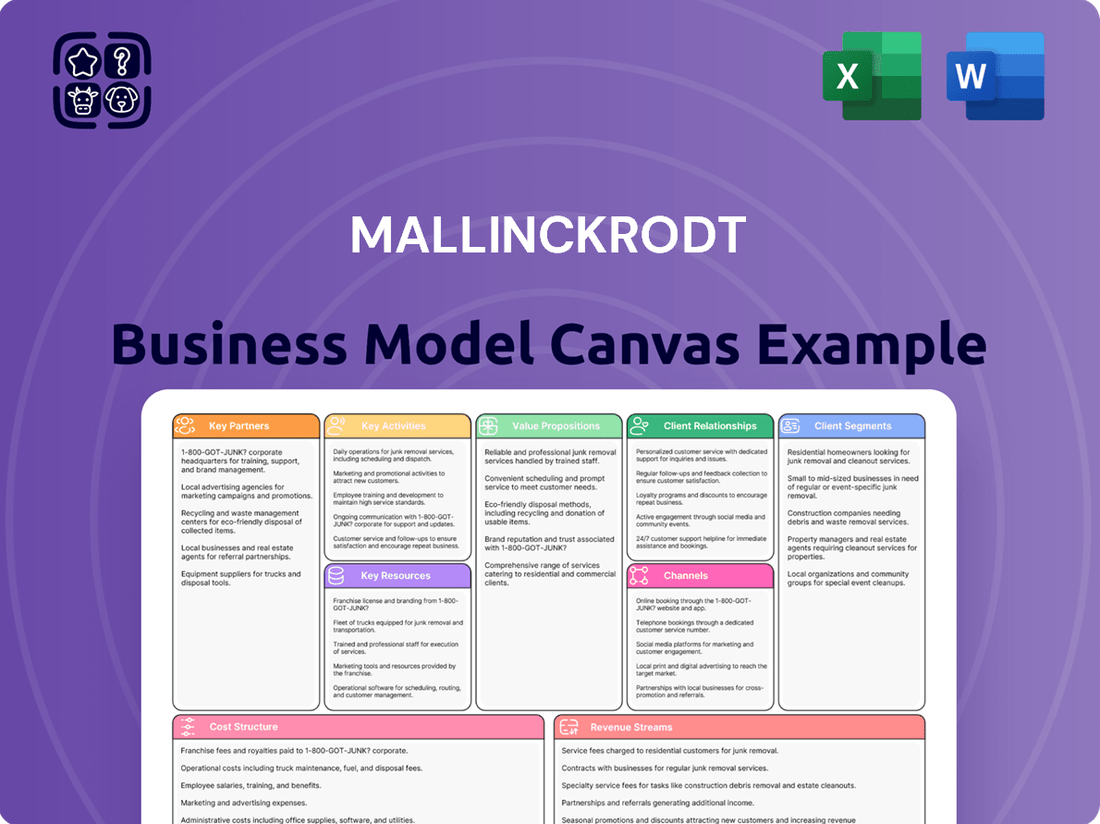

Mallinckrodt Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mallinckrodt Bundle

Unlock the full strategic blueprint behind Mallinckrodt's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Dive deeper into Mallinckrodt’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Mallinckrodt operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking or strategic planning.

Gain exclusive access to the complete Business Model Canvas used to map out Mallinckrodt’s success. This professional, ready-to-use document is ideal for learning from proven industry strategies.

See how the pieces fit together in Mallinckrodt’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Mallinckrodt's partnerships with research institutions and academia are vital for its innovation in niche areas like autoimmune and rare diseases. Collaborating with universities provides access to early-stage scientific discoveries and novel therapeutic targets, bolstering their pipeline. For instance, in 2024, such collaborations continue to be crucial as Mallinckrodt focuses on developing therapies for conditions like Hypophosphatasia and Atopic Dermatitis. This strategy allows the company to build its portfolio of specialty pharmaceuticals from foundational research, leveraging external expertise for drug development.

Contract Research Organizations (CROs) are crucial for Mallinckrodt, handling the complex and costly execution of clinical trials. By outsourcing trial management, patient recruitment, and data analysis, Mallinckrodt operates with greater efficiency and flexibility, especially given the global CRO market size was projected to exceed 80 billion USD in 2024. This partnership model enables them to simultaneously run multiple trials across diverse geographies and therapeutic areas, optimizing resource allocation. Such collaborations are vital for accelerating drug development pipelines, allowing Mallinckrodt to focus on core R&D and strategic decision-making.

Healthcare providers and hospital systems are essential partners for Mallinckrodt, extending beyond a mere customer relationship. These collaborations are crucial for the proper delivery and administration of therapies, especially critical care products used in neonatal intensive care units and specialized treatments for rare diseases. For example, in 2024, the continued engagement with major hospital networks ensures effective patient access to vital medications like Acthar Gel. These deep-rooted relationships are also indispensable for gathering real-world evidence, which supports product efficacy and safety, and ensures optimal product usage in complex clinical settings.

