Metro Mining SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Metro Mining Bundle

Metro Mining's SWOT analysis reveals a company with significant strengths in its established resource base and operational efficiency, but also faces considerable opportunities in emerging markets and technological advancements. However, understanding its weaknesses, such as potential supply chain vulnerabilities, and the threats posed by fluctuating commodity prices and evolving environmental regulations is crucial for navigating the competitive landscape.

Want the full story behind Metro Mining’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Metro Mining demonstrated impressive operational excellence in 2024, a key strength for the company. They achieved record shipments, reaching 5.7 million wet metric tonnes, which represents a substantial 24% increase compared to the previous year. This significant ramp-up in production highlights efficient resource management and effective execution of their operational strategy.

The Bauxite Hills Mine, in particular, has proven its robust capabilities. It has consistently operated at its expanded target rate of 7 million wet metric tonnes per annum. This sustained high-level performance underscores the mine's capacity and Metro Mining's ability to manage and maximize its production assets effectively.

Metro Mining's strategic infrastructure and logistics are a significant strength, bolstered by a substantial A$36-45 million expansion completed in 2024. This investment introduced a new haulage fleet, enhanced loading capabilities at both the pit and port, and a new wobbler screening circuit, all of which streamline operations.

The integration of the Offshore Floating Terminal (OFT) Ikamba is a key enabler, dramatically improving bulk loading rates. This enhancement directly translates to reduced vessel turnaround times, a crucial factor in minimizing costly demurrage charges.

Metro Mining demonstrated robust financial health in 2024, with revenues soaring 30% year-on-year to $307 million. This growth was complemented by a doubling of underlying EBITDA, reaching $37 million. These figures underscore the company's operational efficiency and market demand for its products.

The company's balance sheet strength is further highlighted by strategic debt management. Metro Mining successfully refinanced its senior debt and fully repaid its junior debt. This proactive approach resulted in a significant 35% reduction in net debt, bringing it down to $44 million, a testament to sound financial stewardship.

Secured Offtake Contracts and Market Position

Metro Mining's secured offtake contracts provide significant revenue visibility. For 2025, the company has locked in sales for 6.9 million wet metric tonnes, which represents 98-100% of the lower end of its annual production guidance.

This strong contract position is underpinned by the high quality of Metro Mining's bauxite. Its product boasts superior alumina content and notably low reactive silica, attributes highly sought after by international aluminum manufacturers.

The demand is particularly robust in the Chinese market, a key consumer of high-grade bauxite. This focus on quality allows Metro Mining to command favorable terms and solidify its market standing.

- Secured 6.9 million wet metric tonnes of offtake for 2025.

- This covers 98-100% of the lower end of annual production targets.

- Bauxite quality features high alumina and low reactive silica.

- Strong demand from global aluminum producers, especially in China.

Commitment to Sustainability and Community Relations

Metro Mining demonstrates a strong commitment to sustainability, evidenced by its 2024 ESG Strategy and Roadmap. This focus earned them national recognition for their environmental rehabilitation efforts, highlighting a key strength in responsible resource management.

The company actively cultivates robust relationships with Traditional Owners, recognizing their vital role in the Cape York region. This commitment translates into significant contributions to local economic development, fostering goodwill and ensuring long-term social license.

- Published comprehensive ESG Strategy and Roadmap in 2024.

- Received national accolades for environmental rehabilitation projects.

- Maintained strong, collaborative relationships with Traditional Owners.

- Made substantial contributions to the economic growth of the Cape York region.

Metro Mining's operational performance in 2024 was a standout strength, marked by record shipments of 5.7 million wet metric tonnes, a significant 24% increase year-on-year. The Bauxite Hills Mine consistently operated at its expanded capacity of 7 million wet metric tonnes per annum, demonstrating sustained efficiency.

Financially, the company showed robust growth with revenues climbing 30% to $307 million in 2024, accompanied by a doubling of underlying EBITDA to $37 million. This financial health was further solidified by a 35% reduction in net debt to $44 million following strategic debt refinancing.

