Mitsubishi HC Capital Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mitsubishi HC Capital Bundle

Unlock the strategic blueprint behind Mitsubishi HC Capital's diverse leasing and finance operations. This comprehensive Business Model Canvas reveals how they create value through tailored solutions and build strong customer relationships across various industries. Understand their key partners, revenue streams, and cost drivers to glean actionable insights for your own business strategy.

Partnerships

Mitsubishi HC Capital actively cultivates strategic alliances with major financial institutions, notably MUFG Bank, which functions as a principal financing partner. These collaborations are fundamental to ensuring a steady and varied supply of funding, essential for meeting the company's diverse financial needs across both Japanese yen and international currencies.

These strong ties enable Mitsubishi HC Capital to maintain robust financing capacity and exceptional liquidity management. For instance, in fiscal year 2023, the company successfully secured significant funding lines, underpinning its operational stability and growth initiatives in a dynamic global market.

Mitsubishi HC Capital actively collaborates with equipment manufacturers, dealers, and distributors. This synergy allows them to offer tailored financial solutions, a cornerstone of their business model. For example, their partnership with HD Hyundai Construction Equipment North America exemplifies how they facilitate crucial financing for retail end-customers, dealer rental fleets, and inventory floor plans.

Mitsubishi HC Capital actively partners with technology and digital solution providers to drive their digital transformation (DX) initiatives. These collaborations are key to developing innovative sales processes that are deeply integrated with data analytics, aiming to provide customers with more efficient and tailored solutions.

A prime example of this partnership strategy is the development and offering of services like PC-Life Cycle Management (PC-LCM). This service, powered by external technology expertise, streamlines the entire lifecycle of personal computers for businesses, from procurement to disposal, significantly enhancing operational efficiency and customer value.

In the fiscal year ending March 2024, Mitsubishi HC Capital reported a consolidated net sales revenue of ¥1,385,050 million, underscoring the scale at which these digital partnerships are being implemented to support their diverse business operations and customer service enhancements.

Joint Ventures and Equity Investments in Growth Sectors

Mitsubishi HC Capital actively pursues joint ventures and equity investments to drive expansion within key growth areas, particularly in the renewable energy sector. This strategy allows the company to leverage partnerships and capital for accelerated development and market penetration.

A significant move in this direction was the acquisition of a 20% stake in European Energy A/S. This investment is designed to bolster Mitsubishi HC Capital's presence and capabilities within the rapidly evolving green energy transition.

- Strategic Expansion: Focus on high-growth sectors like renewable energy through collaborative ventures.

- Equity Investment Example: 20% stake acquired in European Energy A/S to foster green energy growth.

- Accelerated Development: Utilizing partnerships and capital to speed up business expansion in target markets.

- Market Penetration: Gaining access to new technologies and customer bases via strategic alliances.

Collaboration with Parent and Affiliated Companies

Mitsubishi HC Capital actively leverages its affiliations with the Mitsubishi and Hitachi corporate groups. This provides a significant advantage by tapping into established customer bases and existing business foundations. For instance, by collaborating with these entities, Mitsubishi HC Capital can offer integrated leasing and financing solutions that resonate with a broad range of clients already familiar with these respected brands.

These strategic partnerships are crucial for driving value creation. They unlock opportunities for synergistic business ventures, allowing Mitsubishi HC Capital to expand its service offerings and reach. The inherent trust and recognition associated with the Mitsubishi and Hitachi names contribute to a more stable and predictable customer flow, facilitating consistent revenue streams and growth.

In 2024, Mitsubishi HC Capital reported robust performance, partly attributed to these strong group relationships. Their consolidated financial results demonstrate the impact of cross-group synergies, with a significant portion of their business volume originating from or being influenced by their parent and affiliated companies. This highlights the tangible economic benefits derived from these key partnerships.

- Access to Established Customer Networks: Mitsubishi HC Capital benefits from the extensive customer relationships already cultivated by Mitsubishi and Hitachi.

- Synergistic Business Opportunities: Collaborations enable the development of new, integrated services that leverage the strengths of all involved parties.

- Enhanced Brand Recognition and Trust: Association with well-known corporate groups lends credibility and fosters customer confidence.

- Stable Revenue Streams: The inherent stability of these affiliations contributes to a more predictable and consistent business performance.

Mitsubishi HC Capital's key partnerships are crucial for its operational success and strategic growth. These alliances span financial institutions, equipment manufacturers, technology providers, and even strategic equity investments, all designed to enhance its service offerings and market reach.

The company's collaborations with financial institutions, such as MUFG Bank, ensure vital funding access, supporting its global operations. Partnerships with equipment makers and dealers, like HD Hyundai Construction Equipment North America, allow for tailored financing solutions for end-customers and inventory management.

Furthermore, alliances with technology firms drive digital transformation, enabling more efficient customer solutions and streamlined operations, as seen with PC-Life Cycle Management services. Strategic equity investments, such as the stake in European Energy A/S, position Mitsubishi HC Capital in high-growth sectors like renewable energy.

Leveraging affiliations within the Mitsubishi and Hitachi groups provides access to established customer bases and enhances brand credibility, leading to stable revenue streams.

| Partnership Type | Key Collaborator Example | Benefit | Fiscal Year 2023/2024 Impact |

|---|---|---|---|

| Financial Institutions | MUFG Bank | Secured significant funding lines, ensuring liquidity and operational stability. | Supported ¥1,385,050 million in consolidated net sales. |

| Equipment Manufacturers/Dealers | HD Hyundai Construction Equipment North America | Facilitates tailored financing for retail customers, rental fleets, and inventory. | Enables comprehensive solutions for equipment lifecycle management. |

| Technology Providers | Unspecified DX Partners | Drives digital transformation and integrated data analytics for sales processes. | Enhances customer value through efficient and personalized solutions. |

| Strategic Equity Investments | European Energy A/S (20% stake) | Accelerates expansion in renewable energy sector and green energy transition. | Bolsters presence and capabilities in a rapidly evolving market. |

| Corporate Group Affiliations | Mitsubishi & Hitachi Groups | Access to established customer bases and enhanced brand recognition. | Contributes to stable revenue streams and synergistic business ventures. |

What is included in the product

A comprehensive, pre-written business model tailored to Mitsubishi HC Capital's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, ideal for presentations and funding discussions with banks or investors.

Provides a clear, structured framework to diagnose and address operational inefficiencies and financial uncertainties within Mitsubishi HC Capital's diverse leasing and financing operations.

Offers a visual roadmap for identifying and mitigating risks in their global asset finance and leasing businesses, simplifying complex financial strategies.