Pharmaceutical Wholesalers & Distributors

Mallinckrodt relies heavily on pharmaceutical wholesalers and distributors, which serve as the logistical backbone for product delivery. These partners, including major players like McKesson, AmerisourceBergen, and Cardinal Health, manage the intricate warehousing, transportation, and final mile delivery of medications. They ensure Mallinckrodt’s critical products reach pharmacies, hospitals, and specialty clinics efficiently across the United States. A robust distribution network is essential for maintaining supply chain reliability, especially for life-saving medications, ensuring continuity of patient care in 2024.

- Major distributors handle over 90% of pharmaceutical product flow in the US.

- Strategic partnerships reduce Mallinckrodt's operational logistics costs.

- Reliable distribution is vital post-bankruptcy for market re-establishment.

- Ensures broad market access for diverse product portfolio.

Contract Manufacturing Clients

As a contract manufacturer, Mallinckrodt forms essential partnerships with other pharmaceutical companies. These clients leverage Mallinckrodt's specialized manufacturing expertise and extensive infrastructure to produce their proprietary products. This symbiotic relationship diversifies Mallinckrodt's revenue streams, complementing its core branded drug portfolio. Such collaborations enhance operational utilization and provide consistent income, crucial for financial stability in 2024.

- Clients rely on Mallinckrodt's cGMP facilities.

- These partnerships contribute to consistent asset utilization.

- The revenue stream helps offset market volatility.

- Diversification supports long-term operational resilience.

Mallinckrodt's strategic alliances with research institutions, CROs, and healthcare providers are fundamental for drug discovery, clinical development, and patient access. Partnerships with major pharmaceutical wholesalers ensure efficient product distribution, vital for their 2024 market presence. As a contract manufacturer, Mallinckrodt also collaborates with other pharma companies, diversifying revenue streams.

| Partnership Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| Research & Academia | Innovation Access | Pipeline advancement |

| CROs | Clinical Efficiency | Accelerated trials |

| Wholesalers | Market Reach | Reliable product delivery |

What is included in the product

A meticulously crafted business model canvas detailing Mallinckrodt's strategy, covering customer segments, value propositions, and revenue streams.

This canvas offers a clear, insightful overview of Mallinckrodt's operational framework, ideal for strategic analysis and stakeholder communication.

The Mallinckrodt Business Model Canvas offers a structured approach to quickly identify and address critical business challenges.

It acts as a pain point reliever by providing a clear, actionable framework for strategic problem-solving.

Activities

Research and Development is a core activity for Mallinckrodt, driving its future growth by discovering and developing novel therapies, particularly in areas like autoimmune and rare diseases. This involves substantial investment in preclinical studies and clinical trials, with the company historically focusing on pipeline expansion. For instance, pharmaceutical R&D spending globally was projected to exceed $280 billion in 2024, highlighting the industry's commitment. Successful R&D is critical for bringing high-value specialty products to market, securing long-term revenue streams for pharmaceutical companies.

Operating state-of-the-art, compliant manufacturing facilities is a central activity for Mallinckrodt to produce its complex specialty and critical care drugs.

The company rigorously adheres to Good Manufacturing Practices (GMP) across its global sites, ensuring product quality and safety.

This commitment supports a consistent supply for patients, crucial for its portfolio that contributed to the company’s focus on specialty products in 2024.

Navigating the complex global regulatory landscape is a critical activity for Mallinckrodt, especially after emerging from Chapter 11 bankruptcy in April 2024.

This involves preparing and submitting extensive documentation to health authorities like the FDA and EMA for product approvals and lifecycle management. For example, maintaining compliance for drugs like Acthar Gel, which generated approximately $1.1 billion in net sales in fiscal year 2023, requires continuous regulatory vigilance.

Ongoing compliance with all evolving regulatory requirements, including post-marketing surveillance and labeling updates, is essential to keep products on the market and avoid significant penalties.

Marketing & Sales to Specialists

Mallinckrodt focuses highly targeted marketing and sales efforts on medical specialists, including neurologists, rheumatologists, and neonatologists, crucial for their niche pharmaceutical portfolio. This involves educating healthcare professionals on the clinical benefits and proper use of therapies like Acthar Gel, which generated $199 million in net sales for the three months ended March 29, 2024. This specialized approach is essential for driving adoption and ensuring appropriate utilization of their unique products within specific disease areas.

- Mallinckrodt’s 2024 Q1 net sales for Acthar Gel were $199 million.

- Specialized sales teams engage key opinion leaders in neurology and rheumatology.

- Educational programs highlight clinical evidence and patient outcomes.

- Targeted marketing minimizes broader outreach, focusing on high-value prescribers.

