MesaLabs Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MesaLabs Bundle

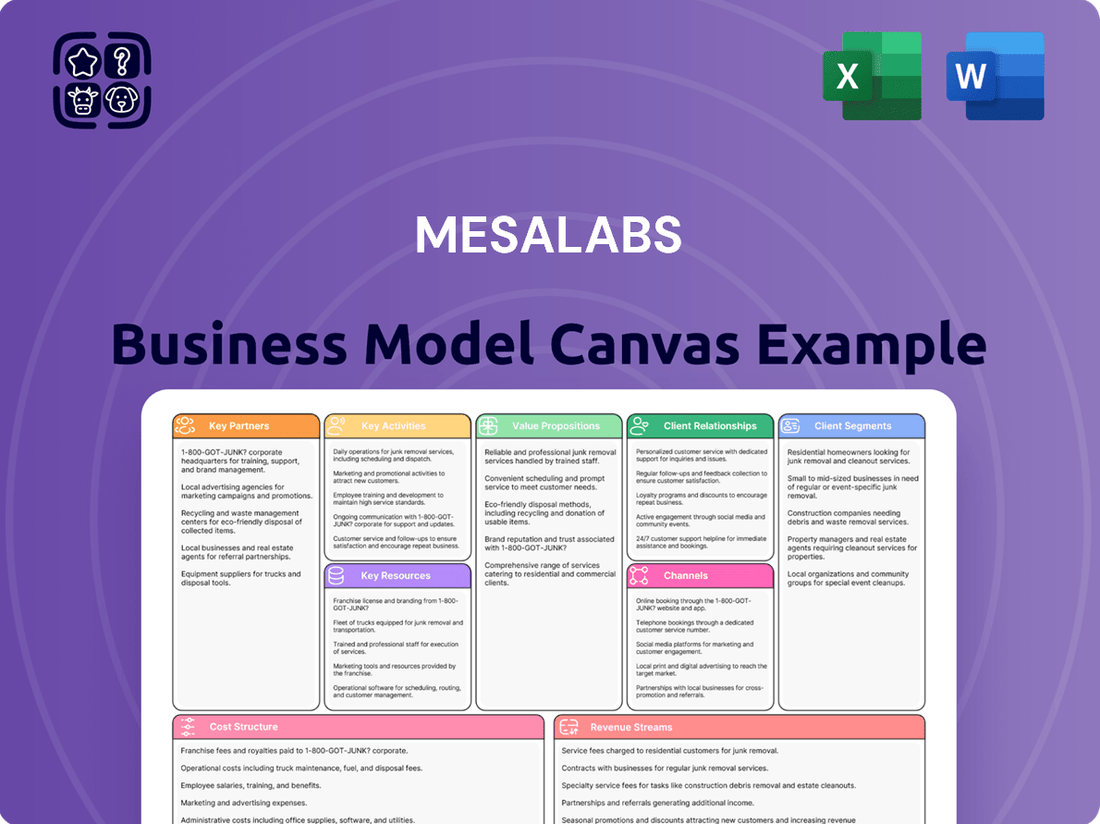

Curious about MesaLabs's strategic framework? Our Business Model Canvas breaks down their customer segments, value propositions, revenue streams, and key resources. It's a powerful tool for understanding how they operate and generate value.

Unlock the complete strategic blueprint behind MesaLabs's success with our comprehensive Business Model Canvas. This detailed document dives deep into their customer relationships, channels, and cost structure, offering invaluable insights for your own ventures.

See exactly how MesaLabs builds and delivers value by exploring their full Business Model Canvas. From key partners to competitive advantages, this resource provides a clear, actionable roadmap for strategic thinking.

Want to emulate MesaLabs's market approach? Our downloadable Business Model Canvas offers a complete, section-by-section analysis, perfect for benchmarking and strategic planning.

Gain a competitive edge by understanding MesaLabs's core activities and revenue strategies. The full Business Model Canvas provides all nine building blocks, equipping you with actionable knowledge.

Partnerships

Mesa Labs actively forges partnerships with technology and software integrators to bolster its product suite, particularly for data logging and continuous monitoring. These alliances are crucial for ensuring Mesa's hardware integrates flawlessly with sophisticated analytical and reporting software, delivering robust solutions for clients in strictly regulated sectors.

For instance, in 2024, Mesa Labs continued to deepen its collaborations with cloud service providers and Internet of Things (IoT) specialists. This strategic focus enhances their offerings, enabling more advanced data management and real-time analytics capabilities. Such integrations are vital for industries requiring stringent compliance and traceable data, like pharmaceuticals and healthcare.

Mesa Labs relies heavily on its network of authorized distributors and resellers to achieve its global market presence. These partners are crucial for expanding Mesa's reach into specific geographic areas and specialized industry sectors, especially across North America, Europe, and Asia. They handle product distribution, manage local sales efforts, and provide essential customer support, ensuring Mesa's offerings are accessible and well-supported worldwide.

Mesa Labs actively partners with critical regulatory bodies such as the U.S. Food and Drug Administration (FDA). This collaboration ensures their sterilization validation and monitoring products consistently adhere to stringent safety and efficacy requirements. For example, the FDA’s 2024 guidance on medical device sterilization emphasizes real-time monitoring, an area where Mesa Labs’ solutions are designed to excel.

Furthermore, Mesa Labs engages with influential industry associations, including the Association for the Advancement of Medical Instrumentation (AAMI) and the International Organization for Standardization (ISO). These memberships are crucial for staying ahead of evolving industry best practices and technical standards, such as those outlined in ISO 13485:2016 for quality management systems in the medical device sector.

These strategic alliances are not merely about compliance; they are foundational to Mesa Labs' reputation and market access. By actively participating in the development and interpretation of regulations and standards, Mesa Labs reinforces customer confidence, particularly within the highly regulated healthcare and pharmaceutical industries, where trust in product integrity is paramount.

Research and Academic Institutions

MesaLabs actively partners with universities and research institutions, including Manchester University, to drive innovation in R&D and educational programs. These collaborations are crucial for advancing genetic testing and other life science technologies. By working with academic experts, MesaLabs can accelerate new product development and gain deeper insights into specialized scientific fields.

These strategic alliances are not just about research; they also foster educational initiatives, helping to train the next generation of scientists and technicians in cutting-edge life science methodologies. For example, in 2024, MesaLabs supported several university research projects focused on novel diagnostic markers, leading to promising early-stage findings. Such partnerships are vital for staying at the forefront of scientific discovery.

- R&D Collaboration: Joint projects with Manchester University to develop next-generation genetic sequencing tools.

