Leslie's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Leslie's, a leading pool and spa supply retailer, operates within a dynamic market shaped by several key forces. Understanding these pressures is crucial for anyone looking to navigate or invest in this sector. We've touched upon the critical elements, but the full picture is far more revealing.

The complete report reveals the real forces shaping Leslie's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pool equipment market, particularly for crucial items like pumps, filters, and heaters, is heavily concentrated. Major players such as Pentair, Hayward, and Zodiac collectively hold a substantial share of this market. This dominance translates into significant bargaining power for these suppliers when dealing with retailers like Leslie's.

With only a handful of primary manufacturers, Leslie's has limited options for sourcing essential pool equipment. This lack of alternatives empowers these key suppliers to dictate terms, potentially leading to increased costs or less favorable contractual arrangements for Leslie's, directly impacting its procurement strategy and profitability.

Suppliers of specialized pool chemicals, like chlorine and algaecides, hold significant bargaining power because these are essential for maintaining pools. The critical nature of these inputs means Leslie's Inc. needs reliable sources to keep its customers satisfied and its operations running smoothly.

While the market is seeing a rise in eco-friendly options, the traditional chemical supply chain can still be quite concentrated. This concentration means fewer suppliers are available, giving them more leverage in price negotiations and terms. For instance, a single major producer of a key chemical could dictate terms, impacting Leslie's cost of goods sold.

Furthermore, the specialized formulations and stringent regulatory approvals required for pool treatment solutions can act as barriers to entry for new suppliers. This specialization limits Leslie's ability to easily switch to alternative providers, thus strengthening the position of existing, qualified suppliers.

Suppliers are experiencing significant economic pressures. We're seeing increased costs for raw materials, a persistent shortage of labor, and ongoing supply chain disruptions. These factors naturally lead suppliers to pass these higher expenses onto their customers, including Leslie's.

For Leslie's, this translates directly into higher costs for essential chemicals and equipment. These increases directly affect the company's cost of goods sold, squeezing profit margins if not managed effectively.

The current inflationary environment further amplifies the bargaining power of suppliers. As they work to protect their own profitability in the face of rising input costs, they have more leverage when negotiating prices with buyers like Leslie's.

Supplier Switching Costs

Supplier switching costs can significantly impact Leslie's bargaining power. While specific data for Leslie's isn't publicly available, for a retailer like Leslie's, changing major equipment or chemical suppliers often incurs substantial expenses. These can include costs associated with recalibrating inventory management systems, retraining employees on new product lines or operational procedures, and ensuring the compatibility of new products with existing infrastructure.

These hidden costs can limit Leslie's flexibility in seeking out alternative suppliers, thereby strengthening the leverage of existing providers. Established, long-term relationships and intricate supply chain networks further exacerbate this challenge, making it difficult for Leslie's to pivot to new vendors swiftly or cost-effectively. This reliance on current suppliers can translate into less favorable pricing or terms for Leslie's.

- High Recalibration Costs: Implementing new supplier systems often requires significant IT investment and operational adjustments.

- Training Investments: Staff require training on new products and processes, adding to the overall cost of switching.

- Product Compatibility Issues: Ensuring new products integrate seamlessly with existing inventory and operational workflows can be complex and expensive.

- Established Supply Chain Inertia: Long-standing supplier relationships create inertia, making rapid transitions difficult and costly.

Importance of Supplier Inputs to Leslie's Operations

The products and components Leslie's sources from its suppliers are absolutely critical for its core business of pool and spa care. Think of chemicals, equipment, and replacement parts – without them, Leslie's simply can't operate or serve its customers effectively. This reliance means suppliers hold substantial sway over how smoothly Leslie's runs and how profitable it can be.

For instance, in 2023, Leslie's reported cost of goods sold of $821.9 million. This figure highlights the significant volume of inputs Leslie's procures, directly illustrating the scale of its dependence on suppliers. A disruption in the supply chain for these essential materials could therefore have a pronounced impact on the company's financial performance and its ability to meet market demand.

- Chemicals: Essential for pool and spa maintenance, representing a core product category for Leslie's.

- Equipment: Pumps, filters, heaters, and cleaning devices are vital for customer satisfaction and service offerings.

- Parts: Replacement components for existing equipment ensure product longevity and customer loyalty.