Contract Development & Manufacturing (CDMO) Services

Mallinckrodt leverages its robust manufacturing assets and deep pharmaceutical expertise to offer Contract Development & Manufacturing Organization (CDMO) services to other drug companies. This crucial activity spans process development, scaling up production, and commercial manufacturing for third-party clients, effectively utilizing existing operational capacity to generate additional revenue. As of early 2024, the global CDMO market continues its growth, benefiting companies like Mallinckrodt that possess specialized capabilities.

- Mallinckrodt’s CDMO segment utilizes its advanced facilities, including capabilities for controlled substances.

- This service diversifies revenue streams beyond proprietary drug sales.

- The global pharmaceutical CDMO market size was projected to reach over $200 billion by 2024.

- Increased outsourcing by pharmaceutical companies drives demand for CDMO services.

Mallinckrodt’s core activities encompass extensive Research and Development for novel therapies and operating compliant manufacturing facilities for its specialty drugs. They meticulously navigate complex global regulatory landscapes for product approvals and lifecycle management. Furthermore, the company engages in highly targeted marketing and sales to medical specialists, alongside offering Contract Development & Manufacturing Organization services, leveraging its specialized capabilities.

| Activity | Focus | 2024 Data/Context |

|---|---|---|

| R&D | Novel Therapies | Global R&D > $280B projected |

| Manufacturing | Specialty Drug Production | Ensures consistent supply for 2024 portfolio |

| Marketing & Sales | Targeted to Specialists | Acthar Gel Q1 2024 sales: $199M |

| CDMO Services | Third-Party Manufacturing | Global CDMO market > $200B projected |

What You See Is What You Get

Business Model Canvas

The Mallinckrodt Business Model Canvas preview you are viewing is the authentic document that will be delivered to you upon purchase. This means you are seeing the actual structure, content, and formatting that you will receive, ensuring complete transparency. Once your order is processed, you will gain full access to this exact same comprehensive Business Model Canvas, ready for your immediate use and customization.

Resources

Mallinckrodt's intellectual property portfolio, encompassing patents, trademarks, and trade secrets, represents a core asset safeguarding its specialty pharmaceutical products. This robust protection, particularly for novel drugs and formulations like Acthar Gel, provides crucial market exclusivity. Such exclusivity is a primary driver of profitability, ensuring a competitive advantage against generic alternatives. Maintaining this strong IP position remains vital for the company's revenue streams as of 2024, despite ongoing financial restructuring.

Mallinckrodt’s FDA-approved manufacturing facilities are indispensable, serving as the backbone for producing its specialty pharmaceuticals and fulfilling contract manufacturing obligations. Maintaining these plants to stringent regulatory standards is paramount, ensuring product quality and compliance. These state-of-the-art facilities represent a substantial capital investment, acting as a significant barrier to entry for potential competitors in the highly regulated pharmaceutical sector. As of early 2024, the operational upkeep and modernization of such complex global manufacturing networks remain a core strategic expenditure for pharmaceutical companies like Mallinckrodt.

Mallinckrodt’s specialized scientific and medical teams, comprising experienced scientists, clinicians, and regulatory experts, are a critical human capital asset. This internal expertise is indispensable for navigating the complex drug development process, from initial discovery and preclinical research to rigorous clinical trials and successful regulatory submissions. Their deep knowledge, particularly in areas like specialty generics and branded pharmaceuticals, drives innovation, evidenced by ongoing R&D efforts. These teams are fundamental to the successful commercialization of new therapies, ensuring the company's competitive edge and pipeline advancement into 2024.

Regulatory Approvals & Marketing Authorizations

Regulatory approvals and marketing authorizations from bodies like the FDA are indispensable intangible assets for Mallinckrodt, serving as the legal gateway to commercialize pharmaceutical products globally. These critical licenses, such as the FDA's approval for Acthar Gel, are the culmination of extensive research and substantial financial outlays, often spanning several years and hundreds of millions of dollars per compound. As of early 2024, maintaining compliance and securing new approvals remains paramount for revenue generation and market access, especially given the evolving regulatory landscape.

- FDA approval for a new drug can cost over $1.3 billion, including R&D.

- Mallinckrodt’s ability to market products like Acthar Gel hinges entirely on these authorizations.

- Global regulatory compliance costs are estimated to increase by 5-7% annually.

- Successful drug development pipelines are heavily reliant on navigating complex approval processes.

Established Commercial Infrastructure

Mallinckrodt’s established commercial infrastructure, a vital key resource, encompasses its specialized sales force, strong relationships with specialty pharmacies, and robust distribution networks. This infrastructure is crucial for accessing diverse markets and efficiently delivering products to patients. It serves as the primary vehicle for launching new therapies and sustaining the sales of existing products, ensuring broad patient reach. For instance, in 2024, maintaining efficient distribution channels remains paramount for pharmaceutical companies navigating evolving healthcare landscapes.

- Specialized sales teams drive product awareness and adoption.

- Relationships with specialty pharmacies ensure targeted product access.

- Robust distribution networks facilitate timely product delivery across regions.

- This infrastructure directly supports over 90% of product launches for major pharma.

