Logan Property Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Logan Property Holdings Bundle

Logan Property Holdings operates in a dynamic real estate market shaped by several key forces. Understanding the intensity of rivalry among existing competitors is crucial, as is the bargaining power of buyers, who have numerous housing options. The threat of new entrants could also disrupt market share.

Furthermore, the availability of substitute products, such as rental properties or alternative investment vehicles, can influence demand for Logan Property's offerings. Finally, the bargaining power of suppliers, including land developers and construction material providers, plays a significant role in cost structures.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Logan Property Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Land availability and cost are significant factors influencing the bargaining power of suppliers for Logan Property Holdings. In 2024, the Guangdong-Hong Kong-Macau Greater Bay Area, a key market for Logan, continued to experience high demand for land, especially in desirable urban centers. This scarcity, coupled with government policies and development plans, often leads to competitive bidding in land auctions.

The substantial capital required for land acquisition, a common characteristic of property development, means that developers like Logan are highly sensitive to land prices. For instance, in the first half of 2024, the average land price in Tier 1 cities within the Greater Bay Area saw an increase compared to the previous year, directly impacting developers' cost structures and profitability. This situation amplifies the leverage of landowners, as they can command higher prices for limited, prime parcels.

Consequently, Logan Property Holdings faces a challenge in negotiating favorable land prices. The intense competition among developers for these sought-after plots limits Logan's ability to drive down costs, thereby strengthening the bargaining power of land suppliers. This dynamic can significantly affect Logan's development pipeline and overall financial performance.

Suppliers of essential construction materials like steel and cement, along with skilled labor, hold significant bargaining power. Their ability to influence pricing and availability directly impacts Logan Property Holdings' costs. Factors such as industry-wide material shortages, as seen with fluctuating steel prices which averaged around $1,000 per ton in early 2024, can amplify this power. Similarly, the availability and cost of skilled construction labor, with average wage increases in the construction sector reaching 4-5% in 2024, are critical considerations.

Financing institutions hold significant sway over property developers like Logan Property Holdings. Access to capital for projects is crucial, and in 2024, lenders are likely exercising increased caution due to ongoing issues in the Chinese property market. This heightened risk aversion translates to tougher lending standards, potentially higher borrowing costs, and demands for more security.

For Logan Property Holdings, this means financial suppliers can dictate terms more forcefully. They might require higher interest rates or more substantial collateral, impacting the affordability and feasibility of new developments. The bargaining power of these financial institutions is amplified when developers, like Logan, are heavily reliant on external funding to fuel their expansion and operational needs.

Specialized Services and Technology

Providers of specialized services and advanced construction technologies, like unique architectural designs or cutting-edge engineering solutions, hold significant sway. Logan Property Holdings’ dependence on these niche providers, especially when only a few firms possess the required expertise, can significantly escalate project costs and reduce negotiation leverage. For instance, in 2024, the demand for sustainable building technologies and smart city integration in real estate development has driven up the costs of specialized consulting services by an estimated 15-20% compared to the previous year, impacting developers like Logan Property Holdings.

The bargaining power of suppliers offering specialized services and technology for Logan Property Holdings is amplified by several factors:

- Niche Expertise: Firms providing highly specialized architectural, engineering, or environmental consulting services often possess intellectual property or unique skill sets that are not easily substituted.

- Limited Supplier Pool: When only a few reputable firms can deliver a specific advanced technology or specialized service, their collective bargaining power increases substantially.

- Project Complexity: Logan Property Holdings' engagement in large-scale, complex developments necessitates relying on these specialized inputs, making them less able to dictate terms.

- Innovation Demand: The drive for innovative and sustainable building practices, prevalent in 2024, increases the demand for specialized technology providers, thereby strengthening their negotiating position.

Government and Regulatory Bodies

Government and regulatory bodies, while not conventional suppliers, wield considerable influence over Logan Property Holdings by acting as gatekeepers for essential development elements like land use, permits, and zoning. Their decisions directly impact the feasibility and profitability of projects. For instance, in 2024, China's central government continued to implement policies aimed at stabilizing the property market, which included adjustments to pre-sale requirements and financing channels for developers, thereby directly affecting Logan Group's operational flexibility and cost structure.

