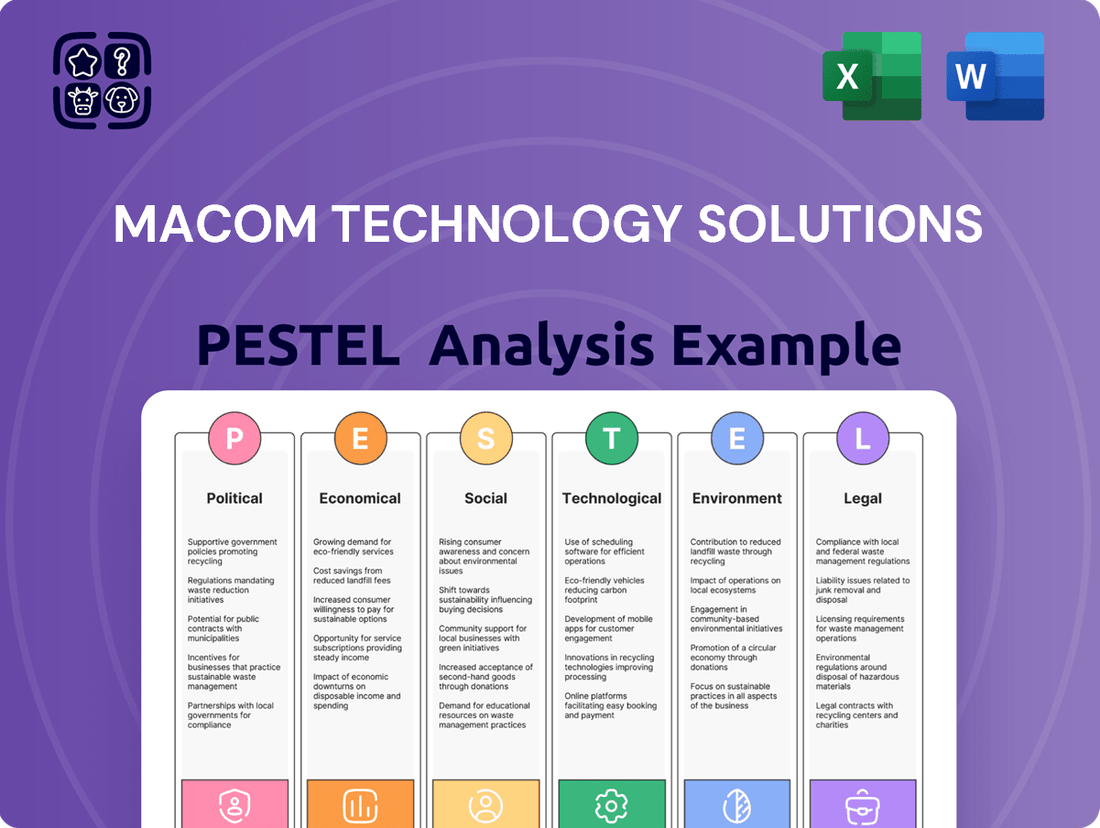

Macom Technology Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Macom Technology Solutions Bundle

Uncover the critical external factors shaping Macom Technology Solutions's trajectory with our meticulously researched PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements create both opportunities and challenges for the company. Gain a competitive edge by leveraging these insights to refine your own market strategies and anticipate future trends. This comprehensive analysis is your key to informed decision-making. Download the full version now to unlock actionable intelligence.

Political factors

Government spending is a critical political factor for MACOM Technology Solutions, particularly through defense contracts. In 2023, approximately 62% of MACOM's revenue was derived from the military and defense sector, highlighting the company's significant reliance on this market. Changes in government defense budgets and evolving geopolitical landscapes directly influence the demand for MACOM's specialized RF, microwave, and millimeterwave components.

Recent government initiatives demonstrate continued support for MACOM's technological advancements. For instance, the company was awarded a $3.4 million U.S. Department of Defense contract under the CHIPS and Science Act. This funding is specifically aimed at fostering innovation in Gallium Nitride on Silicon Carbide (GaN-on-SiC) semiconductor technology, a key area for MACOM's high-performance solutions.

MACOM Technology Solutions' global operations are directly shaped by international trade policies and export controls. These regulations can impact everything from sourcing raw materials to selling finished products worldwide. For instance, tariffs can increase the cost of components MACOM imports or make its products more expensive for international buyers, potentially affecting sales volumes.

The semiconductor sector, in particular, faces scrutiny regarding technology transfer. Stricter export controls can limit MACOM's ability to engage with certain markets or collaborate with international partners. This regulatory landscape is tightening; in 2024 alone, 37 applications for advanced semiconductor technology exports were denied, indicating a more challenging environment for companies like MACOM operating in this space.

The U.S. CHIPS and Science Act presents a significant tailwind for MACOM Technology Solutions. This legislation is designed to bolster domestic semiconductor production, creating a more robust and resilient supply chain within the United States. For MACOM, this translates into tangible opportunities for growth and modernization.

