Lloyds Banking Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lloyds Banking Group Bundle

Navigating the complex external environment is crucial for Lloyds Banking Group's success. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping its future. Understand how regulatory shifts, economic volatility, and evolving consumer behaviors present both challenges and opportunities.

This comprehensive report equips you with the strategic intelligence needed to anticipate market changes and make informed decisions. From understanding the impact of new data privacy laws to forecasting the influence of green finance initiatives, our analysis provides actionable insights.

Don't get left behind in the dynamic financial sector. Gain a critical edge by understanding the forces that will impact Lloyds Banking Group and your own strategy. Purchase the full PESTLE analysis now for immediate access to expert-level market intelligence and actionable takeaways.

Political factors

The UK's new Labour government, elected in July 2024, is set to significantly reshape the financial services sector. Lloyds Banking Group faces an environment with increased focus on economic reform and tighter regulations. The government's anticipated Financial Services Growth and Competitiveness Strategy, expected in Spring 2025, will further define the regulatory landscape. This strategic shift aims to balance sector growth with robust risk management, directly impacting Lloyds' operational compliance through 2025 and beyond.

Lloyds Banking Group operates within a dynamic regulatory environment, experiencing heightened oversight from bodies like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). The UK government actively strengthens these regulators to bolster consumer protection and maintain financial system stability. For 2025, key initiatives include new operational resilience requirements, a continued focus on the Consumer Duty, and addressing non-financial misconduct. This evolving landscape directly impacts Lloyds, with UK banks collectively spending an estimated £1.2 billion on regulatory compliance in 2024. These measures aim to ensure market integrity and firm accountability.

The UK's financial services sector, including Lloyds Banking Group, continues to adapt to the post-Brexit regulatory framework, leading to increased compliance costs. Divergence from EU banking rules necessitates ongoing adjustments, with Lloyds investing in new compliance infrastructure, reflected in its 2024 operational expenditure forecasts. The government and regulators are actively defining a new framework, such as the Edinburgh Reforms, aiming to bolster the UK's competitiveness as a global financial center outside the EU by mid-2025.

Taxation Policies

The potential Labour government, anticipated for 2024-2025, is expected to reform the UK's taxation system, aiming for a more progressive structure and closing existing loopholes. This shift could significantly increase tax liabilities for financial services firms like Lloyds Banking Group, necessitating a re-evaluation of their current financial strategies. For instance, specific proposals from parties like the Liberal Democrats include increasing the digital services tax and restoring bank surcharge and levy revenues to 2016 levels, when the surcharge rate was 8% and the bank levy yield was higher, impacting profitability. Such changes could directly affect Lloyds’ net income and capital allocation in the coming fiscal years.

- Labour's anticipated progressive tax reforms could increase the corporate tax burden on financial institutions.

- Specific proposals target raising the digital services tax and restoring bank levy revenues to 2016 levels.

- Lloyds Banking Group might face higher tax liabilities, impacting its 2024-2025 financial performance.

Public Affairs and Lobbying

Lloyds Banking Group actively engages with UK politicians, policymakers, and regulators to shape public policy, a crucial aspect of their 2024-2025 strategic outlook. The Group retains public affairs agencies for political monitoring and strategic advice, ensuring alignment with evolving legislation. While the company maintains a strict policy against making political donations, they annually seek shareholder authority for political expenditure. This precautionary measure, which received over 99% shareholder approval at the 2024 AGM, allows engagement with stakeholders without breaching relevant legislation.

- Lloyds engages with UK government bodies and regulators like the FCA and PRA.

- Public affairs agencies provide strategic insights into upcoming financial regulations.

- Over 99% shareholder approval for political expenditure at the 2024 AGM.

- Policy prohibits political donations, focusing on policy dialogue instead.

