Manulife Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manulife Bundle

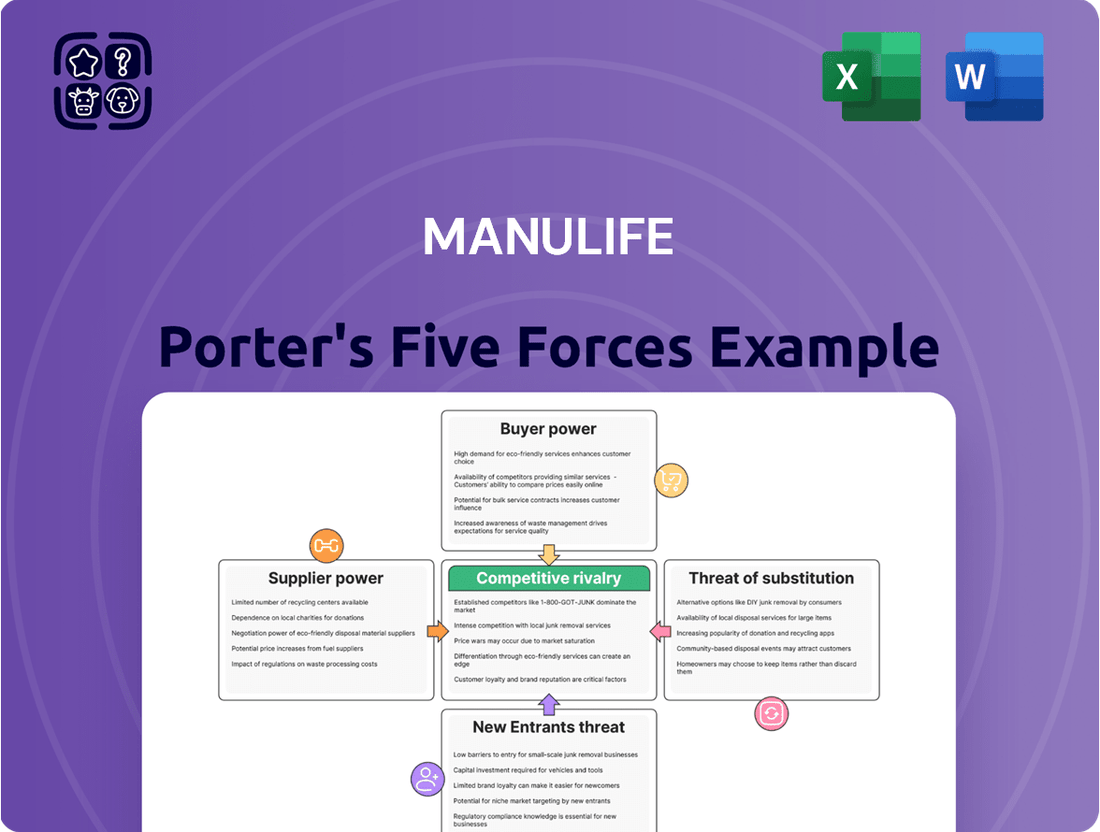

Manulife operates within a dynamic insurance and financial services landscape, shaped by critical competitive forces. Understanding the intensity of rivalry among existing players, the bargaining power of both customers and suppliers, and the ever-present threat of new entrants and substitutes is crucial for strategic success. This brief overview highlights these key pressures, offering a glimpse into Manulife's market environment.

The complete report reveals the real forces shaping Manulife’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Manulife's supplier power is influenced by reinsurers, technology providers, and data analytics firms. Reinsurers are particularly impactful, as they share insurance risks, directly affecting Manulife's capital needs and earnings. The reinsurance sector is projected to see strong operating profits in 2024-2025, boasting solid capitalization, which suggests a relatively stable supply environment.

Technology providers, particularly those in advanced analytics, AI, and cloud computing, are gaining significant bargaining power. Manulife's strategic investments in AI and generative AI underscore the industry's reliance on these transformative technologies. For instance, global spending on AI is projected to reach $200 billion in 2024, highlighting the critical nature of these solutions.

Manulife's pursuit of digital transformation and enhanced customer experiences is heavily dependent on these specialized, rapidly evolving technological solutions. If only a limited number of providers can offer the cutting-edge capabilities Manulife needs, these suppliers' leverage increases substantially, potentially impacting costs and service delivery.

