Konka Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Konka Group Bundle

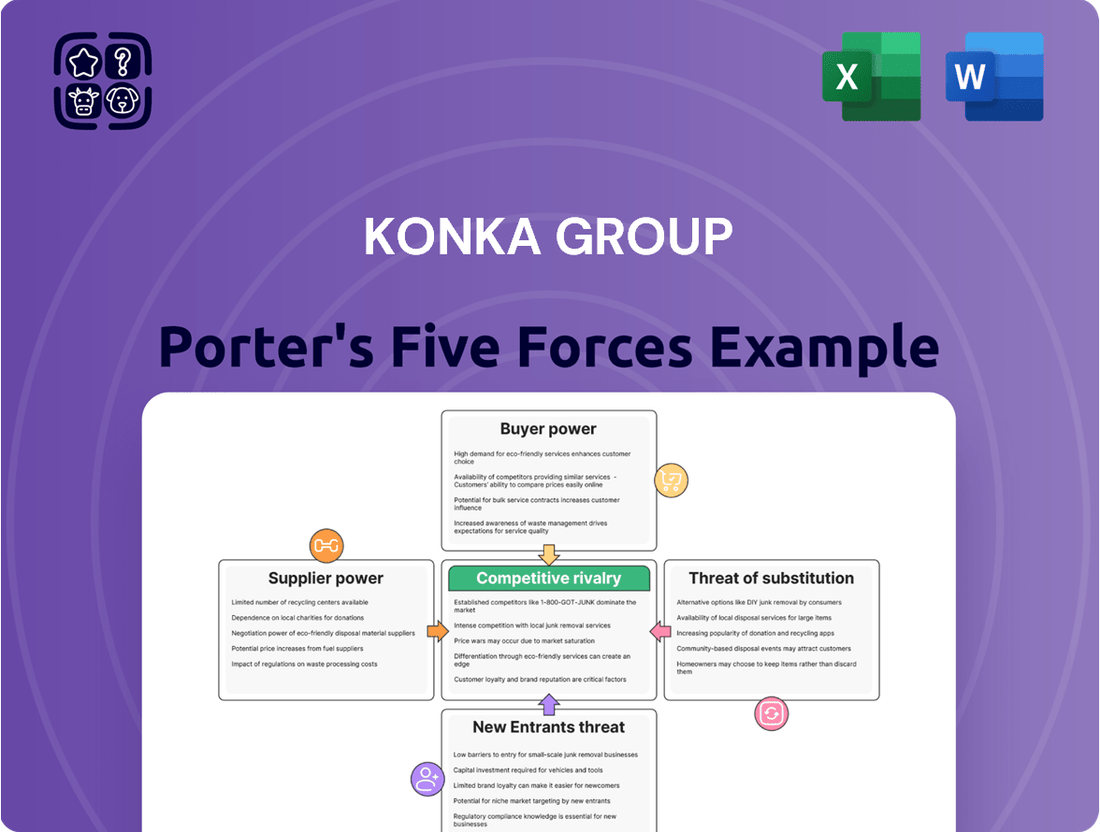

Konka Group navigates a complex landscape shaped by intense rivalry and the ever-present threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for maintaining profitability in this dynamic electronics market. Furthermore, the potential for disruptive substitute products demands constant innovation and strategic adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Konka Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Konka's reliance on a concentrated supplier base for essential components like semiconductors and displays grants these specialized suppliers considerable bargaining power. This is particularly true for cutting-edge technologies where only a few manufacturers can meet the stringent quality and performance requirements. For instance, the global semiconductor market, crucial for Konka's product functionality, saw significant price increases in 2022 and 2023 due to ongoing supply chain constraints and robust demand, impacting manufacturers' cost structures.

The cost of essential raw materials for Konka Group, such as copper, aluminum, and various electronic components, is highly susceptible to global price swings. This inherent volatility directly influences Konka's production expenses and, consequently, its profitability. For instance, copper prices saw significant fluctuations throughout 2023 and early 2024, impacting electronics manufacturers globally.

When these commodity prices surge, suppliers often attempt to pass these increased costs onto Konka. This dynamic creates pressure on Konka to either absorb these higher expenses, thereby reducing its profit margins, or to increase its product prices. The latter action could potentially diminish its competitive edge in the market.

