Leslie's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

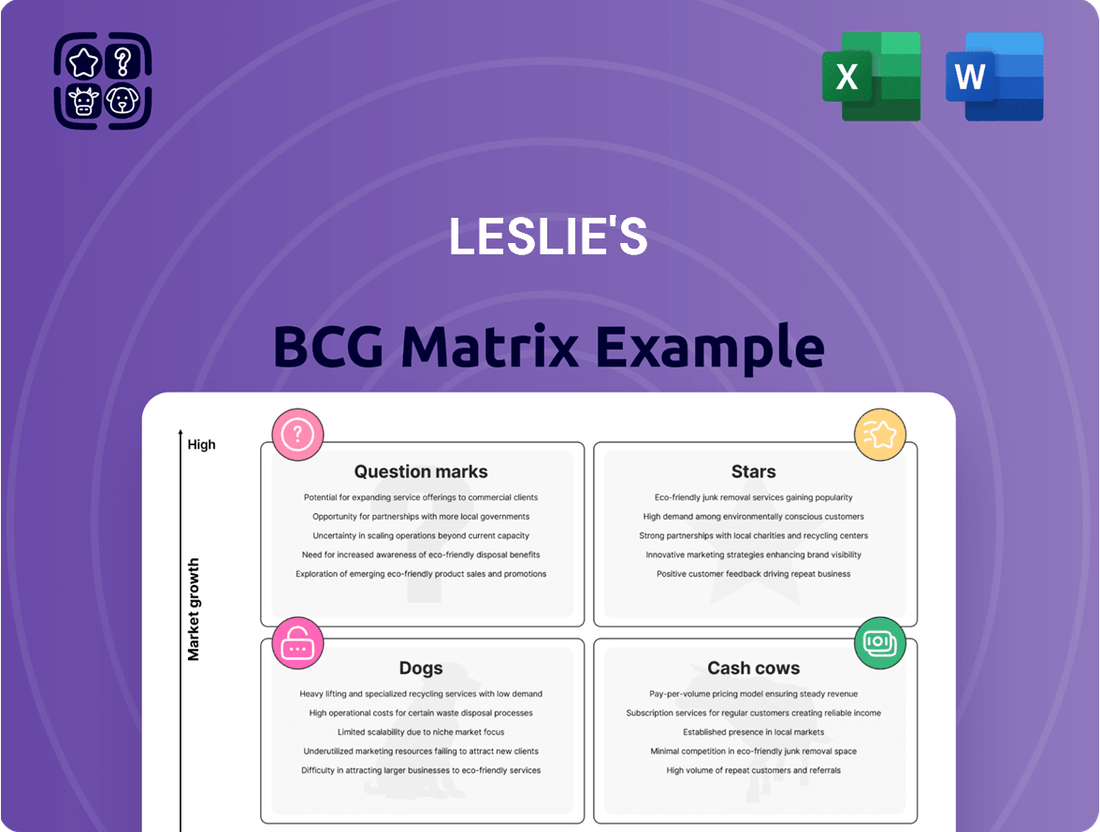

Curious about Leslie's product portfolio performance? Our BCG Matrix analysis offers a strategic glimpse into their market position. See which products are thriving 'Stars', generating steady income as 'Cash Cows', lagging as 'Dogs', or presenting exciting growth potential as 'Question Marks'.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Leslie's.

Stars

Leslie's strategic emphasis on enhancing customer convenience and maximizing asset utilization strongly aligns with the integration of Smart Pool Technology and IoT. This segment, encompassing automated water quality management, energy-efficient operations, and remote pool monitoring, is a clear Star in their BCG Matrix. The market for smart pool monitors is projected to grow at a robust compound annual growth rate of 13.2% from 2024 to 2032, fueled by consumer desire for effortless home management and smart technology integration.

This high-growth potential presents a significant opportunity for Leslie's to solidify its market position. By leveraging its established direct-to-consumer channels and deep service expertise, the company can effectively capture a larger share of this expanding market. The increasing adoption of these advanced pool solutions reflects a broader trend towards connected living and automated home maintenance, making Smart Pool Technology a key area for Leslie's future growth and profitability.

Leslie's Pro Pool Services and Specialized Products are a strong performer, often categorized as a Star in the BCG Matrix. In Q1 fiscal 2025, Pro Pool sales saw a significant 9% increase, outperforming the residential segment which experienced a decline.

