Logan Property Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Logan Property Holdings Bundle

Gain a crucial competitive advantage with our in-depth PESTLE Analysis of Logan Property Holdings. Understand the intricate interplay of political stability, economic fluctuations, social demographics, technological advancements, environmental regulations, and legal frameworks impacting their operations. This analysis is your key to navigating the complex external landscape and making informed strategic decisions. Unlock actionable intelligence and sharpen your market strategy—download the full version now!

Political factors

The Chinese government's commitment to real estate market stability is a significant political factor for Logan Property. Policies like interest rate adjustments and buyer subsidies, observed throughout 2024, aim to bolster demand and confidence. For instance, the People's Bank of China's actions in early 2024 to lower mortgage rates provided some relief to the sector.

Initiatives such as government programs to purchase unsold inventory for social housing projects, a strategy actively pursued in late 2023 and continuing into 2024, are designed to reduce developer overhang and support prices. These measures are critical for Logan Property as they can directly influence sales volumes and access to financing.

While these interventions are intended to foster stability, their long-term success for developers like Logan Property hinges on addressing deeper structural issues within the market. The effectiveness of these policies in restoring robust developer health and market confidence will be closely watched throughout 2025.

China's housing policy, rooted in the principle that homes are for living, not just speculation, directly influences developers like Logan Property Holdings. This core tenet discourages buying properties purely for profit, emphasizing instead the need for affordable housing solutions. For instance, in 2024, the government continued to roll out measures aimed at stabilizing housing prices, such as adjusted mortgage rules in major cities, reinforcing this principle.

This policy shift means Logan must adapt its development strategies to focus on fulfilling genuine housing demand. The company's success will increasingly depend on its ability to build homes that people can afford to live in, rather than anticipating rapid price appreciation driven by investors. This aligns with the ongoing urbanization drive, where providing adequate housing and essential services for a growing urban population is a key government objective.

China's commitment to urbanization, aiming for 70% of its population to be urban residents within five years (by 2029), presents a substantial tailwind for property developers like Logan Property. This demographic shift translates directly into increased demand for housing and related infrastructure.

Logan Property's strategic concentration within the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) is particularly advantageous. The GBA initiative, a key government policy, is driving significant infrastructure investment, such as high-speed rail and bridge projects, which are designed to foster economic integration and boost property values in the region.

For instance, the HZMB Bridge, connecting Hong Kong, Macau, and Zhuhai, has already facilitated increased cross-border movement and economic activity, directly benefiting developers with projects in its vicinity. Logan Property's positioning within this dynamic economic corridor allows it to capitalize on these government-led development plans.

Debt Restructuring and Developer Support

The Chinese government's approach to supporting struggling property developers via debt restructuring is a significant political consideration. Logan Property Holdings recently achieved a crucial milestone by obtaining bondholder consent for a substantial debt restructuring, a development that could influence how similar liquidity challenges are addressed across China's property market. This action signals a governmental inclination to mitigate broader systemic risks within the sector.

This supportive stance is evidenced by various policy initiatives. For instance, in late 2023 and early 2024, authorities continued to roll out measures aimed at stabilizing the property market, including easing some purchase restrictions and encouraging financial institutions to provide necessary funding to developers with viable projects. Logan Property's restructuring, which involved extending the maturity of approximately 14.7 billion yuan ($2 billion) in onshore bonds, highlights the practical application of these policies.

- Government Intervention: Political will exists to prevent systemic collapse by facilitating debt restructuring for key developers.

- Precedent Setting: Logan Property's successful restructuring of its onshore bonds provides a potential blueprint for other developers facing similar financial distress.

- Risk Management: Policy actions aim to manage contagion risks and maintain stability within the vital real estate sector.

- Financial Support: Continued efforts to ensure liquidity access for developers with sound business models are a key political objective.

Geopolitical Tensions and Foreign Investment Sentiment

Escalating geopolitical tensions, particularly concerning China's relationships with Western nations, significantly impact foreign investor sentiment towards the Chinese property market, including the Greater Bay Area. This can directly affect capital flows and overall market confidence.

While Logan Property Holdings focuses on mainland China, broader geopolitical shifts can lead to foreign investors reassessing their exposure. This sentiment can translate into a divestment of assets, as seen in a general trend of reduced foreign direct investment into China during periods of heightened global uncertainty. For example, in 2023, FDI into China experienced a notable decline, reflecting some of these broader concerns, though specific figures for property sector divestment by foreign entities are complex to isolate.

The influence of these tensions extends to currency fluctuations and the perceived risk associated with investing in emerging markets. Logan Property, despite its domestic focus, is indirectly exposed to these global capital market dynamics.

- Geopolitical Uncertainty: Increased tensions create a less predictable investment environment for foreign capital.

- Capital Flight Risk: Heightened geopolitical risks can trigger a sell-off of assets by foreign investors.

- Impact on Market Confidence: Negative sentiment stemming from geopolitical issues can dampen overall property market enthusiasm.

- Currency Volatility: Geopolitical events often lead to currency fluctuations, adding another layer of risk for foreign investors.