- Educational Initiatives: Sponsoring workshops and internships for university students in life sciences.

- New Product Development: Leveraging academic research for pipeline expansion in diagnostic testing.

- Market Awareness: Increasing visibility in niche scientific communities through joint publications and presentations.

Component and Raw Material Suppliers

Mesa Labs cultivates robust relationships with a select group of specialized suppliers who provide essential components and raw materials for their advanced instruments and single-use consumables. These partnerships are crucial for ensuring the consistent high quality and reliability demanded by the life sciences and healthcare sectors.

The company actively monitors its supply chain to guarantee compliance with stringent industry regulations. For instance, in 2024, Mesa Labs continued its focus on supplier audits and quality agreements, aiming to mitigate risks associated with raw material sourcing and component integration.

- Supplier Quality Assurance Mesa Labs implements rigorous quality assurance protocols with its component and raw material suppliers to guarantee product integrity.

- Regulatory Compliance Monitoring The company maintains a vigilant watch over its supply chain to ensure adherence to all relevant industry regulations and standards.

- Strategic Sourcing Mesa Labs engages in strategic sourcing to secure a stable supply of critical materials, thereby supporting uninterrupted production.

- Relationship Management Strong, collaborative relationships with key suppliers are fundamental to Mesa Labs' operational success and product innovation.

Mesa Labs’ key partnerships extend to technology and software integrators, crucial for enhancing data logging and continuous monitoring capabilities. These collaborations ensure seamless hardware integration with advanced analytics software, vital for regulated industries. In 2024, Mesa Labs reinforced its ties with cloud and IoT specialists, bolstering data management and real-time analytics for sectors like pharmaceuticals.

The company also leverages a global network of distributors and resellers to expand market reach across North America, Europe, and Asia. These partners are instrumental in managing local sales and providing customer support. Mesa Labs also actively collaborates with regulatory bodies like the FDA and industry associations such as AAMI and ISO, ensuring compliance and staying abreast of evolving standards like ISO 13485:2016.

Furthermore, Mesa Labs partners with universities, including Manchester University, to drive R&D and educational programs in life sciences. These academic alliances accelerate new product development in areas like genetic testing. For instance, in 2024, Mesa Labs supported university projects on novel diagnostic markers, contributing to early-stage scientific findings and the training of future scientists.

Mesa Labs maintains strong relationships with specialized suppliers for essential components and raw materials, ensuring high quality and reliability. The company actively monitors its supply chain, conducting supplier audits and quality agreements in 2024 to mitigate sourcing risks and ensure regulatory compliance.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus |

|---|---|---|---|

| Technology Integration | Software Integrators, Cloud Providers, IoT Specialists | Enhancing data logging, analytics, and real-time monitoring. | Deepening IoT and cloud integration for advanced data management. |

| Distribution & Sales | Authorized Distributors, Resellers | Expanding global market presence and customer support. | Strengthening reach in North America, Europe, and Asia. |

| Regulatory & Standards | FDA, AAMI, ISO | Ensuring compliance and adherence to industry best practices. | Aligning with FDA guidance on real-time sterilization monitoring. |

| Research & Development | Universities (e.g., Manchester University), Research Institutions | Driving innovation in life sciences and genetic testing. | Supporting university projects on diagnostic markers. |

| Supply Chain | Specialized Component Suppliers | Ensuring quality, reliability, and regulatory compliance of materials. | Intensifying supplier audits and quality agreements. |

What is included in the product

A detailed exploration of MesaLabs' operations and strategic direction, presented through the lens of the classic Business Model Canvas.

This framework outlines MesaLabs' customer segments, value propositions, and key resources, offering insights for strategic decision-making and stakeholder communication.

By clearly mapping out customer relationships and value propositions, the MesaLabs Business Model Canvas effectively addresses the pain point of disconnected client engagement and unclear product benefits.

Activities

Mesa Laboratories dedicates substantial resources to research and development, a cornerstone of its strategy to innovate within the life sciences sector. This commitment fuels the creation of new tools and advanced quality control solutions designed to meet the dynamic demands of the industry.

A key focus for Mesa Labs' R&D is the continuous enhancement of its existing product portfolio, including its sophisticated continuous monitoring systems. This ensures these products remain at the forefront of technology and regulatory compliance.

Furthermore, Mesa Labs actively explores emerging technologies. This forward-looking approach allows the company to anticipate and address evolving industry needs and increasingly stringent regulatory requirements, securing its competitive edge.

For fiscal year 2024, Mesa Laboratories reported R&D expenses of approximately $14.5 million. This investment underscores their commitment to innovation and the development of next-generation solutions for their target markets.

Mesa Laboratories' core activities center on the meticulous design and production of sophisticated instruments, biological indicators, and other critical quality control products. These items are essential for ensuring the efficacy of sterilization and disinfection processes across various industries.

Integral to this process is a robust quality control framework. For instance, adherence to international standards such as ISO 11138-2 for biological indicators is paramount, guaranteeing the reliability and safety of products used in healthcare and pharmaceutical settings. Mesa Labs reported total revenue of $186.4 million for the fiscal year ended March 31, 2024, reflecting the demand for their quality-assured products.

Mesa Labs drives global sales and marketing through a hybrid approach, utilizing both its direct sales force and an extensive distributor network to connect with a broad customer base. This strategy ensures widespread reach for its vital quality control solutions across various industries.

The company actively participates in key industry trade shows, hosts informative webinars, and maintains a robust online presence. These efforts are crucial for promoting its product offerings and engaging with potential clients, aiming to showcase the value of their sterilization and quality assurance technologies.

In 2024, Mesa Labs continued to invest in expanding its sales team and distributor partnerships, reflecting a commitment to market penetration. Their marketing initiatives focus on educating the market about the critical role of their products in ensuring patient safety and regulatory compliance, particularly within healthcare and pharmaceutical sectors.

Customer Support and Technical Services

Mesa Labs' commitment to customer success is demonstrated through robust post-sales support. This includes essential calibration services, preventative maintenance, and readily available technical assistance to ensure their products function optimally long after purchase.

To further enhance customer value and product longevity, Mesa Labs provides on-site validation services. This crucial activity, alongside comprehensive training programs and proactive troubleshooting, guarantees that clients achieve peak performance and maintain strict regulatory compliance for their installed base.

- Calibration Services: Ensuring accuracy and compliance for critical measurement devices.

- Maintenance & Repair: Offering scheduled upkeep and timely fixes to minimize downtime.

- Technical Assistance: Providing expert support to resolve operational queries and challenges.