This robust growth is attributed to improved inventory availability and a rise in pro partner agreements, highlighting Leslie's dominant market position in this high-potential sector.

The company is strategically investing in tailored Pro SKUs and upgrading its Pro store infrastructure. These investments are designed to capitalize on the growth trajectory of this segment, aligning with a strategy to bolster leading business units in expanding markets.

The pool and spa industry is increasingly focused on eco-friendly options, with a projected compound annual growth rate of 6.3% between 2025 and 2029. This trend encompasses sustainable materials, advanced water conservation technologies, and energy-efficient filtration.

Leslie's, as a dominant player, is well-positioned to capitalize on this burgeoning demand for sustainable pool solutions. By developing and promoting products like chlorine-free alternatives or solar-powered systems, the company can tap into a growing segment of environmentally conscious consumers.

Enhanced Digital Platform & Omnichannel Experience

Leslie's is making significant strides in its digital transformation, with e-commerce rapidly approaching 20% of total sales. This strategic investment in expanding online capabilities and refining its omnichannel approach is a key driver of its current success. The company reported a robust 15.7% growth in digital sales in a recent period, underscoring the increasing consumer preference for online convenience.

The ongoing focus on digital engagement, including the potential for same-day delivery, solidifies Leslie's advanced online platform as a Star within its portfolio. As digital sales continue their upward trajectory across the retail sector, Leslie's proactive development in this area positions it for sustained growth and market leadership. This commitment to a seamless online experience is crucial for capturing a larger share of the expanding digital retail market.

- E-commerce nearing 20% of total sales.

- 15.7% growth in digital sales in a recent period.

- Investment in omnichannel experience and potential same-day delivery.

- Digital sales growth aligns with broader retail sector trends.

Premium-Tier Pool Safety Equipment

Premium-tier pool safety equipment falls into the Stars category for Leslie's within the BCG Matrix. The global pool safety equipment market is experiencing robust growth, with projections indicating a compound annual growth rate of 7.5% from 2024 to 2032. This expansion is fueled by heightened consumer awareness regarding pool safety and the implementation of stricter regulatory standards worldwide.

As disposable incomes continue to climb, leading to a greater number of private pool installations, the demand for sophisticated safety solutions is escalating. Leslie's is well-positioned to capitalize on this trend by focusing on high-growth, high-value opportunities within the premium segment. This includes advanced features like smart pool alarms and automated safety covers, which cater to consumers seeking enhanced security and convenience.

Leslie's can solidify its market leadership by offering these premium products, meeting the evolving needs of a discerning customer base. The company's strategy should involve innovation and marketing efforts that highlight the superior safety and technological advantages of its premium offerings.

- Market Growth: Global pool safety equipment market expected to grow at a 7.5% CAGR from 2024-2032.

- Key Drivers: Increased awareness and stringent regulations are primary growth catalysts.

- Opportunity: Rising disposable income and private pool installations drive demand for advanced safety features.

- Leslie's Focus: Leading with premium offerings like smart pool alarms and automated covers represents a high-growth segment.

Leslie's Smart Pool Technology and IoT, alongside its Pro Pool Services and Specialized Products, are strong contenders for the Star category in the BCG Matrix. The company's digital transformation, with e-commerce nearing 20% of total sales and a recent 15.7% growth in digital sales, further solidifies its online platform as a Star. Premium-tier pool safety equipment also qualifies as a Star, driven by market growth and increasing consumer demand for advanced safety features.

The company's strategic focus on these high-growth, high-market-share segments indicates a proactive approach to capitalizing on emerging trends and solidifying its competitive advantage.

| Segment | BCG Category | Key Growth Drivers | Leslie's Strategic Focus | Relevant Data/Projections |

| Smart Pool Technology & IoT | Star | Consumer demand for convenience, smart home integration | Enhancing customer convenience, maximizing asset utilization | Market projected to grow at 13.2% CAGR (2024-2032) |

| Pro Pool Services & Specialized Products | Star | Industry focus on eco-friendly options, improved partner agreements | Investing in tailored Pro SKUs, upgrading Pro store infrastructure | Pro Pool sales up 9% in Q1 FY25; Pool/spa industry CAGR of 6.3% (2025-2029) for eco-friendly options |

| E-commerce & Digital Platform | Star | Consumer preference for online convenience, omnichannel retail | Expanding online capabilities, refining omnichannel approach | E-commerce approaching 20% of total sales; 15.7% growth in digital sales |

| Premium Pool Safety Equipment | Star | Heightened safety awareness, stricter regulations, rising disposable incomes | Focusing on high-value opportunities, advanced safety features | Global pool safety equipment market CAGR of 7.5% (2024-2032) |

What is included in the product

Leslie's BCG Matrix provides a strategic overview of its product portfolio, categorizing items into Stars, Cash Cows, Question Marks, and Dogs.

