Metro Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Metro Mining Bundle

Understand the critical external forces shaping Metro Mining's trajectory. Our comprehensive PESTLE analysis delves into the political stability, economic fluctuations, social attitudes, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a strategic advantage by anticipating market shifts and identifying potential risks and opportunities. Don't be left in the dark; download the full analysis now to unlock actionable intelligence for your business decisions.

Political factors

The Australian government's policy on resource extraction, especially for critical minerals like bauxite, directly shapes Metro Mining's operational landscape. Regulations concerning mining permits, land access, and international trade rules can either streamline or complicate the company's activities.

Recent governmental actions, including the Critical Minerals Strategy and budget allocations for 2024-2025, signal a favorable climate for mining enterprises. These initiatives aim to speed up the identification and development of critical minerals, offering potential advantages for Metro Mining's strategic growth.

Metro Mining's reliance on China as its primary export market makes the political landscape between Australia and China a significant factor. Fluctuations in trade relations, including potential geopolitical tensions or disputes, could directly impact bauxite demand and introduce tariffs. For instance, in 2023, China remained Australia's largest trading partner, but ongoing diplomatic dialogues are essential for stable commodity flows.

These trade dynamics can directly affect Metro Mining's revenue streams. Increased tariffs or reduced demand from China, driven by political friction, could lead to lower sales volumes and profitability for the company. The Australian government's trade policies and diplomatic efforts play a vital role in safeguarding these crucial export markets.

To counter these risks, Metro Mining has strategically diversified its customer base through multi-cargo offtake agreements. Partnerships with major entities like Chalco in China, Emirates Global Aluminium (EGA) in the UAE, and Lubei Steel further spread market exposure. This diversification helps to mitigate the impact of any single market's political or economic downturns.

Queensland's political stability is a cornerstone for Metro Mining's operations at the Bauxite Hills Mine. A stable political climate generally translates to predictable policy, reducing uncertainty for long-term investments. The state government’s commitment to resource development, while balancing environmental concerns, is crucial for maintaining operational continuity.

Shifts in state government or evolving regulatory priorities can introduce new challenges for Metro Mining. For instance, stricter environmental protection measures or updated safety standards, like those seen in recent amendments to Queensland's Resources Safety and Health Legislation, can necessitate significant compliance investments and operational adjustments. These regulatory changes directly impact the cost and feasibility of mining operations.

The regulatory environment in Queensland is dynamic, with ongoing efforts to enhance efficiency and safety in the resources sector. For Metro Mining, this means a constant need to adapt to new legislation and guidelines. For example, in the fiscal year ending June 2024, the Queensland government continued its focus on modernizing mining regulations to ensure both worker safety and environmental stewardship, potentially impacting Metro Mining's operational expenditures.

International Commodity Agreements and Sanctions

Global commodity agreements or sanctions impacting bauxite and aluminum are relatively infrequent but could significantly shift market dynamics. Such measures, if implemented, would alter supply chains and pricing structures for companies like Metro Mining.

Supply disruptions from key bauxite producers, outside of Australia, directly influence global prices. For instance, political instability or export restrictions in major suppliers like Guinea, a significant global producer, can tighten the market. This scenario directly benefits Australian producers as demand for their resources increases, often at higher price points. In 2023, Guinea's bauxite production was estimated to be around 100 million tonnes, making any disruption impactful.

- Geopolitical Risk: Potential sanctions or trade disputes involving major bauxite-producing nations can create supply uncertainties.

- Price Volatility: Disruptions in countries like Guinea, which exported approximately 20% of the world's bauxite in 2023, directly drive up global prices.

- Market Advantage: Metro Mining's position in a tight global bauxite market, exacerbated by external supply issues, has historically led to favorable pricing for its output.

Indigenous Land Rights and Native Title

The recognition and negotiation of Indigenous land rights and Native Title claims present crucial political factors for mining companies in Australia. Metro Mining's operations are situated within the traditional lands and waters of the Ankamuthi People, necessitating a commitment to respectful engagement and the establishment of robust agreements.

This focus on Indigenous partnerships is a growing trend across the Australian mining sector, aiming to foster equitable benefit-sharing and effectively address concerns related to land use. For instance, in 2023, the Federal Government continued to advance reforms aimed at improving engagement with Indigenous communities on resource projects, with ongoing consultations regarding potential new legislative frameworks.

- Native Title Act 1993 (Cth): This legislation underpins the framework for recognizing and dealing with Native Title rights and interests in Australia.

- Indigenous Partnership Agreements: These agreements, like those Metro Mining seeks, outline terms for resource development, employment, training, and community benefits.

- Government Policy: Ongoing policy developments by federal and state governments influence the negotiation and approval processes for mining projects on Indigenous lands.

- Community Consultation: The political landscape demands thorough and ongoing consultation with Traditional Owners and Indigenous representative bodies.

Government policies on critical minerals, like Australia's 2024-2025 budget allocations, create a supportive environment for Metro Mining's growth. Australia's trade relations with China, its primary export market, are crucial; in 2023, China remained Australia's largest trading partner, but geopolitical tensions can impact bauxite demand and tariffs.

