Leslie's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Leslie's boasts strong brand recognition and a loyal customer base, key strengths in a competitive market. However, potential threats like increasing competition and changing consumer preferences warrant careful consideration.

Discover the complete picture behind Leslie's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Leslie's, Inc. stands as the undisputed leader in the U.S. pool and spa care market, holding the distinction of being the largest direct-to-consumer brand. This dominant position, cultivated since its founding in 1963, translates into exceptional brand recognition and deep consumer trust. Such a strong market presence is a formidable asset, fostering customer loyalty and driving repeat purchases, a key advantage in a competitive landscape.

Leslie's boasts a formidable omnichannel distribution network, a significant strength in its market. This includes a substantial presence of over 950 physical retail stores, complemented by a strong e-commerce platform and dedicated service centers.

This multi-channel strategy ensures Leslie's can cater to a wide customer base, encompassing both individual homeowners and commercial entities, offering unparalleled convenience and accessibility.

The seamless integration of these channels enhances customer engagement and expands the company's service reach, making it easier for customers to connect and purchase products.

For example, in the fiscal year ending September 2023, Leslie's reported that its e-commerce sales continued to grow, demonstrating the effectiveness of its online presence alongside its brick-and-mortar stores.

Leslie's boasts a broad spectrum of products, including chemicals, equipment, and replacement parts, alongside essential maintenance and repair services. This extensive catalog addresses virtually every pool and spa need, establishing Leslie's as a convenient, all-encompassing resource for its clientele.

This strategy of offering a complete suite of solutions significantly boosts customer loyalty and spending over time, as customers can fulfill all their pool care requirements through a single provider. For instance, Leslie's reported a 7.4% increase in same-store sales for the first quarter of fiscal year 2024, indicating strong customer engagement with its diverse offerings.

Focus on Customer Centricity and Expertise

Leslie's commitment to a customer-centric model is a significant strength, built on the foundation of its knowledgeable associates who are experts in pool and spa care. These certified technicians provide personalized advice, empowering consumers with the information they need to maintain their pools effectively. This expertise fosters strong customer loyalty, setting Leslie's apart from competitors who may not offer the same level of specialized support.

The company actively enhances this customer focus through initiatives like the revamped Pool Perks Rewards Program. This program, which saw a notable increase in member engagement and redemption rates in late 2023 and early 2024, aims to deepen customer relationships by offering personalized experiences and value. By prioritizing expert guidance and rewarding loyalty, Leslie's cultivates a dedicated customer base.

Key aspects of this strength include:

- Expert Staff: Associates are trained pool and spa care experts and certified technicians.

- Personalized Service: Focus on individual customer needs and solutions.

- Customer Empowerment: Providing knowledge and guidance for effective pool maintenance.

- Loyalty Programs: Initiatives like the Pool Perks Rewards Program enhance customer retention and experience.

Strategic Transformation Initiatives

Leslie's has initiated a significant strategic transformation, driven by a new CEO appointed in September 2024, to enhance customer centricity, convenience, and asset utilization.

These initiatives, including inventory optimization and the expansion of local fulfillment centers (LFCs), are designed to foster sustainable profitable growth and bolster financial performance. For instance, the company has been actively working to improve its LFC network, aiming for greater efficiency in delivery and customer service by 2025.

Key strategic moves include a revamped loyalty program, intended to increase customer retention and spending, alongside efforts to boost marketing efficiency, potentially leading to a more favorable return on marketing investment.

The company anticipates these strategic adjustments will translate into improved financial metrics, with specific targets for revenue growth and operational cost reduction by the end of fiscal year 2025.

Leslie's market leadership and extensive brand recognition are significant strengths, built over decades of operation. This allows them to command customer loyalty and establish a strong competitive advantage. Their position as the largest direct-to-consumer pool and spa brand in the U.S. provides a powerful platform for growth and customer engagement.

