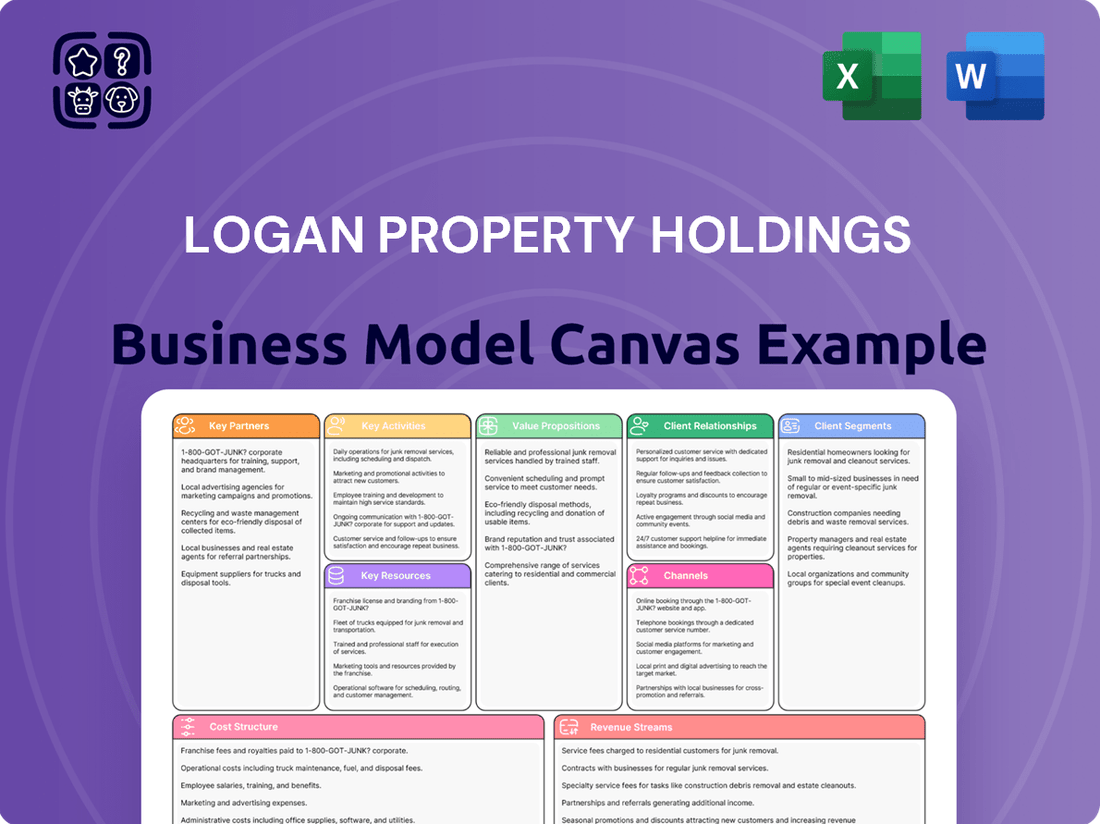

Logan Property Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Logan Property Holdings Bundle

Unlock the full strategic blueprint behind Logan Property Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Logan Property Holdings’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Logan Property Holdings operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Logan Property Holdings’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Logan Property Holdings. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Strong partnerships with government and regulatory bodies are fundamental for Logan Property Holdings, especially for land acquisition and securing crucial development permits. Navigating China's complex regulatory landscape, particularly within the strategic Greater Bay Area, requires robust government relations for project approvals and compliance with zoning regulations. In 2024, as the property sector adapts to new policy directives aimed at stability, strong government ties remain essential for securing land use rights and navigating evolving urban planning rules. These collaborations ensure operational continuity and adherence to local development plans, critical for project success and market access.

Logan Group heavily relies on banks, investment funds, and bondholders for essential project financing and corporate debt, crucial given the capital-intensive nature of property development. As of early 2024, the company continues to navigate significant debt restructuring efforts, highlighting the critical role these financial partnerships play in managing liquidity. Maintaining strong ties with lenders is paramount for securing construction loans and sustaining operations amidst ongoing market challenges. These relationships directly impact Logan's capacity to initiate new projects and complete existing ones.

Logan Property Holdings relies heavily on specialized construction and engineering firms to execute its development projects. These partnerships are crucial for ensuring the timely completion of residential and commercial properties, a key factor in a competitive market. For instance, in 2024, Chinese real estate developers continued to face pressure to deliver projects on schedule, with many outsourcing over 80% of their physical construction work to maintain efficiency and manage costs. These collaborations enable Logan to meet quality standards while optimizing budgets, essential for project profitability.

