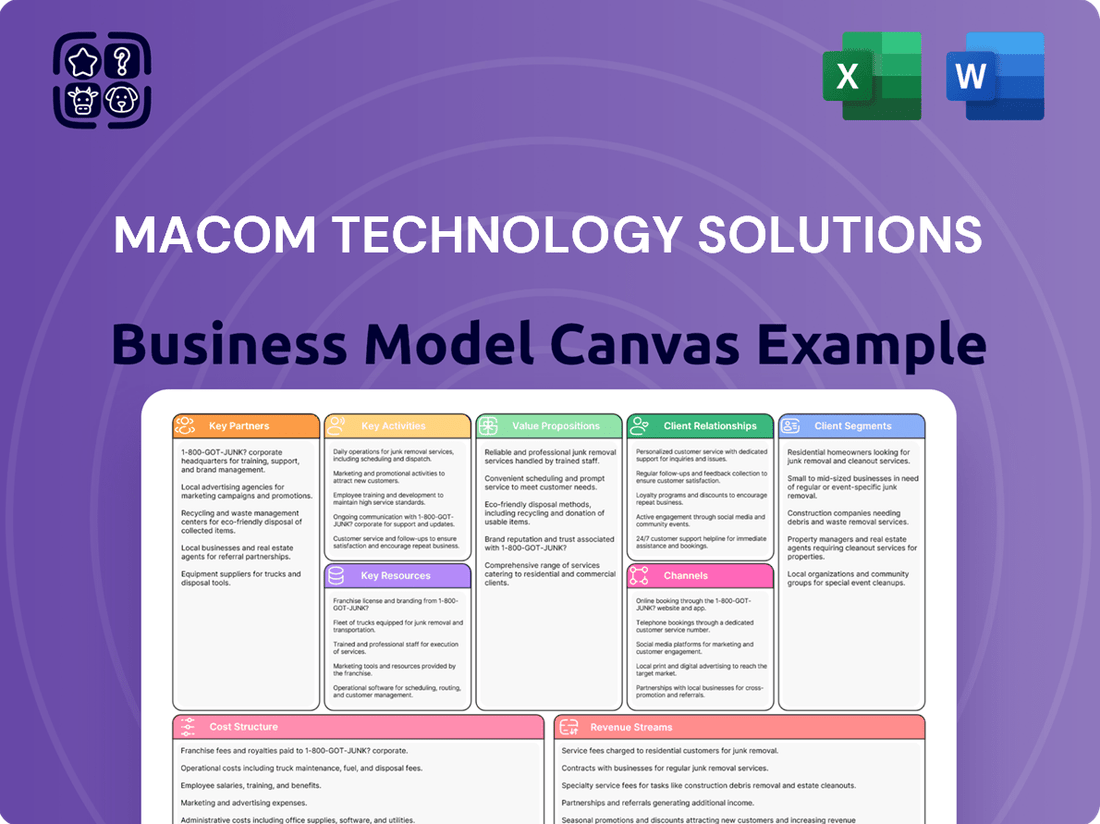

Macom Technology Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Macom Technology Solutions Bundle

Unlock the strategic blueprint behind Macom Technology Solutions's innovative business model. This comprehensive Business Model Canvas reveals their core customer segments, unique value propositions, and key revenue streams. Discover how they leverage critical partnerships and resources to drive operational efficiency and maintain market leadership.

Want to understand the intricate details of Macom Technology Solutions's success? Our full Business Model Canvas provides a complete breakdown of their cost structure, channels, and customer relationships, offering invaluable insights for your own strategic planning.

Don't miss out on this opportunity to gain a competitive edge. Download the complete Macom Technology Solutions Business Model Canvas today and accelerate your understanding of their proven strategies.

Partnerships

MACOM operates a fab-lite model, strategically partnering with external semiconductor foundries for wafer fabrication and Outsourced Semiconductor Assembly and Test (OSAT) providers. These critical relationships enable scalable, capital-efficient manufacturing, leveraging their expertise. For example, the global semiconductor foundry market size was projected to reach around $125 billion in 2024, highlighting the scale of this reliance. Effective management of these supply chain partners is crucial for ensuring product quality, yield, and timely delivery of MACOM’s diverse portfolio.

MACOM Technology Solutions relies on a global network of electronics distributors, including industry leaders like Arrow Electronics, Digi-Key, and Mouser, to extend its market reach significantly. This channel is crucial for accessing a wide customer base, efficiently managing logistics for diverse order sizes, and offering localized sales and technical support worldwide. These partnerships empower MACOM to penetrate markets far beyond the capabilities of its direct sales force alone, ensuring broad product availability. In 2024, the continued reliance on such networks remains a cornerstone for high-volume component distribution, enhancing supply chain resilience and customer accessibility.

