Manulife PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manulife Bundle

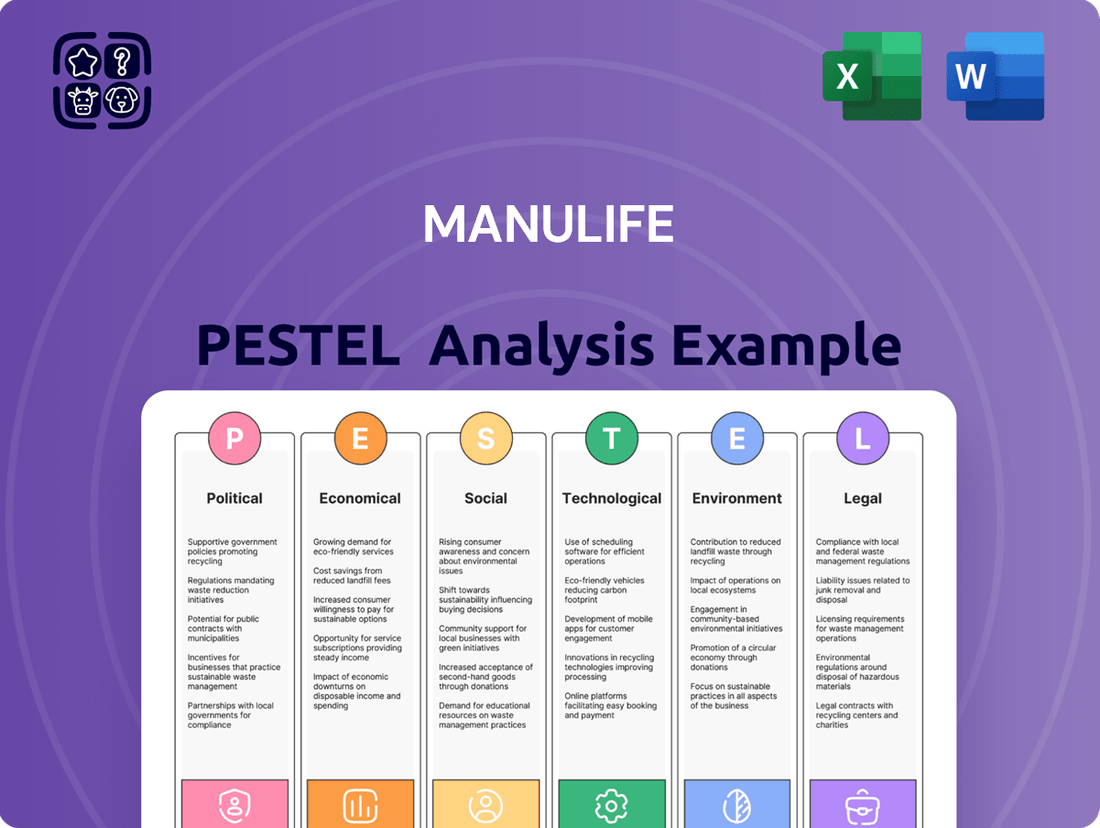

Unlock the strategic landscape surrounding Manulife with our comprehensive PESTLE analysis. We delve into the Political, Economic, Social, Technological, Legal, and Environmental factors that are actively shaping the future of this global financial giant. Understand the opportunities and threats that lie ahead, enabling you to make more informed decisions.

Our expertly crafted analysis provides actionable intelligence, perfect for investors, strategists, and anyone seeking to understand Manulife's operating environment. Don't get left behind in a rapidly evolving market; gain the clarity you need to navigate complex external forces.

Ready to elevate your understanding? Purchase the full Manulife PESTLE analysis today and access deep-dive insights that can inform your own business strategy and investment planning.

Political factors

Government regulatory oversight is a critical political factor for Manulife. Financial services firms like Manulife are subject to a complex web of rules designed to ensure stability and protect consumers. For instance, in 2024, many countries are focusing on enhancing solvency requirements and capital adequacy ratios for insurers, directly impacting how much capital Manulife must hold. This means adapting to potentially higher reserve requirements or adjusted investment strategies.

Changes in regulations can significantly influence Manulife's operational costs and product development. For example, new consumer protection laws might necessitate changes to sales practices or product features, potentially increasing compliance expenses. Furthermore, shifts in cross-border financial regulations could affect Manulife's market access in key regions, influencing its global expansion strategies and revenue streams.

Geopolitical stability is a critical factor for Manulife, a global financial services provider. Shifting trade relations and international tensions can directly impact the company's diverse operations and investment decisions across various continents. For instance, the ongoing trade disputes between major economic powers could lead to increased volatility in global markets, affecting Manulife's investment portfolios and the overall profitability of its international ventures.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new tariffs, can create significant headwinds. These shifts can disrupt the flow of capital, introduce currency exchange rate volatility – a key concern for a company with substantial overseas earnings – and directly influence the financial performance of Manulife's subsidiaries and investment activities in affected regions. For example, in 2023, global trade growth slowed, impacting cross-border investment opportunities.

