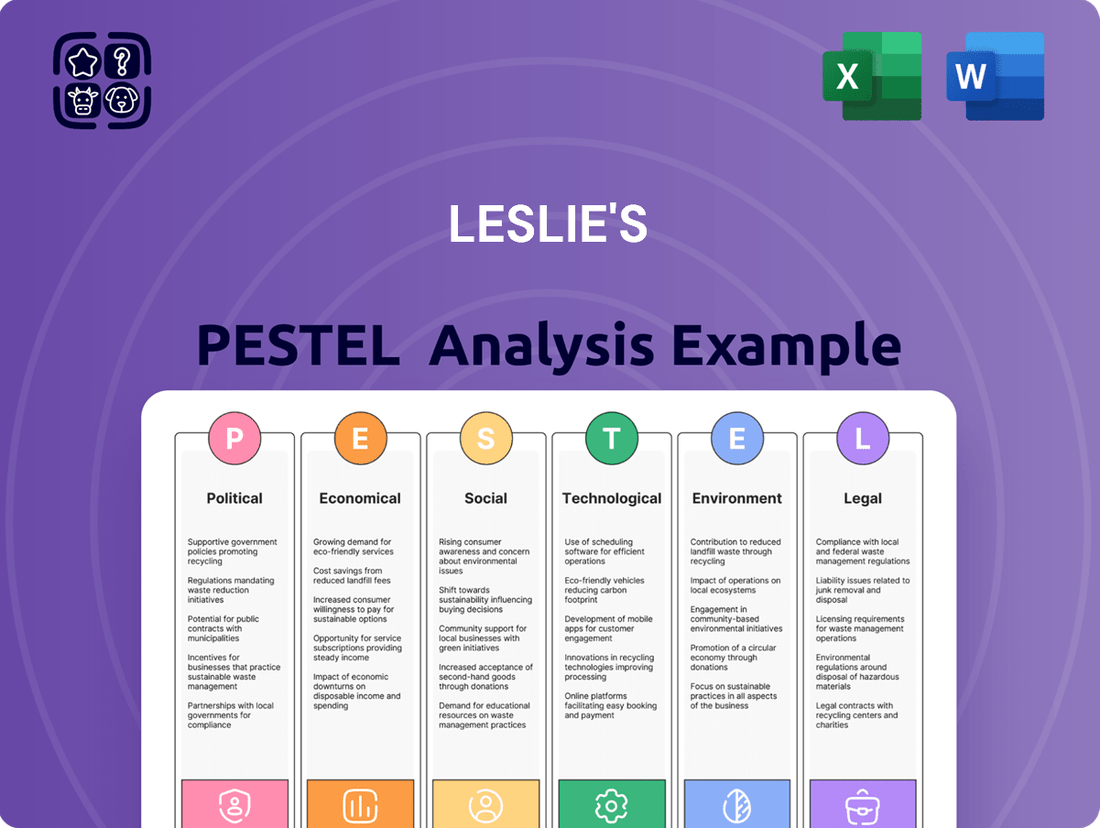

Leslie's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Navigate the complex external forces shaping Leslie's with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the pool supply industry. This ready-made analysis delivers expert insights, perfect for strategic planning and investment decisions. Download the full version now to gain actionable intelligence and sharpen your competitive edge.

Political factors

State and federal governments are tightening water conservation rules, which directly affect how people use pools and spas. For a company like Leslie's, this means adjusting its products and services to meet these tougher standards, particularly in areas facing drought, such as California. In 2023, California continued to implement water reduction targets, impacting outdoor water use, which indirectly influences pool maintenance and water top-offs.

Changes in international trade policies, especially those involving tariffs on pool equipment and chemicals, can directly impact Leslie's expenses. For instance, existing tariffs on goods from China, often between 10% and 25%, could raise the cost of acquiring necessary inventory.

These increased operational costs might necessitate adjustments to Leslie's pricing, potentially affecting consumer demand. Staying informed about policy shifts anticipated for 2024 and 2025 is vital for managing expenses and ensuring the supply chain remains robust.

The Consumer Product Safety Commission (CPSC) plays a crucial role in shaping Leslie's product strategy by setting rigorous safety standards for pool and spa items. These regulations, which can impact everything from product design to packaging, are vital for ensuring consumer well-being and safeguarding Leslie's brand image. For instance, CPSC recalls can be costly; in 2023, the agency announced numerous recalls affecting various consumer goods, highlighting the importance of strict compliance.