The bargaining power of suppliers for Leslie's is substantial due to the concentrated nature of the pool equipment market, where a few major players like Pentair and Hayward dominate. This concentration limits Leslie's sourcing options for critical items such as pumps and filters, allowing these suppliers to dictate terms and potentially increase costs.

Furthermore, the essential nature of pool chemicals, coupled with specialized formulations and regulatory hurdles, creates barriers to entry for new suppliers. This dependency on existing, qualified providers grants them significant leverage in price negotiations, directly impacting Leslie's cost of goods sold, which was $821.9 million in 2023.

Suppliers are also benefiting from inflationary pressures, passing increased raw material and labor costs onto retailers like Leslie's. High switching costs for Leslie's, involving IT recalibration, employee training, and product compatibility, further solidify the suppliers' strong position, making it difficult to find more favorable terms.

What is included in the product

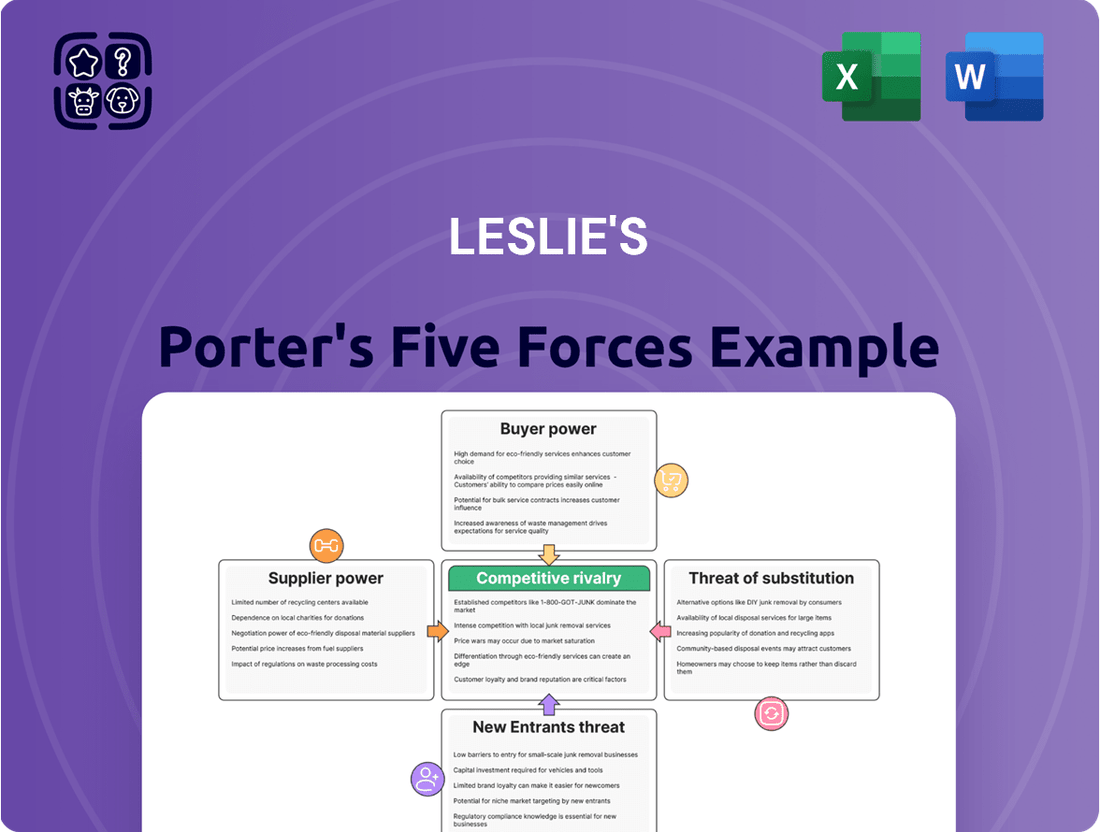

Leslie's Porter's Five Forces Analysis meticulously examines the competitive intensity and profitability potential within the pool and backyard supply industry. It dissects the threats of new entrants, the power of buyers and suppliers, the availability of substitutes, and the intensity of rivalry to reveal Leslie's strategic positioning.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Force.