MACOM has already taken a concrete step, signing a preliminary memorandum of terms for up to $70 million in direct funding through the CHIPS Act. This substantial financial backing is earmarked for critical upgrades and expansion projects at its manufacturing sites located in Massachusetts and North Carolina. These investments are key to enhancing MACOM's production capabilities.

This influx of capital is vital for strengthening the domestic production of semiconductors, which are foundational to numerous critical sectors. Industries such as defense and telecommunications, which rely heavily on advanced chip technology, will benefit from this increased domestic capacity. The CHIPS Act funding directly supports MACOM in its efforts to contribute to this national strategic objective.

Geopolitical Stability and Supply Chain Resilience

Geopolitical stability is a significant concern for MACOM Technology Solutions, especially considering the semiconductor industry's dependence on a few key global manufacturing hubs. Global tensions can easily disrupt these intricate supply chains, impacting production and delivery schedules. For instance, the 2022-2023 global semiconductor shortage underscored how vulnerable these networks are, leading to significant delays and increased costs for companies like MACOM.

MACOM is actively working to bolster its supply chain resilience, partly by leveraging initiatives like the CHIPS and Science Act. This legislation, which aims to re-shore semiconductor manufacturing, provides MACOM with opportunities to increase its U.S.-based production capabilities. This strategic move is designed to insulate the company from the worst effects of international supply chain disruptions and geopolitical instability.

- Geopolitical Risk: Global tensions can disrupt MACOM's supply chain due to the semiconductor industry's reliance on concentrated manufacturing.

- Supply Chain Vulnerability: Events like the 2022-2023 semiconductor shortage highlight the impact of disruptions on production and delivery.

- Mitigation Strategy: MACOM is increasing U.S.-based production, supported by funding from legislation like the CHIPS Act, to reduce reliance on potentially unstable overseas manufacturing.

- CHIPS Act Impact: The CHIPS Act allocated billions, with over $39 billion in manufacturing incentives, directly supporting efforts to create more robust domestic semiconductor supply chains.

Regulatory Environment and Industry Standards

The political landscape directly shapes the regulatory environment for technology companies like MACOM. This includes adherence to industry-specific standards and certifications essential for market penetration and operational credibility. For instance, in 2024, the emphasis on supply chain security and data privacy regulations, such as those influenced by GDPR and similar global frameworks, continues to grow, impacting how semiconductor companies operate and share information.

Compliance with international quality management systems is paramount. MACOM, like many in its sector, likely focuses on standards such as ISO9001. Beyond general quality, specific sectors demand specialized certifications. For example, the automotive industry's reliance on semiconductors means adherence to standards like IATF16949 is critical for supplying components for vehicles, a market that saw robust growth in new vehicle sales in 2024, nearing pre-pandemic levels in many regions.

Similarly, the aerospace sector, a key market for advanced semiconductor solutions, requires rigorous certifications like AS9100D. These standards ensure the reliability and safety of components used in critical applications. The ongoing investments in defense and commercial aviation programs throughout 2024 and projected into 2025 underscore the importance of maintaining these high-level compliances for MACOM's continued market access.

Environmental regulations also play a significant political role, with standards like ISO14001 becoming increasingly important. Companies are expected to demonstrate responsible manufacturing practices and minimize their environmental footprint. This focus is driven by both governmental policies and investor pressure, with a notable increase in Environmental, Social, and Governance (ESG) reporting requirements becoming standard for publicly traded companies by 2024.

- ISO9001: General quality management standard.

- ISO14001: Environmental management standard.

- IATF16949: Automotive quality management standard.

- AS9100D: Aerospace quality management standard.

Government spending, particularly in defense, remains a major driver for MACOM, with around 62% of its 2023 revenue stemming from this sector. Recent government support, like a $3.4 million CHIPS Act contract for advanced semiconductor technology in 2024, underscores this reliance and fosters innovation.

International trade policies and export controls significantly impact MACOM's global operations. Tariffs can increase costs, and in 2024, 37 applications for advanced semiconductor technology exports were denied, illustrating a tightening regulatory environment for technology transfer.

The U.S. CHIPS Act, with its $39 billion in manufacturing incentives, offers MACOM substantial opportunities for domestic production growth. The company has already secured preliminary terms for up to $70 million in funding to upgrade its U.S. manufacturing sites, bolstering domestic semiconductor capacity.

Geopolitical risks, evidenced by the 2022-2023 semiconductor shortage, highlight supply chain vulnerabilities for MACOM. The CHIPS Act's focus on re-shoring manufacturing is a key strategy to build resilience against these disruptions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting MACOM Technology Solutions across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, helping identify potential threats and opportunities within MACOM's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively addressing the pain point of time-consuming data compilation for strategic discussions.

Economic factors

MACOM Technology Solutions' financial health is intrinsically linked to the ebb and flow of global economic growth, directly impacting crucial sectors like telecommunications infrastructure, data centers, and defense. When the global economy expands, investment in these areas typically rises, creating a more favorable demand environment for MACOM's advanced semiconductor solutions.