The Chinese government's commitment to real estate market stability, demonstrated through measures like lower mortgage rates in early 2024 and programs to purchase unsold inventory for social housing, directly impacts developers like Logan Property. These interventions aim to boost demand and reduce developer overhang, though their long-term effectiveness remains a key watchpoint for 2025.

China's urbanization drive, targeting 70% urban residency by 2029, coupled with the strategic GBA initiative, creates significant demand for housing and infrastructure. Logan Property's focus on the GBA allows it to capitalize on government-led investment in projects like the HZMB Bridge.

Logan Property's successful debt restructuring, involving a 14.7 billion yuan ($2 billion) onshore bond extension in late 2023/early 2024, sets a precedent for addressing developer liquidity issues. This reflects a political inclination to manage systemic risks and ensure liquidity for viable projects.

Geopolitical tensions, particularly with Western nations, dampen foreign investor sentiment and can lead to reduced capital flows into China's property market. This indirect exposure affects Logan Property through potential currency volatility and overall market confidence, as seen with a general decline in FDI in 2023.

| Political Factor | Impact on Logan Property | Key Data/Event (2024/2025 focus) |

| Real Estate Market Stability Policies | Influences demand, pricing, and financing access. | PBOC mortgage rate adjustments (early 2024); social housing inventory purchases (ongoing). |

| Urbanization and GBA Strategy | Drives housing demand and infrastructure investment. | 70% urban residency target by 2029; GBA infrastructure projects (e.g., HZMB Bridge). |

| Developer Debt Restructuring Support | Provides a framework for managing financial distress. | Logan Property's 14.7 billion yuan onshore bond restructuring (late 2023/early 2024). |

| Geopolitical Tensions | Affects foreign investor sentiment and capital flows. | General FDI decline in China (2023); ongoing global economic uncertainty. |

What is included in the product

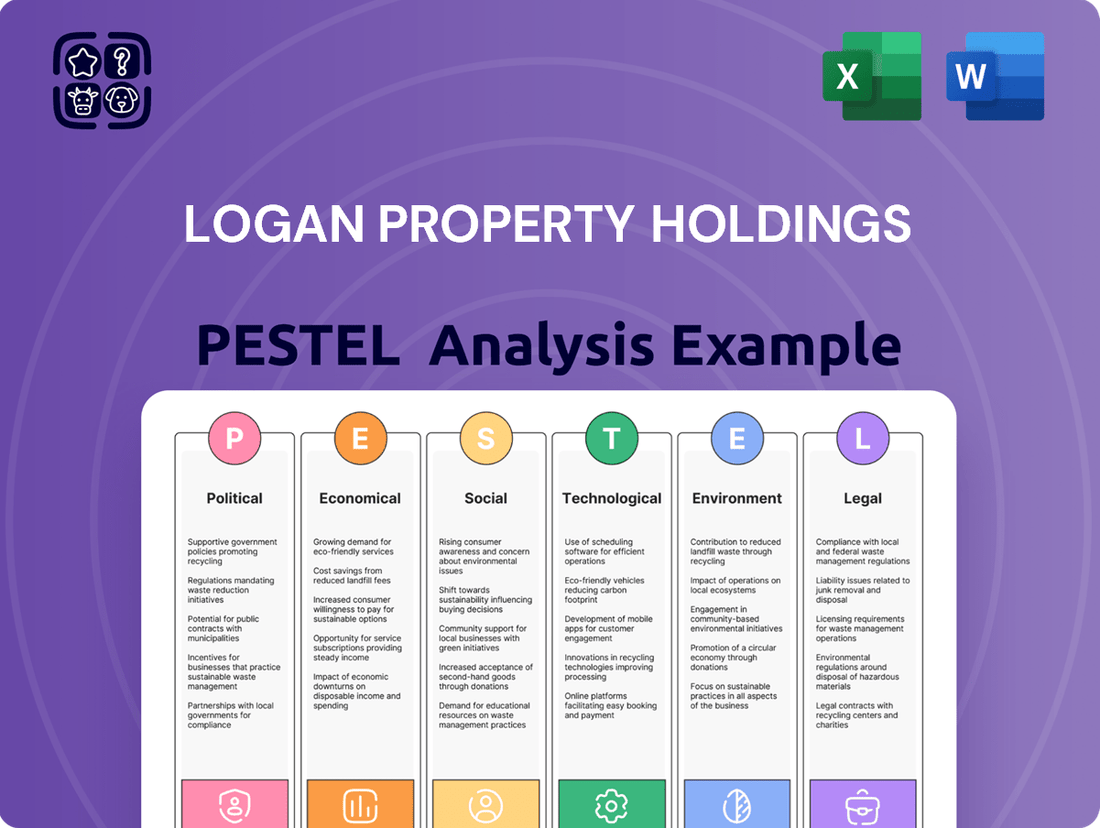

This PESTLE analysis examines the external macro-environmental factors impacting Logan Property Holdings, assessing opportunities and threats across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Logan Property Holdings PESTLE analysis offers a streamlined understanding of external factors, acting as a pain point reliever by providing a clear, summarized version for efficient referencing during critical meetings and strategic planning sessions.

