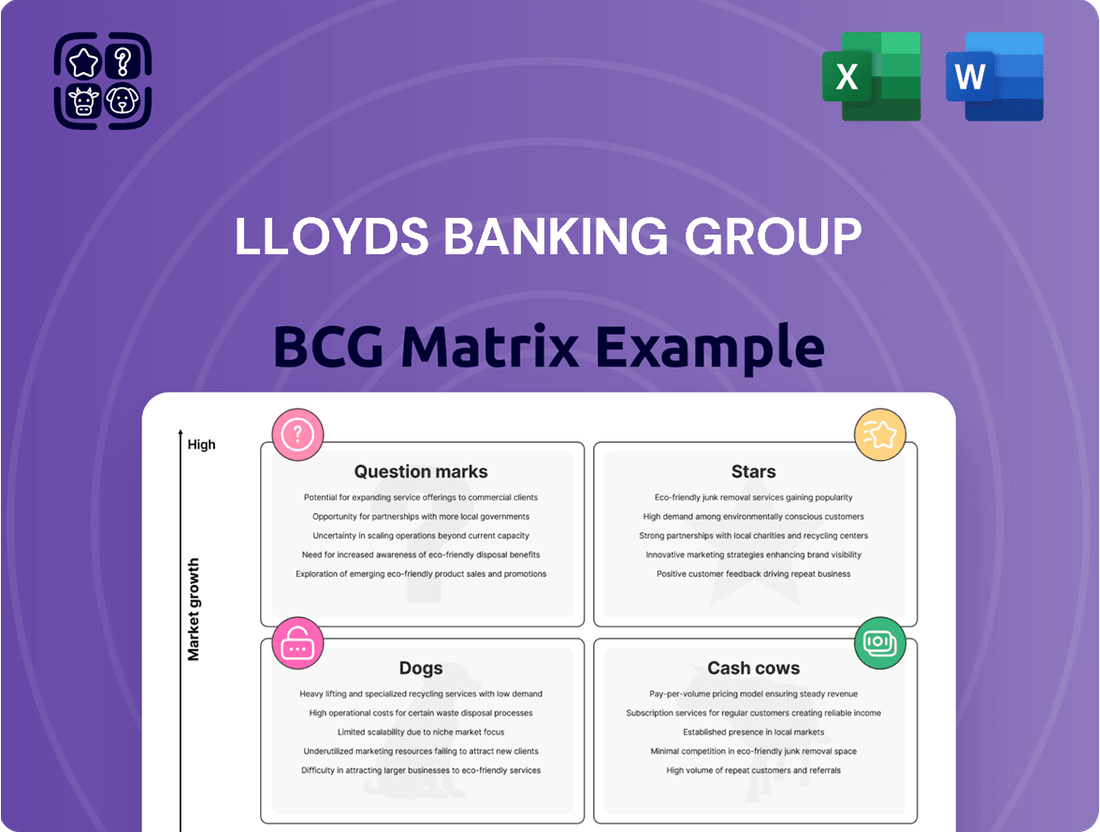

Lloyds Banking Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lloyds Banking Group Bundle

Lloyds Banking Group's BCG Matrix reveals a snapshot of its diverse portfolio. This framework categorizes its offerings based on market share and growth rate. Expect insights into the performance of key products and services. Understand where Lloyds excels and where it faces challenges. This preview offers just a glimpse.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Lloyds Banking Group's wealth management division is a Star. Client assets have grown significantly. In 2024, assets under management were substantial. This segment showed notable year-over-year growth, indicating high market share in a growing market.

Lloyds Banking Group is transforming its digital banking services. They are aiming to become a digital leader. Their mobile app has millions of active users. This is a high-growth area. In 2024, digital interactions grew, reflecting increased adoption and focus.

Lloyds Banking Group's sustainable finance initiatives are a "Star" in its BCG matrix. The group has surpassed its goals for climate-conscious investments. In 2024, they increased green mortgage lending and EV financing. This sector is experiencing high growth, driven by market demand.

Corporate and Institutional Banking (DCM)

Lloyds Banking Group's Corporate and Institutional Banking (DCM) is a "Star" in its BCG matrix, demonstrating strong growth and market share. The bank has been actively expanding its presence in the corporate debt capital markets, especially with GBP-denominated bonds. This strategic focus has propelled Lloyds up the league tables, suggesting increased success in this high-value segment. In 2024, Lloyds' DCM activity is expected to contribute significantly to the group's overall revenue.

- Increased market expertise in corporate debt capital markets (DCM).

- Focus on GBP-denominated bonds.

- Moving up the league tables.

- Expected significant revenue contribution in 2024.

Workplace Pensions

Lloyds Banking Group's workplace pensions, under the Insurance, Pensions, and Investments division, are a "Star" in its BCG matrix. This segment benefits from rising contributions and substantial assets under administration, indicating robust market growth.