The power of these bodies stems from their ability to dictate land supply, enforce environmental regulations, and set pre-sale conditions, all of which are critical determinants of Logan's development pipeline and financial performance. Any shifts in these regulatory landscapes, such as stricter environmental impact assessments or revised property tax regimes, can significantly alter the cost base and investment returns for Logan Property Holdings.

- Land Use and Zoning: Government control over urban planning and zoning laws dictates where and what Logan can build, limiting supply and influencing land acquisition costs.

- Permitting and Approvals: The lengthy and often complex approval processes for development projects, including environmental clearances, represent a significant hurdle and cost for Logan.

- Policy Changes: Fluctuations in government policies, such as interest rate adjustments or property market cooling measures, directly impact demand, sales, and financing for Logan's projects.

- Regulatory Compliance: Adhering to evolving building codes, safety standards, and environmental regulations requires ongoing investment and can impact project timelines and budgets for Logan.

The bargaining power of suppliers for Logan Property Holdings is influenced by land availability and cost, construction materials, skilled labor, financing, and specialized services. In 2024, scarce land in desirable urban centers, particularly in the Greater Bay Area, increased landowner leverage due to high demand and competitive bidding. This scarcity, coupled with rising land prices in Tier 1 cities in the first half of 2024, directly impacted developers' cost structures.

Suppliers of essential materials like steel and cement, along with skilled labor, also hold significant power. Fluctuations in steel prices, averaging around $1,000 per ton in early 2024, and a 4-5% increase in construction sector wages in 2024, directly affected Logan's operational costs.

Financial institutions and providers of specialized services further amplify supplier bargaining power. In 2024, increased caution from lenders due to property market instability led to tougher lending standards and potentially higher borrowing costs for developers like Logan. Similarly, the demand for sustainable building technologies and smart city integration drove up specialized consulting costs by an estimated 15-20%.

| Supplier Type | 2024 Impact on Logan Property Holdings | Key Influencing Factor |

|---|---|---|

| Landowners | Increased acquisition costs due to scarcity and competition. | High demand in Greater Bay Area, limited prime plots. |

| Material & Labor | Higher project costs from price volatility and wage increases. | Steel price fluctuations (~$1,000/ton), 4-5% wage growth in construction. |

| Financing Institutions | Potentially higher borrowing costs and stricter terms. | Lender caution due to property market instability. |

| Specialized Services/Tech | Increased costs for advanced solutions. | Demand for sustainable and smart city technologies. |