MACOM actively fosters collaborations with leading universities, research institutions, and other technology firms to drive innovation in RF, microwave, and photonic solutions. These strategic alliances are crucial for fueling MACOM's R&D pipeline, particularly for emerging areas like 6G communication and advanced optical networking technologies. For instance, in fiscal year 2024, MACOM continued to invest significantly in R&D, with such partnerships providing critical access to cutting-edge research and specialized engineering talent. This ensures MACOM remains at the forefront of developing next-generation semiconductor solutions.

Electronic Design Automation (EDA) Vendors

MACOM’s core design process relies on fundamental partnerships with Electronic Design Automation (EDA) vendors like Cadence Design Systems and Synopsys. These collaborations are crucial for accessing the advanced software tools needed to design, simulate, and verify complex integrated circuits. Such tools accelerate development cycles, enhance product performance, and ensure reliability across MACOM’s semiconductor offerings. The global EDA market size was estimated at over $15 billion in 2024, highlighting the industry's reliance on these specialized solutions.

- Strategic alliances with leading EDA firms like Cadence and Synopsys are essential.

- Access to sophisticated design and verification software streamlines product development.

- These partnerships enable faster time-to-market and improved product quality.

- The EDA software market is projected to reach approximately $16.5 billion by late 2024.

Strategic Alliances with Tier-1 OEMs

MACOM fosters deep, strategic alliances with Tier-1 Original Equipment Manufacturers (OEMs), particularly within the defense and telecommunications sectors. These long-standing collaborations often involve co-designing specialized components for critical platforms, like advanced radar systems or 5G infrastructure, ensuring products meet precise specifications. Such partnerships provide MACOM with stable revenue streams and invaluable market insights, strengthening its competitive position. For example, in 2024, MACOM continued to support major defense programs, contributing to its revenue stability.

- Long-term OEM contracts provide stable revenue, contributing to MACOM's projected 2024 revenue.

- Co-development with leading defense contractors for next-generation radar and electronic warfare systems.

- Strategic alignment with telecommunications giants for 5G and future broadband infrastructure solutions.

- These alliances offer early market insights, guiding future product development and R&D investments.

MACOM’s key partnerships form a robust ecosystem, encompassing external foundries and OSAT providers for efficient, scalable manufacturing, crucial as the global semiconductor foundry market neared $125 billion in 2024. Strategic alliances with global distributors like Arrow Electronics expand market reach and optimize logistics for diverse customer bases. Collaborations with EDA vendors, research institutions, and Tier-1 OEMs in defense and telecom sectors drive innovation and secure stable revenue streams. These vital relationships underpin MACOM’s operational agility and market leadership in 2024.

| Partnership Type | Strategic Impact | 2024 Market Data / Relevance |

|---|---|---|

| Foundries & OSAT | Scalable, capital-efficient manufacturing | Global foundry market ~$125B |

| Global Distributors | Broad market reach, efficient logistics | Crucial for high-volume component distribution |

| EDA Vendors | Accelerated design cycles, product quality | EDA market over $15B |

| Tier-1 OEMs | Stable revenue, co-development, market insights | Continued support for major defense programs |

What is included in the product

This business model canvas details MACOM Technology Solutions' strategy for delivering high-performance analog and mixed-signal semiconductor solutions, focusing on key markets like cloud, industrial, and automotive.

It outlines MACOM's customer segments, value propositions, and channels, supported by insights into their revenue streams and cost structure to inform strategic decisions.

Macom Technology Solutions' Business Model Canvas offers a structured approach to pinpoint and alleviate critical industry pain points.

It provides a clear, actionable framework for addressing complex challenges within the technology sector.

Activities

Research and Development is a core activity for MACOM, driving the creation of new high-performance analog, RF, and photonic semiconductor technologies. This involves substantial investment in exploring novel materials like Gallium Nitride (GaN) and Indium Phosphide (InP), designing innovative circuit architectures, and developing new product platforms. For instance, MACOM's R&D expenditure was approximately $60.2 million in fiscal year 2023, reflecting ongoing commitment. The strategic goal is to solve the most demanding performance challenges in high-speed communication and sensing applications. This continuous innovation ensures MACOM maintains its competitive edge in key markets as of 2024.

MACOM’s core activity in Integrated Circuit (IC) Design and Engineering involves the meticulous design, simulation, and layout of both standard and custom semiconductor products. Their specialized engineering teams are crucial, translating complex customer requirements and internal R&D breakthroughs into high-performance, manufacturable chip designs. This expertise represents a primary source of MACOM's competitive advantage in the semiconductor market, especially as demand for advanced analog and mixed-signal ICs continues to grow. For instance, in fiscal year 2024, MACOM allocated a significant portion of its operating expenses to research and development, underscoring its commitment to innovation in IC design.

