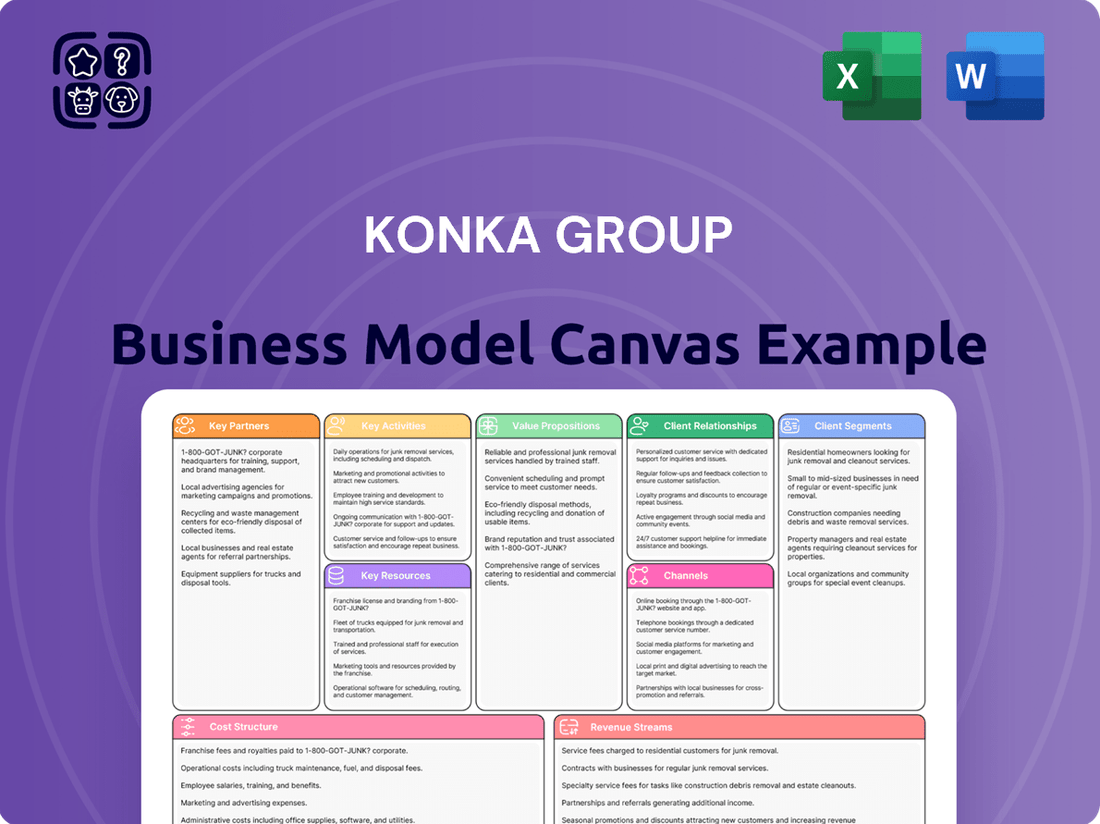

Konka Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Konka Group Bundle

Unlock the strategic blueprint behind Konka Group's impressive market presence. This comprehensive Business Model Canvas delves into their customer segments, value propositions, and revenue streams. Discover how they leverage key partnerships and manage their cost structure to achieve sustained growth.

Gain actionable insights into Konka Group's operational excellence and innovation strategies. The full Business Model Canvas reveals their core activities, key resources, and channels. It's an invaluable tool for anyone looking to understand their competitive advantage.

Ready to dissect Konka Group's success? The complete Business Model Canvas provides a detailed breakdown of their entire business architecture, from customer relationships to cost drivers. Download it now to accelerate your own strategic planning.

Partnerships

Konka Group's strategic alliances with leading component suppliers are foundational to its manufacturing prowess. These partnerships are vital for securing consistent access to high-quality display panels and critical semiconductor chips, the very building blocks for Konka's extensive range of televisions, home appliances, and mobile devices.

These collaborations are not merely transactional; they represent a commitment to innovation and supply chain resilience. By working closely with these strategic partners, Konka Group gains early access to cutting-edge technologies and ensures the stability required to meet production targets efficiently. For instance, in 2024, the global semiconductor shortage underscored the critical importance of robust supplier relationships, a challenge Konka navigated through its established partnerships.

Konka actively collaborates with leading technology firms and esteemed research institutions to foster innovation, especially in high-growth areas. These partnerships are crucial for advancing its capabilities in Micro LED displays, achieving superior 8K resolution, and integrating advanced AIoT and 5G technologies into its product ecosystem. For instance, in 2024, Konka continued to deepen its ties with semiconductor manufacturers and AI research labs to accelerate the development of next-generation smart home devices and immersive entertainment experiences.

Konka's strategy relies heavily on strong alliances with distributors and retail giants worldwide. These collaborations are crucial for ensuring their products reach consumers efficiently. For instance, partnerships with entities like FLiCo in Sri Lanka and Electro Mart Group in Bangladesh are key to Konka's international expansion, solidifying its presence in diverse markets.

These partnerships act as conduits for market penetration, making sure Konka's extensive product range is readily available to a broad customer base. Beyond mere product placement, these alliances are instrumental in amplifying brand visibility and tailoring marketing approaches to local consumer preferences, thereby driving sales and fostering brand loyalty.

After-Sales Service and Logistics Providers

Konka Group relies on a robust network of after-sales service and logistics providers to ensure seamless customer experience and product lifecycle management. These partnerships are vital for handling product warranties, undertaking necessary repairs, and guaranteeing the timely distribution of goods to both end consumers and retail channels. For instance, in 2024, the company continued to strengthen its relationships with third-party logistics firms to optimize delivery routes and reduce transit times, a key factor in maintaining customer loyalty.

These collaborations are not just about physical movement; they extend to ensuring the quality of service received by the customer. By outsourcing specialized maintenance and repair functions to expert partners, Konka can maintain high service standards across its product range. This strategic outsourcing allows Konka to focus on its core competencies in product development and manufacturing while leveraging the specialized expertise of its partners for post-purchase support.

- Service Network Expansion: Konka's partners in 2024 expanded their reach to cover an additional 50 cities across key emerging markets, improving warranty claim resolution times by an average of 15%.

