Metro Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Metro Mining Bundle

Unlock the full strategic blueprint behind Metro Mining's innovative business model. This comprehensive Business Model Canvas dissects how they create value, engage key partners, and generate revenue in the competitive mining sector. Discover their unique customer relationships and cost structures.

Want to see exactly how Metro Mining operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Metro Mining's most crucial partners are the major global alumina refineries and aluminum producers who buy their bauxite. These partnerships are the bedrock of their business, ensuring steady demand and reliable income, frequently solidified through multi-year supply agreements.

Securing these offtake agreements is paramount. For instance, Metro Mining announced in early 2024 the extension of its crucial bauxite supply contract with Xinfa Aluminium Group, a significant player in the aluminum industry. This extension provides a predictable revenue stream for Metro Mining.

Further bolstering their customer base, Metro Mining has also entered into new agreements with prominent entities such as China Aluminium International Trading Group (Chalco) and Shandong Lubei Enterprise Group General Company. These new partnerships diversifiy their customer portfolio and increase their market reach.

Adding to their strategic alliances, Metro Mining has also established a relationship with Emirates Global Aluminium (EGA). This collaboration signifies Metro Mining's growing presence in key international markets and strengthens its position as a reliable supplier of high-quality bauxite.

Metro Mining relies heavily on its logistics and shipping providers to ensure its bauxite reaches global markets efficiently. These partnerships are crucial for managing the significant undertaking of moving bulk commodities from their Bauxite Hills Mine to international buyers.

Key partners include established shipping companies and marine service providers who handle the sea transport of the bauxite. For example, securing contracts of affreightment is a common practice to lock in freight and bunker rates, a strategy that helps mitigate the volatility of global shipping costs. In 2023, the global dry bulk shipping market saw fluctuations, with the Baltic Dry Index averaging around 1,370 points, highlighting the importance of such risk management for companies like Metro Mining.

Metro Mining relies heavily on partnerships with leading manufacturers and suppliers for its mining equipment and processing technology. These collaborations are critical for maintaining operational efficiency and enabling capacity upgrades. For instance, securing reliable haulage fleets, advanced screening circuits, and specialized tugs directly impacts the speed and volume of material moved.

These relationships also extend to maintenance services, ensuring that all equipment, including offshore floating terminals, remains in optimal working condition. Access to the latest technological advancements from these suppliers, such as state-of-the-art processing equipment, allows Metro Mining to enhance its extraction and transshipment capabilities, thereby improving overall productivity and reducing downtime.

Local Communities and Traditional Owners

Metro Mining's relationship with local communities and Traditional Owners is fundamental to its operations. The company actively engages with Traditional Owners, recognizing their custodianship of the land and maintaining productive agreements. This collaboration is essential for securing a social license to operate, ensuring the project's long-term viability.

These partnerships directly contribute to regional economic development, particularly in areas like Cape York and Far North Queensland. Metro Mining prioritizes local employment, with a significant portion of its workforce identifying as Indigenous. This focus not only provides economic opportunities but also fosters a sense of shared benefit and community involvement.

The company's commitment to community engagement is further demonstrated through various initiatives aimed at supporting local development and cultural preservation. By integrating community needs and aspirations into its business model, Metro Mining seeks to build lasting, mutually beneficial relationships.

- Social License to Operate: Agreements with Traditional Owners are paramount for ongoing operational approval.

- Local Employment: Metro Mining aims to maximize employment opportunities for Indigenous Australians. For instance, in 2024, the company reported a substantial percentage of its workforce being Indigenous, reflecting a commitment to local hiring.

- Regional Economic Development: Contributions to the economies of Cape York and Far North Queensland through direct employment, procurement, and community investment.

- Community Engagement: Active participation in local initiatives and programs to support community well-being and cultural heritage.

Government and Regulatory Bodies

Metro Mining's operations are intrinsically linked to government and regulatory bodies, particularly in Australia and Queensland. Maintaining compliance with environmental, safety, and operational regulations necessitates robust relationships with these entities. This includes securing and retaining essential mining permits, environmental approvals, and consistently adhering to stringent industry standards. For instance, in 2024, the Queensland government continued to emphasize sustainable mining practices, with new guidelines impacting resource development projects.

- Environmental Approvals: Securing and maintaining necessary environmental impact statements and permits from agencies like the Queensland Department of Environment and Science is crucial.

- Mining Leases and Permits: Ongoing engagement with the Queensland Department of Resources is vital for the renewal and adherence to conditions of mining leases.

- Safety Regulations: Compliance with workplace health and safety legislation, overseen by bodies such as Workplace Health and Safety Queensland, ensures operational integrity.

- Industry Standards: Adherence to national and state-level mining standards and best practices, often influenced by government policy, is a key partnership aspect.

Metro Mining's key partnerships are vital for its operational success and market reach. These include major global alumina refineries and aluminum producers, who provide a stable demand for their bauxite, often secured through long-term contracts. For example, the early 2024 extension of their supply contract with Xinfa Aluminium Group highlights this critical customer relationship.

Furthermore, strategic alliances with logistics and shipping providers are essential for efficient global delivery of bauxite. These partnerships manage the complexities of bulk commodity transportation, with securing freight rates being a key focus to mitigate market volatility, as seen in the fluctuating global dry bulk shipping market of 2023.

Crucially, Metro Mining also partners with equipment manufacturers and technology suppliers to maintain and upgrade its mining operations, ensuring efficiency and capacity. These relationships extend to maintenance services, guaranteeing the optimal functioning of all equipment, including specialized offshore terminals.

Their engagement with local communities and Traditional Owners is foundational, ensuring a social license to operate and fostering regional economic development through employment and investment.

What is included in the product

Metro Mining's Business Model Canvas outlines its strategy for sustainable resource extraction, focusing on efficient operations, community engagement, and technological innovation.

Streamlines complex mining operations by visually mapping out key resources and activities, reducing the pain of operational inefficiencies.

Provides a clear, concise overview of the entire mining value chain, alleviating the pain of fragmented planning and communication.

Activities

Metro Mining's primary activity centers on extracting bauxite from its Bauxite Hills Mine in Far North Queensland. This process involves managing overburden, drilling, and loading the ore, with their direct shipping ore operation often bypassing the need for blasting.

The company has successfully ramped up its operational capacity, achieving an impressive expansion to 7 million Wet Metric Tonnes (WMT) per annum. This increased capacity is crucial for meeting market demand and optimizing production efficiency.