Data analytics and cybersecurity providers hold considerable sway as suppliers for Manulife. The increasing reliance on data-driven strategies and the paramount importance of safeguarding sensitive information amplify the bargaining power of these specialized firms. A significant data breach could cost a financial institution millions in remediation and reputational damage, as evidenced by the average cost of a data breach in the financial sector, which reached $5.90 million in 2023.

Supplier Power 4

The reinsurance market, a critical component for insurers like Manulife, is experiencing significant shifts. While generally robust, it's contending with increased insured losses from natural catastrophes and the growing impact of social inflation, especially in US casualty insurance lines. This environment suggests a likely rise in casualty reinsurance pricing, which could translate to higher costs for Manulife across specific business areas.

For instance, the escalating frequency and severity of natural disasters in 2023, such as major hurricanes and wildfires, have depleted reinsurer capacity and driven up renewal rates. This trend is expected to continue into 2024, placing upward pressure on Manulife's reinsurance expenses for property-related risks.

- Elevated Natural Catastrophe Losses: Reinsurers faced substantial payouts in 2023, impacting their capital and leading to higher pricing for 2024 renewals.

- Social Inflation Concerns: Increased litigation costs and larger jury awards in the U.S. are driving up claims severity, particularly in casualty lines, forcing reinsurers to price for this risk.

- Potential for Increased Reinsurance Costs: Manulife may see higher premiums for casualty reinsurance, affecting its profitability in these segments.

- Impact on Manulife's Profitability: Rising reinsurance costs could squeeze Manulife's underwriting margins if these increases cannot be fully passed on to policyholders.

Supplier Power 5

The bargaining power of suppliers for Manulife is significantly influenced by the competition for specialized talent. In 2024, the demand for professionals skilled in artificial intelligence and private markets remains exceptionally high across the financial services sector. This intense competition can drive up salary expectations and the overall cost of acquiring and retaining these critical human resources, directly impacting Manulife's operational expenses and profitability.

Consider the following points regarding supplier power for Manulife:

- Talent as a Supplier: In the modern financial landscape, skilled professionals, especially in AI and private markets, function as key suppliers of essential expertise.

- Accelerating Competition: The wealth and asset management industry is witnessing a surge in competition for top-tier talent, making it more challenging and costly for firms like Manulife to attract and retain skilled employees.

- Cost Implications: Increased competition for talent directly translates to higher recruitment costs, competitive compensation packages, and retention bonuses, thereby elevating the cost base for Manulife.

- Impact on Innovation: The ability to secure and keep leading talent is crucial for Manulife's innovation in areas like AI-driven investment strategies and expanding its private markets offerings.

Manulife’s suppliers, particularly reinsurers and technology providers, exert considerable influence. The reinsurance market faces upward pressure on pricing due to increased catastrophe losses and social inflation, potentially raising Manulife’s costs. Similarly, the intense demand for AI and private market talent in 2024 inflates recruitment and retention expenses.

| Supplier Category | Key Influences | 2024/2025 Outlook | Impact on Manulife |

|---|---|---|---|

| Reinsurers | Natural catastrophe losses, social inflation | Rising pricing, stable capitalization | Higher reinsurance premiums, potential margin squeeze |

| Technology Providers (AI, Cloud) | High demand for advanced solutions | Strong global AI spending ($200B in 2024) | Increased costs for critical digital transformation tools |

| Specialized Talent (AI, Private Markets) | Intense competition across financial services | Elevated salary expectations and recruitment costs | Higher operational expenses, impact on innovation |

| Data Analytics & Cybersecurity | Criticality of data strategy and security | High cost of data breaches ($5.90M avg. in finance 2023) | Increased investment needed for data protection and analytics capabilities |

What is included in the product

Tailored exclusively for Manulife, this analysis dissects the competitive forces shaping its financial services environment, highlighting threats and opportunities.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Manulife's diverse customer base, from individual investors to large institutions, wields significant bargaining power. This is amplified by the digital age, offering unprecedented access to information and a vast marketplace of financial products and services. In 2024, the proliferation of online comparison tools and fintech innovations further empowers consumers to scrutinize fees, performance, and product features, driving down costs and demanding greater value.

Customers today have increasingly high expectations for personalized experiences, seamless digital interactions, and customized advice. In 2024, this trend is particularly evident in the financial services sector, where digital platforms offer easy comparison of offerings.