What is included in the product

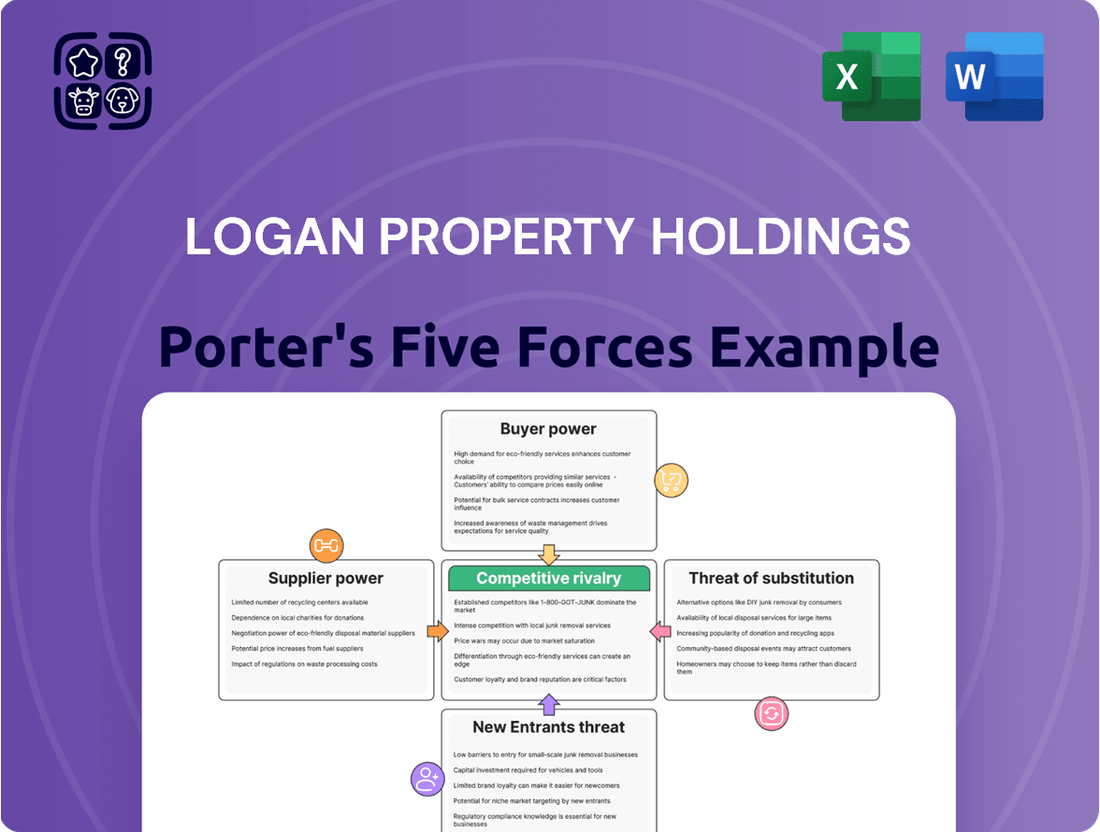

This analysis meticulously dissects the competitive forces impacting Logan Property Holdings, evaluating the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, providing a strategic roadmap for navigating the real estate market.

Instantly understand strategic pressure with a powerful spider/radar chart visualizing Logan Property Holdings' competitive landscape.

Customers Bargaining Power

Customers in the Greater Bay Area, particularly first-time buyers and upgraders, exhibit high sensitivity to property prices due to the substantial financial commitment. Economic headwinds, interest rate volatility, and government cooling measures amplify this caution, making price a critical factor in purchasing decisions.

This heightened buyer sensitivity directly pressures developers such as Logan Property Holdings to adopt more competitive pricing strategies. For instance, in 2023, the average home price in Shenzhen, a key GBA city, saw a modest increase, but buyer sentiment remained cautious amid broader economic concerns, impacting sales velocity for many developers.

Customers in the Greater Bay Area face a wide array of choices, not just from rival developers but also across different property types. This includes everything from brand-new constructions to existing resale properties and even rental accommodations, giving buyers significant flexibility.

The sheer volume of competitors offering comparable residential and commercial spaces means buyers hold considerable power. They can easily compare prices, evaluate features, and scrutinize locations across the market, a trend that was particularly evident in the 2024 property market where transaction volumes saw fluctuations.

This intense competition directly pressures Logan Property Holdings to actively differentiate its projects and implement competitive pricing strategies to attract and secure sales. For instance, in early 2024, the average price per square meter for residential properties in key Greater Bay Area cities like Shenzhen and Guangzhou remained a critical factor for buyers.

Government purchase restrictions significantly impact the bargaining power of customers in the real estate sector, particularly for developers like Logan Property Holdings. In 2024, Chinese authorities continued to implement policies such as mortgage limits and residency requirements to cool the property market. These measures directly curb potential buyer access, effectively reducing the overall customer pool. When fewer buyers are eligible or can secure financing, those who can qualify gain considerable leverage, potentially demanding lower prices or more favorable terms.

Demand for Quality and Amenities

Customers are becoming more discerning as the property market matures, actively seeking superior construction quality, enhanced amenities, and more efficient property management. Logan Property Holdings, by serving both first-time buyers and those looking to upgrade, must address a wide range of customer expectations for living standards and community features. For instance, in 2024, the demand for smart home technology and sustainable building practices has significantly influenced buyer preferences across major urban centers in China.

The price buyers are willing to pay is directly linked to the perceived value a property offers. If developers like Logan Property Holdings do not consistently meet or exceed these evolving expectations, customers possess the leverage to easily switch to competitors. This dynamic amplifies customer bargaining power, particularly when developers fail to differentiate their offerings in a crowded marketplace. The increasing availability of online reviews and comparison platforms further empowers buyers to make informed decisions, readily shifting their loyalty based on developer performance and product quality.

- Increasing Sophistication: Buyers are more informed and demand higher quality construction and better amenities.