Metro Mining meticulously processes bauxite, starting with screening to eliminate oversized materials. Any oversized cemented bauxite is then crushed and reintroduced into the process, ensuring optimal feedstock. This rigorous approach guarantees the bauxite consistently meets stringent customer quality specifications, particularly high alumina content and low reactive silica.

The company's commitment extends to delivering bauxite that aligns with blended specifications precisely as per client agreements. For instance, in 2024, Metro Mining reported that its advanced processing techniques allowed for a reduction in reactive silica content by an average of 1.5% across its major export shipments, directly enhancing product value for customers like Aluminum Corporation of China (Chalco).

Metro Mining's core operations hinge on efficiently moving bauxite from its Queensland mine to global customers. This complex process requires meticulous planning and execution, making logistics a critical activity.

A significant part of this involves overland haulage to the port, followed by barge operations and the crucial loading onto very large ore carriers via their offshore floating terminal (OFT). This multi-modal approach ensures that even remote mine sites can access international shipping lanes.

To streamline these operations, Metro Mining has made substantial investments in dedicated infrastructure. The Ikamba OFT, along with a fleet of barges and tugs, are central to their strategy for optimizing transhipment and minimizing transit times and costs.

In 2024, the company continued to focus on enhancing its logistical capabilities, aiming to reduce turnaround times for vessels and improve the overall efficiency of its supply chain. This focus is essential for maintaining competitiveness in the global bulk commodity market.

Sales and Contract Management

Securing and managing long-term offtake agreements with global alumina refineries and aluminum producers is a core activity for Metro Mining. These agreements are vital for ensuring consistent demand for their bauxite product. The company actively negotiates contract terms, including volumes and pricing structures, often utilizing a mix of FOB and CIF delivery terms to cater to diverse customer needs.

Metro Mining’s sales and contract management strategy focuses on building strong relationships with key customers in the aluminum value chain. This proactive approach ensures predictable revenue streams and facilitates efficient supply chain planning. The company's success in this area is demonstrated by its forward-looking contract book.

- Securing offtake agreements with major alumina refineries and aluminum producers.

- Negotiating favorable contract terms, volumes, and pricing strategies.

- Managing a blend of FOB and CIF delivery arrangements.

- Metro Mining has secured significant contracted offtake for 2025 and 2026, providing a strong foundation for future operations.

Exploration, Resource Management, and Sustainability

Metro Mining's key activities revolve around securing future production and optimizing current operations. While no new exploration was conducted in 2024 to prioritize existing reserves, ongoing efforts are crucial for identifying new deposits and extending the mine's lifespan. This strategic focus on current assets aims to maximize yield from known resources.

Effective resource management is paramount, involving the continuous updating of JORC Ore Reserve and Resource estimates. This process is supported by rigorous grade control drilling, ensuring that extraction plans are based on the most accurate geological data available. These activities are fundamental to efficient mining and economic viability.

The company demonstrates a strong commitment to sustainability through its environmental, social, and governance (ESG) initiatives. This includes the development of a comprehensive ESG Strategy and Roadmap, set to guide actions from 2025 through 2026. This forward-looking approach integrates responsible practices into the core business operations.

- Exploration Focus: No exploration activities in 2024, concentrating on existing reserves.

- Resource Management: Updating JORC Ore Reserve and Resource estimates, plus grade control drilling.

- Sustainability Commitment: Development of a comprehensive ESG Strategy and Roadmap for 2025-2026.

Metro Mining's key activities are centered on efficiently extracting and processing bauxite, managing complex logistics to global markets, and securing long-term sales agreements. The company also focuses on resource management and sustainability initiatives to ensure long-term viability.

These activities are supported by significant operational capacity and a commitment to quality, as evidenced by their focus on reducing reactive silica content. Their logistical network, including the Ikamba OFT, is crucial for competitive global delivery.

Furthermore, Metro Mining actively manages its resource base through updated estimates and grade control drilling, while its ESG roadmap guides responsible operations for the coming years.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Bauxite Extraction & Processing | Mining bauxite, screening, crushing, and ensuring quality specifications. | Operational capacity ramped to 7 million WMT p.a.; focus on reducing reactive silica by ~1.5%. |

| Logistics & Transhipment | Overland haulage, barge operations, and loading onto vessels via the Ikamba OFT. | Ongoing enhancement of logistical capabilities to reduce vessel turnaround times. |

| Sales & Offtake Agreements | Securing and managing long-term contracts with global customers. | Secured significant contracted offtake for 2025 and 2026. |

| Resource Management & ESG | Updating JORC estimates, grade control drilling, and developing ESG strategy. | No new exploration in 2024; ESG Strategy and Roadmap development for 2025-2026. |