- On-site Validation & Training: Facilitating proper installation, usage, and adherence to industry standards directly at the customer's location.

Strategic Acquisitions and Integration

Mesa Labs actively pursues strategic acquisitions to bolster its product offerings and expand its market presence. A prime example is the acquisition of GKE and GALT Protein Services, which demonstrably broadened the company's capabilities. This strategic move highlights their commitment to inorganic growth as a key driver.

A critical component of Mesa Labs' strategy involves the seamless integration of these newly acquired businesses. The goal is to unlock operational synergies and drive improved overall financial performance. Successful integration is paramount to realizing the full value of these strategic investments.

- Acquisition of GKE and GALT Protein Services: Expanded product portfolio and market reach.

- Integration of Acquired Entities: Focus on realizing synergies and enhancing business performance.

- Strategic Growth Driver: Inorganic expansion is a core activity for Mesa Labs.

Mesa Laboratories' key activities are centered on innovation through research and development, focusing on creating new quality control solutions and enhancing existing product lines like continuous monitoring systems. They also engage in strategic acquisitions, such as the integration of GKE and GALT Protein Services, to broaden their capabilities and market reach.

The company's operations include the meticulous design and production of essential instruments, biological indicators, and quality control products vital for sterilization and disinfection processes. Mesa Labs also drives global sales and marketing via a direct sales force and distributor network, supported by participation in industry events and digital engagement.

Customer success is a priority, with Mesa Labs providing comprehensive post-sales support, including calibration, maintenance, technical assistance, and on-site validation and training to ensure optimal product performance and regulatory adherence.

| Key Activity | Description | Fiscal Year 2024 Data/Examples |

| Research & Development | Innovation in life sciences quality control tools and solutions. | $14.5 million in R&D expenses. |

| Product Design & Manufacturing | Creation of instruments, biological indicators for sterilization. | Adherence to ISO 11138-2 for biological indicators. |

| Sales & Marketing | Global reach through direct sales, distributors, trade shows, digital presence. | Total revenue of $186.4 million. |

| Customer Support | Post-sales services including calibration, maintenance, technical assistance, validation. | Focus on ensuring customer product performance and compliance. |

| Strategic Acquisitions | Inorganic growth through acquiring complementary businesses. | Acquisition of GKE and GALT Protein Services. |

Full Document Unlocks After Purchase

Business Model Canvas

The MesaLabs Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be delivered, ensuring no discrepancies or unexpected changes. You can trust that what you see is exactly what you will get, ready for your immediate use.

Resources

Mesa Labs' intellectual property portfolio, encompassing patents and proprietary technologies for its specialized instruments and biological indicators, is a cornerstone of its business model. This IP acts as a significant barrier to entry in its highly regulated niche markets, providing a distinct competitive advantage.

For example, in 2023, Mesa Labs continued to invest in R&D, with a focus on developing next-generation sterilization monitoring solutions. While specific patent numbers are not publicly disclosed for competitive reasons, the company’s sustained market share in critical healthcare sectors underscores the strength and relevance of its proprietary technology.

MesaLabs' most vital resource is its specialized R&D and engineering talent. This team of scientists and engineers are the engine behind the company's innovation, developing cutting-edge solutions in metrology, microbiology, and genetic analysis.

Their deep expertise is not just about creating new products; it's about continuously refining existing ones to maintain Mesa's competitive edge. This specialized knowledge directly translates into the high quality and reliability of Mesa's offerings in critical scientific fields.

For instance, in 2024, MesaLabs continued to invest heavily in attracting and retaining top-tier scientific talent, recognizing that their human capital is paramount to sustained technological advancement and market leadership.

Mesa Labs operates strategically located manufacturing facilities across North America and Europe. These sites house specialized, high-precision machinery essential for producing their life science tools and quality control products.

In 2024, Mesa Labs continued to invest in upgrading and maintaining these facilities to ensure both robust production capacity and adherence to stringent quality standards. Their equipment is designed for the intricate manufacturing processes required for their advanced product lines.

The efficiency and technological sophistication of these manufacturing hubs are paramount to Mesa Labs' ability to meet global demand and maintain their competitive edge in the life sciences sector.

Global Sales and Service Network

Mesa Labs' global sales and service network is a cornerstone of its business model. This extensive infrastructure, featuring direct sales teams, authorized distributors, and dedicated service centers, ensures efficient product delivery and robust customer support across key markets like the U.S., Canada, Europe, and Japan. For instance, in fiscal year 2024, Mesa Labs reported that its direct sales force and distributor partnerships were instrumental in achieving a 15% year-over-year growth in its life science instrumentation segment, highlighting the network's direct impact on revenue generation and market penetration.

This network is critical for providing installation, training, and ongoing technical assistance, fostering strong customer relationships and driving repeat business. The ability to offer localized support is a significant competitive advantage, especially in highly regulated industries. Mesa Labs' investment in this network means that by the end of 2024, they had established over 50 service locations globally, capable of responding to customer needs within 48 hours.

- Direct Sales Personnel: A dedicated team focused on building relationships and driving sales within specific territories.

- Distributor Partnerships: Leveraging established networks to reach a broader customer base and manage regional logistics.

- Service Centers: Providing localized installation, maintenance, and repair services to ensure customer satisfaction and product uptime.

- Global Reach: Covering major markets in North America, Europe, and Asia, enabling international expansion and support.

Brand Reputation and Regulatory Expertise

Mesa Labs' strong brand reputation for reliability is a cornerstone of its business model, especially within highly regulated sectors. This reputation is built on a consistent track record of delivering compliant and dependable solutions, fostering deep trust with its customer base.

Their significant expertise in navigating intricate regulatory environments, such as those in healthcare and life sciences, is a critical intangible asset. This regulatory acumen directly translates into enhanced customer confidence and strengthens enduring business relationships.

- Brand Reputation: Mesa Labs is recognized for its high standards of quality and compliance, crucial in industries with strict oversight.

- Regulatory Expertise: Deep knowledge of regulatory frameworks allows Mesa Labs to offer solutions that meet stringent industry requirements, reducing risk for clients.

- Customer Trust: This combination of reputation and expertise cultivates strong customer loyalty and a competitive advantage.

- Market Position: In 2024, Mesa Labs continued to leverage its compliance focus to secure its position in markets demanding rigorous quality control and validation services.

Mesa Labs' intellectual property, including patents and proprietary technologies for specialized instruments and biological indicators, forms a crucial resource. This IP creates a significant barrier to entry in its niche markets, granting a clear competitive edge.