Manulife's profitability is directly shaped by changes in corporate tax rates, premium taxes, and taxes on investment income across its operating regions. For instance, a reduction in corporate tax rates in Canada, where Manulife is headquartered, could boost its net earnings. Conversely, increases in premium taxes in key markets like the United States or Asia would likely reduce its margins on insurance products.

Favorable tax environments can enhance Manulife's competitive edge by allowing it to retain more earnings for reinvestment or shareholder returns. Conversely, unfavorable tax policies can hinder its growth prospects and its capacity to compete effectively with local players who may benefit from more advantageous tax structures.

As of early 2025, discussions around potential tax reforms in several G7 nations, including adjustments to corporate tax structures, could present both opportunities and challenges for Manulife. The company actively monitors these evolving tax landscapes to optimize its financial strategies and ensure compliance.

Government Healthcare Policies

Government healthcare policies significantly shape the demand for private insurance. For instance, in 2024, many governments are focusing on expanding public healthcare access, potentially reducing the immediate need for certain private health insurance plans. However, this can also create opportunities for Manulife's supplementary products designed to cover gaps in public provisions or offer enhanced services.

The evolving landscape of social security programs also plays a crucial role. Decisions to increase or decrease government spending on pensions and unemployment benefits, as seen in various budget discussions for 2025, can directly impact individuals' disposable income and their willingness to invest in private life insurance and retirement solutions.

Consider these impacts:

- Expansion of Public Healthcare: In countries like Canada, where public healthcare is extensive, government decisions to bolster these services could lead to a more saturated market for basic private health coverage.

- Focus on Preventative Care: Government initiatives promoting preventative health in 2024-2025 might shift consumer focus from reactive treatment insurance to wellness programs, an area Manulife could leverage.

- Social Security Reforms: Changes in social security contributions or benefit levels, as debated in the UK's upcoming fiscal plans, directly influence the attractiveness of private pension and life assurance products.

Political Risk in Emerging Markets

Manulife's significant operations in emerging markets mean it faces heightened political risks. These can range from the threat of nationalization of assets, as seen in certain sectors in some developing nations, to outright political instability that can disrupt economic activity and financial markets. For instance, countries experiencing significant political upheaval often see currency devaluations and capital flight, directly impacting the value of investments and profitability.

Unpredictable policy changes are another major concern. Governments in emerging economies may rapidly alter regulations concerning foreign investment, taxation, or the financial services sector. These shifts can significantly impact Manulife's business model and profitability. For example, a sudden increase in corporate taxes or new capital controls could directly reduce earnings or hinder the repatriation of profits. As of late 2024, several emerging markets were grappling with political transitions, leading to increased policy uncertainty in areas such as financial regulation and foreign ownership limits.

- Nationalization Risk: While direct nationalization of financial institutions is rare, governments may impose stringent regulations that effectively limit private sector operations or favor state-owned enterprises, indirectly impacting Manulife's market share and profitability.

- Political Instability: Emerging markets are often more susceptible to political instability, including protests, coups, or civil unrest. Such events can lead to economic disruption, damage to infrastructure, and a decline in consumer confidence, all of which negatively affect insurance and investment sales.

- Policy Volatility: Frequent changes in government policies, such as alterations in foreign exchange controls, banking regulations, or dividend payout rules, can create an unpredictable operating environment for Manulife. These shifts can impact capital management and investment strategies.

- Geopolitical Tensions: Manulife's exposure to emerging markets also means it's subject to geopolitical tensions between countries, which can lead to trade disputes, sanctions, or other measures that disrupt cross-border financial flows and economic growth.

Government policies concerning financial services directly impact Manulife's operations and profitability through regulations on capital requirements, consumer protection, and market access. For instance, as of early 2025, many jurisdictions are reviewing solvency standards, potentially increasing capital needs for insurers like Manulife.

Tax policies, including corporate and premium taxes, significantly influence Manulife's net earnings and competitive positioning. For example, any changes to corporate tax rates in Canada or the US in 2024-2025 could materially affect the company's bottom line.

Healthcare and social security reforms also play a crucial role, impacting the demand for private insurance and retirement products. Government decisions in 2024-2025 to expand public healthcare or alter pension benefits directly influence individual spending on Manulife's offerings.

Political stability and evolving trade relations are critical for Manulife's global operations. Geopolitical tensions and shifts in trade agreements can create market volatility and affect cross-border investment flows, as seen with the slowdown in global trade growth in 2023.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Manulife, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise PESTLE analysis of Manulife's external environment, presented in an easily digestible format, alleviates the pain of sifting through extensive reports, enabling faster strategic decision-making.

Economic factors

Fluctuations in global interest rates directly impact Manulife's financial performance. For instance, the Bank of Canada maintained its key policy rate at 5.00% throughout much of late 2023 and into 2024, a period where Manulife, like many financial institutions, navigated lower investment yields on its fixed-income portfolios. Conversely, when rates are higher, the cost of borrowing for Manulife's clients can increase, potentially affecting demand for certain products, while also leading to higher returns on new investments.