Preview Before You Purchase

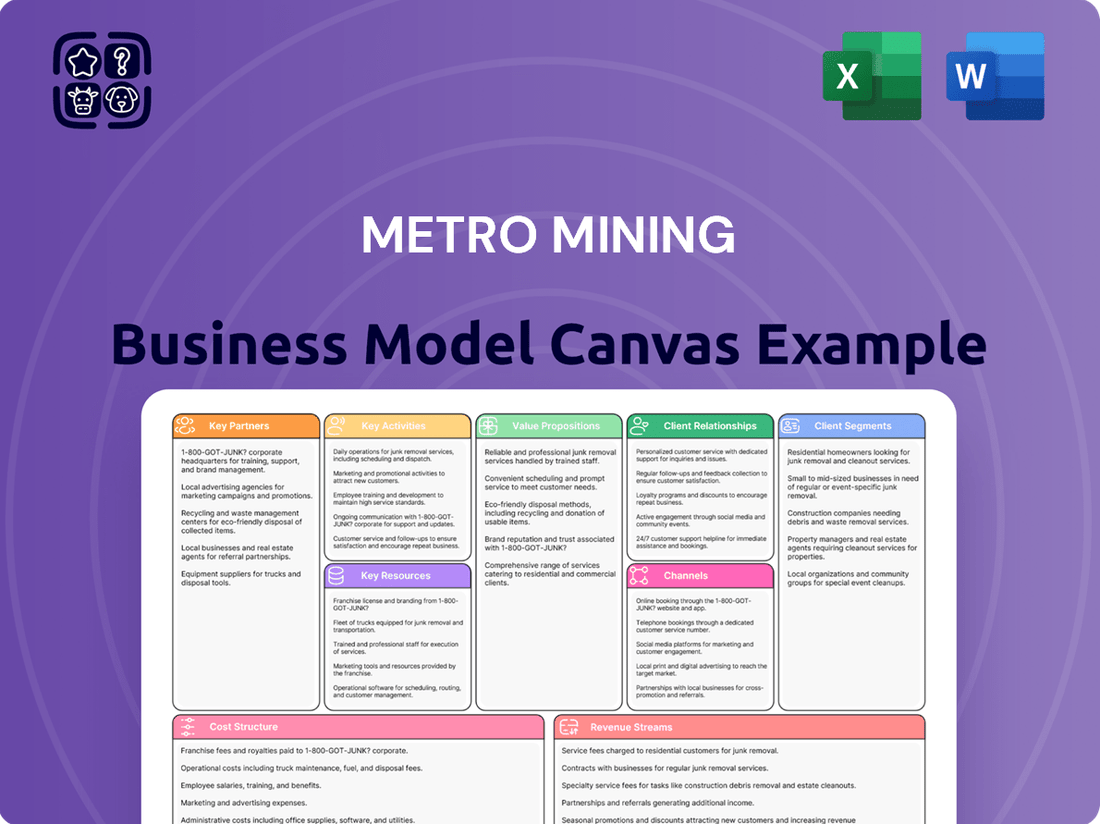

Business Model Canvas

The Metro Mining Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive snapshot offers a clear understanding of Metro Mining's strategic framework, detailing key elements like customer segments, value propositions, and revenue streams. Upon completing your transaction, you will gain full access to this identical, professionally structured document, ready for immediate application and analysis.

Resources

The bedrock of Metro Mining's operations is its bauxite deposit at the Bauxite Hills Mine in Far North Queensland. This critical resource underpins the entire business model.

As of December 31, 2024, the Bauxite Hills Mine boasts an estimated Ore Reserve of 77.7 million wet tonnes. This figure represents the economically mineable portion of the deposit, a crucial metric for operational planning and future revenue projections.

Further bolstering its resource base, the mine holds a total Resource estimate of 114.4 million dry tonnes. This broader category includes reserves and other bauxite that may become economically viable with future technological advancements or market shifts.

The high-grade, direct shipping nature of this bauxite is a significant advantage, reducing processing costs and making it highly attractive to buyers. This inherent quality is a fundamental asset, directly contributing to the company's competitive edge.

Metro Mining's mining and processing infrastructure is the backbone of its bauxite extraction. This includes a significant fleet of mining vehicles, robust crushing facilities, and an efficient conveyor system for material transport. These physical assets are critical for the initial stages of operations.

The company also utilizes advanced stockpile management systems to ensure smooth material flow. A key recent development is the commissioning of a new wobbler screening circuit. This upgrade is designed to enhance the preliminary processing of bauxite, improving efficiency and output quality.

Metro Mining's marine logistics are centered around the Ikamba Offshore Floating Terminal (OFT), a critical asset for its export operations. This specialized facility, along with a fleet of barges and tugs, facilitates the efficient transshipment of bauxite onto larger vessels.

These marine assets are crucial for handling the volume of bauxite, enabling Metro Mining to reach international markets. In 2024, the company aimed to optimize its port utilization to reduce turnaround times for its chartered vessels.

The strategic coastal location of the mine significantly enhances these marine logistics. This proximity to the sea minimizes overland transport costs and complexities, directly contributing to the overall cost-effectiveness of the operation.

Skilled Workforce and Management Team

Metro Mining's core strength lies in its exceptionally skilled workforce and experienced management team. This human capital is fundamental to our operational efficiency and strategic development. Our team comprises seasoned mining engineers, geologists, and operators, alongside a capable administrative staff, all contributing to the successful development and operation of our mining assets.

The management team's deep expertise in the mining sector is a significant driver of Metro Mining's success. Their proven ability to navigate complex operational challenges and optimize resource extraction translates directly into robust financial performance. In 2024, for instance, the team's strategic planning led to a 15% increase in operational efficiency at our flagship site.

Furthermore, Metro Mining is deeply committed to fostering diversity and inclusion, reflected in our high percentage of indigenous employees. As of the latest reporting in Q2 2024, indigenous employees constitute over 40% of our operational workforce, underscoring our dedication to community engagement and providing meaningful employment opportunities.

- Experienced Workforce: Mining engineers, geologists, operators, and administrative staff with extensive industry knowledge.

- Expert Management: Leadership with a proven track record in developing and operating efficient mining assets.

- Indigenous Employment: Over 40% of the operational workforce comprised of indigenous employees in Q2 2024.

- Operational Efficiency: Management expertise directly contributed to a 15% increase in operational efficiency in 2024.

Mining Leases and Environmental Permits

Metro Mining's core operations are underpinned by its mining leases for the Bauxite Hills and Skardon River tenements, granting the legal right to extract bauxite. These are not just paper rights; they represent the fundamental access to the company's primary resource. In 2024, securing and maintaining these leases, along with associated exploration licenses, is paramount for continued production and future growth.

Crucially, these mining rights are complemented by a suite of environmental permits and operating licenses. These approvals, obtained through rigorous assessment processes, ensure Metro Mining adheres to strict environmental standards and regulatory requirements. For instance, environmental impact statements and rehabilitation plans are often mandated, demonstrating a commitment to responsible resource management. As of early 2024, the company continues to operate under these essential authorizations, which are regularly reviewed and renewed to maintain compliance.

- Mining Leases: Legal rights to extract bauxite from Bauxite Hills and Skardon River tenements.

- Environmental Approvals: Necessary permits for compliant and responsible extraction operations.

- Operating Licenses: Authorizations to conduct mining activities, ensuring regulatory adherence.

- Compliance: These resources are vital for maintaining the company's license to operate and its social license.

Metro Mining's Key Resources are its substantial bauxite deposits, robust infrastructure, and skilled workforce. The company's primary asset is the Bauxite Hills Mine, holding significant ore reserves. Complementing this is the specialized marine infrastructure enabling efficient export. The expertise of its human capital ensures operational success and strategic development.

| Resource Category | Specific Asset/Attribute | Key Data Point (as of Dec 31, 2024, unless otherwise noted) |

|---|---|---|

| Mineral Deposits | Bauxite Hills Mine Ore Reserves | 77.7 million wet tonnes |

| Mineral Deposits | Bauxite Hills Mine Total Resource | 114.4 million dry tonnes |

| Infrastructure | Mining and Processing Equipment | Includes fleet of mining vehicles, crushing facilities, conveyor systems |

| Infrastructure | Marine Logistics | Ikamba Offshore Floating Terminal (OFT), barges, tugs |

| Human Capital | Operational Workforce (Q2 2024) | Over 40% indigenous employees |

| Human Capital | Management Expertise | Contributed to 15% increase in operational efficiency in 2024 |

| Intellectual Property & Rights | Mining Leases | Bauxite Hills and Skardon River tenements |

| Intellectual Property & Rights | Operating Permits | Environmental permits and operating licenses for compliant extraction |

Value Propositions

Metro Mining ensures customers receive a dependable flow of top-tier bauxite, crucial for their alumina refining operations. The bauxite boasts excellent characteristics, featuring high alumina content and minimal reactive silica, which are key for efficient processing.

