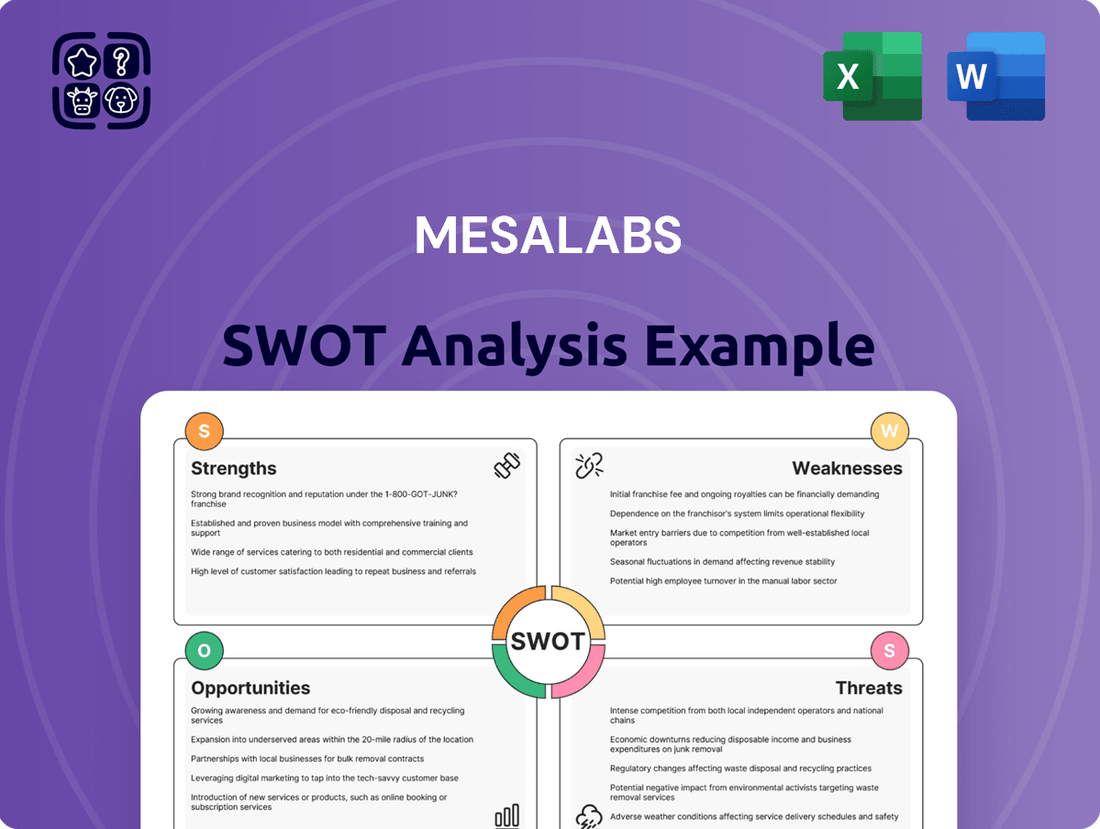

MesaLabs SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MesaLabs Bundle

Mesa Labs exhibits strong market leadership and a robust product portfolio, but faces emerging competitive threats and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want to truly leverage Mesa Labs' competitive advantages and mitigate potential weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Mesa Labs is a recognized global leader in specialized quality control solutions, especially in heavily regulated sectors. This dominant position allows them to set prices effectively and leverage long-standing customer ties, giving them a substantial competitive edge. Their strategic focus on niche markets, fueled by strict regulatory demands, cultivates a stable and resilient business structure.

Mesa Laboratories boasts a comprehensive suite of integrated solutions, encompassing instruments, software, and services, offering a complete package for customer quality control requirements. This unified approach not only cultivates strong customer loyalty but also opens avenues for lucrative cross-selling opportunities, as clients can consolidate their critical quality assurance processes with a single, reliable provider.