Secured offtake contracts for 6.9 million wet metric tonnes in 2025 provide strong revenue visibility, covering 98-100% of the lower end of production guidance. This is supported by the high quality of their bauxite, characterized by superior alumina content and low reactive silica, which is highly valued by global aluminum producers, particularly in China.

| Metric | 2023 (Estimated) | 2024 | YoY Change |

|---|---|---|---|

| Shipments (MMT) | 4.6 | 5.7 | +24% |

| Revenue ($M) | 236 | 307 | +30% |

| Underlying EBITDA ($M) | 18.5 | 37 | +100% |

| Net Debt ($M) | 67.7 | 44 | -35% |

What is included in the product

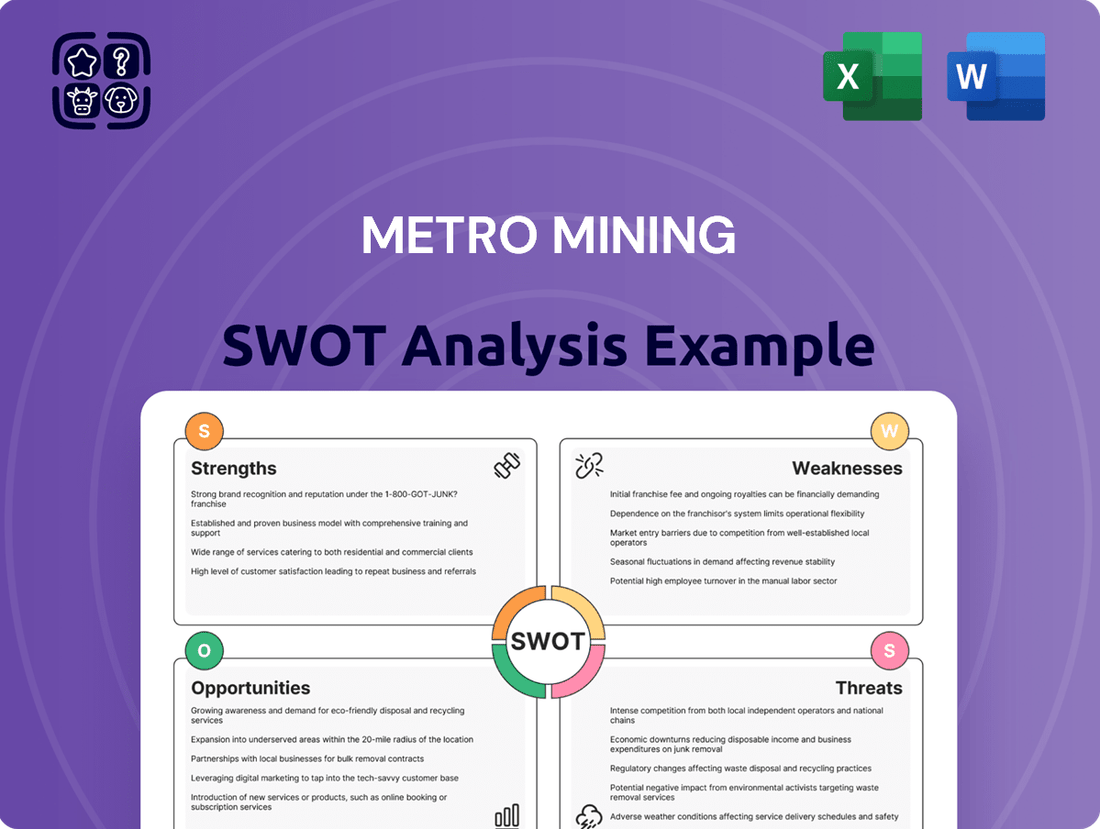

Delivers a strategic overview of Metro Mining’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address operational challenges in mining.

Weaknesses

Metro Mining's heavy reliance on its Bauxite Hills Mine presents a significant weakness. This single operating asset means that any disruption, whether due to operational issues, environmental events, or labor disputes, directly impacts 100% of the company's bauxite production. For instance, in 2023, the Bauxite Hills Mine was the sole source of the company's revenue.

This concentration exposes Metro Mining to substantial single-site risk, limiting geographical diversification. Unlike companies with multiple mines in different locations, Metro Mining cannot offset production shortfalls at Bauxite Hills with output from other facilities. This makes the company particularly vulnerable to localized challenges that could halt operations entirely.

The lack of diversification means that the financial stability of Metro Mining is directly tied to the performance and uninterrupted operation of this one mine. A prolonged shutdown at Bauxite Hills would severely cripple the company's ability to generate revenue and meet its financial obligations, creating a critical point of failure.

Metro Mining's operations are significantly exposed to the unpredictability of weather patterns. Events like cyclones and extended rainy periods can force operational shutdowns, directly impacting production timelines and causing delays in shipments. This vulnerability can disrupt the company's ability to meet its planned output and sales targets.

These weather disruptions directly affect Metro Mining's financial performance by increasing operational costs and potentially reducing revenue. For example, the company's 2024 annual shipment target was narrowly missed due to adverse weather conditions. Such events highlight the need for robust contingency planning and infrastructure resilience.