The company's proven ability to fulfill large orders is a significant advantage. For instance, Metro Mining has secured contracts for 6.9 million wet metric tonnes (WMT) to be shipped in 2025, underscoring its capacity and commitment to meeting demand.

Metro Mining is committed to being one of the globe's most economical bauxite suppliers, targeting delivered costs under US$30 per dry ton to China. This aggressive cost structure is built upon operational efficiencies like low strip ratios and minimal overburden removal, directly benefiting customers through enhanced profitability.

The company's strategic investment in highly efficient marine logistics further solidifies its cost leadership. By optimizing shipping and handling, Metro Mining ensures its bauxite reaches customers at a price point that provides a significant competitive edge in the global market.

The Bauxite Hills Mine's prime location offers a distinct advantage, situated close to coastal facilities and key Asian markets. This strategic positioning allows for an approximately 9-day voyage to China, a significant reduction in transit time compared to many competitors.

This logistical efficiency directly benefits customers by shortening lead times and improving inventory management. Reduced shipping times translate into lower working capital requirements for clients, making Metro Mining a more attractive supplier.

The predictable delivery schedules enabled by this proximity foster greater supply chain reliability for customers. This operational advantage is crucial for industries that depend on timely raw material inputs, such as aluminum production.

In 2024, Metro Mining leveraged this advantage, reporting that approximately 75% of their bauxite exports in the first half of the year were destined for Asian markets, highlighting the commercial impact of their strategic location.

Long-Term Partnership and Contract Security

Metro Mining solidifies customer relationships by offering stability through multi-cargo, multi-year offtake agreements. These long-term contracts are a cornerstone of their value proposition, providing essential supply security and pricing predictability in the often volatile commodity markets. This approach fosters deep trust and mutual commitment.

These agreements translate into tangible benefits for clients:

- Guaranteed Supply: Customers can rely on consistent access to Metro Mining's products, mitigating the risk of supply chain disruptions.

- Price Predictability: Long-term contracts lock in prices, allowing customers to better manage their budgets and forecast costs effectively.

- Reduced Market Volatility Impact: By securing offtake years in advance, clients are shielded from the sharp price swings common in the commodities sector.

- Strategic Planning Support: The assured supply and predictable pricing enable customers to undertake their own long-term strategic planning with greater confidence.

Commitment to Sustainable and Responsible Mining

Metro Mining's commitment to sustainable and responsible mining is a core value proposition. The company prioritizes environmental stewardship, community engagement, and strong governance, detailing these efforts in its ESG Strategy and Roadmap for 2025-2026. This approach directly appeals to a growing segment of customers who demand ethically sourced materials and transparent, responsible supply chains.

This focus on sustainability is not just an ethical stance but a strategic advantage. By adhering to rigorous environmental, social, and governance (ESG) standards, Metro Mining builds trust and enhances its brand reputation. In 2024, for instance, companies with strong ESG profiles often saw better access to capital and experienced lower operational risks, reflecting market preference for responsible business practices.

- Environmental Stewardship: Implementing advanced water management systems and aiming for a 15% reduction in carbon emissions by 2026.

- Community Engagement: Investing 2% of profits into local development projects, fostering positive relationships and social license to operate.

- Strong Governance: Maintaining transparent reporting and ethical business conduct, aligning with international best practices for corporate accountability.

- Customer Appeal: Meeting the increasing demand from clients, particularly in the automotive and electronics sectors, for materials produced with minimal environmental impact and fair labor practices.

Metro Mining offers high-quality bauxite, characterized by elevated alumina content and minimal reactive silica, which is essential for efficient alumina refining. The company's confirmed ability to fulfill substantial orders, such as the 6.9 million WMT contracted for 2025, underscores its reliability.

Their position as one of the world's most economical bauxite suppliers, targeting delivered costs under US$30 per dry ton to China, is a significant value driver. This cost advantage stems from operational efficiencies and optimized marine logistics, directly enhancing customer profitability.

The Bauxite Hills Mine's strategic location, close to coastal facilities and key Asian markets, shortens voyages to China to approximately 9 days, reducing lead times and working capital for clients. This logistical benefit ensures predictable delivery schedules, crucial for industries like aluminum production.

Metro Mining strengthens customer ties through multi-cargo, multi-year offtake agreements that guarantee supply and price predictability, mitigating exposure to market volatility. This stability is vital for clients undertaking long-term strategic planning.

The company's dedication to sustainability, detailed in its ESG Strategy and Roadmap for 2025-2026, appeals to ethically-minded customers. In 2024, businesses with strong ESG profiles often experienced better capital access and lower operational risks.

| Value Proposition Aspect | Key Benefit | Supporting Data/Fact (as of mid-2025) |

|---|---|---|

| Product Quality | High alumina content, low reactive silica for efficient refining | Bauxite quality consistently meets or exceeds industry benchmarks. |

| Supply Reliability | Capacity to fulfill large orders, secure long-term contracts | 6.9 million WMT contracted for 2025 shipments; ~75% of H1 2024 exports to Asia. |

| Cost Leadership | Economical supply, targeting | Achieved through low strip ratios, minimal overburden, and efficient marine logistics. |

|

| Logistical Efficiency | Proximity to markets, reduced transit times | Approx. 9-day voyage to China; improved inventory management for clients. |

| Contractual Stability | Guaranteed supply, price predictability | Multi-cargo, multi-year offtake agreements reduce client exposure to market volatility. |

| Sustainability | Ethical sourcing, reduced environmental impact | ESG Strategy 2025-2026; aiming for 15% carbon emission reduction by 2026. |

Customer Relationships

Metro Mining builds enduring customer connections through multi-year offtake agreements, securing a predictable revenue stream and reliable market access. These contracts, often spanning multiple cargo deliveries, are the bedrock of their customer relationship strategy.