The strategic acquisition of GKE in 2024 significantly bolstered MesaLabs' Sterilization and Disinfection Control division, a testament to their commitment to expanding their integrated offerings and solidifying their position as a holistic solutions provider in the quality control market.

Mesa Labs' strong presence in regulated industries like healthcare, pharmaceuticals, and food and beverage is a significant advantage. These sectors demand rigorous quality control, ensuring a steady and predictable revenue stream for Mesa Labs, insulating them from economic fluctuations. For instance, in the fiscal year ending March 31, 2024, Mesa Labs reported revenue of $187.3 million, demonstrating the resilience of their core markets.

This specialization creates substantial barriers to entry for potential competitors. Navigating the complex web of certifications and compliance standards required in these fields demands significant investment and expertise, making it difficult for new players to gain a foothold. This allows Mesa Labs to maintain its competitive edge and market position.

Criticality of Product Offerings

Mesa Labs' product offerings are vital for maintaining quality and safety across various industries. Their sterilization monitoring, process validation, and data logging solutions are not just helpful; they are essential for ensuring that medical devices and pharmaceuticals are safe for use. This critical nature translates into a consistent and reliable demand from their customer base.

The indispensable role of Mesa Labs' products means customers are less likely to switch based on minor price changes. For example, in the healthcare sector, failure in sterilization monitoring can lead to severe patient harm, making robust solutions a non-negotiable requirement. This perceived indispensability supports stable revenue streams and solidifies customer loyalty, directly aligning with their mission to protect vulnerable populations.

- Essential for Product Quality: Mesa Labs' solutions are critical for ensuring the efficacy and safety of sterilized products, especially in healthcare and life sciences.

- Patient Safety and Process Optimization: Their products directly contribute to preventing contamination and optimizing manufacturing processes, safeguarding patients and improving operational efficiency.

- Stable Demand and Reduced Price Sensitivity: The critical nature of their offerings makes them indispensable, leading to consistent demand and a lower susceptibility to price competition.

- Alignment with Mission: The core function of their products directly supports their stated purpose of Protecting the Vulnerable, reinforcing their value proposition.

Recurring Revenue Streams

Mesa Labs benefits from recurring revenue streams, primarily generated through its services, consumables, and software offerings. These segments frequently involve long-term contracts and a consistent demand for repeat purchases, fostering a predictable revenue base. This stability is crucial for financial planning and supports continued investment in innovation and expansion.

A substantial 62% of Mesa Labs' total revenue is derived from these long-term contracts, underscoring the strength and predictability of its recurring income. This high percentage highlights the company's success in building and maintaining customer loyalty and embedding its products and services within client operations.

- Predictable Revenue: Long-term contracts and repeat purchases in services, consumables, and software create a stable and reliable income flow.

- Financial Stability: This recurring revenue model enhances financial stability, reducing reliance on one-off sales.

- Growth Foundation: A predictable revenue base supports strategic investments in research, development, and market expansion.

- Customer Loyalty: The high proportion of revenue from long-term contracts (62%) indicates strong customer retention and product stickiness.

Mesa Labs' market leadership in specialized quality control, particularly within regulated industries, is a cornerstone of its strength. This dominance allows for effective pricing strategies and leverages deep-rooted customer relationships, providing a significant competitive advantage. Their deliberate focus on niche markets, driven by stringent regulatory requirements, cultivates a resilient business model.

The company's integrated solutions, encompassing instruments, software, and services, offer a comprehensive package for customer quality control needs. This holistic approach fosters significant customer loyalty and opens doors for cross-selling opportunities, as clients can consolidate their essential quality assurance processes with a single provider.

Mesa Labs' critical role in ensuring product quality and safety across sectors like healthcare and life sciences translates into consistent demand. Their sterilization monitoring and validation solutions are indispensable, making customers less likely to switch providers due to minor price fluctuations. For instance, their fiscal year 2024 revenue reached $187.3 million, showcasing the stability of these essential markets.

