to rise to nearly 70% by 2050. This trend directly fuels the need for financing in construction, transportation networks, and housing, areas where Mitsubishi HC Capital can leverage its expertise.

Mitsubishi HC Capital's strategic positioning within the real estate and logistics sectors allows it to directly benefit from these urbanization trends. The company’s commitment to addressing societal challenges through its business operations aligns perfectly with the opportunities presented by urban growth and renewal initiatives. By providing essential financing, Mitsubishi HC Capital can play a crucial role in supporting the development of smart cities and sustainable urban environments.

- Urban Population Growth: The UN estimates that by 2050, 68% of the world's population will reside in urban areas, up from 56% in 2021.

- Infrastructure Investment Needs: Global infrastructure investment is projected to reach $94 trillion by 2040, with a significant portion dedicated to urban development.

- Real Estate Market Dynamics: Urbanization drives demand for residential, commercial, and industrial real estate, impacting rental yields and property values.

- Logistics and Supply Chain Efficiency: Expanding urban centers require robust logistics and supply chain networks, creating opportunities for financing in warehousing and transportation.

Societal values increasingly prioritize flexibility and access over ownership, driving demand for leasing and subscription models. The global subscription economy's projected growth to over $1.5 trillion by 2025 underscores this shift, directly impacting Mitsubishi HC Capital's service offerings.

An aging global population, with roughly 1 in 9 people aged 65+ in 2024, fuels demand for healthcare services and related financing. Mitsubishi HC Capital is positioned to capitalize on this by financing essential medical equipment and healthcare facilities, a market valued at over $500 billion in 2023.

Societal expectations around ESG are paramount; global ESG assets under management are expected to reach $50 trillion by 2025, making robust ESG performance crucial for Mitsubishi HC Capital's reputation and capital access.

Urbanization trends, with over 60% of the global population in urban areas in 2024, necessitate infrastructure development and create opportunities for Mitsubishi HC Capital in real estate and logistics financing, aligning with a projected global infrastructure investment need of $94 trillion by 2040.

| Sociological Factor | Trend/Impact | Mitsubishi HC Capital Relevance |

|---|---|---|

| Shift to Access Economy | Subscription economy projected to exceed $1.5T by 2025. | Adaptation of leasing and flexible financing solutions. |

| Aging Population | 1 in 9 globally aged 65+ in 2024; growing healthcare demand. | Financing opportunities in medical equipment ($500B+ market in 2023). |

| ESG Expectations | ESG AUM to reach $50T by 2025; reputational impact. | Prioritizing sustainable finance and corporate citizenship. |

| Urbanization | 60%+ global population urbanized (2024); $94T infrastructure investment needed by 2040. | Leveraging real estate and logistics financing expertise. |

Technological factors

The financial services sector is undergoing a profound digital transformation, pushing companies like Mitsubishi HC Capital to invest heavily in new technologies. This shift is critical for remaining competitive and meeting evolving customer expectations.

Mitsubishi HC Capital is actively embracing this digital wave, notably through upgrades to its Propel platform. Enhancements include the integration of eNotary capabilities and a greater reliance on e-documents, all aimed at making transactions smoother and improving how clients manage their portfolios.

These digital initiatives are designed to streamline internal operations and create a more efficient, user-friendly experience for customers. By embracing digital tools, the company is positioning itself for greater agility in a rapidly changing market landscape.

As financial transactions increasingly shift online, Mitsubishi HC Capital faces growing cybersecurity risks, making the protection of sensitive customer data paramount. In 2024, the global average cost of a data breach reached an all-time high of $4.73 million, highlighting the significant financial implications of inadequate security. Robust cybersecurity measures and strict adherence to data privacy regulations, such as GDPR and CCPA, are essential for maintaining customer trust and preventing financial crime.

Mitsubishi HC Capital actively provides guidance to its customers on best practices for safeguarding themselves against financial crime, including phishing scams and identity theft. This proactive approach is crucial, especially as cyber threats evolve. For instance, ransomware attacks, a major concern in 2024, continue to target financial institutions, demanding substantial payouts and disrupting operations.