Customers Bargaining Power

Leslie's serves a wide array of customers, from individual homeowners to professional pool contractors, utilizing a multi-channel approach including physical stores, e-commerce, and service operations. This diverse customer base segments the bargaining power significantly.

Residential customers, a substantial segment, generally possess moderate bargaining power. This is primarily due to the availability of numerous alternative suppliers and products in the market, allowing them to shop around for better prices or terms. For instance, in 2023, Leslie's saw its retail segment revenue reach $737.5 million, indicating a large number of individual transactions where customer price sensitivity can be a factor.

Conversely, professional pool contractors, representing a smaller but higher-volume segment, often wield greater bargaining power. Their ability to purchase in bulk and their established relationships with suppliers can lead to more direct negotiations for preferential pricing and service agreements. These professional clients are crucial for Leslie's commercial growth, contributing to their strategic importance in supplier negotiations.

Leslie's customers, particularly homeowners, are quite sensitive to price, especially for ongoing needs like pool chemicals. In 2024, with inflation impacting household budgets, this price consciousness is even more pronounced. They are actively seeking the best value for essential pool maintenance supplies.

The digital age has significantly amplified this. With e-commerce platforms and readily available online reviews and price comparisons, customers can easily see what other retailers are charging. This transparency means Leslie's faces considerable pressure to remain competitive on pricing, as customers can quickly switch if they find better deals elsewhere.

Customers possess significant bargaining power due to the wide availability of alternative retail channels for pool and spa products. They can easily purchase essential items from big-box retailers like Home Depot, which often offer competitive pricing and convenient locations. The prevalence of online marketplaces such as Amazon further amplifies this power, providing a vast selection and the ability to compare prices effortlessly. This accessibility to numerous purchasing options means customers can readily switch suppliers if Leslie's prices or service levels are not perceived as superior, putting pressure on Leslie's to maintain competitive offerings.

Low Switching Costs for Products

The bargaining power of customers is significantly influenced by low switching costs for many standard pool and spa products. For items like chemicals and basic accessories, customers can easily move from Leslie's to a competitor with minimal effort or expense. This lack of lock-in empowers consumers, pushing Leslie's to prioritize customer retention through competitive pricing and loyalty initiatives. In 2023, the pool and spa retail market saw continued competition, with online retailers and big-box stores offering accessible alternatives, further highlighting the importance of customer loyalty for brick-and-mortar businesses like Leslie's.

- Low Switching Costs: Customers face minimal hurdles to change suppliers for commodity pool and spa items.

- Increased Customer Power: This ease of switching grants customers leverage in price negotiations and demands for better service.

- Focus on Loyalty: Leslie's must invest in customer satisfaction and loyalty programs to counteract this power.

- Competitive Landscape: The presence of numerous alternative vendors, both online and physical, reinforces customer choice.

Demand for Value and Convenience

Customers are increasingly looking for more than just a good price; they want a convenient and helpful experience. For pool and spa owners, this means easy access to products, knowledgeable staff who can offer expert advice, and a straightforward shopping process. Leslie's, with its many physical stores, is well-positioned to meet these demands, but it must also ensure its pricing remains competitive to satisfy customers who value both cost savings and a superior service level. The focus on customer-centric approaches is a growing trend across retail, and pool supply is no exception.

Leslie's reported a net sales increase of 5.1% for the fiscal year 2023, reaching $1.17 billion, indicating a healthy demand for their products and services. This growth highlights the importance of their retail footprint and the value customers place on readily available supplies and expert assistance, especially when dealing with the complexities of pool maintenance.

- Customer Priorities: Beyond price, customers value convenience, product availability, and expert advice for pool and spa care.

- Leslie's Advantage: An extensive physical store network and knowledgeable associates offer a competitive edge in providing these conveniences.

- Competitive Pressure: Customers will likely push for a balance of competitive pricing and a smooth, supportive shopping experience.

- Industry Trend: A notable shift towards customer-centric strategies is evident throughout the retail landscape, impacting the pool and spa sector.