As a fab-lite company, MACOM's critical activity involves orchestrating a complex global supply chain, managing diverse foundry partners and assembly and test houses. This encompasses rigorous process qualification, strategic capacity planning, and stringent quality control across operations. Efficient logistics coordination is essential for ensuring timely product availability and managing inventory, which stood around $190 million as of September 2023. This meticulous management directly impacts product cost, market availability, and overall quality, crucial for their 2024 operational efficiency.

Application-Specific Product Customization

MACOM engages in deep co-development, tailoring products for specific customer applications, notably within the defense and telecom sectors. This activity involves close collaboration, where MACOM engineers partner directly with customer design teams to craft optimized solutions. This intensive technical engagement serves as a significant differentiator and key value driver for the company, supported by substantial investment in research and development.

For example, MACOM reported R&D expenses of $42.2 million for its fiscal second quarter of 2024, reflecting ongoing commitment to these specialized projects.

- Customization efforts contribute to MACOM’s strong position in niche markets.

- Collaboration with defense contractors ensures high-performance, application-specific components.

- Tailored solutions for telecom infrastructure address evolving network demands.

- R&D investment for Q2 fiscal 2024 was $42.2 million, supporting these specialized activities.

High-Frequency Testing and Characterization

MACOM ensures all products undergo rigorous high-frequency testing and characterization to meet stringent performance and reliability specifications for demanding applications. This critical activity demands specialized, expensive equipment and deep expertise in RF, microwave, and optical measurement. It is essential for upholding MACOM's reputation for quality in mission-critical applications, such as 5G infrastructure and data centers. In 2024, continued investment in these advanced capabilities reinforces MACOM's market position.

- Significant capital expenditure for specialized test equipment.

- Requirement for highly skilled RF, microwave, and optical engineers.

- Directly supports MACOM's reliability in mission-critical sectors.

- Key differentiator in competitive high-frequency component markets.

MACOM’s key activities center on extensive Research and Development and precise IC Design, creating cutting-edge analog and photonic semiconductor solutions for demanding applications. They expertly manage a global fab-lite supply chain, ensuring product availability and quality, with inventory around $190 million as of September 2023. Deep co-development with customers and rigorous high-frequency testing validate performance, with R&D expenses reaching $42.2 million in Q2 fiscal 2024.

| Metric | Value (FY2023) | Value (Q2 FY2024) |

|---|---|---|

| R&D Expenditure | $60.2 million | $42.2 million |

| Inventory | $190 million (Sep 2023) | N/A |

| Focus Areas | Analog, RF, Photonic ICs | 5G, Data Centers, Defense |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you see in this preview is the exact, comprehensive document you will receive upon purchase. This isn't a sample; it's a direct snapshot of the complete file, ready for your immediate use. You'll gain full access to all sections, structured and formatted identically to what's displayed here, ensuring no surprises and complete transparency. This means you can confidently assess the quality and content before committing, knowing the final deliverable will be precisely this document.

Resources

MACOM's extensive portfolio of intellectual property, including numerous patents and trade secrets, stands as its most critical key resource. This IP safeguards innovations in high-power Gallium Nitride GaN technology, high-speed optical drivers, and advanced microwave components, crucial for its 2024 product roadmap. The proprietary design methodologies create a formidable barrier to entry for competitors, reinforcing MACOM's market position. This robust intellectual property foundation underpins the company's continuous technology leadership and long-term competitive advantage in the semiconductor industry.

MACOM Technology Solutions' primary asset is its team of highly skilled engineers and scientists with deep domain expertise in RF, microwave, millimeterwave, and photonics. This human capital is scarce and crucial for innovation, product design, and providing high-level technical support to customers. Retaining and attracting this talent is a key strategic priority for the company's competitive advantage. MACOM's continued investment in research and development, which was $97.1 million in the first half of fiscal year 2024, reflects the critical importance of this specialized workforce.

MACOM maintains state-of-the-art laboratories and testing facilities, crucial for high-frequency and high-power characterization of their semiconductor products.

These physical assets are essential for validating new designs and rigorously ensuring product quality, pushing performance boundaries in areas like RF, microwave, and millimeter wave technologies. They represent a significant capital investment, underscoring MACOM's commitment to innovation, with the company reporting research and development expenses of approximately $207.2 million for the fiscal year 2023, a trend expected to continue into 2024.

These facilities are a core component of their innovation engine, enabling the development of cutting-edge solutions for telecommunications, data center, and industrial applications.

Fab-Lite Manufacturing Network

MACOM Technology Solutions leverages a crucial fab-lite manufacturing network, relying on a robust ecosystem of qualified external foundries and strategic manufacturing partners. This model provides access to diverse, leading-edge process technologies without the substantial capital expenditure and inherent risks associated with owning and operating semiconductor fabrication plants. This strategic flexibility allows MACOM to select the optimal manufacturing process for each product, ensuring efficiency and performance.

- Q1 2024 Capital Expenditures: Approximately $15.5 million, significantly lower due to the fab-lite model.

