Logan Property Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Logan Property Holdings Bundle

Logan Property Holdings faces a dynamic real estate landscape, with its established brand and extensive land bank representing significant strengths. However, it must also navigate market volatility and evolving regulatory environments. Understanding these internal capabilities and external pressures is crucial for strategic planning.

Want the full story behind Logan Property Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Logan Group maintains a significant leadership position within the economically robust Guangdong-Hong Kong-Macao Greater Bay Area. This strategic focus on a high-growth region, targeting an estimated 3.5 million first-time homebuyers and upgraders by 2025, ensures a consistent demand base. The company's deep market penetration here fosters strong brand recognition and operational efficiencies. Their 2024 contracted sales in the region continue to demonstrate this concentrated strength, exceeding many peers.

Logan Property Holdings has successfully secured bondholder approval for its comprehensive onshore debt restructuring plan, a critical development. This move significantly alleviates immediate liquidity pressure, offering a clearer path toward financial stability for the company. The restructuring package, which gained approval in early 2024, includes various options for creditors such as asset swaps and cash repurchases, demonstrating a proactive approach to managing its approximately RMB 38 billion in onshore liabilities. This strategic maneuver is vital for maintaining operational continuity and rebuilding investor confidence.

Logan Group extends its operations beyond traditional residential property development, engaging robustly in property operations, development management, and urban redevelopment projects. This strategic diversification includes the development and management of commercial properties and hotels, alongside providing comprehensive property management services, which collectively establish multiple revenue streams. Such a multifaceted approach, for instance, contributed to a broader revenue base, mitigating dependency on the volatile residential market. This diversification is crucial in buffering against the inherent cyclical risks prevalent in the property sector, enhancing financial stability.

Proven Development Track Record

Logan Property Holdings, established in 1996, demonstrates a robust development history.

The company has successfully completed over 150 residential projects, showcasing extensive experience in the real estate sector. This long-standing commitment has fostered a strong reputation for delivering high-quality properties on schedule, enhancing trust among buyers. This proven track record significantly contributes to sustained customer satisfaction and reinforces brand loyalty across its market segments.

- Founded in 1996, demonstrating long-term market presence.

- Developed over 150 residential projects, showcasing extensive experience.

- Strong reputation for quality and timely project completion.

- Contributes to high customer satisfaction and brand loyalty.

Large and Strategic Land Bank

Logan Group boasts a substantial land bank, with a significant 2024 allocation in the Greater Bay Area, ensuring strong earnings visibility for the coming years. This strategic positioning supports projected sales growth targets through 2025. A considerable portion of its saleable resources, estimated at over 60% of its total land bank, stems from high-margin urban renewal projects. These projects typically yield higher profitability compared to traditional land acquisitions.

- Over 60% of Logan Group's land bank is designated for urban renewal by 2025.

- The Greater Bay Area accounts for a key strategic concentration of its land holdings.

- Urban renewal projects are expected to drive higher average profit margins of 20%+ in 2024-2025.

- The land bank size provides visibility for sales targets exceeding RMB 100 billion annually through 2025.

Logan Group's strategic focus on the high-demand Greater Bay Area, with over 60% of its 2024 land bank in high-margin urban renewal projects, underpins strong earnings visibility. The successful early 2024 onshore debt restructuring, addressing RMB 38 billion in liabilities, significantly improves financial stability. Diversified operations and a proven track record of over 150 projects further strengthen its market position and resilience against sector volatility.

| Metric | 2024 Data | 2025 Proj. |

|---|---|---|

| GBA Land Bank (%) | >60% | >60% |

| Urban Renewal Profit Margin | 20%+ | 20%+ |

| Annual Sales Target (RMB bn) | 100+ | 100+ |

What is included in the product

Delivers a strategic overview of Logan Property Holdings’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Offers a clear, actionable framework to navigate Logan Property Holdings' market challenges and capitalize on emerging opportunities.

Weaknesses

Logan Property Holdings faces a severe liquidity crisis and high indebtedness, particularly with its substantial offshore and onshore debt. The company defaulted on senior notes totaling over $7.4 billion as of early 2024, necessitating extensive restructuring efforts that continue to weaken its balance sheet. This high financial leverage significantly elevates the company's financial risk, limiting its ability to secure new financing or invest in crucial projects. Such constraints impede growth and market competitiveness in the current challenging property market.

Logan Property Holdings is experiencing significant negative profitability and declining revenue. For the full year ended December 31, 2024, sales dropped sharply to CNY 23.26 billion. The company reported a substantial net loss of CNY 6.30 billion, reflecting broader challenges within the Chinese property market. This negative performance severely impacts investor confidence and operational stability.