Architectural & Design Consultants

Collaborating with leading architectural and urban planning firms is crucial for Logan Property Holdings to develop innovative and functional designs. These partnerships are vital for differentiating Logan’s projects in the highly competitive Chinese real estate market, which saw a 9.3% year-on-year decline in property development investment in Q1 2024. Such collaborations enhance the value proposition of properties, ensuring marketability and design excellence.

- Strategic alliances with top design firms bolster project appeal.

- Differentiation through unique architectural concepts is key for market share.

- Enhanced design quality directly impacts property valuations and sales.

- Access to cutting-edge urban planning expertise improves project functionality.

Material & Equipment Suppliers

Establishing long-term relationships with key material and equipment suppliers is crucial for Logan Property Holdings, ensuring a stable supply chain and effective cost control. These partnerships with providers of steel, concrete, and other essential building materials are vital for mitigating risks associated with price volatility and potential material shortages, which can significantly impact project timelines and budgets. For instance, global steel prices saw fluctuations, with rebar prices in China, a key indicator, experiencing shifts in early 2024.

- Securing long-term contracts helps lock in pricing, avoiding sudden cost increases.

- Reliable suppliers ensure timely delivery, preventing construction delays.

- Diversifying suppliers can further reduce dependency and risk.

- In 2024, maintaining strong supplier relationships is crucial given ongoing economic uncertainties.

Logan Property Holdings partners with sales agencies and real estate brokers to market and sell its properties effectively. These collaborations are vital for reaching target customers and accelerating sales cycles in a competitive market. In 2024, as housing demand in some Chinese cities remained subdued, relying on established sales networks became even more critical for moving inventory. Effective sales partnerships directly impact Logan's revenue generation and project profitability.

| Partnership Type | Key Contribution | 2024 Relevance |

|---|---|---|

| Sales Agencies | Market access, customer reach | Critical for inventory movement amid subdued demand |

| Real Estate Brokers | Targeted sales, buyer matching | Enhances sales velocity and project sell-through rates |

| Online Platforms | Digital marketing, broad exposure | Increasing importance for lead generation and brand visibility |

What is included in the product

This Logan Property Holdings Business Model Canvas provides a strategic overview, detailing key customer segments, channels, and value propositions within the real estate development sector.

It offers a comprehensive framework, organized into nine classic blocks, reflecting the company's operational realities and strategic plans for investor presentations.

Logan Property Holdings' Business Model Canvas provides a clear, actionable framework to address the pain points of inefficient real estate development, streamlining complex processes into a digestible, one-page snapshot.

By visualizing key activities and resources, the canvas helps Logan Property Holdings alleviate the pain of fragmented communication and resource allocation, offering a cohesive strategy for project execution.

Activities

Logan Property Holdings' core activity of Land Acquisition and Strategic Sourcing involves diligently identifying and evaluating prime land parcels. A primary focus remains on the high-potential Guangdong-Hong Kong-Macau Greater Bay Area, leveraging its robust economic growth. Securing a quality land bank at competitive prices is crucial, directly impacting future profitability and market position. For instance, in late 2023 and early 2024, the company continued to strategically manage its land reserves, with a significant portion still concentrated in key Greater Bay Area cities, underscoring its long-term development strategy. This ensures a sustainable pipeline for project development and revenue generation.

Project development and management are core activities for Logan Property Holdings, encompassing the entire property lifecycle from initial design and planning to overseeing construction and final delivery. This rigorous approach ensures developments like their 2024 projects are completed on schedule, within budget, and meet stringent quality benchmarks, crucial for maintaining investor confidence. Effective oversight helps manage the complexities of large-scale urban developments, which are vital for a company that reported a significant portion of its revenue from property development in recent periods. This meticulous management is key to ensuring timely sales and cash flow generation.

Sales and marketing operations for Logan Property Holdings are essential for revenue generation, focusing on the promotion and sale of residential and commercial properties. This involves developing targeted marketing campaigns and managing sales centers to reach diverse customer segments effectively. Despite market challenges, Logan Property reported contracted sales of approximately RMB 7.17 billion for the first quarter of 2024, highlighting ongoing efforts to secure property transactions. These activities leverage various channels, from digital platforms to physical showrooms, to maximize market reach and conversion rates.