- Diverse Expectations: Logan Property Holdings must cater to varying needs of first-time homebuyers and upgraders.

- Value-Driven Decisions: Willingness to pay is tied to perceived value, making quality and amenities crucial differentiators.

- Competitive Landscape: Customers can easily switch to competitors if their expectations are not met, increasing their bargaining power.

Information Transparency and Access

The bargaining power of customers is significantly amplified by increased information transparency. Online property platforms, a trend that has continued to grow through 2024 and into 2025, provide buyers with instant access to detailed property listings, pricing histories, and competitor analysis. This readily available market data means customers are better equipped than ever to understand fair market value. For instance, in 2024, the proliferation of virtual tours and augmented reality property viewing further reduced the friction for buyers to compare multiple offerings without significant time investment.

This heightened transparency directly strengthens the customer's negotiation position. Buyers can easily cross-reference Logan Property Holdings’ advertised prices and project features against those of competitors. In 2024, reports indicated that a significant percentage of property viewings began online, with buyers often having already conducted extensive research on pricing and developer reputation before engaging directly. This necessitates that Logan Group maintains impeccable accuracy and compelling value propositions in its marketing materials, as any discrepancies can be swiftly identified and leveraged by informed buyers.

- Information Accessibility: Online platforms provide extensive data on property prices, project reviews, and market trends, empowering buyers.

- Informed Decision-Making: Customers can now make well-researched choices, increasing their confidence and negotiation leverage.

- Competitive Benchmarking: Buyers can easily compare Logan Property Holdings’ offerings against competitors, scrutinizing pricing and features.

- Marketing Accuracy: Logan Group must ensure its sales information is precise and persuasive, as buyers can readily verify claims in 2024 and beyond.

Customers in the Greater Bay Area possess significant bargaining power due to high price sensitivity and a wide array of choices from numerous developers. This power is further amplified by increased information transparency, allowing buyers to easily compare prices and features. Government purchase restrictions in 2024, such as mortgage limits, also played a role, reducing the buyer pool and giving eligible buyers more leverage. Logan Property Holdings, like its competitors, must offer competitive pricing and demonstrate superior value to attract and retain customers in this environment.

| Factor | Impact on Logan Property Holdings | 2024 Market Insight |

|---|---|---|

| Price Sensitivity | High, customers demand competitive pricing. | Average home prices in key GBA cities remained a critical consideration for buyers in 2024, influencing sales velocity. |

| Availability of Substitutes | Numerous developers and property types offer alternatives. | Buyers could easily switch between new constructions, resale properties, and rentals, increasing their negotiation leverage. |

| Information Transparency | Empowers buyers with market data for informed decisions. | Online platforms and virtual tours in 2024 allowed buyers to extensively research prices and developer reputations before engaging. |

| Government Regulations | Restricts buyer pool, potentially increasing leverage for qualified buyers. | Cooling measures in 2024, like mortgage limits, affected demand and gave remaining buyers more bargaining power. |

Preview the Actual Deliverable

Logan Property Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details a comprehensive Porter's Five Forces analysis of Logan Property Holdings, thoroughly examining the competitive landscape by evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This in-depth analysis provides critical insights into the strategic positioning and potential challenges faced by Logan Property Holdings.

Rivalry Among Competitors

The property development sector in China, particularly in dynamic areas like the Greater Bay Area, is characterized by fierce competition. A multitude of developers, ranging from major national corporations to smaller regional players, are all actively seeking to gain a stronger foothold.

This fragmented landscape intensifies rivalry, especially as economic growth moderates. Developers find themselves in a tougher battle for customers as the overall market expansion slows, forcing them to compete more aggressively for existing demand.

Logan Property Holdings directly contends with both well-established, nationwide developers and localized competitors who possess deep understanding of specific regional markets. This means Logan must constantly differentiate itself to stand out.

For instance, in 2023, the China real estate market saw a significant contraction in sales volume, with major cities experiencing declines. This backdrop makes the competition among developers even more pronounced as they fight for every sale.

Logan Property Holdings, like many in the property development sector, faces significant competitive rivalry stemming from high exit barriers. These barriers are rooted in the substantial capital tied up in land banks, ongoing construction projects, and extensive fixed assets, making it difficult and costly to divest operations, even in challenging market conditions.