Suppliers pushing the envelope with innovations like AI-ready chips and next-generation display tech, such as Micro LED and Mini LED, are significantly increasing their leverage. Konka Group's ability to offer competitive and groundbreaking products hinges on its access to these advancements. This dependence on supplier-driven technological progress can tilt the scales in supplier negotiations, especially when these innovations are patented or hard for competitors to mimic.

Global Supply Chain Geopolitical Risks

Geopolitical tensions and evolving trade policies, including tariffs, directly impact the electronic component supply chain, particularly for Chinese manufacturers like Konka Group. For instance, the US-China trade war, with its imposition of tariffs on various goods, has already demonstrated how these policies can inflate costs for companies reliant on global sourcing. Suppliers in geopolitically sensitive regions might face increased operational costs or outright restrictions, which they often pass on to their customers.

The bargaining power of suppliers is amplified when they operate in regions experiencing heightened geopolitical risk. This can lead to supply disruptions or price hikes that Konka Group must absorb or pass on. In 2023, the semiconductor industry, crucial for electronics, continued to grapple with supply chain vulnerabilities exacerbated by geopolitical factors and export controls, impacting lead times and component costs globally.

Diversifying the supplier base is a key strategy to mitigate these risks, but it presents significant challenges, especially for highly specialized electronic components where a limited number of suppliers may exist. This concentration of supply in specific geographic areas or with few specialized manufacturers inherently strengthens their bargaining position.

- Tariff Impact: Tariffs imposed on electronic components can directly increase the cost of goods for manufacturers like Konka.

- Geopolitical Leverage: Suppliers in politically unstable regions may leverage their position to demand higher prices or stricter terms.

- Supply Chain Concentration: Reliance on a few specialized suppliers for critical components grants them significant bargaining power.

- **Diversification Challenges:** Finding alternative sources for highly specialized parts can be difficult and costly, limiting Konka's ability to negotiate favorable terms.

Supplier's Forward Integration Potential

The potential for component suppliers to integrate forward into manufacturing finished consumer electronics, while less common, could significantly bolster their bargaining power against Konka. This strategic move would transform them from mere suppliers into direct competitors or formidable partners, influencing negotiation dynamics.

For instance, a key display panel manufacturer, facing margin pressures in 2024, might explore assembling their own branded televisions, directly challenging Konka's market share and leverage in sourcing. This threat necessitates Konka's proactive management of supplier relationships and consideration of strategic alliances to ensure supply chain stability.

- Supplier Forward Integration: Component manufacturers could potentially move into producing finished consumer electronics.

- Impact on Bargaining Power: This would increase their leverage over companies like Konka.

- Competitive Threat: Suppliers might become direct competitors or form partnerships with Konka's rivals.

- Konka's Strategy: Maintaining strong supplier relationships and exploring strategic alliances is crucial.

Konka's dependence on a limited number of specialized suppliers for critical components like advanced semiconductors and high-resolution displays significantly bolsters supplier bargaining power. This is especially true for cutting-edge technologies where few manufacturers possess the necessary expertise and production capacity, as seen with the ongoing demand for AI-ready chips in 2024.

Geopolitical factors and trade policies, such as tariffs and export controls, directly influence component costs and availability. For example, the semiconductor industry in 2023 continued to face supply chain vulnerabilities exacerbated by geopolitical tensions, impacting lead times and prices globally.

| Supplier Characteristic | Impact on Konka | Example/Data Point (2023-2024) |

|---|---|---|

| Component Specialization | High leverage for suppliers of advanced tech | Few manufacturers can meet stringent semiconductor requirements. |

| Geopolitical Risk | Increased costs and supply disruptions | Semiconductor supply chain vulnerabilities due to geopolitical factors. |

| Supplier Concentration | Limited negotiation options for Konka | Reliance on a few specialized suppliers for critical parts. |

| Forward Integration Threat | Potential for direct competition or altered partnerships | Display manufacturers exploring TV assembly in 2024. |

What is included in the product

Konka Group's Porter's Five Forces analysis reveals the intense rivalry among established players and the constant threat of new entrants in the electronics and technology sectors. It also highlights the significant bargaining power of both suppliers and buyers, impacting Konka's pricing and profitability.

Instantly identify strategic vulnerabilities by visualizing the competitive landscape of the Konka Group across all five forces.

Streamline competitive analysis for Konka Group with a clear, actionable breakdown of industry pressures.