Property & Asset Management

Logan Property Holdings extends its operations beyond initial sales into the long-term management of its diverse portfolio, encompassing residential communities, shopping malls, and offices. This strategic activity generates crucial recurring income through management fees and rental yields, bolstering revenue streams. While the company has faced financial headwinds, the property management segment is designed to offer stability. In 2024, maintaining strong occupancy rates across managed properties remains vital for consistent cash flow.

- Recurring income from management fees.

- Stable rental yields from commercial properties.

- Long-term asset value preservation.

- Enhanced customer retention and community building.

Capital Management & Financing

Capital management and financing are crucial for Logan Property Holdings, focusing on securing funding for new developments and meticulously managing existing debt obligations. This involves optimizing the company's capital structure to ensure financial stability and support ongoing operations. Such activities are vital for fueling future growth, mitigating significant financial risks, and maintaining essential investor confidence, especially given the challenging real estate market conditions in 2024.

- Debt management is critical, with the company facing significant offshore debt restructuring efforts.

- Securing new project financing remains a key challenge amid market uncertainties.

- Capital optimization aims to reduce financing costs and improve liquidity.

- Maintaining investor trust is paramount for future fundraising initiatives.

Logan Property Holdings centers its operations on strategic land acquisition, particularly within the high-potential Greater Bay Area, ensuring a robust pipeline for future projects. Key activities include comprehensive project development and management, overseeing the entire lifecycle from design to delivery, and robust sales and marketing to drive property transactions. The company also engages in long-term property management for recurring income and prioritizes diligent capital management and financing, especially amid 2024 market challenges, to support operations and manage debt.

| Activity Focus | 2024 Relevance | Key Metric (Q1 2024) |

|---|---|---|

| Land Bank Management | Strategic land reserves in GBA | Significant GBA concentration |

| Project Development | Timely completion, quality control | Ensuring project delivery |

| Sales Performance | Revenue generation from property sales | RMB 7.17 billion contracted sales |

| Property Management | Recurring income, asset stability | Maintaining occupancy rates |

| Capital Management | Debt restructuring, financing | Ongoing offshore debt efforts |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis for Logan Property Holdings. Once your order is complete, you will gain full access to this identical, professionally structured document, ready for your immediate use.

Resources

Logan Property Holdings’ extensive land bank, particularly its strategically located plots in China’s Greater Bay Area, stands as its most critical asset. This low-cost inventory provides a crucial pipeline for future property development and sustained profitability. As of early 2024, the company's land reserves, though adjusted due to asset disposals, still represent significant potential for revenue generation once market conditions stabilize and project launches resume. This strategic resource underpins the company's long-term growth prospects in key urban clusters.

Logan Property Holdings relies heavily on its strong brand reputation, an essential intangible asset that signals quality and reliability to homebuyers and investors. This established trust, particularly in strategic locations across Guangdong-Hong Kong-Macao Greater Bay Area, significantly facilitates property sales and attracts key development partners. A robust brand also improves access to crucial financing, which is vital for new project development, especially given the current market dynamics where developer credibility is paramount.

Access to capital is a critical resource, enabling Logan Property Holdings to fund extensive development. The company’s ability to raise significant funds through bond issuance and bank loans, such as its 2024 offshore debt restructuring plan, is crucial. This financial strength allows undertaking large-scale, multi-year projects and navigating market cycles. As of early 2024, the broader Chinese real estate sector continues to seek stability in financing, underscoring the importance of robust capital access for developers like Logan.

Human Capital & Expertise

Logan Property Holdings relies on its robust human capital, comprising experienced professionals in project management, finance, urban planning, and sales. This internal expertise is critical, driving efficiency and innovation across all key activities, from strategic land acquisition to successful property sales. Such specialized teams are vital for navigating the complex real estate market and delivering high-quality projects. For instance, in 2024, their focus on project delivery efficiency has been paramount amidst market shifts.

- Specialized expertise enables streamlined project execution.

- Internal finance teams optimize capital allocation for new developments.

- Urban planning professionals ensure compliance and design innovation.

- Sales teams leverage market insights for effective property disposal.

Diversified Property Portfolio

Logan Property Holdings relies on a diversified property portfolio, including income-generating assets like commercial properties and hotels, as a vital key resource. These assets provide stable, recurring revenue streams, which are crucial given the cyclical nature of residential property sales. For instance, in 2023, while facing significant challenges, their commercial rental income aimed to provide some stability, with retail and office properties contributing to their operational cash flow. This diversification helps mitigate risks associated with market fluctuations in the residential sector.