Economic factors

The Chinese real estate market has been navigating a difficult period since 2020, marked by falling housing prices and sales volumes. This downturn has significantly impacted developers, leading to financial strain. For instance, Logan Property Holdings reported a net loss of RMB 1.1 billion in the first half of 2024, underscoring the market's challenges.

Logan Property's financial health directly mirrors these market conditions, with gross profit margins hovering around a low 10% in recent reporting periods. The company also faces the challenge of substantial inventory levels, which can be difficult to move in a subdued market, further pressuring its financial performance and liquidity.

China's central government has actively worked to stimulate the property market. For instance, the People's Bank of China (PBOC) has reduced the benchmark 5-year Loan Prime Rate (LPR). This rate, often used for mortgages, saw a 25 basis point cut in December 2023, bringing it down to 4.20%, a significant move to lower borrowing costs for homebuyers.

Further easing of mortgage policies has been implemented, including reductions in minimum down payment ratios and the removal of purchase restrictions in various cities. These adjustments are designed to make property acquisition more accessible and affordable, directly impacting demand for new homes and potentially improving cash flow for developers like Logan Property Holdings.

Consumer confidence in the property market shows a cautious trend, influenced by ongoing economic uncertainties and a general decline in property prices, which directly affects the demand for new residential units. This sentiment is particularly pronounced as potential buyers weigh the risks associated with their household wealth and existing debt levels.

While there are signs of stabilization in the property markets of major first-tier cities, a widespread recovery across the board is contingent upon a significant uplift in overall consumer sentiment. Restoring this confidence is crucial for encouraging purchasing decisions.

For Logan Property Holdings, this cautious consumer outlook translates to a potentially slower sales cycle for new developments. For instance, in Q1 2024, China's consumer confidence index hovered around 90, a level indicating subdued spending intentions, which impacts big-ticket purchases like real estate.

The purchasing power of consumers is further constrained by concerns about job security and stagnant income growth, creating a hesitant environment for substantial investments in property. This situation necessitates adaptable pricing strategies and innovative sales approaches from developers like Logan Property.

Inventory Levels and Supply-Demand Imbalance

High inventory levels of unsold residential properties present a considerable hurdle for the real estate market, impacting companies like Logan Property. As of early 2024, China's property market continued to grapple with a significant overhang of unsold homes, particularly in lower-tier cities, with some estimates suggesting inventory levels were still elevated compared to pre-pandemic periods. This oversupply can exert downward pressure on property prices and potentially dampen the initiation of new development projects, compelling developers to adopt more cautious and market-responsive strategies.

The ongoing efforts to reduce these stockpiles are crucial for market stabilization. For instance, by mid-2024, various local governments and developers were implementing measures such as tax incentives and targeted price adjustments to clear existing inventory. However, the sheer volume means that significant destocking may take time, influencing Logan Property's ability to launch new developments and manage its financial commitments effectively.

- Sustained High Inventory: Unsold residential units remain a key concern, potentially leading to prolonged price stagnation or declines.

- Impact on New Projects: Developers are likely to delay or scale back new construction starts due to the existing oversupply.

- Strategic Adjustments: Companies like Logan Property must adapt by focusing on sales of existing stock and potentially diversifying their development pipelines.

- Market Recovery Pace: The speed at which inventory levels normalize will be a critical indicator of broader market health and developer confidence.

Greater Bay Area Economic Growth and Investment

The Guangdong-Hong Kong-Macau Greater Bay Area (GBA) is a significant economic engine for China, and Logan Property's operations are deeply intertwined with its growth trajectory. This region is projected to continue its robust expansion, fueled by ongoing urbanization trends and intensified inter-city collaboration. For instance, the GBA's GDP reached approximately $1.7 trillion in 2023, showcasing its substantial economic output.

Logan Property's strategic focus on the GBA positions it to capitalize on this dynamic market. The area benefits from initiatives aimed at fostering seamless economic integration, such as enhanced cross-border payment measures. These measures simplify financial transactions, thereby facilitating investment and economic activity within the region. Furthermore, some GBA cities have seen relaxed property purchase restrictions, which can stimulate demand for real estate developments like those undertaken by Logan Property.

- GBA GDP Growth: The GBA's GDP is expected to grow at an average annual rate of over 5% in the coming years, according to government projections.

- Infrastructure Investment: Significant investment continues in GBA infrastructure, including high-speed rail and bridge networks, connecting cities and boosting economic integration.

- Policy Support: Favorable policies supporting innovation, finance, and talent mobility within the GBA are designed to enhance its competitiveness.

- Cross-border Financial Integration: Initiatives like the Wealth Management Connect scheme are improving financial flows and investment opportunities across the GBA.

The Chinese government's efforts to stabilize the property market, including interest rate cuts and eased mortgage policies, aim to boost demand. For instance, the PBOC lowered the 5-year LPR by 25 basis points to 4.20% in December 2023. However, cautious consumer sentiment, influenced by economic uncertainties and job security concerns, continues to temper purchasing power, as seen in the Q1 2024 consumer confidence index hovering around 90.