The UK's Labour government, elected July 2024, is tightening financial regulations, directly impacting Lloyds' compliance and operational costs. Heightened oversight from the FCA and PRA, alongside post-Brexit rule divergence, necessitates significant compliance investment, reflecting in 2024 operational expenditure. Expected progressive tax reforms could increase corporate tax burdens for financial firms by 2025. Lloyds actively engages with policymakers to navigate these evolving political and regulatory landscapes, which influence its strategic outlook.

| Political Factor | Key Impact on Lloyds (2024-2025) | Relevant Data/Metric |

|---|---|---|

| New UK Government | Increased regulatory scrutiny & compliance focus | Anticipated Financial Services Strategy (Spring 2025) |

| Regulatory Environment | Heightened operational resilience & consumer duty requirements | UK banks' estimated £1.2 billion compliance spend (2024) |

| Taxation Reform | Potential increase in corporate tax liabilities | Proposals for bank surcharge/levy at 2016 levels (8% surcharge) |

What is included in the product

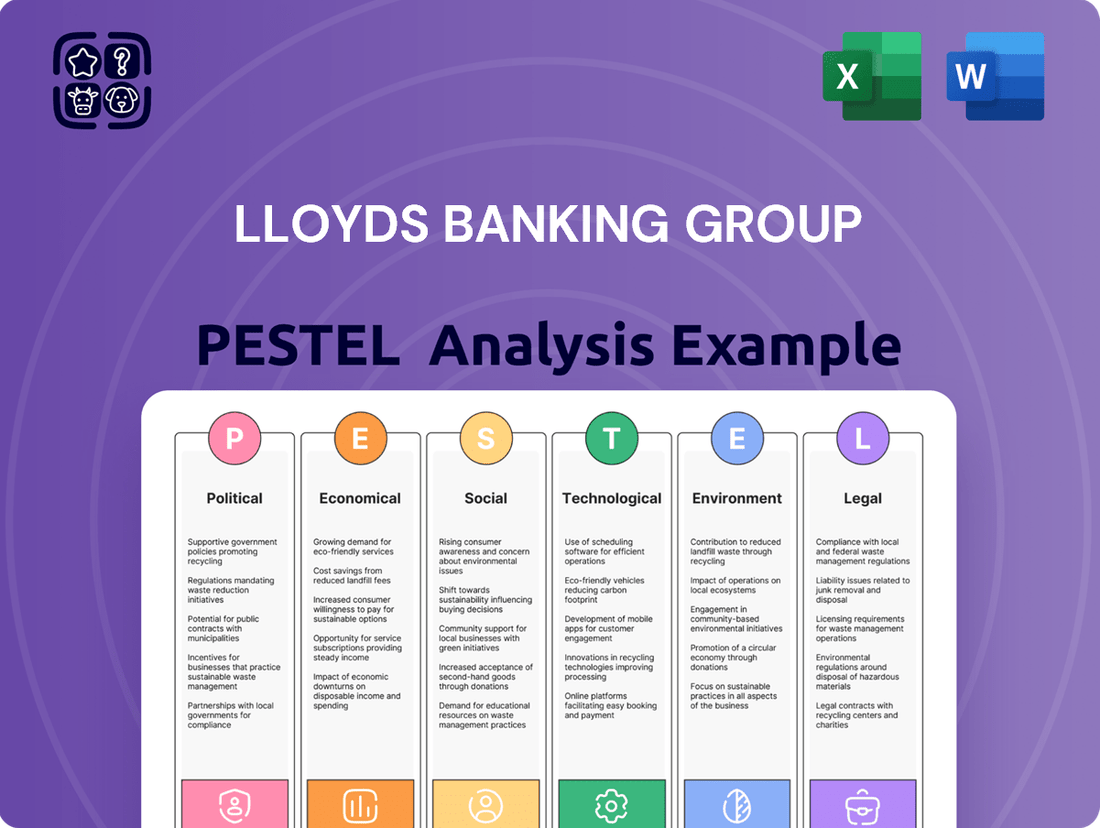

This PESTLE analysis examines the external macro-environmental factors impacting Lloyds Banking Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the banking landscape, offering insights for strategic decision-making.