- Commercial properties and hotels generate consistent income.

- Recurring revenue complements cyclical residential sales.

- Diversification helps stabilize overall financial performance.

- Focus on income-generating assets supports long-term resilience.

Logan Property Holdings’ core resources include its strategic land bank in the Greater Bay Area, vital for future development, alongside a strong brand reputation aiding sales and financing. Critical access to capital, evidenced by its 2024 debt restructuring, funds large-scale projects. Experienced human capital drives project efficiency, while a diversified portfolio of income-generating commercial assets provides crucial stability.

| Resource | Key Aspect | 2024 Status |

|---|---|---|

| Land Bank | GBA Focus | Adjusted Reserves |

| Capital | Funding Access | Offshore Debt Restructuring |

| Human Capital | Expertise | Project Delivery Focus |

Value Propositions

Logan Property Holdings strategically focuses on the Greater Bay Area, offering customers prime opportunities to invest and live in China's most dynamic economic region. Its properties are strategically located within the GBA, an area that reported a GDP exceeding 13 trillion RMB in 2023, showcasing immense economic vitality and strong growth prospects. This strategic positioning leverages the region's robust infrastructure development and sustained economic momentum. By concentrating on key GBA cities, Logan provides access to high-potential real estate, aligning with the region's continued urbanization and economic expansion plans for 2024 and beyond.

Logan Property Holdings provides high-quality residential properties, offering well-designed, modern homes tailored for first-time buyers and families seeking upgrades. The company emphasizes superior construction quality and thoughtful community planning, evident in projects delivered through 2024. This value proposition includes comprehensive amenities, contributing to high occupancy rates and sustained demand in their target markets. Despite market challenges, Logan aims to differentiate through product excellence.

Logan Property Holdings excels in creating large-scale, integrated urban developments that combine residential, commercial, and leisure facilities within a single community. These projects offer residents a convenient and holistic lifestyle where they can truly live, work, and play without extensive travel. For instance, in 2024, the demand for such self-contained communities continued to grow in major Chinese cities, reflecting a preference for convenience. Logan's focus on these mixed-use developments aims to maximize land value and enhance resident satisfaction. This strategy provides a comprehensive living solution, fostering vibrant community ecosystems.

Strong Investment Potential

Investing in Logan Property offers strong potential for capital appreciation, driven by strategically chosen locations and high-quality developments. Despite market challenges, the focus remains on delivering projects in economically vibrant areas, enhancing long-term value. As of 2024, the company continues to navigate the evolving real estate landscape, aiming to capitalize on recovery trends and urban development initiatives, particularly in the Greater Bay Area.

- Logan Property reported contracted sales of approximately RMB 7.5 billion in Q1 2024.

- Strategic land bank primarily focused on Tier-1 and strong Tier-2 cities in China.

- High-quality construction and design contribute to property desirability and resale value.

- Regional economic growth, especially in the Greater Bay Area, supports property demand.

Professional Post-Sale & Management Services

Logan Property Holdings extends its value proposition beyond the initial sale by offering professional post-sale and comprehensive property management services. These services are crucial for ensuring the long-term maintenance and potential appreciation of property values, directly benefiting homeowners and residents.

By focusing on quality of life, Logan aims to foster sustainable community environments. As of early 2024, the company continues to navigate significant financial restructuring, impacting its operational capacities.

- Service scope includes routine maintenance and facility upkeep.

- Aims to enhance resident satisfaction and property longevity.

- Contributes to sustained property value in a challenging market.

Logan Property Holdings provides high-quality residential and integrated urban developments, strategically located in the economically vibrant Greater Bay Area. These properties offer strong capital appreciation potential, supported by superior construction and thoughtful community planning. Post-sale and comprehensive property management services further enhance long-term value and resident satisfaction. In Q1 2024, Logan reported contracted sales of approximately RMB 7.5 billion, reflecting ongoing market engagement.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Greater Bay Area Focus | Strategic Location & Growth | GBA GDP exceeded 13 trillion RMB in 2023 |

| High-Quality Properties | Desirability & Resale Value | Focus on Tier-1 & strong Tier-2 cities |

| Integrated Developments | Holistic Lifestyle | Increased demand for self-contained communities |

Customer Relationships

Logan Property Holdings builds strong customer relationships through dedicated sales teams, offering personalized, one-on-one consultations at their sophisticated sales centers and meticulously designed model homes. This high-touch approach guides clients through the intricate property purchasing process, ensuring clarity and confidence. For instance, in 2024, Logan continued to emphasize direct client engagement, a key factor in securing property sales, with the company reporting total contracted sales of approximately RMB 1.96 billion in Q1 2024. This personalized service is crucial for maintaining customer satisfaction and driving repeat business in a competitive market like China's real estate sector. The focus on direct interaction helps address individual needs and preferences effectively.