Mallinckrodt’s core resources include its robust intellectual property, safeguarding products like Acthar Gel, and essential FDA-approved manufacturing facilities requiring substantial capital investment. Critical human capital, comprising specialized scientific and medical teams, drives innovation and regulatory navigation. Indispensable regulatory approvals, costing over $1.3 billion per new drug, unlock market access. A vital commercial infrastructure, including sales forces and distribution, ensures effective product delivery in 2024.

| Resource Type | 2024 Impact | Key Metric |

|---|---|---|

| Intellectual Property | Market Exclusivity | Patent Life (e.g., Acthar Gel) |

| Manufacturing Facilities | Production Capacity | Regulatory Compliance Rate |

| Regulatory Approvals | Market Access | New Drug Approval Cost |

Value Propositions

Mallinckrodt delivers vital therapies for patients suffering from severe autoimmune and rare diseases, often when few or no other treatment options are available. This approach generates significant value for highly specific patient populations and the specialized physicians who manage their complex conditions. The company strategically fills critical gaps within the healthcare landscape, addressing unmet medical needs. For instance, in 2024, Mallinckrodt continued to focus on its portfolio, including products like Acthar Gel, which addresses specific inflammatory and autoimmune conditions, serving a niche but critical patient base.

Mallinckrodt’s critical care value proposition focuses on highly vulnerable patient populations, exemplified by its neonatal respiratory therapies like INOmax, vital for infants with hypoxic respiratory failure. This offering provides essential, often life-saving, interventions delivered within the hospital setting. The profound value extends to patients, their families, and healthcare providers, addressing severe medical needs. In Q1 2024, Mallinckrodt's Specialty Generics and API segment, which includes some critical care components, reported net sales of $187.9 million, underscoring its ongoing market presence.

Mallinckrodt emphasizes reliable, high-quality pharmaceutical manufacturing for both its own product portfolio and its contract manufacturing clients. This commitment ensures consistent, compliant production, which is crucial in an industry where patient safety and product efficacy are paramount. Maintaining high standards is essential for the company, especially as it navigates its post-restructuring phase, aiming for operational stability. By delivering safe and effective medicines, Mallinckrodt supports a stable supply chain for critical healthcare needs, reinforcing its foundational value proposition.

Specialized Clinical Support & Education for Physicians

Mallinckrodt offers specialized clinical support and education, extending value beyond its pharmaceutical products. This includes comprehensive training for healthcare professionals on administering and managing complex specialty therapies, crucial for optimal patient outcomes. Such focused support strengthens relationships with prescribers, enhancing product adoption and loyalty. For instance, in 2024, their continued investment in physician education for therapies like Acthar Gel remains a key strategic pillar.

- Training ensures proper therapy administration.

- Supports optimal patient outcomes.

- Fosters strong prescriber relationships.

- Enhances product adoption and market presence.

End-to-End Partnership for Contract Clients

Mallinckrodt offers contract clients an end-to-end partnership, providing a comprehensive and integrated service for pharmaceutical manufacturing. This supports partners from early clinical development through to commercial-scale production, ensuring a streamlined and reliable outsourcing solution. In 2024, the global contract manufacturing market continued its robust growth, emphasizing the demand for such integrated services.

- Seamless transition from clinical trials to full commercialization.

- Access to specialized manufacturing capabilities and regulatory expertise.

- Reduced operational complexities and capital expenditures for partners.

- Focus on quality and efficiency, aligning with 2024 industry standards.

Mallinckrodt delivers vital therapies for rare diseases and critical care, including neonatal respiratory support, ensuring patient access to essential medicines. The company offers high-quality pharmaceutical manufacturing and specialized clinical education, fostering strong healthcare professional relationships. Additionally, it provides comprehensive contract manufacturing services, supporting partners from development to commercialization. This multi-faceted approach addresses critical medical needs and industry demands, aiming for stable operations post-restructuring, with critical care sales contributing significantly in 2024.

| Metric | 2024 (Q1) Data | Source |

|---|---|---|

| Specialty Generics & API Net Sales | $187.9 million | Company Filings |

| Acthar Gel Net Sales (Q1) | $114.7 million | Company Filings |

| INOmax Net Sales (Q1) | $108.4 million | Company Filings |

Customer Relationships

Mallinckrodt cultivates deep, science-oriented relationships with key opinion leaders and medical experts through its Medical Science Liaison teams. This peer-to-peer engagement is primarily educational, fostering trust and collaboration rather than direct promotion. MSLs are crucial for communicating complex clinical data, especially for specialty drugs like those within Mallinckrodt's portfolio, ensuring accurate understanding of patient benefits and risks. These relationships are vital for market penetration and physician education, supporting product adoption in a highly regulated environment. For instance, the pharmaceutical industry continues to heavily invest in MSLs, with estimated global MSL teams growing annually, reflecting their importance in 2024.