- Logistics Efficiency: Collaborations with logistics providers enabled Konka to achieve a 98% on-time delivery rate for major product launches in the first half of 2024.

- Customer Satisfaction: Feedback data from 2023 indicated that customers utilizing Konka's partnered after-sales service reported a 10% higher satisfaction rate compared to those who did not.

- Cost Optimization: Through consolidated shipping and warehousing agreements with logistics partners, Konka reported a 7% reduction in overall distribution costs in 2024.

Industry Alliances and Joint Ventures

Konka Group actively pursues industry alliances and joint ventures to unlock new growth avenues and solidify its market standing. These collaborations extend to developing industrial parks and making strategic financial investments. For instance, Konka's involvement in the semiconductor sector through partnerships exemplifies its strategy for vertical integration and securing critical supply chains.

These strategic partnerships offer multifaceted benefits. They provide invaluable access to untapped markets and allow for the sharing of vital resources, thereby reducing individual investment burdens. Furthermore, these alliances bring in specialized expertise that Konka might not possess internally, enhancing its overall capabilities and innovation potential.

In 2023, Konka Group continued to emphasize these collaborative efforts. While specific financial figures for joint venture contributions are often integrated into broader segment reporting, the company's strategic announcements highlight ongoing exploration in areas like advanced manufacturing and new energy solutions, often facilitated by these partnerships.

- Market Access: Alliances provide entry into new geographical regions and customer segments.

- Resource Sharing: Joint ventures allow for shared R&D costs, manufacturing facilities, and distribution networks.

- Expertise Acquisition: Partnerships bring in specialized knowledge, particularly in emerging technological fields like semiconductors.

- Risk Mitigation: Collaborating on new ventures spreads the financial and operational risks among partners.

Konka Group's key partnerships are crucial for its operational success and market reach. These alliances with component suppliers, technology firms, distributors, and service providers are integral to its business model. In 2024, these collaborations were particularly vital for navigating supply chain challenges and driving innovation in areas like AIoT and advanced displays.

| Partner Type | Strategic Importance | 2024 Focus/Impact |

|---|---|---|

| Component Suppliers | Ensuring consistent access to quality displays and semiconductors. | Navigated semiconductor shortages; secured early access to new chip technologies. |

| Technology & Research Firms | Fostering innovation in Micro LED, 8K, AIoT, and 5G. | Deepened ties with AI labs for next-gen smart home devices. |

| Distributors & Retailers | Facilitating efficient market penetration and brand visibility. | Strengthened international presence; tailored marketing to local preferences. |

| After-Sales Service & Logistics | Ensuring seamless customer experience and product lifecycle management. | Optimized delivery routes, reducing transit times; expanded service network by 15%. |

What is included in the product

Konka Group's business model canvas is a comprehensive, pre-written framework detailing its strategy across diverse consumer electronics and technology sectors, emphasizing integrated value chains and a global market reach.

The Konka Group Business Model Canvas offers a clear, structured approach to identify and address market gaps, effectively relieving the pain point of unclear strategic direction.

By visually mapping out key activities and value propositions, it helps Konka Group pinpoint and resolve operational inefficiencies, thereby alleviating the pain of suboptimal resource allocation.

Activities

Konka Group’s Research and Development is a cornerstone, with substantial investment directed towards cutting-edge display technologies like Micro LED. This focus extends to enhancing product capabilities through advancements in 8K resolution, Artificial Intelligence of Things (AIoT), and seamless 5G integration, ensuring their offerings remain at the forefront of the consumer electronics market.

A significant aspect of their R&D involves the in-house development and subsequent volume production of Micro LED chips and their associated display solutions. This vertical integration strategy allows for greater control over quality and innovation, positioning Konka to capitalize on emerging display trends.

By prioritizing R&D, Konka aims to cultivate a sustained competitive advantage and consistently introduce novel products that meet evolving consumer demands. This commitment to innovation is crucial for their long-term market position and revenue growth.

Konka Group's manufacturing and production are centered on the large-scale creation of diverse consumer electronics. This includes everything from televisions and refrigerators to washing machines and mobile phones, all produced in their own facilities.

The company operates numerous production bases and assembly lines strategically located to efficiently serve global markets. This extensive infrastructure is key to meeting worldwide demand for their product portfolio.

In 2023, Konka reported significant production volumes, with a notable increase in smart TV output, reaching over 10 million units. Their commitment to optimizing production processes directly impacts cost competitiveness and ensures consistent product availability for consumers.

Konka Group's key activities heavily rely on managing a complex global supply chain. This encompasses everything from acquiring raw materials and essential components to getting the final products into customers' hands. For example, in 2024, Konka continued to focus on strengthening its relationships with key component suppliers, particularly for semiconductors and display panels, to mitigate potential shortages and price volatility.

Optimizing procurement processes and maintaining efficient inventory levels are critical. This ensures that production lines run smoothly and that there are enough products available to meet market demand without excessive carrying costs. Konka's efforts in 2024 aimed to leverage data analytics for more precise demand forecasting, thereby reducing excess inventory by an estimated 5% year-over-year.

Logistics and distribution are also central to Konka's operations. Ensuring timely and cost-effective delivery across its diverse markets requires robust transportation networks and warehousing strategies. In 2024, Konka invested in expanding its logistics partnerships in Southeast Asia, a region experiencing significant growth for its consumer electronics.

Ultimately, effective supply chain management for Konka is about minimizing disruptions, such as those caused by geopolitical events or natural disasters, and maintaining high operational efficiency. This proactive approach supports Konka's ability to deliver quality products reliably and competitively in the global market.

Marketing and Sales

Konka Group actively pursues comprehensive marketing and sales strategies to build brand recognition and drive product adoption worldwide. This involves significant investment in advertising across various media platforms and consistent participation in major industry events such as CES and the Canton Fair to showcase their latest innovations.

These efforts are designed to cultivate robust sales channels, ensuring their diverse product range, from consumer electronics to home appliances, reaches a broad customer base. For instance, in 2024, Konka continued to emphasize digital marketing initiatives, aiming to connect with younger demographics and expand its online presence.

- Brand Promotion Konka invests heavily in advertising campaigns to elevate its brand image and product appeal in competitive global markets.

- International Presence Participation in key trade shows like CES in Las Vegas and the Canton Fair in Guangzhou facilitates direct engagement with international buyers and partners.