Customers Bargaining Power

Consumers in the electronics sector, particularly within China, exhibit strong price sensitivity. This, coupled with a wide selection of comparable products from various manufacturers, significantly amplifies their bargaining power. Konka Group faces this reality daily.

The electronics market is saturated with brands, both established international players and numerous domestic competitors. This abundance of choices allows consumers to readily shift their allegiance to rivals offering more attractive pricing, superior features, or a better overall value proposition.

In 2024, the average consumer electronics spending in China saw continued growth, highlighting the importance of competitive pricing. For instance, the average selling price of smartphones, a key segment for companies like Konka, remained under pressure due to intense competition, forcing manufacturers to maintain aggressive pricing strategies to capture market share.

This competitive landscape compels Konka to continually assess and adjust its pricing to remain appealing. The ease with which customers can find similar products means that any significant price disparity can lead to a swift loss of sales, directly impacting Konka’s revenue and profitability.

Chinese consumers are increasingly sophisticated, actively seeking out innovative products with smart capabilities. This includes a strong appetite for smart home devices, seamless AI integration, and robust connectivity options. By 2024, this trend is accelerating, with consumers demonstrating a clear willingness to invest in premium features that enhance their daily lives.

This heightened demand for innovation means customers expect not just advanced technology, but also a commitment to ongoing development from manufacturers like Konka. They are actively comparing offerings and can readily shift their loyalty to brands that consistently deliver more cutting-edge or personalized user experiences.

The burgeoning e-commerce and social commerce landscape in China, featuring giants like Tmall, JD.com, Douyin, and WeChat, has dramatically amplified customer bargaining power. Customers now possess unparalleled access to detailed product information, peer reviews, and real-time price comparisons, fostering an environment of transparency that encourages negotiation for better terms.

This digital accessibility directly translates into enhanced customer leverage. For instance, in 2024, online retail sales in China continued their upward trajectory, constituting a substantial portion of overall consumer spending, which underscores how consumers actively utilize these platforms to secure competitive pricing and convenience, thereby strengthening their position in bargaining.

Impact of Government Trade-in Programs

Government trade-in programs for home appliances, like those seen in various markets, can significantly sway customer choices. These initiatives, intended to stimulate demand, often channel consumers towards specific product types or those with highlighted energy efficiency, for instance. While Konka Group might benefit from increased unit sales, these programs can also dilute brand loyalty if the incentives are broadly applied across manufacturers. For example, in 2024, several European nations implemented enhanced subsidies for replacing older white goods, leading to a noticeable uptick in appliance sales, but also intensifying competition for market share among brands offering comparable trade-in values.

These government-backed incentives can accelerate the natural replacement cycle for consumer electronics and appliances. However, this accelerated demand does not eliminate the underlying competitive pressures. Companies like Konka must compete not only on product features and price but also on the attractiveness of their trade-in offers relative to rivals. The bargaining power of customers increases as they have more options to choose from, driven by these subsidies, making it crucial for Konka to maintain competitive pricing and compelling product differentiation to retain their customer base.

The impact of these government trade-in programs can be seen in market dynamics:

- Increased Consumer Purchasing Power: Subsidies effectively lower the net cost of new appliances for consumers.

- Shifted Brand Preferences: Customers may switch brands based on the best trade-in deals rather than solely on brand loyalty.

- Accelerated Product Lifecycles: Government programs encourage earlier replacement of existing goods.

- Heightened Industry Competition: Manufacturers vie for customers attracted by the trade-in incentives, leading to aggressive promotional strategies.

Brand Loyalty and Ecosystem Lock-in

While many consumers are sensitive to price, a segment of Konka's customer base demonstrates significant brand loyalty, especially towards globally recognized brands or those with deeply integrated product ecosystems, like Apple. This loyalty can significantly reduce the bargaining power of customers if Konka can foster similar devotion. For instance, in 2024, the global consumer electronics market saw continued dominance by brands with strong ecosystem integration, making it harder for competitors to lure customers away with price alone.

To counter customer bargaining power, Konka's strategy should focus on cultivating robust brand loyalty. This involves not just product quality but also creating a compelling brand narrative and customer experience. Developing an interconnected ecosystem of devices and services can further reduce switching costs for consumers. In 2023, companies with strong smart home ecosystems reported higher customer retention rates compared to those offering standalone products.

