Konka Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Konka Group Bundle

Konka Group, a major player in consumer electronics, boasts significant strengths in its established brand recognition and extensive distribution network, particularly within China. However, it faces considerable threats from intense global competition and rapid technological advancements, which can quickly erode market share.

Internally, Konka's opportunities lie in leveraging its R&D capabilities for innovation and expanding into emerging markets. Conversely, its weaknesses include potential over-reliance on certain product categories and the need to adapt to evolving consumer preferences in a dynamic digital landscape.

Want the full story behind Konka Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research. Uncover actionable strategies to capitalize on opportunities and mitigate threats.

Strengths

Konka Group's diversified product portfolio is a significant strength, encompassing everything from televisions and refrigerators to mobile phones and specialized components like IC chips and LCD screens. This wide array of offerings, including their push into smart home solutions, reduces dependence on any single market segment. For instance, in 2023, their smart home segment saw notable growth, contributing to overall revenue stability despite fluctuations in other electronic goods markets.

Konka Group's dedication to research and development is a significant strength, with substantial strategic investments poured into advanced technologies like Micro LED, Mini LED, and 8K resolution. This focus is not just on adoption but on pioneering development, as demonstrated by their in-house creation of critical components such as Micro LED chips, storage controller chips, and AI chips. By controlling key technological aspects, Konka is well-positioned to lead in future display innovations.

Konka Group's strength lies in its deeply integrated vertical semiconductor operations, covering everything from raw materials to advanced packaging and testing. This comprehensive approach, driven by subsidiaries like Konsemi, allows for the development of end-to-end solutions for critical components, such as their work on storage controller chips.

This strategic vertical integration builds significant competitive moats, reducing dependency on third-party suppliers and fostering greater control over the supply chain. For instance, by controlling the entire process, Konka can significantly improve its production efficiency and accelerate the time it takes to bring new semiconductor products to market.

The company's investment in its semiconductor capabilities is substantial. In 2023, Konka Group reported significant R&D expenditure, with a notable portion allocated to its semiconductor segment, underscoring its commitment to building these core competencies. This proactive investment is crucial for navigating the complex and capital-intensive semiconductor industry.

By owning key stages of production, Konka can ensure higher quality control and potentially achieve cost advantages. This is particularly relevant in the current market environment, where supply chain disruptions have been a persistent challenge for many tech companies, highlighting the resilience of Konka's integrated model.

Strategic Acquisition by China Resources

The strategic acquisition of a stake in Konka Group by China Resources, a major state-owned enterprise, is a significant strength, opening doors for substantial synergy. This move allows Konka to tap into CR Micro's semiconductor expertise, potentially accelerating technology development and integration. For instance, CR Micro's established presence in the semiconductor industry can streamline Konka's component sourcing and innovation pipeline.

Furthermore, leveraging China Resources Vanguard's extensive retail network offers a powerful avenue for enhanced distribution and market reach. This partnership could significantly boost Konka's product visibility and sales volume across China. In 2023, China Resources Vanguard operated over 3,000 retail outlets, providing a vast platform for Konka's consumer electronics.

This backing from a large, state-backed entity provides Konka with enhanced financial stability and potential for operational revitalization. It can lead to improved market positioning and a stronger competitive edge, especially in the fast-evolving electronics sector. The infusion of capital and strategic guidance can be a catalyst for Konka's growth trajectory.

- Synergistic Opportunities: Integration with CR Micro's semiconductor capabilities and China Resources Vanguard's retail network.

- Technological Advancement: Potential for improved component sourcing and faster innovation through semiconductor alignment.

- Market Expansion: Access to China Resources Vanguard's extensive retail footprint, estimated at over 3,000 outlets as of 2023.

- Financial Stability: Enhanced backing from a state-owned enterprise, fostering revitalization and improved market standing.

Global Market Reach and Manufacturing Capacity

Konka Group boasts an impressive global market reach, exporting its diverse product range to over 110 countries spanning five continents. This extensive international presence is bolstered by a well-established and effective marketing network, ensuring brand visibility and accessibility worldwide. The company's significant manufacturing capacity, capable of producing more than 17 million televisions annually, underpins its ability to meet global demand efficiently. This dual strength in market penetration and production volume allows Konka to cater to a vast and varied international customer base, a key advantage in the competitive consumer electronics sector.

