Mitsubishi HC Capital Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mitsubishi HC Capital Bundle

Mitsubishi HC Capital navigates a complex landscape shaped by intense rivalry and significant buyer power within the leasing and financial services sector. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for assessing their strategic positioning. The availability of substitutes also presents a constant challenge to their market dominance.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Mitsubishi HC Capital’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Mitsubishi HC Capital's primary suppliers are its sources of capital, which include banks, the bond market, and institutional investors. The cost and accessibility of this funding are crucial, directly influencing the company's profitability and its capacity to deliver competitive financial products. For instance, in early 2024, interest rate hikes by central banks globally increased borrowing costs for many financial institutions, potentially impacting Mitsubishi HC Capital's cost of capital.

Interest rate volatility poses a significant challenge for Mitsubishi HC Capital, directly impacting its cost of funds. For instance, if benchmark rates like the US Federal Funds Rate increase from their current levels, the company's borrowing expenses will rise. This can squeeze profit margins, especially if Mitsubishi HC Capital cannot fully pass on these higher costs to its leasing and financing clients.

In 2024, the global interest rate environment has been characterized by cautious movements, with central banks like the Federal Reserve signaling potential rate cuts later in the year, though the timing and magnitude remain uncertain. For example, as of early 2024, the Federal Funds Rate target range was 5.25% to 5.50%. Any sustained upward trend in these rates would directly increase Mitsubishi HC Capital's operational costs.

The bargaining power of suppliers in the financial sector, particularly those providing capital, is thus influenced by these macroeconomic conditions. If interest rates climb, the cost of acquiring funds for lending and leasing activities increases, giving capital providers more leverage over Mitsubishi HC Capital. This can lead to less favorable terms for the company's financing arrangements.

Conversely, a stable or declining interest rate environment, such as the anticipated rate cuts later in 2024, would generally reduce Mitsubishi HC Capital's cost of borrowing. This would lessen the bargaining power of its capital suppliers and potentially improve the company's profitability by allowing for more competitive pricing on its services.

The regulatory landscape significantly impacts the bargaining power of capital suppliers. For Mitsubishi HC Capital, central bank policies and financial regulations, such as capital adequacy ratios and liquidity coverage ratios, directly influence the cost and availability of funding. For instance, in 2024, many central banks continued to grapple with inflation, leading to potentially higher interest rates, which increases the cost of capital for firms like Mitsubishi HC Capital.

Supplier Power 4

Technology providers are crucial suppliers for Mitsubishi HC Capital, offering vital software, platforms, and data analytics. The reliance on these specialized financial tech solutions means suppliers can wield significant leverage, particularly when their offerings are unique or involve high switching costs for Mitsubishi HC Capital.

For instance, the global FinTech market was valued at approximately $1.15 trillion in 2023 and is projected to reach $3.57 trillion by 2030, indicating substantial growth and the increasing importance of technology suppliers. This growth underscores the potential power these providers hold.

- High Switching Costs: Implementing new core banking or leasing management systems can be a lengthy and expensive process, tying Mitsubishi HC Capital to existing providers.

- Specialized Solutions: Niche FinTech tools for risk assessment or specialized data analytics may have few viable alternatives, granting suppliers pricing power.

- Proprietary Technology: Suppliers with unique, patented technology essential for competitive advantage create a strong bargaining position.

- Industry Standards: If a supplier's technology becomes an industry de facto standard, it further solidifies their leverage.

Supplier Power 5

The bargaining power of suppliers for Mitsubishi HC Capital is influenced by the global nature of capital markets. Geopolitical events and international economic conditions directly impact funding costs and the availability of capital, which are crucial for a leasing and finance company like Mitsubishi HC Capital.

Mitsubishi HC Capital, with its extensive and diverse operations, depends heavily on a stable global financial landscape. This stability allows the company to secure favorable terms from its capital suppliers, such as banks and other financial institutions. For instance, in 2024, global interest rates remained a key factor, with the US Federal Reserve holding rates steady for much of the year, influencing borrowing costs worldwide.