What is included in the product

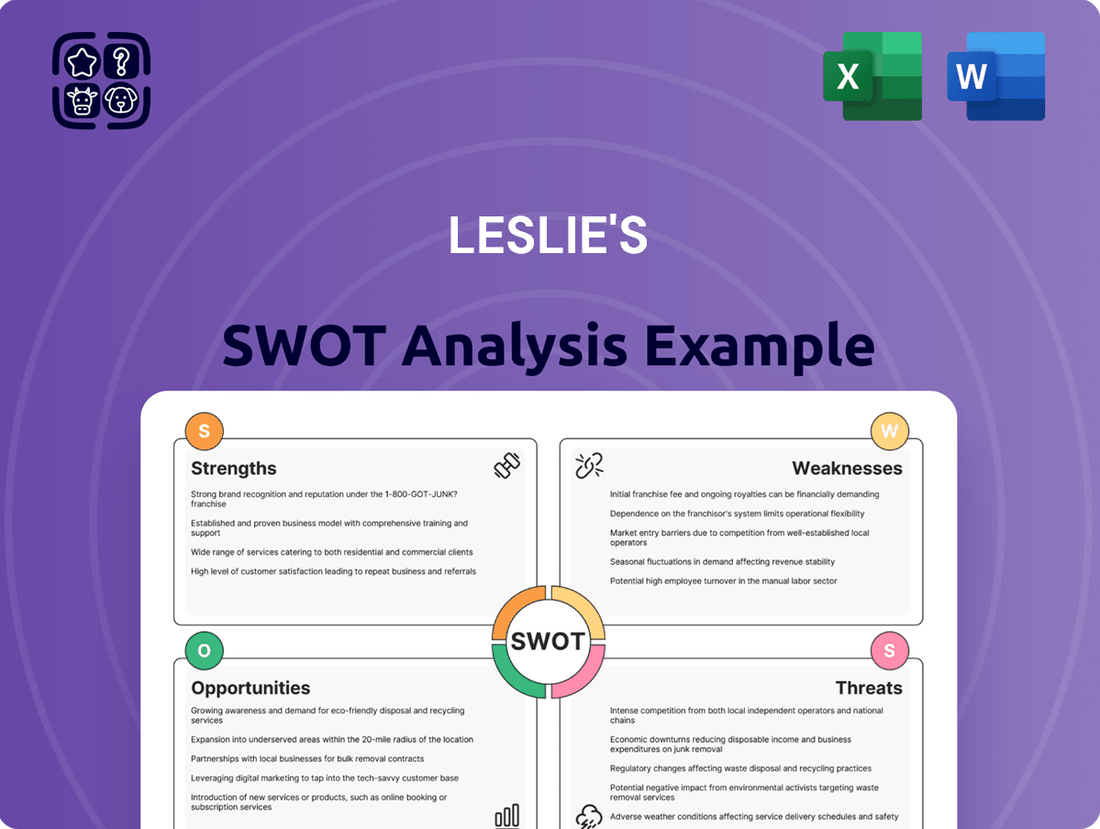

Analyzes Leslie's’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis into an easily digestible format for rapid understanding.

Weaknesses

Leslie's business model is heavily influenced by seasonality, with the first two fiscal quarters, generally corresponding to fall and winter, consistently showing net losses. This is driven by significantly lower sales volumes during these off-peak periods.

This seasonal downturn creates operational deleverage, meaning fixed costs represent a larger portion of expenses relative to revenue, necessitating meticulous cash flow management and strategic inventory planning to ensure readiness for the busier spring and summer pool season.

For instance, in fiscal year 2023, Leslie reported a net loss of $69.3 million in the first quarter and $38.3 million in the second quarter, highlighting the substantial financial impact of its off-season periods.

These quarterly earnings fluctuations, directly tied to the seasonal demand for pool supplies, can present challenges for investors and internal financial forecasting, requiring a long-term perspective beyond individual quarter performance.

Leslie's has faced significant headwinds recently, with fiscal 2024 seeing a notable 8.3% drop in total sales and an 8.8% decline in comparable sales. This downward trajectory persisted into the second quarter of fiscal 2025, where sales fell by 6.1% and comparable sales decreased by 6.7%.

Adding to these concerns, the company also experienced a contraction in its gross margin during Q2 fiscal 2025. These ongoing decreases in both top-line revenue and profitability highlight substantial challenges in meeting market demand and maintaining healthy margins.

Leslie's performance is highly susceptible to broader economic trends, especially shifts in consumer discretionary spending. This is particularly noticeable for higher-priced items and recreational goods, which consumers tend to cut back on when finances are tight. For instance, in Q1 2024, consumer confidence saw fluctuations, indicating potential headwinds for large purchases.