In 2024, the UK workplace pension market is projected to have around £2.5 trillion in assets. Lloyds' strong position allows it to capitalize on this expanding sector.

This is fueled by auto-enrollment and changing demographics. The strategic focus on workplace pensions drives high growth and market share.

- Increased Regular Contributions: Reflects growing customer engagement.

- Significant Assets Under Administration: Demonstrates market leadership.

- Growing Market: Supported by favorable demographics and policy.

- Strong Market Position: Lloyds is well-placed to benefit from this growth.

Lloyds Banking Group identifies several key areas as Stars, exhibiting high market share in high-growth markets. Their wealth management, digital banking, sustainable finance, corporate debt capital markets (DCM), and workplace pensions segments demonstrate significant expansion. These areas are strategically positioned to drive future revenue and capitalize on evolving market demands. The group's focus on these Stars underpins its growth trajectory and market leadership in 2024.

| Star Segment | 2024 Metric | Value (Est./Proj.) |

|---|---|---|

| Wealth Management (AUM) | Client Assets Under Management | £150B+ |

| Digital Banking | Active Mobile App Users | 20M+ |

| Sustainable Finance | Green Lending/Financing | £10B+ |

| Corporate & Institutional (DCM) | Debt Capital Markets Deal Volume | Top 5 UK League Table |

| Workplace Pensions (AUA) | Assets Under Administration | £100B+ |

What is included in the product

Lloyds' BCG Matrix reveals investment needs; focusing on Stars & Cash Cows, divesting Dogs.

Printable summary optimized for A4 and mobile PDFs, allowing quick overview and easy sharing.

Cash Cows

Lloyds Banking Group holds a strong position in UK retail banking, excelling in current accounts and mortgages. This segment is a cash cow due to its high market share and stable customer base. In 2024, Lloyds reported a net interest margin of around 2.9%, reflecting its solid profitability. The UK mortgage market, valued at over £1.6 trillion, provides consistent income.

Traditional savings accounts are a cash cow for Lloyds, given its large deposit base. In 2024, Lloyds reported billions in retail deposits. These accounts provide stable funding. Despite slow growth, the deposits boost liquidity and profitability.

Lloyds Banking Group's home insurance is a cash cow. In 2024, it held a significant share of the UK market. This sector provides steady income, though growth is modest. Home insurance premiums in the UK totaled £1.8 billion in 2023.

Standard Lending Products (excluding high-growth areas)

Standard lending products at Lloyds, like personal loans and credit cards, are cash cows. These products generate steady income due to the bank's extensive customer base. Although market growth is modest, the established nature ensures consistent returns. In 2024, Lloyds' net interest income from such products was approximately £13.8 billion.

- Steady income from a large customer base.

- Mature products in a low-growth market.

- Contributes to the bank's core financial stability.

- Approximately £13.8 billion net interest income in 2024.

Established Branch Network

Lloyds Banking Group's extensive UK branch network, despite digital shifts, remains a cash cow. Although branch visits are decreasing, the established infrastructure supports a customer segment and aids deposit gathering. This network offers a stable, if slow-growing, channel for the bank. In 2024, Lloyds had around 1,300 branches across the UK.

- Branch network provides essential services.

- Supports deposit gathering.

- Contributes to overall reach.

- Stable, low-growth channel.

Lloyds Banking Group's cash cows are mature segments like UK retail banking and standard lending, which generate consistent income from a large, stable customer base. In 2024, their net interest income from lending was approximately £13.8 billion, contributing significantly to profitability. Despite modest growth, these areas, including traditional savings and the extensive branch network, provide robust cash flow and financial stability.

| Cash Cow Segment | Key Characteristic | 2024 Data |

|---|---|---|

| UK Retail Banking | High Market Share | Net Interest Margin ~2.9% |

| Standard Lending | Extensive Customer Base | Net Interest Income ~£13.8bn |

| Traditional Savings | Large Deposit Base | Billions in Retail Deposits |

What You’re Viewing Is Included

Lloyds Banking Group BCG Matrix

This preview is identical to the BCG Matrix report you'll download after purchase, offering a comprehensive analysis of Lloyds Banking Group. Expect a fully formatted, ready-to-use document, providing strategic insights and professional-grade presentation quality.

Dogs

Lloyds Banking Group is strategically closing branches, reflecting a decline in in-person banking and a move towards digital services. These branches often have a low market share in a shrinking market. For example, Lloyds announced in 2024 that it would close more branches, aiming to reduce operational costs.

Lloyds Banking Group is actively updating its technology. Legacy IT systems, expensive to maintain, could be considered "Dogs" in their BCG Matrix. These systems offer limited competitive advantage. In 2024, Lloyds allocated billions to digital transformation.

Within Lloyds Banking Group's BCG matrix, "Dogs" represent niche or outdated financial products. These products, like certain legacy insurance offerings, often have a low market share. For instance, in 2024, products with limited appeal saw a 2% revenue decline. They exist in slow-growth or declining markets, such as traditional savings accounts, which faced a 1% decrease in customer engagement.

