Lloyds Banking Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lloyds Banking Group Bundle

Curious about how Lloyds Banking Group navigates the complex financial services landscape? This Business Model Canvas offers a clear, strategic overview of their operations, from understanding diverse customer segments to forging vital partnerships.

Discover the unique value propositions Lloyds Banking Group offers, including their commitment to customer service and digital innovation. This canvas breaks down how they build and maintain strong customer relationships.

Explore the key activities that drive Lloyds Banking Group's success, from core banking operations to strategic investments. Understand the internal engine powering their market position.

Uncover the revenue streams that sustain Lloyds Banking Group, analyzing their diverse income sources and financial strategies. See how they translate services into profitability.

Want to replicate or adapt this success? Unlock the full strategic blueprint behind Lloyds Banking Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Collaborations with fintech and technology providers are vital for Lloyds Banking Group, driving digital innovation and operational efficiency. These partnerships integrate advanced solutions, like Open Banking APIs, which saw over 7.5 million active users in the UK by early 2024, enhancing customer experience. The Group also leverages AI-driven analytics and robust cybersecurity measures through these alliances. Major providers such as Microsoft supply essential cloud computing services, foundational for Lloyds' digital transformation, enabling the processing of billions of transactions annually.

Partnerships with global payment networks like Visa and Mastercard are fundamental to Lloyds Banking Group's operations. These collaborations enable the issuance and processing of millions of debit, credit, and commercial cards across brands such as Lloyds Bank and Halifax. This core utility facilitates daily transactions for its vast customer base, with UK card spending reaching approximately £77 billion in March 2024. Such alliances ensure seamless financial flows and broad acceptance for customers nationwide.

As a systemically important UK financial institution, Lloyds Banking Group maintains an essential relationship with government bodies and regulators like the Bank of England, Financial Conduct Authority (FCA), and Prudential Regulation Authority (PRA). This partnership is crucial for ensuring compliance with stringent capital adequacy requirements, such as the 2024 Pillar 2A capital requirement, and robust consumer protection standards. It also facilitates adherence to financial stability regulations, including participation in the Bank of England's stress tests. Furthermore, Lloyds actively engages in government-backed financial schemes, like those supporting small and medium-sized enterprises (SMEs), contributing to broader economic resilience.

Insurance & Reinsurance Partners

While Lloyds Banking Group owns Scottish Widows, a key part of its insurance operations involves strategic partnerships with a network of reinsurers. These collaborations are crucial for managing and diversifying the significant financial risk inherent in its extensive insurance and pensions portfolio. Reinsurance agreements protect the insurance division from large-scale claims, ensuring financial resilience and stability, especially given the current economic climate.

- Lloyds Banking Group’s insurance gross written premiums were £1.5 billion in Q1 2024.

- Reinsurance helps manage solvency capital requirements for the insurance business.

- Scottish Widows manages over £170 billion in assets, necessitating robust risk transfer.

- These partnerships mitigate exposure to unforeseen catastrophic events or market shocks.

Intermediary Distributors

Lloyds Banking Group extensively uses independent financial advisors and mortgage brokers, crucial for expanding its market reach. These intermediaries serve as a vital channel, distributing a significant portion of mortgage and insurance products to a broader customer base. This partnership model allows Lloyds to effectively reach customers who specifically seek independent financial advice. In 2024, a substantial percentage of new UK mortgage lending continued to originate through the intermediary channel, highlighting its importance.

- Lloyds leverages a vast network of over 10,000 independent financial advisors and mortgage brokers.

- These partnerships are critical for distributing mortgage and insurance products, particularly for new lending.

- The intermediary channel allows Lloyds to access customers preferring independent advice, especially for complex financial products.

- In 2024, the majority of new UK mortgage originations, often exceeding 80%, flowed through intermediaries, underscoring their strategic value.

Lloyds Banking Group leverages key partnerships with fintech providers for digital innovation, exemplified by over 7.5 million UK Open Banking users by early 2024. Collaborations with global payment networks like Visa facilitate vast card transactions, with UK card spending reaching £77 billion in March 2024. Essential relationships with regulators ensure adherence to 2024 capital requirements, and reinsurers manage risks for its £1.5 billion Q1 2024 gross written premiums. Additionally, over 10,000 independent financial advisors drive new mortgage originations, often exceeding 80% through this channel in 2024.

| Partnership Type | Key Contribution | 2024 Data Point |

|---|---|---|

| Fintech & Tech Providers | Digital Innovation & Efficiency | 7.5M+ UK Open Banking users (early 2024) |

| Global Payment Networks | Seamless Transaction Processing | £77B UK card spending (March 2024) |

| Regulators & Government | Compliance & Stability | 2024 Pillar 2A capital requirement |

| Reinsurers | Risk Management (Insurance) | £1.5B Q1 2024 Gross Written Premiums |

| Independent Advisors | Market Reach & Distribution | 80%+ new UK mortgages via intermediaries (2024) |

What is included in the product

Lloyds Banking Group's Business Model Canvas outlines its strategy for serving diverse customer segments through multiple channels with tailored financial products and services, focusing on strong customer relationships and digital innovation.