The bargaining power of Leslie's customers is substantial, driven by readily available alternatives and low switching costs for many pool and spa products. This means customers can easily choose competitors, forcing Leslie's to focus on competitive pricing and superior customer experience to retain them. The digital environment further amplifies this, providing easy price comparisons and access to a wide range of suppliers.

| Customer Segment | Bargaining Power Driver | Impact on Leslie's |

|---|---|---|

| Residential Customers | Price sensitivity, numerous alternatives | Pressure on pricing, need for loyalty programs |

| Professional Contractors | Bulk purchasing, established relationships | Negotiation leverage for favorable terms |

| Online Shoppers | Price transparency, easy comparison | Intensified competition, need for competitive e-commerce presence |

Same Document Delivered

Leslie's Porter's Five Forces Analysis

This preview shows the exact, professionally written Leslie's Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within Leslie's market. This detailed analysis is ready for your immediate use, providing actionable insights into the strategic factors influencing Leslie's profitability and market position.

Rivalry Among Competitors

Competitive rivalry within the pool and spa care sector is fierce due to a fragmented landscape. Leslie's faces competition from national chains, large home improvement retailers like Home Depot and Lowe's, and a significant number of online-only sellers. This diverse mix of competitors, including many small, independent local businesses, intensifies the battle for market share.

Competitive rivalry at Leslie's is intense, particularly concerning pricing for essential pool supplies like chemicals and basic equipment. Retailers are constantly pressured to offer competitive prices to attract and retain customers. This price sensitivity is a major factor in the market.

Leslie's leverages its direct-to-consumer approach and specialized service offerings to differentiate itself. While price remains crucial, the quality and breadth of services, such as in-home consultations and repairs, are key areas where Leslie's aims to gain an advantage. This dual focus on price and service is vital for navigating the competitive landscape.

The retail environment in 2024 presented significant challenges early on. However, many retailers, including those in the pool and spa sector, experienced a noticeable rebound as the year progressed. This suggests a dynamic market where consumer spending can fluctuate, making pricing and service strategies even more critical.

The pool and spa service sector is witnessing significant consolidation, with private equity firms actively fueling this trend. This influx of capital is creating larger, more formidable competitors, which in turn heightens competitive intensity for existing companies like Leslie's. For instance, the pool service market, while fragmented, has seen substantial private equity buyouts in recent years, with deal volumes increasing year-over-year. This consolidation means fewer, but larger, players are vying for market share, intensifying the rivalry.

Emphasis on Customer Engagement and Loyalty

In a market where customers can easily switch brands, Leslie's and its competitors are placing a significant emphasis on keeping customers engaged and loyal. This strategy is crucial for maintaining market share.

Leslie's has taken steps to strengthen its customer relationships by revamping its Pool Perks Rewards Program. This initiative aims to make it more attractive for customers to return, highlighting the company's commitment to differentiating itself through superior customer experience in a competitive environment.

- Customer Retention Focus: Low switching costs drive companies like Leslie's to prioritize customer retention through loyalty programs.

- Leslie's Pool Perks: The revamp of Leslie's rewards program is a direct response to the need to enhance customer loyalty and differentiate in a competitive landscape.

- Competitive Pressure: The intense rivalry in the pool supply industry necessitates a strong focus on customer engagement to combat customer attrition.

- Customer Experience as a Differentiator: Companies are increasingly relying on excellent customer service and loyalty programs to stand out from competitors.

Economic Headwinds and Market Fluctuations

Economic headwinds like inflation and labor shortages are creating a tougher operating environment across the pool and spa industry. These pressures naturally amplify competitive rivalry as businesses vie for consumer spending, which might become more cautious. Leslie's itself saw a dip in sales and comparable sales during fiscal 2024, reflecting these broader market challenges.

The impact of these economic factors is felt by all players, forcing companies to compete more fiercely for market share. Even with projected growth in the overall market, the fight for consumers could intensify. This environment necessitates strategic adjustments to navigate the shifting economic landscape effectively.

- Inflationary pressures impact input costs and consumer discretionary spending.

- Labor shortages can affect service delivery and operational efficiency for all competitors.

- Shifting consumer preferences require companies to adapt their product and service offerings.

- Leslie's reported a decrease in sales and comparable sales in fiscal 2024, indicating the real-world effect of these economic challenges on individual companies.

Competitive rivalry is a defining characteristic of the pool and spa industry, marked by a fragmented market with numerous players. Leslie's competes against national chains, large home improvement retailers, and a vast number of online sellers, alongside many local independent businesses. This intense competition, particularly on pricing for essential items like chemicals, forces companies to constantly offer value to retain customers.