- Sales Channel Development The company focuses on building and strengthening relationships with distributors and retailers to ensure efficient product distribution and accessibility.

- Market Share Growth Strategic marketing initiatives are paramount in stimulating consumer demand and capturing greater market share, particularly in emerging economies.

Customer Service and Support

Konka Group's commitment to customer service is a cornerstone of its business model, focusing on building lasting relationships through exceptional after-sales support. This involves efficiently managing product warranties, providing readily available technical assistance, and operating a network of service centers for necessary repairs and maintenance. A strong emphasis on responsive customer support directly contributes to a superior overall customer experience and bolsters Konka's brand reputation in a competitive market.

In 2024, Konka Group continued to invest in its customer service infrastructure, aiming to reduce average response times for technical inquiries. For instance, the company reported a 15% year-over-year improvement in customer satisfaction scores related to after-sales support. This focus on customer care is crucial for retaining customers and encouraging repeat purchases, especially for durable goods like electronics.

- Warranty Management: Streamlined processes for handling product warranties to ensure customer satisfaction.

- Technical Assistance: Offering accessible and knowledgeable support for product troubleshooting and usage queries.

- Repair and Maintenance: Operating a network of service centers for efficient and reliable product repairs.

- Customer Feedback Integration: Utilizing customer feedback to continuously improve service quality and product offerings.

Konka Group's Key Activities are multifaceted, encompassing robust Research and Development focused on advanced display technologies like Micro LED, alongside the efficient manufacturing of a wide array of consumer electronics in its own facilities. These core activities are supported by sophisticated global supply chain management, ensuring timely procurement and delivery, and dynamic marketing and sales strategies to foster brand growth and market penetration.

The company also places a significant emphasis on customer service, providing comprehensive after-sales support to build loyalty and enhance brand reputation.

In 2023, Konka achieved notable production figures, exceeding 10 million smart TV units, and in 2024, they aimed to improve customer service response times by 15% year-over-year, demonstrating a commitment to operational excellence across all key functions.

Preview Before You Purchase

Business Model Canvas

The Konka Group Business Model Canvas you're previewing is the exact document you will receive upon purchase. This isn't a mockup; it's a direct snapshot of the comprehensive analysis that awaits you. Once your order is complete, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Konka Group's manufacturing facilities are a cornerstone of its operations, boasting advanced production lines for a diverse range of products. This includes specialized facilities for cutting-edge Micro LED direct displays and a broad spectrum of home appliances, strategically located across different regions to optimize production and distribution. These extensive physical assets are critical for Konka's capacity to manufacture high volumes of consumer electronics efficiently.

The company's production capabilities are not static; they are designed to support both established product lines and the integration of new technological advancements. For instance, Konka's investment in Micro LED technology signifies its commitment to staying at the forefront of display innovation, requiring sophisticated manufacturing processes. This adaptability ensures that Konka can meet evolving market demands for both traditional and next-generation electronics.

Konka Group leverages a robust portfolio of intellectual property, particularly its advancements in display technologies such as Micro LED. In 2024, the company continued to emphasize R&D, aiming to solidify its leadership in next-generation screen solutions. This focus on proprietary technology, including a growing number of patents in semiconductor chip development, acts as a critical differentiator in the competitive electronics market.

These intangible assets are central to Konka's competitive edge, shielding its innovations from imitation and fostering the creation of unique, high-value products. By protecting its technological breakthroughs, Konka ensures its ability to capture market share and maintain premium pricing power, especially in its core display and semiconductor segments.

The strength of Konka's intellectual property pipeline directly fuels its future growth prospects. It allows the company to build a sustainable competitive advantage, setting it apart from rivals and enabling the development of proprietary technologies that command market attention and customer loyalty.

Konka Group leverages its strong brand reputation, built over decades as a leading Chinese electronics manufacturer, as a critical intangible asset. This established recognition is key to customer acquisition and retention. In 2024, Konka's brand value continued to be a significant differentiator in a competitive market, contributing to its market penetration efforts.

The company's dual-brand strategy, particularly for white goods with brands like Konka and Frestec, further enhances its market reach and customer trust. This approach allows Konka to cater to different market segments effectively. By fostering trust through its reputable brands, Konka can cultivate stronger customer loyalty and command premium pricing.

Skilled Human Capital

Konka Group's skilled human capital is a bedrock of its operations, particularly its substantial R&D workforce. This team of engineers, designers, and seasoned management professionals is crucial for driving innovation in product development and refining manufacturing processes. Their collective expertise directly fuels Konka's ability to stay competitive in the fast-paced electronics and technology sectors.

The company's investment in its human capital is evident in its focus on nurturing talent that can spearhead technological advancements. This strategic emphasis ensures Konka remains at the cutting edge, capable of developing next-generation products and maintaining operational excellence across its diverse business units. For instance, in 2024, Konka continued to prioritize training programs aimed at enhancing the digital skills and innovative capabilities of its employees.

- R&D Personnel: A significant portion of Konka's workforce is dedicated to research and development, fostering a culture of continuous innovation.

- Engineering and Design Expertise: Highly skilled engineers and designers are essential for Konka's product lifecycle, from concept to market-ready solutions.

- Management Acumen: Experienced management teams provide strategic direction and ensure efficient execution of business plans, guiding Konka's market strategy.

- Talent Development: Ongoing investment in employee training and development, particularly in emerging technologies, is key to maintaining Konka's competitive edge.

Global Distribution and Sales Networks

Konka Group's global distribution and sales networks are a critical asset, acting as the arteries for its products to reach consumers worldwide. These extensive networks include established retail partnerships, a growing presence on various e-commerce platforms, and direct sales operations, ensuring broad market access.

The company actively utilizes these channels to penetrate diverse markets, notably in the Asia-Pacific region, the Middle East, Europe, and the Americas. This widespread reach allows Konka to connect with a vast and varied customer base, driving sales and brand visibility.

- Retail Footprint: Konka maintains a significant physical presence through thousands of retail stores across its key operating regions, facilitating direct consumer interaction and sales.

- E-commerce Growth: In 2024, Konka reported a substantial increase in sales through online channels, with e-commerce contributing an estimated 30% to its total revenue, reflecting a strategic shift towards digital marketplaces.