This canvas details key revenue streams from lending and fee-based services, supported by robust cost structures and strategic partnerships, all aimed at achieving sustainable growth and profitability.

The Lloyds Banking Group Business Model Canvas offers a clear, structured way to visualize complex banking operations, alleviating the pain of fragmented strategic planning.

It provides a one-page snapshot of key activities, customer segments, and value propositions, streamlining the understanding of their multifaceted business.

Activities

Retail and Commercial Banking forms the core of Lloyds Banking Group's activities, providing essential financial services to millions. This encompasses offering current accounts, savings, mortgages, personal loans, and credit cards to individuals and businesses across brands like Lloyds Bank, Halifax, and Bank of Scotland.

In Q1 2024, the Group's net loans and advances to customers stood at £445.6 billion, demonstrating the significant scale of its lending operations. This segment involves managing a massive volume of daily transactions, rigorous credit assessments, and extensive customer service operations. Lloyds serves over 26 million customers, underpinning its central role in the UK financial landscape.

Through its Scottish Widows brand, a core activity for Lloyds Banking Group involves the comprehensive underwriting and management of life insurance, protection, and pension products. This crucial function encompasses detailed actuarial analysis, robust risk assessment, and the strategic investment management of substantial pension funds. Furthermore, efficient claims processing ensures customer satisfaction and operational effectiveness. This diversified segment generated significant revenue for the group, with Scottish Widows contributing a strong financial performance in 2024, underpinning a vital long-term income stream.

Lloyds Banking Group actively provides comprehensive investment management, financial planning, and private banking services, catering specifically to its affluent and high-net-worth clientele. This core activity emphasizes cultivating enduring client relationships and delivering bespoke financial advice, focused on helping individuals expand and safeguard their assets. For instance, Lloyds' wealth management division reported strong performance in early 2024, contributing significantly to the Group's overall income. This represents a strategically high-margin business line, crucial for the Group's diversified revenue streams and continued profitability.

Risk Management & Regulatory Compliance

A critical, non-discretionary activity for Lloyds Banking Group is the continuous management of credit, market, and operational risk across the entire Group. This encompasses sophisticated stress testing, fraud prevention, and ensuring adherence to a complex web of financial regulations. This activity is fundamental to maintaining the bank's license to operate and its financial stability, especially with evolving regulatory landscapes. For 2024, maintaining strong capital buffers remains key.

- Lloyds reported a Common Equity Tier 1 (CET1) ratio of 13.9% as of Q1 2024, demonstrating robust capital resilience.

- The Group's risk management framework addresses potential impacts from economic volatility and geopolitical shifts.

- Significant investment continues in financial crime prevention and cyber security measures.

- Adherence to UK and international banking standards, including Basel III, is continuously monitored.

Digital Transformation & IT Development

Lloyds Banking Group is heavily invested in its digital transformation, continuously enhancing mobile banking apps and online portals. This crucial activity involves substantial investment in technology infrastructure, data analytics, and robust cybersecurity measures. The goal is to significantly improve customer experience, boost operational efficiency, and maintain a competitive edge against both established banks and emerging neo-bank challengers. For instance, Lloyds aims to have over 20 million digitally active customers by 2024, emphasizing their commitment to digital adoption.

- Lloyds' digital transformation focuses on enhancing mobile and online banking platforms.

- Significant investment is directed towards IT infrastructure, data analytics, and cybersecurity.

- The objective is to elevate customer experience and drive operational efficiencies.

- By 2024, Lloyds targets over 20 million digitally active customers, showcasing strong digital engagement.