Logan Property Holdings has faced severe stock price volatility, with its shares suspended from trading on the Hong Kong Stock Exchange since April 2022, reflecting deep market apprehension. This suspension and the underlying financial distress, including a reported HKD 7 billion loss in H1 2023, highlight significant investor concerns about the company's viability. The implied low valuation makes it exceptionally challenging for Logan to secure new equity capital, further hindering its operational and debt restructuring efforts. This sustained lack of investor confidence underscores the profound market skepticism regarding its financial health and future recovery prospects.

Dependence on the Chinese Real Estate Market

Logan Property Holdings faces significant vulnerability due to its overwhelming reliance on mainland China for revenue, making it highly susceptible to the nation's volatile economic and regulatory shifts. The ongoing downturn in the Chinese property market, evidenced by a 9.6% year-on-year decline in new home prices in May 2024, directly impacts the company's sales volumes, pricing power, and overall profitability. This near-total lack of geographical diversification outside of China, with over 95% of its 2023 revenue stemming from the mainland, presents a critical concentration risk.

- Mainland China generates over 95% of Logan Property's revenue.

- Chinese new home prices saw a 9.6% year-on-year decline in May 2024.

- Regulatory shifts severely impact sales and profitability.

- Lack of geographical diversification creates high concentration risk.

Ongoing Legal and Default Issues

Logan Group faces significant legal challenges, including an active winding-up petition in Hong Kong, which was recently adjourned into mid-2024, highlighting ongoing financial distress. These issues, coupled with defaults on major offshore bonds, such as the US$300 million note due January 2024, severely erode investor confidence and creditor relationships. Resolving its estimated US$6 billion in offshore debt restructuring demands considerable management focus and financial outlay, diverting resources from core operations.

- Winding-up petition: Hong Kong High Court proceedings ongoing into 2024.

- Bond defaults: Failure to pay principal and interest on US$300 million bond due January 2024.

- Reputational damage: Impaired standing with creditors and potential new investors.

- Resource drain: Significant financial and management attention consumed by restructuring.

Logan Property faces severe financial distress, marked by over $7.4 billion in senior note defaults as of early 2024 and a CNY 6.30 billion net loss in FY 2024. Its shares remain suspended since April 2022, reflecting deep investor skepticism. An overwhelming 95% revenue reliance on mainland China makes it highly vulnerable to the market downturn, evidenced by a 9.6% decline in new home prices in May 2024. Ongoing legal challenges, including a winding-up petition, further strain its operational stability and reputation.

