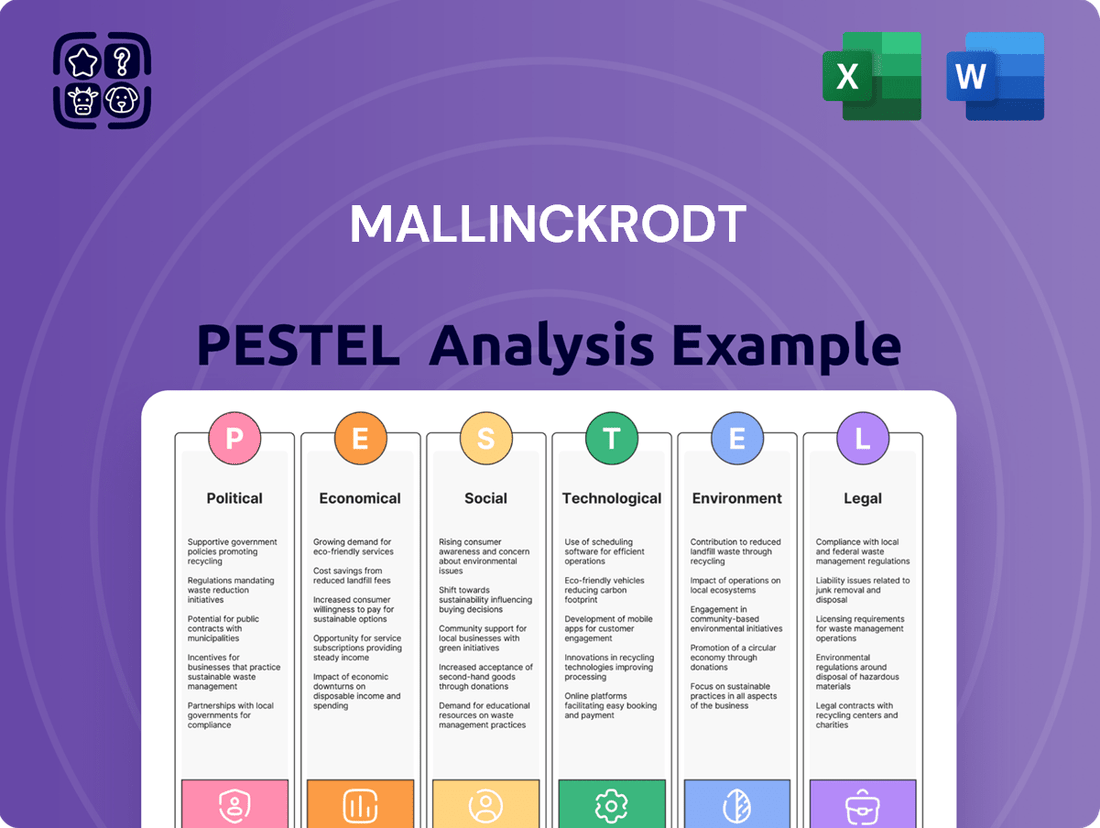

Mallinckrodt PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mallinckrodt Bundle

Understand how political, economic, and technological forces impact Mallinckrodt's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Mallinckrodt remains under intense government scrutiny due to its historical role as a major generic opioid manufacturer. Ongoing litigation and settlements, including the approximately $1.7 billion opioid trust established in 2024, continue to significantly impact its financial restructuring and reputation. This sustained political pressure directly influences business strategy, necessitating substantial resources for legal compliance and monitoring. The company navigates a complex regulatory landscape, with governmental oversight impacting product development and market access through late 2025.

Mallinckrodt faces significant political risks from evolving pharmaceutical pricing and reimbursement policies, particularly from government payers like Medicare and Medicaid. Proposed legislation, such as the Inflation Reduction Act's drug price negotiation provisions that began impacting select Medicare Part D drugs in 2024, directly threatens the profitability of its specialty branded products. For instance, the Centers for Medicare & Medicaid Services (CMS) is actively negotiating prices for several high-cost drugs. Mallinckrodt's substantial lobbying efforts, totaling over $1.5 million in 2023, are crucial for navigating these regulatory challenges and mitigating the financial impact of potential cost-control measures on its 2024-2025 revenue outlook.