Offers a digestible overview of the external forces impacting Lloyds Banking Group, simplifying complex market dynamics for clearer strategic decision-making.

Provides a structured framework to proactively identify and mitigate potential threats and leverage emerging opportunities within the financial sector.

Economic factors

The UK economic growth outlook for 2025 is modest, with Lloyds Banking Group's base case scenario projecting a 1.0% GDP growth, potentially rising to 1.5% by 2027. However, the British Chambers of Commerce anticipates higher business investment throughout 2025. Business confidence shows improvement, as a majority of UK businesses expect increased turnover and profitability in 2025 compared to 2024. This environment shapes lending and strategic planning for financial institutions.

The Bank of England's monetary policy remains a critical economic factor for Lloyds Banking Group. Market expectations point to further interest rate cuts throughout 2025, significantly impacting the financial landscape. Forecasts suggest the bank rate could decrease to 3.75% or even 4% by the close of 2025. These anticipated reductions will directly influence Lloyds' net interest income and reshape its lending margins, requiring strategic adjustments.

Inflation is expected to remain a significant concern for Lloyds Banking Group in 2025. Forecasts indicate a near-term rise before inflation gradually falls back towards the 2% target. The Bank of England projects a temporary increase to 3.5% in the third quarter of 2025. Persistent inflationary pressures could reduce consumer spending power and diminish loan affordability for customers. This directly affects Lloyds' crucial retail banking operations and overall loan book performance.

Unemployment Rates

Unemployment rates are a crucial economic factor for Lloyds Banking Group. The Office for Budget Responsibility (OBR) projects a slight increase in UK unemployment, aligning with Lloyds' base case scenario. The bank forecasts unemployment to reach 4.7% for 2025-2026, up from 4.2% in early 2024. This rise could directly impact the bank by increasing loan defaults and credit losses, affecting its asset quality and profitability.

- OBR and Lloyds both forecast rising unemployment for 2025.

- Lloyds' base case projects 4.7% unemployment for 2025-2026.

- Increased unemployment elevates loan default risks for the bank.

- Higher credit losses could impact Lloyds' financial performance.

Housing Market Trends

The UK housing market anticipates modest price inflation, with Lloyds' base case projecting a 2.0% increase in 2025. As a major mortgage lender, Lloyds' performance is deeply tied to the health of this market. Changes in house prices directly impact the value of its substantial mortgage portfolio and influence demand for new loans. Sustained stability is crucial for the bank's lending profitability and asset quality.

- Lloyds forecasts a 2.0% UK house price increase for 2025.

- Housing market health directly impacts Lloyds' mortgage portfolio.

- New loan demand fluctuates with house price movements.

The UK economic landscape for Lloyds in 2025 features modest GDP growth of 1.0% and anticipated interest rate cuts to 3.75% or 4.0%. Inflation is projected to temporarily increase to 3.5% in Q3 2025, while unemployment is forecast to rise to 4.7% for 2025-2026. A 2.0% house price increase is expected, directly impacting Lloyds' significant mortgage portfolio.

| Economic Indicator | 2025 Projection | Source/Impact |

|---|---|---|

| GDP Growth | 1.0% | Lloyds' base case |

| Bank Rate (EOY) | 3.75% - 4.0% | Market expectations |

| Inflation (Q3) | 3.5% | Bank of England |

| Unemployment | 4.7% | OBR / Lloyds' base case |

| House Price Growth | 2.0% | Lloyds' base case |

Preview the Actual Deliverable

Lloyds Banking Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Lloyds Banking Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization.

Understand how government policies, economic trends, societal shifts, technological advancements, regulatory changes, and environmental concerns shape the strategic landscape for Lloyds.

This in-depth report provides actionable insights for strategic decision-making and risk management within the financial sector.

Sociological factors

Customer banking preferences are rapidly shifting towards digital channels, a significant sociological trend for Lloyds. By early 2025, over 70% of UK consumers are expected to primarily use online or mobile banking for their daily transactions, with a substantial portion open to fully digital, branchless experiences. This preference is particularly pronounced among younger demographics, where over 85% of Gen Z and Millennials favor tech-driven solutions. Lloyds must continue to innovate its digital offerings to retain and attract these customers, adapting to their evolving needs.

