Manulife Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manulife Bundle

Uncover the strategic heartbeat of Manulife with our detailed BCG Matrix analysis. See where their offerings shine as Stars, generate steady income as Cash Cows, lag as Dogs, or present exciting future potential as Question Marks. This preview offers a glimpse into their product portfolio's performance, but the full picture is crucial for informed decision-making.

The complete Manulife BCG Matrix report provides a comprehensive, quadrant-by-quadrant breakdown, complete with data-backed recommendations and a clear roadmap for optimizing your investments and product strategies. Don't just see the potential; seize it.

Gain instant access to the full BCG Matrix and pinpoint which of Manulife's products are market leaders, which are consuming resources without significant return, and where future capital allocation should be directed. Purchase now for a ready-to-use strategic tool that empowers confident action.

Stars

Manulife's Asia insurance business is a standout performer, acting as a strong Star in the company's BCG Matrix. Core earnings in this segment saw a robust 7% jump in Q1 2025, building on an impressive 27% growth in 2024, driving overall top-line expansion across all insurance areas.

This region is undeniably a cornerstone for Manulife's future profitability, contributing a substantial 71% to the company's 2024 new business value. This exceptional performance is underpinned by a burgeoning middle class and a rising demand for insurance products across its Asian markets.

To further capitalize on this momentum, Manulife is actively investing in its proprietary agent capabilities, such as the Manulife Pro initiative, in crucial markets to accelerate growth and solidify its market position.

Manulife's Global Wealth and Asset Management (WAM) segment is a strong performer. In the first quarter of 2025, core earnings saw a significant jump of 24%, building on a robust 30% growth throughout 2024. This impressive financial trajectory is directly linked to an increase in assets under management and administration (AUMA), which climbed 13% to $1,041 billion by Q1 2025. The WAM business consistently attracts positive net flows, pushing its AUM beyond the $1 trillion mark, and plays a crucial role in Manulife's overall higher return on equity.

Manulife's commitment to digital transformation and AI is a cornerstone of its strategy, with multi-billion dollar investments fueling significant progress. By 2024, the company was already realizing substantial benefits from its cloud-based data and AI platform, a key enabler of its forward-looking initiatives.

The widespread adoption of generative AI is a testament to this commitment, with over 75% of Manulife's global workforce actively engaging with tools like ChatMFC. This broad engagement is directly translating into enhanced operational efficiency and fostering innovation across various business functions.

Manulife is actively deploying numerous generative AI use cases, specifically designed to elevate both customer and advisor experiences. The company has a clear financial target, aiming for a threefold return on investment from these AI initiatives by the year 2027.

High Net Worth (HNW) Solutions

Manulife is actively growing its High Net Worth (HNW) solutions globally, with a particular focus on expanding into key international markets. For instance, new offices are being established in strategic locations like the Dubai International Financial Centre to cater to the increasing demand from international HNW and Ultra-HNW individuals.

These HNW solutions are designed to be highly personalized, offering a range of protection and savings products. Manulife leverages its specialized expertise, honed in markets such as Bermuda, Hong Kong, and Singapore, to deliver these tailored offerings.

The strategic push into the HNW segment is driven by significant market growth. Projections indicate that global wealth in these segments is expected to increase by a substantial 38% over the next five years, presenting a compelling opportunity.

- Global HNW Expansion: Manulife is opening new offices in key regions, including the Dubai International Financial Centre.

- Tailored Solutions: The firm offers specialized protection and savings products for HNW and Ultra-HNW clients.

- Leveraging Expertise: Experience from Manulife Bermuda, Hong Kong, and Singapore informs these offerings.

- Market Growth: The global HNW segment is projected to see a 38% wealth increase in the next five years.

Group Benefits in Canada

Manulife's group benefits operations in Canada represent a strong performer within its portfolio. This segment benefits from Manulife's established market leadership, offering a wide array of insurance and retirement solutions to Canadian businesses. The business model itself is attractive due to its capital-light structure and the agility to adjust product pricing, which directly bolsters the company's financial health and revenue generation.

The Canadian group insurance sector saw remarkable growth in 2024, with sales surging by 43%. This significant increase underscores a robust demand for employer-sponsored benefits and highlights Manulife's success in securing large client contracts. Such performance solidifies the group benefits business as a key contributor to Manulife's overall financial success.