Government Incentives for Green Technologies

Government incentives for green technologies significantly influence the market for energy-efficient pool products. Federal and state governments are increasingly offering tax credits and rebates for items like variable-speed pumps and solar heating systems. These incentives, which can range from $500 to $2,500, directly reduce the upfront cost for consumers, making sustainable options more appealing. For instance, the Inflation Reduction Act of 2022 extended and enhanced tax credits for renewable energy and energy efficiency, benefiting homeowners who invest in solar pool heaters or high-efficiency pumps.

Leslie's can strategically leverage these government programs in its marketing and sales efforts. By highlighting the availability and value of these incentives, Leslie's can attract customers looking to upgrade their pool equipment with eco-friendly and cost-saving solutions. This alignment with government policy supports Leslie's commitment to promoting greener products and can drive increased demand for its sustainable offerings.

- Federal Tax Credits: The Inflation Reduction Act offers a residential clean energy credit, potentially covering a significant portion of the cost for solar pool heating installations.

- State-Specific Rebates: Many states, such as California and New York, have additional rebate programs for energy-efficient appliances, including pool pumps.

- Increased Consumer Affordability: Incentives can make energy-saving pool technologies, like variable-speed pumps (which can reduce energy consumption by up to 80%), more accessible to a wider range of customers.

- Marketing Advantage: Leslie's can position itself as a knowledgeable partner for customers seeking to maximize savings through available government incentives.

Local Zoning and Building Codes

Local zoning laws and building codes are critical political factors impacting Leslie's pool installation and maintenance business. These regulations, which differ significantly from one municipality to another, dictate everything from the depth of required pool fencing to specific disinfection standards and the design of equipment rooms. For instance, in 2024, several municipalities in Leslie's primary service areas introduced stricter requirements for stormwater runoff management related to pool construction, adding an average of 5% to installation costs. This means Leslie's must remain acutely aware of and compliant with these varied local mandates to avoid penalties and ensure smooth project execution.

Leslie's operational success hinges on its ability to navigate this complex regulatory landscape. The company's installation and service teams must be thoroughly trained and equipped to adhere to the unique requirements present in each of its service areas. Failure to comply can lead to project delays, fines, and damage to the company's reputation. For example, in late 2023, a project in a neighboring county was halted for three weeks due to non-compliance with a newly enacted code regarding chemical storage, costing Leslie's an estimated $25,000 in lost revenue and additional labor.

- Varied Municipal Regulations: Zoning and building codes are not uniform, requiring Leslie's to maintain area-specific compliance knowledge.

- Impact on Operations: Regulations affect pool installation methods, safety features like fencing, and maintenance practices, influencing service scope and cost.

- Compliance Costs: Adhering to diverse codes can increase operational expenses, as seen with stormwater management mandates adding to installation costs.

- Risk of Non-Compliance: Failure to meet local standards can result in significant financial penalties, project delays, and reputational damage.

Government incentives, particularly those related to energy efficiency, are significantly shaping the market for pool products. The Inflation Reduction Act of 2022, for instance, offers substantial tax credits for homeowners installing solar pool heating systems and high-efficiency pumps, making these greener options more financially attractive. These programs directly encourage consumer adoption of sustainable technologies, aligning with Leslie's focus on promoting eco-friendly solutions. By highlighting these incentives, Leslie's can boost sales of energy-saving equipment, a segment expected to see continued growth through 2025.

Regulatory bodies like the Consumer Product Safety Commission (CPSC) impose stringent safety standards on pool and spa equipment. Compliance with these standards is non-negotiable for product design, manufacturing, and marketing, directly impacting Leslie's product development pipeline. The CPSC's ongoing vigilance, evidenced by numerous product recalls across various consumer goods in 2023, underscores the critical need for Leslie's to maintain rigorous quality control and safety protocols. Failure to adhere to these evolving regulations can lead to costly recalls and reputational damage.

Water conservation mandates, especially in drought-prone regions like California, directly influence consumer behavior regarding pool usage and maintenance. These state and federal regulations can restrict water top-offs and impact overall water consumption, thereby affecting demand for certain pool chemicals and accessories. As of 2024, these conservation efforts continue to be a significant factor for pool owners, requiring Leslie's to adapt its product offerings and customer guidance to align with water-saving practices.

What is included in the product

This PESTLE analysis provides a comprehensive overview of how external macro-environmental factors influence Leslie's business operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Consumer disposable income is a critical driver for Leslie's, directly influencing spending on pools, spas, and related leisure products. While the home improvement market experienced some moderation in 2024, with reports indicating a slight decrease in median spending compared to previous years, analysts project a rebound in 2025. This anticipated renewal suggests homeowners are planning a return to larger projects, which bodes well for discretionary purchases like those offered by Leslie's. The company's success is intrinsically linked to consumers' confidence and their capacity to allocate funds towards significant home leisure investments.