Activities

Mitsubishi HC Capital's key activities revolve around providing a diverse portfolio of financial services. These include leasing, installment sales, and a wide array of financing solutions tailored to various business needs.

The company actively engages in customer finance, assisting individuals and businesses in acquiring assets. Furthermore, it develops vendor solutions, acting as a crucial partner for manufacturers and distributors by facilitating their product sales through accessible financing options.

As of the fiscal year ended March 31, 2024, Mitsubishi HC Capital reported consolidated total revenue of ¥1,243.5 billion, underscoring the scale of its diverse financial service offerings and their impact on supporting various industries.

Mitsubishi HC Capital diligently manages and diversifies its extensive asset portfolio. This includes significant holdings across customer solutions, global business operations, aviation, logistics, real estate, environment and energy initiatives, and the mobility sector. This broad diversification strategy is a cornerstone for achieving stable earnings growth and implementing robust risk management practices.

In fiscal year 2024, Mitsubishi HC Capital reported a consolidated net sales of ¥1,507.1 billion, a testament to the breadth of its diversified operations and effective asset management. The company's commitment to spreading investments across these various segments, from essential services to growth industries, underpins its financial resilience and ability to navigate market fluctuations.

Mitsubishi HC Capital's risk assessment and credit management are fundamental. A key activity involves the continuous evaluation of customer creditworthiness and robust management of credit risk across their entire portfolio. This proactive approach ensures they stay ahead of potential issues.

The company actively monitors credit standing, taking decisive action when a customer's financial health deteriorates. This includes implementing necessary measures to mitigate potential losses and maintain the integrity of their financial assets.

Furthermore, Mitsubishi HC Capital prioritizes risk diversification. They strategically spread their exposure to avoid over-concentration with any single customer, industry sector, or geographic region, a practice critical for financial stability.

For instance, as of the fiscal year ending March 2024, Mitsubishi HC Capital reported total assets of ¥14,718.7 billion, underscoring the significant scale of their operations and the importance of diligent credit management to protect this substantial asset base.

Sustainable Finance and ESG Initiatives Development

Mitsubishi HC Capital actively develops sustainable finance, exemplified by its issuance of green bonds and sustainability-linked loans. These initiatives directly support their commitment to decarbonization and circular economy principles.

The company integrates Environmental, Social, and Governance (ESG) factors into its fundamental business strategy, aiming to foster long-term value creation. This strategic alignment is crucial for navigating evolving market expectations and regulatory landscapes.

- Green Bond Issuance: Mitsubishi HC Capital issued a ¥50 billion green bond in September 2023, with proceeds earmarked for renewable energy projects.

- Sustainability-Linked Finance: The company secured a sustainability-linked loan linked to its greenhouse gas emission reduction targets.

- ESG Integration: ESG considerations are increasingly embedded in credit assessments and investment decisions across their portfolio.

- Circular Economy Focus: Efforts include promoting the use of recycled materials in leased assets and developing asset lifecycle management programs.

Digital Transformation (DX) and Service Innovation

Mitsubishi HC Capital actively pursues digital transformation (DX) to streamline operations and pioneer new business models. This strategic focus is evident in their commitment to data-driven sales approaches and the development of innovative services. For example, in fiscal year 2023, the company reported significant progress in its digital initiatives, with a substantial portion of new business being influenced by digital channels. Their efforts include leveraging advanced digital technologies to deliver cutting-edge solutions to clients across various sectors, enhancing customer engagement and offering more sophisticated service packages.

The company's dedication to DX translates into tangible improvements and new revenue streams. By integrating digital tools, Mitsubishi HC Capital aims to not only optimize internal processes but also to redefine its service offerings. This allows them to provide advanced, data-informed solutions that address evolving customer needs. Their investment in digital infrastructure and capabilities is a cornerstone of their strategy to remain competitive and to unlock future growth opportunities in an increasingly digital-first market.

- Data-Driven Sales Enhancement: Implementing analytics to refine sales strategies and improve customer targeting.

- New Service Development: Creating innovative offerings powered by digital technologies and customer insights.

- Advanced Solution Provision: Utilizing digital platforms to deliver sophisticated and value-added services to clients.

- Operational Efficiency: Streamlining internal processes through digital tools and automation.

Mitsubishi HC Capital's core activities encompass a broad spectrum of financial services designed to support businesses and individuals. These include offering leasing, installment sales, and a variety of financing options. A significant part of their operation involves customer finance, enabling the acquisition of assets for both businesses and consumers.

The company also focuses on vendor solutions, acting as a strategic partner for manufacturers and distributors. This partnership facilitates product sales by providing accessible financing. In fiscal year 2024, Mitsubishi HC Capital reported consolidated net sales of ¥1,507.1 billion, highlighting the extensive reach of these diversified operations and their role in asset financing.

Furthermore, Mitsubishi HC Capital is deeply involved in managing and diversifying its extensive asset portfolio, which spans customer solutions, global operations, aviation, logistics, real estate, environment and energy, and mobility. This diversification, coupled with robust risk assessment and credit management, underpins their strategy for stable earnings and financial resilience. As of March 2024, their total assets stood at ¥14,718.7 billion.