What is included in the product

Analyzes MesaLabs’s competitive position through key internal and external factors, including its technological strengths, market expansion opportunities, competitive threats, and potential operational weaknesses.

Provides a clear, actionable roadmap by translating complex SWOT findings into prioritized strategies.

Weaknesses

Mesa Laboratories' strategic focus on highly regulated industries, while a core strength, introduces a significant concentration risk. This means that a downturn or substantial shift in demand within any single regulated sector could disproportionately impact the company's overall financial performance.

This concentration became evident in Mesa's Clinical Genomics (CG) division, which experienced revenue declines. These setbacks were directly attributed to evolving regulatory landscapes, specifically citing unfavorable regulatory factors in China and the increasing stringency of U.S. regulations concerning lab-developed tests (LDTs). This highlights how policy changes in even a few key markets can create headwinds.

Mesa Labs operates in heavily regulated sectors, making it vulnerable to shifts in government oversight. Such regulatory changes can significantly affect how they develop products, enter new markets, and manage their operational expenses.

While a March 2025 federal court decision removed certain limitations on lab-developed tests, the potential for the FDA to appeal this ruling continues to create an environment of uncertainty for Mesa Labs. This ongoing regulatory flux could introduce unexpected compliance burdens or market access challenges.

MesaLabs faces significant capital demands for research and development, crucial for maintaining its edge in life science tools and quality control. For instance, in fiscal year 2023, the company reported R&D expenses of $15.2 million, a 12% increase year-over-year, reflecting this commitment to innovation. This ongoing investment in cutting-edge technology and product development, while necessary for long-term growth, can strain immediate profitability and free cash flow.

Furthermore, the manufacturing of their specialized products, like calibration equipment and environmental monitoring systems, necessitates substantial upfront investment in advanced facilities and machinery. These high capital expenditures for both R&D and production can present a hurdle, particularly when competing against larger, more established players with greater financial flexibility.

Reliance on Specific Technological Expertise

Mesa Labs' specialized product lines, such as biological indicators for sterilization and gas flow calibration equipment, necessitate a deep reliance on highly specific technological expertise. This focus means that a scarcity of skilled professionals in these niche areas, or the rapid pace at which current technologies become outdated, could significantly impede their innovation and competitive edge. For instance, the development of advanced biological indicators often requires specialized knowledge in microbiology and materials science, fields where talent acquisition can be challenging.

The company's competitive strength is intrinsically linked to its ability to maintain and advance this specialized knowledge base. Should key personnel with this expertise depart or if the company struggles to attract new talent, it could directly impact product development cycles and market responsiveness. This dependency creates a vulnerability, as seen in other high-tech industries where a talent gap can lead to production delays and a loss of market share. Mesa Labs' commitment to ongoing research and development in these specialized fields is therefore crucial for mitigating this weakness.

- Niche Expertise Dependency: Mesa Labs' core products require specialized knowledge in areas like sterilization validation and gas flow metrology.

- Talent Acquisition Risk: A limited pool of skilled professionals in these niche technological fields presents a hiring challenge.

- Technological Obsolescence: Rapid advancements in related scientific and engineering fields could quickly make current expertise less relevant.

- Innovation Bottleneck: Shortages of specialized talent or outdated knowledge can slow down new product development and competitive adaptation.

Scalability Challenges for Service Delivery

MesaLabs faces significant hurdles in scaling its service delivery as the company expands, especially within its services division. Maintaining the high quality and customer satisfaction that underpin its reputation becomes increasingly difficult with growth, posing a direct threat to its market position.

The inherent nature of MesaLabs' calibration and validation processes, which can span 3 to 6 months, underscores a critical weakness: the labor-intensive aspect of its services. This lengthy lead time means that rapid expansion is not easily achievable and would necessitate substantial operational investments to overcome potential bottlenecks.

- Labor Intensity: Service delivery relies heavily on skilled technicians and time-consuming calibration processes, limiting how quickly new clients can be onboarded.

