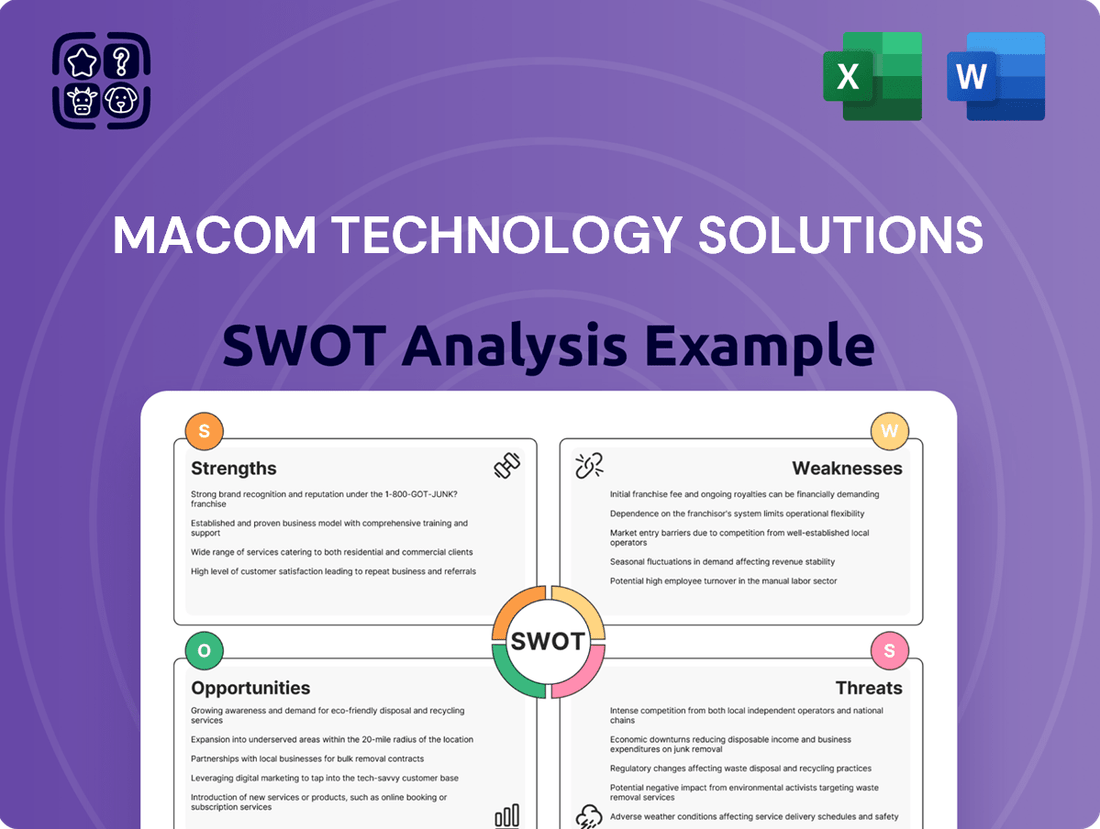

Macom Technology Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Macom Technology Solutions Bundle

Macom Technology Solutions boasts strong market positioning and a robust product portfolio, but faces intense competition and potential supply chain disruptions. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

What you've seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of Macom Technology Solutions, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research. Uncover actionable insights and strategic takeaways.

Strengths

MACOM Technology Solutions maintains a strong, diversified market presence across key sectors, including telecommunications, industrial and defense, and data centers. This broad reach helps mitigate risks associated with the inherent cyclical nature of any single industry. For instance, if the telecom market experiences softness, robust demand from data center and industrial and defense segments can provide a crucial buffer. In its fiscal year 2024, MACOM’s data center and industrial and defense segments collectively contributed over 60% of its revenue, underscoring this strategic balance and resilience. This diversification ensures more stable financial performance.

MACOM Technology Solutions possesses a broad portfolio of high-performance analog, RF, microwave, millimeter-wave, and photonic semiconductor products. This robust offering is underpinned by significant intellectual property in critical technologies like Gallium Nitride (GaN) and Indium Phosphide (InP). For instance, MACOM's GaN-on-SiC technology continues to see strong demand in defense and telecommunications, contributing to its projected revenue growth. This technological depth enables the company to develop highly differentiated products tailored for demanding, high-growth applications across its target markets in 2024 and 2025.

MACOM is strategically positioned to capitalize on booming technology sectors like 5G infrastructure, which continues its global expansion through 2025, and the rapidly growing data center market. The surge in AI and cloud computing is driving unprecedented demand for MACOM's high-speed optical interconnects, with data center spending projected to reach new highs in 2024 and 2025. Additionally, the company's advanced RF solutions are critical for increased global defense spending, securing its role in essential government programs. This strong alignment with high-growth markets ensures robust revenue potential for MACOM.