The sector has seen significant consolidation driven by private equity, leading to larger, more formidable competitors. This trend, coupled with low customer switching costs, compels companies like Leslie's to prioritize customer retention through enhanced loyalty programs and superior service experiences. For instance, Leslie's revamped its Pool Perks Rewards Program to foster greater customer engagement and loyalty, a critical strategy in this highly competitive environment. Economic factors such as inflation and labor shortages in 2024 further amplified this rivalry, as businesses fought for cautious consumer spending, a challenge reflected in Leslie's own fiscal 2024 sales performance.

| Competitor Type | Key Characteristics | Impact on Leslie's |

|---|---|---|

| National Chains | Established brand recognition, broad store networks. | Direct competition for market share, requires strong brand differentiation. |

| Home Improvement Retailers (e.g., Home Depot, Lowe's) | Large customer base, one-stop shopping convenience. | Price competition on basic pool supplies, potential loss of customers seeking convenience. |

| Online-Only Sellers | Lower overhead, aggressive pricing, wide product selection. | Price pressure, need for efficient e-commerce strategy and competitive online pricing. |

| Independent Local Businesses | Personalized service, local market knowledge. | Niche competition, requires strong local presence and service offerings. |

| Private Equity-Backed Consolidations | Increased scale, potentially greater financial resources. | Heightened overall competitive intensity, need for strategic agility and service excellence. |

SSubstitutes Threaten

A significant threat to Leslie's Pool Corp. comes from residential pool owners choosing do-it-yourself (DIY) maintenance. This trend is fueled by readily available online tutorials and a wide selection of generic pool chemicals and equipment found at mass retailers, allowing consumers to sidestep specialized pool care providers.

The accessibility of information and diverse product offerings makes it increasingly feasible for consumers to manage their pool care independently. This bypasses the need for professional services or branded products, directly impacting Leslie's sales of chemicals, equipment, and maintenance services.

For example, in 2024, the home improvement retail sector, which includes many suppliers of DIY pool maintenance items, continued to see robust consumer spending, with some segments reporting year-over-year growth exceeding 5%. This indicates a strong consumer appetite for tackling home maintenance tasks themselves.

The growing adoption of saltwater pool systems poses a significant threat of substitution for traditional chlorine pool chemicals. These systems, which generate chlorine from salt, diminish the demand for packaged chlorine products, a core offering for companies like Leslie's. By 2024, the market for pool and spa chemicals, including traditional chlorine, faced pressure from these evolving consumer preferences.

This shift is fueled by consumer interest in perceived health benefits and reduced irritation associated with saltwater pools, alongside a desire for more convenient, lower-maintenance solutions. This trend directly impacts revenue streams for businesses heavily reliant on selling traditional chlorine and related water treatment chemicals.

While not a direct competitor, alternative leisure activities can pose a threat to the pool and spa industry. For instance, a growing interest in home fitness equipment or subscription-based streaming services might divert discretionary spending that could otherwise go towards pool maintenance or related products. In 2024, consumer spending on home entertainment, including digital subscriptions and gaming, continued to rise, indicating a strong alternative for leisure time and budget allocation.

Professional Pool Service Providers

Customers seeking pool upkeep can choose comprehensive professional pool service providers as a substitute for purchasing and performing maintenance themselves. This shift from DIY to done-for-you services directly diverts potential revenue from Leslie's product sales towards service fees paid to these external providers. While Leslie's does offer its own service options, a robust independent pool service sector presents a significant competitive alternative, directly impacting Leslie's retail product market share.

The threat of substitutes from professional pool service providers is a notable concern for retailers like Leslie's. Consider that a significant portion of pool owners, especially those with limited time or expertise, find it more convenient to outsource maintenance. This trend was evident in the growing pool service industry prior to 2024, with many smaller, independent operators contributing to a fragmented but competitive landscape. These services often bundle chemicals, cleaning, and repairs, offering a complete solution that bypasses the need for consumers to buy individual products from a retail store.

- Consumer Convenience: Professional services offer a hands-off approach, appealing to busy homeowners.

- Bundled Offerings: Many service providers include chemicals and equipment checks, presenting a comprehensive package.

- Expertise and Time Savings: Customers avoid the learning curve and time commitment associated with DIY pool maintenance.