When companies fail to meet these elevated customer demands, the likelihood of customers switching providers grows substantially. For instance, a recent survey indicated that over 60% of consumers are willing to switch financial institutions for a better digital experience, directly amplifying buyer power.

This heightened ability for customers to choose and move between providers means they can exert greater pressure on firms to offer better terms, pricing, and services. In the insurance industry, where Manulife operates, this means customers can easily compare policies and demand more competitive rates.

In the insurance sector, customer loyalty is no longer a given; it's a critical strategic challenge. Manulife's policyholders are increasingly evaluating their options, moving beyond simple inertia to actively seek better value, superior service, or more tailored products. This shift means that retaining customers requires a proactive approach, as evidenced by the growing trend of switching providers for perceived advantages.

Buyer Power 4

The bargaining power of customers in the financial services sector, particularly for an entity like Manulife, is influenced by factors such as switching costs and the availability of alternatives. Lower switching costs for certain financial products, especially with the rise of digital-first solutions and embedded finance, can further empower customers.

For instance, some insurtech companies offer digital-only policies without traditional agents, potentially simplifying the switching process for consumers and increasing their leverage. This trend is reflected in the growing adoption of digital banking services, where customers can easily compare and switch providers. In 2023, fintech adoption reached 82% globally, indicating a significant shift towards digital channels that can facilitate easier customer transitions.

The increasing availability of a wide array of financial products from diverse providers means customers have more choices than ever before. This intensified competition naturally gives buyers more power to demand better terms, lower fees, and superior service. For example, the robo-advisor market has seen substantial growth, offering automated investment management at lower costs, thereby pressuring traditional wealth management firms.

- Lower Switching Costs: Digitalization and embedded finance reduce the effort and expense for customers to move between providers, especially for simpler financial products.

- Increased Product Availability: A wider range of financial products and services from various competitors gives customers more options and bargaining leverage.

- Information Transparency: Online comparison tools and reviews empower customers with readily available information to assess and choose the best offerings, increasing their power.

- Digital-First Solutions: The rise of insurtech and digital banking platforms simplifies the customer journey, making it easier to switch providers and negotiate terms.

Buyer Power 5

The mass-affluent investor segment, a key target for wealth management firms like Manulife, is experiencing a slowdown in asset growth. Projections indicate this segment’s assets will grow at a slower pace in 2024 compared to prior periods, intensifying competition for these clients.

This environment empowers customers. As firms vie for a smaller pool of rapidly expanding assets, clients can leverage their demands for better value and quality service. This increased client leverage translates directly into greater bargaining power for customers seeking favorable terms and fee structures.

- Slower Asset Growth: The mass-affluent segment’s projected slower asset growth for 2024 puts pressure on wealth managers.

- Increased Competition: Firms like Manulife face heightened competition for a more constrained client base.

- Client Demands: Customers are increasingly vocal about their expectations for value and service quality.

- Enhanced Bargaining Power: These factors collectively grant customers greater influence in negotiating fees and service agreements.

Manulife's customers, from individuals to institutions, hold significant power, amplified by digital access and a competitive market. In 2024, online tools and fintech innovations allow easy comparison of fees and performance, forcing providers to offer better value. This means customers can easily switch for superior digital experiences or personalized advice, pressuring Manulife to meet evolving demands.

The bargaining power of Manulife's customers is substantial, driven by increasing transparency and lower switching costs. In 2024, the rise of insurtech and digital banking platforms simplifies transitions, while a growing variety of financial products from competitors means customers can demand better terms and lower fees. For instance, the global fintech adoption rate reached 82% in 2023, illustrating a shift that facilitates easier customer movement.

| Factor | Impact on Manulife | 2024 Context |

|---|---|---|

| Digital Comparison Tools | Increased price sensitivity | Widespread availability of comparison websites |

| Fintech Innovations | Pressure on fees and service models | Growth in robo-advisors and digital-only products |

| Customer Expectations | Demand for personalization and digital experience | Over 60% of consumers willing to switch for better digital services |

| Asset Growth in Mass-Affluent Segment | Heightened competition for clients | Slower projected asset growth for the segment in 2024 |

Same Document Delivered

Manulife Porter's Five Forces Analysis

This preview displays the complete Manulife Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the insurance industry. You are viewing the exact, professionally formatted document that will be available to you immediately upon purchase, ensuring full transparency and immediate utility. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing critical insights for strategic decision-making. Rest assured, the document you see here is the final, ready-to-use report you will receive, containing no placeholders or samples.

