Mitsubishi HC Capital Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mitsubishi HC Capital Bundle

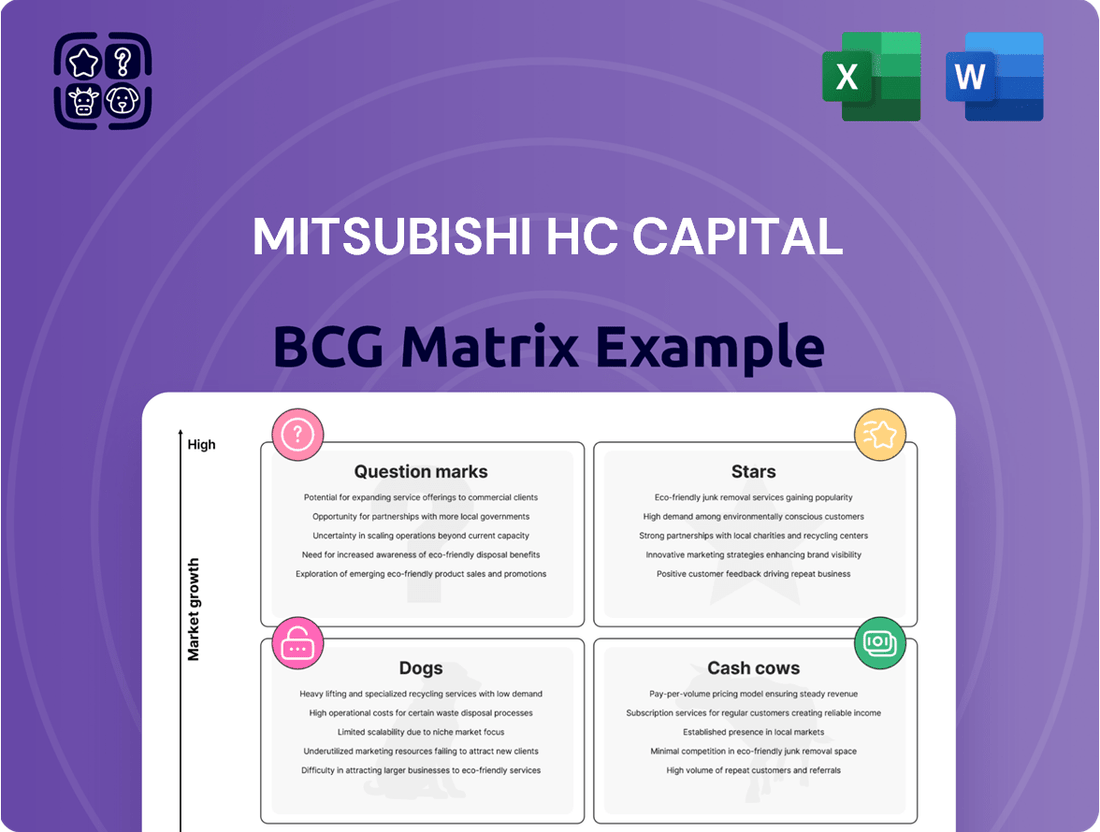

Wondering where Mitsubishi HC Capital's diverse portfolio truly shines, or where it might be faltering? Our insightful preview hints at the strategic positioning of their offerings within the BCG Matrix, but the real power lies in the complete picture.

Uncover which of Mitsubishi HC Capital's ventures are market-leading "Stars," which are reliably generating "Cash Cows," which are underperforming "Dogs," and which are the exciting but uncertain "Question Marks."

This isn't just about categorization; it's about actionable intelligence. The full BCG Matrix report provides the detailed quadrant placements and data-backed recommendations you need to make informed investment and product development decisions.

Don't miss out on the opportunity to gain a clear, strategic roadmap for Mitsubishi HC Capital's future growth. Purchase the full BCG Matrix today and unlock the insights that will drive your business forward.