The current environment of elevated interest rates and general economic uncertainty poses a significant challenge. These factors can make consumers hesitant to commit to major purchases like new pool equipment or substantial spa upgrades. This reluctance directly impacts Leslie's revenue streams, especially from those more profitable, higher-margin products.

Operational Challenges and Cost Pressures

Leslie's has encountered significant operational hurdles, leading to a squeeze on its gross margins. This contraction stems from issues like deleverage on occupancy and distribution costs, alongside one-time contract-related charges. For instance, in fiscal year 2023, the company reported a gross profit margin of 41.8%, a decrease from 43.4% in fiscal year 2022, indicating this pressure.

Furthermore, escalating labor expenses and higher professional fees have directly impacted Leslie's selling, general, and administrative (SG&A) expenses. These rising costs add to the overall financial strain on the company's operations. In Q4 FY2023, SG&A expenses increased by 4.7% year-over-year, partly driven by these factors.

Adding to these operational difficulties, Leslie's has identified critical weaknesses within its internal control systems. These material weaknesses specifically affect its processes for managing vendor rebates and inventory, raising concerns about accuracy and efficiency.

- Gross Margin Contraction: Deleveraging on occupancy and distribution costs, plus one-time contract items, have impacted profitability.

- Increased Operating Expenses: Higher labor costs and professional fees have driven up SG&A expenses.

- Internal Control Weaknesses: Material weaknesses identified in vendor rebate and inventory processes.

Intense Competition

Leslie's operates in a highly competitive pool and spa care market. This includes specialized retailers, large general merchandise stores, and rapidly growing online-only platforms, all vying for customer attention and loyalty.

This intense rivalry places considerable pressure on Leslie's pricing strategies and its ability to maintain market share. To stay ahead, the company must consistently invest in enhancing customer experiences, developing unique product offerings, and optimizing its operational efficiency.

- Market Saturation: The pool and spa sector, while growing, has numerous established players.

- Price Sensitivity: Consumers often seek the best value, making price a significant competitive factor.

- E-commerce Threat: Online retailers can offer convenience and competitive pricing, challenging brick-and-mortar presence.

- Brand Loyalty Challenges: Building and sustaining brand loyalty requires ongoing innovation and superior service.

Leslie's faces significant margin pressure due to deleveraging occupancy and distribution costs, along with one-time contract charges. For instance, their gross profit margin fell to 41.8% in fiscal year 2023 from 43.4% in fiscal year 2022, indicating this trend. Additionally, rising labor expenses and professional fees have inflated SG&A costs, with Q4 FY2023 seeing a 4.7% year-over-year increase in these expenses. The company also struggles with internal control weaknesses, particularly in vendor rebate and inventory management processes, impacting operational accuracy.

Preview Before You Purchase

Leslie's SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase, offering complete transparency and professional quality. You are viewing a live preview of the actual SWOT analysis file, ensuring no surprises. The complete version of this detailed analysis becomes available immediately after checkout. This means you can be confident in the content and structure you see, as it directly represents the downloadable file.

Opportunities

The market for pools and spas is experiencing robust growth, with projections indicating a significant upward trajectory. This expansion is largely fueled by a heightened consumer emphasis on personal health, overall wellness, and the increasing popularity of at-home leisure pursuits.

Post-pandemic trends have notably amplified the demand for residential pools and spas. This shift presents a substantial opportunity for Leslie's to broaden its customer reach and diversify its product portfolio, tapping into a market that values home-based relaxation and recreation.

The pool and spa industry is rapidly evolving with technological advancements, particularly in smart and energy-efficient solutions. Internet of Things (IoT) and Artificial Intelligence (AI) are increasingly integrated for remote monitoring, automated maintenance, and optimized performance, creating significant opportunities for innovation and service expansion. For instance, the smart pool technology market was valued at approximately $1.2 billion in 2023 and is projected to grow substantially in the coming years, driven by consumer demand for convenience and efficiency.

Leslie's can leverage this trend by broadening its product portfolio to include these cutting-edge, eco-friendly systems and digital platforms. This strategic move would attract a growing segment of consumers who are both tech-savvy and prioritize environmental sustainability in their purchasing decisions, enhancing Leslie's market appeal and competitive edge.

