Manulife SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manulife Bundle

Manulife possesses significant strengths in its diversified product portfolio and strong brand recognition, coupled with substantial opportunities for global expansion. However, potential weaknesses like regulatory complexities and competitive pressures require careful navigation. Understand the full picture behind Manulife's market position with our comprehensive SWOT analysis.

This in-depth report reveals actionable insights, financial context, and strategic takeaways, ideal for entrepreneurs, analysts, and investors looking to leverage Manulife's potential. Want the full story behind Manulife's strengths, risks, and growth drivers?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research. Get the insights you need to move from ideas to action and stay ahead of the curve.

Strengths

Manulife boasts a truly global reach, operating in 21 countries and territories. This extensive network is particularly strong in North America and burgeoning markets across Asia, such as Hong Kong, Japan, China, Singapore, and Vietnam. This broad geographic diversification is a significant strength, allowing Manulife to spread its revenue streams and build resilience against economic downturns in any single region.

The company's diversified product portfolio further solidifies its market position. Manulife offers a wide array of financial solutions, encompassing life and health insurance, robust wealth management services, and essential retirement planning. This comprehensive offering serves a broad and varied customer base, effectively mitigating risks by not relying on a single product category for growth.

Manulife's financial performance remains a significant strength, underscored by consistent growth in core earnings. For instance, Q1 2025 saw core earnings reach $1.8 billion, reflecting the company's operational efficiency and market positioning. This robust financial health provides a solid foundation for future strategic initiatives and shareholder returns.

The company's capital position is equally impressive, highlighting its resilience and capacity for expansion. Manulife reported a strong LICAT ratio of 137% in Q1 2025, well above regulatory requirements. This substantial capital adequacy ensures financial flexibility, enabling strategic investments and a prudent approach to capital deployment.

Record insurance new business results in Q1 2025 further emphasize Manulife's competitive edge in its core markets. This achievement signals strong customer demand and effective sales strategies, contributing directly to the company's overall profitability and market share growth.

Manulife's significant commitment to digital transformation, backed by a C$1 billion investment through 2025, is a key strength. This focus on AI, cloud, and mobile platforms is designed to create a superior customer experience and streamline internal operations.

The company is already seeing tangible results, reporting over $600 million in benefits from its digital endeavors in 2024. This demonstrates a clear return on their strategic digital investments.

By mid-2025, Manulife had successfully implemented more than 35 generative AI use cases. The company is projecting a threefold return on these AI investments over a five-year period, highlighting a forward-thinking approach to leveraging advanced technology.

Growth Momentum in Asia

Asia remains a significant engine for Manulife's expansion, demonstrating robust growth in both new business value and underlying earnings. This trend is clearly visible in the company's performance metrics, highlighting the region's strategic importance.

Manulife saw impressive gains in Asia during the first quarter of 2025. Specifically, the new business value in the region surged by 43% compared to the same period in the prior year. Furthermore, core earnings from Asia operations experienced a healthy increase of 7% year-over-year, underscoring the region's profitability.

The underlying drivers for this strong performance are clear. Asia's burgeoning middle class, coupled with a rising demand for financial protection and savings products, creates a fertile ground for Manulife's continued growth. These demographic and economic trends offer substantial opportunities for the company to deepen its market penetration and expand its product offerings.

- Asia's new business value grew 43% year-over-year in Q1 2025.

- Core earnings in Asia increased by 7% in Q1 2025.

- The expanding middle class in Asia drives demand for insurance.

- Significant opportunities exist for further expansion in the Asian market.

Robust Brand Reputation and Customer Centricity

Manulife's long history, dating back to 1887, has cultivated a robust brand reputation built on over 130 years of consistent operation. This longevity translates into significant customer trust and widespread recognition across its global markets.

The company's commitment to customer centricity is a core strategic pillar, evident in its continuous efforts to enhance customer satisfaction. Manulife actively monitors and aims to improve key metrics like Net Promoter Scores (NPS), reflecting a dedication to delivering positive customer experiences.

Serving a vast customer base of over 36 million individuals worldwide underscores the breadth of Manulife's reach and the trust placed in its services. This extensive customer network is a testament to the company's enduring appeal and its ability to meet diverse financial needs.

Manulife's strategic focus on customer delight aims to differentiate it in a competitive landscape by prioritizing service quality and product innovation. This approach is designed to foster loyalty and drive long-term customer relationships.