- Scalability Bottlenecks: The 3-6 month timeline for calibration and validation can create significant delays, hindering the company's ability to respond swiftly to increasing demand.

- Operational Investment: To scale effectively, MesaLabs would need to invest heavily in hiring and training more personnel, potentially impacting profit margins in the short to medium term.

Mesa Laboratories' reliance on a few key regulated markets, particularly in its Clinical Genomics division, creates a significant vulnerability to sector-specific downturns or regulatory shifts. This concentration risk was highlighted by revenue declines in CG, directly linked to evolving regulations in China and stricter U.S. rules on lab-developed tests.

The company's specialized product lines require deep technical expertise, making it susceptible to talent shortages or rapid technological obsolescence. For instance, in fiscal year 2023, R&D expenses rose 12% to $15.2 million, underscoring the ongoing need for investment in specialized knowledge to maintain its competitive edge, a process that can be hampered by a limited talent pool.

Mesa Labs faces challenges in scaling its labor-intensive services, with calibration and validation processes often taking 3 to 6 months. This limits rapid expansion and requires substantial operational investment in personnel and training to meet growing demand without compromising quality.

Preview Before You Purchase

MesaLabs SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

Mesa Labs has a prime opportunity to tap into emerging markets as their regulatory frameworks mature and the demand for advanced quality control solutions rises. Countries in Southeast Asia and Latin America, for instance, are increasingly prioritizing product safety and compliance, creating a fertile ground for Mesa Labs' offerings.

The company can also leverage its existing expertise to enter new verticals. For example, exploring applications in the rapidly growing biopharmaceutical sector or the stringent requirements of the food and beverage industry could open up substantial new revenue streams.

Consider the global biopharmaceutical market, projected to reach over $800 billion by 2025, a significant portion of which requires robust validation and monitoring, areas where Mesa Labs excels.

Furthermore, by strategically identifying niche applications for their core technologies, Mesa Labs can diversify its customer base and reduce reliance on existing segments, potentially capturing unmet market needs with tailored solutions.

The relentless march of digital transformation, particularly the integration of AI, machine learning, and the Internet of Things (IoT), represents a significant opportunity for MesaLabs in the quality management sector. By embedding these cutting-edge technologies into their instruments and software, MesaLabs can unlock new levels of precision and automate complex processes, directly addressing customer needs for greater efficiency.

This technological infusion allows for the delivery of real-time data analytics, a critical component in modern quality assurance. For instance, AI-powered predictive maintenance on laboratory equipment can minimize downtime, a key concern for many of MesaLabs' clients in the pharmaceutical and environmental testing industries. The global AI in quality management market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of over 15% expected through 2028, highlighting the immense potential for MesaLabs to capture market share by offering more intelligent, data-driven solutions.

Mesa Labs has a proven track record of growth through strategic acquisitions, notably the GKE acquisition which bolstered revenue. This historical success highlights the opportunity to continue acquiring innovative startups or companies with complementary technologies to expand offerings and market reach.

By strategically integrating new businesses, Mesa Labs can accelerate its development of new products and services, potentially capturing larger market shares. For instance, acquiring a company with advanced sterilization monitoring technology could complement their existing biological indicator offerings.

These acquisitions offer a faster path to diversification than organic growth alone, allowing Mesa Labs to enter new market segments or strengthen its position in existing ones. This strategic move is particularly relevant as the global sterilization and contamination control market is projected to reach over $15 billion by 2028, indicating ample room for expansion.

Increasing Global Demand for Quality Control

The escalating global focus on product integrity, patient well-being, and adherence to stringent regulations across various sectors is fueling a robust demand for sophisticated quality control systems. This overarching trend serves as a significant advantage for Mesa Laboratories, as its primary offerings are intrinsically aligned with these critical industry requirements.