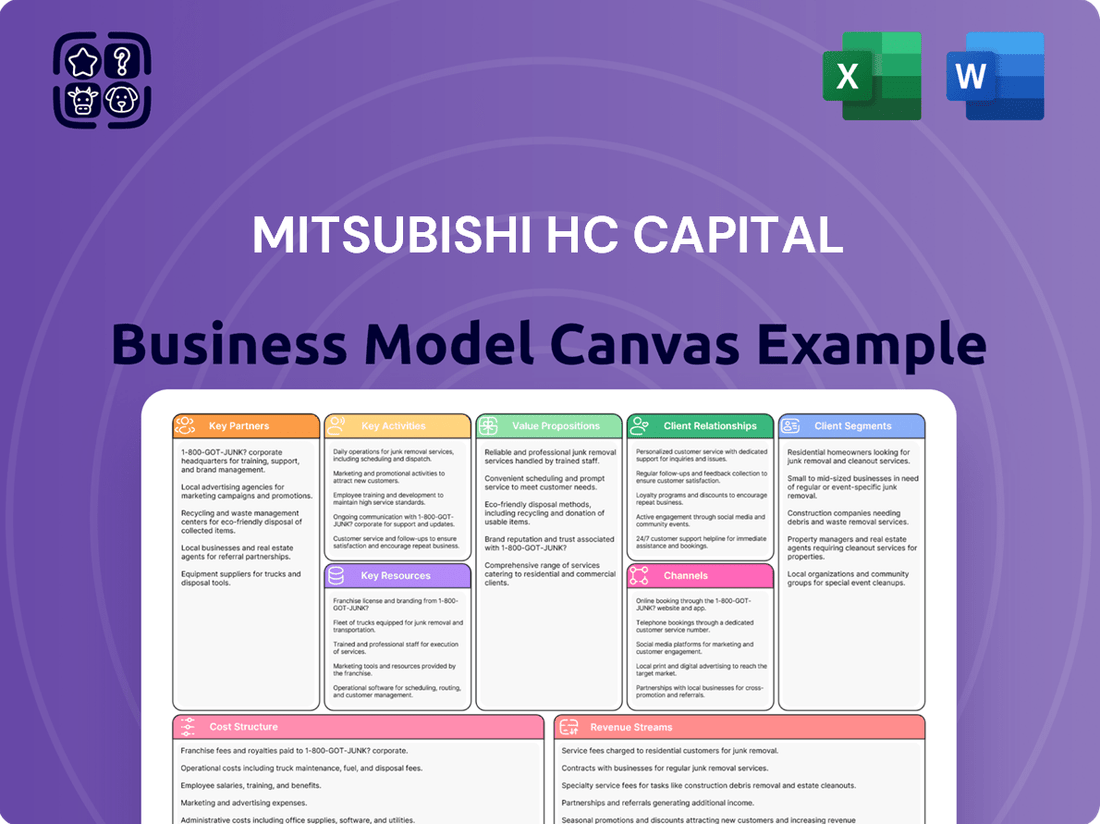

What You See Is What You Get

Business Model Canvas

The Mitsubishi HC Capital Business Model Canvas preview you are viewing is precisely the same document you will receive upon purchase. This means you are seeing the actual, fully formatted Business Model Canvas, not a simplified sample or mockup. Upon completing your order, you will gain immediate access to this exact file, ready for your strategic analysis and planning.

Resources

Mitsubishi HC Capital boasts significant financial resources, allowing it to provide a broad spectrum of leasing and financing solutions to its clientele. This robust financial backing is crucial for supporting its diverse business operations and expansion initiatives.

The company's strong funding capacity is underpinned by enduring partnerships with major global financial institutions. These relationships grant Mitsubishi HC Capital reliable access to a variety of funding sources, including syndicated loans and capital markets.

In 2024, Mitsubishi HC Capital's commitment to financial strength was evident. For instance, its consolidated net sales reached approximately ¥1.5 trillion for the fiscal year ending March 2024, demonstrating the scale of its operations and its ability to generate substantial revenue.

Furthermore, the company actively utilizes diverse financial instruments, such as securitization and asset-backed financing, to optimize its capital structure and enhance its funding flexibility. This strategic approach ensures a consistent and cost-effective supply of capital.

Mitsubishi HC Capital's diversified asset portfolio is a cornerstone of its business model. This extensive collection of tangible and intangible assets spans numerous sectors, providing a robust foundation for its operations. As of March 31, 2024, the company reported total assets of ¥15,773 billion, showcasing the sheer scale of this resource.

This portfolio is strategically spread across key areas like aircraft, marine containers, rolling stock, real estate, and renewable energy projects. Such diversification mitigates risk by not relying on a single market or asset class. For instance, the company's aircraft leasing segment, a significant component, experienced growth in its portfolio value throughout 2023.

Mitsubishi HC Capital's human capital is a cornerstone of its business model, featuring a deep bench of employees possessing extensive knowledge in leasing transactions and financial services. This specialized expertise is crucial for crafting tailored financial solutions that meet diverse client needs.

The company’s workforce navigates complex industry sectors, leveraging their understanding to provide insightful guidance and innovative approaches. For instance, as of the fiscal year ending March 2024, Mitsubishi HC Capital reported a consolidated workforce of approximately 22,800 employees globally, highlighting the scale of its human capital investment.

This talent base is instrumental in developing customized financial solutions, from asset financing to equipment leasing, across various markets. Their ability to understand specific client requirements and market dynamics allows Mitsubishi HC Capital to differentiate its offerings.

The financial performance in FY2023, with consolidated net sales reaching ¥1,487.7 billion, underscores the effectiveness of this human capital in driving business growth and client satisfaction.

Advanced IT Infrastructure and Digital Platforms

Mitsubishi HC Capital's advanced IT infrastructure and digital platforms are critical enablers of its business model. These systems facilitate the efficient processing of lease agreements, customer data, and financial transactions. For instance, their integrated digital platforms allow for streamlined application submission and approval processes, reducing turnaround times for clients.

The company utilizes these technological resources to gather enhanced usage analytics, providing valuable insights into asset performance and customer behavior. This data-driven approach supports the development of innovative financing models, such as 'as-a-service' solutions, which are becoming increasingly important in the market. In 2024, the digital transformation of financial services continued to accelerate, with companies like Mitsubishi HC Capital investing heavily in cloud computing and data analytics to maintain a competitive edge.

- Digital Platforms: Provide end-to-end customer lifecycle management, from application to asset remarketing.

- Data Analytics: Enable predictive maintenance insights and personalized customer offerings.

- 'As-a-Service' Models: Supported by robust IT, these shift focus from ownership to usage and service.

- Operational Efficiency: Achieved through automation and integrated IT systems, reducing manual processing.

Strong Brand Reputation and Stakeholder Trust

Mitsubishi HC Capital leverages a robust brand reputation, cultivated over its extensive history, as a cornerstone of its business model. This reputation is intrinsically linked to its demonstrated commitment to fostering a prosperous and sustainable society, which in turn builds significant stakeholder trust.

This trust extends across its customer base, shareholders, and employees, acting as a critical intangible asset. In fiscal year 2023, the company reported a consolidated net income attributable to owners of the parent of ¥172,601 million, reflecting the financial stability and confidence stakeholders place in its operations and long-term vision.

- Brand Strength: Mitsubishi HC Capital benefits from the established trust and recognition associated with the Mitsubishi name, a significant factor in attracting and retaining customers.

- Stakeholder Confidence: The company's long-standing commitment to corporate social responsibility and ethical business practices underpins the trust it has earned from investors and the broader community.

- Competitive Advantage: A strong brand reputation and high stakeholder trust provide a competitive edge, facilitating easier market penetration and stronger customer loyalty.

- Financial Performance: This trust is often reflected in financial metrics, such as the company's consistent revenue streams and its ability to secure favorable financing terms, as evidenced by its stable financial reports.