Manulife's global presence, spanning 21 countries, is a critical strength, particularly its strong footing in North America and rapidly growing Asian markets. This geographic diversification mitigates risk and stabilizes revenue streams across different economic cycles. The company's product range is equally robust, offering life and health insurance, wealth management, and retirement planning, catering to a wide customer base and reducing reliance on any single segment.

Financially, Manulife demonstrates consistent strength, with Q1 2025 core earnings reaching $1.8 billion, showcasing operational efficiency. Its capital position is also noteworthy, with a LICAT ratio of 137% in Q1 2025, exceeding regulatory requirements and ensuring financial flexibility for strategic investments and shareholder returns.

| Metric | Q1 2025 Value | Previous Year Comparison |

|---|---|---|

| Core Earnings | $1.8 billion | Consistent Growth |

| LICAT Ratio | 137% | Well Above Regulatory Requirements |

| Asia New Business Value | +43% | Year-over-year increase |

| Asia Core Earnings | +7% | Year-over-year increase |

What is included in the product

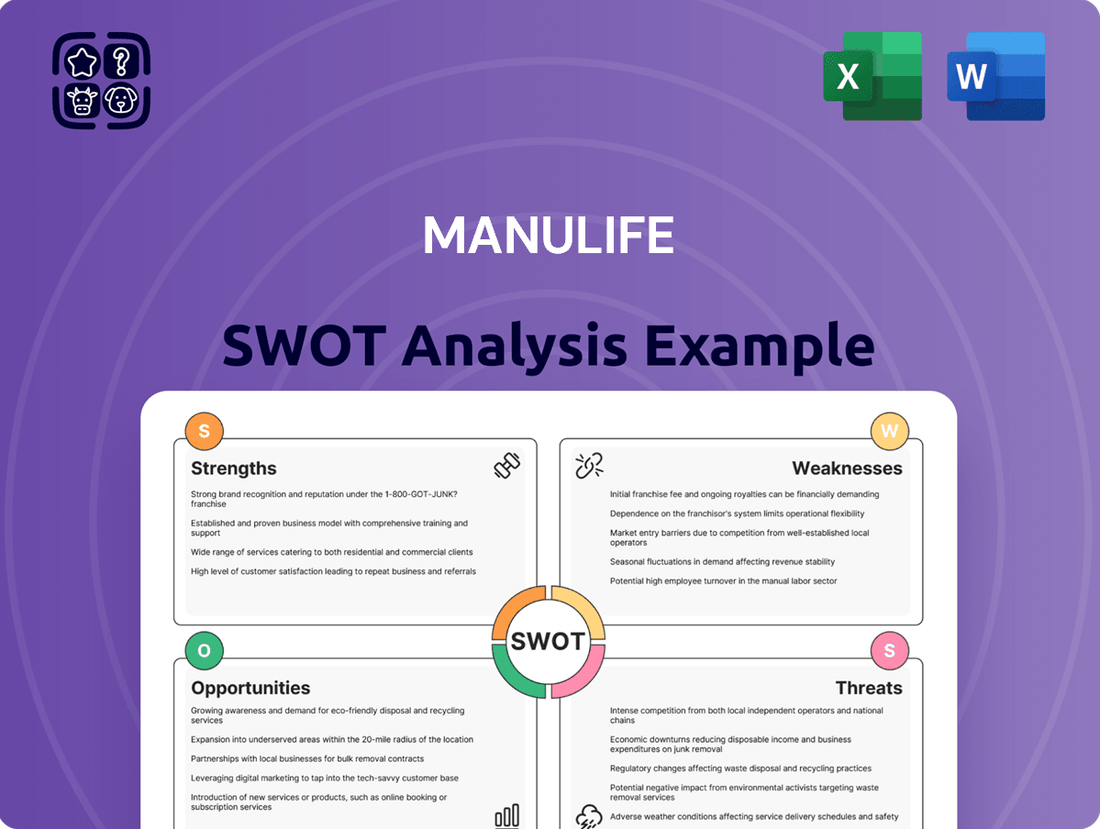

Delivers a strategic overview of Manulife’s internal and external business factors, highlighting its strengths in diverse markets, weaknesses in digital transformation, opportunities in emerging economies, and threats from increased competition and regulatory changes.