- Global Funding Dependency: Mitsubishi HC Capital sources capital from a broad range of global financial institutions.

- Interest Rate Sensitivity: Fluctuations in benchmark interest rates, like the LIBOR transition to SOFR, directly affect the cost of capital.

- Economic Stability: A stable global economy supports consistent access to funding at competitive rates.

- Supplier Concentration: While capital markets are broad, reliance on a few key large financial institutions could increase supplier power.

Mitsubishi HC Capital's suppliers of capital, primarily financial institutions and bondholders, possess significant bargaining power, especially in a rising interest rate environment. For example, the US Federal Reserve's Federal Funds Rate target range was 5.25%-5.50% in early 2024, increasing borrowing costs. This leverage for capital providers can lead to less favorable terms for Mitsubishi HC Capital, impacting its profitability.

Technology suppliers also hold considerable influence, particularly those providing specialized FinTech solutions. The FinTech market's robust growth, projected to reach $3.57 trillion by 2030 from $1.15 trillion in 2023, highlights the increasing reliance on these providers. High switching costs and proprietary technology further amplify their bargaining power.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Mitsubishi HC Capital |

|---|---|---|

| Capital Providers (Banks, Investors) | Interest Rate Environment, Global Economic Stability, Regulatory Policies | Higher borrowing costs, reduced access to capital, potentially lower profit margins |

| Technology Providers (FinTech) | Switching Costs, Specialization, Proprietary Technology, Industry Standards | Increased costs for essential software and platforms, potential vendor lock-in |