A persistently low-interest-rate environment, such as that experienced in prior years, tends to compress the investment income Manulife generates, impacting its profitability. Conversely, the anticipated trajectory of interest rates in 2024 and 2025, with expectations for potential cuts by central banks but still at elevated levels compared to the early 2020s, means Manulife must carefully manage its asset-liability matching. Rising rates can also influence policy surrenders, as policyholders may seek to access cash values when alternative investments offer more attractive returns.

Inflationary pressures remain a significant concern for Manulife. Persistent high inflation, as seen with the US Consumer Price Index (CPI) hovering around 3.4% year-over-year in early 2024, can significantly erode the purchasing power of future insurance payouts, impacting the real value of long-term liabilities. This also drives up Manulife's operational costs, from administrative expenses to claims processing, potentially squeezing profit margins if not effectively passed on or offset.

To counter these effects, Manulife must strategically manage its investment portfolio. By investing in assets that historically perform well during inflationary periods, such as inflation-linked bonds or equities with pricing power, the company aims to protect the real value of its assets against rising prices. Furthermore, careful adjustments to pricing strategies, ensuring premiums keep pace with anticipated inflation without deterring customers, are crucial for maintaining financial stability and profitability in this economic climate.

Strong economic growth, as seen in many developed nations through 2024 and into early 2025, generally boosts disposable incomes. This increased financial capacity directly fuels demand for insurance and wealth management services, benefiting companies like Manulife.

Low unemployment rates are a key indicator of economic health, further supporting higher consumer spending on financial products. For instance, if unemployment remains below 4% in major markets where Manulife operates, it signals a robust consumer base ready to invest in their future security.

Conversely, economic slowdowns or recessions present significant headwinds. A rise in unemployment, potentially exceeding 5-6% in key regions, could lead to reduced new policy sales and an increase in existing policy surrenders as individuals prioritize immediate needs over long-term financial planning.

Downturns also directly impact asset under management (AUM) growth. As investment values decline during economic contractions, Manulife's fee-based revenue streams tied to AUM will likely shrink, affecting overall profitability and growth prospects.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Manulife as a global financial services provider. Fluctuations in exchange rates directly impact the conversion of its international earnings and the valuation of assets held in foreign currencies into its primary reporting currency, typically the Canadian dollar. This can lead to unpredictable swings in reported financial performance, making it harder to forecast results and potentially affecting investor confidence.

For instance, a strengthening Canadian dollar against currencies where Manulife operates extensively, such as the US dollar or the Euro, would translate foreign profits into fewer Canadian dollars. Conversely, a weakening Canadian dollar would boost those reported earnings. This dynamic directly influences Manulife's competitive positioning; for example, pricing for its insurance or investment products in a market where the local currency has weakened against the Canadian dollar might appear more expensive to local consumers, or Manulife may need to absorb the difference to remain competitive.

- Impact on Earnings Translation: In 2024, the Canadian dollar experienced periods of volatility, trading within a range against the US dollar, which directly affects the translation of Manulife's substantial US-based operations.

- Competitive Pricing Pressures: For example, if Manulife's Canadian dollar-denominated costs are high and the USD weakens significantly, its US operations may need to adjust pricing or accept lower profit margins to remain competitive in the American market.

- Asset Valuation Fluctuations: Changes in exchange rates can also alter the book value of Manulife's foreign assets, impacting its balance sheet and capital ratios.

- Hedging Strategies: Manulife employs various hedging strategies to mitigate these currency risks, but the effectiveness and cost of these hedges can also fluctuate with market conditions.

Capital Market Performance

Manulife's financial health is significantly tied to how global equity and bond markets perform. When markets are doing well, often referred to as a bull market, the value of the assets Manulife manages tends to increase. This boosts their assets under management (AUM) and, consequently, the investment income generated. For instance, as of early 2024, many major equity indices showed strong year-over-year gains, benefiting companies like Manulife with substantial investment holdings.

Conversely, a downturn in these markets, known as a bear market, can have the opposite effect. Losses in investment portfolios can directly impact Manulife's profitability. Furthermore, reduced market values can lead to lower fee income from its wealth and asset management operations, as these fees are often calculated as a percentage of AUM. The volatility experienced in late 2023 and early 2024, with fluctuating interest rates and geopolitical uncertainties, highlights this sensitivity.

Looking at the 2024-2025 outlook, analysts anticipate continued market fluctuations. Factors such as inflation rates, central bank policies, and economic growth projections will play a crucial role. Manulife's strategy likely involves navigating these conditions by diversifying its investment strategies and managing risk effectively to mitigate potential downturns while capitalizing on growth opportunities.

Key performance indicators to monitor include:

- Global Equity Market Performance: Tracking major indices like the S&P 500, MSCI World, and relevant regional benchmarks for trends and volatility.