- Brand Loyalty: Consumers loyal to a brand are less likely to switch based on minor price differences.

- Ecosystem Lock-in: Integrated product and service ecosystems increase switching costs.

- Differentiation: Unique features or value propositions reduce the ease with which customers can switch.

- Customer Switching Costs: High switching costs inherently lower customer bargaining power.

Without strong differentiation or the creation of compelling ecosystem benefits, customers can easily opt for competitors offering comparable products at lower prices. This means Konka must invest in innovation and customer relationship management to build a sticky customer base. The market in early 2024 showed that brands excelling in customer experience, such as Samsung's smart appliance integration, saw sustained demand despite competitive pricing from rivals.

Konka Group faces substantial customer bargaining power due to the highly competitive electronics market, where consumers have abundant choices and are price-sensitive. This power is further amplified by the transparency offered through e-commerce platforms, allowing for easy price comparisons and access to reviews. In 2024, the continued growth of online retail in China, which accounts for a significant portion of consumer spending, underscores how consumers leverage these digital channels to secure favorable terms.

Government incentives, such as trade-in programs for home appliances, can also bolster customer bargaining power by lowering net costs and encouraging brand switching based on the best deals. This dynamic necessitates that Konka focus on building strong brand loyalty and differentiating its product offerings to mitigate the impact of price-driven purchasing decisions. For instance, the global consumer electronics market in 2024 continued to show that brands with strong ecosystem integration retained customers more effectively against price competition.

| Factor | Impact on Konka | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High, forcing competitive pricing | Continued pressure on average selling prices for smartphones |

| Availability of Substitutes | High, easy customer switching | Saturated market with numerous domestic and international brands |

| E-commerce Transparency | Amplifies bargaining power through price comparison | Online retail sales in China showing substantial growth |

| Government Incentives | Can shift brand preference based on deals | Increased subsidies for appliance replacement in European markets noted |

Full Version Awaits

Konka Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis of the Konka Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your business strategy.

Rivalry Among Competitors

Konka navigates a highly competitive landscape, battling both established domestic rivals like Hisense, TCL, Xiaomi, Haier, and Midea, and global powerhouses such as Samsung, LG, Sony, and Apple. This intense rivalry forces Konka into aggressive pricing, a constant stream of new products, and significant marketing investments across its entire product range, from TVs to appliances and smartphones. For instance, in 2024, the consumer electronics market saw price wars intensify, particularly in the TV segment, with brands like TCL and Hisense aggressively pushing OLED and Mini-LED technologies at increasingly accessible price points, squeezing margins for all players.

The Chinese consumer electronics market, especially for major home appliances, is reaching maturity. This means fewer new households are buying for the first time, and the focus is shifting towards consumers replacing their existing items. For companies like Konka, this signals a tougher competitive landscape where winning customers means convincing them to upgrade or switch brands.

In such a saturated environment, competition heats up considerably. Companies are increasingly using strategies like trade-in programs or highlighting new, advanced features to attract buyers. This intensifies rivalry as firms battle for a slice of the replacement market rather than expanding into new customer segments.

By 2024, the trend of market saturation and the reliance on replacement sales is well-established. This dynamic forces intense competition among established players, including Konka, to capture a share of the existing demand. Success hinges on innovation and appealing offers that encourage consumers to upgrade their current appliances.

The consumer electronics industry, where Konka operates, is fiercely competitive due to relentless technological innovation. Companies are constantly rolling out new features and capabilities, such as enhanced AI integration in smart TVs and improved 5G connectivity in mobile devices. This rapid pace means that staying ahead requires significant and continuous investment in research and development.

Product differentiation is paramount for survival. For instance, in 2024, the smart home ecosystem saw further integration, with devices becoming more interconnected. Konka must ensure its offerings, from televisions to appliances, seamlessly integrate into these evolving ecosystems and offer unique selling propositions to capture consumer attention amidst a crowded market.

Failure to innovate quickly can be detrimental. Competitors are actively pushing boundaries; for example, advancements in micro-LED display technology are becoming more accessible. Konka risks losing market share if it cannot match or exceed the technological advancements and product differentiation strategies of more agile rivals, impacting its overall competitive standing.