Mitsubishi HC Capital's key resources include substantial financial backing, a diversified asset portfolio, skilled human capital, advanced IT infrastructure, and a strong brand reputation. These elements collectively enable the company to offer a wide range of leasing and financing solutions, manage risk effectively, and maintain stakeholder trust.

| Key Resource | Description | 2024 Data/Insight |

|---|---|---|

| Financial Resources | Robust funding capacity through partnerships and diverse financial instruments. | Consolidated net sales of approx. ¥1.5 trillion (FY ending March 2024). |

| Asset Portfolio | Diversified tangible and intangible assets across various sectors. | Total assets of ¥15,773 billion (as of March 31, 2024). |

| Human Capital | Employees with deep expertise in leasing and financial services. | Approx. 22,800 employees globally (FY ending March 2024). |

| IT Infrastructure & Digital Platforms | Advanced systems for efficient processing and data analytics. | Investment in cloud computing and data analytics to maintain competitive edge. |

| Brand Reputation | Established trust and recognition, linked to societal commitment. | Consolidated net income of ¥172,601 million (FY2023). |

Value Propositions

Mitsubishi HC Capital excels in providing customized leasing, installment sales, and financing services. These solutions are specifically crafted to address the distinct requirements of clients operating in a wide array of industries, ensuring no business is overlooked.

This adaptability is crucial for businesses aiming to secure essential equipment without straining their financial resources. For instance, in 2024, many small and medium-sized enterprises leveraged flexible financing to upgrade their technology infrastructure, a trend that has seen significant growth.

The ability to tailor financial packages allows companies to optimize cash flow management, aligning payments with their operational cycles and revenue streams. This strategic financial planning is a cornerstone of efficient business operations.

This focus on bespoke financial solutions empowers clients to acquire the assets they need to drive growth and innovation, making Mitsubishi HC Capital a strategic partner in their success.

Mitsubishi HC Capital leverages its deep industry-specific expertise to craft tailored financial solutions. This focus spans critical sectors including healthcare, mobility, environment & energy, real estate, aviation, and logistics. For instance, their understanding of the healthcare sector allows for financing options that support vital medical equipment upgrades, a key need given that global healthcare spending was projected to reach over $11 trillion by 2024.

This specialized knowledge is crucial for developing financing strategies that directly address the unique challenges and capitalize on the opportunities within each sector. By understanding the nuances of industries like aviation, where the International Air Transport Association (IATA) anticipated a significant rebound in passenger traffic in 2024, Mitsubishi HC Capital can offer solutions that facilitate fleet modernization and operational efficiency.

Mitsubishi HC Capital actively supports a sustainable future by financing eco-conscious projects and driving decarbonization efforts. This commitment is demonstrated through significant investments in renewable energy sources, contributing to cleaner energy grids.

The company also provides crucial financial backing for electric vehicle (EV) initiatives, recognizing their role in reducing transportation emissions. These actions directly align with and bolster global sustainability targets for environmental protection.

For instance, in fiscal year 2023, Mitsubishi HC Capital's leasing and credit businesses saw a substantial increase in financing for environmentally friendly assets, reflecting growing demand and their strategic focus.

Access to Capital and Enhanced Operational Efficiency

Mitsubishi HC Capital's value proposition centers on providing crucial access to capital, particularly for small and medium-sized enterprises (SMEs). This funding empowers businesses to undertake significant capital investments, directly leading to enhanced operational efficiency. For instance, in fiscal year 2023, the company facilitated a substantial volume of financing, enabling numerous SMEs to upgrade their equipment and streamline processes.

Their financing solutions are deliberately crafted to simplify and accelerate the often-complex funding journey. This streamlined approach means businesses can acquire the necessary assets faster, allowing them to implement improvements and boost productivity without lengthy delays. This efficiency gain is a key driver for their clients' growth and competitiveness in the market.

- Access to Essential Capital: Mitsubishi HC Capital provides vital funding, enabling businesses, especially SMEs, to invest in growth and operational improvements.

- Enhanced Operational Efficiency: By securing capital for equipment upgrades and technology adoption, clients can significantly boost their productivity and streamline operations.

- Accelerated Funding Processes: The company's financing solutions are designed for speed and simplicity, reducing the time businesses spend on securing capital.

- Support for SME Growth: A core focus is empowering smaller enterprises with the financial tools needed to compete and expand.

Global Reach and Local Market Understanding

Mitsubishi HC Capital's global reach is a cornerstone of its value proposition, enabling it to provide financial services across numerous regions. This expansive network is complemented by a deep understanding of local market nuances, ensuring tailored solutions. In 2023, the company reported total assets under management of approximately ¥17.7 trillion (around $120 billion USD at the time of reporting), showcasing its significant international footprint.

This dual capability of global presence and local insight is crucial for effective capital deployment and risk diversification. By operating in diverse economic environments, Mitsubishi HC Capital can mitigate sector-specific or regional downturns. For instance, its presence in both developed markets like North America and emerging markets in Asia allows for a balanced portfolio of opportunities and risks.

The company's strategy leverages its international infrastructure to offer competitive financing and leasing solutions. This global operational base, supported by localized expertise, allows for efficient resource allocation and responsiveness to varying client needs worldwide.

Key aspects of this value proposition include:

- Global Network: Operations spanning key economic regions, facilitating international transactions.

- Local Market Acumen: Tailored services that acknowledge and adapt to specific regional regulations and economic conditions.

- Diversified Risk Management: Spreading investments and operations across different geographies to buffer against localized economic shocks.

- Efficient Capital Deployment: Utilizing its extensive reach to identify and capitalize on global investment and financing opportunities.

Mitsubishi HC Capital's value proposition is built on providing flexible, customized financial solutions tailored to diverse industry needs. They specialize in leasing, installment sales, and financing, ensuring businesses can acquire essential assets without financial strain. This adaptability is crucial, as evidenced by the significant increase in SME technology upgrades in 2024, facilitated by such flexible financing.

Their deep industry expertise, spanning healthcare, mobility, and energy, allows for the development of highly specific financial strategies. For example, understanding the healthcare sector's need for medical equipment upgrades, a market projected to exceed $11 trillion globally by 2024, enables tailored financing options.

The company also champions sustainability by financing eco-conscious projects and EV initiatives, contributing to decarbonization efforts. This commitment is reflected in their fiscal year 2023 results, which showed a substantial rise in financing for environmentally friendly assets.

