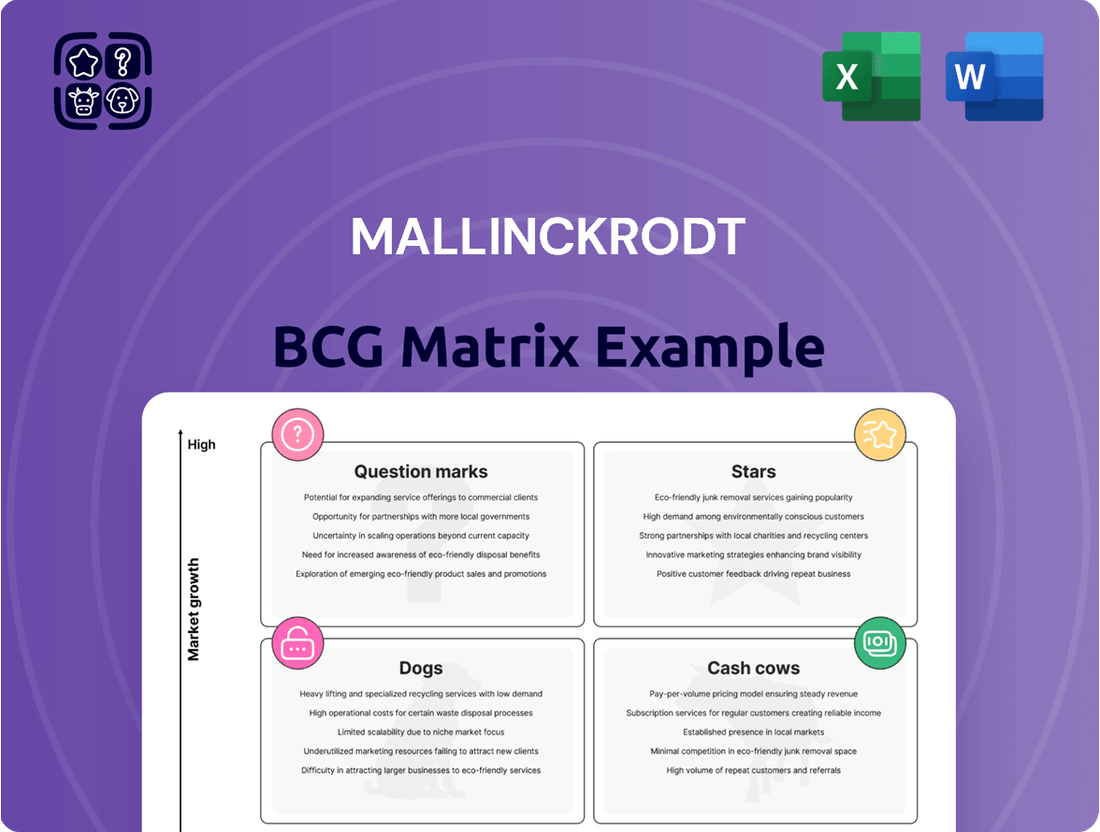

Mallinckrodt Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mallinckrodt Bundle

See a snapshot of Mallinckrodt's product portfolio through the BCG Matrix lens. Discover how its offerings are categorized: Stars, Cash Cows, Dogs, and Question Marks. This overview only scratches the surface of their strategic landscape.

Unlock a deeper understanding. The complete BCG Matrix report reveals quadrant placements, market share data, and growth potential.

Gain strategic insights you can act on immediately. Purchase the full version for a complete, ready-to-use tool.

Stars

Acthar Gel is a crucial product for Mallinckrodt, currently positioned as a Star in its BCG Matrix. The product has shown positive momentum, with net sales increasing in recent quarters. The successful introduction of the SelfJect device is boosting prescriptions. For instance, in Q1 2024, Mallinckrodt reported a 6.9% increase in Acthar sales.

Terlivaz, used for hepatorenal syndrome, is a rising star for Mallinckrodt. The company focuses on boosting its use among healthcare providers. In 2024, Mallinckrodt aims to increase Terlivaz's market share. This involves educating doctors about early treatment. Terlivaz's growth is key to Mallinckrodt's strategy.

INOmax EVOLVE DS, Mallinckrodt's next-gen nitric oxide system, is a Star in the BCG Matrix. Its U.S. hospital rollout is underway. Positive feedback hints at market share gains in critical care. In 2024, the global nitric oxide market was valued at $350 million.

Specialty Generics Portfolio (Select Products)

While the Specialty Generics segment isn't a Star overall, some ADHD products show strong growth, hinting at Star potential for specific generics. Mallinckrodt's focus on these high-performing drugs could drive revenue. In 2024, the ADHD market was valued at billions, with generics capturing a significant share. This strategic focus could enhance Mallinckrodt's market position.