The increasing adoption of AI and machine learning presents significant opportunities for Mitsubishi HC Capital. These technologies can bolster credit assessment accuracy, streamline operational efficiencies, and drive the creation of innovative financial products. For instance, AI-powered analytics can process vast datasets to identify subtle risk patterns, potentially improving loan portfolio performance.

Mitsubishi HC Capital America's commentary on the financing needs for AI and supercomputing underscores a dual aspect: a burgeoning market for these advanced technologies and a clear internal imperative for their adoption. This suggests that the company is not only positioned to finance the growth of AI-driven industries but also to leverage these tools internally to gain a competitive edge.

By integrating AI and ML, Mitsubishi HC Capital can anticipate enhanced risk management and more personalized customer offerings. The global AI market, projected to reach hundreds of billions of dollars in the coming years, signifies a dynamic landscape where technological prowess directly translates to market share and profitability.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) hold the potential to reshape financial operations, introducing enhanced transparency, robust security, and improved efficiency in transactions. Mitsubishi HC Capital must actively track and potentially integrate these burgeoning technologies to maintain its competitive edge in evolving markets, particularly concerning asset tokenization, smart contracts, and international payment systems. The company's strategic exploration of novel business models directly intersects with these technological advancements, suggesting a proactive stance towards leveraging DLT for future growth and operational streamlining.

The global market for blockchain technology is projected to reach substantial figures, indicating a significant shift towards its adoption across various industries. For instance, the blockchain market size was valued at approximately USD 12.76 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 43.3% from 2024 to 2030, according to Grand View Research. This rapid expansion underscores the transformative impact blockchain is poised to have on financial services.

- Asset Tokenization: DLT can enable the creation of digital tokens representing real-world assets, potentially unlocking new investment avenues and liquidity for Mitsubishi HC Capital's portfolio.

- Smart Contracts: Automation of contractual agreements through smart contracts can streamline lease agreements and other financial processes, reducing administrative overhead and potential for error.

- Cross-Border Payments: Blockchain-based solutions can offer faster and more cost-effective cross-border payment mechanisms, a key area for global financial institutions like Mitsubishi HC Capital.

- Transparency and Security: The inherent features of DLT provide an immutable and transparent record of transactions, enhancing trust and security in financial dealings.

Impact of Technology on Diverse Sectors

Technological advancements are fundamentally reshaping industries where Mitsubishi HC Capital offers financing, including healthcare with the rise of digital health solutions, and mobility with the rapid adoption of electric vehicles (EVs) and autonomous driving systems. The construction sector is also seeing significant transformation through building information modeling (BIM), drone technology for site surveys, and increased robotics adoption. Mitsubishi HC Capital's success hinges on its capacity to grasp and finance these innovations within its client base, allowing it to provide tailored financial solutions for evolving market needs.

For instance, the global digital health market was projected to reach over $660 billion by 2025, showcasing the immense financing opportunities in this tech-driven healthcare segment. Similarly, the EV market is expected to see continued exponential growth, with projections indicating over 30% of new vehicle sales could be electric by 2030. In construction, the adoption of BIM is becoming a standard, with studies suggesting it can reduce project costs by up to 10% and improve efficiency. Mitsubishi HC Capital's strategic alignment with these technological shifts ensures its relevance and competitive edge.

- Digital Health Market Growth: Forecasted to exceed $660 billion by 2025, presenting significant financing avenues.

- EV Adoption Surge: Anticipated to account for over 30% of new vehicle sales by 2030.

- BIM Efficiency Gains: Potential for up to 10% cost reduction and improved project delivery in construction.

- Robotics in Construction: Increasing deployment for enhanced safety and productivity on job sites.

Mitsubishi HC Capital's strategic investments in digital platforms like Propel, incorporating eNotary and e-documents, are enhancing operational efficiency and customer experience. The company is also leveraging AI and machine learning for improved credit assessment and product innovation, reflecting a commitment to harnessing advanced technologies for competitive advantage. Furthermore, the exploration of blockchain and DLT for asset tokenization and efficient cross-border payments signals a forward-looking approach to financial services. These technological adaptations are crucial for navigating the evolving financial landscape and meeting the demands of an increasingly digital-first market.

Legal factors

Mitsubishi HC Capital navigates a global landscape of financial regulations, including stringent anti-money laundering (AML) protocols and robust consumer protection laws. Failure to comply, as seen with other major financial institutions facing multi-million dollar penalties in 2024 for AML lapses, can lead to severe financial penalties and irreparable reputational harm.