- Bond Market Yields and Returns: Observing government and corporate bond yields, as well as overall bond market performance, to gauge interest rate impacts and risk appetite.

- Assets Under Management (AUM) Growth: Monitoring Manulife's AUM figures, which are a direct reflection of market performance and client inflows/outflows.

- Investment Income: Analyzing the investment income Manulife reports, a key driver of its profitability, which is heavily influenced by capital market returns.

Economic growth significantly influences Manulife's business. Strong GDP expansion, for instance, in Canada and the US during early 2024, typically translates to higher disposable incomes, driving demand for insurance and wealth management products. Conversely, a slowdown could curb new business and increase policy surrenders.

Interest rate movements are critical. While higher rates can boost investment income on new assets, they also increase borrowing costs for clients and can trigger policy surrenders. The Bank of Canada's steady 5.00% rate through much of late 2023 and 2024 meant lower yields on existing fixed-income portfolios for Manulife.

Inflation also poses a challenge. High inflation, with US CPI around 3.4% year-over-year in early 2024, erodes the real value of future payouts and raises operational costs, impacting profit margins if not managed through pricing adjustments and strategic investments.

Currency fluctuations directly affect Manulife's international earnings. A stronger Canadian dollar in 2024, for example, would reduce the reported value of profits earned in USD or EUR, influencing financial performance and competitive pricing.

Preview Before You Purchase

Manulife PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Manulife delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, competitive landscapes, and strategic considerations. This detailed report provides a robust foundation for understanding Manulife's operational context and future outlook.

Sociological factors

The world's population is getting older. In 2023, over 1.5 billion people were aged 65 and over, a number projected to reach 2.2 billion by 2050. This trend is particularly pronounced in many of Manulife's core markets, like Canada, the US, and parts of Asia. This demographic shift is a significant driver for increased demand for retirement income solutions, annuities, and products that cover long-term care needs.

Manulife is well-positioned to capitalize on this aging global population. The company's focus on wealth and asset management, coupled with its life and health insurance offerings, directly addresses the financial security needs of an older demographic. For instance, Manulife's annuity sales in Canada saw a notable increase in recent years, reflecting this growing demand. By developing specialized products and advisory services tailored to seniors, Manulife can tap into this expanding market segment.

Consumer financial literacy is on the rise, with a growing demand for personalized and digital financial services. This shift influences how Manulife develops and delivers its offerings. For instance, a 2024 report indicated that 65% of millennials actively seek out financial education resources online, signaling a more informed customer base.

Manulife needs to adapt to consumers who are more knowledgeable and expect greater transparency and convenience in their financial interactions. This includes a preference for intuitive digital platforms and clear communication regarding product features and fees. By 2025, it's projected that over 70% of financial transactions will be conducted digitally, underscoring this behavioral trend.

The escalating global focus on health and wellness directly influences the insurance market. As people become more proactive about their well-being, there's a growing demand for life and health insurance products that reflect these lifestyle shifts. For instance, by 2025, the global wellness market is projected to reach $7.0 trillion, underscoring a significant consumer commitment to health.

Manulife can capitalize on this by developing innovative insurance solutions that reward healthy behaviors, such as offering lower premiums for policyholders who meet certain fitness goals or participate in wellness programs. This strategic alignment with consumer values not only meets market demand but also fosters long-term customer loyalty and strengthens Manulife's brand image as a health-conscious insurer.

Workforce Demographics and Expectations

Workforce demographics are shifting, with the gig economy and a younger generation entering the job market, significantly impacting how employees view and demand benefits. Manulife must adapt its group benefits and retirement plans to align with these evolving expectations and diverse employment structures.

For instance, in 2024, a substantial portion of the workforce participates in non-traditional employment. Manulife's strategy needs to accommodate this by offering flexible benefit packages. This includes catering to the increasing demand for portable benefits that follow the worker, not the employer.

- Rising Gig Economy Participation: Approximately 36% of the US workforce has participated in gig work at some point, a trend expected to continue growing through 2025.

- Younger Workforce Expectations: Millennials and Gen Z, who will constitute a larger percentage of the workforce by 2025, prioritize mental health support and flexible work arrangements in their benefits packages.

- Demand for Digital Tools: Employees increasingly expect digital platforms for managing benefits, demonstrating a need for Manulife to invest in user-friendly technology.

- Focus on Financial Wellness: Beyond traditional retirement savings, younger workers are seeking comprehensive financial wellness programs, including education and planning tools.

Social Attitudes Towards Risk and Insurance

Societal views on risk and the necessity of insurance are dynamic, shifting with cultural backgrounds and generational perspectives. For instance, in many Western societies, there's a growing emphasis on personal financial responsibility, which can translate into higher demand for insurance solutions. Conversely, in cultures with stronger community support systems, reliance on formal insurance might be perceived differently.