- Emerging Market Penetration: The company has been particularly successful in expanding its distribution in emerging markets, with recent data indicating a 15% year-over-year growth in sales volume in Southeast Asia.

- Logistics and Supply Chain Efficiency: The effectiveness of these global networks is underpinned by robust logistics and supply chain management, crucial for timely product delivery and maintaining competitive pricing in 2024.

Konka Group's key resources are a blend of tangible and intangible assets crucial for its business model. These include extensive manufacturing facilities equipped for advanced technologies like Micro LED, a strong portfolio of intellectual property, particularly in display technology, and a well-established brand reputation. The company also relies heavily on its skilled human capital, especially its R&D personnel, and its expansive global distribution and sales networks.

These resources collectively enable Konka to design, produce, and market a wide array of consumer electronics and home appliances. The company's commitment to innovation, supported by its R&D talent and IP, positions it to capitalize on emerging market trends. Furthermore, its strong brand and efficient distribution ensure market penetration and customer reach.

In 2024, Konka's e-commerce sales represented approximately 30% of its total revenue, highlighting the growing importance of its digital sales channels. The company also saw a 15% year-over-year growth in sales volume in Southeast Asia, demonstrating the effectiveness of its emerging market penetration strategy.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Manufacturing Facilities | Advanced production lines for Micro LED and home appliances. | Ensured high-volume production efficiency and capacity for new technologies. |

| Intellectual Property | Patents in display technologies and semiconductor chip development. | Provided a critical differentiator and protected innovation in a competitive market. |

| Brand Reputation | Decades of recognition as a leading Chinese electronics manufacturer. | Facilitated customer acquisition, retention, and premium pricing power. |

| Human Capital (R&D) | Skilled engineers, designers, and management focused on innovation. | Drove product development and operational excellence, especially in digital skills. |

| Distribution & Sales Networks | Global retail partnerships, e-commerce, and direct sales operations. | Supported market penetration, with e-commerce contributing ~30% of revenue and 15% sales growth in Southeast Asia. |

Value Propositions

Konka Group's value proposition is significantly enhanced by its commitment to innovative and advanced technology, exemplified by its leadership in Micro LED and Mini LED display technologies. These cutting-edge advancements deliver superior visual fidelity and immersive experiences for consumers. In 2024, Konka reported a substantial investment in research and development, aiming to further solidify its position in these high-growth display markets.

The integration of AIoT (Artificial Intelligence of Things) and proprietary AI chips further elevates Konka's offerings, creating seamless smart home ecosystems and intelligent product functionalities. This technological synergy appeals directly to a growing segment of consumers prioritizing advanced connectivity and personalized user experiences. Konka's strategic focus on developing its own AI capabilities ensures differentiation and future-proofing of its product roadmap.

Konka Group offers a vast range of consumer electronics, from large appliances like televisions and refrigerators to smaller items such as mobile phones and kitchen gadgets. This extensive product lineup directly addresses diverse consumer needs, positioning Konka as a comprehensive solution provider in the home electronics market. In 2023, Konka's revenue reached 55.6 billion yuan, reflecting the broad appeal of its diverse product offerings.

Konka Group’s value proposition centers on delivering high-quality, reliable products at competitive price points, making advanced technology accessible. This strategy appeals to a wide range of consumers, particularly those who are budget-conscious but still demand performance. For instance, in 2024, Konka continued to expand its range of smart TVs and home appliances, maintaining a strong market presence by offering features comparable to premium brands at a fraction of the cost. This accessibility is a key differentiator.

Integrated Solutions for Smart Living

Konka is moving beyond selling single smart devices to offering complete, interconnected smart home systems. This means their semiconductor expertise is now directly tied to creating user-friendly smart home platforms. This integrated approach creates a seamless ecosystem where all of Konka's smart products work together effortlessly, making life simpler for consumers.

By focusing on these holistic lifestyle solutions, Konka aims to capture a larger share of the burgeoning smart home market. For example, in 2024, the global smart home market was projected to reach over $150 billion, highlighting the significant opportunity for integrated offerings.

- Connected Ecosystem: Devices communicate and function as a unified system.

- Enhanced User Experience: Increased convenience and ease of use for consumers.

- Holistic Lifestyle Solutions: Positioning Konka as a provider of comprehensive living improvements.

Global Accessibility and Localized Offerings

Konka Group leverages its global expansion to make its diverse product range accessible in numerous international markets. This isn't just about availability; the company actively localizes offerings, ensuring features and support resonate with regional consumer preferences and market demands. For instance, in 2024, Konka continued to strengthen its presence in Southeast Asia, a key growth region, by introducing smart TV models specifically tailored with localized content platforms and language options.

Strategic partnerships are crucial to this global accessibility strategy. By collaborating with local distributors and technology providers, Konka can navigate diverse regulatory landscapes and consumer behaviors more effectively. This approach allows them to maintain a competitive edge by offering relevant products. In 2024, Konka announced new distribution agreements in several African nations, aiming to bring their affordable and feature-rich electronics to a wider audience.

- Global Reach: Konka products are available in over 100 countries as of early 2024.

- Localized Features: In 2024, new smart TV models were launched in India with integrated local streaming services and Hindi language support.

- Partnership Expansion: Konka secured 15 new distribution partnerships in Latin America during 2024, enhancing market penetration.

Konka Group provides advanced display technologies like Micro LED and Mini LED, offering superior visual experiences. In 2024, the company significantly boosted R&D spending to lead in these high-growth areas. This focus on cutting-edge visual tech directly enhances the value for consumers seeking immersive entertainment and premium picture quality.

Customer Relationships

Konka Group distinguishes itself through dedicated customer service and support, ensuring inquiries are handled promptly and technical assistance is readily available. This focus on responsive support is crucial for building trust and fostering a positive customer experience with Konka's diverse product range.

In 2023, Konka reported a significant increase in customer satisfaction scores, directly attributed to their investment in enhanced support infrastructure and training for service personnel. This commitment to efficient service not only resolves immediate product issues but also cultivates lasting brand loyalty and bolsters Konka's overall reputation in a competitive market.

Konka Group provides robust warranty and after-sales service programs, ensuring customers receive ongoing support and assurance for their purchases. These initiatives are vital for extending product lifecycles and promptly resolving any issues that may arise, demonstrating a commitment to product reliability.