Rivalry Among Competitors

Competitive rivalry in the financial services sector, encompassing life insurance and wealth management, is fierce. Manulife contends with numerous global financial giants, nimble specialized firms, and innovative fintech disruptors, all vying for market share.

In 2024, the global insurance market is projected for steady growth, with the life insurance segment remaining a significant contributor. For instance, the Insurance Information Institute reported that direct premiums written for life insurance in the U.S. reached $847.3 billion in 2022, indicating a substantial market that attracts intense competition.

This intense competition means Manulife must constantly innovate and differentiate its offerings. The rise of digital platforms and personalized financial solutions by competitors puts pressure on traditional business models, demanding agility and a customer-centric approach to retain and attract clients.

The presence of both established players and agile fintechs intensifies the rivalry. Many fintechs, for example, are leveraging AI and big data to offer more tailored investment advice and insurance products, forcing incumbents like Manulife to enhance their digital capabilities and product development cycles.

Technological advancements, particularly the widespread adoption of AI and generative AI, are significantly intensifying competitive rivalry within the financial services sector, impacting firms like Manulife. These technologies allow for hyper-personalized customer experiences and more efficient operational processes, creating a dynamic where early adopters gain a distinct advantage. For instance, AI-driven platforms are streamlining underwriting and claims processing, reducing operational costs and improving turnaround times. This rapid innovation cycle means that companies not investing in and implementing these advanced tools risk falling behind in customer satisfaction and cost competitiveness.

Competitive rivalry within the traditional insurance market is intense, particularly in mature economies where growth is often constrained. To overcome this, firms like Manulife are increasingly emphasizing personalized offerings and supplementary services to attract and retain customers, shifting the competitive battleground beyond mere price points.

This strategic pivot means that companies are fiercely competing on the quality of their service delivery and the uniqueness of their product features. For instance, in 2024, many insurers are investing heavily in digital platforms to enhance customer experience and streamline claims processing, aiming to differentiate themselves in a crowded marketplace.

The drive for differentiation leads to significant innovation, as insurers roll out specialized policies catering to niche markets or incorporating advanced analytics to offer more tailored risk assessments. This focus on value-added propositions is crucial for maintaining market share and fostering customer loyalty amidst a landscape where organic growth is challenging.

Competitive Rivalry 4

The wealth and asset management industry is seeing significant consolidation, largely fueled by private equity and banking institutions. This trend is creating larger, more powerful competitors for Manulife, capable of enhancing their scale and acquiring specialized skills or expanding into new territories more readily.

This consolidation means that Manulife faces rivals with greater financial muscle and broader operational reach. For instance, by mid-2024, private equity firms had invested billions into acquiring asset management businesses, bolstering their capacity to compete aggressively on price and service offerings.

- Increased Scale: Competitors are growing larger through acquisitions, enabling economies of scale that can translate to lower costs and more competitive pricing for clients.

- Enhanced Capabilities: Mergers and acquisitions allow rivals to quickly integrate new technologies, develop specialized investment strategies, or expand their geographic footprint.

- Private Equity Influence: The influx of private equity capital is a major driver, with firms like KKR and Blackstone actively expanding their asset management arms through strategic purchases.

- Bank Integration: Banks are also integrating wealth management services more deeply, leveraging their existing client bases and cross-selling opportunities to challenge independent asset managers.

Competitive Rivalry 5

Competitive rivalry within the financial services sector, particularly for a company like Manulife, is intensifying due to a confluence of factors. Geopolitical uncertainties, such as ongoing global conflicts and trade tensions, create market volatility, impacting investment returns and client confidence. This necessitates a proactive and adaptable approach to strategy.

The evolving regulatory landscape further complicates the competitive environment. For instance, stricter capital requirements and data privacy regulations, like those being considered or implemented in various jurisdictions throughout 2024, demand significant compliance investments and can alter market dynamics. Firms must navigate these external factors while simultaneously competing for market share, making strategic agility crucial for sustained success.

- Increased Competition: The global financial services market is highly competitive, with numerous large, well-established players and agile fintech startups vying for customers.

- Market Volatility: Fluctuations in global markets, driven by geopolitical events and economic shifts, create an unpredictable environment where firms must constantly adjust strategies.

- Regulatory Pressures: Evolving regulations across different regions require continuous adaptation and investment in compliance, impacting operational costs and strategic options.