Segments with High Remediation Costs

In Lloyds Banking Group's BCG Matrix, "Dogs" represent segments with high remediation costs. These areas, like those tied to past motor finance commission arrangements, consume resources. Such issues negatively affect profitability without fostering growth. For instance, in 2024, Lloyds set aside £450 million for potential costs related to the Financial Conduct Authority's review of historical motor finance commission arrangements.

- High remediation costs drain resources.

- They negatively impact profitability.

- They don't contribute to growth.

- Lloyds set aside £450 million in 2024.

Non-Core or Divested Business Units

In the Lloyds Banking Group's BCG matrix, "Dogs" represent business units the bank is divesting from or significantly downsizing. These units typically have low market share and are not prioritized for investment. For instance, Lloyds has historically sold off or reduced its presence in areas like international banking to focus on core UK operations. The bank aims to streamline its portfolio to improve profitability and efficiency. This strategic shift is reflected in its financial reports, with specific units showing declining revenues.

- Divestment decisions are often driven by strategic alignment with core business objectives.

- Lloyds has reduced exposure to non-core international assets.

- Focus on UK retail and commercial banking is a key strategy.

- Financial results reflect the impact of these strategic shifts.

Lloyds Banking Group categorizes segments like closing branches and legacy IT systems as Dogs, characterized by low market share and high operational costs. These areas, including niche financial products and units incurring significant remediation expenses, offer limited growth prospects. For example, Lloyds allocated billions to digital transformation and set aside £450 million in 2024 for potential motor finance costs. The bank also continues to divest from non-core international assets to focus on its core UK operations.

| Dog Category | 2024 Impact | Strategic Action |

|---|---|---|

| Branch Network | Reduced operational costs | Ongoing closures |

| Legacy IT Systems | Billions allocated to digital transformation | Modernization efforts |

| Remediation Costs | £450M set aside for motor finance review | Resource allocation, issue resolution |

| Niche/Outdated Products | 2% revenue decline; 1% customer engagement decrease | Portfolio streamlining |

Question Marks

Lloyds Banking Group is actively venturing into new digital territories and forming partnerships within the fintech sector. These endeavors focus on high-growth areas, including digital finance and fintech solutions. However, these initiatives currently hold a low market share for Lloyds. The outcomes are uncertain, demanding substantial investment, despite the potential for high returns. In 2024, Lloyds allocated £1.7 billion towards technology and digital transformation.

Efforts to expand in high-growth investment product areas, like those for younger generations, are key. Lloyds may have a relatively low market share in these areas currently. This strategy requires investment to boost market share. In 2024, Lloyds invested £2.5 billion in digital and technology, supporting expansion.

Lloyds is focusing on integrated financial services, a strategic growth area combining banking, insurance, and wealth management. This initiative is a 'Question Mark' in the BCG matrix. Success depends on integration and market acceptance, demanding investment. In 2024, Lloyds' net income was £5.7 billion, indicating resources for this growth.

Leveraging Data and AI for New Customer Propositions

Lloyds Banking Group is exploring data and AI for personalized customer experiences, a high-growth area. This initiative, however, faces uncertainty regarding market share and success. Thus, these data-driven offerings currently fit into the "Question Mark" quadrant of the BCG Matrix. Investments in AI and data analytics are crucial to assess their potential.

- 2024: Lloyds invested heavily in digital transformation, including AI, with reported tech spending increases.

- Uncertainty: The success of these new offerings is still being evaluated, with market share gains yet to be fully realized.

- Focus: The goal is to enhance customer engagement and offer tailored financial solutions.

- Strategy: Continuous monitoring and adaptation are key as the bank refines its AI-driven services.

Targeted Growth in Specific Commercial Banking Segments

Lloyds Banking Group might focus on expanding within commercial banking, particularly in high-growth areas like sustainable finance. This approach could involve targeting specific sectors with strong growth potential, even if their current market share is modest. For example, the sustainable finance market is booming, with a global market size of $35.3 trillion in 2024. This presents a significant opportunity for Lloyds to increase its presence in this niche.

- Sustainable finance market size: $35.3 trillion in 2024.

- Focus on specific high-growth segments.

- Potential to increase market share in niche areas.

- Commercial banking remains a core business.

Lloyds' Question Marks are high-growth areas like digital finance, AI, and sustainable finance, where the bank holds low market share. These initiatives demand substantial investment, with £2.5 billion allocated to digital and technology in 2024. Success is uncertain, but these areas offer significant future potential, such as the $35.3 trillion sustainable finance market in 2024.

| Area | 2024 Investment | Market Size |

|---|---|---|

| Digital/Tech | £2.5 Billion | Growing |

| Sustainable Finance | Variable | $35.3 Trillion |

| AI/Data | Included in Tech | Expanding |

BCG Matrix Data Sources

This BCG Matrix employs financial statements, market analysis, and expert reports to ensure dependable strategic insights.