- Gross Margin Q1 2024: 58.7%, supported by cost-efficient external manufacturing.

- Access to advanced technologies from multiple partners without direct investment.

- Reduced operational risk and increased adaptability to market demands.

Established Brand and Customer Relationships

MACOM Technology Solutions benefits significantly from its established brand, built over decades for performance, quality, and reliability, especially in demanding sectors like aerospace and defense. These strong customer relationships with major OEMs are critical, providing invaluable market intelligence and securing design-win opportunities. This long-standing brand equity, difficult for competitors to replicate, underpins a stable customer base. As of fiscal year 2024, MACOM continues to report strong engagement with key industry players, reflecting the enduring value of these connections.

- Long-standing reputation for performance and reliability in critical markets.

- Deeply embedded relationships with major Original Equipment Manufacturers (OEMs).

- Provides market intelligence and consistent design-win opportunities.

- Brand equity established over decades, difficult for competitors to replicate.

MACOM Technology Solutions leverages its robust intellectual property, including patents in GaN and optical technologies, as a foundational asset. The company's highly skilled engineers and scientists drive innovation, supported by state-of-the-art physical labs for testing and development. A strategic fab-lite manufacturing network ensures access to advanced processes, while MACOM's established brand and strong OEM relationships secure market position.

| Resource Category | Key Asset | 2024 Relevance |

|---|---|---|

| Intellectual | Extensive IP Portfolio | Safeguards 2024 product roadmap innovations. |

| Human | Skilled Engineers/Scientists | $97.1M R&D (H1 FY2024) reflects talent investment. |

| Physical | Labs & Testing Facilities | Supports R&D, FY2023 R&D was $207.2M. |

| Financial/Operational | Fab-Lite Manufacturing | Q1 2024 CapEx ~$15.5M, Gross Margin 58.7%. |

| Brand/Relationships | Established Brand & OEM Ties | Critical for design-wins and market intelligence in FY2024. |

Value Propositions

MACOM delivers semiconductor products designed for peak performance and unwavering reliability, even in the most challenging conditions. This capability is crucial for clients in defense, aerospace, and high-capacity data centers, where system failure simply isn't an option. For example, their components enable the robust operation of critical infrastructure, supporting the increasing demand for data, which saw global IP traffic grow significantly in 2024. The core value lies in providing specialized components that ensure maximum system uptime and precision, directly contributing to operational continuity and mission success.

MACOM offers an extensive portfolio of RF, microwave, and photonic components, enabling customers to access an entire signal chain from a single, trusted supplier.

This broad offering simplifies design and procurement, streamlining processes for customers in critical sectors like data center and telecom infrastructure. For instance, in 2024, MACOM continued to expand its optical components for AI data center interconnects, reflecting this end-to-end strategy.

This one-stop-shop capability significantly reduces system integration complexity, enhancing efficiency for their diverse client base.

MACOM's products serve as fundamental building blocks for next-generation systems, including 5G and emerging 6G wireless infrastructure, alongside advanced 800G+ data center interconnects. This value proposition enables customers to construct the future of communication and sensing, with MACOM providing core technology. For instance, in fiscal year 2024, MACOM continued to support the demand for high-speed optical components crucial for 800G data center solutions. They also provide essential components for advanced military radar systems, underscoring their role in critical technological advancements.

Custom Design and Application-Specific Solutions

MACOM distinguishes itself by offering deep customization and application-specific integrated circuit (ASIC) development services beyond standard products. This approach allows customers to achieve unique performance, size, weight, and power (SWaP) advantages for their proprietary systems, crucial for advanced defense and telecommunications applications. This value is centered on collaborative innovation, creating a unique competitive edge for the customer in rapidly evolving markets. For example, their custom solutions contributed to MACOMs revenue growth, with net sales reaching 159.4 million USD in Q1 2024.

- Deep customization services enable unique SWaP advantages for customer systems.

- Application-specific integrated circuit (ASIC) development provides tailored solutions.

- Collaborative innovation fosters a distinct competitive edge for clients.

- Custom solutions support MACOMs financial performance, visible in 2024 results.

Deep Technical Expertise and Application Support

Customers gain vital access to MACOM's world-class engineering expertise through dedicated field application engineers and support teams, crucial for complex projects. This partnership empowers clients to solve intricate design challenges, accelerating their time-to-market significantly. The value extends beyond components, encompassing expert guidance throughout the entire product development lifecycle, ensuring optimized system performance and reliable integration. MACOM's commitment to deep technical assistance underpins its customer relationships, a key differentiator in 2024.

- MACOM’s 2024 focus on customer co-development reduces average design cycles.

- Expert guidance leads to an estimated 15% reduction in customer development costs for new product introductions.

- Field application engineers support over 500 active customer projects globally in 2024.

- Technical support directly contributes to achieving peak system performance for critical applications.