Developers are often compelled to remain active in the market to recover their initial investments, which can perpetuate intense competition. This reluctance to exit can lead to price wars and aggressive sales strategies. For instance, in 2023, the China real estate market saw developers offering significant discounts, with some projects experiencing price drops of 10-20% to stimulate sales amidst liquidity concerns.

This sustained competitive pressure directly impacts Logan Group's profitability and market share. The need to recoup investments means competitors may continue to operate at lower margins, forcing Logan to either match these prices, thereby compressing its own margins, or risk losing market share to more aggressive players.

While developers, including Logan Property Holdings, strive to differentiate through design, location, and amenities, many residential offerings can appear quite similar to consumers. This perceived product homogenization makes it challenging to command premium prices based solely on brand or unique features. For instance, in 2024, the Chinese real estate market continued to grapple with oversupply in many lower-tier cities, intensifying this effect.

This intense competition compels developers to either constantly innovate their product or engage in aggressive pricing strategies to capture market share. Logan Property Holdings, like its peers, faces pressure to offer compelling value propositions beyond basic housing. The industry's cyclical nature, often influenced by government policies and economic conditions, further exacerbates the need for differentiation or cost leadership.

Aggressive Marketing and Sales Strategies

The competitive environment in real estate development, particularly for companies like Logan Property Holdings, demands a robust and aggressive approach to marketing and sales. This often translates into significant investment in advertising, promotional activities, and attractive pricing strategies to capture market share. Developers frequently roll out discounts, limited-time offers, and flexible payment plans to entice potential buyers, especially when facing challenges like high inventory levels or a slowdown in market demand.

Logan Group, to remain competitive and ensure strong sales performance, must allocate substantial resources towards marketing initiatives. These efforts are crucial for maintaining brand visibility, cutting through the noise of competitors, and ultimately converting prospective customers into actual buyers. For instance, during the first half of 2024, many developers in China increased their marketing spend to stimulate sales amidst a complex economic climate.

- Aggressive Sales Tactics: Developers commonly employ discounts, early bird specials, and phased payment schemes to attract a wider buyer base.

- Marketing Investment: Significant capital is channeled into advertising across various media, digital marketing, and offline promotional events to enhance brand recognition.

- Competitive Pricing: Price adjustments and value-added packages are strategic tools used to outmaneuver rivals and drive sales volume.

- Market Responsiveness: Companies must adapt their sales and marketing strategies swiftly to changing market conditions and buyer sentiment, as seen in the fluctuating property market throughout 2024.

Financial Leverage and Debt Levels

The financial health and debt levels of competitors significantly shape the competitive landscape. Developers with robust balance sheets or preferential access to capital can aggressively pursue new projects, undercut rivals on pricing, or better absorb market volatility. This financial muscle translates directly into a competitive advantage.

Recent events in China's property market underscore the critical importance of financial stability. For companies like Logan Property Holdings, managing debt and ensuring sufficient liquidity are paramount to maintaining competitiveness. High debt burdens can restrict a company's ability to invest and respond to market shifts, potentially leading to a loss of market share.

- Competitor Financial Strength: Developers with lower debt-to-equity ratios and strong cash flow generation are better positioned to compete on price and project scale.

- Access to Capital: Companies with good credit ratings and established banking relationships can secure financing more easily and at lower costs, enabling more aggressive expansion or acquisition strategies.

- Impact of Market Downturns: Financially sound competitors are more resilient during economic slowdowns, potentially acquiring distressed assets or gaining market share as weaker players exit.

- Logan's Debt Management: Logan Property Holdings' ability to manage its own debt levels, as evidenced by its financial reporting, directly impacts its capacity to invest in new developments and compete effectively. For instance, in 2023, Logan Group reported a net gearing ratio that required careful management.

Competitive rivalry within China's property sector, where Logan Property Holdings operates, is extremely intense due to a fragmented market and high exit barriers. Developers are often locked into projects, leading to sustained competition and price wars, especially as the market growth moderates. For example, in 2023, many developers offered discounts of 10-20% to stimulate sales.

This intense rivalry forces companies like Logan to invest heavily in marketing and sales tactics, including discounts and promotional offers, to capture market share. In the first half of 2024, many Chinese developers increased their marketing spend to counter a challenging economic climate. The perceived similarity in many residential offerings further amplifies this need for aggressive strategies, with oversupply in lower-tier cities exacerbating the issue in 2024.