The semiconductor industry, by its very nature, is cyclical. This means that demand for products and, consequently, MACOM's revenue, can experience significant swings. Successfully navigating these market cycles is paramount for the company's sustained performance and requires strategic planning to manage periods of both high and low demand.

While certain segments within the telecommunications sector faced headwinds, leading to some softness in fiscal year 2024, MACOM demonstrated resilience. The company's performance was buoyed by robust growth in its data center and industrial & defense markets, showcasing the benefit of its diversified revenue streams in mitigating sector-specific downturns.

Global investment in telecommunications infrastructure, particularly the rollout of 5G and the development of 6G, is a major economic tailwind for MACOM. This expansion directly fuels demand for MACOM’s high-performance radio frequency (RF) and optical components, crucial for these advanced networks. For instance, the global 5G infrastructure market was valued at approximately $45.8 billion in 2023 and is expected to reach $185.6 billion by 2030, growing at a compound annual growth rate (CAGR) of 21.8%, according to various market research reports from late 2024 and early 2025.

MACOM is well-positioned to capitalize on this substantial market growth. Beyond 5G, increased investment in broadband access, including fiber optic deployment, and the burgeoning satellite communications (SATCOM) sector further enhance MACOM's revenue streams within the telecommunications segment. These diverse investment trends underscore the robust economic environment supporting MACOM's core business operations and future expansion opportunities.

The accelerating expansion of hyperscale data centers presents a significant economic tailwind for MACOM Technology Solutions. This growth is intrinsically linked to the surging demand for robust, high-speed connectivity, a core area where MACOM's technological expertise shines.

Artificial intelligence (AI) is a primary driver behind this data center boom. As AI applications become more sophisticated and widespread, the need for processing power and data storage intensifies, directly translating into increased demand for advanced networking components that MACOM provides.

The global data center interconnect market is a prime example of this economic opportunity, projected to hit $14.6 billion by 2025. MACOM's optical components are instrumental in enabling the widespread adoption of next-generation Ethernet speeds, such as 400G and 800G, which are essential for AI workloads.

Further economic incentives, such as potentially lower interest rates in the 2024-2025 period, could stimulate even greater investment in data center infrastructure. This environment is highly favorable for companies like MACOM that supply critical technologies for these expanding facilities.

Research and Development Investment

MACOM Technology Solutions' commitment to research and development is substantial, with a significant portion of its revenue allocated to this area. In fiscal year 2023, the company invested $186.2 million in R&D, representing 25.3% of its total revenue. This sustained investment is crucial for MACOM to maintain its position at the forefront of technological innovation, particularly in the rapidly evolving semiconductor market.

This R&D expenditure directly fuels MACOM's progress in critical technologies like Gallium Nitride (GaN) and Indium Phosphide (InP). These advanced materials are foundational for next-generation applications, including the expansion of 5G networks and the increasing demand for high-speed data center optics. Keeping pace with the relentless pace of technological advancement in the semiconductor industry necessitates this ongoing commitment to innovation.

- Fiscal Year 2023 R&D Investment: $186.2 million

- R&D as a Percentage of Revenue: 25.3%

- Key Technology Focus Areas: GaN and InP

- Target Markets: 5G infrastructure and data center optics

Inflationary Pressures and Supply Chain Costs

Inflationary pressures are a significant concern for MACOM Technology Solutions, directly impacting its operational expenses. Rising costs for essential inputs like raw materials, manufacturing components, and skilled labor can squeeze gross margins, as seen in the broader semiconductor industry. For instance, the Consumer Price Index (CPI) in the US saw a notable increase throughout 2023 and into early 2024, reflecting these widespread inflationary trends that affect procurement budgets.

Supply chain dynamics also play a crucial role. Even without outright shortages, disruptions or constraints can lead to heightened logistics and procurement expenses for MACOM. These increased overheads can affect the company's ability to maintain competitive pricing in the market. For example, shipping costs, a key component of supply chain expenses, remained elevated for much of 2023 compared to pre-pandemic levels, impacting companies like MACOM that rely on global manufacturing and distribution networks.

- Increased Input Costs: MACOM faces higher expenses for semiconductors, precious metals, and labor, impacting its cost of goods sold.

- Logistics Expenses: Elevated freight rates and transportation lead times contribute to higher supply chain costs for components and finished goods.

- Margin Pressure: The company must absorb some of these cost increases or pass them on, risking market share if pricing becomes uncompetitive.

- Procurement Challenges: Even without shortages, securing components at stable prices requires careful management and potentially higher upfront commitments.

Global economic expansion, particularly in telecommunications and data centers, directly fuels demand for MACOM's semiconductor solutions. The semiconductor industry's cyclical nature requires strategic navigation of demand fluctuations, with fiscal year 2024 showing resilience despite some telecom softness, bolstered by data center and defense growth.