- Market Leadership: Manulife is a dominant player in the Canadian group benefits market.

- Financial Characteristics: The business is capital-light and allows for rapid repricing.

- 2024 Performance: Canadian group insurance sales grew an impressive 43% in 2024.

- Key Driver: Strong demand and success in acquiring large clients fueled this growth.

Manulife's Asia insurance business is a significant growth engine, demonstrating strong performance. This segment is a prime example of a Star in Manulife's BCG Matrix, with core earnings up 7% in Q1 2025, following a 27% surge in 2024. Its contribution to new business value reached 71% in 2024, driven by increasing demand in its Asian markets.

The Global Wealth and Asset Management (WAM) segment also shines as a Star. Q1 2025 core earnings jumped 24%, building on a 30% growth in 2024, fueled by a 13% increase in assets under management and administration (AUMA) to $1,041 billion by Q1 2025. This segment consistently attracts net flows and is crucial for Manulife's higher return on equity.

Manulife's Canadian group benefits operations are another strong Star. This capital-light business, benefiting from market leadership, saw a remarkable 43% sales increase in 2024, driven by strong demand and large client wins.

| Segment | BCG Category | Q1 2025 Core Earnings Growth | 2024 Performance Highlight | Key Driver |

| Asia Insurance | Star | 7% | 27% growth | Burgeoning middle class, rising insurance demand |

| Global WAM | Star | 24% | 30% growth | Increase in AUMA, positive net flows |

| Canadian Group Benefits | Star | N/A | 43% sales growth | Market leadership, capital-light structure |

What is included in the product

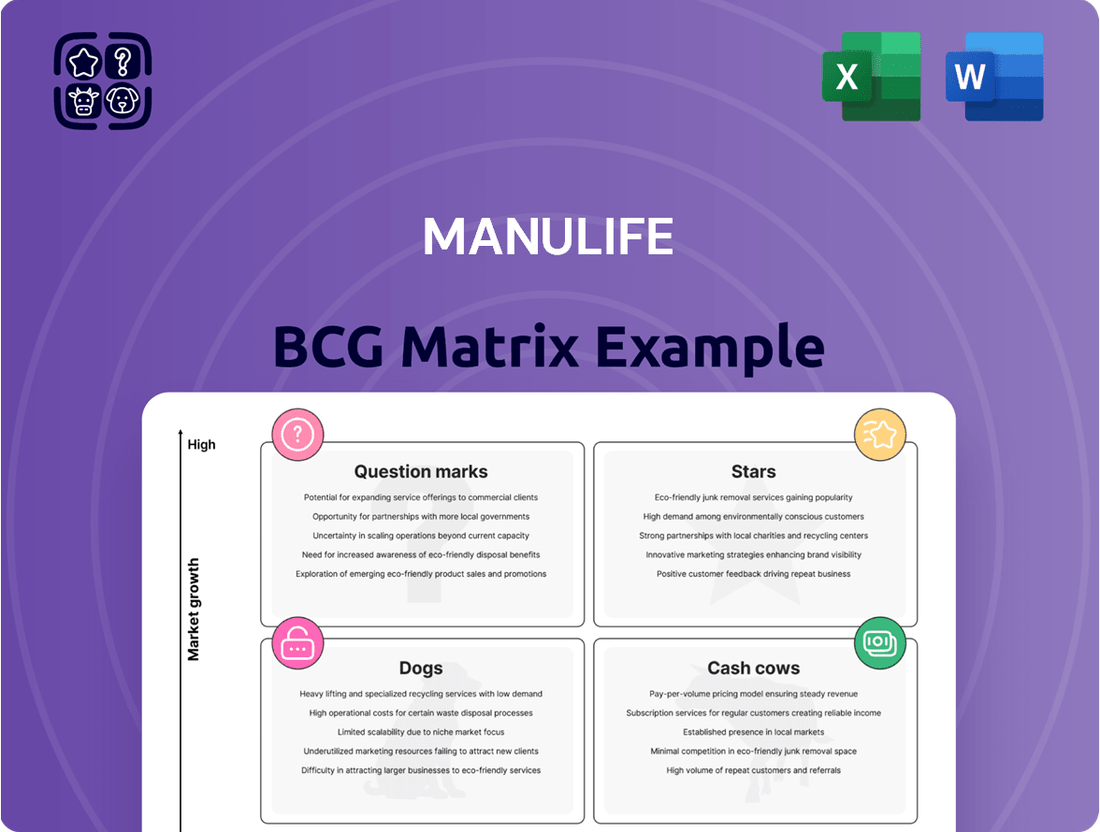

The Manulife BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides clear guidance on which units Manulife should invest in, hold, or divest based on their market share and growth potential.