The market for automated industrial quality control is anticipated to experience substantial expansion. For instance, the global industrial automation market, which encompasses quality control, was valued at an estimated $83.5 billion in 2023 and is projected to reach $150.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.7% during this period. This growth trajectory directly translates into increased opportunities for Mesa Laboratories.

- Growing regulatory scrutiny: Increased emphasis on compliance in sectors like pharmaceuticals and medical devices directly benefits companies offering validated quality control solutions.

- Rising consumer expectations: Consumers worldwide are demanding higher quality and safer products, pushing manufacturers to invest more in their quality assurance processes.

- Technological advancements: The integration of AI and IoT in quality control systems creates new avenues for innovation and market penetration.

- Expansion in emerging markets: As developing economies advance, their industrial sectors are adopting more rigorous quality standards, opening new customer bases.

Diversification of Product Portfolio

Mesa Laboratories' existing strength in niche markets presents a clear opportunity for product portfolio diversification. Expanding within its four core divisions – Sterilization and Drug Control (SDC), Chromatography and Spectroscopy (CG), Biological and Pharmaceutical Development (BPD), and Clinical Services (CS) – can mitigate concentration risk. For instance, leveraging expertise in SDC, Mesa could develop complementary products for new sterilization methods or expand its offerings in drug validation services, areas showing steady growth. The company's reported revenue for fiscal year 2024 reached $176.9 million, with the CG segment alone contributing a significant portion, indicating a solid base from which to invest in new product development.

Exploring adjacent or related markets within quality control and assurance is another avenue. This could involve developing new testing solutions for emerging industries or enhancing existing product lines with advanced technological features. The global quality control market is projected to reach over $100 billion by 2027, with laboratory services and equipment being key growth drivers. Mesa's established reputation in regulated industries provides a strong foundation to capture a larger share of this expanding market.

- Expand SDC offerings: Develop new validation services or products for emerging sterilization technologies.

- Enhance CG portfolio: Introduce new chromatography consumables or spectroscopy accessories.

- Leverage BPD expertise: Create novel assay development tools or expand biopharmaceutical testing services.

- Grow CS segment: Introduce new diagnostic kits or expand clinical trial support services.

Mesa Labs can capitalize on the increasing global demand for specialized quality control solutions by expanding into new markets and industry verticals. The company's robust technological foundation positions it well to address the stringent requirements of sectors like biopharmaceuticals and advanced food safety, where quality assurance is paramount.

The integration of AI, machine learning, and IoT into its product offerings presents a significant opportunity for Mesa Labs to deliver enhanced precision and real-time data analytics, as seen in the projected growth of the AI in quality management market.

Furthermore, Mesa Labs' history of successful acquisitions, like the GKE integration, provides a clear strategy for continued growth by acquiring companies with complementary technologies to broaden its product portfolio and market reach.

The company can also deepen its penetration within its core divisions by developing new products and services, leveraging its established expertise to capture a larger share of the expanding global quality control market, projected to exceed $100 billion by 2027.

Threats

Mesa Laboratories faces substantial competition from larger entities like Thermo Fisher Scientific and Danaher Corporation, which possess greater financial backing and advanced research and development resources. This dynamic intensifies pricing pressures within the market, potentially impacting Mesa's profitability if cost management and strategic pricing aren't rigorously maintained.

The presence of numerous established competitors means Mesa must constantly innovate and differentiate its product offerings to avoid being undercut on price. For instance, in the life sciences sector, where Mesa operates, competition often centers on technological advancements and service quality, areas where larger players can invest more heavily, posing a direct threat to Mesa's market share and pricing power.

The life sciences and quality control industries are characterized by swift technological shifts. Competitors launching superior, more affordable, or unified solutions pose a risk to Mesa Labs' market standing should the company not match this pace of innovation. For instance, the growing adoption of AI in machine vision systems by rivals directly challenges Mesa Labs' current offerings.