Solid Financial Performance

MACOM Technology Solutions demonstrates solid financial performance, marked by strong revenue growth and improving profitability. For its fiscal second-quarter of 2025, the company reported a 30.2% year-over-year revenue increase. MACOM anticipates continued growth, supported by robust cash flow from operations. This financial stability empowers investments in research and development and strategic initiatives, ensuring long-term competitive advantage.

- Fiscal Q2 2025 revenue increased 30.2% year-over-year.

- Strong cash flow from operations supports R&D.

- Positive profitability trends observed through 2024.

- Continued revenue growth is projected for 2025.

Strategic Acquisitions and Partnerships

MACOM has consistently leveraged strategic acquisitions to enhance its technological foundation and broaden product offerings. For instance, the integration of components from the AppliedMicro acquisition in 2017 strengthened its data center connectivity solutions, contributing to a projected 5G market share growth into 2025. The company also fosters partnerships, such as collaborations in GaN-on-SiC for RF applications, which are critical for advancing its defense and industrial segments.

- MACOM’s 2017 acquisition of AppliedMicro's Connectivity Business significantly expanded its data center and telecom presence.

- Strategic partnerships, like those in advanced GaN technology, reinforce MACOM's position in high-growth markets such as 5G infrastructure and defense applications, projected to see continued investment through 2025.

MACOM’s diversified market presence, with industrial and defense and data center segments comprising over 60% of FY2024 revenue, ensures robust stability. Its broad portfolio, including GaN and InP IP, fuels high-growth applications like 5G infrastructure and AI-driven data centers. The company also reported a 30.2% year-over-year revenue increase in fiscal Q2 2025. Strategic acquisitions further strengthen its market position.

| Metric | FY2024 | FY2025 (Projected) |

|---|---|---|

| Industrial & Defense/Data Center Revenue Share | >60% | Consistent |

| Q2 FY2025 Revenue Growth | N/A | +30.2% YOY |

| Data Center Spending | High | New Highs |

What is included in the product

Delivers a strategic overview of Macom Technology Solutions’s internal and external business factors, highlighting its competitive position and market environment.

Offers a clear breakdown of Macom's competitive landscape, highlighting opportunities to leverage strengths and mitigate weaknesses.

Weaknesses

MACOM Technology Solutions faces a notable weakness due to its dependence on a limited number of key customers, which historically has included large telecommunications and data center clients. A substantial portion of MACOM's revenue, potentially exceeding 10% from a single customer in prior fiscal years, makes it susceptible to their purchasing shifts. For example, a significant reduction in orders from a top-tier client, such as a major cloud service provider, could materially impact MACOM's 2024 and 2025 financial performance. This concentration risk means the company's financial results are highly sensitive to the strategic decisions or financial health of these few critical partners.

The semiconductor industry, which MACOM operates within, is inherently cyclical, leading to potential fluctuations in demand and revenue. For instance, the data center market, a key segment for MACOM, can experience significant volatility, impacting revenue stability as seen in projected data center spending shifts. Broader economic downturns, like those influencing global GDP growth forecasts for 2025, directly influence customer spending and overall demand for MACOM’s high-performance analog and mixed-signal semiconductors. This cyclicality necessitates careful inventory and production management.

MACOM Technology Solutions faces inherent integration challenges from its active acquisition strategy, such as the 2023 acquisition of Wolfspeed's RF business. Successfully merging diverse corporate cultures and operational systems is complex and resource-intensive, potentially diverting focus from core operations. There is a risk that the anticipated synergies, like the projected approximately $125 million in annual revenue from the Wolfspeed deal, may not be fully realized if integration falters. Maximizing the value of these strategic moves depends heavily on seamless post-acquisition execution in 2024 and 2025.

Intense Competition

MACOM Technology Solutions faces intense competition within the semiconductor market, encountering rivals across its served segments, including data center and telecom. This competitive landscape, featuring large players like Broadcom and specialized firms, exerts significant pressure on pricing and market share. Continuous innovation is crucial for MACOM to maintain its competitive edge and secure new design wins in a market projected to reach over $600 billion in 2024. This environment necessitates substantial R&D investments to remain at the forefront.

- Market share erosion risk due to aggressive pricing by competitors.

- Increased R&D spending required to counter competitor advancements.

- Pressure on gross margins in highly commoditized product areas.

- Challenges in retaining talent against larger, well-funded rivals.