Significant investments in 5G and 6G infrastructure, along with broadband and satellite communications, are key economic drivers. For instance, the global 5G infrastructure market was valued at approximately $45.8 billion in 2023 and is projected to reach $185.6 billion by 2030, with a CAGR of 21.8%.

The burgeoning AI sector is a primary catalyst for data center expansion, increasing demand for high-speed connectivity components. The data center interconnect market is expected to reach $14.6 billion by 2025, with MACOM's optical components supporting speeds like 400G and 800G essential for AI workloads.

Inflationary pressures and elevated logistics costs, evidenced by sustained higher shipping rates throughout 2023, impact MACOM's operational expenses and margins. The company's substantial R&D investment, $186.2 million or 25.3% of revenue in FY2023, is crucial for maintaining technological leadership in areas like GaN and InP for 5G and data center optics.

| Economic Factor | Impact on MACOM | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Global Economic Growth | Drives demand for telecom, data center, and defense solutions. | Positive outlook for infrastructure investment. |

| 5G/6G Rollout | Increases demand for RF and optical components. | 5G infrastructure market: ~$45.8B (2023) to ~$185.6B (2030), 21.8% CAGR. |

| Data Center Expansion (AI-driven) | Boosts demand for high-speed optical interconnects. | Data center interconnect market: projected to reach $14.6B by 2025. |

| Inflation and Supply Chain Costs | Increases operational expenses and can pressure margins. | Elevated shipping costs and raw material price increases noted through 2023-early 2024. |

| R&D Investment | Enables technological advancement and market leadership. | FY2023 R&D: $186.2M (25.3% of revenue), focusing on GaN and InP. |

What You See Is What You Get

Macom Technology Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Macom Technology Solutions provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the market landscape and strategic considerations for Macom.

Sociological factors

Societal reliance on high-speed internet continues its upward trajectory, fueled by the persistent rise of remote work, the insatiable demand for streaming services, and the ever-expanding ecosystem of Internet of Things (IoT) devices. This increasing dependence on seamless data flow directly translates into a growing need for sophisticated telecommunications and robust data center infrastructure. MACOM's advanced semiconductor solutions are critical enablers for this essential technological backbone.

The global mobile data traffic, for instance, is projected to reach nearly 300 exabytes per month by 2026, a significant leap from approximately 77 exabytes per month in 2021, underscoring the immense societal demand for faster connectivity. This surge directly benefits companies like MACOM, whose components power the networks facilitating this data explosion.

The ongoing adoption of 5G technology, with global 5G connections expected to exceed 1.5 billion by the end of 2024, and the forward-looking anticipation of 6G networks, clearly illustrate society's collective push for ever-faster and more dependable communication capabilities. MACOM's innovations in high-performance analog and mixed-signal components are pivotal in meeting these evolving demands.

The pervasive digital transformation is fundamentally reshaping how businesses and societies operate, with cloud computing adoption accelerating at an unprecedented pace. By the end of 2024, the global cloud computing market is projected to reach approximately $600 billion, a figure expected to continue its upward trajectory through 2025. This massive shift fuels the demand for robust data center infrastructure and advanced connectivity solutions, directly benefiting companies like MACOM.

This societal embrace of digital services and cloud-based operations translates into a sustained need for higher-speed optical interconnects. MACOM's expertise in photonic and RF solutions is therefore critically positioned to capitalize on this trend, as the expansion of data centers worldwide requires increasingly sophisticated components to handle the burgeoning data traffic.

The semiconductor industry's reliance on a highly skilled workforce, encompassing engineers and technicians, presents a critical sociological challenge for companies like MACOM. Ensuring a steady supply of specialized talent is paramount for innovation and production capacity.

MACOM proactively addresses this by investing in workforce development, notably through collaborations with academic institutions such as UMass Lowell and UMass Amherst. These partnerships aim to cultivate a robust pipeline of future talent, directly supporting the company's long-term growth objectives.

Further bolstering labor availability, the CHIPS Act is projected to generate approximately 350 new manufacturing jobs. This initiative directly tackles the industry's need for skilled personnel, aligning with MACOM's operational expansion plans.

Ethical Sourcing and Responsible Business Practices

Societal expectations regarding ethical sourcing and supply chain transparency are significantly shaping how technology firms like MACOM conduct business. Consumers and investors alike are increasingly demanding proof of responsible operations, pushing companies to adopt robust ethical frameworks. This heightened scrutiny means that companies must demonstrate a commitment to fair labor practices and environmental stewardship throughout their entire value chain.

MACOM's reputation and ability to attract investment are directly tied to its adherence to ethical standards. For instance, the semiconductor industry, where MACOM operates, has faced criticism for its complex global supply chains, making transparency a critical differentiator. Companies are actively implementing anti-corruption and anti-bribery policies to ensure integrity across all business dealings.

Responsible sourcing practices are no longer optional but a core component of corporate strategy. This includes ensuring that raw materials are not sourced from conflict zones or produced using exploitative labor.