Customers increasingly expect personalized banking experiences and tailored financial advice, shifting from generic offerings. Banks leveraging data to understand individual needs and provide relevant solutions foster greater loyalty and engagement. Lloyds Banking Group is significantly investing in data analytics and artificial intelligence to deliver these bespoke services, aiming for enhanced customer satisfaction. This strategic focus aligns with their 2024/2025 digital transformation roadmap, where AI-driven insights are crucial for tailored product recommendations and proactive support. By prioritizing personalization, Lloyds seeks to capture market share and deepen relationships within a competitive landscape.

There is a significant and growing societal demand for universal access to financial services, particularly for vulnerable customers and those in geographically isolated communities. The UK government, by early 2025, is advancing plans for a national financial inclusion strategy, poised to mandate regulators like the FCA to prioritize accessibility. Lloyds Banking Group is actively contributing, supporting numerous Cash Access UK banking hubs, with over 100 projected to be operational by late 2024, and enhancing digital and physical accessibility for disabled customers.

Focus on Employee Skills and Wellbeing

The rapid technological shifts demand continuous upskilling, especially in areas like data science and AI, prompting Lloyds Banking Group to invest heavily in workforce development. By early 2025, Lloyds aims to have over 50,000 colleagues engaged in digital skills training programs, enhancing overall digital literacy. This focus extends to employee wellbeing, with initiatives aimed at fostering a supportive work environment and improving retention rates.

- Lloyds aims for 75% of its workforce to complete advanced digital upskilling modules by mid-2025.

- Investment in AI and data science training increased by 15% in 2024, targeting critical skill gaps.

- Employee engagement scores, incorporating wellbeing metrics, rose to 78% in Q1 2025.

- Flexible work options were expanded to 90% of eligible roles by late 2024, supporting work-life balance.

Ethical Considerations and Corporate Responsibility

Public and regulatory scrutiny on banks ethical conduct, including investment policies and tax practices, is intensifying. Lloyds Banking Group faces ongoing criticism, for instance, in 2024 for its financing of companies involved in nuclear weapons and for past misleading climate claims. Maintaining a robust ethical reputation is crucial for customer trust and brand image, directly impacting its nearly 26 million retail customers.

- Lloyds aims for net-zero financed emissions by 2050, facing scrutiny on interim targets.

- Ethical investment policies are increasingly a factor in consumer choice, with 2024 surveys showing rising demand for sustainable banking.

- Regulatory fines for ethical breaches can be substantial, impacting profitability.

Sociological trends show a strong shift towards digital banking, with over 70% of UK consumers preferring online channels by early 2025, especially among younger demographics. Customers also demand personalized financial services, driving Lloyds' 2024/2025 investment in AI and data analytics. Furthermore, there is increasing societal pressure for financial inclusion and ethical conduct, influencing customer trust and regulatory scrutiny.

| Sociological Factor | Key Trend | 2024/2025 Data Point |

|---|---|---|

| Digital Adoption | Shift to online/mobile banking | 70% UK consumers primarily digital by early 2025 |

| Personalization | Demand for tailored financial advice | AI investment central to Lloyds' 2024/2025 roadmap |

| Financial Inclusion | Universal access for vulnerable groups | Over 100 Cash Access UK hubs by late 2024 |

| Workforce Development | Upskilling and wellbeing focus | 50,000+ colleagues in digital training by early 2025 |

| Ethical Conduct | Scrutiny on bank practices | Net-zero financed emissions target by 2050 |

Technological factors

Lloyds Banking Group is significantly investing in artificial intelligence and machine learning to enhance customer experiences and boost operational efficiency. By late 2024, the bank had fully migrated its machine learning systems to Google Cloud's Vertex AI platform, accelerating the deployment of new AI applications. This strategic move allows Lloyds to deliver more personalized services, strengthen risk management frameworks, and drastically cut processing times for financial products like mortgage applications, aiming for real-time approvals by mid-2025.