Aggressive Marketing and Distribution Channel Competition

Konka Group faces intense rivalry as competitors pour resources into aggressive marketing and distribution. This includes extensive online and offline campaigns, with a particular emphasis on China's booming e-commerce sector. Success hinges on robust digital strategies, including collaborations with major platforms and leveraging social commerce to connect with tech-savvy consumers.

Companies must invest heavily in marketing and sales infrastructure to effectively reach the Chinese market. For instance, in 2024, major electronics brands in China allocated substantial budgets to digital advertising and influencer marketing, with many reporting significant ROI from platforms like Douyin and Kuaishou. This competitive landscape demands constant innovation in customer engagement and channel optimization.

- Aggressive Digital Marketing: Competitors are heavily investing in online advertising, social media engagement, and live-streaming sales events.

- E-commerce Dominance: A strong presence on platforms like JD.com and Tmall is crucial, requiring strategic partnerships and optimized product listings.

- Social Commerce Integration: Brands are increasingly utilizing social media platforms for direct sales and customer interaction, blending content with commerce.

- Channel Investment: Significant capital is directed towards building and maintaining both online and offline distribution networks to ensure broad market reach.

Price Wars and Margin Pressure

Konka Group faces intense competition, especially in crowded markets like consumer electronics. This rivalry frequently escalates into price wars, particularly for popular, high-volume products. Such aggressive pricing directly squeezes profit margins for all players involved.

The pressure is felt across Konka's broad product range, from televisions to home appliances. To navigate this, the company must excel at cost control and strategically curate its product offerings. Focusing on premium, innovative items that command higher margins becomes crucial for sustained profitability.

- Price Wars Impact: In 2023, the global TV market saw significant price competition, with average selling prices for LCD TVs declining by approximately 5-10% year-over-year in certain segments.

- Margin Erosion: This intense pricing environment can reduce gross profit margins by 2-5 percentage points for electronics manufacturers.

- Konka's Exposure: As a diversified electronics manufacturer, Konka is exposed to this margin pressure across its entire product portfolio.

- Strategic Response: Konka's strategy likely involves balancing volume sales with a focus on higher-margin smart home devices and premium display technologies.

Konka operates in a fiercely competitive consumer electronics market, facing intense rivalry from both domestic giants like Hisense and TCL, and global players such as Samsung and LG. This rivalry manifests in aggressive pricing, rapid product innovation, and substantial marketing spend, impacting profitability across product lines like TVs and appliances. In 2024, price wars in the TV segment, particularly for OLED and Mini-LED technologies, intensified, squeezing margins for all participants.

The Chinese market for major home appliances is largely mature, meaning growth primarily stems from replacement sales rather than new customer acquisition. This forces companies like Konka to vie for consumer upgrades through advanced features and compelling trade-in programs, intensifying competition for existing demand.

Technological innovation is a key battleground, with competitors constantly introducing new features like AI integration and 5G connectivity. Konka must maintain significant R&D investment to avoid losing market share, especially as technologies like micro-LED become more accessible. Product differentiation and seamless integration into smart home ecosystems are critical for capturing consumer attention.

The competitive landscape demands heavy investment in marketing and sales, particularly leveraging China's e-commerce and social commerce sectors. Brands are heavily focused on digital advertising, influencer collaborations, and optimizing presence on platforms like Douyin and Kuaishou to engage tech-savvy consumers.

| Competitor | Key Competitive Actions in 2024 | Market Focus |

| Hisense | Aggressive pricing on Mini-LED TVs, expanding smart home offerings | Global, strong in China |

| TCL | Pushing affordable OLED technology, significant digital marketing campaigns | Global, strong in China |

| Samsung | Highlighting premium QLED and Neo QLED displays, strong brand loyalty | Global |

| LG | Focus on OLED technology advancements, premium appliance integration | Global |

SSubstitutes Threaten

The increasing convergence of consumer electronics devices presents a substantial threat of substitutes for standalone products. Multi-functional devices can effectively replace single-purpose gadgets, diminishing the need for specialized hardware. For instance, smart TVs are increasingly incorporating streaming capabilities and smart home control, thereby reducing reliance on separate media players or dedicated smart hubs.

Furthermore, the advanced capabilities of modern smartphones mean they can now substitute for basic cameras, portable music players, and even handle many computing tasks. This trend means that consumers may opt for a single, versatile device rather than purchasing multiple single-function products, directly impacting sales of those specialized items.