Simplifies complex competitive landscapes, offering clear strategic direction for Manulife.

Weaknesses

While reinsurance is a vital tool for managing risk, Manulife's recent transactions have presented a challenge to its reported earnings. These deals, designed to de-risk the company's balance sheet, have sometimes led to immediate financial hits that don't reflect the ongoing strength of its core operations.

For instance, in the first quarter of 2025, Manulife's reported Earnings Per Share (EPS) saw a substantial drop of 48%. This significant decline was largely attributable to a realized loss stemming from debt instruments connected to a U.S. reinsurance agreement.

This situation creates a noticeable divergence between what the company's underlying businesses are actually generating (core earnings) and the final numbers that appear on its financial statements (reported earnings). Such a gap can make it harder for investors to get a clear picture of Manulife's day-to-day performance.

Consequently, this can potentially influence how investors perceive the company's financial health and operational efficiency, making it crucial for Manulife to clearly communicate the strategic intent and long-term benefits of these reinsurance activities.

Manulife's Global Wealth and Asset Management (WAM) segment faced a significant downturn in net inflows during the first quarter of 2025. The segment saw inflows drop to $0.5 billion, a stark contrast to the $6.7 billion recorded in the same period of 2024. This decline highlights a vulnerability to market sentiment, as increased redemptions were driven by reduced investor demand in a volatile market environment.

The substantial decrease in net inflows for the WAM segment in Q1 2025, falling from $6.7 billion to $0.5 billion year-over-year, points to a core weakness in its ability to attract and retain assets during periods of market uncertainty. This trend suggests that Manulife's asset management business is particularly sensitive to investor sentiment, which can lead to challenges in achieving consistent asset growth and profitability when market conditions are unfavorable.

Manulife is experiencing growing operational expenses as regulations become more complex and demanding across the various countries it operates in. Keeping up with these evolving rules, particularly concerning data protection and financial reporting standards, often requires significant investment in new systems and personnel.

These regulatory shifts can lead to a noticeable uptick in compliance costs, potentially climbing by an estimated 5-7% year-over-year. Such increases directly affect Manulife's bottom line, squeezing profit margins as more resources are allocated to meeting these stringent requirements.

Exposure to Market Volatility and Economic Slowdown

Manulife, as a global financial services powerhouse, is inherently susceptible to the unpredictable nature of financial markets and the broader economic climate across its diverse operating regions. A global economic slowdown, for instance, could dampen consumer and business spending, directly impacting the demand for Manulife's core insurance and wealth management offerings. In 2023, for example, while many economies saw recovery, persistent inflation and rising interest rates created uncertainty, which can translate into reduced investment in long-term financial products.

Market volatility presents another significant challenge. Fluctuations in equity, bond, and currency markets can directly affect the value of Manulife's substantial investment portfolio. This volatility can lead to lower investment income and potentially impact the company's profitability and capital ratios. For instance, sharp downturns in major stock markets in late 2024 could erode the value of assets under management, requiring adjustments to financial projections and potentially impacting shareholder returns.

- Global Economic Sensitivity: Manulife's revenue streams are tied to the economic health of multiple countries. A synchronized global slowdown, as seen in periods of high inflation and geopolitical tension, directly impacts discretionary spending on financial services.

- Investment Portfolio Risk: The company's investment income is heavily influenced by market performance. Volatile markets in 2024, characterized by fluctuating interest rates and equity price swings, can lead to reduced investment gains and increased risk management costs.

- Impact on Demand: Economic downturns typically reduce demand for life insurance, annuities, and investment products as consumers and businesses prioritize immediate needs over long-term financial planning.

- Currency Fluctuations: Operating globally means Manulife is exposed to foreign exchange rate movements, which can affect reported earnings when translated back to its reporting currency, Canadian dollars.

Complex Organizational Structure and Operational Costs

Manulife's extensive global presence, operating across numerous countries, inherently creates a complex organizational structure. This complexity often translates into significant operational costs as the company manages diverse regulatory environments, varied market conditions, and multiple administrative functions.

Maintaining this vast infrastructure and administrative overhead across these diverse regions contributes to substantial operating expenses. For instance, in 2023, Manulife reported operational costs amounting to CAD 4.3 billion. This figure represents a considerable portion of its total revenue, highlighting the financial strain associated with managing such a widespread and intricate operational footprint.