- Digital Transformation: The rapid adoption of digital technologies by competitors forces traditional players like Manulife to invest heavily in innovation to remain relevant and attract new customer segments.

Competitive rivalry significantly impacts Manulife, with numerous global financial giants and agile fintechs vying for market share in the life insurance and wealth management sectors. In 2024, the global insurance market's steady growth, with U.S. life insurance premiums reaching $847.3 billion in 2022, underscores the intense competition Manulife faces.

Technological advancements, especially AI, are a major driver of this rivalry, enabling hyper-personalized customer experiences and more efficient operations, forcing firms to innovate rapidly. Moreover, consolidation within wealth management, fueled by private equity investments, creates larger, more formidable competitors for Manulife.

Geopolitical uncertainties and evolving regulatory landscapes further intensify this competitive environment, demanding strategic agility and significant compliance investments. Manulife must navigate these external factors while competing for market share, making continuous adaptation crucial for sustained success.

SSubstitutes Threaten

The threat of substitutes for Manulife's core life insurance offerings is significant, stemming from a growing array of alternative financial planning and risk management solutions. For individuals, particularly those with substantial existing wealth, the concept of self-insurance becomes a viable substitute. This involves leveraging personal savings, investment portfolios, or even business equity to cover potential financial shortfalls, thereby reducing reliance on traditional life insurance policies.

Furthermore, the market offers diverse investment vehicles that can effectively substitute for the wealth accumulation and protection aspects of life insurance. Options like low-cost ETFs, mutual funds, or even direct real estate investments can provide comparable or superior returns, coupled with greater liquidity, making them attractive alternatives for risk-averse individuals seeking to build financial security for their beneficiaries.

In 2023, the global InsurTech market continued its rapid expansion, with a notable surge in platforms offering personalized financial planning and investment management services. These digital-first solutions often present a more transparent and cost-effective approach compared to traditional insurance products, directly challenging Manulife's market share by appealing to digitally-savvy consumers who prioritize flexibility and control over their financial futures.

The threat of substitutes in wealth and asset management is significant, particularly from low-cost digital investment platforms and robo-advisors. These alternatives democratize investing by offering readily accessible, often automated investment solutions. For example, by the end of 2023, the global robo-advisor market was valued at over $23 billion, with projections indicating substantial growth as more individuals, especially younger and tech-savvy demographics, seek convenient and affordable ways to manage their wealth.

These digital platforms directly compete with traditional advisory services by providing similar portfolio management and financial planning tools at a fraction of the cost. They appeal to a growing segment of investors who are comfortable with technology and may not require the in-depth, personal relationship offered by a human advisor. This can divert a portion of Manulife's potential client base, especially those focused on cost-efficiency and digital convenience.

Employer-provided benefits and government social security programs represent significant substitutes for individual life and health insurance products. These offerings can reduce the perceived necessity for private coverage, impacting demand for Manulife's offerings. For instance, in 2024, the majority of large employers in North America continued to offer comprehensive health and life insurance plans, a trend that has persisted and may even see slight growth in certain sectors seeking to attract and retain talent.

4

The threat of substitutes for Manulife is significant, particularly from new financial products and services offered by non-traditional players. Embedded finance solutions, which integrate financial services into non-financial platforms, are blurring the lines between industries and providing consumers with alternative ways to access financial products. For instance, a retail platform might offer a buy-now-pay-later option directly at checkout, bypassing traditional lenders. This trend is growing rapidly; by 2025, the global embedded finance market is projected to reach over $7 trillion, according to some industry estimates, highlighting the substantial shift in how consumers engage with financial services.

These substitutes often offer greater convenience and a more seamless user experience, directly competing with Manulife's core offerings in insurance and wealth management. Think about how easily a user can access payment solutions within a ride-sharing app or a social media platform. This convenience factor is a powerful draw for consumers, especially younger demographics. The increasing digital native population is more receptive to these integrated financial experiences, potentially drawing them away from established financial institutions like Manulife.

Furthermore, the rise of fintech companies offering specialized digital-only financial solutions, such as peer-to-peer lending or robo-advisory services, presents another layer of substitution. These platforms can often operate with lower overheads, allowing them to offer competitive pricing. In 2024, the fintech sector continued its robust growth, with investments pouring into innovative solutions that directly challenge traditional banking and insurance models. This competitive pressure necessitates that Manulife continuously innovate and adapt its own digital strategies to remain relevant and attractive to a broad customer base.