Manulife needs to navigate these varying perceptions to tailor its marketing and product offerings effectively. Understanding how different demographics, such as Millennials versus Baby Boomers, perceive risk – for example, with Millennials often prioritizing experiences over traditional asset accumulation – is crucial. In 2024, global insurance penetration rates varied significantly, with developed economies like the United States seeing higher rates compared to some emerging markets, reflecting these underlying social attitudes.

The perceived value of insurance is also influenced by trust in financial institutions and past experiences with claims. Building and maintaining this trust is paramount for Manulife, especially when entering new markets or launching innovative products. A recent survey indicated that over 60% of individuals globally believe insurance is important for financial security, but a significant portion still finds it complex or unaffordable, highlighting an opportunity for clearer communication and accessible product design.

- Generational Differences: Younger generations may favor flexible, digital-first insurance solutions, while older generations might prefer traditional, face-to-face interactions and comprehensive coverage.

- Cultural Nuances: Attitudes towards shared responsibility versus individual accountability impact the perceived need for personal insurance policies.

- Trust and Transparency: Societal trust in financial institutions directly correlates with willingness to adopt insurance products; clear communication about policy terms and claims processes is vital.

- Economic Conditions: Perceptions of risk and the ability to afford insurance premiums are heavily influenced by prevailing economic stability and individual financial well-being.

Societal attitudes towards financial security and risk management are evolving, with a growing emphasis on personalized financial planning and digital accessibility. As of 2024, a significant portion of consumers, particularly younger demographics, are seeking more tailored financial advice and efficient online tools for managing their wealth and insurance needs.

Manulife's strategic approach must account for these shifts by enhancing digital platforms and offering products that cater to diverse life stages and risk appetites. For example, the company's investment in digital advisory services aims to meet the demand for convenient, data-driven financial solutions, with projections indicating continued growth in digital engagement through 2025.

Consumer trust in financial institutions remains a critical factor, influenced by transparency and consistent delivery of value. Building this trust is essential for Manulife to foster long-term customer relationships and expand its market reach, especially as societal expectations for ethical business practices intensify.

Technological factors

Manulife's digital transformation is a critical technological factor, demanding substantial investment in system modernization and automation. This includes implementing AI for claims processing, a move that can significantly reduce turnaround times and improve accuracy. For instance, the broader financial services industry saw AI adoption in operations increase by an estimated 30% between 2022 and 2024, according to industry reports.

Robotic Process Automation (RPA) is also key for streamlining back-office tasks, which can lead to cost savings and increased efficiency. Many financial institutions are reporting efficiency gains of up to 40% in areas where RPA has been successfully deployed. Furthermore, developing intuitive digital platforms for policy management is essential for enhancing customer experience and engagement in 2024 and beyond.

Manulife is increasingly leveraging data analytics and artificial intelligence to understand its customers better, refine its risk assessment processes for underwriting, and tailor its product and service offerings. This strategic adoption of advanced technologies is vital for maintaining a competitive edge in the financial services industry.

These technological advancements empower Manulife with more efficient operational capabilities and enable highly targeted marketing campaigns. For instance, by mid-2024, financial institutions globally reported a significant increase in AI adoption for fraud detection, with some seeing a reduction in false positives by up to 30%, a capability Manulife likely aims to replicate and expand upon.

Manulife, like all financial institutions, operates in an environment where cybersecurity threats are a constant and growing concern. Handling massive volumes of sensitive customer data, from personal identification to financial transaction details, makes the company a prime target for cybercriminals. The integrity of this data and the trust of its millions of customers depend heavily on the strength of its digital defenses.

The financial services sector experienced a significant increase in cyberattacks. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a 15% increase over two years, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial and reputational risks associated with inadequate cybersecurity measures.

Implementing and continuously updating robust cybersecurity protocols is not merely a technical necessity but a core business imperative for Manulife. These measures are crucial for safeguarding data, maintaining customer confidence, and ensuring compliance with stringent data protection regulations like GDPR and CCPA. Failure to do so can result in catastrophic data breaches, leading to severe financial penalties and irreparable damage to brand reputation.

Fintech Innovation and Competition

The financial technology, or fintech, landscape is rapidly evolving, presenting both challenges and opportunities for established players like Manulife. New fintech companies are entering the market with innovative approaches to insurance, investment advice, and payment processing, directly competing with traditional financial services. This surge in innovation means Manulife needs to adapt quickly.

To stay relevant, Manulife is actively engaging with the fintech sector. For instance, in 2024, Manulife’s venture capital arm, Manulife Financial Corporation, continued to invest in promising fintech startups. These investments are strategic, aiming to foster innovation and gain insights into emerging technologies that can enhance Manulife’s digital insurance offerings and robo-advisor platforms.

The competition is fierce. Global fintech funding reached significant levels in 2023 and is projected to remain strong through 2024 and 2025, with a particular focus on areas like embedded finance and AI-driven customer solutions. Manulife’s strategy involves a multi-pronged approach: acquiring promising fintechs, forging strategic partnerships to leverage their technology, and developing its own in-house digital capabilities. This ensures Manulife can meet the increasingly digital-first expectations of its customers.