What is included in the product

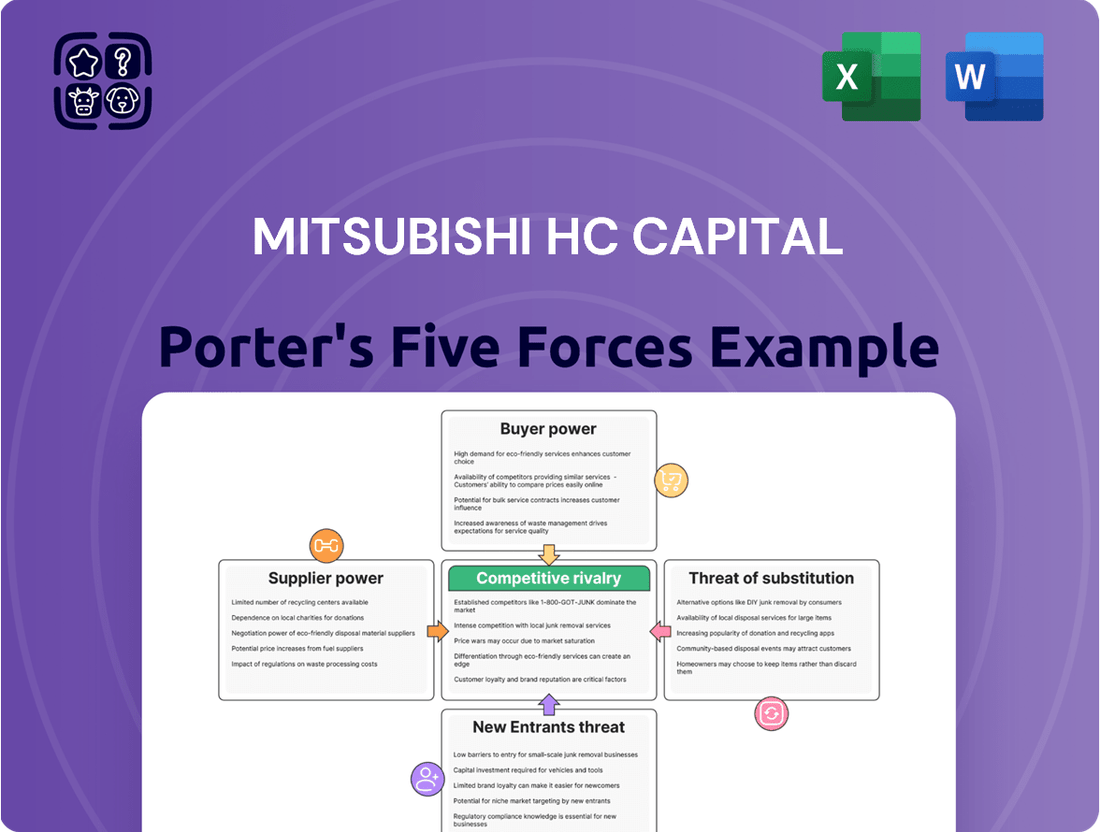

Tailored exclusively for Mitsubishi HC Capital, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products within its operating markets.

Easily identify and mitigate competitive threats with a visual breakdown of Porter's Five Forces, allowing Mitsubishi HC Capital to proactively address market pressures.

Customers Bargaining Power

Mitsubishi HC Capital serves a broad customer base across healthcare, mobility, environment, and real estate, offering leasing and installment sales. The availability of numerous alternative financing providers, including traditional banks and other leasing firms, significantly amplifies customer bargaining power.

Customers can readily compare rates and terms from multiple sources, putting pressure on Mitsubishi HC Capital to offer competitive pricing. For instance, in the competitive equipment leasing market, a business needing new manufacturing machinery might find numerous vendors offering similar financing packages, allowing them to negotiate more favorable terms.

The bargaining power of customers for Mitsubishi HC Capital hinges on switching costs. For highly integrated or bespoke financial solutions, like complex leasing agreements or tailored financing for large projects, customers face higher costs and effort to switch, thus diminishing their power. In 2024, financial service providers often see customer retention rates above 90% for deeply embedded solutions.

Conversely, for more standardized financial products, such as basic equipment financing or readily available capital leases, customers can more readily compare offerings across the market. This ease of comparison, especially with readily available online financial tools and competitor analyses, amplifies customer bargaining power as they can easily switch to a provider offering more favorable terms, potentially impacting Mitsubishi HC Capital's pricing strategies.

Mitsubishi HC Capital's customers exhibit significant bargaining power, particularly when price sensitivity is high. In a competitive landscape, clients scrutinize interest rates, fees, and the total cost of financing, pushing the company to maintain competitive pricing to secure and retain business. For instance, during periods of economic uncertainty or rising interest rates, customers are more inclined to shop around for the best financing terms, directly impacting Mitsubishi HC Capital's ability to command higher margins.

Customer Power 4

The bargaining power of customers is a key factor in analyzing an industry's competitive landscape. When customers have significant leverage, they can often demand lower prices, higher quality, or more services, which can squeeze profit margins for companies like Mitsubishi HC Capital.

Customer concentration is a significant driver of this power. If a few large clients account for a substantial portion of a company's revenue, their ability to negotiate favorable terms becomes considerably stronger. Imagine a scenario where a handful of major corporations make up over 50% of sales; these clients can effectively dictate pricing and contract conditions.

Mitsubishi HC Capital's strategy of cultivating a diversified client base across numerous sectors serves as a crucial mitigator against this risk. By spreading its customer relationships across various industries, the company reduces its reliance on any single customer or a small group of customers. For instance, as of the fiscal year ending March 31, 2024, Mitsubishi HC Capital reported revenue from a broad spectrum of industries, including industrial finance, IT, and mobility, preventing any single segment from dominating its overall financial performance.

- Diversified Revenue Streams: Mitsubishi HC Capital's financial reports for FY2024 indicate revenue contributions from diverse sectors, lessening the impact of any single customer's bargaining power.

- Reduced Customer Concentration Risk: The company's broad client portfolio minimizes the threat posed by large, concentrated customers who could otherwise demand significant concessions.

- Industry-Wide Presence: Operating across sectors like IT, mobility, and industrial finance allows Mitsubishi HC Capital to absorb fluctuations in demand or pricing power within any one specific market.