This analysis helps identify which of Leslie's products warrant investment, maintenance, or divestment to optimize its business.

Strategic clarity by visualizing business unit performance, alleviating the pain of uncertain resource allocation.

Cash Cows

Leslie's core pool chemical sales, particularly chlorine and pH balancers, are a bedrock of their operations, demonstrating robust growth in Q1 fiscal 2025. These are not discretionary items; pool owners must regularly repurchase them to maintain their pools. This recurring demand, within a mature market projected to grow at a 4.3% CAGR from 2025 to 2033, allows Leslie's to maintain a strong market share and generate consistent, high cash flow. The need for significant promotional investment is minimal, making these chemicals a classic cash cow.

Essential pool equipment, such as filters and pumps, represent Leslie's cash cows. These are fundamental, high-demand items for both new pool builds and existing pool maintenance. The swimming pool equipment market is projected to see robust growth, with an estimated CAGR of 5.1% from 2025 to 2034, underscoring the sustained demand for these core products.

Leslie's strong market leadership in this mature segment translates into a significant market share. This dominance allows the company to consistently generate reliable cash flow, which is crucial for funding other strategic growth areas within the business, such as investing in new product lines or expanding market reach.

Routine pool maintenance and repair services represent a significant Cash Cow for Leslie's. The market for these services is robust, projected to grow at a Compound Annual Growth Rate of 7.8% between 2024 and 2025, indicating sustained demand.

Leslie's strong presence, characterized by a wide network of service centers and a substantial number of certified technicians, allows them to capture a considerable market share in this crucial area. This dominance translates into reliable and predictable revenue streams that are vital for the company's financial health.

The profitability of these essential services is also a key factor, with high-profit margins contributing significantly to Leslie's overall earnings. This consistent financial performance solidifies the classification of pool cleaning and maintenance as a Cash Cow within the BCG Matrix framework.

Retail Store Network Sales

Leslie's extensive retail store network, boasting over 950 locations, acts as a cornerstone for customer engagement. This physical presence is critical for reaching both residential and commercial clients directly.

Despite a challenging start in early 2024, the retail sector demonstrated resilience with a notable rebound later in the year. This indicates a mature, stable market environment where Leslie's has solidified its position, consistently generating sales.

- Significant Market Share: Leslie's maintains a strong foothold in the pool and spa retail market through its vast store network.

- Consistent Revenue Generation: The 950+ locations contribute to a steady stream of sales, even amidst market volatility.

- Customer Touchpoint: Stores serve as the primary interface for customer interaction and product accessibility.

- Mature Market Presence: While the sector is mature, Leslie's established presence ensures continued sales performance.

Basic Hot Tub Chemicals and Accessories

Leslie's basic hot tub chemicals and accessories represent a classic cash cow within its product portfolio. Despite a 5% dip in residential hot tub sales during the first quarter of fiscal 2025, the consistent demand from the existing installed base of hot tub owners ensures a high market share in this low-growth segment. These essential items, such as sanitizers, pH balancers, and filter replacements, require very little in the way of new capital expenditure. This allows them to generate stable and predictable profits, contributing reliably to Leslie's overall financial health. The loyal customer base for these maintenance products provides a dependable revenue stream, a hallmark of a strong cash cow.

Key characteristics of this cash cow segment include:

- High Market Share: Leslie's established presence and brand recognition in the pool and spa supply market give it a dominant position in basic hot tub chemicals and accessories.

- Low Market Growth: The overall hot tub market, while experiencing some recent headwinds, is mature, meaning growth in new unit sales is modest.

- Steady Revenue Generation: The recurring nature of chemical purchases and accessory replacements provides a consistent and predictable income stream.

- Minimal Investment Required: Unlike high-growth areas, this segment does not necessitate significant reinvestment for expansion, allowing profits to be distributed elsewhere.

Leslie's core pool chemicals, like chlorine and pH balancers, are definite cash cows. Their sales showed strong growth in Q1 fiscal 2025. This is because pool owners need to buy them regularly, making it a stable market projected to grow at 4.3% annually until 2033. These chemicals don't need much promotion, ensuring consistent cash flow for Leslie's.