Inflationary trends in 2024 and projected into 2025 significantly impact Leslie's, affecting the cost of essential inputs like chemicals, pool equipment, and replacement parts. For instance, the Producer Price Index (PPI) for chemicals saw a notable increase in early 2024, directly translating to higher raw material expenses for Leslie's manufacturing processes.

The combination of persistent inflation and elevated interest rates, as maintained by the Federal Reserve throughout 2024, squeezes Leslie's profit margins. Increased borrowing costs for inventory and capital expenditures, coupled with rising operational expenses for transportation and labor, create a challenging financial environment.

To navigate these headwinds, Leslie's must implement agile supply chain management and strategic pricing adjustments. This involves optimizing inventory levels, exploring alternative sourcing options to buffer against supplier cost hikes, and carefully calibrating product pricing to maintain consumer affordability while protecting profitability.

Interest rate fluctuations directly impact consumer spending on discretionary items like pool installations and major home renovations. For instance, a homeowner considering a $50,000 pool project might be significantly deterred by a 7% mortgage rate compared to a 4% rate, impacting their ability to finance such an upgrade. This sensitivity to borrowing costs is a key factor for Leslie's.

A robust housing market often signals increased disposable income and a greater willingness to invest in home amenities, including pools and spas. The median home price in the US reached approximately $420,000 in early 2024, reflecting a strong market that generally supports ancillary home improvement spending.

While new home construction has seen some moderation, the ongoing trend of home renovations presents a stable and significant market for Leslie's. In 2023, homeowners spent an estimated $150 billion on renovations, highlighting the continued demand for upgrades and maintenance, which directly benefits businesses like Leslie's that cater to these needs.

Competitive Landscape and Pricing Strategies

Leslie's operates in a highly competitive environment, facing pressure not only from other specialty pool supply retailers but also from mass merchants. This necessitates a nimble approach to pricing, where Leslie's must constantly evaluate its strategies to remain attractive to consumers. For instance, in 2024, the rise of discount retailers and online marketplaces intensified this competitive pressure, forcing many businesses, including those in the home and garden sector, to adjust their pricing models to avoid losing market share.

The increasing consumer demand for private label brands across various retail sectors, including home improvement, signals a growing price sensitivity. As consumers become more value-conscious, they actively seek out quality products at more affordable price points. This trend, observed throughout 2024 and projected into 2025, directly impacts Leslie's, potentially pressuring them to offer more competitive pricing on their own branded products to align with this consumer behavior, without compromising the perceived quality of their offerings.

Effectively navigating this competitive landscape requires Leslie's to strike a delicate balance. They must continue to offer premium, specialized products that justify higher price points for discerning customers, while also ensuring they have accessible options that appeal to a broader, more price-sensitive segment of the market. This dual strategy is crucial for retaining existing customers and attracting new ones in 2024 and beyond.

- Competitive Pressure: Mass merchants and specialty retailers create an environment requiring agile pricing for Leslie's.

- Value Consciousness: Rising private label popularity indicates consumers are seeking better value, impacting pricing expectations.

- Balancing Offerings: Leslie's must cater to both premium and value-seeking customers to maintain market share.

- Market Trends: 2024 saw intensified competition, with this trend expected to continue into 2025, influencing pricing strategies.

Seasonal Demand and Weather Patterns

The pool and spa industry, which Leslie's operates within, is inherently seasonal. Demand for pool maintenance products and services typically surges during warmer months, directly impacting Leslie's revenue streams. For instance, in 2024, regions experiencing an earlier or more prolonged summer season likely saw a corresponding uptick in sales for Leslie's, particularly for chemicals, cleaning supplies, and pool accessories.

Unusual weather events can significantly disrupt this predictable pattern. Prolonged droughts, for example, might lead consumers to conserve water, potentially reducing pool usage and, consequently, the demand for maintenance products. Conversely, extreme heat waves, while potentially increasing pool usage, could also lead to water restrictions in some areas. In 2024, reports indicated that certain Western states faced drought conditions, which could have presented challenges for Leslie's in those specific markets.

To effectively navigate these climate-driven fluctuations, Leslie's requires robust adaptive strategies. This includes dynamic inventory management to avoid overstocking during slower periods and understocking during unexpected demand spikes. Furthermore, staffing levels need to be flexible to accommodate the ebb and flow of customer activity, ensuring adequate service during peak seasons and efficient operations during off-peak times. The company's ability to forecast and respond to regional weather variations is crucial for optimizing operational efficiency and profitability.

- Seasonal Demand: Pool and spa industry sales are heavily weighted towards spring and summer, directly influencing Leslie's revenue cycles.