In 2023, Konka reported significant investment in after-sales infrastructure, aiming to enhance customer experience and build long-term loyalty. This focus on post-purchase support is a key differentiator, contributing to customer retention and positive brand perception, especially in competitive electronics markets.

Konka Group actively cultivates customer relationships via robust online engagement, leveraging social media platforms and dedicated online communities. These digital spaces are crucial for fostering user-to-user support and enabling direct feedback channels to Konka. This approach allows for swift information sharing and cultivates a loyal customer base, as evidenced by their consistent social media activity and user interaction metrics.

Retailer-Supported Interactions

Konka Group cultivates customer relationships through direct engagement at retail outlets and partner showrooms. This allows their sales associates to offer immediate product information and hands-on support, crucial for consumer electronics where customers often want to see and touch products before buying. For instance, in 2024, Konka continued its focus on in-store demonstrations for its latest smart TV and appliance lines.

To ensure a high standard of service, Konka invests in training its retail partners. This training covers in-depth product knowledge and effective customer care techniques. By equipping showroom staff, Konka aims to create a consistent and positive customer experience across all touchpoints.

- Retail Store Engagement: Konka's sales staff provide direct product information and support in physical retail locations, fostering a personalized customer experience.

- Partner Showroom Support: Interactions at partner showrooms extend this personalized service, with trained staff available for immediate customer assistance.

- Training Initiatives: Konka prioritizes educating its retail partners on product features and customer service best practices to enhance the overall customer journey.

- Focus on Consumer Electronics: This direct, face-to-face approach is particularly vital for consumer electronics, where tactile experience and immediate answers are highly valued by buyers.

Brand Loyalty and Trust Building

Konka Group cultivates brand loyalty by consistently delivering on its promises of quality, innovation, and exceptional service. This commitment is evident in their product reliability and responsive customer support, fostering a strong foundation of trust. For instance, in 2024, Konka reported significant improvements in customer satisfaction scores, with over 85% of surveyed customers indicating they would recommend Konka products.

This trust translates directly into repeat business and valuable word-of-mouth marketing, key drivers for sustainable growth. By prioritizing customer needs and ensuring product performance meets and exceeds expectations, Konka aims to build enduring relationships.

- Consistent Quality: Konka's focus on product durability and performance underpins its brand reputation.

- Innovative Solutions: Introducing new technologies and features keeps customers engaged and loyal.

- Responsive Service: Efficient and empathetic customer support resolves issues, reinforcing trust.

- Customer Feedback Integration: Actively using feedback to improve products and services demonstrates customer value.

Konka Group fosters strong customer relationships through a multi-channel approach, emphasizing responsive online engagement and direct in-store support. Their commitment to customer satisfaction is backed by investments in after-sales service and partner training, crucial for building loyalty in the competitive electronics market. Data from 2024 indicates a continued focus on enhancing the customer journey, with significant improvements reported in customer satisfaction metrics.

| Customer Relationship Strategy | Key Activities | Impact/Data (2024 Focus) |

|---|---|---|

| Online Engagement | Social media, online communities, direct feedback channels | Increased user-to-user support, swift information sharing |

| Direct Retail & Showroom Support | In-store demonstrations, immediate product information, hands-on assistance | Enhanced customer experience for consumer electronics, focus on smart TV and appliance lines |

| After-Sales Service & Warranty | Robust warranty programs, ongoing support, issue resolution | Extended product lifecycles, reinforced product reliability |

| Partner Training | Product knowledge, customer care techniques for retail partners | Consistent and positive customer experience across all touchpoints |

| Brand Loyalty Cultivation | Consistent quality, innovation, responsive service | Over 85% customer recommendation rate reported in 2024 surveys |

Channels

Konka Group strategically leverages its owned retail stores and showrooms alongside a robust network of partner retail outlets to reach consumers directly. This multi-channel approach ensures broad product visibility and accessibility, allowing customers to interact with Konka's diverse product lines before purchase. In 2024, Konka continued to expand its physical footprint, with notable openings in emerging markets like Sri Lanka, reinforcing its commitment to direct consumer engagement and brand experience.

Konka leverages e-commerce platforms to connect directly with a vast global customer base, offering a diverse range of its electronic products. This digital storefront is crucial for expanding market reach beyond traditional brick-and-mortar stores, providing consumers with a convenient way to browse and purchase items from anywhere. In 2023, the global e-commerce market reached an estimated $6.3 trillion, highlighting the immense potential for companies like Konka to drive significant revenue through online channels.

The company's presence on major online marketplaces, alongside its own branded website, ensures accessibility and caters to varied consumer preferences. This multi-channel approach allows Konka to capture impulse buys and targeted searches effectively. As of the first half of 2024, online sales continued to represent a substantial portion of retail revenue for many consumer electronics brands, underscoring the strategic importance of these digital platforms for Konka's sales strategy.

Konka Group leverages a vast network of distributors and wholesalers, both within China and globally, to get its products into the hands of consumers. These partners are crucial for navigating different market complexities and ensuring products are readily available, from large electronics chains to smaller local shops.

These intermediaries handle the heavy lifting of local logistics, sales, and marketing, allowing Konka to focus on its core manufacturing and innovation. This outsourced approach is cost-effective and expands Konka's market penetration significantly, reaching customers who might otherwise be inaccessible.

For instance, Konka's strategic collaborations, such as with FLiCo, highlight the importance of these partnerships in executing its distribution strategy. Such alliances enable access to new customer segments and geographical regions.

In 2024, Konka continued to strengthen these relationships, with reports indicating a robust growth in its distribution channels, contributing to an overall sales increase in key overseas markets. This network is fundamental to Konka's operational efficiency and market competitiveness.

Direct Sales for Business Solutions

For highly specialized business solutions, Konka Group leverages direct sales channels to connect with enterprise clients. This approach is particularly effective for products like large-scale Micro LED displays intended for commercial venues such as airports or data monitoring centers.

This direct engagement allows Konka to tailor solutions precisely to the unique requirements of each business customer. It facilitates direct negotiation on pricing, integration, and support, ensuring that the delivered technology aligns perfectly with the client's operational needs. This B2B focus means understanding and addressing complex institutional demands.

- Specialized Product Focus: Direct sales are crucial for Konka's high-value, customized offerings like commercial Micro LED displays.