Konka Group's diversified product portfolio is a significant strength, encompassing everything from televisions and refrigerators to mobile phones and specialized components like IC chips and LCD screens. This wide array of offerings, including their push into smart home solutions, reduces dependence on any single market segment. For instance, in 2023, their smart home segment saw notable growth, contributing to overall revenue stability despite fluctuations in other electronic goods markets.

What is included in the product

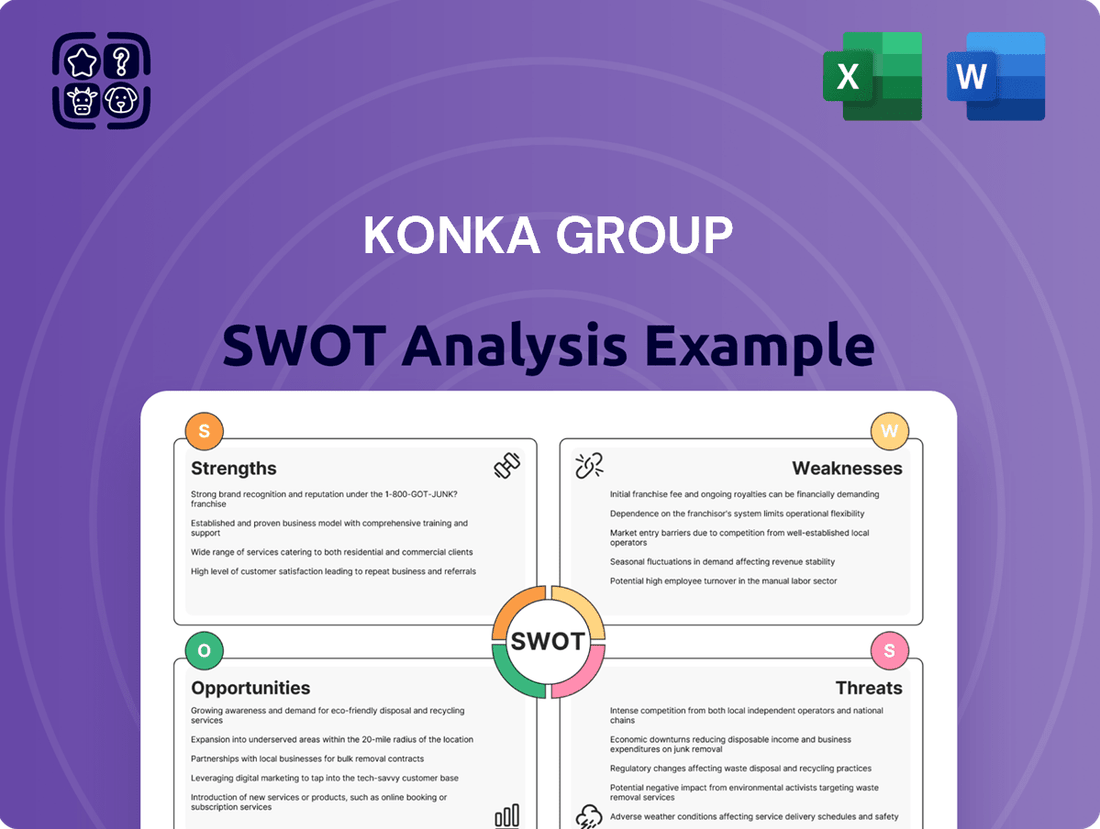

Analyzes Konka Group’s competitive position through key internal and external factors, detailing its strengths in brand recognition and market share alongside weaknesses in product innovation and its opportunities in expanding into new markets and threats from intense competition.

Offers a clear breakdown of Konka Group's competitive landscape to identify actionable growth opportunities.

Weaknesses

Konka Group has been grappling with significant financial underperformance. For 2024, the company projected a substantial revenue decline of 38% and anticipated a net loss amounting to $450 million.