Stars

Mitsubishi HC Capital's Aviation segment is a significant player, showing robust growth in fiscal year 2025. This performance was bolstered by enhanced leasing income and beneficial fiscal period adjustments stemming from its subsidiary, JSA International Holdings. The company's strategic decision to order 50 new-generation narrow-body aircraft, even though they are for future delivery, underscores a determined effort to capture a larger slice of this rapidly expanding market.

This forward-thinking investment in aviation finance is designed to fuel future expansion, requiring upfront capital but promising substantial returns down the line. In fiscal year 2025, the aviation leasing business contributed significantly to the company's overall financial health, with a reported operating income that reflects the sector's strong underlying demand and the company's effective asset management strategies.

The Logistics segment, encompassing marine containers and railcars, demonstrated strong performance in fiscal year 2025, with segment profit rising. This growth was fueled by a healthy pipeline of new transactions and enhanced operational efficiency, particularly in marine container and railcar leasing.

Mitsubishi HC Capital's strategic focus on this sector is evident. For instance, CAI, a key player within the group, made substantial investments in marine containers during 2024, signaling an aggressive push for market dominance. This expansion underscores the segment's position as a high-growth area.

The company is actively expanding its footprint and profitability within this dynamic market. The increasing demand for efficient and flexible logistics solutions, driven by global trade patterns, positions this segment for continued expansion.

Mitsubishi HC Capital, through its dedicated Sustainable Development Group (SDG), is at the forefront of offering specialized financing for environmental initiatives, including clean tech and renewable energy. This strategic focus positions them to capture significant growth in the burgeoning sustainable finance sector.

The company's commitment to ESG innovation is evident in its active pursuit of leadership in decarbonization and environmental solutions. By 2024, the global green finance market was projected to exceed $50 trillion, a testament to the massive opportunity in this space.

AI & Supercomputing Infrastructure Finance

Mitsubishi HC Capital America sees AI and supercomputing infrastructure as a prime growth opportunity heading into 2025. This sector demands financing that is both specialized and capable of scaling alongside rapid technological advancements.

The company anticipates a surge in large-scale projects for AI and cloud computing, necessitating robust financial solutions. By targeting these capital-intensive, high-growth areas, Mitsubishi HC Capital aims to secure a significant portion of emerging market share.

- AI Market Growth: The global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, according to various industry reports, highlighting the immense financing needs for infrastructure.

- Supercomputing Demand: The demand for high-performance computing, crucial for AI training and complex simulations, continues to rise. For example, advancements in AI models require exponentially more processing power.

- Capital Intensity: Building and maintaining AI and supercomputing centers involves substantial upfront investment in hardware, power, and cooling, often running into hundreds of millions or even billions of dollars for hyperscale facilities.

- Financing Solutions: Mitsubishi HC Capital is developing tailored leasing and financing structures to support these massive infrastructure expenditures, enabling organizations to access cutting-edge technology without prohibitive upfront costs.

MHC Mobility Europe (EV & Decarbonization Solutions)

MHC Mobility Europe, a subsidiary of Mitsubishi HC Capital, is positioned as a strong contender in the electric vehicle and decarbonization solutions market. Their integrated leasing and mobility services cater to the growing demand for sustainable transportation, making them a star in the BCG matrix.

The company's strategic emphasis on end-to-end decarbonization solutions directly addresses the accelerating global shift towards electric vehicles. This focus is crucial as many European countries are setting ambitious targets for EV adoption. For instance, Norway aims for all new car sales to be zero-emission by 2025, and the UK plans to ban the sale of new petrol and diesel cars from 2035.

- Market Position: MHC Mobility Europe is a key player in the rapidly expanding EV and decarbonization sector within Europe.

- Growth Potential: The high-growth trend in EV adoption and sustainable mobility provides significant upside for the company.

- Investment Strategy: Mitsubishi HC Capital is actively investing in expanding MHC Mobility Europe's fleet and service offerings to capitalize on market opportunities.

- Competitive Advantage: Integrated leasing and end-to-end decarbonization solutions offer a comprehensive value proposition to customers navigating the EV transition.