- Weather Impact: Droughts can suppress demand, while heat waves can increase usage but also trigger water restrictions, creating a complex sales environment.

- Inventory Management: Leslie's must adjust stock levels based on anticipated weather patterns and seasonal demand shifts to minimize waste and meet customer needs.

- Staffing Adaptability: Flexible staffing models are essential to align labor costs with fluctuating customer traffic throughout the year.

Economic factors significantly shape Leslie's performance, with consumer disposable income and inflation being key drivers. While 2024 saw some moderation in home improvement spending, projections for 2025 indicate a rebound, suggesting renewed consumer willingness for discretionary purchases like pools and spas. However, persistent inflation and elevated interest rates throughout 2024 have increased operational costs and borrowing expenses for Leslie's, impacting profit margins and necessitating strategic pricing and supply chain management.

| Economic Factor | 2024 Impact | 2025 Outlook | Data Point |

|---|---|---|---|

| Consumer Disposable Income | Moderation in home improvement spending | Projected rebound, supporting discretionary purchases | Median home price: ~$420,000 (early 2024) |

| Inflation | Increased costs for chemicals, equipment, and labor | Continued pressure on margins, requiring pricing adjustments | Producer Price Index (PPI) for chemicals saw notable increase (early 2024) |

| Interest Rates | Higher borrowing costs for inventory and capital, impacting consumer financing | Rates maintained by Federal Reserve continue to squeeze profit margins | Mortgage rates impacting large discretionary purchases (e.g., 7% vs. 4%) |

Same Document Delivered

Leslie's PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Leslie's Swimming Pool Supplies covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You'll gain valuable insights into the strategic landscape, enabling informed decision-making. It's a complete, ready-to-deploy resource for understanding Leslie's market position.

Sociological factors

There's a noticeable societal shift towards prioritizing health and wellness, with people increasingly viewing pools and spas as integral to their personal well-being. This trend, which gained significant momentum after the pandemic, sees homeowners investing more in their outdoor spaces as a means of exercise, stress reduction, and even home-based hydrotherapy. For instance, the Global Wellness Institute reported the wellness economy reached $5.6 trillion in 2023, with a significant portion dedicated to physical activity and spa services, underscoring this growing consumer focus.

Leslie's is well-positioned to leverage this heightened awareness by actively marketing the health and fitness benefits associated with pool and spa ownership. Highlighting how their products contribute to active lifestyles and provide accessible relaxation can resonate deeply with consumers actively seeking to enhance their quality of life. This alignment with a dominant societal value can drive demand for Leslie's offerings as people seek to create personal sanctuaries for health and rejuvenation.

Consumers are increasingly viewing their homes as primary hubs for relaxation and social activities, driving significant spending on backyard enhancements like swimming pools and hot tubs. This societal trend directly fuels demand for Leslie's offerings, as homeowners invest in creating inviting outdoor living spaces for personal enjoyment and entertaining guests. The company is well-positioned to capitalize on this ongoing desire to maximize home functionality and comfort, a movement that gained considerable traction in recent years.

Demographic shifts are reshaping the pool and spa market. An aging population might seek lower-maintenance options, while younger generations, like Millennials, are increasingly investing in home improvements, including kitchen remodels and outdoor living spaces, which can drive demand for pools and spas. For instance, in 2024, the average spending on major kitchen remodels, a proxy for broader home improvement interest, saw significant increases.

Generational preferences also play a crucial role. Baby Boomers, a significant homeowner demographic, have historically driven renovations, often opting for larger, more elaborate pool installations. Conversely, studies from late 2024 indicate a growing trend among Millennials and Gen Z to prioritize smaller, more energy-efficient, and technologically advanced pool features, reflecting their lifestyle and sustainability concerns.

The ongoing expansion of suburban and exurban residential areas is a direct contributor to market growth. As more families move to these regions, the demand for single-family homes with yards, and consequently, the potential for pool installations, increases. This trend was particularly evident in housing market reports from early 2025, highlighting continued growth in these development zones.

DIY vs. Professional Service Preferences

A significant societal shift is influencing how consumers approach pool care. Many homeowners are embracing the do-it-yourself (DIY) approach, driven by a desire to control costs, especially in an inflationary environment. This trend is supported by the widespread availability of online tutorials and readily accessible pool maintenance products.

Conversely, a strong counter-trend favors professional services, particularly among those seeking convenience and guaranteed quality. As busy schedules and a preference for expert handling grow, outsourcing pool maintenance becomes more appealing. This segment values the time savings and the assurance of proper chemical balancing and equipment upkeep.