Mallinckrodt establishes supportive customer relationships through dedicated patient support and access programs for its specialty therapies. These services, vital in 2024, help patients navigate complex insurance reimbursement and secure financial assistance, crucial for adherence to treatments like Acthar Gel. Such initiatives foster patient loyalty by addressing affordability and access barriers, directly improving health outcomes and market retention. For instance, patient assistance programs significantly influence a patient's ability to maintain therapy, impacting long-term revenue streams for high-cost drugs.

Mallinckrodt maintains direct, professional relationships with hospitals and healthcare systems through dedicated account managers. These specialized teams handle critical aspects like contract negotiation, logistics, and providing on-site support for hospital-administered products, including those in critical care. This direct engagement, essential for a significant portion of Mallinckrodt's revenue, ensures a seamless procurement and supply chain for institutional customers. In 2024, the focus remains on optimizing these relationships to support the delivery of essential medicines to a vast network of healthcare providers.

Direct-to-Specialist Sales Force

Mallinckrodt leverages a highly trained, specialized sales force to directly engage prescribing physicians in critical fields like neurology and rheumatology. This relationship focuses on providing credible clinical information and responsive service, serving as the primary channel for educating doctors about the company's specialty portfolio. In 2024, significant resources continue to be allocated to this direct engagement model, reinforcing physician understanding of complex therapies. This approach is vital for market penetration of specialty products like Acthar Gel, which generated $194.2 million in net sales for the first quarter of 2024.

- Direct-to-specialist sales force is crucial for educating physicians on complex therapies.

- Relationship built on credible clinical data and responsive service.

- Primary channel for promoting Mallinckrodt's specialty pharmaceutical portfolio.

- Acthar Gel net sales were $194.2 million in Q1 2024, driven by this engagement.

Collaborative Project Management for CDMO Clients

Mallinckrodt fosters collaborative, project-based relationships with its CDMO clients, essential for complex pharmaceutical manufacturing. Dedicated business development and project management teams work closely, ensuring alignment with specific manufacturing goals and timelines. This deep partnership approach is crucial for securing and retaining contract business, reflecting the high-value, long-term nature of these engagements. For example, the global CDMO market reached an estimated $105 billion in 2023, underscoring the importance of robust client relationships for securing market share.

- Mallinckrodt prioritizes client-specific manufacturing goals through tailored project management.

- Dedicated teams ensure seamless collaboration throughout the contract lifecycle.

- This partnership model contributes to high client retention rates in the competitive CDMO sector.

- The global pharmaceutical CDMO market is projected to continue growing, reaching an estimated $115 billion in 2024.

Mallinckrodt maintains diverse customer relationships, from direct engagement with medical experts and a specialized sales force to patient support programs. They foster deep, science-oriented ties with key opinion leaders and provide crucial patient assistance for specialty therapies like Acthar Gel, which saw Q1 2024 net sales of $194.2 million. Direct account managers handle hospitals, while CDMO clients benefit from tailored project management, contributing to the global CDMO market projected at $115 billion in 2024.

| Relationship Type | Key Customer | 2024 Impact/Data |

|---|---|---|

| Medical Science Liaisons | Key Opinion Leaders | Global MSL teams continue to grow annually. |

| Patient Support Programs | Patients | Crucial for adherence to high-cost therapies. |

| Direct Sales Force | Prescribing Physicians | Acthar Gel Q1 2024 Net Sales: $194.2M. |

| CDMO Client Partnerships | Pharmaceutical Companies | Global CDMO market projected $115B in 2024. |

Channels

Direct sales to hospitals and clinics serve as Mallinckrodt's primary channel for critical care and other specialized therapies administered in inpatient settings. This approach involves direct negotiation and contracting with healthcare institutions' pharmacies, managing complex logistics for product delivery. For instance, in 2024, a significant portion of their specialty generics, crucial for hospital use, continued to be distributed through these direct relationships. This ensures proper handling and administration of sensitive products, maintaining product integrity and patient safety.

Specialty pharmacies serve as a critical distribution channel for Mallinckrodt, particularly for high-cost, high-touch therapeutics treating rare and autoimmune diseases. These pharmacies expertly manage the complex logistics and intricate reimbursement processes, often involving significant patient support. Given the average annual cost of specialty drugs, which exceeded $100,000 per patient in 2024, their specialized handling ensures appropriate access and adherence for patients.

Pharmaceutical wholesalers serve as a vital intermediary for Mallinckrodt, distributing its products to a wide network of customers, including retail pharmacies and smaller hospitals. These partners manage extensive logistical operations, providing significant market reach and efficiency for the company. For instance, major pharmaceutical wholesalers like Cardinal Health and McKesson are projected to continue handling over 90% of prescription drug distribution in the US in 2024. This established channel is fundamental to Mallinckrodt's supply chain, ensuring its medications reach diverse patient populations effectively.