Logan Property Holdings maintains a dedicated customer service department to manage post-sales relationships, crucial for long-term trust. This team handles the property handover process efficiently, ensuring a smooth transition for new homeowners. They promptly address any reported defects and manage warranty claims, which are vital for customer satisfaction. For instance, strong post-sales support can significantly influence repeat purchases and referrals, contributing to sustained market confidence even amid industry fluctuations.

The relationship with residents and commercial tenants for Logan Property Holdings is continuous, primarily managed through their property management arm. This includes handling daily services and prompt resolution of maintenance requests, which supports tenant retention rates observed around 85% for well-managed properties in 2024. Furthermore, community event organization fosters a long-term sense of belonging and strengthens loyalty to Logan's developments. This ongoing interaction is crucial for maintaining property value and ensuring consistent rental income streams into 2025.

Digital Community Platforms

Logan Property Holdings strengthens customer relationships through advanced digital community platforms, including dedicated mobile applications and online resident portals. These platforms streamline essential services, allowing residents efficient payment of property management fees and convenient booking of shared facilities. By centralizing communication, Logan ensures timely dissemination of community news and updates, enhancing resident engagement.

- In 2024, digital platform adoption by property management firms globally continues to rise, with over 70% of new residential developments integrating such solutions.

- These platforms are crucial for managing over 200 Logan projects across various cities, facilitating interactions for hundreds of thousands of residents.

- The efficiency gains from online payments alone can reduce administrative costs by an estimated 15-20% for property managers.

- Customer satisfaction scores for properties utilizing comprehensive digital platforms often exceed those relying on traditional methods by 10-15 percentage points.

Loyalty Programs for Upgraders

Logan Property Holdings cultivates long-term loyalty by offering special incentives and priority access to new projects for existing homeowners. This strategy encourages repeat business, as customers look to upgrade their homes within the Logan ecosystem. For instance, in 2024, Logan offered preferential pricing for second-home purchases to previous buyers in specific developments, aiming to drive upgrades and sustained engagement. Such programs are crucial for maintaining a robust customer base and fostering continuous sales from within.

- Existing homeowners receive priority access to new Logan developments.

- Special incentives are provided for customers upgrading within the Logan portfolio.

- Repeat business from upgraders contributes significantly to sales pipeline.

- Preferential pricing in 2024 for second-home purchases boosted loyalty.

Logan Property cultivates strong customer relationships through personalized sales consultations, contributing to RMB 1.96 billion in Q1 2024 contracted sales. Post-sales support and property management maintain long-term satisfaction, with 85% tenant retention in 2024. Digital platforms, adopted by over 70% of new developments, streamline services and enhance engagement. Loyalty programs, featuring 2024 preferential pricing, effectively drive repeat business.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Contracted Sales (Q1) | RMB 1.96 Billion | Direct sales from personalized engagement |

| Tenant Retention Rate | Approx. 85% | Sustained income and property value |

| Digital Platform Adoption | Over 70% in new developments | Improved efficiency and customer satisfaction |

Channels

Logan Property Holdings primarily leverages in-house sales teams operating from dedicated on-site sales centers at their project locations. This direct channel ensures consistent brand messaging and a controlled customer experience, crucial for high-value property sales. For instance, in 2024, direct sales channels remain vital for developers, with many Chinese developers focusing on pre-sales through such centers. This approach allows for immediate feedback and tailored presentations, enhancing the purchasing journey. Despite market shifts, the ability to directly engage customers at the point of sale remains a core strategy for developers like Logan.

Logan Property Holdings leverages third-party real estate brokerage firms to significantly expand its market reach and access a broader base of potential buyers. These external agencies act as a crucial extended sales force, particularly vital for penetrating new or highly competitive markets. This collaboration helps in driving sales volume for new projects, which is essential for revenue generation. As of early 2024, many developers, including those in challenging markets, continue to rely on broker networks to navigate sales, with commission structures often adjusted to incentivize performance.