- Mitigation of Price Sensitivity: A wide customer base can lead to varied price sensitivities across different segments, providing a buffer against widespread demands for lower prices from a concentrated group.

Customer Power 5

Mitsubishi HC Capital's customers, particularly large corporate clients, wield significant bargaining power. The financial services market is characterized by high price transparency, amplified by numerous online comparison platforms and readily accessible information. This allows sophisticated buyers to easily research rates, terms, and service offerings across various providers, including Mitsubishi HC Capital.

This transparency directly fuels customer negotiation leverage. Clients can readily identify the most competitive offers, forcing financial institutions to offer more favorable terms to secure and retain business. For instance, in the leasing sector, where Mitsubishi HC Capital operates, a large fleet operator can solicit quotes from multiple leasing companies and use the lowest bid to negotiate down prices with others. In 2024, the competitive landscape for corporate finance and leasing remained intense, with many institutions vying for market share, further empowering the customer.

The ability to switch providers with relative ease, especially for standardized financial products like equipment leases or loans, also bolsters customer power. Switching costs, while present, are often outweighed by potential savings for major clients. This means Mitsubishi HC Capital must continuously demonstrate value beyond just price, focusing on service quality, specialized expertise, and long-term relationship building to mitigate this power.

- Price Sensitivity: Customers can easily compare rates and terms for leasing and financing, putting pressure on Mitsubishi HC Capital to offer competitive pricing.

- Information Availability: Online comparison tools and industry reports in 2024 provided customers with extensive data to negotiate from a well-informed position.

- Low Switching Costs: For many financial products, the ease with which clients can move to a competitor enhances their bargaining power.

- Market Competition: A crowded financial services market in 2024 meant Mitsubishi HC Capital faced numerous rivals, all competing for the same clientele.

Mitsubishi HC Capital faces substantial customer bargaining power due to the competitive nature of the financial services sector. Customers, especially larger ones, can easily compare rates and terms across numerous providers, driving down prices.

This leverage is amplified by the availability of information and relatively low switching costs for many of Mitsubishi HC Capital's offerings. For instance, in 2024, the leasing and financing market remained intensely competitive, with clients actively seeking the best deals.

The company mitigates this by serving a diverse client base across various industries, reducing reliance on any single customer. However, price sensitivity remains a key factor, compelling Mitsubishi HC Capital to maintain competitive pricing and focus on value-added services to retain its market position.

| Factor | Impact on Mitsubishi HC Capital | Mitigation Strategy |

|---|---|---|

| Price Transparency | High; customers easily compare rates. | Competitive pricing, value-added services. |

| Switching Costs | Low for standardized products. | Focus on service quality, expertise, long-term relationships. |

| Customer Concentration | Risk reduced by diversified client base. | Serving multiple sectors; FY2024 revenue shows broad industry contributions. |

| Information Availability | Amplifies customer negotiation leverage. | Differentiate through specialized solutions and support. |

What You See Is What You Get

Mitsubishi HC Capital Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Mitsubishi HC Capital, offering an in-depth examination of the competitive landscape. You are viewing the exact, professionally written document that will be delivered to you instantly upon purchase, ensuring no surprises and immediate utility. The analysis meticulously dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report is ready for immediate download and application to your strategic decision-making processes.

Rivalry Among Competitors

The financial services and leasing sector is a crowded arena, with Mitsubishi HC Capital facing robust competition. This includes established banks, numerous leasing companies, and increasingly, nimble fintech startups. This dynamic environment necessitates constant innovation and a clear strategy to stand out.

In 2024, the global leasing market is projected to reach over $1 trillion, highlighting the significant scale and attractiveness of the industry. Companies like Mitsubishi HC Capital must therefore differentiate themselves through specialized services, technological adoption, and superior customer engagement to capture market share amidst this fierce rivalry.

Mitsubishi HC Capital faces a competitive landscape where market growth, particularly in Japan's financial leasing sector, directly impacts rivalry. Even with a projected growth in the Japan car leasing market, intense competition can persist if numerous players aggressively pursue market share expansion.