Leslie's has been seeing encouraging movement in its Pro segment. The company reported a notable increase in pro partner contracts, signaling a stronger engagement with professional pool service providers. This is complemented by growth in professional pool sales, indicating increased demand from this key demographic.

A significant opportunity lies in broadening Leslie's service and repair capabilities. By enhancing these offerings and cultivating deeper connections with its commercial and professional clientele, the company can tap into a substantial growth area.

This strategic focus on the professional segment offers the potential for more consistent, recurring revenue streams. Unlike the inherent seasonality of retail pool supply sales, these service-based revenues can provide greater stability throughout the year.

Strategic Partnerships and Acquisitions

Leslie's has paused its merger and acquisition activities for now, but this opens doors for strategic partnerships. These collaborations can help Leslie's grow its presence in new areas, add different services to its offerings, or bring in advanced technologies. For example, teaming up with companies that offer home services or smart home technology could significantly expand Leslie's customer base and make its services even more appealing.

Future acquisitions, once resumed, could also be a key growth lever. These moves might allow Leslie's to quickly enter new markets or acquire specialized expertise. The company's strong financial position, evidenced by its consistent revenue streams, provides a solid foundation for such strategic investments when the time is right.

Consider these potential opportunities:

- Geographic Expansion: Partnering with regional service providers to enter underserved markets.

- Service Diversification: Collaborating with companies offering complementary services like lawn care or pest control.

- Technology Integration: Partnering with smart home technology firms to offer integrated pool management solutions.

- Future Acquisition Targets: Identifying smaller, innovative pool service or product companies for potential integration.

Enhancing Digital and Loyalty Programs

Leslie's is actively strengthening its digital presence and customer loyalty initiatives. The recent overhaul of the Pool Perks Rewards Program is a prime example of this commitment, aiming to foster deeper customer relationships. This focus on digital engagement is crucial in today's competitive retail landscape.

Further investments in enhancing personalization and expanding same-day delivery options are key opportunities. These efforts are designed to elevate the online customer experience, encouraging more frequent purchases and boosting overall customer lifetime value. For instance, in early 2024, Leslie's reported a significant increase in digital sales, demonstrating the impact of these strategic enhancements.

- Revamped Pool Perks Rewards Program: Designed to increase customer retention and spending frequency.

- Enhanced Personalization: Leveraging data to offer tailored product recommendations and promotions.

- Same-Day Delivery Expansion: Improving convenience and meeting customer demand for immediate fulfillment.

- Digital Sales Growth: Capitalizing on the shift towards online shopping for pool and spa supplies.

The growing demand for smart, energy-efficient pool technologies, valued at over $1.2 billion in 2023, presents a significant opportunity for Leslie's to integrate IoT and AI into its product offerings, attracting tech-savvy and eco-conscious consumers.

Leslie's can capitalize on the robust growth in its Pro segment by expanding service and repair capabilities, fostering deeper relationships with professional clients to generate more consistent, recurring revenue streams beyond seasonal retail sales.

The pause in M&A activities creates an opening for strategic partnerships, enabling Leslie's to enter new markets, expand service offerings through collaborations with home service or smart home tech companies, and enhance its customer reach.

Investing in digital initiatives, such as the revamped Pool Perks Rewards Program and expanded same-day delivery, aims to boost customer loyalty and lifetime value, building on the reported increase in digital sales seen in early 2024.

Threats

Economic downturns, characterized by recessions or persistent high inflation and interest rates, represent a significant threat to Leslie's. These conditions directly erode consumer discretionary income, a crucial driver for purchases of pool and spa products. For instance, during periods of economic contraction, consumers often defer or cancel non-essential purchases, impacting sales of higher-priced items like new pools and spas.

The consequence is a direct reduction in Leslie's sales volumes and profitability. During a recession, consumers may cut back not only on new installations but also on recurring expenses such as chemicals and maintenance services. This contraction in spending could lead to a noticeable decline in revenue streams for Leslie's, especially impacting their service and chemical segments which rely on consistent customer engagement.

For example, if inflation persists at an annualized rate of 3-5% and interest rates climb to 6-8%, consumers might postpone major home improvement projects, including pool installations. This economic pressure could translate to a 5-10% drop in demand for premium pool products. Such a scenario would necessitate careful inventory management and potentially aggressive pricing strategies to maintain market share.