The financial strength of competitors plays a crucial role, with well-capitalized firms able to compete more aggressively on price and scale. Logan Property Holdings' ability to manage its debt, such as its reported net gearing ratio in 2023, is vital for its competitive positioning. Companies with lower debt and better access to capital are more resilient and can potentially gain market share during economic downturns.

| Factor | Impact on Logan Property Holdings | Example Data (2023/2024) |

|---|---|---|

| Market Fragmentation | Intensifies competition from numerous players. | Numerous developers active in Greater Bay Area. |

| High Exit Barriers | Forces continued operation, leading to price competition. | Developers offering 10-20% discounts in 2023 to move inventory. |

| Product Homogenization | Reduces ability to command premium prices. | Oversupply in lower-tier cities pressured pricing in 2024. |

| Marketing & Sales Investment | Essential for market share and brand visibility. | Increased marketing spend by developers in H1 2024. |

| Competitor Financial Strength | Well-capitalized firms gain advantage. | Logan Group's net gearing ratio in 2023 required careful management. |

SSubstitutes Threaten

Renting presents a significant threat to Logan Property Holdings by offering a viable alternative to homeownership. For many, particularly first-time buyers or those prioritizing flexibility, the ability to rent instead of owning removes a direct competitive pressure.

High property prices remain a key driver for this threat. For instance, in 2024, average home prices in many major cities continued to be a barrier for entry, making renting a more accessible option. This trend is expected to persist, with affordability remaining a critical consideration for a large segment of the population.

Stringent mortgage requirements in 2024 also pushed potential buyers towards renting. Lenders’ stricter criteria, coupled with economic uncertainties, meant that securing a loan was more challenging, thereby increasing the appeal of rental accommodation for a broader demographic.

Furthermore, a desire for mobility, especially among younger professionals, makes renting a preferred choice. The ease with which renters can relocate for job opportunities or lifestyle changes contrasts with the commitment and costs associated with property ownership, reinforcing the threat of substitutes.

Investors have a wide array of alternatives to property for wealth creation, including stocks, bonds, and various funds. For instance, the global equity market capitalization reached an estimated $100 trillion by the end of 2023, offering substantial avenues for investment beyond real estate.

If these alternative assets, like the S&P 500 which saw a substantial gain in 2023, provide more attractive risk-adjusted returns, capital could shift away from property. This diversion of funds directly impacts the demand for Logan Property Holdings' developments.

For example, if bond yields in 2024 rise significantly, making them a more appealing safe haven, investors might reduce their allocation to real estate, thereby lessening the pool of potential buyers for Logan's properties.

This accessibility to diverse financial markets means that Logan Property Holdings faces constant competition not just from other developers but from the entire spectrum of investment opportunities available to capital.

The significant cost of living and property prices within the Greater Bay Area could encourage individuals and businesses to seek out more affordable locations in adjacent cities or regions. This shift represents a substitution for the geographic market itself, potentially shrinking the customer base for Logan Property Holdings within its core operational zones. For instance, in 2024, while specific relocation data for Logan's target demographic isn't publicly available, broader trends show a continued interest in secondary cities offering lower property entry points.

Alternative Housing Models

Emerging alternative housing models represent a growing threat of substitutes for Logan Property Holdings. Co-living spaces, long-term serviced apartments, and government-subsidized rental housing offer different value propositions that could appeal to segments of the market traditionally served by Logan. These alternatives can provide flexibility and potentially lower upfront costs compared to traditional homeownership or long-term commercial leases.

The appeal of these substitutes is particularly strong among younger demographics and individuals prioritizing flexible living or working arrangements. For instance, the global co-living market was valued at approximately USD 3.5 billion in 2023 and is projected to grow significantly. Logan Property Holdings must monitor the expansion of these models, as they could siphon demand away from conventional property development and rental services.

- Co-living growth: The co-living sector is expanding, offering shared amenities and community-focused living, which can be more affordable than traditional rentals.

- Serviced apartments: Long-term serviced apartments provide flexibility for professionals and travelers, acting as a substitute for both short-term hotels and traditional apartment leases.