Manulife's BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Manulife's traditional individual life insurance products in Canada are a classic cash cow, embodying a mature market where the company holds a solid position. Despite a minor dip in annual premium equivalent (APE) sales in Canada during 2024, primarily attributed to a singular, non-recurring event, this segment remains a reliable source of contractual service margin (CSM).

These offerings consistently generate stable cash flows, a testament to their long-term customer contracts and loyal client base. The mature nature of these products means they require less aggressive marketing spend when contrasted with newer, high-growth ventures, allowing for efficient cash generation. For instance, the stable CSM generated underpins Manulife's ability to fund other strategic initiatives or return capital to shareholders.

Manulife's Canadian Retail Segregated Funds are a prime example of a Cash Cow within the BCG Matrix. The company holds a leading position among Canadian retail segregated fund providers, a market segment characterized by maturity and stable demand. This strong market share translates into consistent fee income generated from a significant pool of assets under management.

Over the last decade, these funds have consistently seen positive net flows, a testament to a dedicated customer base and the reliability of their revenue generation. For instance, in 2023, Manulife's Canadian retail segregated funds contributed significantly to the company's overall earnings, reflecting their established and dependable performance.

Manulife Bank of Canada functions as a solid cash cow within Manulife's portfolio, generating consistent revenue through traditional banking services. It offers products like chequing accounts, lines of credit, and mortgages, which are staples in the financial market. This stability is key, as these services provide a predictable income stream from interest and fees, supporting overall company operations.

In 2023, Manulife reported strong performance in its Canadian operations, with total revenue from its Canadian segment reaching CAD 12.3 billion. The banking segment, a significant contributor, benefits from a well-established customer base and a diverse range of financial products, ensuring reliable profitability. This consistent financial inflow is vital for funding growth initiatives in other business areas.

In-Force US Life Insurance Blocks (after reinsurance)

Manulife has strategically managed its US life insurance business by actively pursuing reinsurance transactions. These moves have notably reduced its exposure to less profitable segments like long-term care and variable annuities. This portfolio optimization leaves a more focused and stable in-force US life insurance block.

Following these risk-transfer initiatives, the remaining US life insurance business is characterized by its predictable cash flow generation. The company has successfully improved both the profitability and risk profile of these operations. This refined book of business is positioned as a key contributor to Manulife's overall financial performance.

Manulife's approach highlights a commitment to enhancing the return profile of its US segment. By shedding riskier, lower-return assets, the company strengthens its core insurance offerings. This strategic realignment is designed to bolster the stability and earnings power of its US operations.

- Portfolio Optimization: Manulife's reinsurance deals have significantly reduced exposure to long-term care and variable annuity blocks, shifting focus to core life insurance.

- Stable Cash Flows: The remaining in-force US life insurance business now generates more predictable and stable cash flows.

- Improved Profitability: Post-reinsurance, these blocks exhibit enhanced profitability and a more favorable risk-return profile.

Established Institutional Asset Management

Manulife Investment Management's institutional asset management division acts as a significant cash cow within the company's BCG matrix. This segment generates a steady stream of fee-based income due to its substantial assets under management from external clients.

Despite a minor dip in institutional net inflows during the first quarter of 2024, this business line has consistently been a major contributor to Manulife's overall earnings. Its strength lies in its broad client base and a history of securing long-term investment mandates.

The reliability of this revenue stream is crucial, as it provides a stable financial foundation that can be leveraged to support and fund other strategic initiatives across the organization.

- Established Client Base: Manulife's institutional asset management serves a diverse range of clients, ensuring consistent demand for its services.