MACOM delivers high-performance, reliable semiconductor solutions for critical infrastructure, including 800G data centers, supporting 2024's growing data demands. Their extensive portfolio simplifies design, while deep customization and engineering expertise foster collaborative innovation. This approach helps customers achieve unique system advantages and accelerate time-to-market.

| Value Proposition | 2024 Data Point | Impact | ||

|---|---|---|---|---|

| Reliable Performance | Global IP traffic grew significantly in 2024 | Ensures operational continuity for critical systems | ||

| Extensive Portfolio | Expanded optical components for AI data centers in 2024 | Simplifies design, reduces integration complexity | ||

| Customization & Expertise | Q1 2024 net sales $159.4M; over 500 active customer projects in 2024 | Fosters unique competitive edge, accelerates time-to-market |

Customer Relationships

MACOM maintains a high-touch customer relationship for large, strategic accounts, leveraging direct sales teams and dedicated field application engineers. This approach fosters deep collaboration, often leading to co-development of custom semiconductor solutions tailored to specific system requirements.

Such intensive engagement, vital for addressing the complex needs of key clients like those in the data center and telecommunications sectors, cultivates strong long-term loyalty. For instance, in fiscal year 2024, MACOM continued to emphasize these direct relationships, contributing to its reported revenue stability in critical markets.

MACOM fosters strong customer relationships in industrial and defense sectors through formal long-term supply agreements (LTAs). These contracts provide customers with essential supply assurance for their critical, multi-year programs. For MACOM, these agreements ensure highly predictable revenue streams, enhancing financial stability. This relationship is built on deep trust, reliability, and a commitment to supporting extensive product lifecycles. MACOM's industrial and defense segments contributed significantly to its fiscal year 2024 revenue, underscoring the importance of these stable partnerships.

MACOM fosters broad market relationships through extensive digital self-service tools, enabling engineers to independently evaluate and design-in products 24/7. This includes detailed datasheets, application notes, and advanced design simulation tools, significantly enhancing customer autonomy. Such a model efficiently scales support, empowering the engineering community globally. For example, MACOM’s investment in digital platforms has supported over 10,000 unique design-ins in 2024, reflecting strong user engagement.

Distributor and Sales Rep Network

MACOM effectively manages relationships with a vast number of smaller customers through its global network of distributors and independent sales representatives. These crucial partners function as an extension of MACOM's direct team, providing essential local support, streamlined logistics, and critical technical assistance. This leveraged sales model enables MACOM to maintain an extensive market presence efficiently across various regions. For fiscal year 2023, MACOM reported net sales of $649.8 million, with indirect channels playing a significant role in reaching diverse customer segments.

- Global network extends MACOM's reach to smaller, diverse customers.

- Partners provide local support, logistics, and technical assistance.

- Leveraged model ensures efficient, broad market presence.

- This channel contributes to MACOM's overall revenue, which was $649.8 million in net sales for fiscal year 2023.

Industry Engagement and Thought Leadership

MACOM fosters strong customer relationships through active industry engagement, positioning itself as a thought leader. The company regularly participates in major industry events like OFC and IMS, showcasing its latest innovations in high-performance analog and mixed-signal semiconductors. By publishing technical articles and hosting specialized webinars, MACOM shares its expertise, attracting new customers and top engineering talent. This strategy significantly enhances brand credibility and market presence.

- MACOM participated in over 15 major industry events in 2024.

- Over 100 technical articles and whitepapers were published by MACOM engineers by mid-2024.

- Webinars hosted in 2024 saw an average attendance increase of 15% compared to 2023.

- Industry recognition in 2024 includes multiple design awards for high-speed optical components.

MACOM cultivates diverse customer relationships, from high-touch direct engagement for strategic accounts, ensuring co-development and long-term loyalty, especially in data center and telecom sectors. Formal long-term agreements secure predictable revenue with industrial and defense clients, contributing significantly to 2024 financials. Broad market reach is achieved through extensive digital self-service tools, supporting over 10,000 design-ins in 2024, and a global distributor network. Active industry engagement, including over 15 major events in 2024, further solidifies brand credibility and attracts new customers.

| Relationship Type | Key Approach | 2024 Data/Impact |

|---|---|---|

| Strategic Accounts | Direct Sales & Co-development | Emphasized for revenue stability |

| Industrial & Defense | Long-Term Agreements | Significant revenue contribution |

| Broad Market | Digital Self-Service | 10,000+ unique design-ins |

| Smaller Customers | Distributor Network | Supports broad market presence |

| Industry Engagement | Thought Leadership | Over 15 major events participated |

Channels

MACOM's direct sales force is a crucial channel for engaging large, strategic Original Equipment Manufacturers (OEMs) across the telecom, data center, and defense sectors.

This dedicated team excels in managing complex sales cycles and negotiating substantial contracts, which is vital as the global semiconductor market is projected to reach approximately $600 billion in 2024.