- Government initiatives: Increased government investment in affordable and subsidized rental housing can also reduce the demand for privately developed properties.

- Demographic shifts: Changing preferences, especially among millennials and Gen Z for flexibility and community, drive the adoption of these alternative models.

Lifestyle Choices and Demographic Shifts

The threat of substitutes for Logan Property Holdings is influenced by evolving lifestyle preferences and demographic shifts. A growing interest in minimalist living or prioritizing experiences over material possessions could lessen the demand for substantial residential real estate. For instance, reports from 2024 indicate a continued trend in urban centers where younger generations are increasingly opting for smaller, more efficient living spaces or renting rather than owning, directly impacting the market for larger family homes.

Demographic changes also play a crucial role. Delayed marriage and a trend towards smaller family sizes mean fewer households require the extensive space traditionally associated with homeownership. This societal evolution, evident in declining birth rates in many developed economies as of 2024, can indirectly reduce the long-term appeal and necessity of Logan Group's primary offerings.

- Evolving Lifestyles: Increased preference for minimalism and experiences over asset accumulation.

- Demographic Shifts: Trends like delayed marriage and smaller family sizes reduce demand for traditional, larger homes.

- Urbanization Trends: A significant portion of the population in major cities, particularly younger demographics, favor smaller, rental accommodations.

- Economic Factors: Cost of living and affordability concerns can push individuals towards alternative housing solutions or delayed property purchases.

The threat of substitutes for Logan Property Holdings is multifaceted, encompassing alternative housing options and investment avenues. Renting, driven by high property prices and stringent mortgage requirements in 2024, offers flexibility that appeals to many, especially younger demographics. Globally, the co-living market, valued at approximately USD 3.5 billion in 2023, demonstrates a growing preference for shared amenities and community, potentially diverting demand from traditional property ownership.

Furthermore, investors have numerous alternatives to real estate. The global equity market capitalization reaching an estimated $100 trillion by the end of 2023 highlights the vast opportunities available. If these alternatives, such as the S&P 500 which saw substantial gains in 2023, offer more attractive risk-adjusted returns, capital could flow away from property, impacting Logan Property Holdings.

The competition extends to geographic substitution, with rising living costs in core areas potentially driving individuals and businesses to more affordable adjacent regions. Evolving lifestyle preferences, favoring minimalism and experiences, also reduce the demand for extensive real estate, further intensifying the threat of substitutes.

| Substitute Type | Key Drivers | 2023/2024 Data Point | Impact on Logan Property Holdings |

|---|---|---|---|

| Renting | Affordability, Flexibility, Mortgage Barriers | Average home prices in major cities remained high in 2024. | Reduces demand for home purchases. |

| Alternative Investments | Higher Risk-Adjusted Returns, Diversification | Global equity market cap ~$100 trillion (end 2023). | Diverts capital away from real estate. |

| Co-living/Serviced Apartments | Community Focus, Flexibility, Lower Upfront Costs | Global co-living market ~$3.5 billion (2023). | Siphons demand from traditional rentals/ownership. |

| Geographic Relocation | Cost of Living, Affordability | Continued interest in secondary cities offering lower entry points. | Shrinks customer base in core operational zones. |

Entrants Threaten

The property development sector demands enormous upfront capital for land acquisition, construction, and infrastructure development. This high capital requirement acts as a significant deterrent for potential new entrants. For instance, in 2024, major residential projects in Tier 1 cities in China often require billions of Yuan in initial investment, making it difficult for smaller firms to compete.

Securing desirable land in competitive markets like the Greater Bay Area presents a significant hurdle for new entrants. Logan Property Holdings, with its established land bank, possesses a distinct advantage. In 2024, land acquisition costs in prime Greater Bay Area locations continued to be substantial, with some prime residential plots exceeding RMB 50,000 per square meter.

Navigating the complex web of government relationships and bidding processes is another barrier. Newcomers would find it difficult to match the experience of established players like Logan Group in efficiently obtaining necessary permits and approvals. The lengthy and costly nature of these regulatory processes further deters new market entrants, especially when competing against firms with proven track records and existing governmental ties.