Essential pool equipment, such as filters and pumps, also function as Leslie's cash cows. These are fundamental items for both new pool construction and ongoing maintenance. The swimming pool equipment market is expected to experience healthy growth, with an estimated 5.1% CAGR from 2025 to 2034, confirming the persistent demand for these core products.

Leslie's strong market position in this mature segment means they hold a significant market share. This dominance allows the company to generate reliable cash flow, which is vital for funding other strategic growth initiatives within the business, such as developing new product lines or expanding their market reach.

Routine pool maintenance and repair services also contribute significantly as a Cash Cow for Leslie's. The market for these services is robust, projected to grow at a Compound Annual Growth Rate of 7.8% between 2024 and 2025, indicating sustained demand.

Leslie's broad retail store network, with over 950 locations, serves as a vital hub for customer interaction, reaching both residential and commercial clients directly. Despite early 2024 challenges, the retail sector showed resilience, reaffirming Leslie's established market position and consistent sales generation in a mature environment.

Basic hot tub chemicals and accessories are also strong cash cows for Leslie's. Even with a 5% dip in residential hot tub sales in Q1 fiscal 2025, the existing installed base ensures consistent demand and a high market share in this slow-growth segment. These essential items require minimal capital expenditure, leading to stable and predictable profits that bolster Leslie's financial health.

| Category | Growth Outlook (CAGR) | Leslie's Position | Cash Flow Impact |

| Core Pool Chemicals | 4.3% (2025-2033) | High Market Share | Consistent, High Cash Flow |

| Essential Pool Equipment | 5.1% (2025-2034) | Strong Market Leadership | Reliable Revenue Streams |

| Maintenance & Repair Services | 7.8% (2024-2025) | Extensive Service Network | High-Profit Margins |

| Basic Hot Tub Chemicals & Accessories | Low Growth (Mature Market) | High Market Share | Stable, Predictable Profits |

What You’re Viewing Is Included

Leslie's BCG Matrix

The BCG Matrix analysis you're previewing is the precise document you'll receive after purchase, offering a comprehensive breakdown of Leslie's product portfolio. This fully formatted report, devoid of watermarks or demo content, is ready for immediate strategic application. You can confidently expect the same in-depth analysis and professional presentation in the version you download, empowering your decision-making. This is the actual, editable file that will be yours to use for planning and presentations, providing actionable insights into Leslie's market position.

Dogs

Certain older or less efficient pool equipment models, or niche products with limited demand, fall into the Dogs category of Leslie's BCG Matrix. These items often possess a low market share within a slow-growing market segment. For example, Leslie's reported in their 2024 investor updates that they are actively working to optimize inventory, which includes identifying and phasing out slow-moving or obsolete stock that ties up capital and incurs holding costs without significant sales generation.

Some of Leslie's smaller or less strategically positioned retail stores might be considered "Dogs" in the BCG Matrix. These locations often struggle with low local market share and contribute very little to the company's overall growth. This is especially true as Leslie's continues to emphasize optimizing asset utilization and refining store layouts to improve efficiency.

These underperforming locations can become significant cash traps. When operational costs, such as rent, utilities, and staffing, exceed the revenue they generate, these stores drain resources. This is particularly concerning if they aren't part of a focused strategic initiative to revitalize or reposition them within Leslie's broader portfolio.

In 2023, Leslie's reported a decline in comparable store sales for certain segments, indicating that not all locations are performing at peak capacity. While specific data on individual store underperformance isn't publicly detailed, the overall trend suggests a need to evaluate the profitability and strategic fit of smaller, less productive outlets within their extensive retail network.

Commodity spa parts, like basic filters or standard pumps, often fall into the Dogs category for Leslie's. These items are frequently undifferentiated, meaning they offer little to distinguish them from what competitors sell. This leads to a marketplace where price becomes the primary deciding factor for consumers.

Because of this intense price competition, Leslie's likely experiences low profit margins on these commodity spa parts. In 2024, the market for these basic components is highly saturated. For instance, reports indicate that the average profit margin for generic pool and spa filters hovers around 10-15%, significantly lower than specialized or proprietary items.

These products consume resources in manufacturing, marketing, and inventory management but contribute minimally to overall market share growth. They don't offer a strong competitive advantage for Leslie's. In fact, the cost of acquiring and selling these parts might even outweigh the revenue generated, making them a drain on the company's resources.