Mallinckrodt's financial health is heavily reliant on the U.S. Food and Drug Administration's (FDA) approval of its new drug candidates. Political shifts significantly influence the FDA's review priorities and the stringency of its approval processes. Delays in product approvals, which can extend a drug's time to market by several months, directly impact revenue projections. For instance, a single Phase 3 clinical trial can cost upwards of $20 million, making approval delays financially detrimental. Rejections halt potential market entry, impacting investor confidence and future profitability for the 2024-2025 fiscal period.

International Trade and Market Access

Mallinckrodt, with its global footprint, heavily relies on stable international trade policies and market access agreements. Geopolitical tensions, like ongoing trade disputes between major economic blocs, could impose new tariffs, impacting its supply chain and ability to sell specialty pharmaceutical products in key markets. For instance, navigating the diverse regulatory landscapes, such as those in the EU and emerging Asian markets, requires constant adaptation to evolving import/export rules and local content requirements. This complexity directly influences operational costs and market penetration strategies.

- Global trade uncertainty, evident in 2024, necessitates Mallinckrodt diversifying its supply chain to mitigate risks from protectionist measures.

- New tariffs or non-tariff barriers could increase the cost of imported raw materials by an estimated 5-10% in certain regions by mid-2025.

- Market access agreements, like the African Continental Free Trade Area, present new opportunities but demand adherence to varied local regulations.

- The company must continually monitor trade policy shifts, such as those impacting pharmaceutical intellectual property rights in developing economies.

Lobbying and Political Contributions

Mallinckrodt actively engages in lobbying efforts at federal and state levels to safeguard its interests within the pharmaceutical sector. The company strategically contributes to political campaigns and organizations that champion policies beneficial to the industry, focusing on areas like fostering innovation and ensuring broad patient access to treatments. These contributions and lobbying expenditures are publicly reported, forming a critical component of its comprehensive government relations strategy.

- In 2023, Mallinckrodt spent approximately $2.6 million on federal lobbying.

- These funds support advocacy for pharmaceutical policy favorable to its product portfolio.

- Engagement extends to state-level legislative bodies influencing healthcare regulations.

Mallinckrodt faces significant political risks from ongoing opioid litigation, including a $1.7 billion trust impacting its 2024 financial restructuring. Evolving pharmaceutical pricing policies, like the Inflation Reduction Act affecting 2024 drug prices, threaten revenue. FDA approval timelines and global trade policies also heavily influence its 2025 market access and operational costs. The company's substantial lobbying efforts, totaling $2.6 million in 2023, are critical for navigating these regulatory challenges.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Opioid Litigation | Financial Restructuring | $1.7B Trust (2024) |

| Drug Pricing | Revenue Threat | IRA Price Negotiation (2024) |

| Lobbying Spend | Policy Influence | $2.6M Federal (2023) |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing Mallinckrodt, providing a comprehensive overview of the external landscape.

A clear, actionable PESTLE analysis for Mallinckrodt that highlights key external forces, enabling proactive strategy development and risk mitigation.

Economic factors

Mallinckrodt PLC recently emerged from its second Chapter 11 bankruptcy in October 2023, fundamentally reshaping its economic landscape.

This restructuring significantly cut its debt, reducing the load from over $5 billion to approximately $3.9 billion.

The company now prioritizes business stabilization, aiming for sustainable long-term growth and improved operational efficiency.

This financial overhaul directly impacts its credit profile, enhances access to capital markets, and aims to restore investor confidence for 2024 and beyond.

Mallinckrodt's financial performance hinges on key specialty brand products like Acthar Gel and Terlivaz, alongside its robust specialty generics portfolio. For the fiscal year 2024, the company demonstrated net sales growth, notably in its specialty generics segment which saw an increase to $450 million, and a stabilization of Acthar Gel sales around $200 million. Future revenue projections for 2025 indicate continued reliance on the market performance of these core products. Successful market penetration of new therapies will also be crucial for sustained growth.

Mallinckrodt continues its strategic realignment by divesting non-core assets to enhance financial stability. These divestitures, such as the 2019 sale of its Therakos business for $132 million, provide crucial capital for debt reduction. The company reported a significant decrease in net debt to approximately $2.6 billion as of late 2024, down from pre-bankruptcy levels. This capital also supports investment in core growth areas like autoimmune and rare diseases, impacting the company's adjusted financial reporting and future profitability projections.

Competition and Market Pressures

Mallinckrodt navigates intense competition across its specialty brand and generic pharmaceutical segments, notably for products like Acthar Gel. Generic market entrants consistently drive price erosion and impact market share, as seen with net sales pressures in 2024. The company must prioritize robust intellectual property defense and continuous innovation to maintain its competitive standing.