The impact of these technological factors is substantial. By embracing fintech, Manulife aims to:

- Enhance customer experience through seamless digital platforms

- Introduce new, agile products and services

- Improve operational efficiency via automation and data analytics

- Access new customer segments through digital channels

Cloud Computing Adoption

Manulife's embrace of cloud computing significantly bolsters its operational agility. This adoption allows for enhanced scalability, crucial for handling fluctuating customer demands and expanding into new markets. For instance, by migrating key services to the cloud, Manulife can rapidly adjust its IT resource allocation, a stark contrast to the lengthy procurement cycles of traditional on-premise infrastructure. This flexibility directly supports their ongoing digital transformation efforts and global growth strategies.

Cost-efficiency is another major technological advantage. Cloud solutions often operate on a pay-as-you-go model, which can lead to substantial savings compared to the capital expenditure required for maintaining extensive data centers. This financial benefit is particularly relevant as Manulife continues to invest in advanced analytics and customer-facing digital platforms. In 2024, many financial institutions reported double-digit percentage reductions in IT operational costs after migrating significant workloads to cloud environments.

Furthermore, cloud-based platforms accelerate product development cycles and improve data management capabilities. Manulife can leverage cloud services for faster deployment of new financial products, better data analytics for personalized customer experiences, and more robust disaster recovery systems. This technological foundation is essential for maintaining a competitive edge in the rapidly evolving financial services landscape, especially with increasing data volumes and regulatory compliance requirements.

- Enhanced Scalability: Cloud adoption allows Manulife to dynamically adjust IT resources based on real-time business needs, supporting rapid growth.

- Cost Optimization: Migration to cloud services can reduce IT operational expenses, freeing up capital for innovation. Reports from 2024 indicated average IT cost savings of 15-20% for companies adopting hybrid cloud models.

- Accelerated Innovation: Cloud infrastructure facilitates quicker development and deployment of new digital products and services, improving time-to-market.

- Improved Data Management & Resilience: Cloud solutions offer advanced data analytics capabilities and more resilient operational frameworks, crucial for data security and business continuity.

Technological advancements are reshaping the financial services sector, pushing companies like Manulife to prioritize digital transformation, AI, and data analytics for enhanced customer experience and operational efficiency. Investment in these areas is crucial for staying competitive. For instance, by mid-2024, financial institutions globally reported a significant increase in AI adoption for fraud detection, with some seeing a reduction in false positives by up to 30%.

Cybersecurity remains a paramount technological concern, with the financial services sector facing increased threats. The global average cost of a data breach reached $4.45 million in 2023, a 15% increase over two years, underscoring the need for robust digital defenses to protect sensitive customer data and maintain trust. This necessitates continuous updates to security protocols to comply with regulations and prevent breaches.

The rapid evolution of fintech presents both challenges and opportunities, driving Manulife to invest in and partner with startups to leverage new technologies. Global fintech funding remained strong through 2024, focusing on areas like embedded finance and AI. Manulife's strategy involves acquiring, partnering, and developing in-house capabilities to meet digital-first customer expectations.

Cloud computing adoption by Manulife offers significant benefits, including enhanced scalability, cost-efficiency, and accelerated innovation. Migrating to cloud environments can reduce IT operational costs, with reports from 2024 indicating average IT cost savings of 15-20% for companies adopting hybrid cloud models, freeing up capital for strategic investments in digital platforms and product development.

| Technological Factor | Impact on Manulife | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Digital Transformation & AI | Improved operational efficiency, enhanced customer experience, better risk assessment. | AI adoption in financial services operations increased by ~30% (2022-2024). AI for fraud detection reduced false positives by up to 30% (mid-2024). |

| Cybersecurity | Mitigation of financial and reputational risks associated with data breaches. | Global average cost of data breach: $4.45M (2023), a 15% increase over two years. |

| Fintech Integration | Access to new technologies, competitive product development, market expansion. | Global fintech funding strong through 2024, focusing on embedded finance and AI solutions. |

| Cloud Computing | Increased agility, scalability, cost optimization, faster product deployment. | Average IT cost savings of 15-20% from hybrid cloud models (2024 reports). |

Legal factors

Manulife navigates a complex web of insurance laws globally, impacting everything from policy wording and premium setting to the financial reserves it must hold. These regulations are designed to protect consumers and ensure the stability of the insurance market. For instance, in Canada, the Office of the Superintendent of Financial Institutions (OSFI) sets capital requirements, and in 2023, Manulife reported total capital of approximately CAD 33.9 billion, well above regulatory minimums.

Failure to comply with these often-evolving legal mandates can result in significant fines and, in extreme cases, the loss of operating licenses, severely disrupting business. Manulife's adherence to regulations like Solvency II in Europe, which dictates capital adequacy, is crucial for its continued operations and reputation. The company's 2024 projections anticipate continued investment in compliance technology and personnel to manage these diverse legal landscapes effectively.