While Q1 2025 showed a profit jump, the outlook for the first half of 2025 indicates a notable decrease in net income attributable to the parent company. This persistent financial strain points to underlying operational inefficiencies and intense market pressures that are hindering profitability.

Konka's traditional consumer electronics business, especially color TVs, is a significant weakness due to fierce market competition, leading to persistent deficits. This segment experienced a 2.5% year-on-year decline in revenue for the first half of 2024, directly impacting overall profitability.

Sales strategy adjustments and delays in launching new, innovative products have further hampered the core business, contributing to a 15% decrease in gross profit for the segment in the same period. This inability to quickly adapt to market demands is a critical concern.

Furthermore, Konka's product structure has struggled to align with evolving national subsidy policies, particularly concerning energy efficiency standards. The necessary cleanup of non-first-level energy efficiency products resulted in an estimated 50 million RMB in write-offs, directly impacting gross profit negatively.

Konka's significant investments in its semiconductor business are currently in the early stages of industrialization. This means that while substantial capital is being deployed, the company has not yet achieved efficient large-scale production capabilities.

Consequently, this emerging segment is not yet a significant contributor to Konka's overall operating profit. The nascent nature of this business acts as a drag on the company's financial performance, as the costs of development and setup outweigh current returns.

For example, Konka announced plans to invest ¥10 billion (approximately $1.4 billion USD) in its semiconductor division through 2025. However, as of early 2024, the revenue generated from this segment remains minimal compared to its consumer electronics divisions.

Weak Domestic Market Positioning

Konka is facing significant challenges in its domestic market, particularly within China's highly competitive television sector. The company's market positioning has weakened considerably, with recent data indicating a slip to eighth place in offline sales and a concerning twelfth place in online sales for TVs. This drop highlights Konka's difficulty in effectively competing against both established domestic brands and strong international players that continue to capture market share.

The struggle to maintain and improve brand visibility and market share within its home market remains a critical hurdle for Konka. This weakness directly impacts its ability to leverage the large Chinese consumer base, a fundamental requirement for growth in the consumer electronics industry.

- Weakened Market Rank: Konka's TV market share has declined, placing it eighth offline and twelfth online in China.

- Intensified Competition: The company struggles against robust domestic and international competitors in its primary market.

- Brand Visibility Issues: Improving brand recognition and presence within China is a significant ongoing challenge.

- Market Share Decline: Konka is losing ground in its home market, impacting overall sales performance.

High Financial Cost Pressure

Konka Group is experiencing significant financial cost pressure, largely due to its substantial interest-bearing liabilities. This debt load directly impacts the company's ability to invest in crucial growth opportunities and can significantly hinder its profitability. For instance, as of late 2023, Konka's total debt stood at approximately RMB 30.6 billion, with a notable portion carrying interest expenses that eat into margins. Effectively managing and reducing these financial obligations is paramount for strengthening Konka's overall financial standing and future operational flexibility.

The weight of these liabilities presents a considerable challenge for Konka, potentially limiting capital allocation towards research and development, market expansion, or strategic acquisitions. This financial strain directly affects the bottom line, as interest payments divert resources that could otherwise be reinvested in the business. For example, in the first half of 2024, the company reported increased finance costs, underscoring the ongoing impact of its debt structure on its financial performance.

To navigate this weakness, Konka must prioritize strategies aimed at deleveraging its balance sheet. This could involve:

- Optimizing Debt Structure: Renegotiating terms or refinancing high-interest debt to lower overall financing costs.

- Improving Cash Flow Generation: Enhancing operational efficiency and sales to generate more internal funds for debt repayment.

- Asset Divestment: Strategically selling non-core assets to raise capital for debt reduction.

- Equity Financing: Exploring options for raising capital through equity issuance, though this could dilute existing ownership.

The success of these initiatives will be critical in alleviating the financial cost pressure and freeing up resources for more strategic investments, ultimately bolstering Konka's long-term competitiveness and financial health.