- Direct Revenue Diversion: Service fees paid to third-party providers represent lost sales for pool supply retailers.

Technological Advancements in Pool Care

Technological advancements present a significant threat of substitutes in the pool care industry. Innovations like smart pool controllers, which automate chemical balancing and temperature regulation, and robotic pool cleaners, which reduce reliance on manual cleaning and certain chemicals, directly substitute for traditional pool maintenance products and services. For instance, the global market for smart home devices, including pool automation, is projected to grow substantially, indicating increasing consumer interest in these substitutes. This trend could potentially decrease demand for chemicals like chlorine and algaecides, as well as reduce the need for professional pool cleaning services, areas where Leslie's Pool Supplies has historically derived substantial revenue.

The increasing sophistication and accessibility of these technologies are key drivers. As these systems become more user-friendly and cost-effective, their adoption rate is likely to accelerate. This shift means consumers might invest in a one-time technology purchase that offers ongoing savings and convenience, thereby reducing their recurring expenditure on pool chemicals and services. For example, by 2024, many households are expected to adopt integrated smart home ecosystems, which often include pool management as a feature.

- Smart pool technology reduces the need for manual chemical additions and monitoring.

- Automated cleaning systems decrease the demand for manual cleaning services and some cleaning chemicals.

- Advanced filtration methods can lower the consumption of water treatment chemicals.

- The growing smart home market indicates a rising preference for automated solutions, impacting traditional pool supply sales.

The threat of substitutes for Leslie's Pool Corp. is multifaceted, encompassing do-it-yourself (DIY) pool maintenance, alternative leisure activities, professional pool services, and technological advancements. The DIY trend, bolstered by accessible online resources and mass-market retail availability of pool supplies, allows consumers to bypass specialized retailers. Furthermore, evolving consumer preferences, such as the adoption of saltwater pool systems, directly reduce demand for traditional chlorine-based chemicals. By 2024, continued growth in the home improvement sector underscored the strength of DIY inclinations, with some segments seeing over 5% year-over-year increases in consumer spending on home maintenance items.

Technological innovations also present a significant substitution threat. Smart pool controllers automate chemical balancing and temperature regulation, while robotic cleaners reduce the need for manual effort and certain chemicals. This trend is supported by the expanding smart home market, indicating a growing consumer preference for automated solutions. For example, by 2024, many households were expected to integrate smart home ecosystems that often included pool management features, potentially decreasing recurring expenditures on chemicals and services.

| Threat Category | Description | 2024 Market Insight/Example |

| DIY Maintenance | Consumers performing their own pool upkeep using readily available products. | Home improvement retail saw robust spending, with some segments growing over 5% year-over-year. |

| Saltwater Systems | Pools using salt to generate chlorine, reducing demand for packaged chlorine. | Continued consumer interest in perceived health benefits and convenience of saltwater systems. |

| Professional Services | Outsourcing pool maintenance to third-party service providers. | Fragmented but competitive landscape of independent pool service operators. |

| Smart Technology | Automated pool controllers and robotic cleaners. | Growth in the smart home device market, including pool automation, signals increasing adoption. |

Entrants Threaten

Establishing a vast physical retail network, similar to Leslie's over 1,000 locations, demands significant upfront capital. This includes substantial investments in acquiring or leasing prime real estate, stocking diverse product lines, and hiring and training a considerable workforce. For example, in 2024, the average cost to open a new retail store can range from $100,000 to over $500,000 depending on size and location, making it a formidable hurdle for aspiring competitors.

This high capital requirement acts as a powerful deterrent for new entrants seeking to challenge Leslie's established direct-to-consumer presence. The sheer financial commitment needed to build a comparable network of stores, coupled with the ongoing operational expenses, effectively limits the number of viable new competitors that can emerge and gain meaningful market traction.

Leslie's, established in 1963, holds a significant advantage as the largest and most trusted direct-to-customer brand in the U.S. pool and spa care market. This long-standing presence has fostered deep customer loyalty and widespread brand recognition. Newcomers would need to invest substantial time and capital to even approach Leslie's established market position.

Building comparable brand awareness and securing customer loyalty is a formidable hurdle for any new entrant. It's not just about offering products; it's about cultivating trust and a consistent experience, which takes years. For instance, Leslie's reported approximately $1.07 billion in net sales for fiscal year 2023, demonstrating the scale of their operation and customer engagement.