- Consumer demand for ethically produced goods is rising, with a 2024 Accenture study showing over 70% of consumers consider sustainability when making purchasing decisions.

- Investor focus on Environmental, Social, and Governance (ESG) factors is intensifying, influencing capital allocation decisions for companies like MACOM.

- Regulatory bodies are increasingly scrutinizing supply chains for compliance with human rights and anti-corruption laws.

- A strong ethical sourcing policy can enhance brand loyalty and provide a competitive advantage in the technology sector.

Health and Safety Standards in Manufacturing

MACOM's dedication to stringent health and safety standards is paramount, especially given the intricate chemicals and processes inherent in semiconductor manufacturing. A strong safety record not only protects its workforce but also bolsters its reputation and social license to operate. In 2023, MACOM reported a Total Recordable Incident Rate (TRIR) of 0.37, significantly below the industry average, highlighting their commitment. This focus ensures operational continuity and minimizes risks associated with workplace accidents.

Adherence to robust health and safety protocols is a key sociological expectation for companies like MACOM. Employees and surrounding communities anticipate a safe working environment, free from undue hazards. MACOM’s investment in safety training and advanced protective equipment underscores this commitment. Their ongoing efforts to maintain a secure workplace are essential for fostering trust and positive relationships with stakeholders.

The company's proactive approach to safety contributes directly to its operational efficiency and employee morale. By prioritizing safety, MACOM reduces the likelihood of costly disruptions and potential liabilities. For instance, the company invested $12 million in facility upgrades in 2024, a significant portion of which was allocated to enhancing safety features and ergonomic improvements. This demonstrates a tangible commitment to employee well-being.

MACOM's health and safety performance is a reflection of its broader corporate social responsibility. A safe manufacturing environment is intrinsically linked to the company's ability to attract and retain talent, as well as maintain positive community relations. Their consistent focus on safety metrics, such as a 98% completion rate for mandatory safety training in early 2025, reinforces their dedication to a secure and responsible operational framework.

Societal demand for high-speed, reliable connectivity continues to grow, driven by remote work, streaming, and IoT expansion. MACOM's semiconductor solutions are essential for this infrastructure. Global mobile data traffic is projected to hit nearly 300 exabytes monthly by 2026, a substantial increase from 77 exabytes in 2021, highlighting the need for MACOM's components.

The increasing adoption of 5G, with over 1.5 billion connections expected by end-2024, and the development of 6G, showcase society's drive for faster communication. MACOM's analog and mixed-signal components are key to meeting these demands.

The digital transformation, including cloud computing's rapid growth, fuels demand for data centers and connectivity. The global cloud market is expected to reach around $600 billion by the end of 2024, continuing its rise into 2025, directly benefiting MACOM.

Societal expectations for ethical sourcing and supply chain transparency are crucial for tech companies like MACOM. Over 70% of consumers consider sustainability in purchasing decisions, according to a 2024 Accenture study.

Technological factors

MACOM's foundation is built on its deep knowledge and extensive patent portfolio in cutting-edge semiconductor materials such as Gallium Nitride (GaN) and Indium Phosphide (InP). These advanced materials are essential for creating powerful and efficient radio frequency (RF) and microwave components, critical for next-generation communication systems like 5G and 6G, as well as for defense sector needs.

The company's commitment to innovation in GaN and InP is a key driver for its competitive edge. For instance, in 2023, MACOM reported a significant portion of its revenue stemming from products utilizing these advanced materials, highlighting their importance to its financial performance. Continued advancements here directly translate to MACOM's ability to differentiate its offerings and maintain leadership in high-performance semiconductor markets.

The global expansion of 5G networks continues, with forecasts indicating that 5G connections will surpass 1.5 billion by the end of 2024 and approach 2 billion by mid-2025, according to various industry reports. This widespread deployment necessitates advanced semiconductor solutions. MACOM's expertise in radio frequency (RF) components, particularly its gallium nitride (GaN) power amplifiers designed for millimeter-wave (mmWave) frequencies, positions it as a key supplier for this critical infrastructure. These components are essential for enabling the high speeds and low latency characteristic of 5G and future 6G communications.

Looking ahead, the groundwork for 6G technology is actively being laid. MACOM is a participant in this evolution, demonstrating its latest innovations for 6G at significant industry gatherings such as the IEEE International Microwave Symposium (IMS) in 2025. This showcases the company's commitment to developing the foundational technologies required for the next leap in wireless communication, which promises even greater bandwidth and connectivity capabilities.

The relentless drive for faster data speeds within data centers, marked by the industry's shift towards 400G, 800G, and the anticipated 1.6T optical products, places a premium on ongoing advancements in optical and photonic components.

MACOM's specialized optical transceiver and linear passive optics (LPO) solutions are instrumental in facilitating these demanding high-speed connections, while simultaneously working to lower power usage in large-scale cloud environments.

For instance, the demand for 400G optical transceivers is projected to see significant growth, with market research indicating a compound annual growth rate (CAGR) of over 25% in the coming years, underscoring the critical need for MACOM's innovations.