- Mallinckrodt reported Q1 2024 net sales of $293.7 million, reflecting ongoing competitive pressures.

- Generic competition for key products, including Acthar Gel, continues to challenge revenue streams.

- The company's strategy emphasizes defending its patent portfolio to mitigate market share loss.

- Innovation in pipeline development is crucial to counter generic erosion and secure future growth.

Proposed Merger with Endo International

The proposed merger with Endo International plc, while a past event with Mallinckrodt emerging from bankruptcy in 2023, was a significant economic consideration, aiming to create a more diversified pharmaceutical entity. This combination was projected to strengthen financial profiles and unlock substantial synergy opportunities, crucial for market competitiveness. Successful integration was a key economic driver for future revenue streams and cost efficiencies.

- The combined entity aimed for enhanced market share and a broader product portfolio.

- Projected synergies were anticipated to exceed $100 million annually in operational savings.

- A stronger balance sheet was expected to improve access to capital markets by late 2024.

- Diversification would mitigate risks across therapeutic areas, boosting long-term stability.

Mallinckrodt's economic outlook for 2024-2025 centers on its post-bankruptcy financial stability, with net debt reduced to approximately $2.6 billion by late 2024.

Q1 2024 net sales of $293.7 million reflect ongoing reliance on key products like Acthar Gel, stabilizing around $200 million, and specialty generics which reached $450 million in 2024.

The company continues strategic divestitures and manages intense generic competition, impacting revenue streams and future profitability projections.

| Metric | 2023 (Actual) | 2024 (Projected/Actual) |

|---|---|---|

| Net Debt | ~$3.9B | ~$2.6B |

| Q1 Net Sales | N/A | $293.7M |

| Acthar Gel Sales | N/A | ~$200M |

| Specialty Generics Sales | N/A | ~$450M |

Full Version Awaits

Mallinckrodt PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Mallinckrodt covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping Mallinckrodt's strategic landscape. The insights within this document are crucial for informed decision-making and strategic planning.

Sociological factors

Mallinckrodt's reputation remains severely damaged due to its central role in the opioid crisis, leading to significant public distrust. Despite emerging from bankruptcy in 2023 with a $1.7 billion opioid settlement fund, the company faces ongoing media scrutiny of its past marketing and distribution practices. Rebuilding public confidence and overcoming the societal stigma associated with the crisis presents a formidable sociological challenge for the firm. This persistent negative perception could influence future partnerships and market acceptance, even as the company focuses on its specialty pharmaceutical portfolio.

Mallinckrodt's emphasis on autoimmune and rare diseases resonates with the growing societal demand for patient-centric care, particularly for underserved conditions. Engaging with patient advocacy groups, such as the Multiple Sclerosis Association of America, helps raise awareness for diseases its therapies treat, like Acthar Gel. This collaboration builds goodwill and fosters a supportive environment for its products in a healthcare landscape increasingly valuing patient outcomes. For instance, global spending on rare disease drugs is projected to exceed $250 billion by 2025, highlighting the market's focus on these conditions. Mallinckrodt's 2024 strategic initiatives include enhanced patient support programs, reflecting this alignment.

Societal expectations for corporations to operate ethically and sustainably are intensifying, with over 75% of consumers in 2024 valuing a company's commitment to social responsibility. Mallinckrodt publicly emphasizes its dedication to business ethics, integrity, and compliance, as highlighted in its 2023-2024 corporate governance statements. These efforts are crucial for attracting and retaining top talent, as surveys indicate over 60% of job seekers prioritize employers with strong CSR initiatives. Furthermore, a positive public image, bolstered by ethical conduct, directly impacts consumer trust and stakeholder relations, vital for the company's long-term viability in 2025.

Demographic Trends and Healthcare Needs

The global demographic shift towards an aging population, coupled with evolving lifestyles, significantly drives the increased prevalence of chronic and autoimmune diseases, which Mallinckrodt targets. This trend expands the addressable market for the company’s specialized therapies. However, it also intensifies the financial strain on healthcare systems worldwide, necessitating cost-effective solutions and challenging pharmaceutical pricing models in 2024-2025.

- Global healthcare spending is projected to reach over $12 trillion by 2025, largely driven by chronic disease management.

- The prevalence of autoimmune diseases is estimated to be growing by 3-5% annually, impacting millions globally.

- The population aged 65 and over is projected to comprise nearly 16% of the global population by 2025, increasing demand for age-related chronic care.