High levels of unsold inventory remain a significant challenge, with elevated stock levels persisting in early 2024, particularly in lower-tier cities. This oversupply pressures prices and may lead to delays in new construction. While destocking efforts are underway, significant market stabilization hinges on normalizing these inventory levels, impacting developers like Logan Property's new project launches and financial management.

| Economic Factor | Impact on Logan Property | Supporting Data (2023-2024) |

|---|---|---|

| Interest Rate Policy | Lower borrowing costs could stimulate demand and reduce financial burdens. | PBOC's 5-year LPR cut to 4.20% (Dec 2023). |

| Consumer Confidence | Subdued confidence limits purchasing power for real estate. | Q1 2024 Consumer Confidence Index ~90. |

| Property Market Inventory | High unsold stock pressures prices and new development plans. | Elevated inventory levels in early 2024, especially in lower-tier cities. |

| Economic Growth (GBA) | Robust regional growth offers opportunities for developers focused on the area. | GBA GDP ~ $1.7 trillion (2023), projected annual growth >5%. |

Preview the Actual Deliverable

Logan Property Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Logan Property Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping their strategic landscape. This detailed report provides actionable insights for informed decision-making.

Sociological factors

China's urbanization is a powerful force, with projections indicating that by 2030, over 70% of the population could reside in urban areas. This massive migration, especially into developing cities in central and western China, directly fuels the demand for residential properties. Logan Property Holdings needs to navigate this shift by understanding that the needs of these new urban dwellers are varied, encompassing not just basic housing but also considerations for affordability and proximity to essential services.

Consumer preferences are shifting dramatically, with a growing demand for smart home technology and sustainable, green building practices. In 2024, the global smart home market was valued at over $100 billion, and it's expected to grow significantly. This trend means Logan Property must integrate these features to attract modern buyers who prioritize convenience and environmental responsibility.

Furthermore, there’s a noticeable trend towards community-focused living, with buyers seeking developments that offer shared amenities and foster social interaction. This desire for integrated living spaces impacts how properties are designed and marketed. Logan Property's success hinges on its ability to adapt its portfolio to these evolving lifestyle choices, catering to both younger generations entering the market and existing homeowners looking for enhanced living environments.

The growing emphasis on 'people-centered urbanization' means developers must prioritize residents' well-being and the quality of urban spaces, moving beyond just building more. This approach encourages creating inclusive communities that offer vital amenities such as education, healthcare, and housing for everyone, including migrant populations. For instance, by 2023, China's urbanization rate reached 66.16%, highlighting the massive scale of urban development and the increasing need for people-focused planning.

Aging Population and Household Formation

China's demographic landscape is shifting with an aging population and a noticeable slowdown in new household formation. This trend directly influences the long-term demand for housing, especially for new property sales, posing a challenge for developers like Logan Property Holdings.

To navigate this, developers must adapt by considering these demographic shifts. This might involve diversifying their product lines beyond traditional housing to include specialized offerings such as elderly care facilities or expanding into rental housing markets, areas the Chinese government is actively encouraging.

- Aging Population Impact: By 2023, China's population aged 60 and above reached 297 million, representing over 21% of the total population. This segment's growing needs present opportunities beyond conventional housing.

- Household Formation Trends: The average household size in China has been decreasing, with a trend towards smaller family units. This, combined with a slower birth rate, means fewer new households are being formed annually compared to previous decades.

- Government Initiatives: The Chinese government has been promoting the development of the eldercare sector and the rental housing market to address these demographic changes and housing needs.

Social Stability and 'Delivering Unfinished Homes'

The social imperative to deliver completed homes, rather than unfinished ones, is a major concern for governments and directly affects public trust in property developers. Logan Property, alongside its peers, faces substantial pressure to finish projects that have stalled. This pressure is amplified by the need to maintain social stability, as unfinished housing projects can lead to widespread public dissatisfaction and unrest.

To address this, governments are stepping in with financial assistance, such as special loans, to help developers like Logan Property complete these stalled developments. This intervention aims to restore buyer confidence and prevent further social disruption. For instance, in late 2023, China's central government continued to explore various measures to support the property sector, including facilitating financing for unfinished projects, with the goal of ensuring social order.

The impact of unfinished homes extends beyond individual buyers; it affects the broader perception of economic stability and the government's ability to manage crises. Logan Property's ability to navigate these social pressures by completing projects will be crucial for its reputation and future operations.

- Social Stability: Unfinished housing projects can lead to social unrest and a decline in public trust.

- Government Intervention: Special loans and financial support are being provided to developers to complete stalled projects.

- Buyer Confidence: The successful delivery of homes is essential for restoring and maintaining confidence among property buyers.

- Developer Pressure: Logan Property, like others, must prioritize project completion to meet social expectations and regulatory demands.

China's rapid urbanization, with over 66% of its population urbanized by 2023, continues to drive housing demand, particularly in developing cities. Logan Property must cater to diverse urban dweller needs, including affordability and access to services.