MHC Mobility Europe stands out as a star within Mitsubishi HC Capital's portfolio, driven by its leadership in the electric vehicle and decarbonization solutions market. This segment directly taps into the accelerating global shift towards EVs, a trend supported by ambitious adoption targets in key European nations. For example, Norway aims for all new car sales to be zero-emission by 2025, highlighting the immense growth potential.

The company's integrated leasing and end-to-end decarbonization services provide a compelling advantage as customers navigate the transition to electric mobility. Mitsubishi HC Capital's active investments in expanding MHC Mobility Europe's fleet and service offerings further solidify its position as a high-growth star.

Stars in the BCG matrix represent high-growth, high-market-share business units. For Mitsubishi HC Capital, MHC Mobility Europe exemplifies this category with its strong position in the expanding EV market and its comprehensive service offerings. The segment is experiencing rapid growth and is expected to continue outperforming due to favorable market trends and strategic investments.

| Segment | BCG Category | Key Drivers | FY25 Outlook |

|---|---|---|---|

| Aviation | Question Mark/Star | New aircraft orders, leasing income growth | Positive, with significant future expansion potential |

| Logistics (Marine Containers, Railcars) | Cash Cow/Star | Strong transaction pipeline, operational efficiency | Continued robust performance and expansion |

| Sustainable Finance (Clean Tech, Renewables) | Question Mark/Star | Growing green finance market, ESG focus | High growth potential driven by decarbonization demand |

| AI & Supercomputing Infrastructure | Question Mark | Rapid tech advancements, capital-intensive projects | Emerging high-growth opportunity requiring specialized financing |

| MHC Mobility Europe (EVs, Decarbonization) | Star | EV adoption, decarbonization solutions, integrated services | Strong growth and market leadership |

What is included in the product

This BCG Matrix analysis offers a tailored view of Mitsubishi HC Capital's portfolio, highlighting units for investment, holding, or divestment.

A clear BCG Matrix visualizes Mitsubishi HC Capital's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Domestic Customer Finance, within Mitsubishi HC Capital's Customer Solutions segment, acts as a dependable Cash Cow. This core business in Japan, centered on machinery and equipment finance leases and installment sales, consistently generates strong cash flow. Although fiscal year 2025 saw a slight dip in segment profit due to portfolio adjustments, it still represents the largest contributor to assets and net income, underscoring its stable, high-yield nature in a well-established market.

Mitsubishi HC Capital's established global business, when viewed outside the specific headwinds in the Americas transportation sector, acts as a reliable Cash Cow. This segment, primarily focused on leasing and loan transactions across mature international markets, commands a significant market share and consistently delivers stable earnings.

While the company anticipates some uptick in credit costs for fiscal year 2025, the robust and diversified nature of its global operations ensures a strong cash flow generation. This consistent financial output is crucial, providing the necessary capital to fuel other strategic initiatives and investments within the broader company portfolio.

Mitsubishi HC Capital's existing aircraft leasing portfolio is a significant cash cow, providing a steady stream of revenue from its established fleet. This mature segment benefits from long-term leases on high-value commercial aircraft, ensuring consistent cash flow. For instance, as of the fiscal year ending March 2024, Mitsubishi HC Capital reported a substantial aircraft leasing business, contributing significantly to its overall financial performance and stability.

Marine Container Leasing (CAI International)

Mitsubishi HC Capital's acquisition of CAI International in 2022 for approximately $1.1 billion significantly bolstered its presence in the marine container leasing market. This move positioned CAI as a prime example of a Cash Cow within the broader Mitsubishi HC Capital portfolio, generating substantial and consistent cash flow.

The marine container leasing business, exemplified by CAI, benefits from a stable demand driven by global trade, ensuring high utilization rates. While growth opportunities might be moderate, the established market share and essential nature of the service provide a reliable income stream. For instance, in fiscal year 2023, CAI contributed significantly to Mitsubishi HC Capital’s leasing segment, demonstrating its value as a mature, cash-generating asset.