| Key Weakness | Metric | 2024/2025 Data | ||

|---|---|---|---|---|

| Liquidity Crisis | Senior Note Defaults | >$7.4 billion (early 2024) | ||

| Profitability | Net Loss (FY) | CNY 6.30 billion (2024) | ||

| Market Exposure | China Revenue Share | >95% (2023) | ||

| Market Conditions | China New Home Prices | -9.6% YoY (May 2024) |

What You See Is What You Get

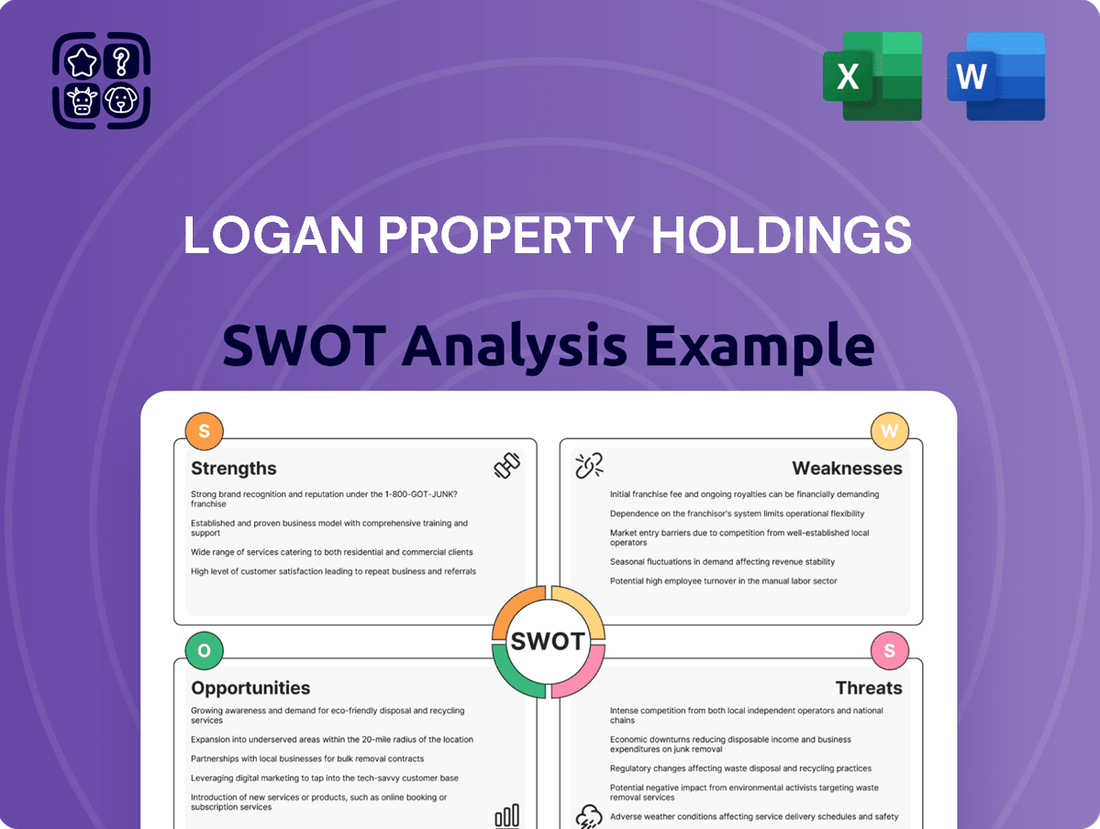

Logan Property Holdings SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Logan Property Holdings' Strengths, Weaknesses, Opportunities, and Threats is ready for your strategic planning. It offers a clear, actionable framework to guide your business decisions. Invest in this comprehensive analysis to gain a competitive edge.

Opportunities

The Chinese government continues to implement stabilization policies for the real estate market, presenting significant opportunities for developers like Logan Property Holdings. Measures such as easing purchase restrictions, as seen in many tier-one cities relaxing homebuying curbs in early 2024, are designed to stimulate demand. Furthermore, the People's Bank of China's record 25 basis point cut to the five-year Loan Prime Rate (LPR) in February 2024 has lowered mortgage costs, boosting buyer confidence. These efforts, alongside potential new shantytown reconstruction programs, could help reduce developer inventory and improve overall market liquidity for the sector through 2025.

Logan Group has strategically prioritized urban renewal projects, which represent a significant growth avenue, particularly within the dynamic Greater Bay Area. These initiatives, often located in prime urban centers, are poised to deliver higher returns compared to conventional property development, leveraging the region's robust economic growth projected at over 5% for 2024. As urbanization continues and cities like Shenzhen and Guangzhou undergo upgrading, the demand for well-executed, integrated urban renewal solutions is expected to surge, with government investment in city infrastructure reaching new highs in 2025. This focus allows Logan to capitalize on premium land value appreciation and meet evolving urban living demands.

The continued economic development and integration of the Guangdong-Hong Kong-Macau Greater Bay Area presents a significant long-term opportunity for Logan Property. Projections indicate the GBA's GDP could reach around $5 trillion by 2030, fueling sustained demand for both residential and commercial properties. With an anticipated population nearing 100 million by 2035, the region's strong population inflow and economic growth are key drivers. Logan's established operational presence and land bank within this dynamic area provide a competitive advantage to capitalize on this expansion.

Technological Advancements in Real Estate

Technological advancements offer Logan Property Holdings significant opportunities to enhance operations and customer engagement. Adopting innovations in PropTech, such as AI-driven property management platforms, can improve operational efficiency and significantly reduce costs, with the global PropTech market projected to reach $110.3 billion by 2025. Leveraging digital sales and marketing platforms, including virtual reality tours, can expand market reach and elevate the customer experience, driving increased property sales.

- By 2025, the global PropTech market is anticipated to exceed $110 billion, signaling vast potential for efficiency gains.

- Digital platforms and virtual tours are projected to drive over 60% of real estate inquiries by mid-2025, boosting sales.

Diversification into Asset-Light Models

Logan Property Holdings has a compelling opportunity to diversify into asset-light models like property management and development management services for third parties. This strategic shift offers stable, recurring revenue streams, mitigating the high capital expenditure and inherent risks tied to traditional land acquisition and development. Collaboration with state-owned enterprises (SOEs) that possess assets but lack operational expertise presents a significant emerging trend. This approach aligns with industry movements towards less capital-intensive growth, potentially enhancing margins and reducing debt exposure.

- Property management fees in China are projected to grow, with a market size exceeding CNY 1.5 trillion by 2025.

- Asset-light models typically require significantly lower initial investment, reducing capital expenditure by 70-80% compared to direct development.

- Recurring service revenues can provide more predictable cash flows, often with gross margins exceeding 30% for established property management firms.