Mitsubishi HC Capital's global reach, with total assets under management around ¥17.7 trillion in FY2023, combined with local market knowledge, ensures efficient capital deployment and risk diversification across different regions.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Customized Financial Solutions | Tailored leasing, installment sales, and financing for specific industry needs. | Facilitated SME technology upgrades in 2024. |

| Industry-Specific Expertise | Deep knowledge in sectors like healthcare, mobility, and energy. | Healthcare global spending projected over $11 trillion by 2024. |

| Sustainability Focus | Financing for renewable energy and EV initiatives. | Increased financing for green assets in FY2023. |

| Global Reach & Local Acumen | Extensive international network with localized understanding. | Total assets under management ~¥17.7 trillion in FY2023. |

Customer Relationships

Mitsubishi HC Capital prioritizes a long-term partnership model, aiming to be more than just a service provider. They engage in a consultative process, actively seeking to understand the dynamic needs of their clients. This proactive engagement fosters enduring trust and a collaborative spirit.

This approach is evident in their consistent client retention rates, which remain strong, indicating satisfaction with their ongoing support. For instance, in fiscal year 2023, Mitsubishi HC Capital reported a significant portion of their revenue derived from repeat business, underscoring the success of their relationship-centric strategy.

Mitsubishi HC Capital often assigns dedicated account managers to its clients, especially those with substantial needs or intricate financing structures. This approach guarantees that large corporations and those undertaking complex projects receive focused support and expert advice tailored to their specific requirements.

These dedicated teams provide personalized attention, guiding clients through every stage of the financing process, from initial structuring to ongoing management. This ensures a smooth and efficient experience, fostering strong, long-term relationships built on trust and expert guidance.

Mitsubishi HC Capital is prioritizing digital engagement to enhance customer relationships. This includes offering robust self-service portals where clients can manage their accounts, track applications, and access support without direct human intervention. For instance, in 2024, a significant portion of new lease applications were initiated and processed digitally, demonstrating the growing reliance on these platforms for efficiency.

These digital tools streamline the financing process, providing quick and efficient access to capital and related services, especially for businesses that meet certain qualification criteria. This focus on user-friendly digital interfaces aims to reduce turnaround times and improve overall customer satisfaction by making interactions more convenient and transparent.

Addressing Social and Environmental Issues Collaboratively

Mitsubishi HC Capital actively cultivates customer relationships by jointly tackling social and environmental challenges. This approach, often termed Sustainability Transformation (SX), goes beyond traditional business interactions to foster shared value creation.

By integrating digital transformation (DX) with SX, the company empowers customers and partner firms to innovate solutions for pressing global issues. This collaborative problem-solving not only deepens partnerships but also drives tangible progress toward a more sustainable future.

For instance, in 2024, Mitsubishi HC Capital's initiatives focused on areas like reducing carbon emissions and promoting circular economy principles. These efforts involved close collaboration with clients across various industries, leading to measurable environmental benefits.

- Fostering Shared Value: Mitsubishi HC Capital collaborates with customers and partners on sustainability initiatives.

- SX and DX Integration: Combining Sustainability Transformation (SX) with Digital Transformation (DX) to address issues.

- Strengthening Partnerships: Collaborative problem-solving enhances relationships and builds trust.

- Driving Sustainable Outcomes: Joint efforts aim to create positive social and environmental impacts.

Diversified Engagement Across Customer Segments

Mitsubishi HC Capital recognizes that one size does not fit all when it comes to customer relationships. They tailor their approach based on the specific needs and scale of each client. For instance, large corporations and government entities might receive dedicated account management and highly customized financing structures. This contrasts with their engagement with small and medium-sized enterprises (SMEs), where more standardized yet flexible solutions are often provided.

Their strategy also involves building strong partnerships with retail businesses. By collaborating with these partners, Mitsubishi HC Capital can offer accessible financing options directly to end consumers, facilitating the purchase of goods and services. This multi-pronged approach ensures a broad market reach and caters to diverse financial requirements across the economic spectrum.

- Segmented Relationship Management: Relationships are cultivated differently for large corporations, government agencies, SMEs, and individual consumers, acknowledging varied service expectations and transaction complexities.

- Retail Partnerships: Collaboration with retail partners allows for integrated financing solutions, making products and services more accessible to a wider consumer base.

- Tailored Financing Solutions: Mitsubishi HC Capital designs specific financing packages and support mechanisms to align with the unique financial capacities and growth objectives of different business sizes.

- Customer Lifecycle Support: Engagement extends beyond initial transactions, focusing on ongoing support and relationship deepening to foster long-term loyalty and value creation across all segments.

Mitsubishi HC Capital cultivates deep, long-term client relationships through a consultative approach, assigning dedicated account managers for complex needs, and leveraging digital platforms for efficient self-service. For example, in fiscal year 2023, a significant portion of their revenue came from repeat business, highlighting their success in fostering loyalty.

This relationship strategy extends to joint sustainability initiatives, integrating digital and sustainability transformations to create shared value and address global challenges. In 2024, their efforts focused on carbon emission reduction and circular economy principles, demonstrating tangible environmental benefits through client collaboration.

| Relationship Aspect | Key Strategy | Client Segment Focus | Example/Data Point |

|---|---|---|---|

| Partnership Model | Consultative, long-term engagement | All segments, with tailored intensity | Strong client retention rates; FY2023 repeat business revenue significant. |

| Dedicated Support | Account managers for complex needs | Large corporations, intricate financing | Ensures focused support and expert advice for tailored solutions. |

| Digital Engagement | Self-service portals, digital processing | SMEs, general clients seeking efficiency | Significant portion of 2024 new lease applications processed digitally. |

| Sustainability Collaboration | Joint SX/DX initiatives | Clients focused on ESG goals | 2024 initiatives targeting carbon reduction and circular economy principles. |

Channels

Mitsubishi HC Capital leverages its direct sales force and business development teams to forge strong relationships with key clients, including major corporations, government bodies, and large enterprises. These teams are instrumental in understanding client needs and crafting tailored financial solutions.

By directly engaging with these sophisticated customers, the company can offer bespoke leasing and financing options, ensuring a deep understanding of each client's unique operational and financial requirements. This direct approach allows for a more agile and responsive service.

For fiscal year 2023, Mitsubishi HC Capital reported significant revenue streams, with their direct sales efforts contributing substantially to their overall financial performance. The focus on building enduring client partnerships through these dedicated teams underpins their market strategy.

These business development professionals are crucial in identifying new market opportunities and expanding the company's footprint within targeted sectors, driving growth through proactive engagement and expert financial advisory services.

Mitsubishi HC Capital leverages vendor programs and expansive dealer networks as key channels to drive equipment financing. These partnerships are vital, enabling them to offer leasing and loan solutions directly to end-users, thereby supporting manufacturers and distributors. For instance, in the construction equipment sector, these networks are instrumental in placing financed machinery with businesses that need it.