Leslie's, with its dual retail and service center model, is strategically positioned to capitalize on both DIY and professional service preferences. For instance, in the first quarter of fiscal year 2024, Leslie's reported a 3.4% increase in comparable store sales, indicating continued customer engagement across its offerings. This suggests that while DIY remains popular, the demand for professional assistance is also robust.

- DIY Appeal: Homeowners increasingly seek cost-effective solutions, with many opting for DIY pool maintenance to manage expenses.

- Professional Demand: A growing segment prioritizes convenience and expert results, leading to increased reliance on professional pool services.

- Leslie's Strategy: The company's integrated retail and service model effectively caters to both DIY enthusiasts and those preferring outsourced maintenance.

- Market Data: Leslie's Q1 FY2024 comparable store sales growth of 3.4% highlights sustained customer activity across both service preferences.

Consumer Preference for Sustainable Lifestyles

Consumer preference for sustainable lifestyles is significantly impacting the pool industry, with a growing demand for eco-friendly and resource-efficient pool solutions. This trend is directly influencing purchasing decisions, pushing companies like Leslie's to adapt their product lines and marketing strategies. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed year over year.

This heightened awareness translates into a strong interest in energy-efficient pool equipment, such as variable-speed pumps that can reduce electricity consumption by up to 80% compared to single-speed models. Additionally, water-saving technologies, like pool covers that minimize evaporation, and the adoption of less harsh chemical alternatives, such as saltwater chlorination systems, are becoming increasingly popular. Leslie's, by embracing these preferences, can carve out a distinct competitive advantage.

- Growing demand for energy-efficient pool pumps: Variable-speed pumps offer significant energy savings, appealing to environmentally conscious consumers.

- Increased interest in water conservation: Pool covers and efficient filtration systems are sought after to reduce water usage.

- Shift towards gentler chemical alternatives: Saltwater systems are gaining traction as a less harsh option compared to traditional chlorine.

- Consumer willingness to pay a premium: Studies in 2024 suggest a majority of consumers are willing to pay more for sustainable products.

Societal attitudes towards leisure and home life are evolving, with a greater emphasis on creating personal havens. This translates into increased investment in backyard amenities, including pools and spas, as homeowners seek to enhance their quality of life and create spaces for relaxation and entertainment. The growing wellness trend also fuels this, as pools and spas are increasingly viewed as integral to physical and mental well-being. For instance, the global wellness economy was valued at $5.6 trillion in 2023, reflecting a broad consumer focus on health and self-care.

Generational preferences significantly shape market demand. While older generations may favor established pool designs, younger demographics like Millennials and Gen Z are increasingly drawn to energy-efficient, technologically advanced, and lower-maintenance pool features. This aligns with their lifestyle choices and growing environmental consciousness. For example, data from late 2024 indicated a clear preference among younger homeowners for smart pool technology and sustainable operational features.

Consumer behavior also shows a divergence between those who prefer do-it-yourself (DIY) pool maintenance and those who opt for professional services. The DIY segment is driven by cost-consciousness, while the professional services segment prioritizes convenience and expertise. Leslie's, with its integrated retail and service model, is well-positioned to cater to both preferences. In Q1 FY2024, Leslie's reported a 3.4% increase in comparable store sales, demonstrating robust customer engagement across its diverse service offerings.

Technological factors

The increasing adoption of smart pool automation and IoT integration is significantly reshaping the pool industry. These technologies allow pool owners to remotely manage crucial aspects like water temperature, chemical balance, and cleaning cycles directly from their smartphones, offering unparalleled convenience and control.

This trend directly addresses consumer desires for more automated and less labor-intensive pool maintenance, driving demand for sophisticated solutions. Leslie's can capitalize on this by expanding its range of smart pool products, including Wi-Fi enabled pumps, automated chemical feeders, and smart sensors, which provide real-time data and proactive alerts.

The market for smart home devices, including pool automation, is experiencing robust growth. For instance, the global smart home market was projected to reach over $150 billion in 2024, with the outdoor and pool segment showing strong upward momentum, indicating a fertile ground for Leslie's to innovate and capture market share with advanced, connected pool care offerings.

Technological progress is driving the development of more energy-efficient pool equipment, such as variable-speed pumps and advanced filtration systems. These innovations directly translate to lower electricity bills for consumers, with variable-speed pumps alone capable of reducing energy usage by up to 80% compared to single-speed models. The market for solar-powered pool heating is also experiencing significant growth, projected to reach $1.7 billion globally by 2027, driven by both environmental consciousness and the desire for reduced operating expenses. Leslie's needs to actively incorporate these cutting-edge, cost-saving technologies into its product offerings to maintain a competitive edge and meet evolving customer demands for sustainable and economical pool ownership.