Leslie's strategy for these Dog products would typically involve minimizing investment, potentially phasing them out if they consistently underperform or focusing on efficient, low-cost production to maintain a minimal presence. The goal is to free up capital and management attention for more promising business areas.

Inefficient or High-Maintenance Pool Cleaning Tools

Inefficient or high-maintenance pool cleaning tools, such as manual brushes and basic skimmers, are likely positioned as Dogs within Leslie's BCG Matrix. These products face a declining market as consumers increasingly favor automated and convenient solutions. For example, the global robotic pool cleaner market was valued at approximately USD 1.2 billion in 2023 and is projected to grow significantly, highlighting the shift away from manual methods.

The sales and profitability of these older cleaning tools are expected to diminish as consumer preferences evolve. This segment represents a low-growth, low-market share area for Leslie's, where investment may not yield substantial returns.

- Low Market Share: Manual cleaning tools have lost ground to advanced alternatives.

- Low Growth Potential: Consumer demand is shifting towards automated pool maintenance.

- Potential for Obsolescence: These products risk becoming outdated as technology advances.

- Reduced Profitability: Declining sales will impact the financial viability of this category.

Older, Less Efficient Chemical Formulations

Older, less efficient chemical formulations in Leslie's portfolio could be categorized as Dogs. These products, while perhaps having a historical market presence, are likely facing diminished demand as newer, more sustainable, and higher-performing alternatives emerge. For instance, by early 2024, the global specialty chemicals market saw a growing emphasis on green chemistry, with companies actively phasing out less eco-friendly legacy products.

The shift in consumer and regulatory preference towards environmentally conscious options directly impacts these older formulations. As the market gravitates towards solutions that offer better efficiency and a reduced environmental footprint, these legacy products are likely experiencing a decline in market share. This trend is evident across various industries, where the adoption of advanced chemical technologies is accelerating.

- Declining Market Share: Older chemical formulations often struggle to compete with newer, more advanced products in terms of performance and environmental impact, leading to a shrinking customer base.

- Increased Competition: The market is increasingly populated by innovative companies offering greener and more efficient chemical solutions, putting pressure on legacy products.

- Regulatory Pressures: Environmental regulations are becoming more stringent, making it challenging and costly for older, less compliant formulations to remain on the market.

- Cost Inefficiencies: In many cases, older formulations are less cost-effective to produce or use compared to their modern counterparts, further eroding their competitive edge.

Dogs within Leslie's BCG Matrix represent products or business units with low market share in a slow-growing or declining industry. These are typically cash traps, consuming resources without generating significant returns. Leslie's strategic approach for these items involves minimizing investment and considering divestment or phasing out to reallocate capital to more promising areas.

For example, certain older, less efficient pool cleaning tools, like basic manual brushes, are likely classified as Dogs. The market for these items is shrinking as consumers increasingly opt for automated solutions. This shift is underscored by the growing robotic pool cleaner market, valued at USD 1.2 billion in 2023, which highlights the decline in demand for manual alternatives.

Leslie's may also categorize some of its less strategically important retail locations as Dogs. These stores typically exhibit low market share within their local areas and contribute minimally to overall company growth. As of 2023, Leslie's reported a decline in comparable store sales in certain segments, suggesting that not all physical locations are performing optimally.

Commodity spa parts, such as generic filters, often fall into this category. They face intense price competition and low profit margins, with average margins for generic filters around 10-15% in 2024. These products consume operational resources without offering a significant competitive advantage or driving market share growth.

| BCG Category | Leslie's Example | Market Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | Older pool cleaning tools (e.g., manual brushes) | Slow-growing/declining market, low market share | Minimize investment, consider divestment |

| Dogs | Underperforming retail stores | Low local market share, minimal growth contribution | Optimize or phase out |

| Dogs | Commodity spa parts (e.g., generic filters) | Saturated market, low profit margins (10-15% in 2024) | Reduce inventory, focus on efficiency |

Question Marks

AI-driven predictive pool maintenance systems represent a significant growth opportunity, aligning with a market trend where 47% of pool service providers are already offering AI-powered solutions. This highlights a substantial shift towards automation and remote management.

While this technological advancement is a high-growth area, Leslie's current market share in fully AI-driven systems might be relatively small. This suggests a need for considerable investment to establish a leading position in this evolving segment.

Subscription-based premium pool care programs represent a promising avenue for Leslie's, aiming to capture recurring revenue through advanced, personalized services that go beyond standard maintenance. This strategy aligns with a growing demand for convenience and expert upkeep in the pool care market.