- Stable Cash Generation: CAI International consistently generates strong cash flows due to high demand for marine containers in global logistics.

- High Market Share: The business holds a significant position in the marine container leasing market, contributing to its stability.

- Low Growth, High Profitability: While not a high-growth sector, the mature market allows for consistent profitability and cash extraction.

- Strategic Importance: Its integration strengthens Mitsubishi HC Capital's logistics sector offerings, providing a reliable revenue base.

Core Real Estate Finance & Owned Properties

Mitsubishi HC Capital's core real estate finance business and its portfolio of owned properties represent a significant Cash Cow. This segment, which includes substantial investments in commercial real estate, is designed to deliver consistent and stable lease fee revenue, along with asset-backed income.

Despite some strategic portfolio adjustments anticipated in fiscal year 2025, the established core holdings within mature real estate markets continue to be a reliable profit generator. These properties consistently produce healthy cash flow through rental income and the appreciation of managed asset values.

For example, as of the fiscal year ended March 2024, Mitsubishi HC Capital's real estate segment reported significant contributions to overall revenue, with leased property revenue forming a cornerstone of its profitability. The company's strategy emphasizes maintaining a strong presence in stable, high-demand markets, ensuring predictable returns.

- Stable Lease Income: The rental income from a diversified portfolio of commercial properties provides a predictable and consistent revenue stream.

- Asset Appreciation: The underlying value of its owned real estate assets contributes to long-term capital growth and asset-backed financing capabilities.

- Mature Market Focus: Investments are concentrated in established markets with proven demand, minimizing risk and maximizing cash flow generation.

- Profitable Operations: The segment consistently demonstrates profitability, contributing significantly to Mitsubishi HC Capital's overall financial stability and cash generation.

Mitsubishi HC Capital's domestic customer finance operations in Japan are a prime example of a Cash Cow. This business, focused on machinery and equipment finance, consistently generates robust cash flow. While fiscal year 2025 saw minor portfolio adjustments impacting segment profit, this sector remains the largest contributor to assets and net income, highlighting its stable, high-yield nature in a mature market.

The established global business, excluding specific challenges in the Americas transportation sector, also functions as a reliable Cash Cow. Primarily engaged in leasing and loan transactions within developed international markets, it holds a significant market share and delivers consistent earnings, reinforcing its role as a stable cash generator for the company.

Mitsubishi HC Capital's aircraft leasing portfolio is a notable Cash Cow, offering a steady revenue stream from its existing fleet. Long-term leases on high-value commercial aircraft ensure consistent cash flow. For the fiscal year ending March 2024, this segment significantly contributed to the company's financial performance and stability.

The marine container leasing business, bolstered by the acquisition of CAI International, is a strong Cash Cow, producing substantial and consistent cash flow. This segment benefits from stable demand in global trade, maintaining high utilization rates and providing a reliable income stream, as evidenced by its significant contribution to the leasing segment in fiscal year 2023.

Mitsubishi HC Capital's real estate finance and owned property portfolio acts as a significant Cash Cow, generating consistent lease fee revenue and asset-backed income. Established core holdings in mature real estate markets continue to be reliable profit generators, producing healthy cash flow through rental income and asset appreciation, with leased property revenue being a cornerstone of its profitability as of the fiscal year ended March 2024.

| Business Segment | BCG Category | Key Characteristic | Fiscal Year 2024 (Approximate Contribution/Metric) |

|---|---|---|---|

| Domestic Customer Finance (Japan) | Cash Cow | Stable, high-yield machinery and equipment finance. Largest contributor to assets and net income. | Significant contributor to net income, representing a core stable asset. |

| Global Leasing & Loans (Excl. Americas Transportation) | Cash Cow | Mature markets, significant market share, consistent earnings. | Contributes substantial and stable earnings to the overall portfolio. |

| Aircraft Leasing | Cash Cow | Long-term leases on high-value aircraft, steady revenue. | Significant contributor to overall financial performance and stability. |

| Marine Container Leasing (CAI) | Cash Cow | High utilization, stable demand, reliable income. | Significant contributor to leasing segment revenue and profitability in FY2023. |

| Real Estate Finance & Owned Properties | Cash Cow | Consistent lease revenue, asset appreciation, mature markets. | Leased property revenue formed a cornerstone of profitability. |

Delivered as Shown

Mitsubishi HC Capital BCG Matrix

The Mitsubishi HC Capital BCG Matrix preview you see is the identical, fully polished document you will receive upon purchase, offering an immediate strategic overview without any watermarks or demo content. This means you're not just seeing a sample, but the actual analysis-ready report, meticulously crafted for professional application and immediate use in your business planning.