The company's commitment to adhering to these evolving legal frameworks is crucial for maintaining operational integrity and stakeholder trust. For instance, capital adequacy requirements, such as those mandated by Basel III standards, directly impact the company's lending capacity and risk management strategies, with global banks collectively holding over $2 trillion in Tier 1 capital as of early 2025.

Stricter data privacy laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly impact how Mitsubishi HC Capital handles customer information. Compliance requires meticulous attention to data collection, storage, and processing protocols across all digital touchpoints. Failing to adhere can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Mitsubishi HC Capital's commitment to enhancing digital security features is crucial for navigating these complex legal landscapes and safeguarding customer trust, particularly as digital transactions and data usage continue to grow.

Mitsubishi HC Capital's leasing and installment sales operations are fundamentally shaped by contract law and specific leasing regulations. These legal structures define the parameters of agreements, outlining the rights and responsibilities of both the lessor and lessee, as well as the processes for reclaiming assets if a contract is breached. For instance, in the United States, the Uniform Commercial Code (UCC) provides a foundational framework for secured transactions, which includes leasing.

Changes in these legal landscapes can significantly influence the company's financial performance and overall risk exposure. For example, new regulations concerning consumer protection in leasing agreements or stricter rules on asset valuation for recovery purposes could necessitate adjustments in pricing models or increase operational costs. The enforceability of lease terms, particularly in cross-border transactions, is also a critical legal consideration.

Taxation Policies and Incentives

Taxation policies significantly shape Mitsubishi HC Capital's operational landscape and client investment strategies. Corporate income tax rates directly impact profitability, while depreciation rules influence the attractiveness of asset financing. For instance, in Japan, where Mitsubishi HC Capital has a substantial presence, the corporate income tax rate for large corporations is 34.6% as of early 2024, a factor that influences lease pricing and returns.

Specific tax incentives, particularly for green technologies, can drive demand for leasing in areas like renewable energy and sustainable infrastructure. These incentives encourage clients to invest in environmentally friendly assets, creating new market opportunities for Mitsubishi HC Capital. The evolving tax environment requires continuous adaptation of financial products and advisory services.

The reduction of bonus depreciation, beginning in 2025, will have a notable impact on equipment purchasing and leasing strategies across various sectors. This policy change, which allows for accelerated depreciation of assets, can alter the cost-benefit analysis for businesses acquiring new equipment. For example, a decrease in the bonus depreciation rate could make leasing a more financially appealing option compared to outright purchase for some clients seeking to manage their tax liabilities.

- Corporate Income Tax Impact: Affects net profits and the overall cost of capital for Mitsubishi HC Capital and its clients.

- Depreciation Rules: Influence the financial attractiveness of leasing versus purchasing capital assets.

- Green Technology Incentives: Drive demand for financing in sustainable sectors, creating growth avenues.

- Bonus Depreciation Changes: Starting in 2025, these changes will necessitate adjustments in equipment acquisition and financing strategies, potentially increasing the appeal of leasing.

Anti-Trust and Competition Law

Mitsubishi HC Capital, as a significant entity in the financial services and leasing sector, operates under stringent anti-trust and competition laws. These regulations are designed to prevent monopolistic behavior and foster a competitive marketplace. Given the company's substantial size and broad range of services, its market actions are closely monitored to ensure they do not unduly restrict competition.

The integration of businesses, such as the 2021 merger that formed Mitsubishi HC Capital, necessitates careful review and approval by competition authorities worldwide to safeguard fair market practices. For instance, in 2024, regulators in various jurisdictions continue to scrutinize large-scale mergers and acquisitions within the financial services industry to assess their potential impact on market concentration and consumer choice.

Adherence to these laws is crucial for maintaining market integrity and preventing anti-competitive practices that could harm smaller players or consumers. Mitsubishi HC Capital must ensure its operations, pricing strategies, and partnership agreements comply with these frameworks to avoid penalties and maintain its license to operate.

- Regulatory Scrutiny: Competition authorities globally, including the European Commission and the U.S. Federal Trade Commission, actively review mergers and business practices to ensure fair competition in the financial leasing sector.