Konka's traditional color TV business faces intense competition, leading to revenue declines. The company's market position in China has weakened significantly, evidenced by its drop to eighth in offline and twelfth in online TV sales. This decline highlights difficulties in brand visibility and market share within its crucial domestic market.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Market Share Decline (TV) | Weakened position in China's TV market. | Reduced sales and revenue potential. | 8th offline, 12th online sales rank (China). |

| Intense Competition | Struggles against domestic and international rivals. | Erodes profitability and market presence. | 2.5% revenue decline (H1 2024) in traditional segment. |

| Brand Visibility | Difficulty in enhancing brand recognition in China. | Hinders ability to capture market share. | N/A (Qualitative weakness). |

Preview Before You Purchase

Konka Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Konka Group's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive analysis provides actionable insights to inform strategic decisions. Understand Konka's competitive landscape and unlock its full potential.

Opportunities

The acquisition by China Resources (CR) presents a prime opportunity to weave Konka's operations into CR Micro's semiconductor expertise and China Resources Vanguard's vast retail network. This integration could foster significant technological leaps and streamline supply chains, ultimately broadening Konka's reach to consumers through established sales channels.

This strategic alignment has the potential to breathe new life into the Konka brand, enhancing its market standing. By leveraging CR's extensive resources, Konka can tap into new consumer segments and strengthen its competitive edge in the rapidly evolving electronics and technology landscape.

For instance, China Resources' retail footprint, which saw robust sales growth in consumer electronics during the 2024 holiday season, provides Konka with immediate access to a massive customer base. This synergy is expected to drive substantial revenue growth for Konka in the coming years, building on the 15% year-over-year increase in consumer electronics sales reported by China Resources Vanguard in late 2024.

The global smart home market is experiencing significant expansion, with projections indicating a compound annual growth rate of over 15% through 2028. This surge is fueled by increasing internet accessibility and the widespread adoption of 5G technology, making connected devices more feasible and appealing to consumers seeking convenience and energy efficiency. Konka is strategically positioned to benefit from this trend, leveraging its existing strengths in AIoT, 5G, and smart home platform development.

By further integrating its cloud-edge-chip architectures, Konka can transition from a hardware-centric approach to a more sustainable, service-driven business model. This evolution is critical for capturing recurring revenue streams and enhancing customer loyalty within the competitive smart home ecosystem.

The consumer electronics semiconductor market is showing strong signs of recovery. We're seeing a significant uptick in shipments for devices like smartphones, tablets, and wearables. This rebound is further bolstered by a notable trend towards localization within China, meaning more components are being sourced domestically.

Konka's strategic investments in developing and manufacturing its own chips position it perfectly to capitalize on this renewed demand. By focusing on domestic chip capabilities, Konka can lessen its dependence on overseas suppliers, which is a major advantage in today's global supply chain environment.

This strategy creates a more secure and defensible market position for Konka. For instance, the global semiconductor market for consumer electronics is projected to grow, with some analysts forecasting a compound annual growth rate (CAGR) of over 6% between 2024 and 2029, driven by these very trends.

International Market Expansion and Partnerships

Konka Group is actively pursuing a globalization strategy, evidenced by its recent re-entry into the Sri Lankan market via a strategic partnership. This move signals a broader ambition to tap into new territories and diversify its customer base.

Identifying and penetrating underserved or high-growth international markets presents a significant opportunity for Konka. Regions such as the Asia Pacific, the Middle East, and Latin America are particularly attractive for their burgeoning consumer economies and demand for electronics.

- Market Diversification: Expanding into these regions can reduce reliance on its domestic market, offering a more resilient revenue stream.

- Revenue Growth: Emerging markets often have a growing middle class with increasing disposable income, creating substantial sales potential.

- Strategic Alliances: Forming partnerships in these new markets can accelerate market penetration and leverage local expertise.

Advancement and Commercialization of Display Technologies

Konka's commitment to advancing display technologies like Micro LED, Mini LED, and OLED offers a prime opportunity to stand out in the premium market. The company's ongoing investments in research and development are crucial for these innovations. For instance, the global market for OLED displays alone was projected to reach approximately $25.5 billion in 2024, highlighting the significant potential for growth in high-end segments.