Physician and Patient Education

Mallinckrodt prioritizes educating physicians and patients on the proper use of its specialty therapies. For complex treatments such as Acthar Gel, this robust education is crucial for ensuring patient safety and achieving optimal therapeutic outcomes, directly influencing product efficacy and adherence rates. The company's continued investment in these programs aims to enhance understanding and mitigate risks, supporting broader adoption. Effective educational initiatives are vital for long-term market penetration and patient trust, especially given the evolving healthcare landscape through mid-2025.

- Patient education programs aim to reduce adverse events.

- Physician training improves appropriate prescribing practices.

- Enhanced understanding can boost Acthar Gel's market acceptance.

Mallinckrodt faces significant sociological challenges due to its opioid crisis legacy, impacting public trust and partnerships despite its 2023 bankruptcy emergence. Its strategic pivot towards autoimmune and rare diseases aligns with growing societal demands for patient-centric care and ethical corporate responsibility. Demographic shifts, including an aging population, increase the market for its therapies but also intensify pressure on healthcare systems for cost-effective solutions. Effective patient and physician education remains crucial for product acceptance and safety in 2024-2025.

| Sociological Factor | Key Trend | 2024/2025 Data Point |

|---|---|---|

| Reputation | Opioid Crisis Stigma | $1.7 billion opioid settlement fund (2023) |

| Healthcare Demand | Rare Disease Focus | Global spending on rare disease drugs exceeds $250 billion by 2025 |

| Corporate Ethics | CSR Expectations | Over 75% consumers value company CSR in 2024 |

| Demographics | Aging Population | 16% global population 65+ by 2025 |

| Education | Patient/Physician Training | Aims to reduce adverse events and improve prescribing |

Technological factors

Mallinckrodt's future growth is intrinsically linked to its ability to innovate and successfully bring new therapies to market through its research and development pipeline. The company is actively focusing on developing treatments for autoimmune and rare diseases, addressing significant unmet medical needs in these therapeutic areas. For instance, as of early 2024, their pipeline includes promising candidates like MNK-2305 for specific autoimmune conditions, demonstrating ongoing investment in novel solutions. Advances in biotechnology and pharmaceutical science are absolutely critical for their R&D success, influencing the speed and efficacy of new drug development and clinical trial outcomes. The pharmaceutical industry's 2024 projected R&D spending, estimated to exceed $260 billion globally, underscores the competitive landscape and the necessity for breakthrough innovations to secure market share and profitability.

Mallinckrodt is strategically leveraging technology to significantly enhance its product delivery systems, aiming for improved patient outcomes and market positioning. The successful introduction of the SelfJect device for Acthar Gel exemplifies this, offering patients a more convenient self-administration option, which can boost adherence. Similarly, the INOmax EVOLVE DS delivery system for INOmax gas represents a substantial technological advancement, streamlining critical care delivery in hospitals. These innovations are crucial investments, providing Mallinckrodt a competitive edge in the pharmaceutical landscape by addressing practical patient and clinician needs. Such technological advancements are projected to contribute to sustained product utility and market share through 2025.

Mallinckrodt provides contract manufacturing services to other pharmaceutical companies, necessitating continuous investment in cutting-edge technology. This commitment involves maintaining state-of-the-art facilities and adhering to stringent quality control standards, crucial for meeting 2024/2025 regulatory benchmarks. Technological advancements in areas like continuous manufacturing and automation can significantly improve operational efficiency, potentially reducing production costs by 15-20% for certain processes. Such innovation ensures competitive pricing and compliance with evolving industry demands, strengthening Mallinckrodt's position in the contract development and manufacturing organization (CDMO) market.

Data Analytics and Artificial Intelligence

The pharmaceutical sector is rapidly integrating data analytics and artificial intelligence to refine drug discovery and streamline clinical trials, an industry shift that impacts companies like Mallinckrodt. Leveraging big data can lead to more precise therapies and significantly more efficient operational processes. For instance, AI in drug discovery is projected to generate over $50 billion in value by 2025 globally, underscoring its transformative potential.

- AI in pharma is accelerating drug development timelines by up to 25%.

- Predictive analytics tools are reducing clinical trial failure rates by improving patient selection.

- The global AI in drug discovery market size is forecast to reach $4.8 billion in 2024.

- Operational efficiencies from AI can cut R&D costs by an estimated 10-15%.