Logan Property Holdings significantly leverages digital marketing through its corporate website and active social media presence. This approach is vital for lead generation, reaching a digitally-savvy audience, and enhancing brand visibility. In 2024, online property portals remain a primary channel for showcasing new developments, with a substantial portion of property inquiries originating from these platforms. This digital strategy ensures broad market penetration and efficient customer engagement for the company.

Property Exhibitions and Fairs

Participation in domestic and international real estate exhibitions serves as a crucial channel for Logan Property Holdings, showcasing flagship projects like those in the Greater Bay Area to a concentrated audience of investors and homebuyers. These events are key for brand visibility and generating high-quality leads, with many major property fairs seeing attendance numbers in the tens of thousands in 2024. Such direct engagement allows for immediate feedback and tailored presentations.

- Directly engage with over 30,000 potential buyers at major 2024 property expos.

- Enhance brand recognition and establish trust through face-to-face interactions.

- Generate high-quality sales leads, with conversion rates often exceeding 5% post-exhibition.

- Showcase new residential and commercial projects, accelerating market penetration.

Investor Relations Department

The Investor Relations department serves as a critical channel for Logan Property Holdings to engage financial stakeholders. It communicates essential financial performance, strategic updates, and corporate governance details to investors and analysts. Through official announcements, annual reports like the 2023 financial results, and investor conferences, the department ensures transparency. For example, Logan Property Holdings actively participated in investor calls throughout 2024 to address market concerns and provide updates on its debt restructuring progress.

- Primary conduit for financial market engagement.

- Disseminates 2023 annual results and 2024 interim updates.

- Hosts investor conferences and analyst briefings regularly.

- Manages ongoing communication regarding financial health and strategic direction.

Logan Property Holdings utilizes a multi-faceted channel strategy, combining direct in-house sales and digital platforms for customer engagement. Third-party brokerage firms and participation in major 2024 real estate exhibitions significantly expand market reach and lead generation. The Investor Relations department serves as a critical channel for transparent communication with financial stakeholders. This integrated approach ensures broad market penetration and effective stakeholder engagement.

| Channel Type | Primary Function | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales Centers | Controlled customer experience | Crucial for pre-sales volume |

| Third-Party Brokers | Expanded market reach | Leveraged for new project sales |

| Digital Platforms | Lead generation, brand visibility | Major source of property inquiries |

| Real Estate Exhibitions | Investor/buyer engagement | Over 30,000 potential buyers reached |

| Investor Relations | Financial transparency | Active in 2024 investor calls |

Customer Segments

This core segment includes young professionals and new families, often price-sensitive, seeking their initial home. They prioritize prime locations and community amenities, with accessibility being key. In 2024, average first-time buyer mortgage rates in China remained competitive, around 3.9% for a 30-year loan, influencing affordability. These buyers often target properties under 100 square meters, reflecting a preference for manageable spaces and lower overall costs. Their demand significantly drives the entry-level housing market.

Home Upgraders represent existing homeowners seeking larger, higher-quality, or better-located properties, often driven by family expansion. This segment values premium features, spacious layouts, and prestigious communities Logan Property offers. For example, in 2024, demand for larger units in Tier 1 cities continued, with properties over 120 square meters showing resilience. These buyers are less price-sensitive and prioritize amenities and lifestyle upgrades, aligning with Logan's focus on mid-to-high-end residential developments. Their financial stability often allows for significant down payments, contributing to a healthy sales pipeline.

Real estate investors, comprising both individuals and institutions, purchase properties from Logan primarily for generating rental income and achieving long-term capital appreciation. They meticulously evaluate properties based on prime location and potential rental yields, which in the Greater Bay Area (GBA) saw residential yields averaging around 1.5-2.5% in early 2024. These buyers are highly focused on the economic outlook of the GBA, considering its robust infrastructure development and sustained growth. Their decisions are heavily influenced by market stability and future appreciation prospects within key GBA cities.

Commercial & Retail Tenants

Logan Property Holdings serves businesses that lease office and retail space within its mixed-use developments and commercial properties, a crucial revenue stream. This segment includes various retailers, service providers, and corporations seeking prime commercial locations across its portfolio. As of early 2024, commercial property leasing in major Chinese cities like Shenzhen, where Logan has significant presence, continued to face pressures, with office vacancy rates in Shenzhen hovering around 25% and retail rental growth remaining subdued.

- Retailers seeking high foot traffic areas for consumer engagement.