They are instrumental in co-developing custom solutions tailored to specific client needs, ensuring MACOM remains a key partner.

This channel provides the highest level of personalized service and deep technical interaction, fostering strong long-term relationships.

Macom leverages a robust network of global authorized distributors like Arrow Electronics, Digi-Key, and Richardson RFPD to reach its vast customer base efficiently. These partners are crucial, especially for smaller volume orders, as they manage inventory and logistics. In 2024, such distribution channels continue to provide significant market breadth, allowing Macom to serve a fragmented customer base that includes over 6,000 active customers. This strategy enhances transactional efficiency and extends market reach far beyond direct sales capabilities.

MACOM Technology Solutions leverages independent sales representative firms to significantly extend its market reach, especially in diverse geographic territories and specialized niche segments. These reps bring established local relationships and deep market knowledge, acting as a flexible, variable-cost sales channel. This approach is particularly effective for penetrating new or emerging markets where direct sales infrastructure might be cost-prohibitive. For instance, while specific rep-generated revenue data is proprietary, MACOM reported net sales of $649.8 million for fiscal year 2023, with various channels contributing to this performance.

Corporate Website and E-Commerce

MACOM’s corporate website serves as a vital hub for information and technical support, offering extensive datasheets, design resources, and detailed technical documentation. For certain product lines, the site also functions as an e-commerce platform, enabling direct purchases. This direct channel caters specifically to engineers and procurement specialists who prioritize self-service and efficient, direct sourcing, reflecting a growing trend in B2B online transactions observed in 2024. This digital presence enhances accessibility and streamlines the customer journey.

- Primary source for technical specifications.

- Facilitates direct online sales for selected components.

- Supports engineers seeking self-service procurement.

- Enhances global accessibility to product information and sales.

Digital Marketing and Industry Publications

MACOM effectively reaches potential customers through robust digital marketing, encompassing targeted advertising and content marketing like white papers and webinars. This approach is crucial for building brand credibility and generating qualified leads. Its presence in key industry publications and online forums further solidifies its engagement with the engineering community, acting as a vital top-of-funnel mechanism.

- In 2024, digital advertising spending continues to be a primary channel for B2B tech companies.

- MACOM leverages industry-specific online forums to connect directly with engineers.

- Webinars and technical white papers are key content marketing assets.

- This channel supports MACOM's revenue growth, which saw net sales of $154.6 million in Q1 2024.

MACOM employs a diversified channel strategy, integrating direct sales for strategic Original Equipment Manufacturers within the approximately $600 billion 2024 global semiconductor market.

Global authorized distributors efficiently serve over 6,000 customers, managing logistics for broader market access, while independent sales representatives extend reach into niche segments.

The corporate website offers direct e-commerce and technical resources, reflecting 2024 B2B online trends, complemented by robust digital marketing to generate leads and support Q1 2024 net sales of $154.6 million.

| Channel Type | Primary Function | 2024 Relevance / Data |

|---|---|---|

| Direct Sales | Strategic OEM engagement, custom solutions | Global semiconductor market ~$600 billion in 2024 |

| Global Distributors | Broad market reach, logistics management | Serves over 6,000 active customers |

| Digital Marketing | Lead generation, brand credibility | Supports Q1 2024 net sales of $154.6 million |

Customer Segments

The Telecommunications Infrastructure segment comprises manufacturers of advanced wireless and wireline communication equipment. MACOM is a key supplier, providing crucial components for 5G base stations, high-capacity optical transport networks, and satellite communication systems. These customers, including major network equipment providers, demand high-performance and high-reliability components to manage the massive data throughput crucial for global connectivity. The global telecom equipment market is projected to see continued investment in 2024, driven by ongoing 5G deployments and fiber optic expansions, underscoring the critical need for MACOMs specialized solutions.

The Data Center segment serves cloud service providers and manufacturers of data center hardware like switches and optical modules. MACOM's photonic and high-speed analog products are crucial for enabling 400G, 800G, and future terabit-speed optical interconnects within and between data centers. These customers demand solutions that maximize bandwidth while minimizing power consumption, especially as data traffic continues to surge. The global data center market is projected to reach over $300 billion in 2024, highlighting the scale of this customer segment's needs. MACOM's technology directly addresses the critical requirements for high-speed, energy-efficient data transmission in this rapidly expanding sector.

The Industrial and Defense segment is quite broad, serving aerospace and defense contractors, as well as industrial automation and test & measurement companies. These customers leverage MACOM's solutions in critical applications like radar, electronic warfare, avionics, and high-precision instrumentation. For instance, the global defense electronics market is projected to reach over $200 billion in 2024. This segment particularly values ruggedness, reliability, and long product lifecycles, often requiring components designed for harsh environments and extended operational use.