These technological leaps are essential for hyperscale operators to meet the ever-increasing bandwidth requirements driven by AI, machine learning, and cloud computing workloads.

Miniaturization and Integration of Components

The relentless drive for smaller, more integrated, and higher-performance semiconductor components presents both a significant technological hurdle and a prime opportunity for companies like MACOM. This miniaturization trend is crucial across various advanced applications.

MACOM's strategic focus on integration is evident in its development of sophisticated multi-chip modules. For instance, their wideband front-end modules are designed for demanding applications such as electronic countermeasures and phased array radar systems, showcasing how integration enhances performance within extremely compact form factors.

Consider the impact on the defense sector, where MACOM components are vital. The global defense electronics market was valued at approximately $250 billion in 2023 and is projected to grow, driven by modernization efforts and the need for advanced radar and electronic warfare capabilities, all of which benefit from component miniaturization.

- Miniaturization enables smaller, lighter, and more power-efficient electronic systems.

- Integration of multiple functions onto single chips reduces complexity and cost.

- MACOM's multi-chip modules are key enablers for advanced defense and aerospace applications.

- The demand for high-performance, compact solutions in 5G infrastructure and data centers further fuels this technological trend.

Quantum Computing and Emerging Technologies

While quantum computing isn't a primary revenue driver for MACOM today, its foundational role in providing high-performance components for advanced applications positions it to capitalize on future breakthroughs. The company's 'Trusted Foundry' status, ensuring supply chain security and quality, is particularly relevant as sensitive industries explore quantum technologies. For instance, the global quantum computing market is projected to reach tens of billions of dollars by the early 2030s, with significant investments being made in research and development by major tech players and governments.

MACOM's ability to adapt and integrate its current semiconductor expertise into emerging technological paradigms, such as those requiring specialized components for quantum systems, could unlock substantial long-term market opportunities. As quantum computing matures, the demand for specialized, high-quality semiconductor solutions will undoubtedly grow. MACOM's strategic focus on high-performance analog and mixed-signal components aligns well with the potential needs of this nascent but rapidly evolving sector.

- Market Growth: The quantum computing market is anticipated to experience exponential growth, with projections suggesting it could exceed $5 billion annually by 2027, and potentially reach over $60 billion by 2030, according to various industry analysts.

- Investment Trends: Venture capital funding in quantum technologies saw significant increases in 2023 and early 2024, indicating strong investor confidence in the sector's future potential.

- Technological Synergy: MACOM's expertise in areas like RF, microwave, and high-speed optical components could be directly applicable to the development of control systems and interfaces for quantum computers.

MACOM's technological foundation in Gallium Nitride (GaN) and Indium Phosphide (InP) is critical for advancements in 5G and 6G, with 5G connections expected to exceed 1.5 billion by the end of 2024. Their GaN power amplifiers are essential for the high speeds and low latency of these networks. The company is also actively developing components for 6G, showcasing innovations at industry events like the IEEE International Microwave Symposium in 2025.

The company's high-speed optical components, particularly for 400G, 800G, and 1.6T applications, are vital for data centers. Demand for 400G optical transceivers is projected for over 25% CAGR, supporting AI and cloud computing workloads.

MACOM's focus on miniaturization and integration, seen in their multi-chip modules for defense and aerospace, addresses the need for smaller, more efficient systems. This trend is important for the global defense electronics market, valued around $250 billion in 2023.

While quantum computing is a future focus, MACOM's high-performance components could support this growing market, projected to reach tens of billions by the early 2030s. Their expertise in RF and optical components aligns with the needs of quantum system development.

Legal factors

The semiconductor sector is a hotbed for patent disputes. MACOM is no stranger to this, having previously pursued legal action to secure its exclusive rights to technologies such as GaN-on-Silicon, highlighting the critical nature of protecting its innovations.

These intellectual property battles aren't just for show; they have real financial consequences. Companies facing infringement claims or disagreements over licensing can incur substantial legal fees, pay out significant damages, or even face injunctions that halt product sales, directly impacting revenue streams.

For instance, patent litigation in the semiconductor industry can be incredibly protracted and expensive, with some cases costing millions in legal fees alone, a significant factor for companies like MACOM that operate in such a competitive and innovation-driven market.

MACOM Technology Solutions operates under stringent U.S. and international export control and sanctions regulations. This is especially critical due to its substantial presence in the defense industry, where its advanced semiconductor products are integral. A significant portion of MACOM's revenue, for instance, is historically tied to defense and aerospace markets, making compliance paramount.

Evolving regulatory landscapes and shifts in enforcement can directly affect MACOM's capacity to distribute its high-performance semiconductor solutions to specific geographic areas or clientele. In 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to update its Entity List and Export Administration Regulations (EAR), impacting numerous technology exports.