Lloyds Banking Group's core activities encompass extensive retail and commercial banking, with Q1 2024 net loans at £445.6 billion, serving over 26 million customers. They also provide comprehensive insurance and pension services via Scottish Widows, alongside wealth management for affluent clients. Critical functions involve robust risk management, evidenced by a Q1 2024 CET1 ratio of 13.9%, and significant digital transformation, targeting over 20 million digitally active customers by 2024.

| Key Activity | 2024 Metric | Value |

|---|---|---|

| Net Loans & Advances | Q1 2024 | £445.6 billion |

| CET1 Ratio | Q1 2024 | 13.9% |

| Digital Customers Target | By 2024 | 20+ million |

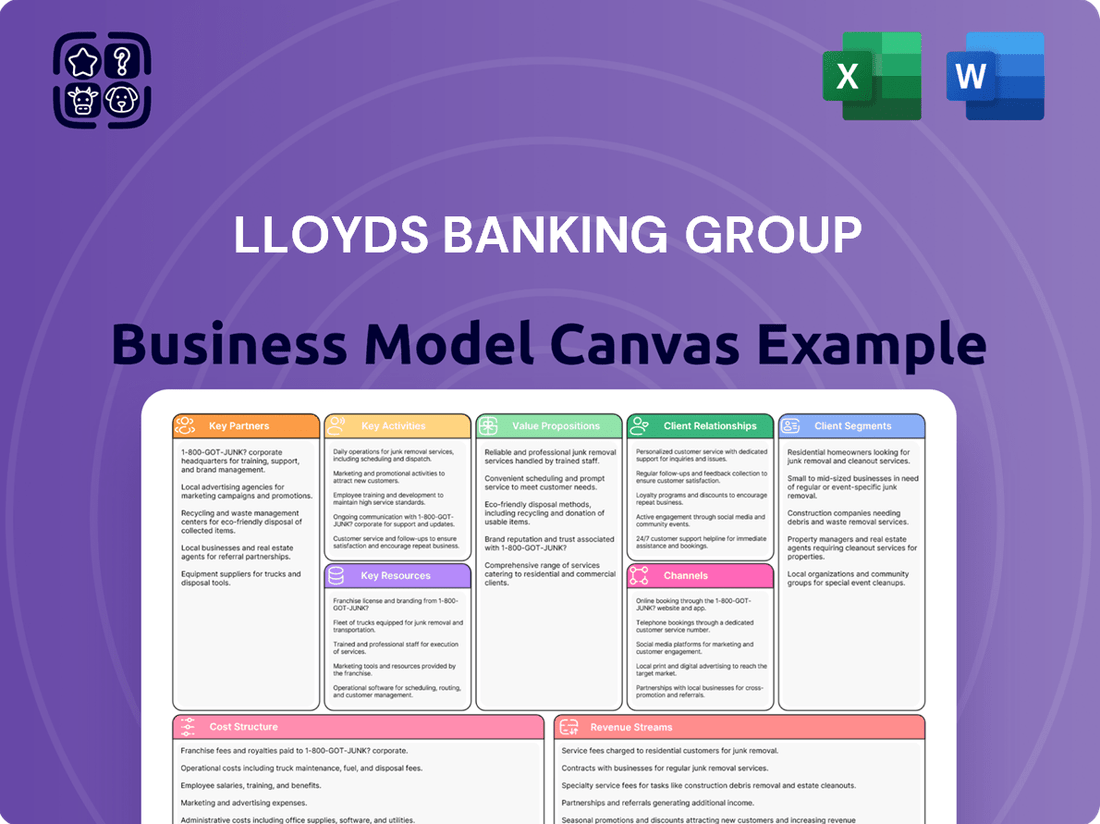

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Lloyds Banking Group you are previewing is the actual document you will receive upon purchase. This comprehensive breakdown details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are seeing a direct snapshot of the final, ready-to-use deliverable, ensuring no surprises and full access to all content and pages immediately after your order is complete.

Resources

The Group's robust portfolio of trusted brands, including Lloyds Bank, Halifax, Bank of Scotland, and Scottish Widows, forms a primary asset. This deep brand equity, cultivated over centuries, instills significant confidence and loyalty among customers. It serves as a powerful tool for customer acquisition, with Lloyds Banking Group maintaining a leading share in UK personal current accounts in 2024. This enduring reputation also supports customer retention in a highly competitive market.

A robust balance sheet and substantial capital reserves are pivotal for Lloyds Banking Group. This financial strength, underscored by a Common Equity Tier 1 (CET1) ratio of 14.7% as of Q1 2024, enables the Group to lend on a massive scale. It allows Lloyds to absorb potential losses and meet stringent regulatory capital adequacy requirements. This significant financial foundation supports its extensive lending and investment activities across the UK.

Lloyds Banking Group boasts an extensive customer base, serving over 26 million retail and commercial clients across the UK as of 2024.

This vast network provides a stable and low-cost deposit base, crucial for funding operations.

The extensive customer relationships also enable significant cross-selling opportunities for diverse financial products.

Moreover, the rich data generated from this base is invaluable for developing new offerings and refining risk assessments.