Metro Mining mitigates these risks by diversifying its customer base with agreements like those with Chalco in China and Emirates Global Aluminium (EGA) in the UAE, spreading market exposure. Queensland's political stability is vital for Metro Mining's Bauxite Hills Mine, ensuring predictable policy and reduced investment uncertainty, though evolving regulations can necessitate compliance investments.

Disruptions from other bauxite producers, such as political instability in Guinea (which produced about 20% of global bauxite in 2023), can tighten the market and benefit Australian producers like Metro Mining through higher prices. The company also navigates Indigenous land rights and Native Title claims, with ongoing federal government reforms in 2023 aiming to improve engagement with Indigenous communities on resource projects.

What is included in the product

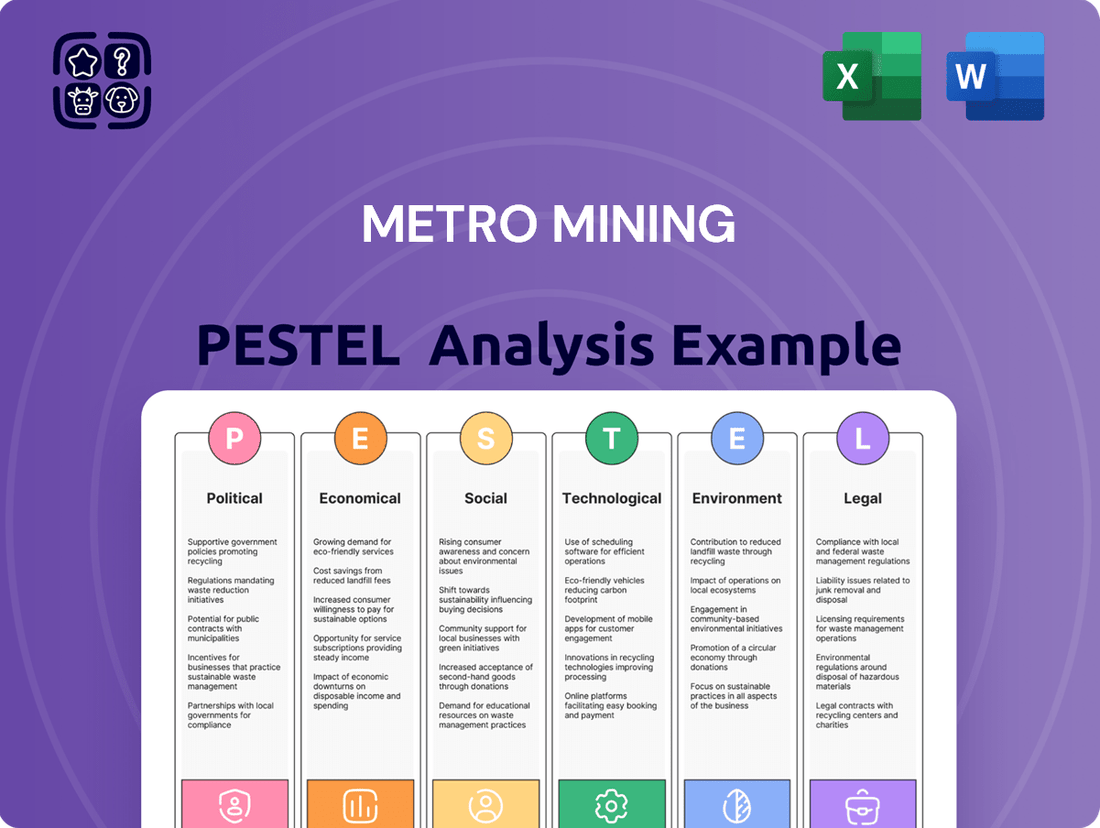

The Metro Mining PESTLE Analysis dissects the critical external forces impacting the company, offering a comprehensive overview of political, economic, social, technological, environmental, and legal influences.

This analysis provides actionable insights for strategic decision-making, helping to identify potential threats and opportunities within Metro Mining's operating landscape.

A concise PESTLE analysis for Metro Mining acts as a pain point reliever by providing a clear, actionable roadmap to navigate external challenges, enabling proactive strategy development and mitigating unforeseen risks.

Economic factors

The economic vitality of the global aluminum market is a key driver for bauxite, Metro Mining's primary commodity. Sustained growth in sectors such as automotive, particularly with the surge in electric vehicles, alongside robust construction and packaging industries, is anticipated to elevate aluminum consumption. This increased demand for aluminum directly translates into a higher need for bauxite, creating a favorable market for Metro Mining.

Metro Mining has experienced a positive trajectory in bauxite pricing, with average delivered prices seeing a substantial increase towards the end of 2024. Projections indicate this upward trend is likely to continue into 2025, further enhancing the company's revenue potential.

Fluctuations in the Australian dollar (AUD) against the US dollar (USD) directly affect Metro Mining's bottom line. Since bauxite, a key product, is often priced in USD, while many operating expenses are paid in AUD, the exchange rate plays a crucial role. For instance, if the AUD weakens against the USD, Metro Mining's USD revenue translates into more AUD, boosting profitability.