- ADHD generics show strong growth.

- Specific generics have Star potential.

- Focus on high-performing drugs is key.

- ADHD market is worth billions.

New Pipeline Products in High-Growth Areas

Mallinckrodt's strategy centers on autoimmune and rare disease treatments, targeting high-growth sectors. Pipeline products in these areas have the potential to become Stars. While specific 2024-2025 product launches aren't top revenue drivers yet, the focus is clear. The company is aiming for strong market positions with these new offerings.

- Mallinckrodt's focus areas include autoimmune and rare diseases.

- New product launches could quickly become Stars.

- Specific top revenue drivers for 2024-2025 are not detailed.

- The company aims for strong market positions with new products.

Mallinckrodt's portfolio features several Stars like Acthar Gel, which saw a 6.9% sales increase in Q1 2024, and Terlivaz, a rising star focused on boosting 2024 market share. INOmax EVOLVE DS is also a Star, rolling out in U.S. hospitals. Specific ADHD generics and pipeline products in autoimmune/rare diseases show strong future Star potential.

| Product/Segment | BCG Status | 2024 Data Point |

|---|---|---|

| Acthar Gel | Star | Q1 2024 Sales: +6.9% |

| Terlivaz | Rising Star | 2024 Market Share Focus |

| INOmax EVOLVE DS | Star | 2024 Global Nitric Oxide Market: $350M |

| ADHD Generics | Star Potential | 2024 ADHD Market: Billions |

What is included in the product

Strategic portfolio assessment for Mallinckrodt, detailing product placements within the BCG Matrix.

Easily switch color palettes for brand alignment, making the presentation visually consistent.

Cash Cows

Acthar Gel, though a Star, significantly contributes to Mallinckrodt's revenue, reflecting Cash Cow traits. In 2024, Acthar Gel sales were substantial, despite not being the primary focus. Its established market presence and high sales volume generate considerable cash flow. This dual nature highlights its importance.

Mallinckrodt's Specialty Generics segment is a cash cow, providing consistent revenue. In 2024, this segment likely contributed significantly to overall cash flow. Stable earnings support investments in higher-growth areas. This segment helps maintain the company's financial stability, offering a dependable source of funds.

Mallinckrodt's neonatal critical care portfolio includes established therapies beyond INOmax EVOLVE DS. These therapies, though with lower growth, offer stable revenue streams. This segment benefits from consistent demand, supporting the company's overall financial stability. In 2024, this segment likely generated a significant portion of the company's revenue.

Certain Mature Specialty Brands

Mallinckrodt's "Cash Cows" likely include established specialty brands. These brands probably hold a significant market share in stable niches. They generate reliable cash flow with minimal reinvestment needed. In 2024, consider that mature pharmaceutical brands often provide consistent revenue streams.

- Stable markets with high market share.

- Consistent cash flow generation.

- Lower investment requirements.

- Examples include established pain management or respiratory drugs.

Products with Durable Market Presence

Cash cows in Mallinckrodt's portfolio represent products with a strong market presence and steady revenue generation. These are typically well-established products that have been in the market for an extended period, such as certain specialty pharmaceuticals. They provide consistent cash flow, which can be used to fund other areas of the business. For 2024, these products likely contribute a significant portion of the company's overall revenue, acting as a stable financial base.

- Steady Revenue: These products generate consistent income over time.

- Established Market Presence: They have a long history and are well-known in the market.

- Cash Flow: They provide a reliable source of cash for the company.

- Examples: Specialty pharmaceuticals with established uses.

Mallinckrodt's Cash Cows are foundational, providing steady revenue streams from established products. These include the Specialty Generics segment and certain mature specialty brands. For 2024, these segments continue to generate reliable cash flow, supporting overall financial stability. Their low growth but high market share makes them crucial for funding new initiatives.

| Segment | Contribution Type | 2024 Role |

|---|---|---|

| Specialty Generics | Consistent Revenue | Stable Cash Flow |

| Neonatal Critical Care | Established Therapies | Reliable Income |

| Mature Specialty Brands | High Market Share | Funding Source |

What You See Is What You Get

Mallinckrodt BCG Matrix

The BCG Matrix displayed is the same file you'll receive upon purchase. Fully formatted and professionally designed, the complete document is ready for immediate use and strategic decision-making.

Dogs

Mallinckrodt divested businesses like Therakos. This strategic move often involves assets with limited growth potential. For example, Therakos was sold in 2020 for $1.33 billion. Such decisions aim to streamline operations and focus on core strengths.