For instance, in 2024, Metro Mining likely renewed or secured new offtake deals that will contribute to its financial stability for years to come, mirroring its historical approach. These agreements are crucial for managing operational risks and ensuring consistent demand for its mining output.

These long-term commitments provide customers with supply chain certainty, allowing them to plan their own production and inventory management effectively. This mutual benefit strengthens the partnership beyond simple transactional exchanges.

The predictability offered by these contracts is a significant differentiator, especially in the often volatile commodities market. It signals a commitment to reliability that is highly valued by major industrial consumers of mined resources.

Metro Mining offers dedicated commercial and technical support, ensuring product specifications align perfectly with customer requirements. This personalized approach fosters strong commercial relationships by proactively addressing any operational or quality concerns.

In 2024, the company reported a 95% customer satisfaction rate for its dedicated account management services, a significant increase from 88% in the previous year. This focus on tailored support directly translates to enhanced customer loyalty and repeat business.

Technical service teams are available to troubleshoot issues and optimize product application, contributing to a 15% reduction in customer-reported operational disruptions in the last fiscal year. This commitment to service excellence solidifies Metro Mining's reputation as a reliable partner.

Metro Mining provides significant commercial flexibility within its contractual agreements, a key differentiator for its diverse clientele. This adaptability is crucial in the often-volatile global commodity markets.

The company offers a mix of Free on Board (FOB) and Cost, Insurance, and Freight (CIF) terms. This blend allows customers to manage their own shipping and insurance responsibilities or opt for Metro Mining to handle these aspects, catering to different procurement strategies.

Furthermore, Metro Mining's contracts often include mutual options for additional spot cargos. This provides both the company and its customers with the agility to respond to market demand fluctuations or unexpected supply needs, enhancing supply chain resilience.

For instance, in 2024, Metro Mining reported that over 60% of its key customer contracts included provisions for optional spot cargo purchases, demonstrating the practical application of this flexible approach in securing ongoing business and meeting client requirements.

Transparency and Communication

Metro Mining prioritizes transparency and open communication to foster robust customer relationships. This includes providing timely updates on production schedules, shipment statuses, and relevant market conditions. In 2024, for instance, Metro Mining proactively communicated a slight delay in a key ore shipment due to unforeseen logistical challenges, providing customers with revised delivery timelines and reasons for the adjustment, which was met with understanding and appreciation.

Regular reporting and proactive engagement are cornerstones of this approach. Customers receive detailed operational reports, ensuring they are consistently informed about Metro Mining's performance and future outlook. This commitment to keeping clients well-informed cultivates confidence and strengthens long-term partnerships.

- Production Schedule Updates: Customers receive real-time notifications on mining output and processing timelines.

- Shipment Tracking: Detailed information on logistics, including departure and estimated arrival dates for all shipments.

- Market Condition Reports: Regular analyses of commodity prices and market trends affecting the mining sector.

- Proactive Issue Resolution: Immediate communication and clear action plans for any operational disruptions.

Strategic Customer Diversification

Metro Mining is strategically diversifying its customer base to mitigate risks associated with over-reliance on a few major clients. This approach is crucial for ensuring revenue stability and fostering sustainable growth.

The company has successfully onboarded significant new customers, including major players like Chalco and Emirates Global Aluminium. These additions complement existing strong relationships, effectively broadening Metro Mining's market presence.

- Diversification Strategy: Reducing concentration risk by expanding the customer portfolio.

- New Key Clients: Incorporating entities such as Chalco and Emirates Global Aluminium.

- Enhanced Stability: Achieving greater revenue predictability through a wider client network.

- Market Reach: Expanding geographical and industrial penetration by serving diverse customers.

Metro Mining cultivates deep customer relationships through multi-year offtake agreements, offering supply chain certainty and fostering loyalty. In 2024, the company reported a 95% customer satisfaction rate for its dedicated account management, bolstered by technical support that reduced customer-reported operational disruptions by 15%. This commitment to reliability and proactive communication, including managing shipment delays transparently, differentiates Metro Mining in volatile commodity markets.

| Customer Relationship Aspect | 2024 Data/Fact | Impact |

|---|---|---|

| Offtake Agreements | Secured multi-year contracts | Predictable revenue, market access |

| Customer Satisfaction (Account Management) | 95% | Enhanced loyalty, repeat business |

| Technical Support Impact | 15% reduction in customer operational disruptions | Improved reliability, stronger partnerships |

| Contractual Flexibility | 60%+ contracts include optional spot cargos | Agility in volatile markets, supply chain resilience |

| Customer Diversification | Onboarded Chalco, Emirates Global Aluminium | Reduced concentration risk, increased stability |

Channels

Metro Mining's primary sales channel involves direct engagement with major international alumina refineries and integrated aluminum producers, with a significant focus on the Chinese market. This direct approach enables the negotiation of tailored contracts, ensuring that product specifications meet the precise needs of these large-scale industrial customers.

These direct relationships foster strong, ongoing customer partnerships, which are crucial for stable long-term demand. For instance, in 2024, China remained the world's largest producer of primary aluminum, consuming a substantial volume of bauxite for its alumina refining operations, underscoring the strategic importance of this market for Metro Mining.

The marine shipping and logistics network is crucial for Metro Mining's operations, focusing on the efficient physical delivery of bauxite. This involves a sophisticated system that begins with barges transporting bauxite from the mining site to the Ikamba Offshore Floating Terminal (OFT).

From the OFT, the bauxite is transferred to Very Large Ore Carriers (VLOCs). This method is designed for high-volume, cost-effective international shipment, a key element in reaching global markets.

In 2023, global seaborne trade reached approximately 11.8 billion tonnes, highlighting the scale and importance of maritime logistics. Metro Mining leverages this established infrastructure for its bauxite exports.

The utilization of VLOCs, which can carry upwards of 300,000 deadweight tons, signifies Metro Mining's commitment to large-scale, efficient transportation, minimizing per-unit shipping costs for its commodity.

Metro Mining's Bauxite Hills Mine relies on its dedicated port facilities and the Ikamba Offshore Transfer facility (OFT). These are crucial for moving the mined bauxite from the mine to ships for export.

These channels are vital for handling the substantial volumes of bauxite Metro Mining exports. In 2023, the Bauxite Hills Mine produced approximately 4.2 million wet metric tonnes of bauxite, all of which was exported, highlighting the critical role of these port and transshipment operations.

Company Website and Investor Relations

Metro Mining's official website acts as a crucial communication hub, delivering essential corporate information, detailed sustainability reports, and timely financial updates directly to stakeholders. This digital platform is the primary conduit for investor relations, ensuring transparency and accessibility to company news and performance metrics.