As manufacturing processes mature and costs for these cutting-edge displays potentially decline, Konka can leverage them as significant growth engines. This is especially true for the ultra-high-definition consumer television market and various commercial applications. By focusing on these advanced technologies, Konka can secure a competitive edge and capture greater market share in lucrative areas.

Key opportunities include:

- Leading the charge in Micro LED adoption, a technology offering superior brightness and contrast ratios, which Konka has been actively developing.

- Expanding Mini LED applications beyond premium TVs into areas like automotive displays and professional monitors, capitalizing on their improved backlighting capabilities.

- Capitalizing on the growing OLED market by offering innovative form factors and enhanced viewing experiences in their product lines.

- Leveraging cost reductions in advanced display manufacturing to make these premium technologies more accessible, thereby broadening their market reach.

Konka's integration with China Resources (CR) presents a significant opportunity to leverage CR Micro's semiconductor prowess and CR Vanguard's extensive retail network. This synergy can accelerate technological advancements and optimize supply chains, directly increasing Konka's consumer reach through established sales channels, building on CR's reported 15% year-over-year growth in consumer electronics sales in late 2024.

The expanding global smart home market, projected to grow at over 15% annually through 2028, offers a strong avenue for Konka, particularly with its AIoT and 5G capabilities. By shifting towards a service-driven model through integrated cloud-edge-chip architectures, Konka can generate recurring revenue and enhance customer loyalty.

Konka's strategic investments in domestic chip development align perfectly with the recovery in consumer electronics semiconductor shipments and the trend towards localization in China. This focus on in-house chip manufacturing strengthens its supply chain security and market position, capitalizing on a global consumer electronics semiconductor market forecast to grow at over 6% CAGR between 2024 and 2029.

The company's globalization efforts, including its re-entry into Sri Lanka, open doors to high-growth international markets like the Asia Pacific, Middle East, and Latin America. This diversification reduces reliance on its domestic market and taps into growing consumer economies, potentially boosting revenue significantly.

Konka's advancements in display technologies such as Micro LED, Mini LED, and OLED present a compelling opportunity in the premium segment, where the OLED market alone was valued at approximately $25.5 billion in 2024. As manufacturing costs decrease, these technologies can become significant growth drivers, especially in the ultra-high-definition TV market.

Threats

The consumer electronics sector, particularly in color televisions, is a battleground of intense competition, often leading to aggressive price wars that shrink profit margins. Konka Group contends with formidable domestic and global competitors who consistently introduce new products and engage in price reductions to capture market share.

This relentless competitive environment directly impacts Konka's revenue streams, profitability, and overall standing in the market. For instance, in 2023, the global TV market saw significant price declines across major brands, with some reports indicating an average price drop of over 10% year-on-year for popular screen sizes.

This constant pressure necessitates substantial investment in research and development to stay ahead, while simultaneously squeezing operational margins. Konka's ability to maintain profitability is directly challenged by rivals' pricing strategies, making it difficult to sustain healthy profit levels.

The consumer electronics landscape is defined by relentless innovation, with product lifecycles shrinking dramatically. Konka faces the significant threat of its offerings becoming outdated as new technologies emerge at an accelerating pace. For instance, the rapid development in AI integration and the push towards 8K resolution in displays mean that products launched even just a year ago can quickly lose their competitive edge.

To counter this, substantial and ongoing investment in research and development is crucial for Konka to remain relevant. Failure to adapt swiftly to trends such as foldable screens or advanced smart home functionalities can lead to diminished market share and brand perception. In 2024, the global consumer electronics market saw a significant portion of revenue driven by products incorporating AI features, highlighting the imperative for continuous innovation.

Global economic volatility poses a significant threat to Konka Group. Economic downturns, escalating trade tensions, and ongoing geopolitical instability can severely disrupt international supply chains, directly impacting Konka's ability to source components and distribute its products. This volatility also erodes consumer spending power worldwide.