Dogs

Mitsubishi HC Capital's strategic divestment of DFL Lease Co., Ltd., Shutoken Leasing Co., Ltd., and Sekisui Leasing Co., Ltd. in 2024 clearly places these entities in the 'Dog' quadrant of the BCG matrix. These subsidiaries likely exhibited low market share within their respective segments and faced limited growth prospects, making them prime candidates for divestiture.

The decision to sell off these bank-affiliated leasing businesses underscores Mitsubishi HC Capital's focus on streamlining its operations and reallocating resources towards more promising ventures. By shedding these underperforming assets, the company aimed to enhance its overall capital efficiency and concentrate on core competencies that align with its high-value-added strategy.

This portfolio optimization is a common tactic for managing 'Dog' units, which, while potentially still generating some revenue, do not offer the growth potential or market dominance to justify continued investment. The divestitures signal a proactive approach to portfolio management, ensuring that capital is deployed where it can yield the highest returns.

The Americas Transportation Finance segment within Mitsubishi HC Capital's Global Business segment is currently underperforming. This is evidenced by increased credit costs experienced in fiscal year 2025, directly impacting profitability.

This underperformance suggests a Dogs category placement, indicating low growth and low relative market share. The sector faces challenges with profitability that may be outpaced by operational expenses or inherent risks.

Mitsubishi HC Capital is aware of these issues and is actively working to improve the situation. Strategies such as more stringent credit screening processes are being implemented to mitigate future losses and stabilize this segment.

For instance, during fiscal year 2024, the company's consolidated net income attributable to owners of the parent was ¥108.3 billion, a significant increase from the previous year, yet the Americas transportation sector acted as a drag on overall performance.

Mitsubishi HC Capital's divestment of Miyuki Building in 2024, a significant real estate rental company, signals a strategic shift. While the sale yielded substantial gains, the company likely viewed its ongoing rental operations as a low-growth segment. This move points to a deliberate reallocation of capital towards areas offering higher potential returns or strategic alignment within their wider portfolio.

Discontinued European Branch Operations (UK Subsidiary)

Mitsubishi HC Capital's UK subsidiary, Mitsubishi HC Capital UK PLC, has been actively divesting from underperforming European markets. In fiscal year 2025, the company recognized pre-tax losses stemming from its discontinued operations in the Czech Republic, Slovakia, and Hungary. This strategic move aligns with the BCG Matrix principle of exiting 'Dog' business units, characterized by low market share and minimal growth potential.

The decision to withdraw from these specific Eastern European markets reflects a broader strategy to enhance operational efficiency and reallocate resources towards more promising ventures. By shedding these underperforming assets, Mitsubishi HC Capital aims to improve its overall financial performance and focus on core competencies.

- Discontinued Operations: Pre-tax losses from Czech Republic, Slovakia, and Hungary operations in FY2025.

- Strategic Rationale: Exit of low market share and low growth potential businesses (Dogs).

- Financial Impact: Recognition of losses to streamline operations and improve efficiency.

- Business Focus: Reallocation of resources towards more strategic and profitable areas.

Specific Underperforming Renewable Energy Projects in Japan

Mitsubishi HC Capital's Environment & Energy segment, despite being a growth area, faced significant headwinds in fiscal year 2025. A specific renewable energy project in Japan incurred substantial credit costs, signaling a considerable underperformance. This situation strongly suggests that this particular venture falls into the 'Dog' category within the BCG matrix.