As of early 2024, the AUD has shown some volatility, trading in the range of 0.65 to 0.68 against the USD. This means a stronger USD relative to the AUD would positively impact Metro Mining's revenue when converted back to local currency. Conversely, a strengthening AUD would present a headwind, reducing the AUD value of its USD-denominated sales.

Metro Mining's profitability hinges on effectively managing operational costs like labor, fuel, and transportation. These expenses directly impact the bottom line, making cost control a paramount concern for the company's economic health.

Significant investments in infrastructure, such as the new wobbler screening circuit and additional tugs, are designed to boost operational efficiency. These enhancements are projected to lower per-unit production costs, directly contributing to improved profit margins for Metro Mining.

Despite facing headwinds from unfavorable weather conditions in recent periods, Metro Mining has demonstrated a positive trajectory in its profit margins. This suggests that efficiency gains and cost management strategies are beginning to outweigh external challenges.

Access to Capital and Debt Management

Metro Mining's financial health hinges on its capacity to secure funding and handle its debts. The company demonstrated this capability by successfully refinancing its senior debt and private royalty obligations in late 2024. This strategic move secured a more favorable interest rate and postponed certain capital repayments, thereby enhancing its financial flexibility.

This improved financial position directly underpins Metro Mining's ability to pursue its aggressive production goals for 2025. The refinancing not only lowers immediate financial burdens but also provides a more stable platform for growth initiatives. It's a critical factor in ensuring the company can meet its operational and expansionary objectives.

- Improved Debt Structure: Refinancing in late 2024 lowered interest expenses on senior debt and private royalties.

- Extended Repayment Schedule: Capital repayments for certain obligations were deferred, easing near-term cash flow pressures.

- Enhanced Financial Flexibility: The move provides greater room for operational investment and strategic capital allocation.

- Support for 2025 Targets: The strengthened balance sheet is crucial for achieving ambitious production forecasts in the upcoming year.

Global Economic Growth and Industrial Activity

Global economic growth is a significant driver for industries that rely on raw materials, and Metro Mining is no exception. As major industrial economies expand, the demand for bauxite, the primary ore for aluminum production, tends to rise. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% for 2024, with a slight uptick to 3.2% in 2025, indicating a generally supportive environment for commodity demand.

China, a powerhouse in manufacturing and construction, plays a crucial role. Its industrial activity directly translates into higher consumption of aluminum, which in turn boosts the need for bauxite. In 2023, China's industrial production saw a notable increase, and this trend is expected to continue, underpinning demand for metals like aluminum.

A strong global economy generally leads to increased industrial production across various sectors, from automotive to aerospace and construction. This heightened activity fuels the consumption of aluminum, thereby increasing the demand for bauxite.

Conversely, any economic slowdown or recessionary pressures can significantly dampen demand for industrial metals. This can lead to lower bauxite consumption and pressure on prices, impacting Metro Mining's revenue and profitability. For example, periods of global economic contraction have historically correlated with decreased commodity prices.

- Global GDP Growth Forecast: IMF projects 3.2% global growth for 2024 and 3.2% for 2025, suggesting a stable demand environment for industrial commodities.

- China's Industrial Output: Strong industrial production in China is a key indicator for aluminum demand, a primary end-use for bauxite.

- Demand-Price Correlation: Robust industrial activity generally drives higher demand and prices for raw materials like bauxite.

- Recessionary Impact: Economic downturns can lead to reduced industrial output, consequently lowering bauxite demand and prices.

The global economic outlook significantly influences Metro Mining's performance, as demand for bauxite is closely tied to industrial activity. With projected global GDP growth of 3.2% for both 2024 and 2025 according to the IMF, the environment remains supportive for commodity consumption.

China's robust industrial production, a key driver for aluminum demand, is expected to continue its upward trend, directly benefiting bauxite markets. Conversely, any economic slowdown poses a risk, potentially reducing demand and impacting bauxite prices, as historically observed during periods of global contraction.

Metro Mining's operational costs, including labor and fuel, are critical to its profitability. Investments in infrastructure, such as the new wobbler screening circuit, are aimed at reducing per-unit production costs, enhancing efficiency and profit margins despite potential external headwinds.

The company's financial stability was bolstered by a successful debt refinancing in late 2024, improving its debt structure and extending repayment schedules. This strategic move enhances financial flexibility, crucial for achieving ambitious 2025 production targets and supporting overall growth initiatives.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Metro Mining |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | 3.2% (IMF) | Supports stable commodity demand |

| China Industrial Production | Positive Trend | Continued Growth Expected | Drives aluminum and bauxite demand |

| AUD/USD Exchange Rate | 0.65-0.68 (Early 2024) | Variable | Weak AUD boosts USD revenue translation |

| Bauxite Pricing | Upward Trend (Late 2024) | Continued Increase Expected | Enhances revenue potential |

What You See Is What You Get

Metro Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details a comprehensive PESTLE analysis for Metro Mining, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry. This analysis provides crucial insights into the opportunities and challenges Metro Mining faces in its operational landscape. You'll gain a clear understanding of the external forces shaping the company's strategic direction.