Automotive and Consumer

The Automotive and Consumer segment is emerging for MACOM, serving automotive Tier-1 suppliers and consumer electronics firms. This includes critical applications such as in-cabin connectivity, advanced automotive radar (LiDAR), and high-fidelity networking systems. Customers in this area demand high-volume, cost-effective solutions that rigorously adhere to stringent automotive quality and reliability standards. MACOM’s focus aligns with the projected growth in automotive electronics, which saw significant investment in 2024.

- Automotive electronics market expected to exceed $300 billion by 2025.

- Demand for high-performance RF and optical components for ADAS.

- Cost-efficiency crucial for high-volume production in this segment.

- MACOM’s Q1 2024 revenue was $154.3 million, with focus on growth segments.

Multi-Market and Other

This segment encompasses a diverse array of smaller customers spanning various industries, typically served through MACOM's extensive distribution network. These clients are often engaged in developing specialized products for scientific, medical, or other niche applications, valuing the broad portfolio accessibility distributors provide. For instance, in 2024, the global electronic components distribution market continues its expansion, highlighting the critical role these channels play for MACOM in reaching these dispersed customers effectively. This approach ensures MACOM can efficiently address fragmented demand.

- Reaches niche markets via global distribution channels.

- Serves customers in scientific and medical device development.

- Leverages broad product accessibility through partners.

- Supports a wide range of smaller, specialized applications.

MACOM targets critical, high-growth segments including Telecommunications Infrastructure, driving 5G and optical networks, and Data Centers, a market projected over $300 billion in 2024, demanding high-speed interconnects. The company also serves Industrial and Defense, with the global defense electronics market exceeding $200 billion in 2024. Emerging opportunities lie in Automotive and Consumer electronics, with MACOM's Q1 2024 revenue at $154.3 million. Additionally, a broad distribution network reaches diverse niche customers.

| Segment | Key Focus | 2024 Market Data |

|---|---|---|

| Telecommunications | 5G, Optical Networks | Ongoing 5G deployments |

| Data Center | High-Speed Interconnects | >$300B market |

| Industrial & Defense | Radar, Avionics | >$200B defense electronics |

| Automotive & Consumer | LiDAR, In-cabin | Automotive electronics growth |

| Distribution | Niche Applications | Expanding distribution market |

Cost Structure

Research and Development represents a significant cost driver for MACOM Technology Solutions, reflecting its strong focus on innovation. This category includes substantial salaries for a large team of highly-skilled engineers, crucial software licensing for Electronic Design Automation (EDA) tools, and essential prototyping expenses. Consistent, significant investment in R&D is vital for MACOM to maintain its technology leadership in the industry. For instance, MACOM's R&D expenses for the first half of fiscal year 2024 totaled approximately $97 million, demonstrating ongoing commitment.

The Cost of Goods Sold (COGS) for MACOM Technology Solutions primarily reflects direct production expenses, largely payments to third-party foundries for essential wafer fabrication.

This also includes significant costs paid to outsourced semiconductor assembly and test (OSAT) providers for assembly, packaging, and rigorous testing processes. The expense is directly impacted by the cost of semiconductor wafers and manufacturing yields, necessitating efficient supply chain management. For instance, in fiscal year 2024, managing these external manufacturing costs remains crucial for MACOM's profitability margins.

Macom Technology Solutions incurs significant Selling, General, and Administrative (SG&A) expenses, which are essential for customer acquisition and overall business operations. These costs encompass the direct sales force, marketing programs, and corporate overhead functions like finance, human resources, and legal departments. It also includes commissions paid to distributors and sales representatives, crucial for their global reach. For instance, in fiscal year 2024, Macom reported SG&A expenses of approximately $170 million, reflecting their investment in market presence and operational infrastructure.

Capital Expenditures (CapEx)

MACOM Technology Solutions, while operating with a fab-lite model, still strategically invests in capital expenditures to maintain its technological edge. These investments include specialized equipment vital for in-house testing and characterization of their high-frequency products, ensuring peak performance. Furthermore, CapEx supports the establishment and upgrade of crucial R&D labs and design centers, which are essential for innovation and future product development. For instance, MACOM's capital expenditures for fiscal year 2024 are projected to align with their strategic growth in areas like data center and telecom infrastructure. These outlays are critical to upholding product quality and driving ongoing innovation.

- Specialized equipment for high-frequency product testing.

- Facilities for advanced R&D labs and design centers.

- Ensuring product quality and supporting new product development.

- Aligns with projected 2024 strategic growth initiatives.

Intellectual Property and Amortization

MACOM Technology Solutions' cost structure for intellectual property includes significant expenses tied to acquiring new technologies and entire companies. This category also covers the amortization of intangible assets, a direct result of past strategic acquisitions. Legal fees for securing and defending patents are a continuous expense, reflecting MACOM's commitment to innovation and market position. These expenditures highlight MACOM's dual growth strategy, balancing organic research and development with strategic inorganic expansion, crucial for maintaining a competitive edge in the semiconductor industry.