Lloyds Banking Group continues its robust digital transformation, fundamentally shifting towards cloud-based technologies to enhance operational agility and customer experience. This strategic pivot, a core part of its 2024 plan, significantly boosts scalability and reliability across its vast digital services. By migrating critical data and systems to the cloud, Lloyds aims to accelerate innovation, supporting its goal of becoming a leading digitally-enabled bank. This foundational technological shift is crucial for future product development and service delivery, impacting over 26 million customers by 2025.

Lloyds Banking Group actively collaborates with fintech startups to foster innovation and integrate new technologies, a strategy essential for staying competitive in 2024. Through its Launch Innovation Programme, Lloyds provides a platform for tech innovators to partner with the bank, developing solutions that enhance customer experience and operational efficiency. For instance, in 2023, Lloyds invested in and partnered with several emerging fintechs, aiming to streamline digital processes and enhance its financial product offerings. These strategic partnerships are crucial for Lloyds to remain at the forefront of digital banking, ensuring it offers cutting-edge services to its extensive customer base. This approach helps Lloyds leverage external expertise, accelerating its digital transformation journey.

Open Banking and Data Sharing

The progression towards Open Finance, building on the established success of Open Banking, presents significant avenues for product innovation and elevated customer experiences. By enabling more seamless data sharing, Lloyds Banking Group can develop highly personalized and integrated financial products, leveraging insights from over 12.5 million Open Banking payments processed in the UK during March 2024 alone. This strategic shift necessitates a robust and secure data infrastructure, a key area of ongoing investment for the Group to ensure compliance and customer trust.

- Open Finance is projected to expand beyond payments to savings, investments, and pensions by 2025.

- Lloyds aims for enhanced data-driven personalization to improve customer engagement by 2025.

- Investment in secure API frameworks is crucial for compliance with evolving data regulations.

Cybersecurity and Data Privacy

As a major financial institution, Lloyds Banking Group prioritizes robust cybersecurity and data privacy for its millions of customers. The escalating sophistication of cyber threats, with an average cost of a data breach in the financial sector reaching approximately USD 5.97 million globally in 2024, necessitates continuous, substantial investment in advanced security measures. This ongoing commitment is crucial for safeguarding sensitive customer data and maintaining the high level of trust essential in the digital banking landscape.

- Lloyds invests significantly in enhancing its digital defenses, a critical spend within its 2024/2025 technology budget.

- The banking sector faces millions of attempted cyberattacks annually, underscoring the constant threat.

- Protecting customer data is paramount to complying with regulations like GDPR and maintaining public confidence.

Lloyds Banking Group is rapidly advancing its digital capabilities, leveraging AI and cloud technologies to enhance customer services and operational efficiency, targeting real-time mortgage approvals by mid-2025. The bank's strategic focus includes expanding Open Finance beyond payments by 2025 and fostering fintech collaborations. Substantial investment in cybersecurity remains crucial, given the average financial sector data breach cost of USD 5.97 million in 2024, to protect its 26 million customers.

| Technological Focus | 2024/2025 Target | Key Metric/Impact |

|---|---|---|

| AI/ML Integration | Real-time mortgage approvals | Mid-2025 goal |

| Cloud Migration | Enhanced scalability | Impacts 26 million customers by 2025 |

| Open Finance Expansion | Beyond payments to savings/investments | 12.5M UK Open Banking payments (March 2024) |

| Cybersecurity Investment | Robust data protection | Avg. data breach cost: USD 5.97M (2024 financial sector) |

Legal factors

The Financial Services and Markets Act 2023 establishes the UK's post-Brexit regulatory framework, directly impacting Lloyds Banking Group's operations. This legislation grants regulators new objectives, notably a secondary aim to foster the UK economy's international competitiveness and growth. Lloyds must adapt to these evolving rules, which include new powers for the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) to modify retained EU law. For instance, the PRA's 2024 business plan highlights a focus on embedding these new responsibilities, influencing Lloyds' capital requirements and market conduct. The Act's implementation, ongoing through 2025, necessitates continuous compliance adjustments for the bank to maintain its market position.