In 2023, the Japanese financial services sector, which includes leasing, saw continued activity, though specific growth rates for financial leasing can vary. The presence of both large, established financial institutions and niche leasing specialists means Mitsubishi HC Capital must constantly innovate and offer competitive terms to stand out.

Competitive rivalry within the financial services sector, particularly for companies like Mitsubishi HC Capital, is intense, driven by the need to differentiate through specialized offerings. Companies actively seek to set themselves apart by providing unique financial solutions, supplementary value-added services, or deep industry-specific knowledge. This strategic focus helps to mitigate direct price-based competition.

Mitsubishi HC Capital leverages its commitment to customized solutions across a broad array of industries. This approach is designed to reduce the likelihood of direct confrontation solely on pricing. For instance, in 2024, the leasing industry, a core area for Mitsubishi HC Capital, saw continued innovation in tailored financing packages for sectors like renewable energy and advanced manufacturing, where specific risk assessments and flexible terms are paramount.

Competitive Rivalry 4

Mitsubishi HC Capital operates in a sector where high fixed costs are a significant factor. Companies must invest heavily in infrastructure and technology to remain competitive. This necessitates driving high utilization rates to spread these substantial costs across a wider customer base, naturally leading to intense competition as firms vie for market share.

The financial services industry, including leasing and capital solutions, often presents considerable exit barriers. These can include long-term contractual commitments with clients and stringent regulatory requirements that make it difficult and costly for underperforming firms to leave the market. Consequently, even less profitable entities may persist, contributing to sustained competitive pressure.

- High Fixed Costs: The leasing industry requires substantial upfront investment in assets and technology, forcing companies to compete aggressively for volume to achieve economies of scale.

- Exit Barriers: Long-term lease agreements and regulatory compliance in financial services can trap companies in the market, even if they are not highly profitable, thus intensifying rivalry.

- Industry Concentration: While fragmented in some segments, the capital markets sector also features large, established players, including Mitsubishi HC Capital, whose strategic decisions significantly impact competitive dynamics.

- Customer Loyalty: Building and maintaining strong customer relationships is crucial, but aggressive pricing and innovative service offerings from competitors can erode loyalty, leading to a constant battle for clients.

Competitive Rivalry 5

The financial services sector, particularly leasing, often sees significant consolidation. The formation of Mitsubishi HC Capital Inc. itself, through mergers and acquisitions, is a prime example of this trend. This strategy aims to bolster market share, create cost efficiencies through economies of scale, and ultimately dial down the intensity of competition.

While consolidation can lead to fewer, larger entities, the competitive landscape can remain fiercely contested. For Mitsubishi HC Capital, this means facing off against other well-capitalized global players who are also pursuing growth and efficiency. The market for leasing services remains dynamic, with constant pressure to innovate and offer competitive pricing.

In 2023, the global leasing market continued its robust growth, with projections indicating sustained expansion. For instance, the International Financial Services (IFS) sector, which encompasses leasing, saw a notable increase in deal volumes for mergers and acquisitions. This indicates ongoing strategic repositioning by major players to capture greater market share and operational advantages.

- Consolidation Drivers: Mergers and acquisitions are key strategies in financial services to gain market share and achieve economies of scale.

- Competitive Intensity: Despite consolidation, the leasing industry remains highly competitive with numerous large and well-resourced players.

- Market Dynamics: Mitsubishi HC Capital competes in a sector where innovation and pricing are constant factors driving rivalry.

- Industry Trends: The financial services sector, including leasing, has experienced significant M&A activity, reflecting a drive for market dominance and efficiency.

Mitsubishi HC Capital operates in a highly competitive financial services and leasing market. The presence of numerous leasing companies, banks, and emerging fintech firms means differentiation is key. The global leasing market, projected to exceed $1 trillion in 2024, underscores the intense rivalry for market share.