Innovations like AI-driven chemical balancing and UV-C purification are transforming pool maintenance, making it more precise and eco-friendly. These advanced systems reduce the need for harsh chemicals, leading to clearer and safer water. For instance, AI can optimize chlorine levels, potentially reducing chemical usage by up to 20% while maintaining optimal sanitation.

Leslie's is well-positioned to capitalize on this trend by offering these cutting-edge water quality solutions. Customers are increasingly seeking convenience and sustainability, and these technologies deliver both. The market for smart pool technology is projected to grow significantly, with some reports estimating a compound annual growth rate (CAGR) of over 10% in the coming years, indicating strong demand for such advancements.

E-commerce and Digital Retail Platforms

The retail landscape is increasingly defined by unified commerce, where consumers expect a smooth transition between online and in-store interactions. Leslie's commitment to its robust online platform is therefore paramount. This digital presence allows the company to connect with a significantly broader customer base, offering them convenient access to its product catalog and valuable information, thereby enhancing their shopping journey.

Leslie's strategic investments in its e-commerce capabilities are directly fueling its growth trajectory. By focusing on areas like personalized product recommendations and optimizing delivery logistics, the company aims to enhance customer satisfaction and drive repeat business. For instance, Leslie's reported that its e-commerce sales represented approximately 22% of its total net sales in the fiscal year 2023, a testament to the growing importance of its digital channels.

- Unified Commerce Expectations: Consumers now demand integrated online and offline shopping experiences, blurring the lines between digital and physical retail.

- Online Platform Reach: Leslie's strong e-commerce presence is essential for accessing a wider market and providing easy product access and information.

- Investment in Digital Capabilities: Ongoing investment in personalization, efficient delivery, and user experience is critical for Leslie's continued e-commerce success.

- E-commerce Contribution: In fiscal year 2023, e-commerce accounted for around 22% of Leslie's total net sales, highlighting its significant role in the company's revenue.

Robotic Pool Cleaners and Maintenance Tools

Technological advancements in robotic pool cleaners are significantly reducing the manual effort required for pool maintenance. These devices, now incorporating AI for intelligent navigation, can map pool layouts and identify areas with concentrated debris, leading to more efficient cleaning cycles. This innovation directly benefits homeowners by offering a more convenient and effective solution for keeping their pools pristine.

Leslie's can capitalize on this trend by expanding its range of advanced robotic pool cleaning solutions. The market for these smart devices is growing, with the global robotic pool cleaner market projected to reach approximately $1.8 billion by 2027, indicating strong consumer adoption. Offering these high-tech tools aligns with customer demand for convenience and time-saving products.

- AI-Powered Navigation: Robots can now create virtual maps of pools, optimizing cleaning paths and ensuring comprehensive coverage.

- Enhanced Efficiency: Targeted debris removal and improved water circulation reduce cleaning time and energy consumption.

- Market Growth: The increasing demand for automated home solutions drives innovation and sales in the robotic pool cleaner sector.

- Leslie's Opportunity: Expanding product lines to include these advanced cleaners can attract new customers and enhance loyalty.

Technological advancements are revolutionizing pool care, with IoT integration and smart automation offering unprecedented convenience. Consumers can now manage pool functions remotely via smartphones, a trend supported by the global smart home market's projected growth to over $150 billion in 2024. Leslie's can leverage this by expanding its smart pool product lines, including Wi-Fi pumps and smart sensors, to meet this demand for connected and automated solutions.

Legal factors

Leslie's, a significant player in the pool chemical market, faces stringent federal and state regulations. These rules cover everything from how chemicals are made and labeled to how they're stored and ultimately disposed of, all crucial for public safety and safeguarding the environment.

For instance, the Environmental Protection Agency (EPA) oversees regulations like the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), which requires proper registration and labeling of pesticides, including many pool sanitizers. State-specific environmental agencies often impose even stricter rules on chemical handling and waste disposal, with California's Department of Toxic Substances Control (DTSC) being a notable example of a state with robust chemical management laws.

Failure to navigate this complex legal landscape can result in substantial penalties. In 2023 alone, the EPA reported significant enforcement actions against companies for violations of environmental laws, leading to millions in fines. For Leslie's, even minor breaches could trigger costly legal battles, operational disruptions, and severe damage to its brand reputation, impacting investor confidence and customer loyalty.

Leslie's operates under stringent product liability laws, meaning the company is accountable for any harm caused by its products if they are found to be defective or unsafe. This necessitates a robust quality control system to mitigate risks and potential legal repercussions.

Adherence to consumer protection laws is paramount, requiring Leslie's to provide truthful product information and honor warranty commitments. These regulations are in place to ensure fair dealings and build consumer trust.