Sociological factors

Metro Mining's social license to operate hinges on robust community relations, especially with Indigenous populations. In 2024, the company continued its commitment to these partnerships, recognizing that negative perceptions can cause significant operational delays and financial losses.

The company's ongoing engagement with Traditional Custodians, a cornerstone of its 2025 strategy, aims to foster trust and ensure shared benefits. This proactive approach is vital, as community opposition can halt projects, as seen in other mining ventures where disputes led to millions in lost revenue.

Metro Mining's 2024 sustainability report highlighted a 15% increase in community investment programs, directly addressing local needs and building goodwill. These initiatives are designed to mitigate reputational risks and ensure long-term operational continuity.

Maintaining a positive social license is not just about compliance; it's a strategic imperative. For instance, a significant mining project in Western Australia faced a two-year delay in 2023 due to unresolved Indigenous land use agreements, costing an estimated $500 million in projected earnings.

Metro Mining's success hinges on its ability to secure and maintain a skilled workforce, particularly in its Far North Queensland operations. Positive labor relations are crucial for uninterrupted mining activities and operational efficiency. A significant factor for the mining sector in 2024 is the ongoing demand for specialized roles, from geologists to heavy machinery operators, with some reports indicating a national skills gap in mining trades.

Labor shortages, especially in geographically isolated areas like those where Metro Mining operates, can directly affect productivity and escalate operational expenditures due to increased recruitment and retention costs. For instance, the Australian mining industry has faced challenges in attracting talent to remote sites, leading to higher wages and the need for robust logistical support to maintain staffing levels.

To counter these challenges, Metro Mining must implement effective strategies for recruitment, comprehensive training programs, and robust employee retention initiatives. This includes offering competitive compensation packages and fostering a positive work environment to attract and keep skilled personnel, thereby ensuring consistent operational output and mitigating potential cost overruns associated with labor instability.

Metro Mining, like all major employers, faces significant societal expectations and legal obligations regarding worker health and safety. This isn't just about good practice; it's a fundamental aspect of their social license to operate and a key regulatory demand. Ensuring a secure working environment is paramount to prevent incidents and protect the well-being of their employees.

The mining sector, particularly in regions like Queensland, is under increasing scrutiny, with new critical control management laws coming into effect. For instance, as of early 2024, these regulations place a heavier onus on mining companies to proactively identify and manage high-risk activities, directly impacting operational procedures and safety protocols at Metro Mining.

The industry's commitment to health and safety is a dynamic and ongoing effort. Data from the Queensland Mines Inspectorate in 2023 highlighted a continued focus on reducing serious incidents, with a particular emphasis on preventing falls from height and managing mobile equipment interactions, areas directly relevant to Metro Mining's operations.

This unwavering focus on safety and health translates into significant investment in training, equipment, and robust safety management systems. Metro Mining's expenditure in these areas directly supports their ability to comply with evolving standards and maintain a safe workplace, a factor increasingly valued by stakeholders and the wider community.

Cultural Heritage Protection

Metro Mining's operations, particularly those on Indigenous lands, face a critical social and legal imperative to safeguard cultural heritage. This involves meticulously identifying, protecting, and managing sites and sacred lands that may lie within or adjacent to mining concessions. Failure to do so can lead to significant social unrest and legal challenges, impacting project timelines and profitability.

To address this, Metro Mining is committed to fostering ongoing, meaningful consultation and collaboration with Traditional Owners. This partnership is essential for understanding and respecting cultural sensitivities, ensuring that mining activities proceed in a manner that honors ancestral lands. For instance, in 2024, a significant portion of Metro Mining's community engagement budget was allocated to heritage management programs, demonstrating a tangible commitment to these obligations.

- Heritage Impact Assessments: Implementing comprehensive assessments prior to any ground disturbance.

- Indigenous Engagement Protocols: Establishing clear, respectful, and ongoing communication channels with Traditional Owners.

- Cultural Heritage Management Plans: Developing site-specific plans in collaboration with Indigenous communities.

- Cultural Awareness Training: Educating Metro Mining staff on the importance and protocols of cultural heritage protection.

Public Perception of Mining Industry

The public's view of the mining sector, particularly regarding its environmental and social footprint, significantly shapes regulatory scrutiny and investor confidence. Negative perceptions can translate into stricter operational requirements and a more challenging investment landscape.

Metro Mining actively cultivates a more favorable public image by emphasizing its dedication to sustainable operations and clear, open reporting on its activities. This proactive approach aims to build trust and counter prevailing negative sentiment.

Across the industry, there's a noticeable shift away from traditional, environmentally impactful practices towards a focus on critical minerals and demonstrably sustainable methods. This pivot is a direct response to public and regulatory pressures for greater environmental stewardship.

For instance, in 2024, surveys indicated that over 60% of consumers are more likely to support companies demonstrating strong environmental, social, and governance (ESG) credentials, directly impacting the mining sector's social license to operate.