MACOM operates in a landscape where data privacy and cybersecurity are paramount, with regulations like the California Consumer Privacy Act (CCPA) and GDPR continuing to shape compliance requirements. As of early 2024, the global average cost of a data breach reached an estimated $4.45 million, highlighting the significant financial and reputational risks associated with security lapses. MACOM's reliance on digital operations and handling of sensitive customer information means it must invest heavily in data protection measures to avoid substantial penalties and litigation stemming from potential information system compromises.

Environmental Regulations and Compliance

MACOM Technology Solutions, like all semiconductor manufacturers, must navigate a complex web of environmental regulations. Compliance with laws governing waste management, chemical handling, and emissions is not just a best practice but a strict legal requirement. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards under the Resource Conservation and Recovery Act (RCRA) for hazardous waste generated during semiconductor fabrication.

MACOM's commitment to environmental stewardship means actively adhering to these legal mandates and international environmental guidelines. This dedication extends to its supply chain, where MACOM expects its partners to uphold similar standards for environmentally responsible operations. This focus is critical, as the semiconductor industry often deals with specialized chemicals and processes that require meticulous environmental oversight to prevent pollution and ensure worker safety.

Key areas of regulatory focus for companies like MACOM in 2024-2025 include:

- Air Emissions: Regulations on volatile organic compounds (VOCs) and greenhouse gases emitted from fabrication processes.

- Water Discharge: Strict limits on pollutants in wastewater discharged from manufacturing facilities.

- Chemical Management: Compliance with regulations concerning the storage, use, and disposal of hazardous chemicals used in chip production.

- Waste Disposal: Proper classification, treatment, and disposal of solid and hazardous waste generated during manufacturing.

Failure to comply with these environmental laws can result in significant penalties, including substantial fines and operational disruptions. For example, in recent years, several companies in the electronics manufacturing sector have faced multi-million dollar settlements for environmental violations, underscoring the financial and reputational risks associated with non-compliance.

Government Contract Compliance

MACOM Technology Solutions' reliance on government contracts, particularly within the defense sector, necessitates rigorous adherence to a complex web of legal and regulatory requirements. Failure to comply with these mandates can lead to severe repercussions.

For instance, a significant portion of MACOM's revenue in fiscal year 2024, estimated to be in the hundreds of millions based on their reported defense segment performance, is tied to these agreements. Non-compliance with government procurement regulations, including those related to cybersecurity, export controls (like ITAR), and ethical sourcing, could result in contract termination, substantial fines, or even debarment from future government business.

These legal factors demand that MACOM maintains robust internal controls and compliance programs. This includes:

- Strict adherence to Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS) clauses.

- Ensuring ethical business practices and preventing conflicts of interest in all government contract dealings.

- Maintaining compliance with cybersecurity standards mandated by government agencies, such as those outlined by the Department of Defense.

- Managing export control regulations diligently, especially for technologies with military applications.

The potential financial and reputational damage from non-compliance underscores the critical importance of proactive legal and regulatory management for MACOM's ongoing success in this market segment.

MACOM operates under stringent U.S. and international export control and sanctions regulations, particularly critical due to its significant defense industry presence. Evolving regulatory landscapes and enforcement shifts can directly impact MACOM's ability to distribute its products globally. As of 2024, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) actively updates its Entity List and Export Administration Regulations (EAR), affecting technology exports.

MACOM's reliance on government contracts, especially in defense, demands strict adherence to legal and regulatory requirements like the FAR and DFARS. Non-compliance can lead to contract termination, fines, or debarment, impacting its substantial defense segment revenue, estimated in the hundreds of millions for fiscal year 2024.

The semiconductor sector is rife with patent disputes, and MACOM has actively protected its innovations, such as GaN-on-Silicon technologies. These intellectual property battles can incur millions in legal fees and potential damages, directly affecting revenue streams in this innovation-driven market.

Data privacy and cybersecurity are paramount, with regulations like CCPA and GDPR shaping compliance. In early 2024, the average global cost of a data breach was approximately $4.45 million, underscoring MACOM's need for robust data protection to avoid penalties.

Environmental factors

MACOM Technology Solutions is actively working to lessen its environmental footprint, particularly concerning carbon emissions and the broader impact of climate change. Their strategy, spanning from 2023 through 2025, focuses on tangible actions to achieve these goals and manage associated risks.

A key initiative is the implementation of a Combined Cooling, Heating, and Power (CCHP) Plant. This advanced system is designed to significantly reduce the company's carbon output. Specifically, it's projected to cut Scope 1 and 2 emissions by an estimated 1,900 metric tons annually.

MACOM Technology Solutions places a significant emphasis on water conservation, integrating it as a core element of its environmental sustainability strategy, especially within its manufacturing operations. The company is committed to responsible water usage across its own facilities.

This commitment extends to its supply chain, as MACOM expects its third-party foundries and contract manufacturers to uphold its Supplier Code of Conduct, which specifically addresses environmental practices, including water management.

While specific water usage figures for MACOM's 2024-2025 operations are not publicly detailed, the semiconductor industry, in general, is a significant water consumer. For context, the U.S. semiconductor industry alone used an estimated 21 billion gallons of water in 2022, highlighting the importance of conservation efforts for companies like MACOM.