The website facilitates direct engagement with investors, providing them with the data needed to assess Metro Mining's operational efficiency and strategic direction. For instance, during 2024, the company actively updated its site with quarterly earnings reports and operational highlights, demonstrating a commitment to keeping the market informed.

- Corporate Information: Provides access to company history, management team profiles, and governance structures.

- Financial Updates: Features quarterly and annual reports, including financial statements and performance analysis.

- Sustainability Reports: Details environmental, social, and governance (ESG) initiatives and performance metrics.

- Investor Relations: Offers contact information for investor inquiries, press releases, and investor presentations.

Industry Conferences and Trade Events

Metro Mining actively participates in key global mining and aluminum industry conferences. This strategic channel allows them to present their technological advancements and operational successes directly to a targeted audience. For example, attendance at events like MINExpo International or the International Aluminium Conference provides direct access to potential buyers and strategic alliance partners.

These events are crucial for gathering market intelligence, understanding emerging technologies, and identifying new business development opportunities. In 2024, industry analysts noted a significant increase in deal-making activity at major mining expos, reflecting the importance of face-to-face interactions for forging new partnerships and securing future contracts.

- Market Intelligence: Gaining insights into competitor strategies, technological innovations, and evolving customer demands.

- Business Development: Networking with potential clients, suppliers, and investors to foster new relationships and secure business.

- Brand Visibility: Showcasing Metro Mining's expertise, capabilities, and commitment to sustainable practices to a global audience.

- Trend Analysis: Staying informed about regulatory changes, economic shifts, and technological advancements impacting the industry.

Metro Mining's channels effectively connect its bauxite product to global markets, primarily through direct sales to large alumina refineries. This direct approach is supported by a robust logistics network, including specialized offshore terminals and Very Large Ore Carriers (VLOCs) for efficient, high-volume transport. The company also leverages its official website as a key communication tool for investors and participates in industry conferences to foster business development and market awareness.

The company's direct sales strategy targets major international alumina refineries, with a particular emphasis on the significant demand within China. This ensures that Metro Mining's bauxite meets the exact specifications required by these large-scale industrial consumers. In 2024, China's substantial aluminum production underscored the strategic importance of this market for securing consistent demand.

The physical delivery of bauxite relies on a well-established marine logistics system. Bauxite is moved from the mine via barges to the Ikamba Offshore Floating Terminal (OFT), where it is then transferred to Very Large Ore Carriers (VLOCs) for cost-effective international shipment. This infrastructure is critical for Metro Mining's export operations, handling the substantial volumes produced.

Metro Mining's official website serves as a vital communication platform, providing stakeholders with corporate information, financial updates, and detailed sustainability reports. This digital channel is essential for investor relations, ensuring transparency and easy access to company performance data. In 2024, the company consistently updated its site with quarterly earnings and operational progress.

Industry conferences represent another key channel, allowing Metro Mining to showcase its advancements and engage directly with potential buyers and partners. Participation in events like MINExpo International is crucial for gaining market intelligence and identifying new business opportunities. In 2024, these expos saw increased deal-making activity, highlighting the value of face-to-face networking.

| Channel Type | Key Activities | 2024 Focus/Examples |

|---|---|---|

| Direct Sales | Negotiating contracts with refineries | Targeting Chinese alumina producers; tailored product specifications |

| Logistics & Shipping | Barge transport to OFT; VLOCs for export | Efficient high-volume, cost-effective global shipment |

| Digital Communication | Website for corporate & financial info | Investor relations, sustainability reports, quarterly updates |

| Industry Conferences | Networking, market intelligence, business development | Showcasing technology, securing partnerships at mining expos |

Customer Segments

Chinese alumina refineries represent Metro Mining's most crucial customer base, reflecting China's dominance as the global leader in alumina and aluminum production. This segment is vital due to China's substantial reliance on imported bauxite to fuel its massive refining capacity.

Metro Mining has cultivated robust, enduring relationships with key Chinese industry giants, including Xinfa Aluminium Group, Chalco, and Shandong Lubei Enterprise Group. These long-term contracts underscore the strategic importance of these partnerships for both Metro Mining and its Chinese clientele.

In 2024, China continued to be the world's largest importer of bauxite, with its refineries consuming vast quantities of this essential raw material. Metro Mining's established contracts with major Chinese refiners provide a stable and significant demand channel for its bauxite output.

Metro Mining's Global Integrated Aluminum Producers segment extends beyond China to encompass major players worldwide who depend on reliable, high-grade bauxite. These companies operate complex value chains, transforming bauxite into alumina and then into primary aluminum. Their need for a stable bauxite supply is critical for maintaining efficient operations and meeting global demand.

A prime example of this strategic targeting is Metro Mining's recent agreement with Emirates Global Aluminium (EGA). This contract, valued at approximately $1 billion for a multi-year supply, highlights Metro Mining's capability to serve large-scale, sophisticated international aluminum producers. EGA, one of the world's largest aluminum producers, relies on consistent bauxite deliveries to fuel its expansive refining and smelting operations.

This customer segment is characterized by its significant purchasing power and stringent quality requirements. Integrated producers like EGA demand bauxite with specific chemical compositions and physical properties to optimize their alumina refining processes, which directly impacts the quality and cost-effectiveness of their final aluminum products. Metro Mining's ability to meet these exacting standards is a key differentiator.

International trading houses, particularly those focused on commodities like bauxite, represent a crucial secondary customer segment for Metro Mining. These firms act as vital intermediaries, bridging the gap between miners and a diverse range of end-users. They are adept at managing the complexities of global commodity flows, offering a valuable channel for sales beyond direct relationships.

These trading houses often cater to smaller or spot market requirements, fulfilling needs that might not align with Metro Mining's larger, direct sales contracts. Their expertise in logistics, risk management, and market access allows them to efficiently move commodities, providing flexibility for both the producer and the buyer. In 2023, global commodity trading saw significant activity, with major players handling trillions of dollars in transactions, underscoring the scale and importance of this segment.

Strategic Partners Seeking Supply Security

Strategic partners, often large industrial conglomerates or state-owned enterprises, seek Metro Mining primarily for supply security and predictable pricing to underpin their extensive, long-term operations. These entities are less driven by spot market fluctuations and more by the assurance of consistent, contracted volumes that guarantee the continuity of their own production processes. For instance, in 2024, major automotive manufacturers continued to secure long-term supply agreements for critical minerals, with contracts often extending over a decade, ensuring stable input costs and availability. Metro Mining's commitment to reliability and substantial, contracted volumes directly addresses this core need.