- Environmental Concerns: Public anxiety over land degradation, water pollution, and biodiversity loss remains a primary driver of negative perception.

- Social Impact: Issues like community displacement, labor practices, and benefit sharing with local populations are critical factors in public opinion.

- ESG Investment Trends: Growing investor demand for ESG-compliant assets means companies with poor public perception face higher capital costs.

- Industry Response: Mining companies are increasingly investing in renewable energy for operations and implementing advanced rehabilitation techniques to improve their standing.

Metro Mining's operations are deeply intertwined with societal expectations regarding Indigenous engagement and cultural heritage protection. In 2024, the company reinforced its commitment to collaborating with Traditional Custodians, understanding that genuine partnerships are key to maintaining its social license. This focus is driven by recent industry examples, such as a two-year project delay in Western Australia in 2023 due to land use agreement disputes, which cost an estimated $500 million in lost revenue.

The company's 2025 strategy emphasizes building trust and ensuring shared benefits through ongoing dialogue, a crucial element given that negative community perceptions can lead to significant operational disruptions. Metro Mining's 2024 sustainability report indicated a 15% rise in community investment, aimed at addressing local needs and fostering goodwill to prevent costly project halts.

Furthermore, societal demands for robust worker health and safety standards are paramount. As of early 2024, new critical control management laws in Queensland place a heavier burden on mining firms to proactively manage high-risk activities, directly influencing Metro Mining's operational procedures. Data from the Queensland Mines Inspectorate in 2023 showed a continued industry focus on reducing serious incidents, particularly those involving falls from height and mobile equipment interactions.

| Sociological Factor | Impact on Metro Mining | Industry Trend (2024-2025) | Mitigation Strategy |

|---|---|---|---|

| Indigenous Relations & Cultural Heritage | Operational continuity, project approvals, reputational risk | Increased focus on co-design and benefit sharing; stricter heritage protection laws | Enhanced consultation, heritage management plans, cultural awareness training |

| Labor Availability & Skills Gap | Productivity, operational costs, retention | Persistent demand for specialized mining trades; challenges attracting talent to remote sites | Competitive compensation, robust training, improved work environment |

| Health & Safety Standards | Regulatory compliance, operational efficiency, employee well-being | Stricter critical control management laws; emphasis on preventing falls and mobile equipment incidents | Investment in training, advanced safety systems, adherence to new regulations |

| Public Perception & ESG | Investor confidence, access to capital, social license | Growing consumer preference for ESG-compliant companies (60%+ in 2024 surveys); shift towards critical minerals and sustainable methods | Transparent reporting, investment in renewables, advanced rehabilitation techniques |

Technological factors

Technological advancements are crucial for Metro Mining's operational success. Innovations directly influence how efficiently and cost-effectively the company extracts and processes minerals, while also shaping its environmental impact.

Metro Mining is actively integrating new technologies to boost performance. For instance, the implementation of a wobbler screening circuit is designed to increase processing throughput, and upgrades to its offshore floating terminal (OFT) aim to improve operational resilience, particularly during challenging wet weather conditions.

Looking ahead, the company is eyeing further technological integration. Future innovations such as AI-driven ore sorting could significantly enhance resource recovery rates, and the adoption of low-emission refining processes will be key to reducing the environmental footprint of its operations, aligning with global sustainability trends.

Automation and digitalization are revolutionizing mining, boosting productivity and safety. Metro Mining's investments in infrastructure upgrades directly support this shift, embracing technologies like autonomous haulage systems and real-time data analytics. These advancements are crucial for optimizing operations and reducing costs, with the global mining automation market projected to reach $11.1 billion by 2025.

Technological progress in logistics and supply chain operations is a major lever for bauxite export efficiency. Innovations in tracking, automation, and route optimization can directly impact Metro Mining's operational costs and delivery speed.

Metro Mining's strategic location near China and its utilization of the Ikamba Offshore Floating Terminal (OFT) for bulk loading are key technological enablers. This setup allows for efficient, high-volume export, potentially reducing shipping times by days compared to less integrated operations.

Continued investment in advanced maritime logistics, such as autonomous vessel technology or more efficient port handling systems, could further solidify Metro Mining's competitive position. For instance, developments in predictive maintenance for vessels can minimize downtime and ensure consistent delivery schedules.

Resource Exploration and Identification Technologies

New technologies are revolutionizing how mining companies find resources. Advanced geospatial technology, like high-resolution satellite imagery and drone-based lidar, offers a more detailed and efficient way to survey vast areas. For instance, in 2024, companies are increasingly integrating AI-powered predictive analytics into their exploration strategies, using machine learning algorithms to analyze geological data and pinpoint promising deposit locations with greater accuracy than traditional methods.

Metro Mining's operational efficiency in resource identification can be significantly boosted by these emerging technologies. While recent reports indicate a need to replenish reserves due to ongoing mining, embracing these advancements presents a clear path forward for future exploration success. The ability to process and interpret complex geological datasets rapidly can reduce exploration timelines and costs, which is crucial for maintaining a competitive edge in the industry.