MACOM Technology Solutions actively pursues waste reduction, aiming to divert materials from landfills. In 2023, the company continued its strategy of partnering with specialized third-party vendors for the responsible decommissioning and recycling of surplus electronic equipment, reflecting a growing industry trend towards circular economy principles.

The company's commitment extends to implementing localized recycling programs across its operational sites. These efforts are designed to minimize MACOM's direct environmental impact by promoting the reuse and repurposing of materials, aligning with broader sustainability goals observed within the semiconductor industry during 2024.

Chemical Management in Manufacturing

MACOM Technology Solutions actively manages the environmental impact of its semiconductor manufacturing, particularly concerning chemical usage. The company is dedicated to minimizing its reliance on hazardous substances and ensuring compliance with stringent environmental regulations. This commitment extends to actively seeking alternatives and improving processes to reduce emissions.

The semiconductor industry relies heavily on a variety of chemicals for fabrication. MACOM's strategy involves reducing the use of ozone-depleting substances, volatile organic compounds (VOCs), and hazardous air pollutants (HAPs). For instance, many semiconductor facilities have seen significant reductions in VOC emissions through improved process controls and material substitution. According to industry reports from 2023, major semiconductor manufacturers have invested billions in environmental control technologies to meet evolving standards.

- Reduced Chemical Footprint: MACOM aims to decrease the overall volume of chemicals used in its manufacturing processes.

- Regulatory Compliance: Adherence to global environmental laws and standards governing chemical handling and disposal is a core priority.

- Emission Control: Efforts are focused on minimizing the release of ozone-depleting substances, VOCs, and HAPs into the atmosphere.

- Sustainable Alternatives: The company explores and implements greener chemical alternatives where feasible without compromising product quality.

Supply Chain Environmental Responsibility

MACOM Technology Solutions extends its environmental commitment beyond its own operations to its entire supply chain, expecting its partners to uphold environmentally sustainable business practices. This collaborative strategy is crucial for mitigating climate impact and ensuring responsible resource management across the entire value chain.

This focus on supply chain environmental responsibility is increasingly vital as global regulations and customer expectations around sustainability tighten. For instance, by 2024, many companies are facing increased scrutiny on Scope 3 emissions, which encompass emissions from a company's value chain, including its suppliers. MACOM’s proactive stance helps them navigate these evolving demands and build a more resilient business model.

- Supplier Audits: MACOM likely conducts regular environmental audits of its key suppliers to ensure compliance with its sustainability standards.

- Code of Conduct: A comprehensive supplier code of conduct likely outlines specific environmental expectations, such as waste reduction and energy efficiency targets.

- Collaborative Initiatives: The company may engage in joint projects with suppliers to identify and implement eco-friendly solutions, potentially sharing best practices in areas like packaging or logistics.

- Risk Mitigation: By fostering environmental responsibility within its supply chain, MACOM reduces the risk of disruptions due to environmental non-compliance or resource scarcity.

MACOM Technology Solutions is prioritizing environmental sustainability, with a focus on reducing its carbon footprint and managing climate change risks. Their 2023-2025 strategy includes implementing a Combined Cooling, Heating, and Power (CCHP) plant, projected to cut Scope 1 and 2 emissions by approximately 1,900 metric tons annually.

Water conservation is a critical aspect of MACOM's operations and supply chain management, with expectations for third-party manufacturers to adhere to environmental standards. While specific water usage data for 2024-2025 isn't detailed, the semiconductor industry's significant water consumption, estimated at 21 billion gallons in the US in 2022, underscores MACOM's conservation efforts.

MACOM is actively pursuing waste reduction, particularly through the recycling of surplus electronic equipment via specialized vendors, aligning with circular economy principles. Localization of recycling programs aims to minimize direct environmental impact, a trend observed across the semiconductor sector in 2024.

The company is committed to minimizing hazardous chemical usage and emissions, including ozone-depleting substances and VOCs, in its semiconductor manufacturing processes. This aligns with industry-wide investments, with major manufacturers allocating billions to environmental control technologies as of 2023.

| Environmental Initiative | Target Metric/Action | Projected Impact (Annual) | Timeframe |

| CCHP Plant Implementation | Reduction of Scope 1 & 2 emissions | 1,900 metric tons | 2023-2025 |

| Water Conservation | Responsible usage in manufacturing | N/A (Industry context: US semiconductor water usage ~21 billion gallons in 2022) | Ongoing |

| Waste Reduction | Recycling of surplus electronic equipment | N/A (Focus on diversion from landfills) | Ongoing |

| Chemical Management | Minimizing hazardous substances & emissions | N/A (Industry context: Billions invested in control tech by 2023) | Ongoing |

PESTLE Analysis Data Sources

Our PESTLE analysis for Macom Technology Solutions utilizes a comprehensive blend of data from official government publications, reputable financial institutions, and leading technology research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape affecting Macom.