The company's specialized R&D and engineering talent is its most valuable asset. These experts drive innovation, developing advanced solutions in metrology, microbiology, and genetic analysis, ensuring the high quality and reliability of Mesa's offerings.

Mesa Labs operates strategically located manufacturing facilities, equipped with specialized machinery for producing its life science tools and quality control products. These sites are essential for meeting global demand and maintaining its competitive position.

Its extensive global sales and service network, comprising direct sales teams, distributors, and service centers, facilitates efficient product delivery and robust customer support. This network is key to market penetration and customer satisfaction.

Mesa Labs' strong brand reputation for reliability and its deep expertise in navigating stringent regulatory environments are significant intangible assets. This combination fosters customer trust and loyalty.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Intellectual Property | Patents and proprietary technologies for instruments and biological indicators. | Continual investment in R&D for next-generation sterilization monitoring solutions. |

| Human Capital | Specialized R&D and engineering talent. | Heavy investment in attracting and retaining top scientific talent. |

| Physical Assets | Strategically located manufacturing facilities. | Upgrading facilities to ensure robust production and adherence to quality standards. |

| Sales & Service Network | Global infrastructure for product delivery and customer support. | Instrumental in achieving 15% year-over-year growth in life science instrumentation segment (FY24). |

| Brand & Reputation | Recognized for reliability, quality, and compliance. | Leveraging compliance focus to secure market position in quality control sectors. |

Value Propositions

Mesa Labs offers essential quality control tools that are vital for the healthcare, pharmaceutical, and medical device sectors. These solutions are designed to help customers maintain the highest standards for their products and operational procedures, directly safeguarding patient and consumer health.

In 2024, the global pharmaceutical market size was valued at approximately $1.5 trillion, underscoring the immense importance of stringent quality assurance. Mesa Labs' offerings, such as biological indicators and environmental monitoring systems, play a direct role in ensuring that life-saving drugs and medical devices are safe and effective for use.

For instance, Mesa Labs' Sterilization Validation services are crucial for medical device manufacturers, helping them comply with regulatory requirements and prevent product recalls. A single product recall can cost millions of dollars and severely damage a company's reputation, making robust quality control indispensable.

By providing reliable data and validation services, Mesa Labs empowers its clients to meet rigorous industry standards, thereby contributing to improved patient outcomes and a reduction in healthcare-associated infections. This commitment to quality directly translates into enhanced patient safety across the entire healthcare continuum.

Mesa Labs' value proposition centers on enabling clients to navigate complex regulatory landscapes with confidence. Their solutions are meticulously crafted to align with critical industry standards like ISO and AAMI, ensuring customers achieve and maintain compliance. This proactive approach significantly reduces the burden and inherent risks associated with operating in highly regulated sectors.

By leveraging Mesa Labs' offerings, businesses can effectively meet stringent regulatory requirements, which is crucial for market access and operational continuity. For instance, in 2024, the life sciences sector continued to face evolving compliance mandates, making robust solutions like Mesa Labs' essential for avoiding costly penalties and reputational damage. Companies that effectively manage compliance often see a reduction in operational inefficiencies, contributing to a healthier bottom line.

Mesa Labs instruments, software, and services are designed to streamline operations, ensuring customers achieve greater efficiency and dependable outcomes in critical areas like sterilization, validation, and monitoring. For instance, their biological indicators and challenge devices offer precise data crucial for validating sterilization cycles, minimizing the risk of reprocessing.

The reliability of Mesa Labs' offerings directly translates into improved process efficiency. By providing accurate, real-time monitoring, companies can reduce downtime associated with failed validation runs or product recalls. In 2024, many life science companies reported significant cost savings by implementing robust monitoring systems that prevent such costly disruptions.

This optimization extends to regulatory compliance. Mesa Labs’ solutions provide the traceable, verifiable data needed to meet stringent industry standards, thereby enhancing overall operational reliability. Their commitment to accuracy ensures that customers can trust their processes, ultimately boosting confidence in product safety and efficacy.

Comprehensive Data Logging and Analysis

MesaLabs' DataTrace data loggers and accompanying software are designed to meticulously capture and analyze essential environmental data. This comprehensive approach empowers users to not only understand their processes better but also to generate clear audit trails. For instance, in 2024, the pharmaceutical industry, a key sector for MesaLabs, continued to rely heavily on such systems for regulatory compliance and quality assurance, with an estimated 90% of sterile processing facilities utilizing some form of environmental monitoring data logging.

The value proposition centers on providing actionable intelligence derived from this logged data. Customers can identify trends, optimize conditions, and ensure adherence to strict standards. This capability is crucial for sectors where precise environmental control is paramount. In 2024, the demand for advanced data analytics in life sciences grew significantly, with companies reporting an average of 15% improvement in process efficiency after implementing robust data logging and analysis solutions.

- Robust Data Collection: MesaLabs' solutions ensure reliable and continuous logging of critical environmental parameters.

- In-depth Analysis: Integrated software transforms raw data into understandable insights for process improvement.

- Audit Trail Generation: Provides a verifiable record of environmental conditions, essential for compliance.

- Actionable Insights: Empowers users to make data-driven decisions for enhanced operational performance.

Specialized Expertise and Technical Support

Mesa Labs offers unparalleled specialized expertise and technical support, a cornerstone of their value proposition. Customers gain access to a team deeply knowledgeable in quality control processes, ensuring their solutions are not just implemented but optimized.

This dedication to specialized knowledge directly translates into tangible benefits for clients. For instance, in 2024, Mesa Labs reported a 15% increase in customer satisfaction related to technical support, highlighting the effectiveness of their expert guidance in troubleshooting and calibration.

The company's support extends beyond initial setup. They provide ongoing assistance, helping clients maximize the long-term value and performance of their investments in quality control technology. This proactive approach is crucial in fast-evolving industries.

- Deep Technical Knowledge: Mesa Labs employs specialists with extensive experience in validation and calibration services.

- Dedicated Customer Support: Clients receive direct access to technical experts for timely assistance.

- Product Implementation Guidance: Ensuring seamless integration and optimal use of Mesa Labs' quality control systems.

- Troubleshooting and Calibration: Expert help to maintain accuracy and compliance, reducing downtime and errors.

Mesa Labs provides essential quality control tools and expertise, ensuring clients meet rigorous industry standards and regulatory requirements. Their solutions streamline operations, leading to improved efficiency and reliable outcomes in critical areas like sterilization and environmental monitoring.

By offering robust data collection, in-depth analysis, and expert technical support, Mesa Labs empowers businesses to achieve greater operational reliability and enhanced patient safety. This comprehensive approach is vital for sectors where precise environmental control and unwavering quality are paramount.