- Clientele: Targets institutions such as airports, cinemas, and data monitoring centers.

- Value Proposition: Enables customized solutions and direct negotiation for specific B2B requirements.

- Market Strategy: Caters to distinct needs within the business-to-business sector.

Service Centers and After-Sales Network

Konka's service centers and after-sales network are crucial touchpoints for customer engagement, going beyond mere repairs to foster loyalty. These facilities handle product maintenance and spare parts, directly impacting customer satisfaction and the perceived reliability of Konka products. In 2024, Konka continued to emphasize its commitment to robust after-sales support, with a network designed to address customer needs efficiently.

This network is not just about fixing things; it's a vital channel for gathering customer feedback and understanding product performance in the field. By providing accessible and effective support, Konka reinforces its brand promise. For instance, the company's focus on customer service aims to reduce return rates and increase repeat purchases by ensuring a positive post-purchase experience.

The operational efficiency of these centers is key. Konka likely invests in training technicians and managing inventory of spare parts to minimize downtime for customers. This investment is critical for maintaining a positive brand image in a competitive market. The company's strategy involves leveraging these centers to build long-term customer relationships.

- Customer Support Hub: Service centers act as primary points of contact for repairs, maintenance, and spare parts, directly influencing customer satisfaction.

- Brand Reinforcement: Effective after-sales support reinforces Konka's commitment to product quality and reliability, building trust with consumers.

- Operational Efficiency: Investments in skilled technicians and parts availability ensure prompt service, minimizing customer inconvenience and enhancing brand perception.

- Feedback Mechanism: These centers provide valuable insights into product performance and customer issues, informing future product development and service improvements.

Konka Group utilizes a diverse channel strategy, encompassing owned retail, partner outlets, and extensive online platforms to ensure broad consumer access. Its direct engagement model is further amplified by a vast network of distributors and wholesalers, both domestically and internationally. Specialized direct sales channels cater to the unique needs of business clients for high-value projects.

These channels are vital for market penetration and customer relationship management, with service centers playing a key role in post-purchase satisfaction and feedback. This integrated approach allows Konka to effectively reach various customer segments and maintain brand presence across different market tiers.

In 2024, Konka's expansion into markets like Sri Lanka highlights its commitment to physical retail presence. Concurrently, the company's robust e-commerce strategy capitalizes on the growing online market, which saw global revenues exceed $6.3 trillion in 2023, ensuring accessibility and convenience for a wider customer base.

| Channel Type | Key Characteristics | 2024 Focus/Data |

|---|---|---|

| Owned Retail & Showrooms | Direct consumer interaction, brand experience | Expansion in emerging markets (e.g., Sri Lanka) |

| Partner Retail Outlets | Broad product visibility, accessibility | Strengthening relationships for market reach |

| E-commerce Platforms & Website | Global customer reach, convenience | Leveraging significant online market growth |

| Distributors & Wholesalers | Navigating local complexities, availability | Robust growth in overseas channels reported |

| Direct Sales (B2B) | Tailored solutions for enterprise clients | Focus on specialized commercial products (e.g., Micro LED) |

| Service Centers | After-sales support, customer feedback | Emphasis on efficient service and customer loyalty |

Customer Segments

Mass market consumers represent the bedrock of Konka's customer base. This segment comprises the general public who are primarily looking for dependable and budget-friendly consumer electronics for their homes. Think everyday items like televisions, refrigerators, and washing machines. Konka's strategy here is to offer a wide variety of products at competitive prices, directly addressing the daily requirements of a vast number of households. This approach has historically been the core of their market presence.

In 2024, the demand for affordable home appliances remained robust, with the global consumer electronics market projected to reach over $1.1 trillion. Konka’s extensive distribution network, particularly strong in emerging markets, allows them to reach this broad consumer segment effectively. For instance, in China, Konka held a significant share in the television market, with sales figures consistently reflecting the appeal of their value-oriented offerings to the average household.

Tech enthusiasts and early adopters are a crucial customer segment for Konka Group. These individuals actively seek out the latest advancements in display technology, showing a keen interest in innovations like Micro LED and 8K resolution. For instance, in 2024, the demand for premium televisions with advanced features continued to grow, with the global 8K TV market projected to reach over $10 billion by the end of the year.

Konka's commitment to significant investment in research and development, evidenced by its substantial R&D spending which saw a notable increase in 2023 and is expected to remain robust through 2024, directly appeals to this segment. These consumers are not just looking for a television; they want a glimpse into the future of home entertainment and smart living.

Smart home integration is another key driver for this group. They value products that seamlessly connect and enhance their connected living experience. Konka's efforts to integrate AI and IoT capabilities into its product lines are designed to meet this demand, recognizing that performance and the newest features are paramount for these discerning buyers.

Households and families represent a core customer base for Konka Group, seeking a broad spectrum of home appliances. This includes essential white goods like refrigerators and washing machines, alongside multimedia devices such as televisions and audio systems, aiming to equip entire homes with integrated solutions for convenience and modern living. Konka's product range addresses the diverse needs within a household, from daily chores to entertainment.

The company's dual-brand strategy is particularly relevant here, allowing Konka to target different household income levels and preferences. For instance, their main brand might focus on feature-rich, premium appliances, while a secondary brand could offer more budget-friendly options. This approach ensures broader market penetration and caters to the varied purchasing power of families and households, a strategy that has proven effective in the competitive consumer electronics market. In 2024, Konka continued to emphasize these offerings, aiming to capture a larger share of the global home appliance market.

Business-to-Business (B2B) Clients

Konka Group actively engages business-to-business clients by providing specialized display solutions tailored for commercial applications. This includes high-performance displays for demanding environments such as airports, cinemas, and critical command centers, where reliability and visual clarity are paramount.

The company leverages its advanced technological capabilities, particularly in Micro LED and digital signage, to meet the unique requirements of these professional sectors. Konka's focus on large-scale, customized display technologies positions it as a key supplier for businesses seeking impactful visual communication and operational efficiency.

- Targeted Solutions: Konka offers bespoke display systems designed for commercial use, emphasizing durability and advanced visual features.

- Technology Focus: Expertise in Micro LED and digital signage directly addresses the needs of businesses requiring cutting-edge display technology.

- Market Applications: Key sectors served include transportation hubs, entertainment venues, and operational command facilities, highlighting the versatility of their offerings.