- High Infrastructure Costs: Significant investment is required to maintain physical and digital infrastructure across its global operations.

- Administrative Overhead: Managing diverse teams, compliance, and support functions in multiple jurisdictions adds to administrative expenses.

- Complexity-Driven Inefficiencies: The sheer scale and diversity of operations can sometimes lead to inefficiencies that drive up costs.

- 2023 Operational Costs: CAD 4.3 billion highlights the financial impact of this complex structure.

Manulife's significant reliance on reinsurance agreements, while strategic for de-risking, can create a disconnect between reported earnings and underlying business performance. For example, a 48% drop in reported EPS in Q1 2025 due to a reinsurance deal loss illustrates this weakness, potentially obscuring the operational strength of its core businesses from investors.

The company's Global Wealth and Asset Management segment faced a substantial decline in net inflows in Q1 2025, dropping to $0.5 billion from $6.7 billion in Q1 2024. This highlights a vulnerability to market sentiment and challenges in asset growth during uncertain economic periods.

Manulife's global operations lead to high infrastructure and administrative costs, contributing to significant operating expenses. In 2023, these costs reached CAD 4.3 billion, impacting profit margins and underscoring the financial strain of managing a complex, widespread operational footprint.

| Weakness | Description | Financial Impact Example |

| Reinsurance Earnings Impact | De-risking transactions can cause short-term reported earnings volatility, masking core business performance. | Q1 2025 reported EPS down 48% due to reinsurance deal loss. |

| WAM Net Inflow Decline | Sensitivity to market sentiment leads to reduced asset inflows during uncertain economic times. | Q1 2025 WAM net inflows fell to $0.5 billion from $6.7 billion in Q1 2024. |

| High Operational Costs | Managing a complex global structure with diverse regulations results in significant overhead. | 2023 operational costs were CAD 4.3 billion. |

Preview the Actual Deliverable

Manulife SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document thoroughly examines Manulife's Strengths, Weaknesses, Opportunities, and Threats. It's designed to provide actionable insights for strategic planning. You'll gain a clear understanding of the company's competitive landscape and internal capabilities.

Opportunities

Asia's insurance market presents a significant growth runway for Manulife, building on its established presence and momentum. Projections indicate robust expansion in this sector, driven by favorable demographic and economic trends.

The burgeoning middle class across Asia, coupled with increasing life expectancies, fuels demand for insurance products. Furthermore, relatively low insurance penetration rates in many Asian economies highlight substantial room for Manulife to broaden its customer reach and diversify its product portfolio.

For instance, in 2024, the Asian insurance market was expected to see premiums grow by over 6%, with digital adoption accelerating customer acquisition. Manulife's strategic investments in digital platforms and localized product development are well-positioned to capitalize on this opportunity.

Manulife's substantial, multi-billion dollar commitment to digital transformation and AI is a prime opportunity to elevate customer interactions. This investment allows for the creation of more intuitive and responsive services, directly addressing evolving customer expectations.

By integrating generative AI and moving tech infrastructure to the cloud, Manulife can significantly speed up the launch of new offerings. This agility, coupled with improved operational efficiency, means customers benefit from faster access to innovative products and services.

The strategic deployment of AI enables personalized solutions tailored to individual customer needs, a key differentiator in today's competitive market. This focus on personalized experiences can foster stronger customer loyalty and drive revenue growth.

For instance, by mid-2025, Manulife aims to have a significant portion of its technology assets operating on cloud platforms, facilitating quicker product rollouts and enhanced data analytics capabilities to better understand and serve its customer base.

The global retirement market is a significant growth area, with projections indicating it will reach $52.7 trillion by 2025. This expansion is largely fueled by aging populations worldwide, creating a sustained demand for retirement planning and solutions.

Manulife is well-positioned to leverage this opportunity by enhancing its retirement product offerings. The company can focus on segments experiencing notable growth in their 65+ populations, particularly in Canada, the United States, and various Asian markets.

By tailoring its products and marketing efforts to these demographics, Manulife can capture a larger share of this burgeoning market. For instance, the population aged 65 and over in Canada is projected to increase significantly in the coming years, presenting a direct opportunity for Manulife's retirement services.