Multi-Channel Infrastructure

Lloyds Banking Group leverages a robust multi-channel infrastructure, combining a large physical network with advanced digital platforms. This dual presence, including approximately 1,000 branches and over 17 million active digital users as of 2024, is crucial. It enables the Group to cater to diverse customer preferences, from those seeking in-person advice to those preferring convenient online transactions.

- Physical network: Approximately 1,000 branches and extensive ATM access.

- Digital reach: Over 17 million active digital users in 2024.

- Customer choice: Supports varied interaction methods, enhancing accessibility.

- Strategic advantage: Ensures broad market penetration and service delivery.

Human Capital & Expertise

The Group's human capital, comprising over 60,000 colleagues as of early 2024, is foundational. This workforce includes skilled bankers, relationship managers, data scientists, risk analysts, and technology professionals. Their collective expertise in financial services, risk management, and digital innovation is essential for operating a complex financial institution. This human capital drives strategy, innovation, and crucial customer relationships, underpinning the Group's operational effectiveness.

- Workforce strength: Over 60,000 colleagues as of early 2024.

- Key roles: Bankers, data scientists, risk analysts, technology experts.

- Core expertise: Financial services, risk management, digital innovation.

- Strategic impact: Drives strategy, innovation, and customer engagement.

Lloyds Banking Group's key resources include its powerful brand portfolio, exemplified by Lloyds Bank, and significant financial strength, with a 14.7% CET1 ratio as of Q1 2024. An extensive customer base of over 26 million clients and a robust multi-channel infrastructure, including approximately 1,000 branches and 17 million digital users in 2024, are also pivotal. These are complemented by over 60,000 skilled colleagues as of early 2024, driving strategic operations.

| Resource Category | Key Asset | 2024 Data |

|---|---|---|

| Brand Equity | Leading UK Brands | Leading share in UK personal current accounts |

| Financial Capital | Balance Sheet Strength | CET1 Ratio: 14.7% (Q1 2024) |

| Customer Base | Client Network | Over 26 million retail & commercial clients |

| Infrastructure | Physical & Digital Reach | ~1,000 branches; 17M+ active digital users |

| Human Capital | Skilled Workforce | Over 60,000 colleagues (early 2024) |

Value Propositions

Lloyds Banking Group offers a truly comprehensive suite of financial services, acting as a one-stop-shop for customers' diverse needs. This includes everything from everyday banking to mortgages, loans, investments, insurance, and pensions, simplifying complex financial management for over 26 million UK customers in 2024. This integrated approach provides immense convenience, allowing individuals and businesses to manage their entire financial life seamlessly within a single, trusted ecosystem. By offering such a wide array of products, Lloyds enables efficient financial planning and decision-making for its extensive client base.

As one of the UK's largest and oldest financial institutions, Lloyds Banking Group offers a fundamental value proposition of trust and stability. Customers rely on the Group to securely manage their deposits and long-term financial assets, including pensions. This deep-seated confidence is critical, especially given the Group's significant market presence with over 26 million customers as of early 2024. Their robust balance sheet further reinforces this security, underpinning their reputation as a reliable financial custodian.

Lloyds Banking Group ensures unparalleled accessibility through a robust multi-channel approach, allowing customers to engage via physical branches, mobile apps, online banking, or telephone service centers. This comprehensive strategy caters to diverse preferences, offering 24/7 digital availability while maintaining a vital human connection through its extensive branch network. As of 2024, Lloyds continues to optimize its digital platforms, with millions of customers actively using its mobile banking app for daily transactions, complementing its significant branch presence.

Tailored Solutions for Diverse Segments

Lloyds Banking Group offers tailored solutions, ensuring products and service levels meet the unique needs of diverse customer segments. This targeted approach serves over 26 million customers, from students to high-net-worth individuals and from small businesses to large corporations. For instance, wealth management provides personalized advice for affluent clients, while SME banking delivers specialized support to UK businesses. This commitment ensures relevance and value across its comprehensive portfolio.

- Personalized wealth management services cater to high-net-worth individuals.

- Specialized banking solutions are provided for small and medium-sized enterprises.

- Dedicated financial products are designed for students and retail customers.

- Corporate banking divisions address the complex needs of large corporations.

Supporting UK Households & Businesses

Lloyds Banking Group positions itself as a crucial pillar of the UK economy, providing essential financing for both households and businesses. This commitment reinforces its image as a responsible corporate citizen, appealing to a strong sense of national interest and community. By facilitating homeownership and enterprise, the Group demonstrates a tangible contribution to the prosperity of its customers and the wider country.