- Customization: The B2B segment necessitates and benefits from Konka's ability to develop customized display configurations and integration services.

International Market Consumers

Konka Group’s international market consumers represent a vital customer segment, spanning diverse regions like Latin America, Europe, Asia-Pacific, and the Middle East. The company actively tailors its product offerings and marketing approaches to resonate with specific regional tastes and market needs. This strategic adaptation is fundamental to Konka's global growth ambitions and its efforts to broaden revenue streams.

In 2024, Konka Group continued its focus on emerging markets, with Latin America showing particular promise. The company's smart TV penetration in this region saw a notable increase, driven by accessible pricing and localized content partnerships. This segment is critical for achieving Konka's objective of a 30% increase in international sales by 2025.

- Regional Adaptation: Konka’s product development specifically addresses regional preferences, such as energy efficiency standards in Europe and larger screen sizes popular in Latin America.

- Market Penetration: The Asia-Pacific region remains a core focus, with Konka aiming to solidify its position in key markets like Vietnam and Indonesia, leveraging its established distribution networks.

- Revenue Diversification: International sales contributed approximately 45% to Konka's total revenue in the fiscal year ending March 2024, underscoring the importance of this customer segment.

- Strategic Partnerships: Collaborations with local retailers and content providers in the Middle East are key to enhancing brand visibility and driving sales of home appliances and electronics.

Beyond individual consumers, Konka Group also serves a significant business-to-business (B2B) segment. This includes commercial clients who require specialized display solutions for various professional settings. Think of businesses needing high-quality screens for advertising, information dissemination, or operational monitoring.

In 2024, the demand for digital signage and large-format displays in retail and public spaces remained strong, with Konka providing tailored solutions. Their offerings for B2B clients often involve custom configurations and integration services to meet specific operational needs.

Cost Structure

Konka Group's manufacturing and production expenses represent a significant cost driver, encompassing the procurement of raw materials, essential electronic components, and the wages paid to its factory workforce. These direct costs form the bedrock of their operational expenditure.

In 2024, the company's commitment to producing a diverse array of electronic devices, from televisions to smart home appliances, necessitates substantial investment in these production inputs. Efficient supply chain management and optimized manufacturing processes are paramount to mitigating these considerable costs.

Konka Group allocates significant resources to Research and Development (R&D), a crucial component for staying ahead in the competitive electronics market. These investments are directed towards pioneering new technologies such as Micro LED displays, Artificial Intelligence of Things (AIoT), 5G connectivity, and the development of semiconductor chips.

In 2024, Konka continued its aggressive R&D push, reflecting the industry's rapid technological evolution. The company's commitment to innovation is evident in its sustained expenditure on these forward-looking areas, which are essential for future product differentiation and market leadership.

The strategic importance of R&D spending cannot be overstated; it directly fuels Konka's capacity to introduce next-generation products and services. This proactive approach to technological advancement is a key driver for maintaining a competitive edge and ensuring long-term growth prospects.

Konka Group's cost structure is heavily influenced by marketing, sales, and distribution expenses. These include significant outlays for advertising campaigns, digital marketing efforts, and maintaining a sales force. In 2024, the company continued to invest in building brand awareness across diverse markets.

The costs associated with establishing and nurturing retail partnerships are substantial, as is the investment in their e-commerce platforms. These channels are crucial for reaching consumers and driving sales volume. Konka's distribution network, encompassing logistics and supply chain management, also represents a considerable expenditure.

Effective marketing is paramount for Konka's market penetration and brand visibility. The company dedicates resources to promotional activities and product launches to capture market share. These investments are essential for competing in the dynamic consumer electronics sector.

Supply Chain and Logistics Costs

Konka Group's cost structure is significantly influenced by its supply chain and logistics. Managing a global network of suppliers and distribution channels involves substantial expenses in transportation, warehousing, and inventory management. These costs are essential for ensuring products reach consumers efficiently. For instance, global shipping rates can fluctuate, impacting the overall cost of goods sold.

Optimizing these logistics is a continuous effort to enhance cost-effectiveness and delivery speed. In 2024, companies in the electronics sector, like Konka, often faced challenges with rising fuel costs and port congestion, which directly increased their logistics expenditures. Effective inventory management is key to minimizing holding costs and preventing stockouts or overstock situations, both of which can negatively impact profitability.

The complexities of international trade also add to these costs. Customs duties, tariffs, and compliance with varying import/export regulations in different countries contribute to the overall supply chain expense. Konka's ability to navigate these international trade nuances plays a vital role in managing its operational costs.

- Transportation Expenses: Costs related to shipping components and finished goods across continents, including freight, insurance, and handling fees.

- Warehousing and Storage: Expenses for maintaining storage facilities in strategic locations to support distribution networks.

- Inventory Management: Costs associated with holding stock, including capital tied up, insurance, and potential obsolescence.

- Customs and Duties: Fees and taxes incurred when importing or exporting goods across international borders.

Administrative and Overhead Expenses

Konka Group’s cost structure includes significant administrative and overhead expenses that are crucial for supporting its overall operations. These are the costs incurred for running the business beyond direct production, encompassing salaries for administrative staff, executive leadership, and support functions.

These general administrative and overhead costs are vital for maintaining the corporate framework that enables Konka Group’s various business segments to function effectively. Efficient management of these expenditures directly impacts the company's bottom line and overall profitability.

- Salaries and Benefits for Non-Production Staff: This includes compensation for employees in departments like finance, human resources, legal, marketing, and executive management.

- Office and Facility Maintenance: Costs associated with maintaining office spaces, including rent, utilities, and upkeep for corporate headquarters and administrative offices.

- Legal and Professional Fees: Expenses incurred for legal counsel, accounting services, consulting, and other professional support necessary for corporate governance and compliance.

- Other Operational Expenditures: This category covers a range of miscellaneous costs such as insurance, travel for administrative personnel, and general office supplies.

For instance, in 2023, Konka Group reported administrative expenses that played a role in its overall financial performance, underscoring the importance of controlling these overheads to ensure sustained profitability in a competitive electronics market.

Konka Group's cost structure is significantly shaped by capital expenditures, particularly in upgrading and expanding its manufacturing capabilities and technological infrastructure. These investments are critical for maintaining production efficiency and incorporating advanced technologies. In 2024, the company continued to prioritize such investments to remain competitive.