Manulife navigates a complex web of data privacy and protection laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), which significantly impact its operations. Strict adherence to these regulations is paramount, requiring robust data handling, secure storage, and transparent consent mechanisms to safeguard customer information. Non-compliance can lead to substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the critical nature of Manulife's data governance practices in 2024 and beyond.

Manulife operates under stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations worldwide, crucial for combating financial crime. These laws mandate rigorous internal controls, including thorough client due diligence and the reporting of suspicious transactions, to prevent the company's services from being exploited for illicit purposes.

In 2024, financial institutions like Manulife are investing heavily in advanced technology and enhanced training to meet evolving AML/ATF standards. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national regulations and requiring continuous adaptation by global financial players.

Failure to comply with these regulations can result in substantial fines and severe reputational damage. Manulife's commitment to robust compliance frameworks is therefore essential for maintaining trust with customers, regulators, and the broader financial ecosystem, safeguarding its operational integrity.

Consumer Protection Legislation

Consumer protection legislation significantly shapes how Manulife operates, particularly concerning fair sales practices and transparent disclosure requirements. These laws ensure customers receive accurate information about financial products and services, impacting how Manulife markets its offerings and handles customer inquiries. In 2024, regulatory bodies continued to emphasize enhanced disclosure for investment products, with potential fines for non-compliance reaching millions.

Compliance with these regulations is not just a legal necessity but a cornerstone of maintaining customer trust and brand reputation. Manulife, like other financial institutions, must adhere to stringent rules regarding complaint handling procedures to address customer grievances effectively. Failure to do so can lead to reputational damage and loss of business. For instance, in the first half of 2025, the Canadian financial sector saw a notable increase in consumer complaints related to digital service accessibility, prompting regulators to issue new guidelines.

- Fair Sales Practices: Ensuring ethical and transparent sales tactics in all customer interactions.

- Disclosure Requirements: Providing clear and comprehensive information on product features, risks, and fees.

- Complaint Handling: Establishing robust procedures for addressing and resolving customer issues promptly.

- Regulatory Scrutiny: Adapting to evolving consumer protection laws and enforcement actions by financial regulators.

Competition and Antitrust Laws

Manulife operates under stringent competition and antitrust laws designed to prevent monopolies and foster a fair marketplace in financial services. These regulations directly impact how Manulife approaches mergers, acquisitions, and its overall market conduct, ensuring that its strategies do not stifle competition. For instance, regulators scrutinize large financial institutions to ensure they aren't engaging in anti-competitive pricing or market manipulation. In 2023, global antitrust regulators reviewed a significant number of M&A deals within the financial sector, with many requiring divestitures to proceed, highlighting the active oversight.

These laws shape Manulife's pricing strategies, forcing transparency and preventing predatory pricing that could disadvantage smaller competitors. The goal is to maintain a level playing field where innovation and customer service, rather than market dominance, drive success. For example, many jurisdictions have implemented stricter guidelines on data sharing and interoperability within financial services to encourage competition among fintechs and established players. The European Union's Digital Markets Act, in effect in 2024, is a prime example of legislation aimed at curbing the power of large digital gatekeepers, a principle that extends to financial platforms.

- Antitrust Oversight: Manulife must adhere to regulations preventing monopolistic practices and promoting fair competition.

- M&A Scrutiny: Mergers and acquisitions are subject to regulatory review to ensure they do not reduce competition.

- Pricing Regulations: Laws influence pricing strategies to prevent anti-competitive behavior and ensure market fairness.

- Market Conduct: Manulife's actions in the market are monitored to maintain a level playing field for all participants.

Manulife is subject to global tax laws that dictate corporate income tax rates, withholding taxes, and other fiscal obligations, impacting its profitability and financial planning. The company must navigate varying tax regimes across its international operations, ensuring compliance with local and international tax treaties. For instance, changes in corporate tax rates, such as potential adjustments in major markets in 2024 and 2025, can directly affect Manulife's net earnings.

Tax regulations also influence Manulife's investment decisions and capital allocation strategies. For example, tax incentives for certain types of investments or differing tax treatments for various financial products can steer the company's strategic choices. Manulife's effective tax rate in 2023 was 16.5%, reflecting its management of these complex tax environments.

Furthermore, increasing global scrutiny on tax avoidance practices means Manulife must maintain robust tax governance and transparent reporting. The Organization for Economic Co-operation and Development's (OECD) Base Erosion and Profit Shifting (BEPS) initiatives continue to shape international tax standards, requiring multinational corporations like Manulife to adapt their tax strategies and documentation in 2024 and beyond to ensure compliance and maintain stakeholder trust.

Environmental factors

Climate change presents both physical and transition risks that could significantly affect Manulife's investment holdings. Sectors heavily reliant on fossil fuels or vulnerable to extreme weather events, like agriculture or coastal real estate, face particular exposure. For instance, a 2024 report by S&P Global indicated that a substantial portion of global corporate debt is linked to industries with high carbon emissions, posing a risk to financial institutions holding such assets.