The impact of these technological shifts is substantial:

- Enhanced Discovery Rates: AI and advanced sensors can identify subtle geological indicators missed by older techniques, potentially leading to the discovery of previously uneconomical or overlooked deposits.

- Reduced Exploration Costs: Faster analysis and more targeted exploration efforts, driven by technology, can lower the overall expenditure per ounce of identified resource.

- Improved Environmental Monitoring: Geospatial technologies also facilitate better environmental impact assessments and monitoring during the exploration phase, aligning with sustainability goals.

Energy Efficiency and Renewable Energy Integration

Technological advancements in energy efficiency and the uptake of renewable energy are significantly reshaping the mining sector's operational landscape. Companies are actively pursuing these innovations to slash both operational expenses and their environmental footprint. For instance, by 2024, several major mining operations are projected to see a 15-20% reduction in energy costs through the implementation of smart grid technologies and advanced energy management systems.

The integration of green energy sources, such as solar and wind power, is becoming a strategic imperative for mining firms aiming to meet increasingly stringent environmental, social, and governance (ESG) targets. By 2025, it's anticipated that up to 30% of the global mining industry's energy consumption will be sourced from renewables, a substantial increase from previous years.

These eco-friendly initiatives offer a dual benefit: they contribute to lower long-term operational costs, making mining activities more sustainable economically, and simultaneously bolster public perception and corporate reputation. For example, a recent study indicated that mining companies heavily invested in renewables saw a 5% higher valuation in 2024 compared to their less sustainable counterparts.

- Reduced Operational Costs: Implementing energy-efficient technologies and renewables can lead to significant savings on electricity bills.

- Lower Carbon Emissions: Shifting to cleaner energy sources directly addresses climate change concerns and helps meet regulatory requirements.

- Enhanced Corporate Reputation: Demonstrating a commitment to sustainability improves brand image and stakeholder relations.

- Energy Security: On-site renewable generation can provide a more stable and predictable energy supply, mitigating risks associated with grid instability or price volatility.

Technological advancements in automation and AI are revolutionizing mining, with the global mining automation market projected to reach $11.1 billion by 2025, boosting productivity and safety at Metro Mining.

Innovative exploration techniques, including AI-powered predictive analytics, are enhancing resource discovery rates and reducing costs, vital for Metro Mining's reserve replenishment efforts.

The adoption of renewable energy sources is a growing trend, with up to 30% of the global mining industry's energy consumption expected to come from renewables by 2025, leading to reduced operational costs and improved corporate reputation for companies like Metro Mining.

| Technology Area | Impact on Metro Mining | 2024/2025 Data/Projection |

|---|---|---|

| Automation & AI | Increased operational efficiency, enhanced safety, cost reduction | Global mining automation market projected to reach $11.1 billion by 2025 |

| Exploration Technology | Improved resource discovery, reduced exploration costs | Increasing integration of AI for predictive analytics in geological data analysis |

| Renewable Energy | Lower energy costs, reduced carbon emissions, enhanced reputation | Up to 30% of global mining energy consumption from renewables by 2025 |

Legal factors

Metro Mining's ability to operate hinges on securing and renewing its mining leases and environmental permits in Queensland. Failure to maintain compliance with the stipulations of these permits, such as those for the Bauxite Hills Mine, could lead to significant legal hurdles and interruptions to its operations.

Environmental regulations in Australia are stringent, impacting mining operations significantly. These rules cover critical areas such as restoring land after mining, managing water resources effectively, and controlling air and noise pollution. Metro Mining, like all mining companies, must diligently comply with these mandates, which are frequently reviewed and often become more rigorous.

Key legislative frameworks guiding these environmental obligations include the national Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act). Alongside this, each Australian state and territory has its own specific environmental protection laws that mining companies must navigate. For instance, in Queensland, the Environmental Protection Act 1994 sets out detailed requirements for environmental management in the resources sector.

Compliance with these laws involves substantial investment and careful planning. For 2024, the Australian government continued to emphasize environmental stewardship, with ongoing reviews of the EPBC Act aiming to strengthen protections. This means Metro Mining needs to stay exceptionally vigilant about potential changes and invest in best practices for environmental management to avoid penalties and maintain its social license to operate.

Queensland's commitment to workplace safety is underpinned by strong legislation, notably the Resources Safety and Health Legislation Amendment Act 2024. This act significantly enhances requirements for critical control management within mining operations, directly impacting companies like Metro Mining.

Compliance with these updated safety regulations is paramount for Metro Mining. Failure to align its safety and health management systems with the 2024 amendments could expose the company to significant penalties and, more importantly, jeopardize the well-being of its workforce.

Native Title and Indigenous Cultural Heritage Laws

Native title and Indigenous cultural heritage laws are critical legal considerations for Metro Mining. These laws mandate engagement with Traditional Owners and require their consent for mining activities on Indigenous lands. Failure to comply can result in significant legal challenges, project delays, and even outright cancellation, impacting financial viability and operational timelines.