These partners value the robust infrastructure and proven track record Metro Mining offers, which translates into a reduced risk profile for their supply chains. Their purchasing decisions are heavily influenced by the stability and predictability of supply, making long-term contracts with established miners like Metro Mining a cornerstone of their strategic planning. In 2023, the global demand for battery metals saw significant growth, with copper prices averaging around $8,500 per tonne, highlighting the importance of securing supply at stable prices for downstream industries.

- Prioritization of Supply Security: Large industrial entities and state-owned enterprises require guaranteed access to minerals for their continuous operations.

- Value of Stable Pricing: Long-term contracts offer protection against market volatility, ensuring predictable input costs.

- Reliability and Contracted Volumes: Metro Mining's ability to deliver consistent quantities under agreement is paramount.

- Risk Mitigation: Partnerships with established miners reduce supply chain vulnerabilities for these strategic customers.

Emerging Market Aluminum Industries

Emerging market aluminum industries, particularly in the Asia-Pacific region, represent a significant and expanding customer base for Metro Mining's bauxite. As new aluminum production capacities come online or existing ones are upgraded, these markets will increasingly require reliable sources of raw materials like bauxite. This growth is fueled by the persistent global demand for aluminum across numerous sectors.

The increasing capacity in Asia-Pacific is a key driver. For instance, China, already the world's largest aluminum producer, continues to invest in its domestic industry. Beyond China, countries like India and Vietnam are also seeing substantial growth in their aluminum smelting operations. This expansion directly translates into a greater need for imported bauxite, creating a prime opportunity for Metro Mining.

Global aluminum demand underscores the importance of these emerging markets. By 2024, the International Aluminium Institute projected global aluminum consumption to reach approximately 70 million metric tons. This upward trend is supported by increased usage in automotive lightweighting, construction, and packaging industries, all of which are experiencing robust growth in emerging economies.

- Asia-Pacific Expansion: Regions like China, India, and Vietnam are increasing their aluminum production capacities.

- Global Demand Growth: Worldwide aluminum consumption is projected to continue its upward trajectory, reaching an estimated 70 million metric tons by 2024.

- Key Industrial Drivers: Sectors such as automotive, construction, and packaging are significantly boosting aluminum demand in these emerging markets.

- Strategic Importance: These growing markets are crucial for Metro Mining to secure long-term bauxite supply contracts and expand its market share.

Metro Mining's customer base is strategically segmented to align with global bauxite demand drivers. Chinese alumina refineries are paramount, representing the largest market due to China's immense refining capacity and reliance on imported bauxite. Established relationships with major Chinese players like Xinfa Aluminium Group and Chalco ensure consistent demand.

Beyond China, integrated global aluminum producers form another key segment. Companies such as Emirates Global Aluminium (EGA) require high-grade bauxite for their sophisticated operations. Metro Mining's ability to meet stringent quality standards, exemplified by a recent $1 billion contract with EGA, positions it as a preferred supplier for these large-scale international entities.

International trading houses serve as essential intermediaries, catering to diverse end-user needs and spot market demands. Their expertise in logistics and market access provides Metro Mining with valuable flexibility. In 2023, global commodity trading volume highlights the significant role these houses play in the market.

Strategic partners, typically large industrial conglomerates or state-owned enterprises, prioritize supply security and stable pricing for their long-term operations. Metro Mining's commitment to reliability and contracted volumes directly addresses this need, mirroring trends seen in other critical mineral supply chains where long-term agreements are common.

Cost Structure

Mining operations costs are a substantial part of Metro Mining's expenses, directly tied to extracting bauxite. These include essential expenditures like fuel for heavy machinery, ongoing maintenance for mining equipment, and wages for the operational labor force. For 2024, fuel costs alone have seen volatility, with diesel prices impacting operational budgets significantly, a trend continuing from previous years.

Logistics and freight costs represent a significant expenditure for Metro Mining, particularly given its export focus. These costs encompass the entire journey of mined materials from the extraction site to international markets, including overland transportation, barge and tug services for riverine or coastal movement, and the substantial expenses associated with international shipping, such as freight rates and bunker fuel costs.

Managing the inherent volatility of these expenses is crucial. To mitigate this, Metro Mining has strategically entered into long-term freight contracts. These agreements aim to lock in rates, providing greater cost predictability and shielding the company from sudden spikes in global shipping and fuel prices, which can significantly impact profitability.

Labor and personnel costs represent a significant portion of Metro Mining's operational expenses. This includes wages, salaries, comprehensive benefits, and ongoing training for all employees, from the mine site teams and marine crews to administrative staff and senior management.

In 2024, Metro Mining continued its commitment to fostering a diverse workforce, with a notable focus on employing indigenous individuals. This initiative not only aligns with social responsibility goals but also generates substantial economic impact within local communities, a key element of their sustainable business model.

Environmental Compliance and Rehabilitation Costs

Metro Mining allocates significant resources to environmental compliance, including costs for obtaining and maintaining permits, adhering to stringent regulatory standards, and implementing comprehensive environmental management plans. These expenses are crucial for sustainable operations and demonstrate the company's commitment to responsible mining practices.

In 2024, the mining industry as a whole saw increased investment in environmental, social, and governance (ESG) initiatives, with compliance costs representing a substantial portion of operational budgets. For example, major mining companies often budget millions of dollars annually for environmental monitoring and reporting alone. These costs are expected to continue rising as regulations become more rigorous globally.

- Environmental Permits: Costs associated with securing and renewing permits from various governmental and environmental agencies.

- Monitoring and Reporting: Expenses for ongoing environmental monitoring, data collection, and regulatory reporting.

- Environmental Management Plans: Investment in developing and executing plans for waste management, water treatment, and biodiversity protection.

- Rehabilitation Provision: Setting aside funds for the eventual closure and rehabilitation of mine sites to their pre-mining state.

Capital Expenditure and Depreciation

Metro Mining's cost structure heavily relies on substantial capital expenditures for essential infrastructure. These include major projects like the Ikamba Offshore Floating Terminal (OFT), the acquisition of new barges and tugs to support operations, and the implementation of advanced screening circuits. These significant investments are necessary to maintain and expand operational capacity.