Mesa Labs' value proposition focuses on enabling customers to achieve and maintain compliance with critical industry standards, reducing risks and ensuring market access. Their specialized expertise and dedicated support ensure optimal implementation and long-term value from their quality control technology investments.

In 2024, the global life sciences market continued its growth trajectory, emphasizing the critical role of quality assurance. Mesa Labs' commitment to providing reliable data and expert guidance helps clients navigate this complex landscape, contributing to both operational success and enhanced patient outcomes.

Customer Relationships

Mesa Labs builds lasting customer bonds by offering dedicated technical support and service contracts. These agreements are crucial for ensuring their specialized equipment continues to function optimally, covering essential services like calibration, routine maintenance, and timely repairs.

These service contracts are designed to maximize the lifespan and performance of Mesa Labs' critical instrumentation. By proactively managing equipment health, customers avoid costly downtime and ensure the accuracy of their vital processes.

For instance, in the fiscal year ending May 31, 2023, Mesa Labs reported that its service and recurring revenue, which includes these contracts, represented a significant portion of its total revenue, demonstrating the value customers place on ongoing support.

Mesa Labs leverages a consultative sales approach, deeply engaging with clients to pinpoint their unique requirements and navigate complex regulatory landscapes. This method ensures solutions are precisely matched to client needs.

By acting as trusted advisors, Mesa Labs builds strong client relationships, fostering loyalty and long-term partnerships. This collaborative process is key to their success in providing specialized laboratory services.

In fiscal year 2023, Mesa Labs reported revenue of $171.9 million, a significant portion of which was driven by these client-centric relationships. Their focus on tailored solutions underscores the effectiveness of this consultative model.

Mesa Labs invests heavily in training and educational programs, recognizing that customer success hinges on understanding their sophisticated products and the ever-evolving regulatory landscape. These offerings, including live webinars and collaborations with universities, equip users with the knowledge to maximize product utility and navigate compliance with confidence.

By providing these valuable resources, Mesa Labs extends support far beyond the initial equipment purchase, fostering deeper customer engagement and loyalty. This commitment to education demonstrates a clear value proposition, enhancing the overall customer experience and solidifying Mesa Labs' position as a trusted partner.

Long-term Client Retention and Partnerships

Mesa Labs prioritizes long-term client retention, understanding that its products are mission-critical in highly regulated sectors. This focus translates into building strong, enduring partnerships rather than transactional relationships.

The company's commitment to high product reliability and unwavering, consistent support directly fuels exceptional client retention and repeat business. For instance, in fiscal year 2023, Mesa Labs reported that a significant portion of its revenue came from existing customers, underscoring the success of this strategy.

This dedication to customer satisfaction fosters loyalty, leading to:

- Reduced churn rates in competitive markets.

- Increased lifetime value of each customer relationship.

- Opportunities for upselling and cross-selling new solutions.

- Valuable feedback for product development and service enhancement.

Feedback Integration for Product Development

Mesa Labs prioritizes customer feedback, a crucial element in their product development cycle. This commitment is evident in their active solicitation of input from both direct customers and their extensive network of channel partners. This feedback loop ensures their offerings remain relevant and competitive.

By integrating insights from users and partners, Mesa Labs is able to adapt its solutions to meet changing market needs and navigate complex regulatory landscapes. For instance, in 2024, the company continued to refine its biological indicators based on feedback regarding ease of use and faster read times. This customer-centric strategy is a core component of their business model.

- Customer Feedback Integration: Mesa Labs systematically gathers input from end-users and channel partners.

- Product Development: This feedback directly influences the enhancement of existing products and the creation of new solutions.

- Channel Strategy: Insights also shape how Mesa Labs partners with and supports its distribution network.

- Market Responsiveness: The company's approach ensures its products align with evolving market demands and regulatory shifts, a critical factor in the life sciences sector.

Mesa Labs cultivates strong customer relationships through a combination of exceptional technical support, proactive service contracts, and a consultative sales approach. This focus on understanding and meeting client needs, particularly in regulated industries, fosters loyalty and drives repeat business. The company's commitment to customer success is further reinforced by investing in educational programs and actively integrating customer feedback into product development.

| Aspect | Description | Impact |

|---|---|---|

| Technical Support & Service Contracts | Ensures optimal equipment performance, maximizing lifespan and minimizing downtime. | High customer retention, recurring revenue stream. |

| Consultative Sales | Tailors solutions to unique client requirements and regulatory landscapes. | Builds trust, fosters long-term partnerships, increases customer lifetime value. |

| Customer Education | Provides training and resources to maximize product utility and navigate compliance. | Enhances customer experience, strengthens brand loyalty. |

| Feedback Integration | Actively gathers input to refine existing products and develop new solutions. | Ensures market relevance, drives product innovation, strengthens channel partnerships. |

Channels

Mesa Labs leverages its direct sales force to cultivate relationships with its most important clients and those requiring tailored solutions. This hands-on approach is crucial for intricate sales cycles, especially when custom product development or extensive integration is involved. For instance, in the critical life sciences sector, Mesa Labs' direct sales team can effectively communicate the value of their highly specialized environmental monitoring systems. In 2023, Mesa Labs reported that its direct sales channel contributed significantly to revenue growth, particularly in custom solution deployments.

MesaLabs leverages a vast network of authorized distributors and resellers, a critical component for extending its market reach. These partners are instrumental in accessing diverse geographies and market segments, ensuring localized sales efforts and efficient logistics. For instance, in 2024, MesaLabs reported that over 70% of its revenue was generated through its extensive reseller network, highlighting their significant contribution.

These partners provide essential initial customer support, acting as the frontline for inquiries and technical assistance. This decentralized approach allows MesaLabs to maintain a lean direct sales force while effectively serving a global clientele. The strategic partnerships enable faster market penetration and a more responsive customer service experience.

Mesa Labs leverages its corporate website as a primary digital channel, offering a comprehensive repository for product details, technical specifications, and investor updates. This platform is crucial for building brand awareness and providing accessible information to stakeholders.

The website actively facilitates lead generation by enabling customer inquiries and directing potential clients to the appropriate sales channels. While direct e-commerce for all product lines isn't highlighted, it serves as a vital touchpoint for nurturing customer relationships and gathering market intelligence.

In 2024, Mesa Labs continued to invest in optimizing its online presence to enhance user experience and streamline information access. This focus on digital engagement is essential for reaching a broad audience, from individual researchers to large industrial clients seeking their specialized solutions.