The Financial Conduct Authority's Consumer Duty, fully effective by July 2024 for closed products, mandates that Lloyds Banking Group deliver good outcomes for its 26 million UK customers. The incoming UK government is expected to reinforce consumer protection, notably by regulating Buy Now, Pay Later products, with legislation anticipated in 2025. Lloyds must ensure its £300 billion in customer loans and services adhere to these evolving high standards, minimizing potential fines which totalled over £200 million across the industry in 2023 for various compliance breaches.

The increasing reliance on customer data for personalization and AI-driven services, such as predictive analytics for lending in 2024, makes compliance with data protection regulations like GDPR paramount for Lloyds Banking Group. Secure and ethical handling of this data is a significant legal and reputational risk, evidenced by potential fines reaching up to 4% of annual global turnover for severe breaches. Lloyds must maintain robust data governance and privacy frameworks to mitigate these risks, ensuring customer trust and avoiding substantial penalties in the evolving digital landscape.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

The UK government and regulators maintain a high priority on combating financial crime. Lloyds Banking Group is subject to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating robust systems to prevent illicit financial flows. The government intends to intensify efforts, evidenced by the Economic Crime Plan 2023-2026, which aims to reduce money laundering. Non-compliance can lead to significant penalties, impacting financial performance and reputation, as seen with substantial fines issued across the sector.

- UK financial crime losses estimated at over £100 billion annually in 2024.

- FCA regulatory fines for AML breaches reached significant sums for financial institutions in 2023-2024.

- Lloyds invested heavily in compliance technology, with 2024 expenditure focusing on enhanced detection capabilities.

Employment and Non-Financial Misconduct Rules

Regulators are intensifying scrutiny on non-financial misconduct and diversity within financial firms. The Financial Conduct Authority (FCA) anticipates finalizing its rules on non-financial misconduct in early 2025, impacting all UK financial institutions, including Lloyds Banking Group.

Lloyds must proactively adapt its corporate culture and employment practices to align with these evolving standards, which aim to foster more inclusive and ethical workplaces. This regulatory push could lead to increased compliance costs, potentially impacting profitability as firms invest more in training and governance frameworks.

- FCA final rules on non-financial misconduct expected in early 2025.

- Increased regulatory focus on diversity and inclusion metrics.

- Potential for higher operational costs for compliance initiatives.

- Reputational risks tied to failure in meeting new standards.

Post-Brexit regulations, notably the FSMA 2023, are fundamentally reshaping Lloyds Banking Group's operating landscape, with full implementation ongoing into 2025. The Consumer Duty, effective July 2024, mandates enhanced customer outcomes, while anticipated 2025 legislation will regulate Buy Now, Pay Later products. Increased regulatory scrutiny on financial crime, data privacy, and non-financial misconduct demands robust compliance, with FCA rules on misconduct expected in early 2025.

| Legal Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| FSMA 2023 Implementation | Regulatory adaptation | Full implementation ongoing through 2025 |

| Consumer Duty & BNPL | Customer protection & new regulations | Consumer Duty fully effective July 2024; BNPL legislation anticipated 2025 |

| Financial Crime & Data Privacy | Compliance & risk mitigation | UK financial crime losses >£100B annually 2024; GDPR fines up to 4% global turnover |

Environmental factors

Lloyds Banking Group is deeply committed to supporting the shift towards a low-carbon economy, setting ambitious sustainability goals for 2024 and beyond. The bank actively aims to enable the UK's transition to net zero, having facilitated over £10 billion in green finance by the end of 2023, and helps customers adopt more sustainable choices. Regulatory bodies like the PRA and FCA are closely scrutinizing Lloyds' performance against these climate targets, alongside increasing public and investor pressure. This heightened scrutiny focuses on the bank's progress, including its target for a 75% reduction in financed emissions from its oil and gas portfolio by 2030.