- Embedded Finance Growth: The global embedded finance market is expected to exceed $7 trillion by 2025, indicating a substantial shift in financial service delivery.

- Customer Convenience: Non-traditional financial solutions often provide superior convenience, integrating financial services directly into everyday digital platforms.

- Fintech Innovation: Specialized fintech offerings, like robo-advisors and P2P lending, present direct competition with lower operational costs and potentially better pricing.

- Digital Demographics: Younger, digitally native consumers are more inclined to adopt these integrated and specialized financial services, impacting traditional players.

5

The threat of substitutes for Manulife's traditional insurance and wealth management products is escalating, particularly from agile fintech and insurtech firms. These disruptors often target specific market segments with digital-first, streamlined solutions that can be more appealing to certain customer demographics. For instance, by mid-2024, the global insurtech market was projected to reach over $2.5 billion, showcasing significant growth and investment in alternative insurance models.

These specialized companies can offer niche products, like parametric insurance triggered by specific events, or simplified digital platforms for investments, presenting a direct alternative to Manulife's broader offerings. This trend is amplified by evolving customer expectations for convenience and lower costs, pushing traditional players to innovate or risk losing market share. In 2023, over 70% of consumers expressed interest in digital-first financial services, highlighting the growing demand for these substitute solutions.

Furthermore, the increasing accessibility of DIY investment platforms and peer-to-peer lending services also acts as a substitute for traditional savings and investment products. Manulife must continuously adapt its digital capabilities and product innovation to remain competitive against these emerging and often more flexible alternatives.

- Fintech & Insurtech Growth: The global insurtech market is expanding rapidly, with projections indicating continued strong growth through 2024 and beyond.

- Customer Preference Shift: A significant majority of consumers are showing a preference for digital-first financial service experiences.

- Niche Product Appeal: Specialized, often digitally delivered, financial products are gaining traction by meeting specific customer needs efficiently.

- Competitive Pressure: Manulife faces direct competition from these agile substitutes, necessitating ongoing innovation in its digital offerings and product design.

The threat of substitutes for Manulife's core life insurance and wealth management services is considerable, driven by a dynamic financial landscape. Individuals can increasingly self-insure by leveraging substantial personal investments, reducing the need for traditional life insurance. Furthermore, readily available low-cost ETFs and mutual funds offer comparable wealth accumulation potential with greater liquidity, directly challenging the value proposition of life insurance as an investment vehicle. By the close of 2023, the global robo-advisor market, a key substitute for traditional wealth management, was valued at over $23 billion, underscoring the growing appeal of digital, cost-effective alternatives.

Embedded finance solutions, integrating financial services into non-financial platforms, also pose a significant substitution threat. These offerings, such as buy-now-pay-later options at retail checkouts, bypass traditional financial institutions. The global embedded finance market is projected to exceed $7 trillion by 2025, indicating a major shift in how consumers access financial products, often prioritizing seamless digital experiences over traditional offerings.

Entrants Threaten

The threat of new entrants in the financial services sector, especially for companies like Manulife operating in insurance and wealth management, is generally low. This is primarily due to substantial capital requirements needed to establish operations and meet regulatory obligations. For instance, in 2024, regulatory capital requirements for life insurers in many jurisdictions remain stringent, often running into hundreds of millions of dollars.

Furthermore, the industry demands significant investment in technology, data analytics, and compliance infrastructure, creating another layer of entry barriers. Building a trusted brand and a loyal customer base in financial services takes years, if not decades, of consistent performance and ethical conduct, which new players lack. Manulife's established reputation and long history in the market significantly insulate it from direct competition from nascent entities.

The threat of new entrants in the insurance and wealth management sector, particularly for a company like Manulife, is significantly mitigated by high regulatory complexity and substantial compliance costs. New players must invest heavily in legal and compliance infrastructure to navigate diverse global and local regulations, a considerable hurdle for smaller startups. For instance, in 2024, compliance costs for financial institutions globally continue to rise, with many reporting a significant portion of their operating budget dedicated to meeting regulatory requirements.

Building extensive distribution networks, a crucial element in the insurance and wealth management sectors, presents a significant barrier for new entrants. This process is not only time-consuming but also demands substantial capital investment. Manulife, for instance, leverages a formidable global network comprising over 109,000 agents and thousands of distribution partners. This established infrastructure serves a massive customer base of over 36 million individuals worldwide, making it exceedingly difficult for newcomers to match its reach and market penetration.