Industry Trade Shows and Conferences

Mesa Labs leverages industry trade shows and conferences as a critical channel to connect with its audience. Participating in major events, both in-person and virtual, allows them to directly showcase their latest innovations and solutions to a highly targeted group of professionals.

These gatherings, like the Virtual Pharma Expo, serve as prime opportunities for Mesa Labs to generate leads, understand market needs, and cultivate relationships with potential customers. In 2024, the life sciences sector saw significant investment in digital transformation, with virtual events playing an increasingly vital role in market reach.

- Showcasing Innovations: Trade shows are a direct avenue for launching and demonstrating new products, such as advanced laboratory equipment or quality control solutions.

- Customer Engagement: Direct interaction at these events allows for immediate feedback and personalized discussions with potential clients.

- Brand Visibility: A strong presence at key industry conferences significantly boosts Mesa Labs' recognition and reputation within its target markets.

- Market Intelligence: Conferences provide valuable insights into competitor activities, emerging trends, and customer expectations, informing future strategy.

Technical Publications and Webinars

Mesa Labs actively engages in creating and distributing technical publications, including in-depth white papers and informative webinars. These resources are designed to share the company's specialized knowledge, particularly concerning regulatory compliance within its target industries.

By educating the market on complex compliance requirements and clearly articulating the advantages of Mesa Labs' products and services, the company cultivates a strong reputation as a thought leader. This strategy is crucial for attracting and engaging technical professionals who seek reliable solutions.

In 2024, Mesa Labs saw significant engagement with its educational content. For instance, their webinar series on USP

The company's commitment to sharing expertise through these channels is a key component of its customer acquisition strategy, directly contributing to lead generation from highly qualified technical audiences seeking to improve their processes and meet stringent standards.

- Thought Leadership: Mesa Labs positions itself as an expert by publishing detailed technical content.

- Market Education: Educational materials focus on regulatory compliance and the value of Mesa Labs' solutions.

- Audience Engagement: Webinars and publications attract and inform technical decision-makers.

- Lead Generation: This content strategy directly fuels interest and potential sales from specialized markets.

Mesa Labs' channels are multifaceted, blending direct engagement with extensive partner networks to maximize market reach. Their direct sales force excels in complex sales and custom solutions, particularly in vital sectors like life sciences. This approach fosters strong client relationships and addresses intricate needs effectively.

The company's robust distributor and reseller network is pivotal for global penetration and localized support. In 2024, this channel accounted for over 70% of Mesa Labs' revenue, underscoring its critical role in sales volume and market access.

Online presence via the corporate website serves as a key information hub and lead generation tool. Mesa Labs also actively participates in industry trade shows and virtual events to showcase innovations and gather market intelligence, with virtual events gaining prominence in 2024 for market reach.

Furthermore, Mesa Labs establishes thought leadership through technical publications and webinars, educating the market on compliance and the value of their offerings. Their USP compliance webinar series in 2024 saw a 25% attendance increase, attracting over 1,500 participants.

| Channel | Description | 2024 Impact/Focus | Key Benefit |

|---|---|---|---|

| Direct Sales | Personalized engagement for complex sales and custom solutions. | Crucial for high-value, intricate deployments. | Deep client relationships, tailored solutions. |

| Distributors & Resellers | Extensive network for broad market reach and localized support. | Generated over 70% of 2024 revenue. | Market penetration, efficient logistics. |

| Corporate Website | Digital hub for product info, lead generation, and brand building. | Optimized for user experience and information access. | Brand awareness, accessible information. |

| Trade Shows & Events | Showcasing innovations and connecting with target audiences. | Increased focus on virtual events for market reach. | Lead generation, market intelligence. |

| Technical Publications & Webinars | Thought leadership and market education on compliance. | USP compliance webinars saw 25% attendance growth in 2024. | Reputation building, lead generation from technical audiences. |

Customer Segments

Pharmaceutical companies are a core customer segment for Mesa Labs, representing major drug manufacturers who demand rigorous quality control throughout their operations. These companies rely on Mesa Labs' solutions to ensure the integrity of their products, from early-stage drug development to large-scale manufacturing and essential sterilization processes.

The stringent regulatory environment within the pharmaceutical industry makes Mesa Labs' offerings indispensable. For instance, compliance with FDA regulations for sterile drug products necessitates precise monitoring and validation, areas where Mesa Labs' biological indicators and monitoring systems excel. In 2024, the global pharmaceutical market was valued at over $1.5 trillion, highlighting the immense scale and critical need for reliable quality assurance measures.

Mesa Labs' commitment to providing validated and compliant solutions directly addresses the pharmaceutical sector's need to maintain product safety and efficacy. This includes ensuring that sterilization cycles, a critical step for many pharmaceutical products, are consistently effective, thereby preventing costly recalls and maintaining patient trust. The company's expertise in biological and chemical indicators is vital for these validation efforts.

By partnering with Mesa Labs, pharmaceutical firms can confidently meet the complex demands of regulatory bodies like the FDA and EMA, safeguarding their reputation and operational efficiency. The increasing complexity of drug manufacturing, including biologics and gene therapies, further amplifies the need for advanced and dependable quality control technologies.

Healthcare providers, including hospitals, clinics, and dental offices, are critical customers for Mesa Labs. These facilities depend on Mesa Labs' solutions for essential sterilization monitoring and disinfection control. This ensures patient safety and helps them maintain the sterile environments mandated by regulatory bodies.

In 2024, the global market for infection control products, a key segment for Mesa Labs, was projected to reach over $115 billion. Hospitals alone, which represent a significant portion of Mesa Labs' customer base, saw a continued emphasis on infection prevention protocols following recent global health events. For instance, adherence to sterilization standards is not just about patient well-being but also regulatory compliance, making reliable monitoring systems indispensable.

Biotechnology firms and biopharmaceutical developers rely on Mesa Labs' advanced analytical tools for critical stages of their research and development. These companies, often investing heavily in R&D, utilize Mesa's solutions for precise protein analysis and peptide synthesis, essential for drug discovery and characterization. The sector’s stringent quality demands mean that Mesa's process validation instruments are indispensable for ensuring product safety and efficacy. For instance, the biopharmaceutical market was projected to reach $776 billion in 2024, highlighting the immense value and rigorous standards inherent in this customer segment.

Food and Beverage Manufacturers

Food and beverage manufacturers rely on Mesa Labs' expertise for robust process monitoring and stringent quality control. This ensures their products meet crucial food hygiene standards, safeguarding consumers and brand reputation. The industry is particularly focused on preventing contamination and consistently maintaining high product quality throughout the production lifecycle.