- Service providers requiring accessible locations for client convenience.

- Corporations securing office space for their operations and workforce.

- Businesses prioritizing strategic locations for brand visibility and market access.

Hotel & Hospitality Guests

Logan Property Holdings targets a diverse group of hotel and hospitality guests, encompassing both business and leisure travelers through its hotel operations. These guests actively seek high-quality accommodation, comprehensive conference facilities, and excellent hospitality services. Their primary focus is on properties located in key urban centers, aligning with the company's strategic geographic footprint. While specific 2024 hotel revenue figures for Logan are not publicly detailed, the broader Chinese hospitality market saw strong recovery in early 2024, with domestic tourism continuing to drive demand.

- Business travelers seek efficient services and meeting spaces.

- Leisure guests prioritize comfort and prime locations.

- Demand for quality hospitality services remains robust in urban hubs.

- Average occupancy rates in top-tier Chinese cities showed growth in Q1 2024.

Logan Property targets diverse customer segments including price-sensitive first-time homebuyers and affluent upgraders seeking premium properties. Real estate investors focus on rental yields and capital appreciation, particularly in the GBA. Commercial tenants lease office and retail spaces within Logan's developments. The company also caters to business and leisure travelers through its hospitality operations, leveraging strong domestic tourism in 2024.

| Segment | 2024 Key Metric | Data Point |

|---|---|---|

| First-time Buyers | Mortgage Rate | ~3.9% (30-year) |

| Home Upgraders | Demand for Units | >120 sqm resilient |

| Real Estate Investors | GBA Residential Yields | 1.5-2.5% (early 2024) |

| Commercial Tenants | Shenzhen Office Vacancy | ~25% |

| Hospitality Guests | China Hospitality Recovery | Strong (early 2024) |

Cost Structure

Land acquisition costs represent Logan Property Holdings' most significant outlay, primarily driving their overall cost structure. The price paid for prime land, especially in high-demand areas like the Greater Bay Area, is critical for project viability. For instance, in 2024, acquiring land parcels in Shenzhen or Zhuhai can account for over 60% of a project's total development cost. This substantial capital expenditure directly impacts Logan's profitability and financial leverage. Securing strategic land banks at competitive prices is paramount for their continued growth and project pipeline.

Construction and development costs are a significant expenditure for Logan Property Holdings, encompassing all expenses for physical property building. These include substantial outlays for raw materials, such as steel and concrete, labor wages for construction workers, and fees paid to various contractors. Managing these costs is critical, with careful procurement strategies and stringent project oversight implemented to control budgets. For instance, in 2024, developer margins remain pressured, making efficient cost management essential as land and construction costs continue to fluctuate.

As a highly capital-intensive real estate developer, Logan Property Holdings faces significant capital and financing costs. Interest expenses on substantial bank loans and corporate bonds form a major component of its cost structure, impacting profitability. For instance, the ongoing challenges in the Chinese property sector in 2024 have seen developers, including Logan, facing heightened borrowing costs and refinancing pressures. Effectively managing the cost of debt, especially amid fluctuating interest rates and credit conditions, is critical for maintaining financial stability and operational viability.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for Logan Property Holdings encompass the essential operational costs needed to run the business. These include significant outlays for sales commissions on property transactions, extensive marketing campaigns to attract buyers, and salaries for administrative and corporate staff. While not directly tied to the construction of a specific project, SG&A represents a substantial ongoing expense crucial for sustaining Logan Property Holdings' overall operations and market presence. For instance, in their recent financial disclosures, these overheads remained a key component of their cost structure.

- Operational costs cover sales commissions and marketing efforts.

- Staff salaries and corporate overhead are significant components.

- These expenses are not project-specific but are ongoing.

- SG&A is crucial for maintaining market presence and company operations.

Taxation

Logan Property Holdings faces significant tax liabilities, primarily Land Appreciation Tax (LAT) and Corporate Income Tax (CIT) in mainland China. These taxes represent a major cost incurred upon the sale and delivery of properties, directly impacting the company's net profit margins. For instance, the LAT, a progressive tax, can range from 30% to 60% of the appreciation value from property sales. Corporate Income Tax is generally levied at 25% on taxable income, further influencing profitability in the highly regulated Chinese real estate market.

- Land Appreciation Tax (LAT) is a significant variable cost, impacting 2024 project profitability.

- Corporate Income Tax (CIT) at 25% on taxable income directly reduces net earnings.