In 2024, the company's focus on strengthening these relationships is evident. By providing accessible financing options through trusted vendor and dealer channels, Mitsubishi HC Capital facilitates a smoother sales process for their partners. This approach not only boosts equipment sales but also builds long-term loyalty within these critical industry segments.

Mitsubishi HC Capital increasingly utilizes online platforms and digital portals to enhance customer experience and operational efficiency. These digital channels streamline the entire financing application process, from initial inquiry to final approval, offering greater accessibility for clients.

In 2024, the company reported a significant increase in digital engagement, with over 60% of new financing applications initiated through their online portal. This digital-first approach allows for faster processing times, with many standard applications being reviewed within 24-48 hours.

These portals not only facilitate new business but also provide existing clients with a secure space to manage their accounts, view financing details, and access support services. This focus on digital service delivery reflects a broader industry trend toward greater convenience and responsiveness.

Strategic Partnerships and Affiliated Companies

Mitsubishi HC Capital leverages its deep connections within the Mitsubishi and Hitachi groups as crucial channels for business development. These affiliations provide access to a vast and established customer base across various industries, facilitating significant deal flow and market penetration. For example, in fiscal year 2023, these group synergies contributed to a substantial portion of new leasing contracts, demonstrating their ongoing importance.

Beyond its core group relationships, Mitsubishi HC Capital actively cultivates other strategic partnerships. These alliances serve as vital conduits for expanding service offerings and reaching new market segments. Collaborative ventures with technology providers and industry-specific specialists enable the company to offer more comprehensive and tailored solutions to its clients, driving revenue growth. The company reported a YOY increase in revenue from joint ventures in the first half of 2024.

- Mitsubishi and Hitachi Group Synergies: Direct access to a broad customer base and cross-selling opportunities within these powerful conglomerates.

- Technology Partnerships: Collaborations with leading tech firms to integrate advanced solutions into leasing and financing offerings.

- Industry-Specific Alliances: Joint ventures with companies specializing in sectors like renewable energy or healthcare to target niche markets effectively.

- Financial Institution Collaborations: Partnerships with banks and other financial entities to broaden funding sources and offer more diverse financial products.

Global and Regional Subsidiaries

Mitsubishi HC Capital leverages a robust network of global and regional subsidiaries to serve diverse international markets. This structure allows for localized strategies, ensuring offerings resonate with specific customer needs and comply with regional regulations.

Key subsidiaries, such as Mitsubishi HC Capital America and Mitsubishi HC Capital UK, are instrumental in this global expansion. For instance, as of the fiscal year ending March 2024, Mitsubishi HC Capital reported consolidated revenue of ¥1,684.3 billion, with its international operations forming a significant portion of this total, demonstrating the reach and impact of its subsidiary network.

- Global Reach: Operates through subsidiaries in North America, Europe, and Asia, facilitating access to key economic regions.

- Localized Strategies: Tailors financial products and services to meet the unique demands and regulatory environments of each market.

- Market Adaptation: Empowers subsidiaries to innovate and adjust their business models based on local competitive landscapes and economic trends.

- Revenue Contribution: International segments, driven by these subsidiaries, consistently contribute a substantial share to the company's overall financial performance.

Mitsubishi HC Capital utilizes a multi-faceted approach to reach its customers. This includes a direct sales force for large corporate clients, vendor and dealer networks for equipment financing, and increasingly, digital platforms for streamlined applications and account management.

Strategic partnerships, including those within the Mitsubishi and Hitachi groups, alongside industry-specific alliances, further expand their market reach and service capabilities. A global network of subsidiaries ensures localized strategies and compliance with regional regulations, contributing significantly to overall revenue.

For fiscal year 2023, consolidated revenue reached ¥1,684.3 billion, with international operations playing a vital role. In 2024, over 60% of new financing applications were initiated online, highlighting the growing importance of digital channels.

| Channel | Key Characteristics | 2024 Insights/Data |

|---|---|---|

| Direct Sales Force | Builds strong relationships with major corporations and government bodies; offers tailored financial solutions. | Instrumental in understanding complex client needs and crafting bespoke leasing options. |

| Vendor & Dealer Networks | Facilitates equipment financing by partnering with manufacturers and distributors; supports end-user access to machinery. | Strengthened relationships in 2024 to simplify sales processes and foster loyalty. |

| Online Platforms/Digital Portals | Streamlines financing applications, enhances customer experience, and provides account management. | Over 60% of new applications initiated online in 2024; faster processing times (24-48 hours for standard applications). |

| Group Synergies (Mitsubishi/Hitachi) | Leverages established customer bases within conglomerates for deal flow and market penetration. | Contributed significantly to new leasing contracts in FY2023. |

| Strategic Partnerships | Collaborations with tech providers and industry specialists to expand service offerings and reach new segments. | Reported YOY increase in revenue from joint ventures in H1 2024. |

| Global Subsidiaries | Serves diverse international markets with localized strategies and regulatory compliance. | International operations formed a significant portion of FY2024 consolidated revenue of ¥1,684.3 billion. |

Customer Segments

Large corporations and enterprises represent a crucial customer segment for Mitsubishi HC Capital, seeking substantial financing for significant capital expenditures. These businesses, operating across diverse sectors like manufacturing, technology, and infrastructure, require tailored financial solutions to acquire high-value equipment, fund large-scale projects, and manage complex investment portfolios.

Mitsubishi HC Capital's offerings for this segment are designed to meet the scale and sophistication of their needs. For instance, in 2024, the company continued to support major industrial players with leasing and financing packages for advanced machinery and operational infrastructure, reflecting the ongoing demand for technological upgrades and expansion within these large organizations.

The financial services provided are comprehensive, encompassing equipment leasing, asset finance, and project finance, all structured to align with the long-term strategic objectives of these enterprises. This focus on customized, large-scale financial solutions underscores Mitsubishi HC Capital's commitment to partnering with major corporations in their growth and development initiatives.

Mitsubishi HC Capital provides crucial financing solutions tailored for Small and Medium-sized Enterprises (SMEs). These businesses often require capital for vital investments in new equipment, operational expansion, and smoothing out cash flow. This segment is particularly significant in 2024, as many SMEs find traditional bank lending more constrained, making alternative financing options indispensable for their growth and stability.

Mitsubishi HC Capital's public sector segment focuses on delivering leasing and financial solutions tailored for government agencies. This involves supporting the acquisition of essential assets and the development of critical infrastructure projects. For instance, in 2024, governments globally continued to invest heavily in public works and digital transformation, areas where specialized leasing can be particularly impactful.