Leslie's, as a major player in the pool supply industry, benefits significantly from economies of scale. This means they can purchase inventory in larger quantities, leading to lower per-unit costs. For instance, in 2023, Leslie's reported net sales of $1.05 billion, indicating a substantial purchasing volume that smaller competitors cannot easily replicate.

Established relationships with key suppliers are another hurdle for new entrants. Leslie's likely has long-standing partnerships that secure favorable pricing, early access to new products, and reliable delivery. These supply chain advantages are difficult and time-consuming for newcomers to build, creating an immediate cost disadvantage.

A new entrant would face a considerable challenge in matching Leslie's operational efficiencies. The ability to spread fixed costs like marketing and distribution over a larger sales volume allows Leslie's to offer competitive pricing. This cost advantage makes it harder for new businesses to enter the market and gain traction without significant initial investment.

Regulatory Hurdles and Expertise

The pool chemical industry presents significant regulatory hurdles that new entrants must overcome. Compliance with environmental protection agencies and local health departments regarding chemical handling, storage, and disposal is paramount. For instance, the Environmental Protection Agency (EPA) mandates strict guidelines under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) for pesticide products, which include many pool chemicals.

Developing the necessary expertise in pool chemistry, water treatment, and safety protocols is another substantial barrier. New companies would need to invest in training staff and potentially hire specialists, adding to initial operational costs. This technical knowledge is crucial for ensuring product efficacy and customer safety, differentiating established players who have built this expertise over time.

- Regulatory Compliance: Navigating EPA and state-level regulations for chemical safety and environmental impact.

- Safety Standards: Adhering to stringent safety protocols for handling, packaging, and transportation of chemicals.

- Technical Expertise: Requiring specialized knowledge in water chemistry, treatment, and equipment maintenance.

Access to Skilled Labor and Technicians

The pool and spa care industry, especially the service side, is grappling with a notable shortage of skilled labor. This scarcity directly impacts the threat of new entrants. For any new company aiming to break into this market, securing qualified technicians and knowledgeable retail staff presents a substantial hurdle.

Attracting and adequately training these essential personnel requires significant investment in time and resources. Leslie's, having already built a robust workforce and developed comprehensive training programs, possesses a distinct advantage. This established infrastructure allows Leslie's to onboard and retain talent more effectively than a newcomer would likely be able to.

Consider the implications for a new business; they would need to compete for a limited pool of experienced individuals or fund extensive training from scratch. For instance, industry reports from late 2023 and early 2024 continued to highlight a persistent demand for qualified HVAC and pool service technicians, with some regions reporting vacancy rates exceeding 15% for specialized roles. This labor gap makes it difficult and costly for new players to scale their operations quickly and efficiently.

- Labor Shortage Impact: New entrants face difficulties in finding and training skilled pool and spa technicians.

- Training Investment: Significant capital and time are needed for new companies to develop their own skilled workforce.

- Leslie's Advantage: Established training programs and an existing workforce give Leslie's a competitive edge in talent acquisition.

- Market Dynamics: High demand for technicians in 2024 suggests continued challenges for new market entrants seeking qualified staff.

The threat of new entrants for Leslie's is relatively low due to significant barriers. High capital requirements for establishing a physical retail presence, as seen in Leslie's over 1,000 locations, demand substantial upfront investment in real estate, inventory, and staffing. For example, opening a new retail store in 2024 can cost between $100,000 to over $500,000, a significant hurdle for newcomers.

Brand loyalty and established market presence, built over decades since Leslie's founding in 1963, further deter new entrants. Achieving Leslie's recognized brand status and customer trust requires considerable time and financial commitment. Leslie's reported approximately $1.07 billion in net sales for fiscal year 2023, underscoring the scale of their customer engagement and market penetration.

Economies of scale in purchasing and operational efficiencies also create a competitive advantage for Leslie's. Their ability to buy in bulk, as indicated by their 2023 net sales of $1.05 billion, leads to lower per-unit costs that new entrants struggle to match. These factors, combined with established supplier relationships and regulatory compliance knowledge, make market entry challenging.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, industry association statistics, and reputable market research reports from firms like Statista and IBISWorld.