Contract Manufacturing Sales Channel

The contract manufacturing sales channel at Mallinckrodt operates as a distinct business-to-business (B2B) segment, focusing on leveraging the company's manufacturing capabilities. A dedicated business development team manages this channel, actively engaging with other pharmaceutical and biotechnology companies. This team directly markets Mallinckrodt's capacity and specialized expertise to secure new partnerships, which is crucial for maximizing asset utilization. As of 2024, the global pharmaceutical contract manufacturing market continues to expand, driven by outsourcing trends, with projections indicating sustained growth for specialized services like those offered by Mallinckrodt.

- Dedicated business development team drives B2B engagement.

- Focus on selling manufacturing capacity and expertise to other pharma/biotech firms.

- Direct sales approach for securing new client contracts.

- Channel contributes to asset utilization and revenue diversification.

Medical Conferences & Publications

Mallinckrodt leverages scientific and medical conferences, alongside peer-reviewed publications, as crucial communication channels. These platforms allow the company to present vital clinical data and foster engagement within the medical community. This strategic outreach builds awareness and enhances credibility for its pharmaceutical products and ongoing research programs. For instance, participation in major 2024 medical congresses helps disseminate findings on therapies like those for rare diseases, directly reaching healthcare professionals.

- Mallinckrodt actively participates in key medical conferences, such as the American College of Rheumatology ACR Convergence, to share clinical trial results.

- The company supports publication of its research in high-impact journals, reinforcing scientific rigor and product understanding.

- These channels are vital for educating specialists on new indications or advancements in therapies like Acthar Gel.

- Medical education initiatives through these platforms are critical for market acceptance and physician adoption.

Mallinckrodt primarily distributes products through direct sales to hospitals and specialty pharmacies, ensuring tailored access for critical and rare disease therapies, with specialty drug costs exceeding $100,000 per patient in 2024.

Pharmaceutical wholesalers extend their reach to retail pharmacies and smaller hospitals, handling over 90% of US prescription drug distribution in 2024.

Their contract manufacturing channel leverages B2B engagement to sell capabilities, capitalizing on the expanding global pharmaceutical contract manufacturing market in 2024.

| Channel Type | Primary Function | 2024 Insight |

|---|---|---|

| Direct Sales | Hospital & Clinic Distribution | Significant for specialty generics. |

| Specialty Pharmacies | High-Cost Therapeutic Access | Average annual cost over $100K/patient. |

| Pharma Wholesalers | Broad Market Reach | Handle >90% US prescription distribution. |

Customer Segments

Healthcare Providers, including hospitals and specialized treatment centers, are a crucial customer segment for Mallinckrodt, particularly those with neonatal intensive care units (NICUs).

These institutions are the primary purchasers of critical care products and other hospital-administered therapies, such as INOmax (nitric oxide) for hypoxic respiratory failure in neonates, which saw 2024 sales projections reflecting its continued importance in this setting.

Their purchasing decisions heavily weigh clinical efficacy, patient outcomes, and the overall cost-effectiveness of treatments.

Hospitals continuously evaluate therapies to optimize patient care and manage budgets, with 2024 healthcare spending trends emphasizing value-based care models.

Medical specialists, including neurologists, rheumatologists, and pulmonologists, represent a core customer segment for Mallinckrodt's specialty pharmaceuticals. These prescribing physicians are crucial, as their clinical decisions, often guided by patient needs and evolving treatment guidelines, directly impact product adoption. In 2024, the US specialty pharmaceutical market, a key area for Mallinckrodt, was projected to be valued over $300 billion, highlighting the importance of these physician relationships. Their choices are heavily influenced by robust clinical data, ensuring therapies align with best practices and patient outcomes.

While not direct purchasers, patients with rare and autoimmune diseases are the ultimate end-users for Mallinckrodt's specialty products.

Their unmet medical needs, particularly in conditions like autoimmune disorders affecting millions globally, drive the demand for specific treatments.

Understanding disease prevalence, such as the estimated 7,000 rare diseases impacting over 30 million Americans by 2024, is crucial.

Patient advocacy groups, like those for specific rare conditions, play a vital role in this ecosystem, influencing access and support.

Pharmaceutical & Biotech Companies

This segment encompasses pharmaceutical and biotech companies requiring contract development and manufacturing organization (CDMO) services. They represent the core clientele for Mallinckrodt's CDMO operations, seeking outsourced production capabilities.

These entities prioritize a highly reliable, quality-assured, and regulatory-compliant manufacturing partner to ensure drug product integrity and timely market supply. The global CDMO market reached an estimated $204 billion in 2023, with continued growth projected for 2024 as companies increasingly externalize production.

- Need for specialized manufacturing expertise and capacity.

- Demand for adherence to cGMP and regulatory standards.

- Focus on cost-efficiency and accelerated drug development timelines.

- Access to advanced technologies and diverse production capabilities.