Shifting consumer preferences favor smart home technology and green building, reflecting a global market valued at over $100 billion in 2024. Integrating these features is key for Logan Property to attract environmentally conscious buyers.

There's a growing desire for community-centric living, prompting developers to create spaces with shared amenities. Logan Property's success depends on adapting its offerings to these evolving lifestyle choices.

China's aging population, exceeding 297 million people aged 60+ by 2023, and a trend towards smaller households necessitate a diversification of property offerings, potentially into eldercare or rental markets.

The social imperative to complete housing projects is significant, as unfinished developments erode public trust and can lead to social instability. Government support, including special loans, is crucial for developers like Logan Property to complete stalled projects and restore buyer confidence.

Technological factors

The real estate sector, both globally and particularly in China, is seeing a significant uptake in Property Technology, or PropTech. This includes digital tools for managing properties, facilitating sales, and streamlining facility operations. For Logan Property, integrating these solutions offers a clear path to boosting efficiency and improving how customers interact with their services.

By embracing PropTech, Logan Property can tap into innovations like artificial intelligence for data analysis and online platforms for smoother property transactions. For instance, in 2024, the global PropTech market was valued at an estimated $25 billion, with China representing a substantial portion of this growth, driven by demand for smarter, more efficient real estate management.

The burgeoning integration of Artificial Intelligence of Things (AIoT) is revolutionizing property and facility management, directly impacting how assets are operated. This technological shift presents significant opportunities for companies like Logan Property to enhance operational efficiency and resident experience.

Logan Property can leverage AIoT for sophisticated energy management, optimizing consumption through intelligent systems that adapt to occupancy and environmental conditions. For instance, smart building solutions can reduce energy waste by up to 30% in commercial spaces. This not only cuts operational costs but also aligns with increasing environmental sustainability demands from stakeholders and regulators.

Furthermore, AIoT facilitates predictive maintenance, allowing for the proactive identification and resolution of potential issues before they escalate, thereby minimizing downtime and repair expenses. Imagine sensors detecting anomalies in HVAC systems or elevators, triggering maintenance requests automatically. This proactive approach can significantly extend asset lifespan and reduce unexpected capital expenditures, a crucial factor in Logan Property's long-term asset value.

Security monitoring is another area where AIoT offers substantial benefits, enabling advanced surveillance and access control systems. AI-powered analytics can detect unusual patterns, enhancing resident safety and property security. This technological advancement contributes to creating more secure, intelligent, and desirable residential and commercial environments, directly supporting Logan Property's market positioning.

Robotics are increasingly becoming a game-changer in China's real estate industry, tackling critical issues like labor scarcity and rising costs. Companies are turning to robots to boost efficiency and safety on construction sites. For instance, by 2024, the global construction robotics market is projected to reach $3.9 billion, indicating significant growth and adoption.

Logan Property Holdings can strategically integrate industrial robots into its construction phases, potentially automating tasks like bricklaying or welding, thereby reducing reliance on manual labor and improving precision. This move could significantly streamline project timelines and enhance the structural integrity of buildings.

Furthermore, the adoption of service robots for tasks such as cleaning, security surveillance, and routine facility maintenance in completed properties presents a valuable opportunity. These robots can operate with greater consistency, leading to improved service quality and resident satisfaction, while also freeing up human staff for more complex roles.

Big Data Analytics and Predictive Modeling

The increasing sophistication of big data analytics and predictive modeling offers significant advantages for real estate firms like Logan Property. These technologies are transforming how property valuations are conducted, investment opportunities are identified, and customer preferences are anticipated. By leveraging these tools, Logan Property can move beyond traditional methods to gain deeper insights into market dynamics and consumer behavior, enabling more precise forecasting and strategic planning. For instance, in 2024, real estate analytics platforms are increasingly incorporating AI to predict property value fluctuations based on a multitude of variables, from local economic indicators to social media sentiment.

Logan Property can harness big data to optimize its operations and enhance decision-making across various functions. Predictive modeling can assist in identifying prime development locations by analyzing demographic shifts, infrastructure development plans, and potential return on investment. Furthermore, understanding consumer behavior through data analytics allows for the creation of more targeted marketing campaigns and the development of properties that better meet market demand. This data-driven approach is crucial in a competitive landscape where agility and foresight are paramount. For example, real estate technology companies reported a 25% increase in the use of AI-powered analytics for market forecasting in 2023, a trend expected to continue into 2024.

- Enhanced Property Valuation: Utilizing AI algorithms to analyze vast datasets, including sales history, local amenities, and economic indicators, for more accurate and dynamic property valuations.

- Optimized Investment Analysis: Employing predictive models to forecast market trends, identify high-potential investment zones, and assess project viability with greater precision.

- Personalized Customer Recommendations: Leveraging big data to understand buyer preferences and market demand, enabling tailored property suggestions and marketing efforts.

- Improved Project Planning: Using data analytics to inform site selection, design choices, and construction timelines, leading to more efficient and cost-effective project execution.