- In 2024, Lloyds Bank continues to be the UK's largest mortgage lender, supporting homeownership.

- The Group is a leading provider of financing to UK businesses, including small and medium-sized enterprises (SMEs).

- Their lending activities directly contribute to economic growth and job creation across the UK.

- This core focus underpins their role as a significant financial partner for millions of Britons.

Lloyds Banking Group delivers comprehensive financial solutions, simplifying banking for over 26 million UK customers in 2024. Their value hinges on trust and stability, supported by a robust balance sheet and extensive multi-channel accessibility. Tailored offerings meet diverse segment needs, from mortgages to SME financing, underscoring their role as a key pillar of the UK economy.

| Value Proposition | Key Metric (2024) | Impact | ||

|---|---|---|---|---|

| Comprehensive Solutions | Over 26 million UK customers | Streamlined financial management | ||

| Trust & Stability | UK's largest retail bank | Secure asset management | ||

| Economic Contribution | Largest UK mortgage lender | Supports homeownership & enterprise |

Customer Relationships

Digital self-service stands as the primary relationship model for Lloyds Banking Group's mass-market retail segment, leveraging highly-rated mobile apps and online banking portals. This approach empowers customers with 24/7 control over their finances, offering significant convenience and efficiency. For instance, Lloyds Bank's mobile app consistently holds high ratings, reflecting strong user satisfaction. This model is highly cost-effective for the bank, aligning with modern consumer expectations for seamless digital interactions.

Lloyds Banking Group cultivates strong relationships with commercial, corporate, and high-net-worth clients through dedicated relationship managers and private bankers. This approach delivers a highly personalized, high-touch service, offering tailored advice and bespoke financial solutions. This model is critical for driving client retention and fostering growth within these high-value segments, contributing significantly to the Group’s overall profitability. In 2024, Lloyds continues to prioritize these relationships, recognizing their importance for sustained business success and client loyalty.

Despite the significant shift towards digital banking, Lloyds Banking Group's in-person branch network remains a crucial element of its customer relationship strategy. These branches provide essential face-to-face assistance for complex financial transactions and offer personalized advice, catering to customers who prefer or require direct interaction. This approach helps build trust and maintains strong relationships within local communities. As of 2024, Lloyds Banking Group continues to rationalize its network, with planned closures, yet physical presence remains vital for key customer segments and complex service delivery.

Automated & Assisted Support

Lloyds Banking Group leverages a robust blend of automated and assisted support channels to manage customer relationships efficiently. This includes AI-powered chatbots for instantaneous responses to common inquiries and extensive telephone banking centers for complex issues, ensuring comprehensive coverage. This strategic approach balances the need for rapid digital self-service with the critical availability of human interaction for intricate financial matters. For example, Lloyds continues its significant investment in digital transformation, with digital interactions growing and customer service centers managing millions of calls annually.

- Lloyds’ digital channels handle a substantial portion of customer interactions, with their app users exceeding 20 million as of early 2024.

- Their customer contact centers remain vital, processing millions of calls yearly for more complex banking needs.

- The group actively invests in AI and machine learning to enhance automated query resolution, aiming for faster, more personalized service by 2025.

- This dual strategy optimizes operational efficiency while maintaining high customer satisfaction across diverse service requirements.

Community Engagement

Lloyds Banking Group strengthens customer relationships and brand loyalty through extensive community engagement and sponsorships. By visibly supporting local communities and national causes, the Group cultivates a positive brand image, fostering shared values beyond simple transactions. For instance, in 2023, Lloyds helped 1.4 million people improve their financial health and supported 58,000 small businesses to start up or grow, demonstrating tangible community impact.

- Lloyds aims to support 2.5 million people with financial health by 2025.

- The Group committed to £100 million in social impact investment by 2025.

- Over 1.4 million people were supported in improving financial health in 2023.

- 58,000 small businesses received support for growth or startup in 2023.

Lloyds Banking Group maintains diverse customer relationships through robust digital self-service, serving over 20 million app users in early 2024, alongside dedicated relationship managers for high-value clients. A vital branch network and hybrid support channels ensure comprehensive assistance. Community engagement further strengthens loyalty, as seen by supporting 1.4 million people in 2023.

| Relationship Channel | Key Metric (2024) | Impact |

|---|---|---|

| Digital Self-Service | 20M+ app users (early 2024) | High convenience & cost-efficiency |

| Customer Contact Centers | Millions of calls annually | Complex issue resolution |

| Community Engagement | 1.4M people supported (2023) | Enhanced brand loyalty & trust |

Channels

The digital banking platforms, encompassing the mobile apps and online banking websites for Lloyds, Halifax, and Bank of Scotland, are pivotal channels for the Group. These platforms offer a comprehensive suite of services, from daily banking and secure payments to applying for new products, serving millions of customers. As of early 2024, Lloyds Banking Group reported approximately 20.3 million active digital users, highlighting the centrality of this channel. It is fundamental to the Group's strategy for enhancing customer engagement and driving operational efficiencies across its brands, reducing reliance on physical branches.