While Leslie's possesses a substantial customer base, the market's current adoption rate for these more elaborate, bundled subscription packages may be relatively low. This positions such premium programs as a 'Question Mark' within the BCG framework, indicating a need for significant investment in marketing and customer education to drive adoption.

For instance, a successful premium subscription could include services like weekly water chemistry balancing, seasonal equipment inspections, and even minor repairs, all bundled at a predictable monthly cost. Developing these tiered offerings could unlock substantial, consistent revenue streams.

The challenge lies in demonstrating the value proposition effectively to encourage customers to upgrade from basic services. Data from 2024 indicates a trend towards service-based revenue models in the home maintenance sector, with many companies reporting increased customer retention through subscription plans.

Specialized luxury pool and spa installations and remodels represent a potential Star or Question Mark for Leslie's. While the overall pool and spa market is robust, this niche segment likely has a low current market share for Leslie's. This would necessitate significant upfront investment in design expertise, highly skilled labor, and sophisticated project management capabilities to capture this high-growth, albeit currently underdeveloped, area.

Advanced Water Conservation & Recycling Technologies

Advanced water conservation and recycling technologies for pools are emerging as a significant growth area, driven by heightened environmental consciousness and stricter regulations. This sector is characterized by high potential, but also by nascent market penetration. Leslie's, while a leader in traditional pool supplies, may currently hold a relatively small share of this innovative segment. For example, the global smart water management market, which encompasses pool recycling, was valued at approximately $19.7 billion in 2023 and is projected to grow at a compound annual growth rate of over 15% through 2030, indicating substantial future demand.

To capitalize on this trend, Leslie's would need to strategically invest in research and development or forge partnerships to build its presence.

- Market Growth Potential: The increasing emphasis on sustainability positions water conservation and recycling technologies as a high-growth market.

- Leslie's Current Position: Leslie's may have a low market share in these emerging, high-growth solutions, requiring dedicated attention.

- Strategic Imperatives: Investment in R&D and the formation of strategic alliances are crucial for Leslie's to develop and market these advanced offerings effectively.

- Industry Data: The smart water management sector, relevant to pool recycling, is experiencing robust growth, with projections indicating sustained expansion in the coming years.

Niche Commercial Pool Solutions (e.g., Municipal Pools)

Niche commercial pool solutions, such as those for municipal pools, represent a potential star or question mark in Leslie's BCG Matrix. While Leslie's has a presence in the commercial sector, these highly specialized segments often demand unique equipment and service expertise, suggesting a high-growth opportunity where Leslie's current market share might be relatively low.

Capturing significant market share in municipal pools requires a tailored approach and substantial investment in specialized product lines and service capabilities. For instance, a municipal pool might require specific filtration systems or chemical treatment protocols that differ from standard commercial installations.

- High Growth Potential: The demand for well-maintained public aquatic facilities drives growth in municipal pool services.

- Specialized Needs: Municipal pools often have stringent safety regulations and require specialized equipment not common in other commercial settings.

- Investment Required: Entering this niche effectively necessitates investment in specific product lines and trained service personnel.

- Market Penetration: Leslie's current penetration in this specific segment may be lower than in broader commercial markets, indicating a growth opportunity.

Subscription-based premium pool care programs fall into the Question Mark category for Leslie's. These programs offer high growth potential by providing recurring revenue through advanced, personalized services, but current adoption rates might be low.

Significant investment in marketing and customer education is needed to highlight the value proposition and encourage upgrades from basic services. Industry data from 2024 shows a trend towards service-based revenue models in home maintenance, with subscriptions boosting customer retention.

Leslie's must strategically demonstrate the benefits of these premium packages to convert a larger portion of its customer base, making them a key area for focused development and investment to potentially shift them towards a Star.

Specialized luxury pool and spa installations represent another Question Mark. This niche segment offers high growth but requires substantial upfront investment in design, skilled labor, and project management, areas where Leslie's may currently have a low market share.

| BCG Category | Product/Service Offering | Market Growth | Leslie's Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Subscription-based premium pool care | High | Low to Moderate | Increase marketing and customer education to drive adoption and achieve Star status. |

| Question Mark | Luxury pool/spa installations | High | Low | Significant investment in specialized expertise and capabilities needed to capture market share. |

BCG Matrix Data Sources

Our BCG Matrix leverages financial reports, market research, and sales data to provide a comprehensive view of product performance and market share.