Potential for Supply Chain Disruptions

MACOM, like many semiconductor firms, faces significant vulnerability to global supply chain disruptions. Component shortages, such as those seen through late 2023 and early 2024 for specific high-performance chips, can severely impact its production timelines. Geopolitical tensions, particularly concerning critical manufacturing hubs in Asia, present ongoing risks to product delivery and operational stability. Managing these complex supply chain challenges remains a critical operational priority for MACOM through 2025, directly affecting revenue forecasts and market responsiveness.

- Global semiconductor supply chain volatility remains high, influencing MACOMs operational planning for 2024-2025.

- Industry reports indicate continued risk of specialized component shortages impacting lead times.

- Geopolitical factors, including trade policies and regional stability, directly influence MACOMs access to key materials and manufacturing capacity.

MACOM faces revenue volatility from its reliance on a few large customers, with over 10% from single clients, making it vulnerable to spending shifts through 2025. The semiconductor industry's cyclical nature and intense competition, demanding substantial R&D investments in a market exceeding $600 billion in 2024, pressure margins and market share. Integration challenges from acquisitions like Wolfspeed's RF business in 2023 and ongoing global supply chain vulnerabilities, including component shortages in early 2024, pose operational risks. These factors collectively impact MACOM's stability and growth prospects.

| Weakness Area | Key Impact | 2024-2025 Data Point | ||

|---|---|---|---|---|

| Customer Concentration | Revenue sensitivity to client spending | Over 10% revenue from single customer | ||

| Market Cyclicality | Demand and revenue fluctuations | Data center spending shifts through 2025 | ||

| Integration Risks | Synergy realization post-acquisition | Wolfspeed RF acquisition (2023) | ||

| Intense Competition | Pressure on pricing and market share | Semiconductor market over $600B (2024) | ||

| Supply Chain Vulnerability | Production delays, operational stability | Component shortages (late 2023-early 2024) |

Same Document Delivered

Macom Technology Solutions SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Macom Technology Solutions, covering its Strengths, Weaknesses, Opportunities, and Threats. This comprehensive overview is designed to provide actionable insights for strategic planning. Upon purchase, you'll gain access to the complete, detailed report, allowing you to fully leverage this critical business intelligence.

Opportunities

The explosive growth of artificial intelligence and cloud computing is fueling massive investment in data center infrastructure. This trend creates a significant opportunity for MACOM's high-speed optical components, which are essential for data center interconnects. The global data center interconnect market is projected to reach $14.6 billion by 2025, driven by the increasing demand for data processing. MACOM is well-positioned to capitalize on this expansion, leveraging its advanced semiconductor solutions.

The ongoing global rollout of 5G networks and the development of future communication technologies create a significant opportunity for MACOM's advanced RF and microwave semiconductor solutions. The global 5G infrastructure market is projected to reach approximately USD 35.8 billion by 2025, demonstrating robust growth. This expansion directly fuels demand for MACOM’s specialized products, essential for base stations and network equipment. Furthermore, the broader telecom chip market anticipates steady growth through 2025, driven by continuous infrastructure upgrades and increased data traffic. MACOM is well-positioned to capitalize on this sustained demand within the telecommunications sector.

Increased global defense spending, projected to surpass $2.5 trillion by 2025, fuels demand for high-performance semiconductors in modern military systems. The semiconductor market in military and aerospace is forecast to reach approximately $7.5 billion by 2025, showing robust growth. Additionally, the industrial sector's increasing automation and adoption of advanced technologies, with the global industrial automation market exceeding $300 billion by 2025, provide significant avenues for MACOM's specialized solutions. This sustained demand across both sectors presents a strong growth opportunity.

Emerging Automotive Applications

The automotive industry's rapid shift towards electric and autonomous vehicles significantly boosts semiconductor content per vehicle. This trend creates substantial opportunities for MACOM in advanced driver-assistance systems (ADAS) and high-speed in-vehicle connectivity. The automotive semiconductor market is projected for robust growth through 2025, driven by these innovations.

- The semiconductor content per vehicle is expected to reach over $1,500 by 2025 in premium electric vehicles.

- The global automotive semiconductor market is forecast to exceed $80 billion by 2025.

Geographic Market Expansion

MACOM can find significant growth by expanding into emerging technology regions, especially within the Asia-Pacific semiconductor market. Countries like China and India are making substantial investments in their domestic semiconductor industries, projecting continued growth. For instance, the semiconductor market in China is anticipated to reach approximately $280 billion by 2025. Expanding its presence and sales channels in these fast-growing regions could be a major driver of future revenue for MACOM, leveraging the increasing demand for advanced connectivity solutions.

- Asia-Pacific semiconductor market growth projected at a 9.5% CAGR through 2025.

- China's semiconductor market is expected to exceed $280 billion by 2025.

- India's semiconductor consumption is forecast to reach $80 billion by 2026.

- Strategic partnerships in these regions can amplify MACOM's market penetration.