- In 2024, MACOM continues to invest in R&D, with a focus on new product development that could lead to further patent filings.

- The amortization of acquired intangible assets, such as those from the recent acquisition of OMMIC SAS, directly impacts the company's reported earnings.

- Legal costs associated with intellectual property protection are a recurring operational expense, safeguarding MACOM's proprietary technologies.

- MACOM's strategic acquisitions are a key driver of its intellectual property portfolio expansion, enhancing its market offerings.

MACOM Technology Solutions' cost structure is driven by significant investments in innovation and operational efficiency, reflecting its fab-lite model. Key expenditures include substantial R&D for product development, amounting to approximately $97 million in the first half of fiscal year 2024. The company also incurs considerable COGS through third-party foundries and OSAT providers, alongside SG&A expenses of about $170 million in fiscal year 2024 for market presence and corporate functions.

| Cost Category | Primary Driver | 2024 Data (Approx.) |

|---|---|---|

| Research and Development | Innovation, product development | $97M (H1 2024) |

| Cost of Goods Sold | Third-party manufacturing | Crucial for profitability |

| SG&A Expenses | Sales, marketing, operations | $170M (FY 2024) |

Revenue Streams

The primary revenue stream for MACOM Technology Solutions is generated through the sale of its extensive portfolio of standard, or catalog, products. These highly specialized components are distributed to a diverse customer base, primarily leveraging MACOM's direct sales force and its robust global distribution network. This stream is characterized by a high volume of transactions spanning numerous market segments, contributing significantly to the company's overall financial performance. For instance, in fiscal year 2024, MACOM continued to see strong demand for its standard products across areas like data center and industrial applications.

MACOM generates significant revenue from the design and sale of custom application-specific integrated circuits (ASICs) and specialized subassemblies. These high-value products are developed in close partnership with specific customers, predominantly large original equipment manufacturers (OEMs) within the defense and telecom industries. This revenue stream often commands higher margins due to its customized nature and involves longer-term contracts, contributing to MACOM's stable financial outlook. For example, MACOM's net sales for the second quarter of fiscal year 2024, ending March 29, 2024, were $157.8 million, reflecting sustained demand across its various segments, including these custom solutions. These bespoke offerings are crucial for critical infrastructure and advanced military applications.

MACOM generates revenue from Non-Recurring Engineering (NRE) fees, specifically for custom product development. This revenue is recognized for the extensive engineering work, design, and prototyping services provided to customers before a custom solution enters mass production. NRE fees are crucial as they help offset the substantial research and development investment required for these tailored solutions, an investment that for companies like MACOM typically runs into the hundreds of millions annually, as seen in their ongoing R&D efforts through 2024.

Licensing and Royalties

MACOM Technology Solutions may license its intellectual property to other companies, which can generate high-margin royalty revenue. While not a primary focus, this stream allows MACOM to monetize its advanced technologies in markets it does not directly serve. This opportunistic approach complements their core product sales, which drove MACOM's net revenue to approximately $156.4 million in Q1 2024.

- IP licensing offers high-margin royalty income for MACOM.

- This strategy helps monetize technology in non-core markets.

- It supplements MACOM's primary product sales revenue.

Long-Term Supply Agreements

MACOM secures a significant portion of its revenue through long-term supply agreements, particularly with defense and major telecom customers. These multi-year contracts provide predictable, recurring income, enhancing the company's financial stability. For instance, the Industrial and Defense segment, often characterized by such long-term programs, contributed $53.3 million to MACOM's revenue in the second quarter of fiscal year 2024. This consistent revenue stream offers clear visibility into future financial performance.

- Long-term agreements ensure predictable revenue streams.

- Major customers include defense and telecom sectors.

- Industrial and Defense revenue reached $53.3 million in Q2 2024.

- These agreements enhance financial stability and visibility.

MACOM’s core revenue stems from high-volume standard product sales, complemented by custom ASICs and subassemblies, which generated $157.8 million in Q2 2024 net sales. Additional income derives from Non-Recurring Engineering fees for custom development, offsetting significant R&D investments. MACOM also secures predictable revenue through long-term supply agreements, notably with defense and telecom customers, contributing $53.3 million from its Industrial and Defense segment in Q2 2024, alongside opportunistic IP licensing.

| Revenue Stream | Key Contribution | 2024 Data Point |

|---|---|---|

| Standard Products | High volume sales | Strong demand in 2024 |

| Custom Solutions | High-value, bespoke | Q2 2024 net sales: $157.8M |

| Long-Term Agreements | Predictable income | Q2 2024 Industrial/Defense: $53.3M |

Business Model Canvas Data Sources

The Macom Technology Solutions Business Model Canvas is informed by a blend of internal financial data, market research reports, and competitive intelligence. This multi-faceted approach ensures a comprehensive understanding of our market position and strategic direction.