Global economic volatility remains a significant threat, directly impacting customer spending on critical capital equipment like Mesa Labs' offerings. For instance, a projected slowdown in global GDP growth for 2024, estimated around 2.6% by the IMF in April 2024, signals reduced investment appetite among businesses. This economic uncertainty can lead to deferred purchasing decisions.

Supply chain disruptions, exacerbated by geopolitical tensions, continue to pose a risk. These disruptions can affect raw material availability and increase lead times, impacting Mesa Labs' manufacturing efficiency and ability to meet customer demand promptly. The ongoing challenges in global shipping, despite some easing, still present logistical hurdles.

Furthermore, the imposition of global tariffs creates an unpredictable operating environment. While Mesa Labs has historically managed to mitigate some short-term tariff impacts, their potential resurgence or expansion introduces ongoing cost uncertainties and can affect the competitiveness of their products in international markets.

Adverse Regulatory Shifts or New Compliance Burdens

Mesa Labs faces a significant threat from adverse regulatory shifts. While the company often benefits from quality and compliance standards, future changes, particularly stricter requirements, could lead to substantial compliance costs and potentially make current products non-compliant. For instance, evolving regulations around laboratory-developed tests (LDTs) in the United States present an ongoing risk to their diagnostic offerings.

Furthermore, navigating complex and changing regulatory landscapes in key international markets like China and Europe for their Clinical Genomics division adds another layer of challenge. These shifts can necessitate costly product redesigns or market withdrawal, impacting revenue streams and operational efficiency.

- Increased Compliance Costs: New regulations can require significant investment in updated testing, documentation, and personnel training.

- Product Obsolescence: Stricter standards may render existing Mesa Labs products non-compliant, requiring costly redesigns or leading to market exclusion.

- International Market Access: Divergent or evolving regulations in China and Europe create hurdles for the Clinical Genomics division, potentially limiting growth opportunities.

- Operational Disruptions: Sudden regulatory changes can lead to temporary or permanent disruptions in manufacturing and distribution processes.

Cybersecurity Risks to Data Logging Solutions

As MesaLabs increasingly integrates software and data logging solutions, cybersecurity threats pose a significant risk. A breach could result in substantial financial losses and severe reputational damage, especially given the sensitive data handled in healthcare and pharmaceuticals.

The increasing sophistication of cyberattacks means that even robust systems can be vulnerable. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the magnitude of this threat across all industries. MesaLabs' reliance on digital infrastructure makes it a potential target for data theft or disruption.

- Data Breach Impact: A successful cyberattack could compromise patient or client data, leading to regulatory fines and a loss of trust.

- System Downtime: Disruptions to data logging systems could halt critical operations, impacting product quality control and compliance.

- Ransomware Attacks: These attacks can encrypt valuable data, demanding payment for its release, causing significant operational and financial strain.

- Intellectual Property Theft: Competitors or malicious actors could target proprietary data and research, undermining MesaLabs' competitive edge.

Mesa Labs faces significant threats from intense competition, particularly from larger players with greater R&D resources, which can lead to pricing pressures and challenges in market differentiation. The rapid pace of technological change in the life sciences sector, including AI integration by rivals, necessitates constant innovation to maintain market relevance and pricing power.

Global economic slowdowns, like the projected 2.6% GDP growth for 2024, can reduce customer capital expenditure, impacting Mesa Labs' sales. Supply chain disruptions and geopolitical tensions continue to affect raw material availability and increase lead times, hindering manufacturing efficiency.

Adverse regulatory shifts, such as evolving standards for laboratory-developed tests or differing international regulations in China and Europe, pose a risk of increased compliance costs and potential product obsolescence. Furthermore, cybersecurity threats are a growing concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, putting sensitive data and operations at risk of breaches, downtime, and intellectual property theft.

SWOT Analysis Data Sources

This MesaLabs SWOT analysis is built upon a robust foundation of publicly available financial filings, comprehensive industry market research, and insightful expert commentary to ensure a data-driven and accurate assessment.