SSubstitutes Threaten

Customers of Mitsubishi HC Capital have many ways to get the assets or funding they need, not just through leasing or installment plans. A major alternative is buying assets outright, often with a standard bank loan. This is particularly attractive for businesses with healthy finances.

For instance, in 2024, many businesses continued to favor direct asset ownership, especially for critical infrastructure where long-term control is paramount. This trend is supported by the availability of diverse traditional financing options, with commercial bank lending remaining a robust channel for capital expenditure, as evidenced by the continued growth in corporate loan portfolios across major economies.

Alternative financing models present a notable threat to Mitsubishi HC Capital's traditional leasing and lending services. Options like crowdfunding, peer-to-peer lending, and embedded finance solutions from non-financial firms are gaining traction, especially for small businesses or specialized asset financing. These substitutes can offer more tailored terms or speedier access to funds, potentially diverting clients.

For instance, the global crowdfunding market reached an estimated $20 billion in 2023, demonstrating a significant and growing appetite for these alternative capital sources. Similarly, the peer-to-peer lending sector continues to expand, providing businesses with direct access to capital outside traditional banking channels. This diversification of funding options means Mitsubishi HC Capital faces increased competition from entities not directly involved in asset finance.

The threat of substitutes for Mitsubishi HC Capital's financing services is significant, particularly through in-house financing. Many large corporations, especially those with robust cash flow like Apple or Microsoft, can leverage their substantial retained earnings to acquire assets directly, bypassing the need for external financing. For instance, in 2023, Apple reported over $168 billion in cash and marketable securities, providing ample capacity for self-funded capital expenditures. This internal funding capability directly reduces demand for leasing and other financial products offered by companies like Mitsubishi HC Capital.

4

The threat of substitutes for Mitsubishi HC Capital's offerings is intensifying due to the growing popularity of subscription-based models. For instance, in the automotive sector, services like car-sharing platforms and flexible leasing options are gaining traction, providing consumers with alternatives to traditional ownership or long-term financing. This trend is also evident in equipment leasing, where usage-based rental agreements are becoming more prevalent.

These subscription services often include comprehensive packages covering maintenance, insurance, and upgrades, presenting a compelling all-in-one solution. This bundling can diminish the perceived value of outright purchase or traditional finance leases. For example, many companies are now opting for Device-as-a-Service (DaaS) for their IT equipment, which includes hardware, software, and lifecycle management, directly impacting the demand for capital equipment financing.

The increasing accessibility and convenience of these alternative models mean that customers may no longer see the necessity of committing to long-term asset ownership or leasing arrangements. This shift can fragment the market and pressure pricing for traditional leasing and financing products. The global Device-as-a-Service market, for example, was valued at approximately $11.3 billion in 2023 and is projected to grow significantly, indicating a substantial shift in how businesses acquire and manage technology assets.

- Subscription models offer bundled services, reducing the need for traditional ownership.

- Car-sharing and flexible leasing are growing substitutes in the automotive sector.

- Device-as-a-Service (DaaS) presents a substitute for IT equipment financing.

- The global DaaS market reached $11.3 billion in 2023, highlighting a significant market shift.

5

While traditional financial leasing remains Mitsubishi HC Capital's core business, emerging technological advancements pose a potential threat of substitutes. For instance, blockchain-based financing and decentralized finance (DeFi) platforms, though in their early stages for large-scale corporate funding, could offer more streamlined and transparent alternatives to conventional leasing and financing models in the long run. These innovations might reduce the need for intermediaries and traditional financial structures, potentially impacting demand for Mitsubishi HC Capital's services.

The evolving landscape of corporate financing presents a dynamic threat. As of early 2024, while widespread adoption of DeFi for large corporate capital raises remains limited, the underlying technology continues to mature. Companies are increasingly exploring alternative funding avenues beyond traditional banking and leasing, driven by a desire for efficiency and cost reduction.

- Technological Disruption: Blockchain and DeFi offer potential for more efficient and transparent funding mechanisms, acting as long-term substitutes.

- Nascent but Growing: While not yet a major threat for large-scale corporate finance, these technologies are rapidly developing.