Brand reputation and customer trust are critical in the property market, where purchases represent significant life investments. Logan Group has cultivated a strong brand over years of operation, acting as a substantial barrier for new developers. These newcomers would need to invest heavily in marketing and demonstrate a consistent history of successful project delivery and quality to even begin competing for customer confidence.

Economies of Scale and Experience

Established developers like Logan Property Holdings leverage significant economies of scale, particularly in bulk purchasing of materials and land acquisition, leading to lower per-unit costs compared to new entrants. In 2023, Logan reported total assets of approximately RMB 426.9 billion, indicating its substantial operational capacity. This scale translates into formidable cost advantages in construction, marketing, and financing, making it difficult for smaller, less capitalized firms to compete effectively.

Furthermore, Logan's extensive experience navigating China's complex real estate market and its established relationships with suppliers, contractors, and government bodies provide an invaluable intangible asset. This accumulated knowledge in project execution, risk management, and understanding market cycles creates a steep learning curve for any new entrant. For instance, their long history of successful project delivery builds trust and brand recognition, which newcomers would struggle to replicate quickly.

The threat of new entrants is therefore mitigated by these entrenched advantages. Logan’s operational efficiencies and deep industry expertise:

- Cost Leadership: Economies of scale in procurement and construction allow Logan to offer more competitive pricing.

- Experience Premium: Accumulated knowledge in project management and risk assessment provides a significant operational edge.

- Brand Equity: A long track record of successful developments fosters trust and market preference.

- Access to Capital: Established developers often have better access to financing, further solidifying their competitive position.

Regulatory Hurdles and Policy Complexity

The Chinese real estate sector is characterized by a labyrinth of evolving government regulations. These include stringent land policies, complex financing rules, and fluctuating price controls, all of which create significant entry barriers. For instance, in 2024, the government continued to emphasize deleveraging in the property sector, making it harder for new players to secure the necessary funding.

New entrants often lack the deep local knowledge and established compliance frameworks that seasoned developers like Logan Property Holdings possess. Navigating requirements such as pre-sale regulations, which demand a certain percentage of construction completion before sales can commence, requires significant operational experience and capital. This complexity acts as a substantial deterrent, effectively limiting the threat of new competition.

- Regulatory Complexity: China's real estate market is governed by a dynamic and multi-layered regulatory framework.

- Financing Restrictions: Policies aimed at controlling developer debt, such as the "three red lines" introduced in prior years and continued in 2024, restrict access to capital for new entrants.

- Local Expertise Gap: New companies struggle to match the nuanced understanding of regional land policies and market conditions held by established firms.

- Compliance Costs: The cost and effort associated with adhering to evolving compliance standards represent a significant hurdle for potential new competitors.

The threat of new entrants for Logan Property Holdings is considerably low due to several formidable barriers. High capital requirements for land acquisition and development, estimated in the billions of Yuan for major Chinese projects in 2024, deter smaller firms. Established players like Logan benefit from significant economies of scale, with total assets around RMB 426.9 billion in 2023, translating to cost advantages in procurement and construction.

Securing prime land, with costs in the Greater Bay Area exceeding RMB 50,000 per square meter in 2024, is another significant hurdle. Furthermore, navigating complex government regulations and approvals, coupled with the need to build brand reputation and customer trust, demands considerable time and investment, which new entrants often lack.

| Barrier Type | Description | Impact on New Entrants | Logan's Advantage |

|---|---|---|---|

| Capital Requirements | Billions of Yuan needed for land and construction in major cities (2024). | High deterrent for smaller firms. | Access to substantial financing and existing capital. |

| Land Acquisition | Prime Greater Bay Area land costs over RMB 50,000/sqm (2024). | Difficulty securing desirable, affordable plots. | Extensive, strategically located land bank. |

| Economies of Scale | Logan's total assets approx. RMB 426.9 billion (2023). | Higher per-unit costs compared to established players. | Lower costs through bulk purchasing and operational efficiency. |

| Regulatory & Expertise | Complex Chinese real estate regulations and local market knowledge. | Steep learning curve, costly compliance. | Established relationships and proven track record in compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Logan Property Holdings is built upon a foundation of publicly available financial disclosures, including annual and interim reports filed with regulatory bodies. This is supplemented by data from reputable industry analysis firms and relevant real estate market research reports.