4

While the insurance industry traditionally presents high barriers to entry, including significant capital requirements and regulatory hurdles, technological shifts are beginning to democratize access. Fintech and insurtech innovations are particularly impactful, enabling new players to adopt digital-first strategies that bypass the need for extensive physical branch networks, a major historical cost for incumbents. For instance, companies like Kin Insurance and Ethos Life have successfully leveraged technology to streamline policy acquisition, demonstrating how digital platforms can reduce upfront investment and accelerate market penetration. This evolution suggests that while established players benefit from scale and brand recognition, the threat from nimble, digitally-native entrants is growing.

The evolving landscape is evidenced by the increasing investment in insurtech. In 2023, global insurtech funding reached approximately $3.2 billion, indicating continued investor confidence in new models that challenge traditional insurance operations. These new entrants often focus on specific niches or customer segments, utilizing data analytics and AI to offer more personalized and efficient customer experiences.

- Technological advancements in fintech and insurtech are lowering entry barriers.

- Digital-first models reduce the need for extensive physical infrastructure.

- Companies like Kin and Ethos exemplify the success of tech-enabled insurance sales.

- The global insurtech funding in 2023, around $3.2 billion, highlights investor interest in new entrants.

5

The threat of new entrants in the insurance and financial services sector, particularly for a company like Manulife, is moderately high. A significant barrier is the substantial capital required to establish operations, build a customer base, and comply with stringent regulatory frameworks. For instance, in 2024, new insurtech startups often face significant hurdles in securing seed funding and subsequent rounds to scale their operations effectively against established giants.

Access to proprietary data and advanced analytics is a key differentiator. Manulife leverages decades of historical customer data to refine its product offerings and enhance risk assessment models. New entrants must either develop these capabilities from scratch, which is time-consuming and expensive, or acquire them, often at a premium.

However, the increasing accessibility of AI tools in 2024 is starting to democratize some aspects of data analysis, potentially lowering the barrier for agile new players. This could enable them to offer more personalized products or more efficient customer service, challenging incumbents.

Despite this, the ingrained trust and brand loyalty that established players like Manulife enjoy, built over many years, remain a formidable obstacle. New entrants need to invest heavily in marketing and building credibility to attract customers away from familiar and trusted brands.

- Capital Requirements: High initial investment needed for licensing, technology, and marketing.

- Data Access: Established firms possess vast historical data, a significant advantage over new entrants.

- Regulatory Hurdles: Navigating complex and evolving financial regulations is a major challenge.

- Brand Loyalty: Incumbents benefit from established trust and customer relationships.

- Technological Advancements: While AI democratizes some aspects, significant tech investment is still required.

The threat of new entrants for Manulife remains generally low due to significant capital requirements, stringent regulatory compliance, and the need for established trust. For instance, in 2024, regulatory capital for life insurers often exceeds hundreds of millions of dollars, a substantial barrier for startups. Building a trusted brand in financial services takes years, making it difficult for new players to compete with Manulife's long-standing reputation and extensive customer base of over 36 million.

While fintech and insurtech innovations are lowering some entry barriers by enabling digital-first strategies, these new entrants still face considerable challenges. Companies like Kin Insurance and Ethos Life have seen success, but they often focus on specific niches. Global insurtech funding in 2023 was around $3.2 billion, indicating investor interest, but scaling to compete with established players like Manulife requires overcoming significant hurdles in data access and brand loyalty.

| Barrier Type | Description | Example for Manulife |

| Capital Requirements | High initial investment for licensing, technology, and marketing. | Regulatory capital often in the hundreds of millions of dollars (2024). |

| Regulatory Hurdles | Navigating complex and evolving financial regulations. | Compliance costs are a significant portion of operating budgets globally. |

| Brand Loyalty & Trust | Established firms benefit from ingrained trust and customer relationships. | Manulife's decades of operation build strong customer loyalty. |

| Distribution Networks | Building extensive agent and partner networks is time-consuming and costly. | Manulife's network of over 109,000 agents. |

| Data & Analytics | Access to historical data for product refinement and risk assessment. | Manulife leverages decades of customer data for competitive advantage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Manulife is built upon a robust foundation of data, including Manulife's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific research from reputable sources and analyses of regulatory filings to provide a comprehensive view.