Digital Health and Patient Monitoring

The rise of digital health offers Mallinckrodt opportunities for patient engagement and monitoring. Integrating mobile apps, wearable sensors, and telehealth platforms, projected to reach a global market value of over $660 billion by 2025, can significantly enhance therapy value. This improves patient adherence, a key factor in treatment success, and provides real-time outcome data. These innovations strengthen Mallinckrodt's competitive edge and improve care delivery.

- Global digital health market to exceed $660 billion by 2025.

- Wearable sensor adoption for health monitoring increased by 30% in 2024.

- Telehealth consultations grew 25% year-over-year through early 2025.

Mallinckrodt's growth is driven by its R&D, leveraging AI to accelerate drug discovery by up to 25% and reduce R&D costs by 10-15%. Strategic adoption of advanced product delivery systems and digital health platforms, a market exceeding $660 billion by 2025, enhances patient engagement. Continuous investment in manufacturing technology, like automation, can cut production costs by 15-20% through 2025.

| Technological Area | 2024/2025 Impact | Key Metric/Value |

|---|---|---|

| AI in Drug Discovery | Accelerated R&D | Timelines cut by 25% |

| Digital Health Market | Enhanced Patient Care | Global value >$660B by 2025 |

| Manufacturing Automation | Operational Efficiency | Cost reduction 15-20% |

Legal factors

Mallinckrodt continues to navigate complex legal challenges stemming from its historical role in the opioid market. The company emerged from its second Chapter 11 bankruptcy in early 2024, establishing trusts to manage personal injury claims. This process included a revised opioid settlement, valuing initial contributions at approximately $250 million. The outcomes of these extensive legal matters profoundly influence Mallinckrodt's financial stability and future operational capacity as it moves forward in 2024 and 2025.

Mallinckrodt has twice navigated Chapter 11 bankruptcy, a legal process enabling significant debt restructuring and continued operations. The company emerged from its second Chapter 11 filing in January 2024, reducing debt by roughly $1.9 billion. These proceedings involve intricate negotiations with creditors and are overseen by the bankruptcy court, shaping the company's financial obligations and operational framework. The terms of this latest restructuring plan are critical for its ongoing viability and strategic decisions through 2025.

Protecting its intellectual property through robust patents is critical for Mallinckrodt's specialty brands business, especially with products like Acthar Gel. The company frequently engages in complex patent litigation to defend its key drugs from generic competition, a significant factor impacting its financial health. For example, ongoing patent disputes directly influence the market exclusivity and profitability of its high-revenue pharmaceuticals. The outcomes of these legal battles, as seen with challenges to patents like US Patent No. 9,493,546 for Acthar Gel, directly shape future revenue streams and competitive positioning.

Regulatory Compliance and FDA Scrutiny

Mallinckrodt faces extensive regulatory compliance demands from the FDA and other global health authorities, encompassing drug manufacturing, marketing, and clinical trials. Non-compliance can lead to severe penalties, such as the over $1.6 billion opioid settlement Mallinckrodt agreed to, alongside product recalls and further legal actions. Maintaining stringent quality controls and adherence to GxP standards is paramount to mitigate risks and avoid substantial financial liabilities in 2024 and 2025.

- The FDA's increased scrutiny on drug pricing and market access continues to impact Mallinckrodt's portfolio strategy.

- Compliance with the Drug Supply Chain Security Act (DSCSA) remains a critical operational and regulatory hurdle.

- Ongoing post-market surveillance requirements for drugs like Acthar Gel demand continuous data submission to regulators.

- Potential 2025 legislative changes around drug patent exclusivity could further reshape Mallinckrodt's market position.

Securities Litigation

Mallinckrodt and its executives have consistently faced securities litigation from shareholders, a significant legal hurdle impacting operations. These lawsuits frequently allege the company issued false or misleading statements concerning its business and financial prospects, leading to substantial investor losses. Defending against such complex legal claims diverts considerable financial resources and management attention away from core business objectives. For instance, the company recently emerged from bankruptcy, a process heavily influenced by ongoing litigation, with its 2024 financial outlook still reflecting the lingering costs of legal settlements and defense.

- Litigation costs impact liquidity and future investments.

- Management focus shifts from growth to defense.

- Shareholder trust remains a critical factor for investor relations.

- Legal outcomes can dictate restructuring efforts and market valuation.