The UK continues to solidify its position as a global leader in green finance, driving new regulations and extensive disclosure requirements for financial institutions like Lloyds Banking Group.

Mandatory transition plans, aligning with the Paris Agreement, are expected for large companies and financial institutions, with frameworks like the UK's Transition Plan Taskforce (TPT) Disclosure Framework becoming pivotal from early 2025.

This necessitates Lloyds to deeply integrate climate considerations into its lending and investment decisions, impacting its £400 billion loan book and strategic capital allocation.

The Prudential Regulation Authority (PRA) is also increasing scrutiny, ensuring banks manage climate-related financial risks effectively, influencing Lloyds' capital requirements and risk assessments for 2024-2025.

There is an increasing demand for transparent and comprehensive ESG reporting from investors and regulators, influencing Lloyds Banking Group's operations. Lloyds publishes an annual sustainability report, with the 2024 report detailing progress towards net-zero targets and sustainable finance commitments. However, the accuracy of these disclosures is under scrutiny, as evidenced by the Advertising Standards Authority's ruling in early 2024 against some of Lloyds' environmental claims regarding their green banking products, emphasizing the critical need for credible data.

Physical and Transition Risks

As a significant lender, Lloyds Banking Group faces substantial physical risks, like the impact of extreme weather events on property values within its £170 billion UK mortgage book by early 2025, and transition risks from the decarbonization shift. This includes potential financial losses as industries move away from carbon-intensive operations, directly affecting corporate loan portfolios. The bank is actively assessing these exposures, a key focus given the Bank of England's prudential regulatory emphasis on climate-related financial risk management.

- Lloyds aims to reduce financed emissions across key sectors by 2030, targeting a 75% reduction in power generation and 50% in oil and gas.

- By 2024, Lloyds integrated climate risk into its credit assessments for large corporate clients.

- The bank reported a £2.2 billion exposure to climate-vulnerable real estate assets in its 2023 financial disclosures.

Operational Emissions Reduction

Lloyds Banking Group actively reduces its operational carbon footprint as part of its environmental strategy. A key initiative involves migrating its machine learning platform to Google Cloud, which has resulted in a significant saving of 27 tonnes of CO2 operational emissions. These efforts directly support the Group’s broader sustainability goals, enhancing its corporate image and aligning with evolving environmental regulations expected in 2024 and 2025.

- Operational CO2 savings: 27 tonnes from Google Cloud migration.

- Strategic focus: Reducing carbon footprint aligns with 2025 sustainability targets.

Lloyds Banking Group is deeply integrating climate considerations, aiming for a 75% reduction in financed oil and gas emissions by 2030 and facilitating over £10 billion in green finance by late 2023. Regulatory pressure from the PRA and FCA, alongside the UK's 2025 TPT Disclosure Framework, significantly influences its climate risk management and capital allocation. The bank also faces scrutiny on ESG disclosures, as seen with the Advertising Standards Authority's 2024 ruling, while actively reducing operational CO2 emissions by 27 tonnes through cloud migration.

| Environmental Aspect | 2023/2024 Data | 2025 Outlook |

|---|---|---|

| Financed Emissions Target (Oil & Gas) | 75% reduction by 2030 | Ongoing integration into lending |

| Green Finance Facilitated | Over £10 billion (by end 2023) | Continued growth, aligning with UK net zero |

| Regulatory Framework | PRA/FCA scrutiny, UK's TPT Disclosure Framework | Mandatory transition plans from early 2025 |

| Operational CO2 Savings | 27 tonnes (Google Cloud migration) | Further reductions aligned with 2025 targets |

PESTLE Analysis Data Sources

Our PESTLE analysis for Lloyds Banking Group is grounded in comprehensive data from official government publications, reputable financial news outlets, and leading market research firms. This ensures insights into political stability, economic forecasts, technological advancements, and regulatory changes are both current and authoritative.