Digital Transformation in Sales and Marketing

Digital transformation is fundamentally reshaping how real estate is bought and sold. Consumers increasingly expect seamless online experiences, pushing companies like Logan Property to adapt. This shift means moving away from purely physical sales methods towards robust digital platforms that cater to modern buyer preferences.

Logan Property can significantly boost its market reach and efficiency by investing in its digital sales infrastructure. Enhancing virtual tour technology, for instance, allows potential buyers to explore properties remotely, a crucial feature in today's globalized and mobile market. Furthermore, optimizing online engagement strategies, such as targeted social media campaigns and interactive property portals, can attract and convert a wider audience.

By embracing these technological advancements, Logan Property can streamline the entire purchasing journey, making it more convenient and appealing for buyers. This digital-first approach is not just about convenience; it's about meeting evolving consumer expectations and staying competitive in a rapidly digitizing industry. For example, by mid-2024, the global real estate market saw a significant increase in online property viewings, with some regions reporting over 60% of initial property searches starting online.

- Increased Consumer Reliance on Digital Channels: By late 2024, over 70% of real estate inquiries in major urban centers were initiated online.

- Virtual Tour Adoption: Properties featuring high-quality virtual tours in 2024 saw an average of 25% more engagement compared to those without.

- Online Lead Generation: Digital marketing efforts accounted for approximately 55% of new buyer leads for property developers in the Asia-Pacific region throughout 2024.

- Streamlined Transaction Processes: The integration of digital tools for contract signing and payment processing is becoming a standard expectation, improving transaction speed by up to 30%.

Technological advancements in PropTech are transforming real estate operations, offering Logan Property significant efficiency gains through AI and online platforms. The global PropTech market's estimated $25 billion valuation in 2024, with China being a major contributor, highlights this trend.

AIoT integration enhances property management by enabling smart energy consumption and predictive maintenance, potentially reducing energy waste by up to 30% and extending asset lifespan. Robotics are also gaining traction in construction, with the global market projected to reach $3.9 billion by 2024, addressing labor shortages and improving precision on sites.

Big data analytics and predictive modeling are crucial for informed decision-making, from property valuation to identifying investment opportunities, with AI-driven market forecasting seeing a 25% increase in usage in 2023. Digital transformation is also reshaping sales, with over 70% of inquiries initiated online by late 2024, and properties with virtual tours experiencing 25% more engagement.

Legal factors

Logan Property Holdings navigates a dynamic legal landscape in China’s real estate market. Key national legislation such as the Civil Code and the Urban Real Estate Administration Law establish fundamental property rights and transaction procedures. Local ordinances further shape operations, particularly concerning urban renewal projects, land use zoning, and the intricate processes of property transfers, all of which require diligent compliance.

China's 'Three Red Lines' policy, introduced in August 2020, imposed strict leverage limits on property developers, aiming to curb systemic financial risk. These benchmarks included a liability-to-asset ratio below 70%, net gearing below 100%, and cash to short-term debt ratio above 1x. For developers like Logan Property Holdings, which were highly leveraged, this policy significantly restricted their ability to access new financing, forcing a slowdown in growth and necessitating substantial debt restructuring to meet the new criteria.

The legal framework for land use rights and acquisition in China significantly shapes Logan Property Holdings' operations. Regulations concerning land sales, zoning, and the redevelopment of urban villages are pivotal for the company's capacity to secure new development sites and manage its existing land reserves.

In 2023, China's Ministry of Natural Resources continued to emphasize stricter land use controls, impacting how developers like Logan can acquire and utilize land. For instance, policies aimed at curbing speculative land hoarding can influence acquisition costs and availability.

The process of urban village redevelopment, a key area for many developers, is governed by specific local regulations that can vary considerably. These rules dictate compensation, resettlement, and the pace of such projects, directly affecting Logan's project pipelines and timelines.

Furthermore, changes in land auction mechanisms and bidding requirements, often updated annually, present both opportunities and challenges for Logan in expanding its land bank. These legal shifts necessitate continuous adaptation in the company's acquisition strategies.

Property Sales and Transaction Regulations

Regulations surrounding property sales and transactions, encompassing aspects like deed taxes, home purchase limitations, and mortgage lending rules, have a direct impact on Logan Property's sales figures and overall revenue. These legal frameworks dictate the ease and cost associated with buying and selling real estate, influencing buyer demand and developer activity.

Recent policy shifts in various markets have aimed to invigorate property transactions. These adjustments often include measures to lower associated costs, such as reduced stamp duties or transfer taxes, and to broaden the pool of eligible buyers by easing mortgage qualification criteria or introducing subsidies.

For instance, in early 2024, several Asian economies saw adjustments to property transaction regulations designed to boost market liquidity. Some regions implemented temporary waivers on certain transaction taxes for specific property types or price brackets, aiming to encourage quicker sales cycles for developers like Logan Property.

- Deed Taxes and Transaction Costs: Fluctuations in deed taxes and transfer fees directly impact the final purchase price, influencing buyer affordability and transaction volume.