- Efficiency Drivers: The appeal of reduced intermediation and lower costs in alternative financing models is a key driver for their potential adoption.

- Market Exploration: Businesses are actively investigating these new avenues, indicating a growing awareness and potential future shift away from traditional methods.

The threat of substitutes for Mitsubishi HC Capital is multifaceted, encompassing direct asset purchase, alternative financing models, and subscription-based services. Many large corporations, possessing substantial cash reserves, can opt for self-funded asset acquisition, thereby bypassing external financing needs. For instance, in 2023, Apple's substantial cash holdings of over $168 billion provided ample capacity for self-funded capital expenditures, directly impacting the demand for leasing and financing products from entities like Mitsubishi HC Capital.

Furthermore, the rise of subscription-based models, such as Device-as-a-Service (DaaS) for IT equipment, presents a significant alternative. These models bundle hardware, software, and lifecycle management, offering a comprehensive solution that can diminish the perceived value of traditional financing. The global DaaS market's valuation of approximately $11.3 billion in 2023 underscores the substantial shift in how businesses procure and manage technology assets, directly challenging conventional financing structures.

Emerging technologies like blockchain and decentralized finance (DeFi) also represent potential long-term substitutes. While their adoption for large-scale corporate funding is still nascent as of early 2024, these platforms promise more streamlined and transparent financing mechanisms. The continuous maturation of these technologies and businesses' increasing exploration of efficient, cost-reduction-driven funding avenues signal a potential future shift away from traditional intermediated financial services.

| Substitute Type | Example | 2023/2024 Data Point | Impact on Mitsubishi HC Capital |

| Direct Asset Purchase (Self-funded) | Large corporations with high cash reserves | Apple's $168B+ cash and marketable securities (2023) | Reduces demand for external financing. |

| Alternative Financing | Crowdfunding, P2P Lending | Global crowdfunding market ~$20B (2023) | Diversifies funding options, diverting clients. |

| Subscription Models | Device-as-a-Service (DaaS) | Global DaaS market ~$11.3B (2023) | Offers bundled services, reducing need for traditional finance. |

| Emerging Technologies | Blockchain/DeFi | Nascent but maturing for large corporate finance (early 2024) | Potential for future streamlined, transparent funding alternatives. |

Entrants Threaten

The threat of new entrants into the financial services and leasing sector, where Mitsubishi HC Capital operates, is generally considered moderate to low. This is largely due to substantial barriers like the significant capital investment required to establish operations and the complex web of regulatory compliance. For instance, in 2024, the global leasing market, a core area for companies like Mitsubishi HC Capital, is valued in the trillions of dollars, indicating the scale of investment needed to compete effectively.

New players must contend with rigorous licensing procedures and ongoing compliance with financial regulations, which demand considerable expertise and resources. These hurdles are not easily overcome, especially for entities without established financial standing or a deep understanding of market intricacies. The need for robust risk management frameworks and sophisticated IT infrastructure further elevates the entry barriers, making it challenging for newcomers to gain a foothold.

New entrants face considerable hurdles in the financial services sector, particularly when competing with established entities like Mitsubishi HC Capital. Building brand loyalty and trust takes years, and without this, new players often struggle to attract clients away from trusted, long-standing institutions. For instance, in the leasing industry, which Mitsubishi HC Capital heavily operates in, the average client relationship can span many years, making initial customer acquisition a significant challenge for newcomers.

The threat of new entrants for Mitsubishi HC Capital is relatively low. A significant barrier is the substantial capital required to establish a presence in the leasing and finance industry. New players would need access to a diversified and cost-effective funding base, which is challenging to secure. For instance, in 2023, the global leasing market was valued at trillions of dollars, demanding immense financial resources for any meaningful entry.

Incumbent firms like Mitsubishi HC Capital benefit from established credit ratings and deep relationships with institutional investors, granting them preferential borrowing costs. Newcomers may face considerably higher interest rates or limited access to capital markets, making it difficult to compete on price and scale.