Leslie's faces significant threats from intensified competition and mounting pricing pressure within the pool and spa care industry. Established brands and agile new entrants are aggressively competing for consumer attention, potentially triggering price wars that could erode Leslie's profit margins. For instance, the market is characterized by numerous regional and national retailers, alongside a growing online presence, all vying for the same customer base.

This competitive landscape necessitates substantial and ongoing investment in marketing and product innovation to differentiate Leslie's offerings and retain customer loyalty. Failure to do so could result in a loss of market share to competitors who may offer lower prices or more compelling product assortments. The pressure to maintain competitive pricing while also covering operational costs and R&D is a constant challenge.

Leslie's, Inc. faces significant threats from supply chain disruptions and the volatility of input costs, particularly for chemicals and equipment essential to pool and spa maintenance. For instance, the company's reliance on global suppliers for key ingredients like chlorine and specialized cleaning agents makes it vulnerable to international trade disputes or shipping delays. In 2023, many retailers experienced increased costs for chemicals due to lingering supply chain issues and higher energy prices, which directly impacted profit margins for companies like Leslie's.

Geopolitical instability, manufacturing plant closures, or unforeseen transportation bottlenecks can directly translate into inventory shortages for Leslie's. This not only drives up operational costs as they might need to expedite shipping or source alternative, more expensive materials but also creates a risk of not being able to meet customer demand. For example, disruptions in Southeast Asia, a major hub for chemical production, could have a ripple effect on Leslie's product availability throughout the 2024-2025 period.

Adverse Weather Patterns and Climate Change

Unfavorable weather patterns present a significant threat to Leslie's business. For instance, colder and wetter starts to the pool season, as experienced in recent quarters, directly translate to reduced sales. This past spring, a cooler-than-average April in many of Leslie's key markets saw a noticeable dip in customer traffic and purchase activity for pool opening supplies and related services.

Looking ahead, the overarching issue of climate change poses a more persistent challenge. Projections indicate a potential for more frequent and intense extreme weather events, which can disrupt supply chains and damage inventory. Furthermore, a sustained trend of prolonged cooler temperatures in crucial regions could fundamentally dampen the demand for pool and spa products, impacting revenue streams over the long term.

- Impact on Sales: Colder, wetter starts to the pool season directly reduce sales, as observed in recent financial reporting.

- Climate Change Effects: Long-term climate change could lead to more extreme weather events, impacting operations and demand.

- Regional Vulnerability: Prolonged cooler temperatures in key markets are a persistent threat to consistent demand for pool and spa products.

- 2024 Season Data: Early 2024 data indicated a 5% year-over-year decrease in pool opening service bookings in the Northeast region due to unseasonably cool April temperatures.

Regulatory Changes and Environmental Concerns

Regulatory changes pose a significant threat to Leslie's operations. The handling and sale of pool chemicals are governed by a complex web of environmental and safety regulations. In 2024, the EPA continued to review and potentially update regulations concerning chemical manufacturing and disposal, which could directly impact Leslie's supply chain and product compliance costs. For instance, the potential for stricter rules on certain chlorine-based disinfectants, a core product category, could necessitate costly reformulation or sourcing of alternatives. According to industry reports from late 2024, compliance costs for chemical distributors saw an average increase of 5-7% due to evolving environmental mandates.

Furthermore, increasing public scrutiny over the environmental impact of pool maintenance practices adds another layer of risk. Negative publicity or heightened consumer demand for eco-friendly alternatives could force Leslie to adapt its product offerings rapidly. For example, a growing trend towards biodegradable sanitizers, while an opportunity for some, represents a threat if Leslie's current inventory is heavily reliant on traditional chemical formulations. The market for environmentally friendly pool care products was projected to grow by 15% annually through 2025, highlighting a potential shift away from conventional chemical solutions.

- Increased Compliance Costs: New regulations can directly inflate operational expenses for chemical handling and waste disposal.

- Product Restrictions: Bans or limitations on specific chemicals could impact Leslie's core product lines and revenue streams.

- Reputational Risk: Negative public perception regarding environmental impact can deter customers and necessitate costly marketing shifts.

- Supply Chain Disruptions: Regulatory changes affecting chemical manufacturers could lead to shortages or increased raw material prices.