These engagements necessitate a deep understanding of public finance regulations and the unique objectives government bodies aim to achieve. The company's offerings are designed to align with these stringent requirements, ensuring compliance and efficient resource allocation. The demand for flexible financing for public services remained robust throughout 2024, driven by the need to modernize and expand citizen-facing initiatives.

Industry-Specific Clients (e.g., Healthcare, Aviation, Energy)

Mitsubishi HC Capital tailors its services to meet the unique demands of industry-specific clients, including those in the robust healthcare sector. This focus allows for the development of highly specialized financial solutions. For example, in 2024, the global healthcare equipment leasing market was projected to reach over $100 billion, highlighting the significant financing needs within this industry.

The company's deep understanding of sectors like aviation and energy enables it to offer customized financing, such as fleet management solutions for airlines or project finance for renewable energy developments. Mitsubishi HC Capital's commitment to these high-growth areas is demonstrated by its strategic investments and partnerships aimed at supporting the expansion of these vital industries.

Clients in real estate and logistics also leverage Mitsubishi HC Capital's expertise for their capital expenditure requirements. By providing flexible leasing and financing options, the company facilitates the acquisition of essential assets, contributing to operational efficiency and growth within these competitive markets.

Mitsubishi HC Capital's industry-specific approach means clients receive financial products designed not just for general use, but for the specific operational and regulatory environments of their sectors. This specialized support is crucial for businesses operating in capital-intensive fields.

Individual Consumers (via Retail Partners)

Mitsubishi HC Capital, through its consumer finance arms like Novuna Consumer Finance in the UK, directly engages individual consumers by offering seamless point-of-sale financing at retail locations. This strategy allows customers to acquire goods and services immediately, making larger purchases more accessible. For example, in 2024, Novuna Consumer Finance continued to expand its partnerships, facilitating millions of transactions across various retail sectors, from electronics to furniture.

The company strategically leverages its relationships with a broad network of retail partners, including major high-street brands and online marketplaces, to reach this customer segment. These collaborations are crucial for integrating financing options directly into the purchasing journey. In 2024, the company reported a significant increase in its retail finance volume, driven by these strong partnerships, which now number in the thousands across the UK and Europe.

- Retail Partnerships: Access to over 5,000 retail partners in 2024, covering diverse sectors.

- Point-of-Sale Financing: Enabling immediate purchases for consumers at the checkout.

- Personal Lending: Offering flexible personal loan options to meet individual financial needs.

- Consumer Trust: Building confidence through reliable and transparent financing solutions.

Mitsubishi HC Capital serves a diverse range of customers, from large corporations needing significant capital for expansion to SMEs seeking essential equipment financing. The company also caters to public sector entities requiring infrastructure development and specific industry clients like healthcare and aviation, offering tailored financial solutions. Furthermore, through its consumer finance arms, it provides direct point-of-sale financing to individual consumers via extensive retail partnerships.

| Customer Segment | Key Needs | 2024 Focus/Data |

|---|---|---|

| Large Corporations | Large-scale equipment, project finance, complex portfolios | Continued support for industrial players' technological upgrades and expansion. |

| SMEs | New equipment, operational expansion, cash flow smoothing | Indispensable for growth as traditional lending remained constrained. |

| Public Sector | Essential assets, infrastructure projects, modernization | Robust demand for flexible financing for citizen-facing initiatives and digital transformation. |

| Industry-Specific (Healthcare, Aviation, Energy, Real Estate, Logistics) | Specialized equipment, fleet management, project finance | Healthcare leasing market projected over $100 billion; support for renewable energy developments. |

| Individual Consumers | Point-of-sale financing, personal loans | Novuna Consumer Finance facilitated millions of transactions via over 5,000 retail partners. |

Cost Structure

Mitsubishi HC Capital's cost structure is heavily influenced by its cost of capital, primarily consisting of interest expenses on its substantial borrowings and outstanding bonds. In fiscal year 2024, the company reported significant interest expenses, reflecting its reliance on debt financing to support its extensive leasing and lending operations.

Effectively managing funding requirements across diverse currencies and international markets is a critical financial activity for Mitsubishi HC Capital. This involves navigating varying interest rate environments and foreign exchange exposures to secure capital at the most favorable terms, directly impacting the company's overall profitability.

Operational and administrative expenses form a significant part of Mitsubishi HC Capital's cost structure, encompassing general administrative costs, personnel salaries, and overheads essential for its global financial services operations. These expenses are crucial for managing a diverse portfolio of business segments and supporting a substantial workforce.

In fiscal year 2023, Mitsubishi HC Capital reported selling, general and administrative expenses amounting to ¥243.8 billion. This figure reflects the significant investment in maintaining a robust global infrastructure and managing its varied business lines effectively.

The company's commitment to managing a large employee base and diverse business segments, from IT services to equipment leasing, inherently drives these operational and administrative costs. These expenditures are vital for ensuring smooth day-to-day operations and supporting strategic growth initiatives across its international presence.

Mitsubishi HC Capital faces credit costs stemming from potential customer defaults and provisions for bad debts. These expenses are particularly pronounced in sectors like transportation, which can be volatile due to economic shifts. For instance, in fiscal year 2023, the company reported a net charge-off ratio of 0.26%, indicating the actual amount of unrecoverable debt relative to total loans.

To counter these credit risks, the company invests significantly in robust risk management systems. These systems are designed to identify, assess, and mitigate potential losses, thereby protecting its financial health. This proactive approach is crucial for maintaining profitability, especially when operating in diverse and sometimes unpredictable markets.

Technology and Digital Transformation Investments

Mitsubishi HC Capital dedicates substantial resources to its technology and digital transformation efforts. These investments are crucial for optimizing operations, delivering superior customer experiences, and pioneering new business avenues.

The company's commitment to digital transformation (DX) is evident in its ongoing expenditures across various technological domains. These outlays are designed to build robust IT infrastructure, develop advanced digital platforms, and integrate cutting-edge technologies.

- IT Infrastructure Upgrades: Continued investment in cloud computing, data analytics, and cybersecurity to ensure scalability and security.

- Digital Platform Development: Expansion and enhancement of online portals and mobile applications for seamless customer interaction and service delivery.

- Emerging Technologies: Exploration and implementation of AI, IoT, and blockchain to create innovative solutions and improve operational efficiency.

- DX Initiative Funding: Significant allocation of capital towards projects aimed at modernizing business processes and fostering a data-driven culture.

Depreciation and Amortization of Leased Assets

Depreciation and amortization of Mitsubishi HC Capital's extensive leasing portfolio are significant cost drivers. This accounting practice reflects the systematic allocation of the cost of tangible and intangible assets over their useful lives, effectively recognizing the gradual decline in their value due to wear and tear, obsolescence, or usage. For a leasing company, these non-cash expenses are paramount to understanding the true cost of generating revenue from its leased assets.