The high credit costs associated with this Japanese renewable energy project point to its low profitability and potential for future returns. Even within a burgeoning market like renewable energy, operational issues or unforeseen expenses can transform a promising venture into a drain on resources. The company's stated intention to recover this business early indicates a recognition of its current 'Dog' status and a strategy to either improve its performance or divest.

- Project Underperformance: A specific Japanese renewable energy project incurred significant credit costs in FY2025, indicating it is not meeting financial expectations.

- BCG Matrix Classification: Due to its low returns and high credit costs, this project is likely categorized as a 'Dog' despite operating in a growth sector.

- Segment Context: While the broader Environment & Energy segment is a growth area for Mitsubishi HC Capital, this individual project is an outlier.

- Recovery Strategy: The company is actively working towards an early recovery of this underperforming business.

Mitsubishi HC Capital's strategic divestments and recognition of losses in specific business areas clearly place certain operations within the 'Dog' quadrant of the BCG matrix. These are typically characterized by low market share and limited growth potential, prompting the company to shed these assets to improve overall capital efficiency and focus on higher-return ventures.

The Americas Transportation Finance segment, for example, experienced increased credit costs in fiscal year 2025, impacting profitability and suggesting a 'Dog' classification due to low growth and market share. Similarly, the divestment of Miyuki Building in 2024, a real estate rental company, points to a perception of low growth within that segment. Mitsubishi HC Capital UK PLC's exit from the Czech Republic, Slovakia, and Hungary in fiscal year 2025, which resulted in pre-tax losses from discontinued operations, also exemplifies the management of 'Dog' units by divesting from underperforming markets.

Even within growth sectors like Environment & Energy, a specific Japanese renewable energy project incurred substantial credit costs in fiscal year 2025, indicating underperformance and likely 'Dog' status. The company is actively pursuing recovery strategies for this particular venture, highlighting a proactive approach to portfolio optimization.

| Business Unit/Segment | BCG Classification | Key Indicators (FY2024/FY2025) | Strategic Action |

| DFL Lease Co., Shutoken Leasing, Sekisui Leasing | Dog | Divested in 2024; historically low market share and growth prospects | Divestiture |

| Americas Transportation Finance | Dog | Increased credit costs impacting profitability in FY2025 | Active management, stringent credit screening |

| Miyuki Building (Real Estate Rental) | Dog | Divested in 2024; perceived as low-growth segment | Divestiture |

| UK Operations (Czech Rep., Slovakia, Hungary) | Dog | Pre-tax losses from discontinued operations in FY2025 | Exit from underperforming markets |

| Japanese Renewable Energy Project (Environment & Energy) | Dog | Significant credit costs in FY2025, indicating low profitability | Strategy for early recovery |

Question Marks

Mitsubishi HC Capital is strategically positioning its Data Utilization Platform Services within its 2025 MTMP as a key growth driver, acknowledging the significant potential in the digitalization trend. This initiative reflects a forward-looking approach to leveraging data for enhanced business operations and customer value.

The company recognizes that its current market share in providing these platforms is likely in its early stages, indicating a significant opportunity for expansion and market penetration. This nascent position necessitates a focused effort to build a strong foundation for future growth.

Achieving substantial market adoption and establishing a competitive advantage will require considerable investment in both the development and scaling of these data services. For instance, according to IDC, worldwide spending on AI systems is projected to reach $204 billion in 2024, highlighting the massive investment occurring in data-driven technologies.

This commitment to investment is crucial for Mitsubishi HC Capital to effectively compete and innovate in the rapidly evolving landscape of data utilization platforms, ensuring they can meet the increasing demands of a digitally transformed market.

Mitsubishi HC Capital's new digital signage business in office restrooms, a collaboration with AGC and JR East Marketing & Communications, is currently positioned as a Question Mark in the BCG Matrix. As of January 2025, this venture is in a proof-of-concept stage, indicating its nascent market presence and low market share.