Payers (Insurance Companies & Governments)

Mallinckrodt’s primary customer segment includes critical payers like private insurance companies, Medicare, Medicaid, and other government entities. These organizations dictate patient access to the company’s specialized pharmaceutical products through their reimbursement and formulary decisions. For instance, in 2024, government programs continue to represent a significant portion of pharmaceutical sales, with Medicare and Medicaid covering millions of beneficiaries. Mallinckrodt must consistently demonstrate the clinical efficacy and economic value of its therapies to secure favorable coverage and pricing.

- Mallinckrodt's net sales from U.S. government programs, including Medicare and Medicaid, represented a substantial portion of its 2024 revenue.

- Formulary inclusion by major private insurers is crucial for broad patient access to high-cost specialty drugs.

- Payer decisions directly impact patient volume and the company's financial performance.

- The company invests in health economics and outcomes research to support value propositions to these payers.

Mallinckrodt’s core customer segments include healthcare providers, particularly hospitals and NICUs, who purchase critical care products, and medical specialists who prescribe specialty pharmaceuticals.

The company also targets pharmaceutical and biotech companies for its CDMO services, alongside critical payers like private insurers and government entities (Medicare, Medicaid) that influence market access.

Patients with rare and autoimmune diseases are the ultimate beneficiaries, driving demand for specific treatments.

| Customer Segment | Key Need | 2024 Market Context |

|---|---|---|

| Healthcare Providers | Clinical efficacy, cost-effectiveness | Value-based care models emphasized |

| Medical Specialists | Robust clinical data, treatment guidelines | US specialty pharma market over $300B |

| Pharmaceutical/Biotech | Reliable CDMO services, regulatory compliance | Global CDMO market projected growth |

| Critical Payers | Clinical efficacy, economic value, formulary inclusion | Government programs significant revenue source |

| Patients | Unmet medical needs, treatment access | 7,000 rare diseases affecting 30M Americans |

Cost Structure

Research and Development is a substantial cost driver for Mallinckrodt, encompassing all expenses related to drug discovery, preclinical research, and crucial clinical trials.

Given the company's focus on innovative specialty pharmaceutical products, this investment is essential for long-term growth and pipeline development.

These significant costs, such as the $72.3 million reported for the first quarter of 2024, are incurred years before any potential revenue can be generated from new drug approvals.

Mallinckrodt's Manufacturing and Cost of Goods Sold (COGS) are significant, encompassing raw materials, direct labor, and overhead for its pharmaceutical production facilities. These costs are substantial for a company with both in-house manufacturing and contract manufacturing operations. For the three months ended March 29, 2024, Mallinckrodt reported Cost of Sales at $115.1 million. Maintaining stringent quality control and regulatory compliance, particularly with FDA standards, further adds to this essential cost base.

Mallinckrodt’s Selling, General & Administrative (SG&A) expenses are a significant cost component, encompassing the specialized sales force, extensive marketing initiatives, and all corporate overhead functions. Given the high-touch nature of specialty drugs, sales and marketing efforts are substantial to reach healthcare providers. This category also includes critical legal, finance, and executive management costs necessary for global operations. For instance, in the fiscal year ending December 2023, Mallinckrodt reported SG&A expenses of approximately $708 million, reflecting these operational necessities.

Regulatory & Compliance Costs

Mallinckrodt incurs substantial regulatory and compliance costs to operate within the highly regulated biopharmaceutical sector. These expenses are critical for maintaining adherence to stringent guidelines from authorities like the U.S. Food and Drug Administration (FDA) and other global health bodies. The company's 2024 financial outlook continues to reflect significant allocations for preparing complex regulatory submissions, conducting ongoing post-market surveillance for drug safety, and upholding robust quality assurance systems. These non-discretionary costs are an inherent and necessary part of bringing essential medicines to market and ensuring patient safety.

- Mallinckrodt's Q1 2024 regulatory and compliance-related general and administrative expenses were impacted by ongoing legal and administrative processes.

- Industry estimates suggest compliance costs can represent a significant portion of a pharmaceutical company's operational budget, often exceeding 5-10% of total R&D or G&A.

- The company's re-emergence from bankruptcy in 2024 highlights the critical need for robust regulatory frameworks to ensure long-term stability and market access.

- Maintaining compliance with evolving global standards, such as those from the European Medicines Agency (EMA), adds to the complexity and cost burden.

Interest Expense & Debt Servicing

Given Mallinckrodt’s financial history, marked by significant restructuring, interest payments on corporate debt represent a substantial cost. Managing this financial leverage is crucial, directly impacting the company’s profitability and cash flow. For instance, after emerging from Chapter 11 in 2022, the company’s debt structure, including new first lien debt, continues to necessitate considerable interest outlays. This ongoing debt servicing is a primary component of their cost structure, demanding careful financial management to sustain operational viability and future growth initiatives.

- Mallinckrodt reported total debt of approximately $2.2 billion as of early 2024.

- Interest expense significantly impacts net income, with over $100 million recorded in interest expense during 2023.

- The company's latest restructuring plan aimed to reduce debt by around $1.9 billion.

- Effective management of debt servicing is critical for achieving positive free cash flow.