The national branch network remains a vital channel for Lloyds Banking Group, facilitating customer acquisition and addressing complex service needs across the UK. It ensures a strong brand presence, serving individuals who prefer face-to-face interactions and acting as a community banking hub. This physical presence, despite ongoing network optimization, with Lloyds Bank operating hundreds of branches into 2024, is crucial for building trust and serving diverse demographics, including those less digitally inclined.

Telephone Banking Centers serve as a vital channel for Lloyds Banking Group, offering direct human support for customers seeking assistance, resolving issues, or conducting transactions over the phone. These dedicated call centers provide an essential alternative for individuals unable or unwilling to use digital channels or visit a physical branch. In 2024, Lloyds continues to emphasize comprehensive customer service across all touchpoints, with telephone banking playing a crucial role in maintaining accessibility and personal interaction. This ensures a broad reach for their services, complementing their digital and branch networks.

ATM Network

The widespread ATM network provides Lloyds Banking Group customers with crucial access to basic services like cash withdrawals and balance inquiries. This channel ensures 24/7 convenience and accessibility for essential banking needs across the UK. As of early 2024, the network remains a fundamental part of the nation's financial infrastructure, supporting daily transactions for millions.

- Lloyds Banking Group operates one of the largest ATM networks in the UK, enhancing customer reach.

- These ATMs facilitate over 160 million cash withdrawals annually across the UK.

- The network remains vital for cash access, particularly for vulnerable groups and in areas with limited branch presence.

- Ongoing investment ensures reliability and security for millions of daily transactions.

Third-Party Intermediaries

Lloyds Banking Group utilizes a robust network of independent mortgage brokers and financial advisors, serving as a vital third-party channel. These intermediaries actively market and distribute Lloyds' diverse range of mortgage and insurance offerings directly to their established client bases. This approach significantly extends the Group's market reach, contributing to its leading position in the UK mortgage market in 2024, without incurring the direct costs associated with employing a large sales force.

- Intermediaries provide access to a broader client base.

- This channel reduces direct sales and marketing overheads.

- It enhances Lloyds' mortgage and insurance product distribution.

- The Group remains a top UK mortgage lender in 2024, partly via this channel.

Lloyds Banking Group employs a diverse channel strategy, balancing extensive digital platforms, serving 20.3 million active users in early 2024, with its crucial physical branch network. Telephone banking and a vast ATM network, handling over 160 million annual cash withdrawals, ensure broad accessibility across the UK. Third-party intermediaries, particularly for mortgages, significantly extend the Group's market reach, underpinning its leading position in the UK mortgage market in 2024.

| Channel | 2024 Metric | Data Point |

|---|---|---|

| Digital | Active Users | 20.3 Million |

| ATM Network | Annual Withdrawals | >160 Million |

| Mortgage Market | UK Position | Leading Lender |

Customer Segments

Retail Banking Customers represent Lloyds Banking Group's most expansive segment, serving over 26 million individuals and families throughout the UK. Their diverse financial needs span essential current and savings accounts, alongside more complex products such as mortgages, personal loans, and credit cards. These customers are primarily reached through the Group's prominent mass-market brands, including Lloyds Bank and Halifax. As of 2024, this segment remains central to the Group's operations, reflecting its strong market share in UK retail banking.

Small and Medium-Sized Enterprises (SMEs) represent a crucial customer segment for Lloyds Banking Group, encompassing UK-based businesses seeking a comprehensive suite of financial products. These include essential business bank accounts, commercial lending solutions, efficient payment processing, and vital asset finance. Lloyds is a leading provider of finance to this segment, with its net lending to SMEs in 2024 supporting over 90% of UK businesses. This segment is widely recognized as the backbone of the UK economy, contributing significantly to employment and GDP.

This segment for Lloyds Banking Group encompasses major UK and multinational corporations, alongside financial institutions and government bodies. These clients require sophisticated financial solutions, including bespoke corporate financing and robust risk management frameworks. They also utilize advanced treasury and trade services, plus direct access to capital markets for funding and investment. This is a high-value, relationship-driven segment, contributing significantly to the Group's wholesale banking revenue, which saw strong performance in 2024.