MACOM is poised for significant growth driven by expanding data center infrastructure, propelled by AI and cloud computing, with the global interconnect market reaching $14.6 billion by 2025. The accelerating 5G rollout and future telecom advancements, alongside increasing defense spending and industrial automation, further boost demand for its specialized semiconductors. Furthermore, the automotive sector's shift to EVs and autonomous systems, with the global automotive semiconductor market exceeding $80 billion by 2025, presents substantial opportunities. Strategic expansion into high-growth Asia-Pacific markets, like China's anticipated $280 billion semiconductor market by 2025, offers additional avenues for revenue growth.

| Opportunity Area | Market Projection (2025) | Key Driver |

|---|---|---|

| Data Center Interconnect | $14.6 Billion | AI & Cloud Computing Growth |

| 5G Infrastructure | $35.8 Billion | Global Network Expansion |

| Automotive Semiconductors | >$80 Billion | EV & ADAS Adoption |

| China Semiconductor Market | >$280 Billion | Domestic Industry Investment |

Threats

The semiconductor industry faces intense competition from numerous global players, pushing MACOM Technology Solutions to continuously innovate. Competitors are heavily investing in research and development; for instance, leading semiconductor firms project significant R&D expenditures well into 2025 to maintain technological superiority. This aggressive landscape can lead to substantial pricing pressures, particularly in high-volume segments, and could impact MACOM's market share in key areas like optical and RF components.

Global geopolitical instability, including escalating trade tensions and sanctions, significantly threatens the semiconductor industry. Such factors disrupt intricate supply chains, as seen with ongoing U.S.-China export controls impacting advanced chip technology, potentially shifting market access for companies like MACOM. These policy changes can raise operational costs, influencing profit margins, especially given MACOM Technology Solutions' extensive international manufacturing and sales footprint, which makes it highly susceptible to evolving trade policies.

A global economic slowdown or recession could significantly reduce customer spending across MACOM's key markets, impacting demand for its semiconductor products. For instance, while the semiconductor market is projected to grow by 13.1% in 2024, persistent inflation and geopolitical instability could dampen this outlook. Market uncertainty, such as recent questions regarding the future growth trajectory of AI hardware needs, can negatively affect investor sentiment. This uncertainty is reflected in cautious enterprise spending forecasts for 2025, potentially limiting new project investments. Such conditions could directly hinder MACOM's revenue growth and stock performance.

Supply Chain Constraints

The global semiconductor supply chain presents a significant threat, with potential shortages impacting MACOM's production and delivery schedules. Analysts project that persistent constraints in manufacturing capacity could limit the availability of critical components, especially given the surging demand from data centers. For instance, the market for high-performance analog and mixed-signal components, crucial for MACOM, is experiencing lead times extending into late 2024 for some specialized parts. This volatile environment could hinder MACOM's ability to meet customer demand and capitalize on growth opportunities in key markets.

- Global wafer foundry capacity utilization remains high, exceeding 90% into Q1 2025.

- Lead times for certain power management and RF components, vital for MACOM, extended by 10-15 weeks in late 2024.

- Industry reports indicate a potential shortfall of 5-7% in advanced packaging capacity through 2025.

Rapid Technological Change

The semiconductor industry faces constant, rapid technological advancements, posing a significant threat to MACOM Technology Solutions. MACOM must continuously invest heavily in research and development to keep pace with evolving standards and customer requirements across its markets, including data center and telecom. Failure to innovate and adapt to new technologies could quickly render existing products obsolete, leading to a substantial loss of market competitiveness.

- In fiscal year 2023, MACOM reported R&D expenses of $133.5 million, highlighting the ongoing investment required.

- The transition to higher data rates, such as 800G and 1.6T for optical networking, demands continuous product portfolio updates.

MACOM faces intense competition and geopolitical risks, like U.S.-China trade controls impacting market access and raising costs. Global economic slowdowns could curb demand, despite 2024 semiconductor market growth projections of 13.1%. Supply chain constraints, with wafer foundry utilization exceeding 90% into Q1 2025 and extended lead times for vital components, threaten production. Constant innovation is crucial, given MACOM's $133.5 million R&D in FY23, to counter rapid technological obsolescence.

| Threat Metric | 2024 Data | 2025 Data | ||

|---|---|---|---|---|

| Global Wafer Foundry Utilization | >90% (Q1 2024) | >90% (Q1 2025) | ||

| Component Lead Time Extension | 10-15 weeks (late 2024) | |||

| Advanced Packaging Capacity Shortfall | 5-7% (projected) |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating Macom Technology Solutions' official financial filings, comprehensive market research reports, and expert industry commentary to provide a clear and actionable SWOT assessment.