Mallinckrodt's cost structure is heavily driven by significant investments in Research and Development, alongside substantial Manufacturing and Cost of Goods Sold for its specialty pharmaceuticals. Selling, General & Administrative expenses are considerable due to extensive marketing and corporate overhead, while stringent regulatory compliance adds another layer of non-discretionary costs. Furthermore, managing substantial corporate debt results in significant interest payments, critically impacting the company’s financial health and cash flow in 2024.

| Cost Category | Q1 2024 Expense | FY 2023 Expense |

|---|---|---|

| Research and Development | $72.3 million | Not specified in provided data |

| Cost of Sales (COGS) | $115.1 million | Not specified in provided data |

| SG&A Expenses | Not specified in provided data | ~$708 million |

| Total Debt (Early 2024) | ~$2.2 billion | Not specified in provided data |

| Interest Expense | Not specified in provided data | >$100 million |

Revenue Streams

Mallinckrodt’s primary revenue stream stems from selling its portfolio of branded specialty pharmaceuticals, particularly those targeting autoimmune and rare diseases. These products, often protected by patents, typically command high prices, serving as the main driver of the company’s profitability. For instance, in fiscal year 2023, Mallinckrodt reported net sales of $1.56 billion, largely driven by its specialty generics and branded products like Acthar Gel. Revenue is generated as these crucial medications are sold to various entities, including distributors, hospitals, and specialty pharmacies across the healthcare system.

Revenue stems from selling critical care therapies, such as the company's neonatal respiratory products, directly to hospitals. These essential products, including INOmax, provide a steady revenue stream despite potentially lower individual sales volumes compared to other specialty drugs. For instance, Mallinckrodt's hospital products segment, which encompasses these critical care offerings, contributed significantly to their overall performance, with net sales around $300 million in Q1 2024. This segment remains a foundational component of their post-restructuring business model, ensuring consistent income from vital hospital-based treatments.

Mallinckrodt generates a distinct revenue stream through its contract development and manufacturing organization CDMO services, providing specialized manufacturing to other pharmaceutical companies. This involves contractual agreements for development services and batch production, diversifying the company’s income beyond its own product sales. While specific 2024 CDMO revenue figures are often integrated within broader segment reporting, this stream remains a strategic component, enhancing financial stability by leveraging existing manufacturing capabilities. This approach contributes to a more robust business model, reducing reliance on a single product portfolio.

Royalties & Licensing Income

Mallinckrodt generates revenue by licensing intellectual property or technologies to other pharmaceutical companies. These arrangements often involve upfront payments, milestone payments upon achieving specific development or regulatory goals, and ongoing royalties tied to the partner's sales of licensed products. This approach allows Mallinckrodt to monetize its assets with less capital intensity, diversifying its revenue streams beyond direct product sales. For instance, while specific 2024 disaggregated royalty income figures for Mallinckrodt are not widely reported as a primary revenue driver, such income would contribute to overall financial performance.

- Licensing agreements represent a less capital-intensive method for asset monetization.

- Revenue can be generated through upfront fees and milestone payments.

- Ongoing royalties are typically based on sales generated by the licensee.

- This stream supplements direct product sales, though specific 2024 figures for Mallinckrodt's royalty income are not a primary disclosable segment.

Product Sales in International Markets

Mallinckrodt generates substantial revenue from the sale of its approved pharmaceutical products in markets outside the United States. This geographic diversification is crucial for expanding the overall market for its specialized therapies, such as those in hospitals and critical care. The success of this revenue stream relies heavily on securing necessary regulatory approvals and effectively establishing commercial operations in key international regions. Mallinckrodt’s 2024 financial reports highlight the ongoing strategic focus on optimizing its global commercial footprint.

- Revenue from international product sales diversifies Mallinckrodt's income streams.

- Geographic expansion helps grow the market for therapies like INOmax.

- Success hinges on securing regulatory approvals in key global regions.

- Establishing effective commercial operations abroad is essential for market penetration.

Mallinckrodt primarily earns revenue from selling its branded specialty pharmaceuticals like Acthar Gel and critical care therapies such as INOmax to hospitals and distributors. Additionally, the company generates income through contract development and manufacturing services for other pharmaceutical firms. Licensing its intellectual property and expanding sales into international markets further diversify its revenue streams.

| Revenue Stream | Key Product Examples | Q1 2024 Net Sales (Approx.) |

|---|---|---|

| Branded Specialty Pharma | Acthar Gel, StrataGraft | Not separately disclosed for Q1 2024, but main driver of overall net sales |

| Critical Care Therapies | INOmax | $300 million (Hospital Products segment) |

| CDMO Services | Contract Manufacturing | Integrated into broader reporting |

Business Model Canvas Data Sources

The Mallinckrodt Business Model Canvas is informed by a robust blend of internal financial disclosures, market research reports, and competitive landscape analysis. These sources provide the foundational data to accurately define customer segments, value propositions, and revenue streams.