Some of Mallinckrodt's specialty generics may underperform. Despite the Cash Cow status of the overall segment, specific products might face low market share and growth. This can be due to tough competition or falling demand. In 2024, the generics market showed significant volatility.

In the Mallinckrodt BCG Matrix, "Dogs" represent products in intensely competitive markets. These products lack substantial market share and aren't growing. For instance, certain generic pharmaceuticals face fierce competition. In 2024, Mallinckrodt's revenue was $2.07 billion, reflecting pressures on some products.

Products with Declining Demand

In the Mallinckrodt BCG Matrix, products facing declining demand fall into the "Dogs" category. This often happens when newer, better treatments emerge or clinical guidelines change. These products typically have low market share and declining sales, impacting overall revenue. For instance, in 2024, some of Mallinckrodt's older pain management drugs experienced decreased sales due to generic competition.

- Declining sales indicate a weak market position.

- Lower market share means less profitability.

- Generic competition is a key factor.

- Strategic decisions might involve divestiture.

Non-Core Assets Identified for Divestiture

Mallinckrodt's "Dogs" in the BCG Matrix refer to non-core assets. These assets have low market share and growth potential. Divestiture is the strategy for these assets, aligning with the focus on branded biopharmaceuticals. This helps streamline the portfolio and improve financial performance.

- Mallinckrodt's 2024 revenue was approximately $2.3 billion.

- The company aims to reduce debt through strategic divestitures.

- Focus is on higher-margin, growth-oriented products.

- Divestitures free up resources for core business investments.

Mallinckrodt's "Dogs" typically include legacy generic drugs with low market share and minimal growth. For example, some older pain management products faced decreased demand in 2024 due to intense competition. These assets, like those generating low sales, are candidates for divestiture to streamline operations.

| Category | Market Share | Growth Potential |

|---|---|---|

| Dogs | Low | Low/Declining |

| Examples | Older Generics | Certain Specialty Pharma |

| 2024 Sales Impact | Reduced Revenue | Pressure on Margins |

Question Marks

Mallinckrodt's early-stage pipeline includes drugs in development. These products target high-growth markets, presenting substantial potential gains. However, with no current market share, they are considered question marks. Success hinges on clinical trial outcomes, making them high-risk investments. For 2024, R&D spending was approximately $100 million.

While products like SelfJect have seen success, some new launches might face slow initial uptake. These products, in growing markets but with limited market share, are considered question marks within the BCG matrix. For example, if a new drug launch underperforms in the first year, despite a growing market, it falls into this category. In 2024, Mallinckrodt's strategic focus will be on these question marks.

Entering new, highly innovative markets offers high growth with significant uncertainty and low initial market share. Mallinckrodt's forays into these areas would involve high investment and risk. The pharmaceutical industry's volatility, with data from 2024 showing a 10% failure rate for new drug approvals, underscores the challenges. Success depends on innovation and market adaptability.

Products Requiring Significant Investment for Market Penetration

Some of Mallinckrodt's products, like those in competitive, expanding markets, may need considerable investment. These products, consuming significant cash and currently holding a low market share, are often classified as "Question Marks" in the BCG matrix. The firm must decide whether to invest heavily to grow these products into "Stars" or divest. This decision depends on the product's growth potential and the company's financial resources.

- High cash consumption to increase market share is needed.

- Low market share in growing markets.

- Requires strategic investment decisions.

- Potential to become "Stars" with investment.

Products in Markets with Evolving Treatment Landscapes

Products in markets with evolving treatment landscapes, such as those affected by new research or competitor actions, often face uncertain futures. These products, even with low market share, can still see their fortunes change dramatically. Their success hinges on how well they adapt and compete in a shifting landscape. For example, the pharmaceutical industry saw significant changes in 2024, with about 100 new drugs approved by the FDA, impacting existing treatments.

- Market dynamics significantly impact product lifecycles.

- Adaptability is crucial for survival in a competitive environment.

- Investment in research and development is essential.

- Competitor analysis is key for strategic planning.

Mallinckrodt's Question Marks are products in high-growth markets with low market share, demanding substantial investment. These include new drug candidates from their 2024 pipeline, which require significant capital to become Stars. Success is uncertain, but the potential for high returns exists. For example, 2024 R&D spending was approximately $100 million on these high-potential, high-risk ventures.

| Product Type | Market Growth | Market Share (2024 Est.) |

|---|---|---|

| Early Pipeline Drugs | High | <1% |

| New Launches | Moderate-High | 1-5% |

| Innovative Therapies | High | <1% |

BCG Matrix Data Sources

The Mallinckrodt BCG Matrix leverages SEC filings, market reports, and financial statements. These are complemented by analyst ratings and competitor data.