- Market Share Impact: Mitsubishi HC Capital's significant market share in areas like IT equipment leasing requires constant vigilance to ensure its competitive strategies do not lead to market dominance that stifles innovation or raises prices.

- Compliance Costs: Maintaining compliance with diverse international anti-trust regulations involves substantial legal and administrative resources, impacting operational expenditures.

- Merger Approvals: Past integrations, like the 2021 business consolidation, were contingent upon meeting specific competition law requirements stipulated by relevant national and international regulatory bodies.

Mitsubishi HC Capital's operations are significantly influenced by evolving legal and regulatory frameworks, including stringent compliance with anti-money laundering (AML) laws and consumer protection mandates. For instance, the global financial sector faced over $5 billion in AML-related fines in 2024, highlighting the critical need for robust compliance. Adherence to capital adequacy requirements, such as Basel III, directly impacts lending capacity and risk management, with global banks holding over $2 trillion in Tier 1 capital by early 2025.

Environmental factors

Mitsubishi HC Capital faces increasing pressure from global climate change concerns and the drive for decarbonization. This environmental shift necessitates a strategic pivot towards sustainability, influencing their financing decisions and operational strategies.

The company is actively embracing sustainability transformation (SX), evident in its commitment to ambitious greenhouse gas (GHG) emission reduction targets. They aim to achieve net zero emissions by fiscal year 2050, a critical benchmark for businesses operating in the current global landscape.

A key aspect of this strategy involves channeling financial resources into sectors that demonstrably contribute to positive environmental impact. For example, their investments in renewable energy projects and green infrastructure are growing, reflecting this commitment.

In FY2023, Mitsubishi HC Capital reported a 3.5% reduction in Scope 1 and 2 GHG emissions compared to FY2022, indicating early progress in their decarbonization efforts, with further reductions planned through energy efficiency improvements and renewable energy adoption.

There's a growing appetite for green financing, seen in the surge of green bonds and loans designed to back eco-friendly initiatives. This trend is reshaping how companies access capital and invest in a more sustainable future.

Mitsubishi HC Capital is actively participating in this shift, channeling investments into green assets and supporting clean energy ventures. Their involvement spans solar power, wind energy, and battery storage solutions, demonstrating a clear commitment to aligning their financial strategies with pressing environmental objectives.

The global green bond market, for instance, saw significant issuance, with estimates suggesting it could reach over $1 trillion in 2024, reflecting robust investor demand for sustainable investments. Mitsubishi HC Capital's focus on these areas positions them to capitalize on this expanding market segment.

Growing concerns over the finite nature of raw materials are fueling a global push towards circular economy principles. This paradigm shift prioritizes reusing, repairing, and recycling products and materials to minimize waste and maximize their value over time. For instance, the Ellen MacArthur Foundation estimates that a global shift to a circular economy for plastics could generate $400 billion annually by 2040.

As a prominent leasing company, Mitsubishi HC Capital is strategically positioned to be a key player in this transition. By extending the operational life of leased assets through robust maintenance and refurbishment programs, and by facilitating the resale or recycling of equipment at the end of its lease term, the company directly contributes to resource efficiency. This approach not only reduces environmental impact but also aligns with the increasing demand from businesses for sustainable operational models.

Environmental Regulations and Reporting

Mitsubishi HC Capital operates within an evolving landscape of environmental regulations. Stricter emission standards and the growing demand for mandatory ESG (Environmental, Social, and Governance) reporting are key factors. These regulations necessitate greater transparency regarding a company's environmental impact and performance.

In response, Mitsubishi HC Capital actively complies with these directives. The company is enhancing its disclosures, particularly concerning climate change-related risks and opportunities. This includes aligning its reporting with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

- Focus on TCFD Alignment: Mitsubishi HC Capital's commitment to TCFD recommendations signifies a proactive approach to climate risk disclosure, a trend gaining momentum among global corporations.

- Stricter Emission Standards: The company must navigate increasingly stringent emission limits across its diverse operations, impacting everything from energy consumption to supply chain logistics.

- Mandatory ESG Reporting: The push for mandatory ESG reporting means that Mitsubishi HC Capital is subject to more rigorous scrutiny of its environmental footprint and sustainability initiatives by regulators and investors alike.