- Fee-Based Income: The segment's business model relies on fees generated from managing substantial assets, providing predictable revenue.

- Historical Earnings Contribution: This division has a proven track record of delivering significant earnings to Manulife.

- Support for Growth: The stable income from this cash cow allows Manulife to invest in and develop other business areas.

Manulife's Canadian traditional individual life insurance products are a prime example of a Cash Cow. These mature offerings, despite a slight dip in annual premium equivalent (APE) sales in Canada during 2024, continue to deliver consistent contractual service margin (CSM). Their stable cash flows, fueled by long-term contracts and a loyal customer base, require less marketing investment compared to growth-oriented ventures. This efficiency in cash generation supports Manulife's broader strategic objectives and capital return strategies.

| Business Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Canadian Traditional Life Insurance | Cash Cow | Mature market, stable CSM, loyal customer base, low investment needs. | Consistent reliable cash flow, supports other strategic initiatives. |

Full Transparency, Always

Manulife BCG Matrix

The Manulife BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means you'll get the complete strategic analysis, free from watermarks or demo content, ready for immediate implementation in your business planning.

Dogs

Manulife's US life insurance portfolio includes segments like older long-term care and variable annuity products that have demonstrated lower returns and elevated risk profiles. These specific blocks have historically tied up substantial capital, consequently dampening the company's overall profitability and return on equity metrics.

To address this, Manulife has strategically pursued reinsurance transactions to lessen its exposure to these capital-intensive and underperforming areas. For instance, in 2023, Manulife completed a significant reinsurance deal for a block of its US variable annuity business, which had approximately $7 billion in reserves. This move is designed to free up capital and enhance financial leverage.

Manulife US REIT has strategically divested some office properties, like Plaza in Secaucus, New Jersey, and Capitol in Sacramento, California. These sales were driven by challenges such as elevated vacancy rates in their respective submarkets.

These specific assets were identified as cash traps, meaning they consumed capital without offering significant growth potential and yielded minimal returns. For instance, vacancy rates in some of these locations have been notably higher than the national average for office spaces in 2024.

The primary objective behind these divestitures is to unlock liquidity, which can then be used to reduce existing debt obligations. By doing so, the REIT can improve its financial flexibility and strengthen its balance sheet.

This freed-up capital is intended to be redeployed into opportunities that offer better prospects for growth and higher returns, aligning with Manulife US REIT's strategy to enhance overall portfolio performance and shareholder value.

Certain older insurance products within Manulife's portfolio might be characterized by high administrative burdens. These legacy offerings, due to their complexity or outdated systems, often demand substantial manual effort and incur disproportionately high operational costs. While not always labeled as 'dogs' in a traditional sense, if these products also exhibit low market share and minimal growth prospects, they could function as inefficient drains on resources.

Manulife's strategic focus on digital transformation is a key indicator of efforts to address these inefficiencies. For instance, in 2023, the company announced significant investments in technology aimed at streamlining operations and enhancing customer experience across its product lines. This initiative directly targets the reduction of administrative overhead associated with older, more complex systems and products, suggesting areas where efficiency gains are a priority.

Segments Impacted by California Wildfire Provisions

Manulife's Corporate and Other segment felt the sting of the California wildfires, reporting a dip in core earnings. This was directly linked to provisions set aside for its property and casualty reinsurance business, highlighting the volatile nature of such exposures.

While not a primary focus for Manulife, this particular line of business is characterized by its low growth potential coupled with significant risk. The financial impact of these specific liabilities, especially if not adequately managed or reinsured, can indeed deplete capital reserves without adding to the company's strategic expansion efforts.

- California Wildfire Impact: Manulife's Corporate and Other segment saw core earnings reduced due to wildfire-related provisions.

- P&C Reinsurance Exposure: This segment, while not a core product, carries high risk and low growth in property and casualty reinsurance.

- Capital Drain Risk: Unmanaged or unreinsured specific liabilities from events like wildfires can drain capital.

- Strategic Growth Hindrance: These types of risks can negatively affect earnings and divert resources from growth-oriented initiatives.