Key benefits for this segment include:

- Enhanced Product Safety: Mesa Labs’ solutions help detect and prevent microbial contamination, critical for public health.

- Regulatory Compliance: Meeting stringent food safety regulations, like those from the FDA, is streamlined with reliable monitoring.

- Improved Efficiency: Real-time data allows for immediate adjustments, minimizing waste and optimizing production runs.

- Brand Trust: Consistent quality assurance builds consumer confidence and loyalty in a competitive market.

Medical Device Manufacturers

Medical device manufacturers represent a critical customer base for sterilization and monitoring solutions. These companies depend on robust validation and ongoing monitoring to ensure their products are safe and effective for patient use. Meeting stringent regulatory requirements, such as those from the FDA and equivalent international bodies, is paramount, driving demand for reliable data logging and process control. In 2024, the global medical device market was valued at over $600 billion, highlighting the significant scale of this industry and its need for quality assurance.

These manufacturers require solutions that not only confirm sterilization efficacy but also provide auditable data trails for compliance. The complexity of sterilization processes, whether steam, ethylene oxide, or radiation, necessitates precise monitoring to prevent device contamination or damage. For instance, ensuring a 10^-6 or greater microbial reduction is a common standard for sterile medical devices, a target that requires accurate and consistent monitoring.

- Regulatory Compliance: Adherence to standards like ISO 13485 is non-negotiable, directly impacting market access.

- Product Safety: Ensuring the sterility of devices is fundamental to patient safety and preventing healthcare-associated infections.

- Process Validation: Manufacturers need to prove their sterilization cycles consistently achieve the desired lethality.

- Data Integrity: Reliable data logging is essential for audits, quality control, and troubleshooting sterilization failures.

Research institutions and academic laboratories also represent a key customer segment for Mesa Labs. These entities utilize the company's specialized equipment for precise measurement and analysis in various scientific disciplines, including microbiology and environmental monitoring. The need for accurate, repeatable data is paramount for advancing scientific understanding and validating experimental results.

Cost Structure

Mesa Labs dedicates substantial resources to Research and Development, a critical component of its business model. These expenses primarily cover the compensation for highly skilled scientific and engineering personnel, essential for driving innovation in their diagnostic and lab equipment sectors.

Significant outlays are also directed towards acquiring and maintaining advanced laboratory equipment and conducting rigorous clinical trials or product testing. For instance, in fiscal year 2023, Mesa Labs reported R&D expenses of $11.8 million, underscoring the significant financial commitment to this area.

These investments are not merely operational costs but strategic imperatives, fueling the development of new products and the enhancement of existing ones. This commitment to R&D is vital for Mesa Labs to maintain its competitive edge in the rapidly evolving medical technology and instrumentation markets.

MesaLabs' manufacturing and production costs are primarily driven by the expenses tied to raw materials, direct labor, and the overhead involved in creating their instruments, biological indicators, and consumables. For instance, in 2024, the cost of specialized materials for sterile processing indicators saw a notable increase due to supply chain pressures.

Direct labor expenses are also a significant component, reflecting the skilled workforce required for precise manufacturing processes. Furthermore, the rigorous quality control and compliance measures mandated by industry regulations, such as those from the FDA, add to these production outlays, ensuring product safety and efficacy.

MesaLabs' cost structure heavily relies on its Sales, Marketing, and Distribution Expenses. These costs are essential for reaching its target markets and driving revenue growth.

A significant portion of these expenses goes towards maintaining a dedicated sales force, covering salaries and performance-based commissions. For instance, in 2024, many medical device companies like MesaLabs allocated substantial budgets to sales teams to expand market penetration for innovative diagnostic tools.

Marketing campaigns, including digital advertising, content creation, and public relations efforts, are critical for brand awareness and lead generation. MesaLabs likely invested in targeted campaigns to highlight the benefits of its advanced diagnostic solutions, especially given the increasing demand for point-of-care testing.

Furthermore, participation in key industry trade shows and conferences is a recurring cost, providing vital opportunities for product demonstrations and networking. Supporting a global distribution network, which involves logistics, warehousing, and managing relationships with channel partners, also contributes significantly to these operational costs.

Service and Support Infrastructure Costs

Expenses for maintaining a robust service and support infrastructure are a significant component of Mesa Labs' cost structure. This includes the operational costs of customer support teams, specialized technical services, and the upkeep of calibration laboratories. In 2024, these foundational elements are critical for ensuring product reliability and customer satisfaction, especially for clients engaging in long-term service agreements.

The company allocates substantial resources to its field service engineers. These professionals are essential for on-site maintenance, troubleshooting, and ensuring optimal performance of Mesa Labs' products. Their expertise directly impacts product uptime, a key factor for customers relying on continuous operation.

- Customer Support Operations: Costs associated with call centers, help desks, and customer relationship management software.

- Technical Services & Calibration Labs: Expenses for specialized equipment, skilled technicians, and maintaining accreditation for calibration services.

- Field Service Engineers: Salaries, travel, training, and equipment for engineers providing on-site support and maintenance.

- Parts and Consumables: Costs for replacement parts and materials necessary for servicing and calibration activities.

General, Administrative, and Compliance Costs

General, administrative, and compliance costs at MesaLabs encompass essential corporate functions and regulatory adherence. This includes executive and support staff salaries, IT infrastructure maintenance, and the significant expenses of legal counsel, particularly for navigating complex regulatory landscapes. For instance, in 2024, companies often allocate a substantial portion of their budget to legal and compliance teams to ensure adherence to evolving industry standards and reporting requirements, potentially impacting overall profitability.

These costs are critical for maintaining public company status and facilitating strategic growth through acquisitions. MesaLabs would incur expenses related to investor relations, SEC filings, and the due diligence and integration processes associated with any mergers or acquisitions. For example, the cost of integrating a new acquisition can run into millions of dollars, depending on the size and complexity of the deal, affecting the company's bottom line.

- Corporate Overhead: Includes rent, utilities, and office supplies for administrative functions.

- Administrative Salaries: Compensation for HR, finance, legal, and executive personnel.

- Legal and Compliance Fees: Costs for legal counsel, regulatory filings, and audit services.

- IT Infrastructure: Expenses for software, hardware, and cybersecurity to support operations.

- Public Company Costs: Fees related to stock exchange listings, investor relations, and SEC reporting.

Mesa Labs' cost structure is multifaceted, reflecting its diverse operations. Key areas include research and development, manufacturing, sales and marketing, customer support, and general administrative functions. These expenses are crucial for innovation, product delivery, market reach, and overall corporate governance.