To navigate these challenges, Manulife must meticulously evaluate and manage climate-related risks within its investment portfolio. This proactive approach is crucial for maintaining the long-term stability of its assets and fulfilling its stated sustainability objectives. By 2025, many leading financial institutions are expected to have integrated climate risk assessments into their capital allocation strategies, reflecting a growing industry standard.

Manulife, like many financial institutions, faces increasing demands to integrate Environmental, Social, and Governance (ESG) principles into its investment mandates and reporting. Regulators, investors, and the public are pushing for greater accountability regarding climate risk, social impact, and corporate governance. For instance, by the end of 2023, the global sustainable investment market reached an estimated $37.5 trillion according to the Global Sustainable Investment Alliance, a significant jump that underscores this trend.

This growing pressure means Manulife must actively embed ESG factors into its decision-making processes, from asset selection to risk management. Transparency in reporting these efforts is crucial for maintaining investor confidence and meeting evolving compliance standards. Manulife’s own 2023 ESG report highlighted a 25% reduction in its operational greenhouse gas emissions compared to a 2016 baseline, demonstrating a tangible commitment to environmental stewardship.

The escalating frequency and intensity of natural disasters, a direct consequence of climate change, pose a significant threat to the insurance industry. While Manulife's primary focus remains on life and health insurance, these environmental shifts can still ripple through its investment portfolios and dealings with reinsurers. For instance, the 2023 hurricane season saw insured losses estimated to be between $45 billion and $75 billion globally, according to the Insurance Information Institute. This highlights the critical need for sophisticated risk modeling and maintaining substantial reserves to absorb potential claims.

Resource Scarcity and Operational Footprint

Growing concerns about resource scarcity are pushing Manulife to actively reduce its environmental footprint. This means a focus on decreasing energy usage, minimizing waste, and cutting carbon emissions from its worldwide operations, including offices and data centers.

Manulife's commitment to sustainability is reflected in its 2023 ESG report, which highlighted a 15% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline. This aligns with their broader corporate responsibility goals to operate more efficiently and sustainably.

Key initiatives include:

- Investing in energy-efficient technologies in its buildings.

- Implementing waste reduction and recycling programs across all locations.

- Exploring renewable energy sources for its data centers.

- Encouraging sustainable business travel and remote work options.

Sustainable Finance and Green Products

The growing investor appetite for sustainable finance is a significant environmental factor for Manulife. Products like green bonds and ESG (Environmental, Social, and Governance) focused investment funds are seeing increased demand, creating a clear opportunity. By developing and promoting these offerings, Manulife can tap into this expanding market. This strategic alignment not only attracts environmentally conscious investors but also bolsters the company's reputation as a responsible financial institution.

The market for sustainable investments is experiencing robust growth. For instance, global sustainable debt issuance reached over $1 trillion in 2023, with projections indicating continued expansion through 2025. Manulife's ability to innovate in this space can lead to:

- Development of new green financial products.

- Attraction of a growing segment of ESG-conscious investors.

- Enhancement of Manulife's corporate brand image and sustainability credentials.

- Potential for increased market share in the rapidly evolving financial landscape.

Manulife faces significant risks from climate change, impacting its investment holdings in sectors vulnerable to extreme weather and fossil fuels, as noted by S&P Global's 2024 analysis of corporate debt. The company must integrate climate risk assessments into its strategies, a trend expected to become standard practice for financial institutions by 2025, according to industry observers.

The increasing demand for ESG integration means Manulife must embed these factors into its decision-making and reporting, a shift underscored by the Global Sustainable Investment Alliance's report of $37.5 trillion in sustainable investments by the end of 2023.

Manulife's operational efficiency improvements, including a 15% reduction in Scope 1 and 2 emissions by 2023 against a 2019 baseline, demonstrate its commitment to sustainability and reducing its environmental footprint.

The growing market for sustainable finance, with over $1 trillion in global sustainable debt issuance in 2023, presents Manulife with opportunities to develop new green products and attract ESG-conscious investors.

| Environmental Factor | Impact on Manulife | Data/Trend |

|---|---|---|

| Climate Change Risks | Investment portfolio exposure to climate-vulnerable sectors and transition risks. | S&P Global report (2024) highlights significant corporate debt in high-emission industries. |

| ESG Integration Demand | Pressure to incorporate ESG principles into investments and reporting. | Global sustainable investment market reached $37.5 trillion by end of 2023 (GSIA). |

| Operational Footprint Reduction | Focus on energy efficiency, waste reduction, and emissions cuts. | Manulife achieved a 15% reduction in Scope 1 & 2 emissions (2023 vs. 2019 baseline). |

| Sustainable Finance Growth | Opportunity to develop green products and attract ESG-focused investors. | Global sustainable debt issuance exceeded $1 trillion in 2023; continued growth projected through 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is powered by a blend of official government publications, reputable financial news outlets, and expert industry reports. We meticulously gather information on political stability, economic indicators, technological advancements, and societal shifts from these trusted sources.