Certain Low-Margin Savings Products in Asia

Certain low-margin savings products in Asia, particularly those with low return on equity (ROE) and a shrinking market share, can be classified as dogs within Manulife's portfolio. For instance, in 2024, while Asia remained a key growth driver for Manulife, some of its savings products in the region struggled with profitability. These products contributed to a diluted overall margin, impacting the company's financial performance. Manulife's strategic focus is to shift its sales towards higher-margin health and protection products.

The challenge with these savings products lies in their inherent low profitability, which can drag down the performance of more successful business lines. If a product has a low margin and also a small market presence, it's a clear indicator of a dog in the BCG matrix.

- Weak Profitability: Certain Asian savings products exhibited low ROE, impacting overall margin expansion in 2024.

- Market Share Concerns: In specific Asian markets, these low-margin savings products held a relatively small market share.

- Dilutive Effect: The sales mix skewed towards these products weakened Manulife's new business value margin in the region.

- Strategic Shift: Manulife aims to pivot sales towards higher-margin health and protection products in Asia.

Products or business segments that exhibit low growth and low market share, often referred to as 'Dogs' in the BCG Matrix, require careful management. These are typically characterized by low profitability and can consume resources without generating significant returns.

Manulife US REIT's divestment of underperforming office properties, such as Plaza in Secaucus, New Jersey, exemplifies the strategy to exit such 'Dog' assets. These properties faced high vacancy rates, a clear indicator of low market attractiveness and growth in 2024.

Similarly, certain older, low-margin savings products in Asia, noted for low ROE and shrinking market share in 2024, also fit the 'Dog' profile. Manulife's strategic pivot to higher-margin products aims to address these less profitable areas.

The property and casualty reinsurance business within the Corporate and Other segment, particularly when exposed to volatile events like the 2023 California wildfires, can also act as a 'Dog' if it presents high risk and low strategic growth potential, draining capital.

| Asset/Product Type | BCG Classification | Key Challenges | 2024 Observation | Strategic Action |

| US Variable Annuity Block | Dog (Historically) | Capital intensive, lower returns | Reinsurance completed in 2023 | Reinsurance to free up capital |

| Underperforming Office Properties (e.g., Plaza, Secaucus) | Dog | High vacancy rates, low returns | Elevated vacancy in submarkets | Divestiture to unlock liquidity |

| Certain Asian Savings Products | Dog | Low ROE, shrinking market share | Struggled with profitability in 2024 | Shift sales to health/protection products |

| P&C Reinsurance (Specific Liabilities) | Dog (Potential) | High risk, low growth, capital drain | Wildfire provisions impacted earnings | Manage risk, consider reinsurance |

Question Marks

Manulife is strategically expanding into Southeast Asian markets like Indonesia, Vietnam, and the Philippines, capitalizing on their robust economic growth and favorable demographics. These emerging markets present substantial upside potential due to burgeoning middle classes and increasing insurance adoption rates, even though Manulife's current market share is lower compared to its more established operations.

These regions are experiencing rapid economic development, with Vietnam's GDP projected to grow by approximately 6.0% in 2024, and Indonesia also showing strong growth. This expansion is a deliberate move to secure future market leadership by investing in areas with high unmet insurance needs and a growing demand for financial services from a youthful population.

Manulife's iFUNDS digital wealth platform in Singapore, launched as the first integrated digital solution for Unit Trusts and Investment-Linked Plans, represents a strategic move to cater to the growing demand for financial freedom and passive income solutions. The platform was further enhanced in 2025, focusing on providing financial consultants with a consolidated view, aiming to streamline their client engagement and product offerings.

While iFUNDS is positioned as an innovator, its current standing within Manulife's portfolio, when viewed through the lens of a BCG Matrix, likely places it in the 'question mark' category. This is due to the substantial investments required for its development and ongoing promotion to achieve significant market penetration and profitability. Its success hinges on its ability to convert early adoption into sustained market share in a competitive digital wealth landscape.

As of early 2025, Manulife has reportedly allocated significant resources towards marketing and user acquisition for iFUNDS, signaling a strong belief in its future potential. However, detailed figures on iFUNDS' current market share and profitability relative to these substantial investments are not yet publicly available, reinforcing its 'question mark' status as it navigates the critical phase of scaling its user base and revenue generation.