Wealth & High-Net-Worth Individuals (HNWI)

This affluent customer segment, comprising Wealth & High-Net-Worth Individuals, actively seeks specialized services beyond standard retail banking offerings. Lloyds Banking Group targets them with dedicated private banking, bespoke investment management, and complex financial and estate planning solutions tailored to their sophisticated needs. This strategic focus ensures a significant contribution of high-margin fee income to the group's overall revenue.

- Lloyds Banking Group's Wealth division reported assets under administration (AUA) of £204.6 billion at the end of Q1 2024.

- The group aims to grow its wealth management business, which serves these clients, by expanding its propositions.

- HNWI clients contribute significantly to fee-based revenue streams, enhancing profitability.

- Private banking services for this segment often command higher fees due to personalized advice and complex product offerings.

Insurance & Protection Customers

Insurance & Protection Customers encompass individuals and corporate clients mitigating financial risk through a range of products. This segment is primarily served by Scottish Widows, offering essential solutions like life insurance, critical illness cover, and income protection. Corporate pension schemes also form a significant part of their offerings, addressing long-term financial security needs. This customer base represents a stable and enduring revenue stream for the group. As of the end of 2023, Scottish Widows managed over £170 billion in assets, illustrating its significant market presence.

- Individuals and corporate clients seeking financial risk mitigation.

- Products include life insurance, critical illness, and income protection.

- Corporate pension schemes are a key offering.

- Scottish Widows manages over £170 billion in assets as of late 2023.

Lloyds Banking Group serves a broad customer base, including over 26 million UK retail customers and Small and Medium-Sized Enterprises, supporting over 90% of UK businesses in 2024. Corporate and institutional clients utilize bespoke financial solutions, while Wealth & High-Net-Worth Individuals benefit from specialized services, with AUA reaching £204.6 billion in Q1 2024. Insurance and protection needs are met by Scottish Widows, managing over £170 billion in assets.

| Segment | Key Offering | 2024 Data | ||

|---|---|---|---|---|

| Retail Banking | Accounts, Mortgages | 26M+ Customers | ||

| SMEs | Business Lending | 90%+ UK Businesses | ||

| Wealth & HNWI | Private Banking | £204.6B AUA (Q1) |

Cost Structure

Staff costs represent Lloyds Banking Group's most significant expense, covering salaries, bonuses, pensions, and other benefits for its extensive workforce. These expenditures span all operations, from customer-facing branch roles to senior executives and specialized IT and risk professionals. In 2023, the Group reported administrative expenses, which include staff costs, totaling approximately £10.1 billion. This substantial investment is critical for retaining talent and supporting the Group's 60,000+ employees across its diverse business segments, ensuring operational continuity and strategic execution.

A significant and expanding cost for Lloyds Banking Group is investment in its technology and infrastructure. This includes substantial expenditure on maintaining and upgrading core banking systems and developing digital platforms to enhance customer experience. Data center operations also contribute to these costs, ensuring robust system availability. A crucial and growing area is cybersecurity, with Lloyds investing heavily to protect customer data and critical systems, reflecting the increasing digital threat landscape in 2024.

Lloyds Banking Group incurs substantial costs related to regulatory compliance, a significant part of its cost structure. This includes the Bank Levy, which for UK banks like Lloyds remains a key expense, alongside contributions to the Financial Services Compensation Scheme. For the first quarter of 2024, Lloyds reported a statutory profit after tax of £1.2 billion, reflecting ongoing operational costs tied to extensive risk management frameworks and reporting systems mandated by regulators. These levies and compliance efforts are critical for maintaining operational integrity and market trust.

Property & Premises

The Property & Premises cost category covers all expenses related to Lloyds Banking Group's extensive physical footprint across the UK. This includes rent, business rates, utilities, and maintenance for its network of branches and corporate offices. Despite ongoing optimization, such as reducing its branch count to around 1,100 by early 2024, these remain significant structural costs. For instance, Lloyds reported property-related expenses as part of its administrative costs, which stood at £8.7 billion for the full year 2023, reflecting the scale of its operations.

- Rent, business rates, utilities, and maintenance are key components.

- Covers an extensive network of UK branches and corporate offices.

- Remains a significant structural cost despite optimization efforts.

- Reflected within administrative expenses, which were £8.7 billion in 2023.

Marketing & Advertising

Lloyds Banking Group incurs significant costs for marketing and advertising to promote its diverse brands and products, attracting and retaining customers across the UK. This expenditure covers extensive advertising campaigns across various channels, including television, digital platforms, and print media. Investments also extend to strategic sponsorships and other promotional activities, all designed to strengthen brand equity and market presence. For the first quarter of 2024, Lloyds reported total operating expenses, which include marketing, indicating continued investment in customer acquisition and brand visibility.