Strategic Acquisitions in Technology and Financial Services

Manulife is actively channeling substantial capital towards strategic acquisitions, particularly within the technology and financial services sectors. The company's focus areas include emerging technologies like artificial intelligence, blockchain, and innovative insurtech platforms, aiming to bolster its digital infrastructure.

These targeted acquisitions present a significant opportunity for Manulife to accelerate its digital transformation, integrate cutting-edge solutions, and ultimately improve customer experience. For instance, by acquiring fintechs, Manulife can gain access to advanced data analytics for personalized product offerings.

- Acquisition Focus: AI, blockchain, insurtech, and other digital capabilities.

- Capital Allocation: Significant capital reserves earmarked for M&A activities in these strategic areas.

- Expected Benefits: Enhanced digital services, innovation acceleration, and expanded market presence.

Focus on ESG and Sustainability Initiatives

Manulife's strong commitment to Environmental, Social, and Governance (ESG) principles, as detailed in its 2024 Sustainability Report, presents a significant opportunity. This focus on its Impact Agenda is increasingly resonating with investors and consumers who prioritize socially responsible and sustainable financial products.

The company's proactive initiatives, such as the Forest Climate Fund and its investments in longevity and mental health research, directly address growing market demand.

- Attracting socially conscious investors: Manulife's ESG focus appeals to a growing segment of the investment community.

- Enhanced customer loyalty: Aligning with customer values fosters stronger relationships and brand preference.

- Market differentiation: Sustainability initiatives set Manulife apart in a competitive financial services landscape.

- Long-term value creation: Investing in sustainable practices can lead to more resilient business models and reduced operational risks.

Manulife is capitalizing on the expanding Asian insurance market, where premiums were projected to grow over 6% in 2024. Their digital transformation investments, including AI and cloud adoption, position them to better serve customers and launch new products faster, aiming for significant cloud asset migration by mid-2025.

The global retirement market, expected to reach $52.7 trillion by 2025, offers a substantial growth avenue, particularly as aging populations in Canada, the US, and Asia increase demand for planning solutions.

Strategic acquisitions in AI, blockchain, and insurtech are enhancing Manulife's digital capabilities and customer experience. Their commitment to ESG principles, highlighted by initiatives like the Forest Climate Fund, appeals to socially conscious investors and consumers, fostering loyalty and market differentiation.

Threats

Manulife contends with a fiercely competitive financial services sector, where established players and agile newcomers vie for customers in both insurance and wealth management. This saturation means constant pressure on pricing, potentially squeezing profit margins and market share. For instance, in 2024, the global insurance market experienced significant competition, with major players like AIA and Prudential actively expanding their offerings, forcing Manulife to invest heavily in digital transformation and product innovation to stand out.

To counter this, Manulife must continually innovate and differentiate its product and service offerings. Failing to do so risks losing ground to competitors who may offer more attractive pricing or more advanced digital solutions. The company's 2025 strategic focus on enhancing customer experience and digital capabilities is a direct response to this threat, aiming to build loyalty and capture new market segments amidst intense rivalry.

Global market volatility remains a significant concern for Manulife. Fluctuations in interest rates and a general slowdown in global economic growth can directly impact the company's investment income. For instance, rising interest rates, a trend observed throughout 2024 and continuing into early 2025, can pressure investment portfolios and reduce the attractiveness of certain financial products.

These economic headwinds also threaten to dampen demand for Manulife's diverse range of financial products and services. As consumers and businesses face tighter economic conditions, discretionary spending on insurance, wealth management, and other financial solutions may decrease. This could lead to slower revenue growth across key business segments.

Furthermore, economic slowdowns increase the risk of higher expected credit losses. Manulife, like other financial institutions, must account for potential defaults on loans and other credit exposures. Provisions made for events such as the California wildfires in late 2024, and the company's reported increase in expected credit losses in Q1 2025, underscore the tangible impact of these macroeconomic threats on financial performance.

Manulife faces significant challenges from an increasingly complex regulatory landscape. New rules around data privacy, like GDPR and similar frameworks, necessitate substantial investments in compliance and technology to protect customer information. The implementation of IFRS 17 and IFRS 9, for instance, has already required considerable resources for financial reporting adjustments.

The financial services sector is also navigating evolving global tax regulations, including discussions around global minimum taxes, which could impact Manulife's international operations and tax liabilities. Failure to adapt to these changes or the sheer cost of implementing new compliance measures can directly translate into higher operational expenses and put pressure on profit margins for the company.