Manulife's introduction of new hybrid indexed universal life insurance solutions in the US positions these offerings as potential Stars within its product portfolio, aligning with the BCG Matrix framework. These products are designed for affluent customers, a segment showing increased demand for accumulation-focused insurance, indicating a strong market potential.

The new solutions boast enhanced living benefits and a simplified digital application, aiming to attract a key demographic. As relatively new entrants, they necessitate considerable investment in marketing and sales infrastructure to drive adoption and achieve market penetration necessary for growth.

The success of these hybrid indexed universal life policies hinges on their ability to capture a significant share of the growing affluent market segment. Initial adoption rates and customer feedback will be crucial indicators of their trajectory towards becoming profitable Stars.

By focusing on the accumulation aspect, these products cater to a specific need within the affluent market, which saw a 15% increase in demand for wealth-building insurance products in 2024 according to industry reports.

FutureStepTM Digital Retirement Plan for US Small Businesses

Manulife's FutureStepTM digital retirement plan, launched in collaboration with Vestwell, targets the U.S. small business sector. This move aims to bolster Manulife's standing in a segment identified as having significant growth potential. The plan's effectiveness will be measured by its adoption rate and its ability to carve out a competitive niche against established providers.

The small business retirement market in the U.S. represents a substantial opportunity. In 2024, an estimated 6.5 million small businesses in the U.S. offer retirement plans, but a significant portion, around 30%, still do not provide such benefits, according to industry estimates.

- Market Opportunity: The U.S. small business retirement market is vast, with millions of businesses lacking retirement plan offerings.

- Competitive Landscape: FutureStepTM faces competition from established players and other digital solutions in the retirement plan space.

- Growth Potential: Successful adoption of FutureStepTM could significantly increase Manulife's market share in this high-growth segment.

- Strategic Importance: This initiative aligns with Manulife's strategy to expand its digital offerings and reach underserved markets.

Sustainable Investing Products & Natural Capital Investments

Manulife Investment Management is actively building its presence in sustainable investing, particularly within natural capital. As of 2024, the firm manages over $16 billion in assets dedicated to timberland and agriculture, demonstrating a significant commitment to these tangible, resource-based investments.

The company is actively developing new investment solutions in natural capital, including climate bond and climate equity strategies. This focus aligns with a growing global demand for investments that offer both financial returns and positive environmental impact. These are considered nascent product categories, meaning their market share is still being established.

The potential for growth in natural capital investments is substantial, driven by increasing investor appetite for ESG-aligned strategies and the recognition of natural resources as critical assets. For Manulife, these emerging product categories represent a 'question mark' within the BCG framework, signifying high growth potential but requiring further development to solidify market position.

- Commitment to ESG: Manulife is integrating Environmental, Social, and Governance (ESG) factors across its investment strategies.

- Natural Capital Assets: Manulife Investment Management oversees more than $16 billion in timberland and agriculture assets as of 2024.

- Developing Strategies: The firm is creating climate bond and climate equity strategies to tap into sustainable finance trends.

- High Growth Potential: Natural capital investments are a 'question mark' due to their high growth prospects and developing market share.

Question Marks represent new products or services with high growth potential but a low market share. Manulife's iFUNDS digital wealth platform in Singapore and its new hybrid indexed universal life insurance solutions in the US are prime examples of these 'question marks'. They require significant investment to gain traction and establish market dominance.

The success of these 'question mark' products hinges on their ability to capture market share and achieve profitability. Manulife is actively investing in marketing and development for these offerings, recognizing their potential to become future market leaders if managed effectively.

The firm's focus on sustainable investing, particularly in natural capital, also places these emerging strategies in the 'question mark' category. While the market is growing, these products are still in their early stages of development and market penetration.

Manulife's strategic allocation of resources to these areas underscores a commitment to innovation and capturing future market opportunities, even with the inherent risks associated with 'question mark' products.

| Product/Service | Market Growth Potential | Current Market Share | Investment Required | BCG Category |

|---|---|---|---|---|

| iFUNDS (Singapore) | High | Low | High | Question Mark |

| Hybrid Indexed Universal Life Insurance (US) | High | Low | High | Question Mark |

| Natural Capital Investments | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including internal financial reports, market share analysis, and industry growth projections, to provide strategic clarity.