Furthermore, regulatory hurdles and the need for specialized expertise in areas like risk assessment and asset management present additional challenges for potential entrants. Building the necessary infrastructure and reputation takes considerable time and investment, further deterring new competition.

4

Economies of scale are a significant barrier for new entrants in the financial services sector, including leasing. Established firms like Mitsubishi HC Capital can leverage their substantial asset base to spread fixed operational costs, such as technology infrastructure and compliance, across a larger volume of business. This allows them to offer more competitive pricing and financing terms.

For instance, in 2023, major global leasing companies managed trillions of dollars in assets, a scale that is difficult for a new player to replicate quickly. Smaller, newer entrants would likely face higher per-unit operating costs, making it challenging to compete on price with incumbents who benefit from established distribution channels and lower borrowing costs.

The threat of new entrants is therefore moderate. While the financial services sector is generally attractive, the capital intensity and regulatory hurdles inherent in leasing operations create significant barriers.

- High initial capital requirements for acquiring assets and establishing operational infrastructure.

- Established brand recognition and customer loyalty favoring incumbents.

- Regulatory compliance which can be costly and time-consuming for new firms.

- Access to cheaper capital for larger, more established financial institutions.

5

The threat of new entrants in the capital leasing sector, particularly concerning Mitsubishi HC Capital, is influenced by technological shifts. Fintech innovations can indeed lower some entry barriers, allowing nimble startups to target specific niches. For instance, advancements in digital onboarding and AI-driven credit assessment could streamline processes for new competitors.

However, substantial hurdles persist. The capital-intensive nature of leasing, requiring significant upfront investment in assets, remains a primary barrier. Furthermore, building the necessary trust and reputation in a market where financial stability and long-term reliability are paramount takes considerable time and resources. Mitsubishi HC Capital benefits from its established track record and scale, making it difficult for newcomers to immediately compete on credibility.

Robust cybersecurity and data privacy are non-negotiable in today's financial landscape. New entrants must invest heavily in these areas to protect sensitive client information and comply with evolving regulations. Scalable IT infrastructure is also crucial for handling large transaction volumes and providing seamless customer experiences. These requirements represent significant upfront and ongoing operational costs that can deter potential new players.

- Technological Advancements: Fintech can lower some entry barriers by enabling niche service offerings.

- Capital Intensity: Significant upfront investment in assets remains a major deterrent for new entrants.

- Reputation and Trust: Building credibility in the leasing sector requires substantial time and demonstrated financial stability.

- Operational Requirements: High costs associated with cybersecurity, data privacy, and scalable IT infrastructure are critical challenges.

The threat of new entrants for Mitsubishi HC Capital in the financial services and leasing sector is generally low to moderate. Significant barriers include the immense capital required for asset acquisition and infrastructure, coupled with stringent regulatory compliance. For instance, the global leasing market, a key area for Mitsubishi HC Capital, was valued in the trillions of dollars in 2024, underscoring the substantial financial commitment needed to enter.

New entrants face hurdles like complex licensing, rigorous financial regulations, and the necessity for robust risk management and IT systems. Building brand trust and customer loyalty, which can take years to cultivate in industries where long-term relationships are common, also presents a substantial challenge for newcomers seeking to compete with established firms like Mitsubishi HC Capital.

Economies of scale further deter new entrants, as established companies like Mitsubishi HC Capital leverage their large asset bases to reduce per-unit operating costs. In 2023, major leasing firms managed trillions in assets, a scale difficult for new players to match, impacting their ability to compete on pricing due to higher potential borrowing costs and operational expenses.

While fintech innovations might lower some entry barriers by enabling niche offerings, the core challenges of capital intensity, reputation building, and extensive operational requirements like cybersecurity remain significant deterrents. These factors collectively contribute to a moderate threat level for new entrants aiming to compete with established entities.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Mitsubishi HC Capital leverages data from company annual reports and investor presentations, complemented by industry-specific market research from firms like IBISWorld and Statista.