- Home Purchase Restrictions: Policies like foreign ownership limits or quotas can significantly affect demand in certain market segments where Logan Property operates.

- Mortgage Lending Policies: Stricter loan-to-value ratios or increased interest rates can dampen buyer purchasing power, thereby affecting sales velocity.

- Government Stimulus Measures: Initiatives such as property tax rebates or first-time buyer grants can create favorable market conditions, potentially boosting Logan Property's sales performance.

Environmental Protection Laws and Building Standards

China's environmental protection laws are becoming increasingly stringent, directly impacting property developers like Logan Property. New regulations focus on areas such as soil pollution remediation, energy-efficient building designs, and the use of sustainable construction materials. For instance, by the end of 2023, many Chinese cities had updated their green building evaluation standards, pushing for higher percentages of renewable energy integration in new developments.

These evolving standards necessitate significant adjustments in Logan Property's operations. Project design must now incorporate features that reduce environmental impact, influencing everything from site selection to waste management during construction. The choice of building materials is also under scrutiny, with a growing emphasis on recycled and low-emission options to meet compliance requirements.

Logan Property's adherence to these regulations affects its financial planning and project timelines. Meeting higher environmental benchmarks can lead to increased upfront costs for materials and specialized construction techniques. However, compliance also presents opportunities for enhanced brand reputation and potentially lower long-term operating costs for the buildings themselves due to improved energy efficiency.

- Stricter Regulations: China's commitment to environmental protection translates into more rigorous laws for property developers, covering pollution control and resource management.

- Green Building Mandates: There's a push for higher energy efficiency and the adoption of sustainable practices in construction, influencing design and material sourcing.

- Compliance Costs: Logan Property must factor in potential increases in project expenses to meet these environmental and building standards.

- Future Opportunities: Adhering to these standards can lead to improved market perception and long-term operational savings for developments.

The legal landscape in China significantly impacts Logan Property Holdings, particularly concerning financial regulations and property development. The 'Three Red Lines' policy, introduced in August 2020, imposed strict leverage limits, with a net gearing ratio below 100% and a liability-to-asset ratio below 70% being key benchmarks. These regulations have directly influenced developers' access to financing and necessitated strategic debt management to ensure compliance.

Furthermore, evolving land use regulations and urban renewal policies, often updated at the local level, dictate how Logan Property can acquire and develop land. For instance, stricter controls on land hoarding, emphasized by the Ministry of Natural Resources in 2023, can affect land acquisition costs and availability, requiring agile strategic responses.

Transaction-related laws, including deed taxes and home purchase restrictions, directly influence sales volumes and revenue streams. Recent policy adjustments in early 2024 in various Asian markets have seen measures like reduced stamp duties to invigorate property transactions, a trend Logan Property would monitor closely.

Environmental protection laws are also a critical legal factor, with updated green building standards by the end of 2023 in many Chinese cities pushing for higher energy efficiency. These necessitate increased investment in sustainable materials and construction techniques, impacting project costs and design.

| Regulation Area | Key Aspect | Impact on Logan Property | Relevant Period |

|---|---|---|---|

| Financial Leverage | 'Three Red Lines' (Net Gearing <100%, Liability/Asset <70%) | Restricted financing access, necessitated debt restructuring | Introduced August 2020, ongoing compliance |

| Land Acquisition & Development | Stricter land use controls, urban renewal policies | Influences land costs, availability, and project timelines | Ongoing, with emphasis in 2023 |

| Property Transactions | Deed taxes, home purchase restrictions, stimulus measures | Affects sales volume, buyer affordability, and market liquidity | Monitoring trends from early 2024 |

| Environmental Standards | Green building mandates, energy efficiency | Increases upfront costs, influences design and material choices | Updated standards by end of 2023 |

Environmental factors

China's commitment to green development, including targets for carbon neutrality, significantly impacts property developers. Initiatives like Beautiful China 2025 underscore the need for sustainable building practices, pushing companies like Logan Property Holdings to adopt eco-friendly methods.

This translates to incorporating green production, utilizing sustainable materials, and designing energy-efficient structures. For instance, by 2023, China's green building sector was estimated to reach 2 billion square meters of construction area, highlighting the market's shift towards environmentally conscious development.

Logan Property Holdings' alignment with these national environmental goals is crucial for long-term viability and market competitiveness. Failing to adapt to these sustainability mandates could lead to regulatory penalties and a diminished brand reputation.

China's commitment to carbon neutrality by 2060 significantly influences the real estate market. Logan Property must integrate eco-friendly construction materials and energy-efficient designs to meet evolving environmental regulations and consumer demand for sustainable living spaces. This shift is critical as the nation pushes for greener urban development, impacting building standards and operational efficiency.

The drive towards low-carbon development means Logan Property should explore investments in renewable energy sources for its developments, such as solar panels on residential and commercial buildings. Furthermore, enhancing energy management systems within existing and new properties can substantially reduce operational carbon footprints and potentially lower long-term utility costs for residents and businesses. For instance, by 2024, many Chinese cities are implementing stricter energy efficiency codes for new constructions.