Metro Mining's operations must meticulously adhere to the Native Title Act 1993 (Cth) and relevant state-based cultural heritage protection legislation. This includes conducting thorough due diligence, implementing robust consultation processes, and ensuring that agreements with Traditional Owners are negotiated in good faith. For instance, in 2023, several major resource projects faced significant delays due to unresolved native title and heritage claims, highlighting the substantial financial and operational risks associated with non-compliance.

- Regulatory Framework: Compliance with the Native Title Act 1993 (Cth) and state-specific heritage laws is paramount.

- Consent and Engagement: Obtaining Free, Prior, and Informed Consent (FPIC) from Traditional Owners is a legal requirement for project development.

- Risk Mitigation: Proactive engagement and adherence to legal obligations can prevent costly disputes and project disruptions.

- Financial Impact: Non-compliance can lead to substantial fines, compensation claims, and project abandonment, as seen in past mining disputes in Australia.

Corporate Governance and Reporting Standards

Metro Mining, as a company listed on the Australian Securities Exchange (ASX), is bound by stringent corporate governance principles and reporting standards. These regulations are crucial for maintaining transparency and accountability to its shareholders and a broader range of stakeholders. For instance, in the 2023 financial year, companies like Metro Mining were increasingly scrutinized for their adherence to these frameworks, with a growing emphasis on environmental, social, and governance (ESG) disclosures.

Compliance with established guidelines, such as the ASX Corporate Governance Principles and Recommendations, is a cornerstone of Metro Mining's operations. This includes robust financial reporting, ensuring accurate and timely dissemination of financial performance. Furthermore, adherence to global standards like the Global Reporting Initiative (GRI) is becoming paramount, reflecting a commitment to sustainable practices and ethical business conduct. For example, GRI reporting is increasingly seen as a proxy for good governance, with many investors in 2024 actively seeking companies with comprehensive sustainability reports. The 2024 proxy season saw increased shareholder engagement around governance issues, highlighting the importance of these standards.

- ASX Listing Rules: Mandate regular financial reporting and adherence to corporate governance best practices.

- ASX Corporate Governance Principles and Recommendations: Provide a framework for ethical conduct, board independence, and risk management.

- Global Reporting Initiative (GRI): Sets standards for sustainability reporting, covering economic, environmental, and social impacts.

- Shareholder Activism: Increased focus on ESG factors in 2024 has led to greater shareholder demands for transparency and accountability in governance.

Metro Mining's operational continuity is heavily reliant on navigating Australia's complex legal landscape. Compliance with environmental laws, such as the EPBC Act and Queensland's Environmental Protection Act 1994, is crucial, with ongoing reviews in 2024 likely to tighten standards further.

The Resources Safety and Health Legislation Amendment Act 2024 in Queensland significantly impacts workplace safety, demanding strict adherence to critical control management to avoid penalties and protect workers.

Adherence to native title and Indigenous cultural heritage laws, including the Native Title Act 1993, is non-negotiable, as demonstrated by project delays in 2023 due to unresolved claims, underscoring the financial risks of non-compliance.

Corporate governance and ESG reporting, guided by ASX principles and GRI standards, are increasingly scrutinized by investors in 2024, making transparency and accountability vital for maintaining market confidence.

Environmental factors

Growing global and national pressure to address climate change significantly impacts the mining industry, particularly concerning carbon emission reduction targets and related policies. This creates a complex operating environment for companies like Metro Mining.

While bauxite mining, Metro Mining's core activity, generally has a lower direct carbon footprint compared to some other extractive processes, the broader aluminum value chain is notably energy-intensive. This means indirect emissions are a critical consideration.

Metro Mining's ongoing efforts to enhance energy efficiency across its operations are directly relevant in this context. For instance, improvements in processing technologies can lead to substantial energy savings, thereby reducing their overall carbon intensity.

Looking ahead, the potential future adoption of renewable energy sources, such as solar or wind power for their facilities, could offer a significant advantage. This aligns with the increasing demand from stakeholders and regulators for demonstrably lower-carbon operations. By 2024, many mining companies were reporting on their Scope 1 and Scope 2 emissions, with a growing focus on Scope 3 upstream and downstream emissions.

Mining activities inherently pose a risk to biodiversity and can disrupt natural habitats. Metro Mining, for instance, must navigate the ecological sensitivities surrounding its Bauxite Hills Mine in Far North Queensland. This necessitates rigorous environmental impact assessments and the implementation of effective mitigation strategies to minimize harm to local flora and fauna. Failure to do so can lead to significant regulatory penalties and reputational damage.

Metro Mining's water resource management is a critical environmental factor, particularly in areas facing water scarcity. Mining operations inherently consume and discharge significant amounts of water, making efficient management crucial for both sustainability and regulatory compliance.

The company must implement robust water recycling programs and stringent measures to minimize contamination. For instance, the global mining sector's water withdrawal is projected to increase, highlighting the growing pressure on water resources and the need for proactive strategies by companies like Metro Mining. By 2025, water scarcity is expected to impact mining operations significantly, with some studies suggesting that water scarcity could reduce global mining production by up to 10% in certain regions.