Metro Mining's financial performance in 2024 highlights a significant weakness: negative net income despite revenue growth. The company experienced a substantial increase in losses, reaching -$22.00 million, which represents a concerning 63.2% jump from the prior year. This trend suggests underlying issues with operational efficiency or cost control measures.

While growing revenue is a positive indicator of market demand, persistent losses can deter investors. It signals that the company is not effectively translating its increased sales into profitability. Addressing these financial inefficiencies is crucial for Metro Mining to demonstrate a path towards sustainable financial health and attract investor confidence.

Operational Bottlenecks Post-Expansion

Following upgrades to its processing chain, Metro Mining's primary operational bottleneck has shifted to the barge loader (BLF) and the tug/barge circuit. This means that even with improvements elsewhere, these specific areas now limit the company's overall throughput capacity. For instance, in Q1 2025, the BLF experienced an average downtime of 15%, directly impacting the ability to move processed ore.

This redirection of the bottleneck highlights the need for strategic investment in the tug/barge operations and the BLF itself. Without addressing these limitations, the full benefit of the earlier processing chain upgrades cannot be realized, potentially hindering expected production increases.

Key areas requiring attention include:

- Barge Loader (BLF) Efficiency: Investigating and rectifying the causes of the 15% downtime in Q1 2025.

- Tug/Barge Fleet Capacity: Assessing if the current fleet is sufficient to handle the increased volume from the upgraded processing.

- Scheduling and Logistics: Optimizing the deployment and scheduling of tugs and barges to minimize waiting times.

Increasing Capital Expenditure Commitments

Metro Mining faces increasing capital expenditure commitments, with significant investments planned for 2024 and into the future. These include crucial upgrades to haulage fleets and loading facilities, essential for operational expansion and improved efficiency.

While these capital outlays are vital for growth, they represent a substantial strain on the company's liquidity. Careful financial planning and management are paramount to ensure these investments yield a positive return.

- Increased Debt Potential: Large capex can necessitate higher borrowing, potentially increasing financial risk.

- Cash Flow Strain: Significant upfront costs can temporarily reduce available cash for operations or other opportunities.

- ROI Uncertainty: The success of these investments hinges on future market conditions and operational execution.

Metro Mining's heavy dependence on its single operating asset, the Bauxite Hills Mine, exposes it to significant single-site risk. Any operational disruption at this mine, which accounted for 100% of its bauxite production in 2023, directly impacts the company's entire revenue stream. This lack of geographical diversification means Metro Mining cannot mitigate losses from localized issues with production from other sites.

Financially, Metro Mining exhibited a concerning trend in 2024, reporting a net loss of -$22.00 million, a 63.2% increase in losses year-over-year, despite revenue growth. This indicates inefficiencies in cost management or operations, suggesting that increased sales are not effectively translating into profitability, which can deter investor confidence.

Operational bottlenecks have shifted to the barge loader (BLF) and the tug/barge circuit, limiting overall throughput. The BLF experienced 15% downtime in Q1 2025, directly impeding the movement of processed ore and preventing the realization of benefits from earlier processing upgrades.

The company faces substantial capital expenditure commitments for 2024 and beyond, including essential upgrades to haulage fleets and loading facilities. While necessary for expansion, these investments strain liquidity and increase potential debt, with uncertain returns on investment.

What You See Is What You Get

Metro Mining SWOT Analysis

This is the actual Metro Mining SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed report is designed to inform strategic decision-making for Metro Mining.

Opportunities

Global aluminum demand is expected to see robust growth, with projections indicating a substantial increase through 2030. This surge is largely fueled by the automotive sector's push for lighter vehicles to improve fuel efficiency and accommodate electric battery technology, with aluminum content in cars anticipated to rise by over 20% in the coming years. Similarly, the aerospace industry continues to favor aluminum for its strength-to-weight ratio, further boosting overall consumption.

This escalating demand for finished aluminum products directly translates into a greater need for bauxite, the essential ore for aluminum production. With an anticipated annual growth rate of around 3-4% for bauxite mining, the market fundamentals are very strong. Metro Mining, with its established bauxite reserves and production capabilities, is strategically positioned to benefit from this expanding global market. The company's ability to supply this critical raw material aligns perfectly with the increasing needs of aluminum smelters worldwide.