Logan Property Holdings, like all major developers, navigates a complex web of environmental regulations. In 2024, compliance with environmental impact assessments remains paramount. This means meticulously evaluating potential effects on air quality, water resources, and soil integrity for every new development.

Failure to comply with these environmental protection laws can lead to significant penalties and project delays. For instance, specific regulations around contaminated land remediation and robust waste management practices are critical. Logan Property must demonstrate adherence to standards that safeguard natural resources and public health.

Resource Scarcity and Waste Management

Growing global concerns over resource scarcity, particularly in construction materials like steel and concrete, directly impact property developers. For instance, the United Nations Environment Programme reported in 2024 that the construction sector accounts for approximately 38% of global CO2 emissions, highlighting the environmental pressure to reduce material consumption and waste. Logan Property Holdings must navigate these challenges by prioritizing efficient resource utilization.

Effective waste management is becoming a regulatory and operational imperative. In 2023, China's Ministry of Housing and Urban-Rural Development continued to push for stricter regulations on construction waste, aiming to increase recycling rates. Logan Property can address this by integrating circular economy principles into its development strategies, focusing on green design and the comprehensive utilization of both industrial and domestic waste streams within its projects to minimize landfill dependency and material costs.

Key strategies for Logan Property Holdings include:

- Adopting modular construction techniques to reduce on-site waste and improve material efficiency, a trend gaining traction in the 2024 global construction market.

- Investing in advanced waste sorting and recycling technologies for construction debris, aligning with China's 2025 targets for waste reduction in major cities.

- Sourcing sustainable and recycled materials for new developments, a market segment projected for significant growth through 2025.

- Implementing robust waste management plans at every project stage, from demolition to new build, to track and minimize waste generation.

Urban Ecological Protection and Green Spaces

The push for people-centered urbanization in China, particularly evident in the Greater Bay Area, places a significant emphasis on enhancing urban ecological protection and expanding green spaces. This approach directly impacts property developers like Logan Property Holdings by requiring them to integrate robust green infrastructure into their projects. A key directive is the zoning requirement for 20% of urban areas to be designated as ecological protection zones, a standard that Logan's developments must adhere to.

Logan Property's strategic focus on the Greater Bay Area means its development pipeline is directly influenced by these environmental mandates. Integrating green infrastructure isn't just about compliance; it's about creating more livable and desirable urban environments, which can translate into higher property values and stronger market appeal. This aligns with broader national goals to improve urban biodiversity and environmental quality.

- 20% Ecological Protection Zoning: This is a critical regulatory benchmark for urban development projects in China, including those by Logan Property.

- Greater Bay Area Focus: Logan's significant presence in this region means its projects are at the forefront of implementing these people-centered urbanization policies.

- Green Infrastructure Integration: Developers are increasingly expected to incorporate features like parks, green roofs, and sustainable drainage systems into their designs.

- Urban Biodiversity Enhancement: Projects are encouraged to contribute positively to local ecosystems, supporting a wider range of plant and animal life within urban settings.

China's commitment to carbon neutrality by 2060, coupled with initiatives like Beautiful China 2025, mandates sustainable development. This means Logan Property Holdings must prioritize eco-friendly construction, energy-efficient designs, and the use of sustainable materials. For instance, in 2023, China's green building sector was projected to reach 2 billion square meters, underscoring a significant market shift.

Compliance with environmental impact assessments and protection laws is crucial in 2024, covering air quality, water resources, and soil integrity. Failure to adhere to these regulations can result in penalties and project delays, emphasizing the need for robust waste management and contaminated land remediation practices.

The construction sector's significant CO2 emissions, around 38% globally as of 2024 according to the UNEP, pressure developers like Logan Property to improve resource efficiency. This includes adopting modular construction and investing in waste sorting technologies to meet 2025 waste reduction targets.

People-centered urbanization, particularly in the Greater Bay Area, requires integrating green infrastructure and ecological protection zones, with a 20% zoning requirement for such areas. Logan Property's strategies must align with these mandates to enhance urban biodiversity and create more livable spaces.

| Environmental Factor | Impact on Logan Property Holdings | Supporting Data/Trend |

|---|---|---|

| Carbon Neutrality Goals | Necessitates green building practices and energy efficiency. | China aims for carbon neutrality by 2060; Beautiful China 2025 initiative. |

| Environmental Regulations | Requires strict adherence to impact assessments, waste management, and land remediation. | Penalties for non-compliance; 2023 push for stricter construction waste regulations. |

| Resource Scarcity & Emissions | Drives focus on material efficiency and waste reduction. | Construction sector accounts for ~38% of global CO2 emissions (2024 estimate); 2025 waste reduction targets for major cities. |

| Urban Green Spaces | Requires integration of green infrastructure and ecological protection zones. | 20% ecological protection zoning requirement in urban areas; focus on Greater Bay Area development. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Logan Property Holdings is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading real estate market research firms. We incorporate economic indicators, regulatory updates, and industry-specific reports to provide a comprehensive overview.