The Consumer Product Safety Commission (CPSC) consistently highlights the importance of safety in the pool and spa industry. For instance, in 2023, the CPSC reported thousands of pool and spa-related injuries, underscoring the critical need for Leslie's to maintain and exceed rigorous product safety standards across its entire product line.

Leslie's, operating numerous retail stores, service centers, and a corporate headquarters, navigates a complex web of labor laws. These regulations govern everything from minimum wage requirements to workplace safety and anti-discrimination policies, directly affecting their operational costs and human resource strategies.

Potential shifts in federal or state minimum wage laws represent a significant factor. For instance, if the federal minimum wage were to increase, it could directly impact Leslie's payroll expenses, particularly for their numerous retail and service roles. Similarly, evolving regulations around overtime pay or mandated employee benefits could add further costs.

The landscape of unionization is also a critical consideration. Increased union activity or the successful organization of employee groups within Leslie's could lead to new collective bargaining agreements, potentially altering wage structures, benefit packages, and overall employment terms. This can influence operational flexibility and financial planning.

Furthermore, Leslie's must remain vigilant regarding changes in employment discrimination laws and regulations concerning working conditions. Compliance with these evolving standards is paramount to avoid legal challenges and maintain a positive brand reputation, requiring ongoing investment in training and policy updates.

Data Privacy and Cybersecurity Regulations

Leslie's operates a significant online platform, necessitating strict adherence to data privacy regulations like the California Consumer Privacy Act (CCPA). As of early 2024, the CCPA continues to evolve, impacting how companies manage consumer data. Failure to comply can result in substantial fines, with potential penalties reaching thousands of dollars per violation. The company must also consider emerging federal privacy legislation that could impose further obligations on data handling practices.

Protecting customer information through robust cybersecurity is paramount for Leslie's. Data breaches not only expose the company to significant legal liabilities but also erode invaluable customer trust. In 2023, the average cost of a data breach in the retail sector reached $4.99 million, highlighting the financial risks involved. Investing in advanced cybersecurity measures is therefore essential to safeguard sensitive data and maintain operational integrity.

- CCPA Enforcement: California's Attorney General actively enforces CCPA, with fines potentially reaching $7,500 per intentional violation.

- Cybersecurity Investments: Companies are increasingly allocating larger budgets to cybersecurity. For instance, global spending on cybersecurity solutions was projected to reach over $200 billion in 2024.

- Customer Trust Impact: A data breach can lead to a significant drop in customer retention, with studies indicating that over 60% of consumers will stop doing business with a company after a breach.

Intellectual Property and Patent Laws

Leslie's, Inc. navigates a landscape where intellectual property and patent laws are critical for both protection and competitive positioning. The company may hold patents for its proprietary pool and spa products, such as advanced filtration systems or innovative chemical formulations, safeguarding its unique innovations from imitation.

Compliance with patent laws is essential to avoid infringing on the intellectual property rights of competitors, which could lead to significant legal challenges and financial penalties. For instance, in 2023, the global patent market saw continued robust activity, with companies investing heavily in R&D to secure new patents across various sectors, highlighting the importance of a strong IP portfolio.

Leslie's must also be vigilant in monitoring the patent landscape to identify potential licensing opportunities or threats. The ability to legally protect its own product designs and technological advancements is a key factor in maintaining its market share and profitability.

- Patent Protection: Leslie's actively pursues patents to protect its unique product innovations and technologies.

- Infringement Avoidance: The company diligently works to avoid infringing on the existing patents of competitors.

- Competitive Edge: Strong intellectual property rights are crucial for Leslie's to maintain its competitive advantage in the market.

- Legal Risk Mitigation: Adherence to patent laws helps Leslie's prevent costly legal disputes and protect its financial stability.

Legal factors significantly shape Leslie's operations, from product safety regulations enforced by agencies like the EPA and CPSC to labor laws governing employee relations. Compliance with these mandates, including data privacy laws like CCPA, is crucial to avoid substantial fines and protect brand reputation, as seen in the millions in penalties levied for environmental violations in 2023.

The company must also manage product liability, ensuring all pool and spa chemicals and equipment meet rigorous safety standards to prevent costly lawsuits and maintain customer trust. Adherence to consumer protection laws, requiring truthful marketing and honored warranties, further reinforces the need for diligent legal oversight.

Navigating intellectual property laws is also key, with Leslie's investing in patent protection to safeguard its innovations and avoid infringing on competitors' rights, a critical aspect in the competitive pool supply market where global patent activity remains robust.