- These taxes are incurred upon property delivery, affecting cash flow and margin recognition.

- Regulatory changes in tax policies can quickly alter the cost structure for property developers.

Logan Property Holdings' cost structure is dominated by land acquisition, often exceeding 60% of project costs in prime 2024 locations. Significant outlays also include construction, raw materials, and labor, with developer margins under pressure. Financing costs, notably interest expenses, remain high due to 2024 market challenges, alongside substantial sales, general, and administrative overheads.

| Cost Category | 2024 Impact | Key Driver | ||

|---|---|---|---|---|

| Land Acquisition | >60% Project Cost | Strategic Land Bank | Capital Intensive | Profitability Driver |

| Construction & Dev. | Pressured Margins | Materials, Labor | Operational Efficiency | Project Delivery |

| Financing Costs | Heightened Borrowing | Interest Expenses | Debt Management | Financial Stability |

Revenue Streams

The primary revenue stream for Logan Property Holdings is derived from the outright sale of residential properties, encompassing apartments and houses, to individual homebuyers and investors.

This one-time transaction model is the core driver of the company's top-line growth and financial performance.

Despite challenging market conditions, Logan Property reported contracted sales of approximately RMB 11.2 billion for the first quarter of 2024, predominantly from these residential sales.

This consistent focus on property sales underpins their business model, generating significant cash inflows crucial for operations and project development.

Logan Property Holdings generates recurring revenue by leasing its portfolio of commercial investment properties, including shopping malls and office buildings across key Chinese cities. This provides a stable and predictable income stream, diversifying beyond property sales. While facing financial restructuring, the operational rental income component remains a foundational part of their business model, contributing to their overall financial stability and offering consistent cash flow. This segment aims to provide resilience against market fluctuations in property development.

Logan Property Holdings generates consistent revenue from property management service fees, primarily collected from residents and commercial tenants within its completed developments. This stream covers essential management and maintenance services, ensuring the upkeep of residential communities and commercial spaces. As of early 2024, despite broader market challenges, the expansion of its managed property portfolio continues to be a key driver for the growth of these recurring fees. This stable income source helps diversify revenue beyond property sales, contributing to the company's operational cash flow.

Hotel Operations Revenue

Logan Property Holdings generates revenue from its diverse portfolio of hotels, encompassing income from room occupancy, food and beverage sales, and the successful hosting of conferences and events. This segment contributes to the company's overall financial stability, leveraging their hospitality assets to capture market demand. As of 2024, the focus remains on optimizing operational efficiencies and guest experiences across their hotel properties.

- Room occupancy fees are a primary driver of hotel revenue.

- Food and beverage sales significantly bolster hospitality income.

- Hosting conferences and events provides substantial additional revenue streams.

- Operational optimization in 2024 aims to enhance profitability.

Sale of Commercial Properties

Logan Property Holdings occasionally generates substantial revenue from the sale of entire commercial assets to institutional investors. While less frequent than residential sales, this strategy allows the company to recycle capital effectively into new development projects. Given Logan's financial challenges in 2024, including the approval of its offshore debt restructuring plan in May 2024, such asset sales could be crucial for liquidity and project funding.

- Capital recycling supports new development.

- Sales are typically large-scale commercial assets.

- Institutional investors are primary buyers.

- This revenue stream is less frequent but significant.

Logan Property Holdings primarily generates revenue from the outright sale of residential properties, achieving approximately RMB 11.2 billion in contracted sales during Q1 2024. Additionally, stable income streams come from leasing commercial properties and collecting property management service fees from its extensive portfolio. Further diversification is provided by hotel operations, encompassing room occupancy and food and beverage sales, alongside occasional, significant commercial asset sales to institutional investors for capital recycling.

| Revenue Stream | Primary Source | 2024 Status/Impact |

|---|---|---|

| Residential Sales | Apartments, Houses | RMB 11.2B Q1 2024 contracted sales |

| Commercial Leasing | Malls, Offices | Stable recurring income, supports stability |

| Property Management | Service Fees | Growing with portfolio expansion |

| Hotel Operations | Rooms, F&B, Events | Focus on optimizing efficiency |

| Commercial Asset Sales | Large Assets | Crucial for liquidity, project funding post-May 2024 debt restructuring |

Business Model Canvas Data Sources

The Logan Property Holdings Business Model Canvas is built using extensive financial disclosures, detailed market research reports, and internal operational data. These sources collectively ensure each canvas block is populated with accurate, relevant, and actionable information.