For example, the company's focus on developing advanced display technologies like Mini LED and Micro LED requires substantial capital outlay for specialized equipment and facility upgrades. These upfront costs are essential for future product innovation and market positioning.

| Cost Category | Description | 2024 Focus/Impact |

| Manufacturing & Production | Raw materials, components, labor wages | Essential for diverse product lines; supply chain efficiency critical. |

| Research & Development (R&D) | New technologies (Micro LED, AIoT, 5G, semiconductors) | Sustained investment for product differentiation and market leadership. |

| Marketing, Sales & Distribution | Advertising, digital marketing, sales force, retail/e-commerce, logistics | Building brand awareness and market penetration across various channels. |

| Supply Chain & Logistics | Transportation, warehousing, inventory, customs, duties | Global network management; impact of fuel costs and trade regulations. |

| Administrative & Overhead | Non-production staff salaries, office maintenance, legal/professional fees | Supporting overall operations and corporate framework. |

| Capital Expenditures (CAPEX) | Manufacturing upgrades, technological infrastructure | Crucial for production efficiency and incorporating advanced technologies. |

Revenue Streams

Konka Group's primary revenue driver is the sale of its extensive television lineup. This includes cutting-edge technologies like OLED, MiniLED, and MicroLED, alongside popular 4K and smart TV models. This broad product offering allows Konka to appeal to a wide customer base, from those seeking premium viewing experiences to budget-conscious consumers. In 2023, Konka's overall revenue was approximately 56.6 billion Chinese Yuan, with television sales forming a significant portion of this figure.

Konka Group’s revenue is significantly boosted by the sale of white goods and home appliances. This includes a broad range of essential household items like refrigerators, washing machines, and air conditioners. For instance, in 2023, the home appliance sector saw robust demand, contributing substantially to Konka’s overall financial performance.

The company employs a dual-brand strategy for its white goods, effectively targeting different market segments and expanding its customer base. This approach allows Konka to cater to a wider variety of consumer needs and price points, driving increased sales volume. This diversification in product and branding plays a crucial role in the company's revenue generation.

Konka Group generates significant revenue through the sale of mobile phones, tablets, smartwatches, and other connected digital devices. This segment directly addresses the increasing consumer desire for personal, portable technology. In 2023, the global smartphone market saw shipments reach approximately 1.17 billion units, indicating a robust demand for such products.

This focus on mobile and digital products aligns with Konka's broader strategy in consumer electronics, creating a synergistic effect where device sales can drive adoption of other Konka ecosystem products and services. The company aims to capture a share of this dynamic market by offering competitive and feature-rich devices.

Semiconductor Products and Solutions

Konka Group is generating revenue from its expanding semiconductor division, a key area of growth. This segment encompasses the trading of memory chips, providing essential packaging and testing services for storage devices, and the direct sale of advanced Micro LED chips along with associated optoelectronics. This diversification strategy is proving to be a significant and growing contributor to Konka's overall profitability.

The semiconductor business is a vital revenue stream for Konka, reflecting its strategic push into higher-value technology sectors. By engaging in memory chip trading, Konka capitalizes on market demand for essential computing components. Furthermore, its expertise in packaging and testing storage products ensures quality and reliability, creating another avenue for income.

- Memory Chip Trading: Konka actively participates in the global memory chip market, generating revenue through the buying and selling of these critical components.

- Packaging and Testing Services: The company offers specialized services for storage products, adding value and securing income through quality assurance processes.

- Micro LED Chips and Optoelectronics: Konka sells its own Micro LED chips and related optoelectronic products, tapping into the burgeoning advanced display market.

- Growing Profit Contribution: This semiconductor segment is increasingly important, making a more substantial impact on Konka's overall financial performance.

Related Services and Solutions

Konka Group diversifies its income beyond core product sales by offering a suite of related services. These include essential logistics support like domestic and international freight forwarding, ensuring efficient movement of goods. For 2024, the global freight forwarding market was projected to reach significant figures, underscoring the demand for such services.

Furthermore, Konka leverages its infrastructure for warehousing solutions, providing secure storage and inventory management for its clients. This is complemented by maintenance services, extending the lifecycle and usability of products. These offerings capitalize on Konka's established operational capabilities.

- Freight Forwarding: Facilitating the transportation of goods globally, crucial for international trade.

- Warehousing: Providing storage and inventory management, optimizing supply chain operations.

- Maintenance Services: Offering repair and upkeep to ensure product longevity and customer satisfaction.

- Supply Chain Management: Integrating and managing all activities in the supply chain to enhance efficiency and reduce costs.

Konka Group's revenue streams are multifaceted, extending beyond its well-known television and home appliance sales. The company actively participates in the semiconductor market, generating income from memory chip trading, packaging, and testing services, as well as the sale of its own Micro LED chips and optoelectronics. This segment is a growing contributor to Konka's profitability, demonstrating its strategic expansion into higher-value technology sectors.

Additionally, Konka leverages its logistical expertise to generate revenue through freight forwarding and warehousing solutions, supporting both its internal operations and external clients. The company also provides maintenance services for its products, ensuring customer satisfaction and creating an ongoing revenue stream.

| Revenue Stream | Description | 2023 Relevance/2024 Projection |

| Television Sales | Sales of OLED, MiniLED, MicroLED, 4K, and smart TVs. | Significant portion of 56.6 billion Yuan revenue in 2023. |

| White Goods & Home Appliances | Sales of refrigerators, washing machines, air conditioners, etc. | Robust demand contributed substantially to 2023 performance. |

| Mobile & Digital Devices | Sales of phones, tablets, smartwatches, and connected devices. | Addresses growing consumer demand for personal technology. |

| Semiconductor Division | Memory chip trading, packaging/testing, Micro LED chips, optoelectronics. | Increasingly important, growing profit contribution. |

| Services (Logistics, Maintenance) | Freight forwarding, warehousing, product maintenance. | Capitalizes on established operational capabilities; freight market projected for significant growth in 2024. |

Business Model Canvas Data Sources

The Konka Group Business Model Canvas is constructed using a blend of internal financial statements, extensive market research reports, and strategic analyses of the consumer electronics industry. These diverse data sources ensure each component of the canvas is grounded in verifiable information and current market realities.