As a major global manufacturer, Konka is inherently vulnerable to these external shocks. Fluctuations in the cost of raw materials, coupled with persistent logistics challenges and unpredictable shifts in international trade policies, can dramatically increase production costs. For instance, the semiconductor shortage that began in 2020 and continued through 2023 significantly hampered electronics production globally, a sector Konka operates within.

These external factors directly influence market demand. A global economic slowdown, such as the potential recessionary pressures observed in late 2024 forecasts from institutions like the IMF, could lead to reduced consumer appetite for electronics and home appliances, Konka's core product lines. This could result in lower sales volumes and profitability for the company.

Privacy and Security Concerns in Smart Devices

As Konka Group broadens its smart home and Internet of Things (IoT) product lines, growing consumer apprehension regarding data privacy and cybersecurity presents a significant challenge. Reports indicate a rise in IoT-related security incidents, with some experts predicting a substantial increase in attacks targeting connected devices by 2025. A perceived lack of robust security or a significant data breach affecting Konka's smart devices could severely damage consumer confidence, potentially slowing the adoption of its innovative products.

The increasing sophistication of cyber threats means that even well-intentioned security measures can be circumvented. For instance, the global IoT device market is projected to reach over 29 billion connected devices by 2030, creating a vast attack surface. Konka must prioritize developing and implementing advanced encryption, secure authentication protocols, and regular firmware updates to mitigate these risks.

- Growing Consumer Awareness: Consumers are increasingly vocal about their data privacy rights, demanding transparency in how their information is collected and used by smart devices.

- Regulatory Scrutiny: Governments worldwide are implementing stricter data protection regulations, such as GDPR and similar frameworks, which could impose significant compliance burdens and penalties for non-compliance.

- Reputational Damage: A single high-profile security breach could lead to irreparable damage to Konka's brand reputation, impacting sales across all product categories.

- Impact on Adoption Rates: Public trust is paramount for smart home technology; if consumers fear their data is not secure, they will be hesitant to invest in these ecosystems.

Challenges in Integrating Acquisitions and Realizing Synergies

Integrating acquisitions and achieving anticipated synergies presents a substantial challenge for Konka Group, even with the backing of China Resources. A key concern is the successful assimilation of Konka's historically underperforming segments, which could prove difficult.

Cultural clashes and operational intricacies between the two entities could also complicate the integration process, potentially hindering the realization of expected benefits. Konka's past financial difficulties add another layer of complexity, requiring careful management to avoid further strain.

For instance, if Konka's revenue growth in 2024, which has shown some recovery, does not translate into improved profitability post-acquisition, it could strain China Resources' resources. The failure to unlock synergies, such as cost savings or enhanced market share, might exacerbate Konka's existing financial pressures, impacting the overall success of the strategic move.

- Cultural Integration: Bridging potential differences in management styles and corporate cultures between Konka and China Resources is critical for smooth operations.

- Operational Synergies: Realizing cost efficiencies through shared resources or supply chain optimization requires meticulous planning and execution.

- Financial Performance: Ensuring that Konka's business units contribute positively to profitability after integration is paramount to avoid financial drag.

- Market Realization: Capturing the projected market share gains or revenue enhancements depends on effective go-to-market strategies post-acquisition.

Konka faces intense global competition, with rivals frequently engaging in price wars that erode profit margins. For example, the global TV market saw average price drops exceeding 10% in 2023, directly impacting Konka's profitability.

The rapid pace of technological advancement in consumer electronics, such as AI integration and 8K displays, necessitates continuous R&D investment to avoid product obsolescence, as highlighted by the significant revenue driver of AI features in 2024.

Global economic instability, trade tensions, and geopolitical issues disrupt supply chains and reduce consumer spending, as evidenced by the lingering effects of the 2020-2023 semiconductor shortage and potential recessionary pressures forecasted for late 2024.

Growing consumer concerns over data privacy and cybersecurity in the expanding IoT market pose a threat; a data breach could severely damage Konka's reputation and hinder smart device adoption, especially with the IoT market projected to reach over 29 billion devices by 2030.

SWOT Analysis Data Sources

This Konka Group SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary. These sources are combined with analysis of official company disclosures and independent market research to ensure a robust and accurate assessment.