Physical and Transition Risks from Climate Change

Mitsubishi HC Capital is increasingly exposed to both physical and transition risks stemming from climate change. Physical risks, such as intensified storms or rising sea levels, could directly damage leased assets or disrupt operations, potentially leading to increased insurance costs or asset write-downs. For instance, a significant portion of the global leasing market for infrastructure and transportation assets, key areas for Mitsubishi HC Capital, is susceptible to these weather-related impacts.

Transition risks, driven by the global shift towards a low-carbon economy, pose a substantial threat to asset values and the company's business model. This includes the potential for policy changes, such as carbon pricing or stricter emissions standards, which could devalue assets in carbon-intensive sectors. Furthermore, rapid technological advancements in areas like renewable energy and electric vehicles may render existing leased equipment obsolete faster than anticipated. In 2024, the International Energy Agency reported continued strong growth in renewable energy capacity, highlighting the accelerating transition away from fossil fuels.

Mitsubishi HC Capital is actively incorporating these climate-related risks into its strategic planning and risk management processes. This involves scenario analysis to understand potential impacts under different climate pathways and developing strategies to mitigate these exposures. The company's commitment to sustainability is reflected in its efforts to finance and support the transition to a greener economy, aiming to align its portfolio with evolving market demands and regulatory landscapes.

- Physical Risk Impact: Extreme weather events, such as floods or typhoons, can directly affect the condition and usability of leased assets, potentially increasing maintenance costs and downtime.

- Transition Risk Drivers: Policy shifts, such as stricter emissions regulations or carbon taxes, along with technological advancements like improved battery technology for electric vehicles, can significantly impact the residual value of leased assets.

- Strategic Integration: Mitsubishi HC Capital is integrating climate risk assessment into its overall enterprise risk management framework, employing scenario analysis to gauge potential financial impacts.

- Market Response: Growing investor and regulatory pressure for climate-related disclosures and sustainable business practices is influencing corporate strategy and financial decision-making across the leasing industry.

Mitsubishi HC Capital is actively addressing environmental challenges by focusing on decarbonization and sustainability transformation (SX). Their commitment is evident in their net zero emissions target by fiscal year 2050 and increasing investments in green sectors like renewable energy.

In FY2023, the company achieved a 3.5% reduction in Scope 1 and 2 GHG emissions, demonstrating progress. They are also capitalizing on the growing green finance market, with a focus on solar, wind, and battery storage solutions, aligning with the global green bond market projected to exceed $1 trillion in 2024.

The company is also embracing circular economy principles by extending the life of leased assets and facilitating resale or recycling, contributing to resource efficiency. Mitsubishi HC Capital is enhancing its climate-related disclosures, aligning with TCFD recommendations to navigate stricter environmental regulations and mandatory ESG reporting.

Mitsubishi HC Capital is actively integrating climate risk management into its strategy, addressing both physical and transition risks. This includes scenario analysis and developing mitigation strategies to adapt to evolving market demands and regulatory landscapes driven by the global shift to a low-carbon economy.

| Environmental Factor | Mitsubishi HC Capital's Response/Impact | Key Data/Trend (2024/2025 Focus) |

|---|---|---|

| Climate Change & Decarbonization | Commitment to net zero emissions by FY2050; investments in green sectors. | Achieved 3.5% reduction in Scope 1 & 2 GHG emissions in FY2023. |

| Green Finance Market | Active participation via investments in renewable energy projects. | Global green bond market projected to exceed $1 trillion in 2024. |

| Circular Economy | Extending asset life, facilitating resale/recycling for resource efficiency. | Focus on sustainable operational models demanded by businesses. |

| Regulatory Landscape | Compliance with stricter emission standards and ESG reporting mandates. | Alignment with TCFD recommendations for enhanced climate risk disclosure. |

| Climate-Related Risks | Integrating physical and transition risk management into strategy. | Scenario analysis to understand impacts of policy, technology shifts. |

PESTLE Analysis Data Sources

This PESTLE analysis for Mitsubishi HC Capital is informed by a comprehensive review of official government reports, financial news outlets, and leading industry publications. We leverage data from international economic bodies and technology forecasting firms to ensure a well-rounded perspective.