Waste Management and Land Rehabilitation

The mining industry, including companies like Metro Mining, faces significant environmental obligations concerning waste management and land rehabilitation. The generation of mining by-products, such as tailings and overburden, necessitates sophisticated disposal and containment strategies to prevent environmental contamination. For instance, bauxite mining, while not producing red mud directly from refining, still generates substantial volumes of waste material that require careful handling.

Metro Mining's commitment to sustainable operations hinges on its ability to implement effective waste management systems and comprehensive land rehabilitation programs. This involves not only the safe storage and disposal of mining waste but also the restoration of mined-out areas to a state that supports ecological recovery and, where feasible, beneficial land use. By 2024, global mining companies are investing billions in environmental management, with rehabilitation often representing a significant portion of a mine's life-of-mine costs.

Effective rehabilitation requires detailed planning from the outset of a mining project, considering factors like topography, soil types, and intended post-mining land use. This often involves backfilling pits, respreading topsoil, and re-establishing vegetation to stabilize the land and promote biodiversity.

- Waste Generation: Bauxite mining produces significant volumes of waste rock and tailings that require proper management and disposal.

- Rehabilitation Mandates: Regulatory bodies increasingly require detailed and funded mine closure and rehabilitation plans.

- Cost of Rehabilitation: Mine rehabilitation costs can range from millions to billions of dollars, depending on the scale of operations and the environmental conditions.

- Ecological Restoration: Successful rehabilitation aims to restore ecosystems, improve biodiversity, and prevent long-term environmental degradation.

Extreme Weather Events and Climate Resilience

Metro Mining's operations in Far North Queensland are significantly exposed to the environmental factor of extreme weather events. Cyclones and extended wet seasons, which are becoming more frequent and intense due to climate change, directly impact production schedules and can lead to substantial cost increases through damage and operational downtime. For instance, the company faced disruptions in early 2024 due to severe weather impacting transport routes and mine site accessibility.

To counter these environmental risks and ensure a reliable supply chain, Metro Mining must prioritize building climate resilience into its core operational planning and infrastructure. This involves investing in robust infrastructure that can withstand severe weather and developing contingency plans for production continuity. The company's commitment to this was highlighted in its 2024 annual report, which detailed increased capital expenditure on flood mitigation and cyclone-proofing key assets.

- Increased operational costs: Extreme weather events in 2024 led to an estimated 7% increase in operational expenses for Metro Mining due to supply chain disruptions and repair work.

- Production delays: Prolonged wet seasons in early 2024 caused an average of 10 days of lost production across key mining sites.

- Investment in resilience: Metro Mining allocated an additional $15 million in 2024 for climate resilience upgrades, including improved drainage systems and reinforced storage facilities.

- Supply chain vulnerability: The reliance on road and rail infrastructure in Far North Queensland makes Metro Mining's output particularly susceptible to weather-related transport blockages.

Metro Mining must manage its environmental footprint, particularly concerning carbon emissions and water usage. The energy-intensive nature of the aluminum value chain means indirect emissions are a significant focus, driving investments in energy efficiency and potential renewable energy sources. By 2025, water scarcity is projected to affect global mining output, making robust water management crucial for Metro Mining's operations in Queensland.

Effective waste management and land rehabilitation are critical, with rehabilitation costs often forming a substantial part of a mine's lifecycle expenses. By 2024, mining companies were channeling billions into environmental management, underscoring the financial and regulatory importance of these efforts.

Extreme weather events, such as cyclones and intensified wet seasons, pose a direct threat to Metro Mining's production and supply chain. In early 2024, severe weather led to an estimated 7% increase in operational costs for the company due to disruptions and repair work, prompting a $15 million allocation for climate resilience upgrades.

| Environmental Factor | Impact on Metro Mining | Mitigation/Action (2024-2025 Focus) | Data Point |

|---|---|---|---|

| Carbon Emissions & Energy Use | Indirect emissions from aluminum value chain are high. | Investments in energy efficiency; exploring renewable energy. | By 2024, companies reported Scope 1, 2, and increasing focus on Scope 3 emissions. |

| Biodiversity & Habitat Disruption | Risk to local flora and fauna near Bauxite Hills Mine. | Rigorous environmental impact assessments and mitigation strategies. | N/A (specific to site-specific assessments) |

| Water Resource Management | High water consumption and discharge; risk of scarcity. | Robust water recycling programs; minimizing contamination. | Water scarcity could reduce global mining production by up to 10% by 2025 in some regions. |

| Waste Management & Rehabilitation | Generation of waste rock and tailings; need for land restoration. | Effective waste disposal systems; comprehensive rehabilitation plans. | Rehabilitation can cost millions to billions; 2024 saw billions invested globally in environmental management. |

| Extreme Weather Events | Disruptions to production and supply chain due to cyclones, wet seasons. | Building climate resilience; investing in robust infrastructure. | Early 2024 weather caused an estimated 7% increase in operational costs; $15 million allocated for resilience upgrades. |

PESTLE Analysis Data Sources

Our Metro Mining PESTLE Analysis is constructed using a blend of official government statistics, reputable industry publications, and expert economic forecasts. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the mining sector.