Cybersecurity Risks and Data Breaches

Manulife, like all financial institutions, is a prime target for cyberattacks, especially given its handling of extensive customer data. A significant data breach in 2024 or 2025 could result in substantial financial penalties, potentially millions of dollars, and severe damage to its brand reputation. This threat requires ongoing, significant investment in advanced cybersecurity defenses to safeguard sensitive information and maintain customer confidence.

The financial services industry saw a notable increase in cyber threats in recent years. For instance, reports from late 2023 and early 2024 indicated a rise in ransomware attacks specifically targeting large financial corporations. Manulife's exposure to these risks underscores the need for robust, adaptive security protocols.

- Increased Frequency of Attacks: The financial sector remains a top target for cybercriminals.

- Data Breach Impact: A breach could lead to direct financial losses and significant reputational harm for Manulife.

- Erosion of Trust: Losing customer trust due to a security incident can have long-lasting negative effects on business.

- Investment in Security: Continuous and substantial investment in cybersecurity is critical to mitigate these threats.

Impact of Gig Economy on Group Insurance

The growing gig economy presents a significant challenge for Manulife's group insurance offerings. As more individuals opt for freelance or contract work, their reliance on traditional employer-sponsored benefits diminishes. This trend, which saw the U.S. freelance workforce grow to an estimated 64 million in 2023, directly impacts the pool of potential group insurance participants. Manulife must adapt to this evolving employment landscape.

This shift away from traditional employment models threatens a key revenue stream for Manulife. Without the structure of a single employer, the acquisition and administration of group plans become more complex. The decline in employees covered by large corporate policies means fewer opportunities for Manulife to secure and maintain these valuable contracts.

The increasing prevalence of independent workers means a smaller customer base for traditional group insurance products. By 2027, it's projected that 40% of the U.S. workforce could be independent contractors, a stark contrast to previous decades. This contraction of the traditional market necessitates a strategic re-evaluation of Manulife's product development and distribution channels to cater to this dispersed workforce.

Manulife faces the threat of reduced demand for its established group insurance solutions as the gig economy expands. This fundamental change in how people work directly erodes the traditional market for group plans.

- Decreased Demand: The rise of freelancers reduces the number of individuals covered by traditional employer-sponsored group insurance.

- Market Fragmentation: The gig economy leads to a more dispersed workforce, making it harder to offer standardized group plans.

- Revenue Impact: A shrinking pool of corporate clients for group insurance can lead to a significant decrease in a key revenue stream for Manulife.

- Competitive Pressure: Insurers who successfully adapt to offer tailored solutions for gig workers could gain a competitive advantage.

Manulife faces intense competition from both established insurers and nimble fintech startups, particularly in the digital insurance and wealth management sectors. This crowded market forces continuous innovation and can compress profit margins, as seen with competitors like Sun Life and Equitable Life enhancing their digital offerings throughout 2024 and early 2025. The company's ability to adapt its product suite and customer engagement strategies will be crucial to maintaining market share amidst this rivalry.

Economic downturns and market volatility pose a significant threat by impacting investment income and potentially reducing demand for financial products. For instance, the global economic slowdown predicted for late 2024 and continuing into 2025, coupled with fluctuating interest rates, directly affects Manulife's investment portfolio performance. Higher expected credit losses, as indicated by a rise in provisions in Q1 2025, further illustrate the tangible financial impact of these macroeconomic headwinds.

The evolving regulatory landscape, including data privacy mandates and changes in accounting standards like IFRS 17, necessitates ongoing investment in compliance and technology. Navigating global tax reforms, such as discussions around minimum corporate taxes, also presents a challenge that could impact international operational costs and tax liabilities for Manulife.

Manulife is also vulnerable to sophisticated cyberattacks, a persistent threat in the financial services industry, which saw a notable increase in ransomware targeting large corporations during 2024. A data breach could result in substantial financial penalties and severe reputational damage, requiring continuous, significant investment in cybersecurity defenses to protect sensitive customer data and maintain trust.

SWOT Analysis Data Sources

This Manulife SWOT analysis is informed by comprehensive data from official financial filings, extensive market research, and authoritative industry reports, ensuring a robust and evidence-based assessment.