As of fiscal year-end March 2024, Mitsubishi HC Capital's financial statements highlight the impact of these costs. For instance, the company reported depreciation and amortization expenses totaling approximately ¥168.4 billion for the fiscal year ended March 31, 2024. This figure underscores the substantial capital investment in its leased equipment and the ongoing accounting recognition of its consumption.

- Asset Value Decline: This cost directly represents the reduction in the economic value of leased machinery, vehicles, aircraft, and other equipment as they age and are used.

- Financial Reporting: Depreciation and amortization are crucial for accurate financial reporting, impacting profitability and the book value of assets on the balance sheet.

- Tax Implications: These expenses often provide tax shields, reducing a company's taxable income and, consequently, its tax liability.

- Capital Allocation: Understanding these costs is vital for Mitsubishi HC Capital's capital allocation decisions, influencing pricing strategies for new leases and the timing of asset replacements.

Mitsubishi HC Capital's cost structure is significantly shaped by its cost of capital, primarily interest expenses on substantial borrowings and bonds. In fiscal year 2024, these expenses were a major outlay, reflecting its reliance on debt to fund extensive leasing and lending. Operational and administrative costs, including personnel and overheads, are also substantial, amounting to ¥243.8 billion in selling, general, and administrative expenses for fiscal year 2023, supporting its global operations and workforce.

| Cost Component | Fiscal Year 2024 (Estimated/Reported) | Fiscal Year 2023 (Reported) | Significance |

| Cost of Capital (Interest Expense) | Significant | Substantial | Primary driver due to debt financing |

| Operational & Administrative Expenses | Ongoing Investment | ¥243.8 billion (SG&A) | Supports global infrastructure and workforce |

| Credit Costs (Net Charge-off Ratio) | Managed Risk | 0.26% | Mitigation through risk management systems |

| Depreciation & Amortization | Approx. ¥168.4 billion | N/A (FY23 data not explicitly stated separately here) | Reflects asset value decline in leasing portfolio |

Revenue Streams

Mitsubishi HC Capital's core revenue stems from the interest earned on its diverse leasing and loan portfolios. This robust income stream is a cornerstone, particularly supporting its Customer Solutions and Global Business divisions.

For the fiscal year ending March 2024, the company reported significant interest income, reflecting the broad reach of its financial services. This financial engine is key to maintaining stable earnings and funding future growth initiatives.

Mitsubishi HC Capital generates revenue through a variety of fees tied to its financial services. These include arrangement fees for structuring deals, advisory fees for expert guidance, and service charges for bespoke financing solutions. For instance, managing intricate financial arrangements often incurs specific fees reflecting the complexity and resources involved.

Mitsubishi HC Capital realizes revenue from selling assets that have been leased out once their contract periods conclude. This also encompasses the strategic divestment of investment securities and stakes in affiliated companies and subsidiaries.

These sales can involve various asset classes, including properties like real estate or international infrastructure projects, contributing to the company's diverse income streams.

For the fiscal year ending March 31, 2024, Mitsubishi HC Capital reported gains on sales of assets and investments as a component of its overall financial performance, though specific figures for this particular revenue stream are often embedded within broader financial disclosures.

Rental Income from Equipment and Vehicles

Mitsubishi HC Capital generates significant revenue through the rental of various assets, including essential equipment and vehicles. This stream is particularly strong for categories like marine containers, railcars, and diverse vehicle fleets. The company offers both flexible short-term rentals and more stable long-term leasing agreements, catering to a wide range of customer needs across different industries.

This rental income forms a core component of their business model, providing a predictable revenue flow. For instance, in fiscal year 2023, the leasing segment, which heavily features equipment and vehicle rentals, contributed substantially to their overall financial performance. This segment is crucial for maintaining consistent cash flow and supporting the company's asset-heavy operations.

- Marine Containers: Rental income derived from leasing a global fleet of marine containers.

- Railcars: Revenue generated from leasing specialized railcars to transportation and logistics companies.

- Vehicles: Income from short-term and long-term rentals of a diverse range of vehicles, from passenger cars to commercial trucks.

- Equipment: Rental revenue from various industrial and specialized equipment used across different sectors.

Income from Equity-Method Affiliates and Joint Ventures

Mitsubishi HC Capital generates revenue through its share of profits from companies where it has significant influence, but not outright control, utilizing the equity method of accounting. This approach acknowledges its strategic investments in various ventures, contributing to a diversified income base.

These equity-method affiliates often operate in growth sectors, such as renewable energy, which aligns with the company's forward-looking investment strategy. For example, in fiscal year 2024, the company reported significant contributions from these equity method investments, demonstrating their growing importance to overall profitability.

- Income from Equity-Method Affiliates: Mitsubishi HC Capital earns a portion of the net income from these associated companies, reflecting its ownership stake and influence.

- Diversification of Revenue: This stream provides a valuable hedge against volatility in its core leasing and financing operations by tapping into the performance of diverse businesses.

- Strategic Investment Focus: Revenue generation here is closely tied to the success of strategic investments, particularly in areas like renewable energy projects and specialized financial services.

- Contribution to Profitability: For the fiscal year ending March 31, 2024, the equity in earnings of affiliated companies and joint ventures contributed substantially to the company's operating income, underscoring the financial impact of these partnerships.

Mitsubishi HC Capital also generates revenue through fees associated with managing and servicing its extensive portfolios, including arrangement, advisory, and service charges. These fees are crucial for optimizing deal structures and providing specialized financial solutions.

The company benefits from gains realized through the strategic sale of assets, such as leased equipment, real estate, and investment securities. This divestment strategy contributes to capital recycling and overall financial performance.

For the fiscal year ending March 31, 2024, the company's financial results highlighted the importance of these various revenue streams in achieving robust profitability.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Interest Income | Earnings from leasing and loan portfolios. | Core contributor to stable earnings. |

| Fees and Commissions | Charges for arrangement, advisory, and service. | Supports specialized financial solutions. |

| Gains on Sales of Assets/Investments | Proceeds from selling leased assets and securities. | Aids capital recycling and performance. |

| Rental Income | Revenue from leasing marine containers, railcars, vehicles, and equipment. | Provides predictable cash flow. |

| Equity in Earnings of Affiliates | Share of profits from associated companies. | Contributes to diversified income base. |

Business Model Canvas Data Sources

The Mitsubishi HC Capital Business Model Canvas is informed by a robust blend of internal financial statements, operational data, and customer feedback. These sources provide a comprehensive view of the company's performance and market position.