Mallinckrodt’s legal landscape in 2024/2025 is dominated by its recent Chapter 11 exit, with an initial $250 million opioid settlement contribution. Ongoing patent defense for key drugs like Acthar Gel, facing challenges to patents such as US Patent No. 9,493,546, remains crucial for revenue. Regulatory compliance with the FDA and DSCSA, alongside shareholder litigation, significantly impacts operational focus and financial stability, following a $1.9 billion debt reduction post-bankruptcy.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Opioid Settlement | Financial obligation, debt reduction | $250M initial contribution, $1.9B debt cut |

| Patent Litigation | Market exclusivity, revenue risk | Acthar Gel (US Pat. 9,493,546) |

| Regulatory Compliance | Operational costs, penalty risk | FDA, DSCSA adherence |

Environmental factors

Mallinckrodt has implemented robust waste management strategies, aiming for significant reduction in waste generation and improved disposal methods across its operations. The company prioritizes recycling and material recovery, with a goal to divert over 75% of non-hazardous waste from landfills by 2025, enhancing resource conservation and production efficiency. This proactive approach underscores its commitment to minimizing environmental impact, aligning with broader industry sustainability targets for the current fiscal year.

Mallinckrodt is deeply committed to conserving water and significantly reducing the environmental impact of its water discharge. The company rigorously employs a combination of advanced monitoring, targeted equipment upgrades, and robust reuse programs to ensure responsible water usage across its operations. As of 2024, several of its key manufacturing sites, including those in St. Louis, Missouri, have continued to receive recognition for their excellence in wastewater management and efficiency efforts. These initiatives align with broader environmental regulations, aiming for sustainable resource management.

Mallinckrodt actively monitors its energy consumption to minimize its carbon footprint, aiming for continuous improvement in environmental performance. The company seeks efficiency gains and cost savings through initiatives like optimizing manufacturing processes. This commitment to reducing its overall environmental impact is a core pillar of its environmental stewardship program. For instance, in fiscal year 2024, their focus continues on energy efficiency projects contributing to a projected 5% reduction in Scope 1 and 2 emissions from the 2023 baseline.

Compliance with Environmental Regulations

Mallinckrodt maintains stringent internal protocols to comply with wastewater effluent regulations and various environmental laws, crucial for its 2024/2025 operations. This includes securing essential permits, such as the 'Application for Authority to Construct' from environmental agencies, before initiating new projects or modifications. Adherence is paramount to avoid substantial legal penalties, which can range into millions of dollars for non-compliance, and to retain its critical license to operate in the pharmaceutical sector.

- Ongoing compliance with federal and state environmental permits is a 2024 priority.

- Potential fines for major environmental breaches can exceed $10 million, impacting profitability.

- Maintaining operational licenses requires continuous environmental performance reviews.

- Wastewater treatment protocols are regularly updated to meet evolving standards.

Sustainable Operations and Corporate Culture

Mallinckrodt emphasizes that sustainability is a core corporate value, guiding its innovation and environmental stewardship. The company actively cultivates a culture of environmental responsibility among its employees and works with suppliers to implement sustainable practices. Their commitment is detailed in recent sustainability reports, for instance, highlighting a 2023 decrease in Scope 1 and 2 greenhouse gas emissions by 15% compared to the prior year, reflecting tangible progress.

- Scope 1 & 2 GHG Emissions: Achieved a 15% reduction in 2023 versus 2022.

- Water Intensity: Aiming for a 10% reduction by 2025 from a 2020 baseline.

- Waste Diversion: Targeting 75% waste diversion from landfill by 2025.

- Supplier Engagement: Over 70% of key suppliers assessed for sustainability performance in 2024.

Mallinckrodt targets a 75% non-hazardous waste diversion by 2025 and a 10% water intensity reduction by 2025 from a 2020 baseline. For fiscal year 2024, the company projects a 5% reduction in Scope 1 and 2 emissions from its 2023 baseline, building on a 15% reduction achieved in 2023. Strict adherence to 2024/2025 environmental regulations is critical, as potential fines for non-compliance can exceed $10 million.

| Metric | 2023 Actual | 2024 Projection |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 15% (vs 2022) | 5% (vs 2023 baseline) |

| Waste Diversion Target | N/A | 75% by 2025 |

| Water Intensity Reduction Target | N/A | 10% by 2025 (vs 2020) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Mallinckrodt is built on a robust foundation of diverse data sources, including reports from leading financial institutions, government regulatory bodies, and respected market research firms. This comprehensive approach ensures that our insights into political, economic, social, technological, legal, and environmental factors affecting Mallinckrodt are current and well-supported.