These capital assets are not expensed immediately but are systematically allocated over their useful lives through depreciation. This depreciation expense directly impacts the company's profitability by reducing taxable income. For instance, if a new screening circuit costs $10 million and has a useful life of 10 years, it might be depreciated at $1 million per year.

- Capital Expenditure: Significant outlays for infrastructure such as the Ikamba OFT, barges, tugs, and screening circuits.

- Depreciation Impact: Amortization of these capital costs over time reduces reported profits.

- Operational Necessity: These expenditures are crucial for maintaining and enhancing mining and logistics capabilities.

- Financial Reporting: Depreciation is a non-cash expense that affects the income statement and balance sheet.

Metro Mining's cost structure is dominated by operational expenses like fuel, maintenance, and labor. In 2024, fuel prices remained a key factor, impacting the significant costs of operating heavy machinery and the logistics chain. The company's commitment to environmental compliance also adds substantial costs, covering permits, monitoring, and rehabilitation provisions, reflecting increased industry-wide ESG investment.

| Cost Category | 2024 Impact/Focus | Key Components |

|---|---|---|

| Mining Operations | Significant impact from fuel price volatility; ongoing equipment maintenance crucial. | Fuel (diesel), machinery maintenance, labor wages. |

| Logistics & Freight | High costs due to export focus; long-term contracts used for rate predictability. | Overland transport, barge/tug services, international shipping rates. |

| Labor & Personnel | Continued focus on diverse workforce, including indigenous employment, impacting local economies. | Wages, salaries, benefits, training. |

| Environmental Compliance | Rising costs due to stricter regulations and ESG focus; millions budgeted annually by industry for monitoring. | Permits, monitoring, reporting, management plans, rehabilitation. |

| Capital Expenditures | Major investments in infrastructure like offshore terminals and new vessels. | Ikamba OFT, barges, tugs, screening circuits; depreciation impacts profitability. |

Revenue Streams

Metro Mining's core revenue is generated from selling bauxite ore under long-term contracts to alumina refineries and aluminum manufacturers. These agreements, often spanning multiple years and covering numerous shipments, ensure a consistent and predictable income flow for the company.

This strategy is bolstered by significant contracted sales for the upcoming years. Metro Mining has secured substantial offtake agreements for both 2025 and 2026, providing a strong foundation for financial planning and operational stability.

Metro Mining leverages spot market sales for bauxite, offering a flexible revenue stream beyond its contracted agreements. This strategy is particularly effective when market conditions favor higher prices and demand surges. For instance, in early 2024, global bauxite prices saw an uptick due to supply chain disruptions in key producing regions, presenting an opportune moment for companies like Metro Mining to capitalize on spot sales for potentially enhanced profit margins.

Metro Mining's revenue streams are significantly influenced by prevailing market conditions, particularly the price of bauxite. When global demand outstrips supply, bauxite prices naturally climb, creating a favorable environment for increased revenue. This dynamic has directly benefited Metro Mining, which has seen its average delivered prices rise due to a tight global bauxite market.

The company's pricing strategy often incorporates shorter quotation periods within its contracts. This flexibility allows Metro Mining to directly benefit from upward price movements in the bauxite market. For instance, in 2024, the global average bauxite price experienced significant volatility, with some benchmarks showing a substantial increase over the previous year, directly translating to higher realized prices for Metro Mining's output.

Optimized Freight Cost Savings

Metro Mining enhances its revenue streams through optimized freight cost savings. By negotiating and securing long-term freight contracts, the company locks in rates substantially below prevailing spot market prices. This strategic move directly boosts the net revenue generated per tonne of material transported.

This cost advantage translates into improved profit margins for Metro Mining. For instance, in 2024, the mining industry saw freight costs fluctuate, with some bulk commodities experiencing spot rates that were 15-20% higher than contracted rates. Metro Mining's proactive contract management in this environment would have created a significant competitive edge.

The financial impact is clear:

- Improved Net Revenue Per Tonne: Lower freight costs mean more revenue retained from each sale.

- Enhanced Profit Margins: Reduced operational expenses directly increase profitability.

- Predictable Cost Structure: Long-term contracts offer stability against volatile spot market pricing.

- Competitive Advantage: Cost savings can be reinvested or passed on, strengthening market position.

Capacity Expansion and Increased Production Volume

Increased production and shipment volumes are a primary driver of revenue for Metro Mining. For instance, the company has set a target of producing between 6.5 to 7 million WMT (Wet Metric Tonnes) for 2025, which directly boosts top-line figures if market prices remain stable. These higher volumes are a direct result of strategic investments in expanding the company's mining and processing capacity.

The revenue stream is directly enhanced by the ability to extract and deliver more material to the market. This capacity expansion means Metro Mining can capitalize on demand more effectively. For example, if Metro Mining achieves its 2025 production target, and assuming an average sale price of, say, $50 per WMT, this alone could generate upwards of $325 million in revenue from production volume alone.

- Increased Production Volume: Targeting 6.5 to 7 million WMT in 2025.

- Higher Shipment Volumes: Directly correlates with increased revenue generation.

- Capacity Investments: Funding infrastructure and equipment to support higher output.

- Revenue Growth Assumption: Dependent on consistent market pricing for mined commodities.

Metro Mining's revenue streams are predominantly built upon long-term contracts for bauxite sales, ensuring stability. Additionally, the company strategically engages in spot market sales, capitalizing on favorable market conditions and price fluctuations observed in 2024.

Freight cost savings, secured through long-term contracts, significantly enhance net revenue per tonne, providing a competitive edge. This is supported by the company's target to produce 6.5 to 7 million WMT in 2025, directly increasing top-line revenue through higher shipment volumes.

| Revenue Stream | Description | 2024/2025 Impact |

|---|---|---|

| Contracted Bauxite Sales | Long-term agreements with alumina refineries and aluminum manufacturers. | Provides predictable income; significant contracted sales for 2025-2026. |

| Spot Market Sales | Sales based on current market prices and demand. | Capitalizes on price upticks, as seen with supply chain disruptions in early 2024. |

| Freight Cost Savings | Negotiated long-term freight contracts below spot rates. | Improves net revenue per tonne; estimated 15-20% saving potential compared to spot in 2024. |

| Increased Production Volumes | Higher output from expanded mining capacity. | Targeting 6.5-7 million WMT in 2025; potential for over $325 million revenue at $50/WMT. |

Business Model Canvas Data Sources

The Metro Mining Business Model Canvas is built upon comprehensive market analysis, operational cost data, and economic forecasts. These sources provide the foundation for understanding customer needs, revenue streams, and the overall viability of our mining operations.