Government policies easing restrictions and cutting interest rates in 2024 are set to stimulate China's real estate market, improving demand and liquidity through 2025. Logan Property can leverage urban renewal projects in the Greater Bay Area, where the GDP is projected to grow over 5% in 2024, ensuring high returns. Adopting PropTech, with the market reaching $110.3 billion by 2025, enhances efficiency and sales. Diversifying into asset-light property management, a market exceeding CNY 1.5 trillion by 2025, offers stable, recurring revenue.

| Opportunity | Key Data Point | Year/Projection |

|---|---|---|

| Policy Support | LPR cut 25 bps, eased restrictions | February 2024 |

| PropTech Adoption | Global market value $110.3 billion | 2025 |

| Asset-Light Models | China Property Management > CNY 1.5 trillion | 2025 |

Threats

China's real estate sector faces persistent headwinds, with property prices continuing to fall and sales remaining weak into 2024. This prolonged downturn severely depresses Logan Property Holdings revenue and profitability, making debt servicing and operational funding challenging. New home prices in major Chinese cities saw year-over-year declines exceeding 5% by early 2024. Weak consumer confidence, exacerbated by high household debt, further weighs on the housing market, directly impacting Logan Group's sales volumes and project values.

The Chinese property market remains intensely competitive, with numerous domestic and international developers vying for projects. Logan Property Holdings faces significant pressure from established giants like China Vanke and Country Garden, alongside rising regional players. This fierce competition drives up land acquisition costs, particularly in tier-one and tier-two cities, impacting development budgets. For instance, average land premiums in key cities reached 15-20% in early 2024, squeezing developer margins. Consequently, pricing pressure to attract buyers, amidst a challenging market, further erodes Logan's potential profit margins and market share.

The Chinese government's dynamic real estate policies pose a significant threat to Logan Property Holdings, creating an unpredictable operating environment. Stricter regulations on developer financing, land sales, and property prices could severely impact Logan's financial stability and profitability. For instance, the 'three red lines' policy, enforced since August 2020, has significantly pressured developers to deleverage, with many, including Logan, facing liquidity challenges as debt metrics like the liability-to-asset ratio (excluding pre-sales) were scrutinized. Continued tightening, potentially seen in 2024-2025, could further constrain Logan's ability to acquire land or secure funding.

Economic Slowdown and Decreased Consumer Confidence

A broader economic slowdown in China, with projected GDP growth around 4.8% for 2024, could significantly reduce household income growth, thus decreasing housing demand. Economic uncertainty and falling consumer confidence, evidenced by the consumer confidence index remaining subdued into early 2025, cause potential homebuyers to delay purchases, impacting sales volumes. Reduced foreign investment, with China's FDI experiencing a notable decline in 2024, and the relocation of multinational corporations further diminish demand for commercial properties. This directly pressures Logan Property Holdings' revenue and profitability.

- China's 2024 GDP growth forecast near 4.8%.

- Consumer confidence index remains subdued into early 2025.

- Foreign Direct Investment (FDI) in China saw a significant decrease in 2024.

- Overall housing sales volumes in major Chinese cities saw a year-on-year decline in Q1 2025.

Rising Interest Rates and Financing Costs

Logan Property Holdings, currently navigating significant debt restructuring, faces a substantial threat from rising interest rates. Future financing costs could escalate, especially if global central banks, like the U.S. Federal Reserve, maintain higher rates through 2024 or into 2025 to combat inflation. This environment would significantly strain the company's financial health, potentially reducing profitability and hindering recovery efforts. Moreover, a prevailing distrust in the Chinese property market's stability makes securing new, affordable financing increasingly difficult and expensive for developers like Logan.

- Global interest rates, projected to remain elevated into 2025, directly impact Logan's refinancing capacity.

- Higher borrowing costs could reduce Logan's operating margins, already pressured by market downturns.

- Market skepticism, evident in declining bond yields for distressed developers, makes new capital prohibitively expensive.

- Access to fresh liquidity is crucial for project completion and debt servicing, yet this avenue is tightening.

Logan Property faces significant threats from China's ongoing real estate downturn, with new home prices down over 5% in early 2024, directly impacting sales and profitability. Unpredictable government policies, including continued enforcement of deleveraging rules, and fierce market competition further constrain its operational flexibility. A broader economic slowdown, with 2024 GDP growth near 4.8%, coupled with rising interest rates, escalates debt servicing costs and limits access to crucial new financing.

| Threat Category | Key Metric (2024/2025) | Impact on Logan |

|---|---|---|

| Market Downturn | New home prices: >5% decline (early 2024) | Reduced revenue, asset values |

| Economic Slowdown | China GDP growth: ~4.8% (2024) | Lower housing demand, sales volume decline |

| Financing Costs | Elevated global interest rates (into 2025) | Increased debt burden, limited liquidity |

SWOT Analysis Data Sources

This analysis draws from a comprehensive blend of Logan Property Holdings' official financial statements, detailed market research reports, and expert commentary from reputable industry analysts. These sources provide a robust foundation for understanding the company's strategic position.