This initiative taps into the burgeoning smart building technology sector, presenting high growth potential. However, its early stage necessitates significant investment for validation and scaling, a hallmark of Question Mark ventures.

Mitsubishi HC Capital's 2025 Medium-Term Management Plan (MTMP) prioritizes expanding its 'Finance + Services' offering. This strategic pivot moves beyond traditional leasing to integrate financial solutions with value-added services. The company sees this as a key growth driver to transform its business model.

While this integrated service approach represents a high-growth ambition, Mitsubishi HC Capital's market share in these specific combined offerings is still in its nascent stages of development. This indicates it's likely positioned as a question mark in the BCG matrix, requiring careful strategic nurturing.

Achieving success in this expansion will demand substantial investment in developing new service capabilities and, crucially, in fostering strong customer adoption of these integrated solutions. The company's ability to execute this will determine its future market positioning.

Innovation Investment Fund Initiatives

Mitsubishi HC Capital is actively cultivating future growth through its Innovation Investment Fund. This initiative acts as a strategic incubator, allowing the company to explore novel business models and develop high-value-added services that lie beyond its current market strengths.

These forward-looking investments are specifically directed towards sectors exhibiting significant growth potential. By venturing into these less-established areas, Mitsubishi HC Capital aims to identify and nurture future market leaders.

- Innovation Investment Fund: Mitsubishi HC Capital’s commitment to exploring new business models and high-value services.

- Target Areas: Investments focus on high-growth potential sectors outside the company's current core market share.

- Strategic Nature: These ventures are characterized by their inherent risk and require significant capital and long-term strategic support.

- BCG Matrix Alignment: The aim is to develop these nascent investments into future 'Stars' within the BCG framework.

Emerging Mobility as a Service (MaaS) Offerings Beyond Core Leasing

Mitsubishi HC Capital's ventures into broader Mobility as a Service (MaaS) offerings beyond core vehicle leasing are currently positioned as a Question Mark within its BCG matrix. While MHC Mobility Europe is a recognized Star for its leadership in the EV transition, the company's strategic expansion into diverse MaaS solutions requires further development to establish a significant market presence.

The acquisition of Mobility Mixx in 2022 marked a clear intention to enter the MaaS supply chain, signaling a commitment to this burgeoning sector. This move is pivotal as the MaaS market is projected for substantial growth, with various segments offering new revenue streams.

Despite this strategic acquisition, the actual market share across Mitsubishi HC Capital's diverse MaaS portfolio likely remains relatively low. Significant investment and the cultivation of strategic partnerships will be crucial to scaling these offerings and solidifying their position in the competitive MaaS landscape.

- MaaS Market Entry: Acquisition of Mobility Mixx in 2022 signifies strategic commitment to the MaaS sector.

- Growth Potential: MaaS represents a high-growth area, offering diversification beyond traditional leasing.

- Market Share: Current market share in diverse MaaS offerings is likely nascent, requiring further development.

- Strategic Imperatives: Continued investment and strategic partnerships are essential for MaaS expansion and market penetration.

Mitsubishi HC Capital's ventures in the digital signage business, particularly in office restrooms, are currently in their early stages, mirroring the characteristics of a Question Mark in the BCG matrix. This nascent phase means low market share but operates within a high-growth sector, exemplified by the increasing adoption of smart building technologies.

The company's strategic expansion into broader Mobility as a Service (MaaS) offerings, beyond its established vehicle leasing, also falls into the Question Mark category. Despite strategic moves like the 2022 acquisition of Mobility Mixx, the market share across its diverse MaaS portfolio is still developing, requiring significant investment to capture the sector's projected growth.

Similarly, Mitsubishi HC Capital's focus on integrating 'Finance + Services' represents a high-growth ambition where its market share is still nascent. This strategic pivot necessitates substantial investment to build new service capabilities and drive customer adoption, positioning these integrated offerings as Question Marks needing careful nurturing.

BCG Matrix Data Sources

Our BCG Matrix for Mitsubishi HC Capital leverages comprehensive financial reports, industry-specific market research, and growth projections to accurately position business units.