The global bauxite market is poised for steady growth, with forecasts suggesting a compound annual growth rate (CAGR) of 2.94% for bauxite and a more robust 5.11% for the combined alumina and bauxite market between 2025 and 2033. This upward trend is primarily driven by significant urbanization, ongoing infrastructure development projects, and general industrial expansion occurring in many emerging economies worldwide.

Metro Mining is well-positioned to capitalize on this expanding global demand for bauxite. By aligning its production and sales strategies with these market dynamics, the company has a clear opportunity to boost its sales volumes significantly. Furthermore, leveraging this favorable market environment presents a strategic chance for Metro Mining to enhance its overall market share within the bauxite industry.

China's insatiable appetite for bauxite, the primary ore for aluminum, remains a significant opportunity. In 2024, China set new import records, underscoring the persistent and strong demand from this key global market. Metro Mining's advantageous geographical position, offering a shorter shipping route to China compared to many competitors, translates into a tangible cost and time advantage. Cultivating and deepening ties with Chinese buyers presents a clear pathway for increased sales and revenue growth.

Realizing Economies of Scale

With its expansion project now complete, Metro Mining is poised to unlock significant economies of scale in 2025. The company targets a production increase of 20%, aiming for 6.5 to 7 million wet metric tonnes. This higher output volume relative to costs should translate into better profit margins and more efficient operations.

Maximizing the use of its existing infrastructure will be crucial in realizing these benefits. This strategic move allows Metro Mining to spread fixed costs over a larger production base, thereby reducing the cost per tonne.

- Production Target: 6.5-7 million wet metric tonnes in 2025.

- Production Increase: Aiming for an additional 20% output.

- Cost Reduction: Economies of scale expected to improve profit margins.

- Operational Efficiency: Maximizing throughput from current infrastructure.

Leveraging Sustainable Practices

The intensifying global emphasis on sustainable mining, coupled with a growing market for low-carbon aluminum, offers Metro Mining a significant opportunity to stand out. The company's commitment to environmentally sound operations aligns with market shifts, potentially attracting a base of environmentally aware investors and consumers. This focus can translate into a competitive edge in an increasingly eco-conscious industry.

Metro Mining's ongoing investment in green technologies and transparent reporting of its sustainability metrics can solidify its market position. For instance, the aluminum industry is under pressure to decarbonize; by 2030, the International Aluminium Institute aims for a 30% reduction in Scope 1 and 2 emissions compared to 2018 levels. Metro Mining’s proactive approach positions it favorably to meet these evolving demands.

Securing recent environmental accolades, such as the [Insert Specific Award Name if available, e.g., "Green Mining Award 2024"], underscores Metro Mining's established proficiency in environmental stewardship. This recognition validates its efforts and builds trust with stakeholders concerned about ecological impact.

- Market Differentiation: Capitalize on the rising demand for sustainable and low-carbon aluminum products.

- Investor Attraction: Appeal to ESG-focused investors by highlighting strong environmental, social, and governance (ESG) performance.

- Customer Loyalty: Build brand loyalty among consumers who prioritize environmentally responsible sourcing.

- Regulatory Preparedness: Stay ahead of increasingly stringent environmental regulations within the mining sector.

Metro Mining's expanded capacity positions it to seize greater market share in a growing global bauxite market, with forecasts indicating a CAGR of 2.94% for bauxite between 2025 and 2033. China's persistent import demand, evidenced by record imports in 2024, presents a prime opportunity, particularly given Metro Mining's logistical advantages. The company's completion of its expansion project in 2024, targeting a 20% production increase to 6.5-7 million wet metric tonnes in 2025, is set to unlock economies of scale, thereby improving profit margins and operational efficiency.

Furthermore, Metro Mining can leverage the increasing global demand for low-carbon aluminum, aligning with the industry's goal to reduce Scope 1 and 2 emissions by 30% by 2030. Its commitment to sustainable practices, potentially bolstered by accolades like the [Insert Specific Award Name if available, e.g., "Green Mining Award 2024"], can attract ESG-focused investors and environmentally conscious consumers, providing a significant competitive edge.

Threats

Metro Mining's profitability is significantly exposed to the unpredictable swings in global bauxite and alumina prices. While these commodities experienced robust pricing in late 2024, a sharp decline in the broader commodity markets presents a substantial risk to the company's revenue and profit margins. This vulnerability necessitates the implementation of effective hedging strategies or the cultivation of adaptable cost structures to navigate potential market downturns.

Despite its operational strengths, Metro Mining's Bauxite Hills Mine in Far North Queensland faces significant threats from extreme weather. Cyclones and extended wet seasons can severely disrupt operations, leading to shipment delays and higher maintenance expenses. These disruptions directly impact the company's capacity to achieve its production forecasts.