Leslie's faces evolving labor laws that impact payroll and workplace practices, with potential minimum wage increases and changes in overtime regulations directly influencing operational costs. Unionization efforts could also reshape employment terms, necessitating careful management of employee relations and compliance with anti-discrimination statutes.

Environmental factors

Increasing water scarcity, especially in drought-prone areas like California and Arizona, directly affects the pool industry. Leslie's must highlight water-saving products, such as high-efficiency filters and rainwater collection systems, to meet growing environmental awareness and potential regulations. This proactive approach also involves promoting smart pool covers, which can reduce water evaporation by up to 95%.

The disposal of pool chemicals and associated waste materials is governed by increasingly stringent environmental regulations. Leslie's must ensure its operational procedures and the guidance provided to customers align with safe and responsible disposal practices to mitigate pollution risks. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets standards for hazardous waste management, which can impact how certain pool chemicals are handled by businesses and consumers alike. Leslie's plays a vital role in educating its customer base on proper chemical handling and disposal, a responsibility underscored by a growing consumer demand for eco-friendly solutions, with sustainability initiatives gaining traction in the retail sector throughout 2024 and projected to intensify in 2025.

The pool industry is seeing a significant push towards lower energy use and smaller carbon footprints. This is fueled by increasing environmental consciousness and the rising cost of utilities. For example, electricity prices in the US saw a 4.1% increase in 2023 compared to 2022, according to the U.S. Energy Information Administration (EIA).

Leslie's can actively participate in this shift by highlighting and selling energy-saving pool equipment. Think variable-speed pumps, LED lighting, and pool covers designed to retain heat. Promoting solar-powered pool heaters and automation systems that intelligently manage filtration and heating cycles can also significantly cut energy consumption for customers.

The concept of net-zero energy pools is becoming more popular. These systems aim to generate as much energy as they consume, often through solar panels. As of early 2024, the residential solar market continues to grow, with installations increasing year-over-year, making these solutions more accessible and cost-effective.

Climate Change Impact on Pool Usage

Changing climate patterns, marked by more extreme weather, are directly influencing the pool season. For instance, extended periods of high temperatures in many regions can lengthen the demand for pool-related products, while increased storm frequency or inconsistent humidity might shorten it or impact water quality, requiring more frequent chemical adjustments. Leslie's needs to be agile, adjusting its product mix and service advice to align with these unpredictable environmental shifts.

The impact on water chemistry and maintenance is significant. Unpredictable rainfall patterns and fluctuating temperatures can disrupt the delicate balance of pool water, potentially leading to increased demand for specific chemicals like algaecides or pH balancers. Leslie's reported in its Q1 2024 earnings that a significant portion of its sales are driven by seasonal demand, underscoring the sensitivity of its business to weather patterns. In 2023, the company saw a 5% increase in sales of pool chemicals in regions experiencing prolonged heatwaves, as documented in their annual report.

- Extended warm seasons: Can boost demand for pool opening and maintenance supplies.

- Extreme weather events: May lead to increased need for pool repair and water treatment chemicals.

- Shifting humidity levels: Can affect water clarity and require different maintenance strategies.

Sustainability in Product Sourcing and Packaging

Consumers increasingly prioritize sustainability, influencing purchasing decisions for pool and spa products. This trend translates to a demand for products made from responsibly sourced materials and packaged in eco-friendly ways. Leslie's can leverage this by highlighting sustainable sourcing and packaging in its marketing, potentially boosting brand loyalty among environmentally aware customers.

Leslie's commitment to sustainability can extend throughout its supply chain. For instance, exploring partnerships with suppliers who utilize recycled plastics or renewable resources for product components and packaging materials would align with consumer expectations. By 2024, many companies reported increased investment in sustainable packaging solutions, with a significant portion seeing positive impacts on brand perception and sales.

- Increased consumer preference for eco-friendly products.

- Growing demand for sustainable sourcing of raw materials.

- Emphasis on environmentally responsible product packaging.

- Opportunity for Leslie's to enhance brand image and customer appeal.

Environmental factors significantly influence Leslie's operations and product offerings. Water scarcity concerns are driving demand for water-saving pool accessories, with smart covers capable of reducing evaporation by up to 95%. Stricter regulations on chemical disposal necessitate consumer education on safe practices, aligning with a growing demand for eco-friendly solutions. The push for energy efficiency is evident, with electricity prices rising and consumers seeking energy-saving equipment like variable-speed pumps and solar heaters.

PESTLE Analysis Data Sources

Our PESTLE analysis for Leslie's is built on a robust foundation of publicly available data. We source information from government economic reports, industry-specific market research, and reputable financial news outlets to ensure a comprehensive understanding of the macro-environmental factors influencing Leslie's.