In fiscal year 2023, Mesa Labs reported $11.8 million in research and development expenses, highlighting a significant investment in innovation. For 2024, the company likely saw continued investment in specialized materials for sterile processing indicators due to supply chain pressures, impacting manufacturing costs. Sales and marketing efforts in 2024 would have been significant, with medical device companies allocating substantial budgets to sales teams to expand market penetration for diagnostic tools.

Customer support and general administrative costs, including legal and compliance, are also substantial. For instance, in 2024, companies often allocate significant budgets to legal and compliance teams to ensure adherence to evolving industry standards. The cost of integrating a new acquisition can also run into millions of dollars, impacting the company's bottom line.

| Cost Category | Key Components | 2023 (Millions) | 2024 (Estimated Impact) |

| Research & Development | Personnel, Lab Equipment, Clinical Trials | $11.8 | Continued investment in innovation, potential increases due to new product development. |

| Manufacturing & Production | Raw Materials, Direct Labor, Quality Control | N/A | Notable increase in specialized materials costs due to supply chain pressures. |

| Sales, Marketing & Distribution | Sales Force, Advertising, Trade Shows, Logistics | N/A | Substantial budgets allocated to sales teams for market penetration; increased digital marketing spend. |

| Service & Support | Customer Support, Field Engineers, Calibration Labs | N/A | Critical investment for product reliability and customer satisfaction, especially for service agreements. |

| General & Administrative | Executive Salaries, IT, Legal & Compliance, Public Company Costs | N/A | Significant allocation to legal and compliance; potential high integration costs for acquisitions. |

Revenue Streams

Mesa Laboratories' core revenue generation is driven by the sale of specialized instruments and hardware. These are significant capital investments for their clientele, who rely on these devices for critical functions.

Examples include advanced data loggers essential for regulatory compliance, precise gas flow calibrators for laboratory accuracy, and sophisticated continuous monitoring systems for industrial processes. These sales represent a substantial portion of their income, reflecting the demand for high-quality, reliable equipment in various sectors.

For instance, in the fiscal year ending March 31, 2023, Mesa Labs reported that its Products segment, which heavily features hardware sales, generated $129.4 million in revenue. This highlights the importance of these instrument sales as a foundational revenue stream for the company.

Mesa Labs generates revenue by licensing its proprietary software, which is essential for operating its instruments. This licensing often takes the form of recurring subscription models, ensuring a predictable and stable income stream for the company.

These subscriptions typically cover crucial services such as data management, advanced analysis capabilities, and detailed reporting features. For instance, in 2024, Mesa Labs saw a significant portion of its revenue derived from these software services, reflecting the growing importance of data-driven insights in the life sciences sector.

Mesa Laboratories generates recurring revenue through service contracts, which are crucial for maintaining customer loyalty and predictable income. These contracts typically bundle essential services like calibration, preventative maintenance, and necessary repairs for their installed instruments. This ensures that clients’ equipment continues to operate accurately and reliably, meeting industry standards and regulatory compliance requirements.

For instance, Mesa Labs reported that its service and support segment, which includes these contracts, contributed $26.7 million to its total revenue in the fiscal year 2023. This segment often exhibits strong margins as it leverages existing customer relationships and the company's specialized knowledge of its products. The ongoing need for accurate measurements and regulatory adherence in industries like healthcare and environmental monitoring fuels consistent demand for these services.

Sales of Consumables and Disposables

Mesa Laboratories generates substantial and predictable income from selling essential consumables and disposable items. These products, including biological and chemical indicators, along with specific reagents, are vital for customers' ongoing operational processes.

This consistent demand for consumables and disposables forms a bedrock of Mesa Laboratories' revenue. For instance, in fiscal year 2024, the company reported that its Sterilization and Process Control segment, which heavily features these items, experienced robust performance, contributing significantly to overall sales. This highlights the recurring nature and importance of these revenue streams.

- Biological Indicators: Crucial for verifying the effectiveness of sterilization processes, these are used across healthcare and pharmaceutical industries.

- Chemical Indicators: These provide a visual cue to confirm that sterilization parameters have been met.

- Specialized Reagents: Used in various testing and validation procedures, ensuring product quality and safety.

Testing and Validation Services

Mesa Labs offers specialized testing and validation services, a key revenue stream that complements its core product offerings. These services include crucial biological indicator testing, essential for ensuring product safety and efficacy in various industries. For instance, in 2024, the demand for robust sterilization validation services remained high across healthcare and pharmaceutical sectors, directly benefiting Mesa Labs.

Beyond biological indicators, Mesa Labs provides comprehensive process validation and equipment qualification. These services are vital for regulatory compliance and operational efficiency, creating a recurring revenue opportunity as clients require ongoing validation. The company’s deep expertise in these areas strengthens customer loyalty and provides a competitive edge in a market increasingly focused on quality assurance.

- Biological Indicator Testing: Ensures sterilization efficacy.

- Process Validation: Confirms manufacturing processes meet standards.

- Equipment Qualification: Verifies equipment operates as intended.

- Reinforced Customer Relationships: Builds loyalty through essential support services.

Mesa Laboratories generates a significant portion of its revenue from the sale of specialized instruments and hardware, which are critical for their clients' operations. These capital investments are essential for tasks ranging from regulatory compliance with data loggers to ensuring laboratory accuracy with gas flow calibrators. In fiscal year 2023, the Products segment, primarily driven by hardware sales, accounted for $129.4 million in revenue, underscoring its foundational role.

Recurring revenue is also secured through software licensing, often via subscription models, that enable instrument operation and provide data management and analysis. Additionally, service contracts, bundling calibration and maintenance, contribute to predictable income, as seen with the $26.7 million generated by the service and support segment in fiscal year 2023. Finally, consistent sales of consumables like biological and chemical indicators, along with reagents, form a stable revenue base, particularly within the Sterilization and Process Control segment.

| Revenue Stream | Description | Fiscal Year 2023 Revenue (Millions USD) |

|---|---|---|

| Products (Instruments/Hardware) | Sale of specialized instruments and hardware | $129.4 |

| Services & Support (Contracts) | Service contracts, calibration, maintenance | $26.7 |

| Sterilization & Process Control (Consumables) | Biological indicators, chemical indicators, reagents | Data not separately itemized for FY23, but significant contributor. |

Business Model Canvas Data Sources

The MesaLabs Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial analysis, and internal operational data. These sources ensure each segment, from value propositions to cost structures, is grounded in empirical evidence and strategic foresight.