- Marketing spend is crucial for customer acquisition and retention.

- Advertising campaigns span TV, digital, and print.

- Sponsorships and promotions bolster brand equity.

- These costs are a key component of operating expenses.

Lloyds Banking Group's cost structure is dominated by staff expenses, alongside significant investments in technology and infrastructure to support digital transformation. Regulatory compliance, including the Bank Levy, imposes substantial fixed costs, critical for operational integrity. Property and premises, despite branch optimization, remain considerable outlays, complemented by ongoing marketing efforts for brand visibility. These core expenditures collectively shape the Group's financial performance.

| Cost Category | 2023 Expense (£bn) | 2024 Trend |

|---|---|---|

| Staff & Admin | 10.1 | Stable/Rising |

| Property | 8.7 | Optimizing |

| Tech & Cyber | Significant | Increasing |

Revenue Streams

Net Interest Income (NII) is the primary revenue source for Lloyds Banking Group, reflecting the core of its lending operations. This income is the crucial difference between interest earned on assets like mortgages, customer loans, and investments, and the interest paid out on customer deposits and other liabilities. For the first quarter of 2024, Lloyds reported a NII of £3.26 billion, demonstrating its significant contribution to the Group's financial performance. The Group's profitability is highly sensitive to shifts in interest rates, which directly influence its Net Interest Margin, a key indicator of its lending efficiency.

Fees and commissions are a significant and diverse revenue stream for Lloyds Banking Group, generated by charging for specific services. This includes income from monthly account fees, overdraft fees, and credit card fees, alongside payment transaction fees. Fees from corporate finance advisory services also contribute substantially to this category. In 2023, Lloyds reported other income, largely comprising fees and commissions, of £4.6 billion. This income stream is notably less sensitive to interest rate fluctuations compared to Net Interest Income, offering a stable revenue base.

This revenue stream, primarily driven by the Scottish Widows brand, collects premiums from customers for life insurance, pensions, and various protection policies. It also includes fees earned from managing substantial pension and investment funds, contributing significantly to non-interest income. For example, in 2024, the Group continued to see stable contributions from these long-term contracts. This provides a robust, diversified, and predictable income source, balancing the Group’s broader financial services portfolio.

Wealth Management Fees

Wealth Management Fees represent a key revenue stream for Lloyds Banking Group, generated from services provided to high-net-worth clients. These fees stem from private banking, investment management, and comprehensive financial planning. Typically, this revenue is charged as a percentage of assets under management (AUM), making it a high-margin stream closely tied to financial market performance.

- Lloyds' Wealth division reported £206 billion in Assets Under Management (AUM) as of December 2023.

- This segment's underlying profit reached £215 million in 2023, showcasing its profitability.

- Fee income is directly impacted by market gains, enhancing revenue during bull markets.

- Services include bespoke financial advice and portfolio management for affluent customers.

Other Operating Income

Other Operating Income represents diverse revenue streams for Lloyds Banking Group, beyond core banking activities. This includes gains from the sale of assets, income from trading activities in financial markets, and earnings from equity stakes in other businesses. While these sources can be more volatile and typically smaller than net interest income or fees, they are crucial for overall profitability. For instance, in Q1 2024, Lloyds Banking Group reported significant other income contributions.

- Lloyds Banking Group’s Q1 2024 results indicated Other income was £1,048 million.

- This category includes gains from financial instrument movements and asset disposals.

- Such income supplements core lending and fee-based revenues.

- It reflects strategic financial market engagement and portfolio management.

Lloyds Banking Group generates revenue primarily from Net Interest Income, which was £3.26 billion in Q1 2024, reflecting its core lending operations. Significant contributions also come from fees and commissions, alongside stable insurance premiums and fund management fees. Wealth Management fees, tied to £206 billion in AUM as of December 2023, and Other Operating Income, at £1,048 million in Q1 2024, further diversify the Group’s income streams.

| Revenue Stream | Q1 2024 (GBP) | FY 2023 (GBP) |

|---|---|---|

| Net Interest Income (NII) | £3.26 billion | £13.7 billion |

| Other Income (Fees & Commissions, Other Operating) | £1.05 billion | £4.6 billion |

| Wealth Management AUM (Dec 2023) | - | £206 billion |

Business Model Canvas Data Sources

The Lloyds Banking Group Business Model Canvas is constructed using a blend of internal financial data, extensive market research, and ongoing strategic analysis. These diverse sources ensure a comprehensive and accurate representation of the group's operations and market position.