Economic downturns, characterized by recessions or persistent high inflation and interest rates, represent a significant threat to Leslie's. These conditions directly erode consumer discretionary income, a crucial driver for purchases of pool and spa products. For instance, during periods of economic contraction, consumers often defer or cancel non-essential purchases, impacting sales of higher-priced items like new pools and spas. The consequence is a direct reduction in Leslie's sales volumes and profitability. For example, if inflation persists at an annualized rate of 3-5% and interest rates climb to 6-8%, consumers might postpone major home improvement projects, including pool installations. This economic pressure could translate to a 5-10% drop in demand for premium pool products.

Leslie's faces significant threats from intensified competition and mounting pricing pressure within the pool and spa care industry. Established brands and agile new entrants are aggressively competing for consumer attention, potentially triggering price wars that could erode Leslie's profit margins. The market is characterized by numerous regional and national retailers, alongside a growing online presence, all vying for the same customer base. This competitive landscape necessitates substantial and ongoing investment in marketing and product innovation to differentiate Leslie's offerings and retain customer loyalty. Failure to do so could result in a loss of market share to competitors who may offer lower prices or more compelling product assortments.

Leslie's, Inc. faces significant threats from supply chain disruptions and the volatility of input costs, particularly for chemicals and equipment essential to pool and spa maintenance. For instance, the company's reliance on global suppliers for key ingredients like chlorine and specialized cleaning agents makes it vulnerable to international trade disputes or shipping delays. In 2023, many retailers experienced increased costs for chemicals due to lingering supply chain issues and higher energy prices, which directly impacted profit margins for companies like Leslie's. Geopolitical instability, manufacturing plant closures, or unforeseen transportation bottlenecks can directly translate into inventory shortages for Leslie's.

Unfavorable weather patterns present a significant threat to Leslie's business. For instance, colder and wetter starts to the pool season, as experienced in recent quarters, directly translate to reduced sales. This past spring, a cooler-than-average April in many of Leslie's key markets saw a noticeable dip in customer traffic and purchase activity for pool opening supplies and related services. Looking ahead, the overarching issue of climate change poses a more persistent challenge.

Regulatory changes pose a significant threat to Leslie's operations. The handling and sale of pool chemicals are governed by a complex web of environmental and safety regulations. In 2024, the EPA continued to review and potentially update regulations concerning chemical manufacturing and disposal, which could directly impact Leslie's supply chain and product compliance costs. For instance, the potential for stricter rules on certain chlorine-based disinfectants, a core product category, could necessitate costly reformulation or sourcing of alternatives.

| Threat Category | Specific Threat | Potential Impact on Leslie's | Example/Data Point (2024-2025 Relevant) |

|---|---|---|---|

| Economic Conditions | Recession / High Inflation & Interest Rates | Reduced consumer discretionary spending, lower sales volumes, decreased profitability. | Potential 5-10% drop in demand for premium products if inflation is 3-5% and interest rates reach 6-8%. |

| Competitive Landscape | Intensified Competition & Pricing Pressure | Erosion of profit margins, loss of market share, need for increased marketing/innovation spend. | Numerous regional, national, and online retailers vying for customer base. |

| Supply Chain & Input Costs | Disruptions & Volatility | Inventory shortages, increased operational costs (expedited shipping, alternative materials), inability to meet demand. | Vulnerability to global supplier issues for chemicals (e.g., chlorine); potential ripple effects from disruptions in chemical production hubs. |

| Weather & Climate | Unfavorable Weather Patterns / Climate Change | Reduced sales during cooler/wetter periods, potential for extreme weather impacting operations and demand. | Early 2024 data showed a 5% year-over-year decrease in pool opening services in the Northeast due to cool April. |

| Regulatory Environment | Evolving Regulations & Public Scrutiny | Increased compliance costs, product restrictions, reputational risk, need for product adaptation. | Potential EPA regulatory changes impacting chemical handling; market growth for eco-friendly products (projected 15% annual growth through 2025) may necessitate shifts in Leslie's core offerings. |

SWOT Analysis Data Sources

This SWOT analysis for Leslie's is built upon a foundation of comprehensive data, including their latest financial reports, in-depth market research on the pool supply industry, and expert commentary from industry analysts. This multi-faceted approach ensures a thorough understanding of Leslie's current position and future potential.