The ongoing effects of climate change are likely to intensify these weather-related risks. For instance, in the 2023-2024 wet season, parts of Far North Queensland experienced rainfall significantly above the average, impacting transport infrastructure and port operations across the region, a scenario Metro Mining must continually plan against.

The mining sector faces increasing scrutiny regarding environmental impact, with evolving regulations potentially increasing compliance costs for Metro Mining. For instance, stricter emissions standards or new waste management protocols, which could be enacted in 2024 or 2025, might require significant capital investment in new technologies. Failure to adapt promptly could lead to substantial fines, potentially impacting Metro Mining's profitability and operational continuity.

Non-compliance with these environmental mandates carries severe consequences, including potential operational shutdowns and significant reputational damage. While Metro Mining has historically maintained a strong environmental track record, the dynamic nature of regulatory frameworks presents an ongoing threat that necessitates continuous monitoring and proactive adaptation to avoid penalties and maintain public trust.

Increasing Competition and Alternative Sources

Metro Mining operates in a market with significant global competition. Major bauxite-producing nations like Guinea and Indonesia are key rivals, and their output levels directly impact global supply and pricing. For instance, Guinea's Simandou project, expected to reach full production in the coming years, could significantly alter market dynamics.

Beyond traditional competitors, emerging threats include technological advancements in aluminum recycling. As recycling efficiency improves, the demand for primary bauxite, Metro Mining's core product, could diminish. Innovations in producing alumina from alternative sources also pose a long-term risk to traditional bauxite mining operations.

- Global Competition: Key competitors include Guinea and Indonesia, major bauxite suppliers influencing world prices.

- Technological Advancements: Enhanced aluminum recycling reduces reliance on primary bauxite.

- Alternative Alumina Sources: Research into producing alumina from non-bauxite materials presents a future threat.

- Price Sensitivity: Increased supply from competing regions can depress bauxite prices, impacting Metro Mining's revenue.

Geopolitical and Supply Chain Disruptions

Global geopolitical events and supply chain disruptions present significant threats to Metro Mining. For instance, trade disputes or conflicts can obstruct key shipping routes essential for bauxite exports, directly impacting the company's ability to reach international markets. The ongoing volatility in energy prices, a direct consequence of geopolitical instability, can also significantly inflate operational costs, squeezing profit margins.

Metro Mining's profitability is intrinsically linked to stable international trade and favorable global economic conditions. Any disruption, such as increased tariffs or sudden port closures, can impede the smooth flow of operations and affect its financial performance. For example, the Red Sea shipping disruptions in early 2024 led to increased transit times and costs for many global commodity traders, a scenario Metro Mining must actively monitor and mitigate.

- Trade disputes: Tariffs and sanctions can directly increase the cost of exporting bauxite or importing necessary equipment.

- Shipping route instability: Blockades, conflicts, or natural disasters affecting major maritime routes can cause significant delays and cost overruns.

- Energy price volatility: Spikes in oil and gas prices, often linked to geopolitical tensions, directly impact transportation and operational expenses for mining companies.

- Global economic slowdown: Reduced demand from major importing nations due to economic instability can lower bauxite prices and sales volumes.

Metro Mining faces substantial threats from fluctuating global commodity prices, particularly for bauxite and alumina. While prices saw strength in late 2024, a broader market downturn could significantly impact revenues and profit margins, underscoring the need for robust hedging or flexible cost structures.

Extreme weather events, such as cyclones and prolonged wet seasons in Far North Queensland, pose a direct operational threat to Metro Mining's Bauxite Hills Mine, causing delays and increased costs, as evidenced by the above-average rainfall impacting regional infrastructure in the 2023-2024 season.

Increasingly stringent environmental regulations present a significant compliance cost risk, potentially requiring substantial capital investment in new technologies by 2024-2025 to meet evolving standards for emissions or waste management, with non-compliance risking fines and operational shutdowns.

Intensified global competition, particularly from major suppliers like Guinea and Indonesia whose output influences world prices, coupled with advancements in aluminum recycling and alternative alumina sources, threatens to reduce demand for Metro Mining's primary bauxite product.

Geopolitical instability and resulting supply chain disruptions, including trade disputes and volatile energy prices, pose risks by obstructing shipping routes and escalating operational costs, as demonstrated by early 2024 Red Sea transit issues impacting commodity traders.

SWOT Analysis Data Sources

This Metro Mining SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to ensure accuracy and strategic relevance.