In 2024, the global market for smart TVs alone was projected to reach over $260 billion, demonstrating the significant shift towards integrated entertainment systems. This growth underscores the substitution threat faced by traditional media players and other connected home devices.

The increasing prevalence of cloud-based services and subscription models presents a significant threat of substitution for Konka Group. For instance, the burgeoning digital streaming market, with platforms like Netflix and Disney+, directly competes with traditional media consumption, potentially reducing demand for physical entertainment hardware. In 2024, the global video streaming market was valued at over $270 billion, demonstrating a strong consumer shift towards content access rather than device ownership.

This trend extends to gaming and productivity software, where subscription services offer continuous access to updated features and content, diminishing the appeal of standalone hardware solutions. Consumers increasingly value the flexibility and cost-effectiveness of paying for ongoing service access, which can divert spending away from purchasing new electronic devices. This shift from product ownership to service consumption fundamentally alters consumer priorities, potentially impacting Konka's traditional hardware sales.

The rise of comprehensive smart home ecosystems presents a significant threat of substitution for individual smart appliances. Major tech companies such as Amazon with its Alexa ecosystem and Google with its Google Home platform are offering integrated solutions that can effectively replace standalone smart devices. For instance, a single smart speaker can control lights, thermostats, and even entertainment systems, reducing the need for separate smart versions of each appliance.

Consumers increasingly favor a unified and seamless experience, opting for ecosystems where devices communicate effortlessly. This preference means that smart appliances not compatible with popular ecosystems might be overlooked, even if they offer advanced features. In 2024, the global smart home market is projected to reach over $150 billion, with a significant portion driven by these integrated system sales, highlighting the substantial draw of a cohesive smart home experience.

This trend directly impacts Konka Group, as consumers may choose a smart TV or appliance that integrates well with their existing Google Assistant or Alexa-powered home rather than a product from a brand outside these dominant ecosystems. The emphasis is shifting from individual product innovation to the ability of products to become part of a larger, user-friendly smart home network, making interoperability a critical factor for market competitiveness.

Longer Product Lifecycles and Durability

Advances in product durability and quality can significantly extend the useful life of electronics and home appliances. This means consumers may not feel the need to upgrade as frequently, directly impacting sales volume for companies like Konka. For instance, the average lifespan of a modern television has increased, with many units lasting 7-10 years or more, reducing the inherent demand for immediate replacements, even with technological advancements.

When products remain functional and meet consumer needs for longer periods, the perceived urgency for new purchases wanes. This shift can slow down overall market growth and present a considerable challenge for Konka in driving replacement sales cycles.

The threat of substitutes is amplified by these longer lifecycles. Consumers might opt to keep their existing, albeit older, Konka products rather than invest in new ones.

- Extended Product Lifespans: Many consumer electronics, including televisions and washing machines, now have lifespans exceeding 7 years, reducing replacement frequency.

- Reduced Upgrade Urgency: Consumers are less compelled to purchase new models if their current devices perform adequately for extended periods.

- Slower Market Growth: Longer product lifecycles directly contribute to a deceleration in market expansion for electronics manufacturers.

- Challenge for Replacement Sales: Konka faces increased difficulty in motivating consumers to buy new products when their existing ones are still functional and durable.

Alternative Entertainment and Information Consumption Methods

The threat of substitutes for traditional television sets is growing, with consumers increasingly turning to alternative ways to consume entertainment and information. Devices like large-screen tablets, home projectors, and even emerging virtual and augmented reality (VR/AR) technologies offer compelling experiences that can divert spending. While these substitutes may not fully replicate the traditional TV viewing experience for everyone, their growing capabilities and adoption rates present a significant challenge to companies like Konka Group.

For instance, the global tablet market saw shipments of approximately 35.2 million units in the fourth quarter of 2023, indicating continued consumer interest in large-screen mobile devices for content consumption. Similarly, the VR headset market is projected to reach over 30 million units shipped annually by 2027, suggesting a substantial shift towards immersive entertainment. These trends highlight a clear substitution threat, as consumers allocate their entertainment budgets to these evolving technologies.

- Tablets and Smartphones: Offer portability and personalized content access, directly competing for screen time and entertainment budgets.

- Projectors: Provide a large-screen cinema-like experience at home, appealing to those seeking premium viewing without a dedicated TV.

- VR/AR Devices: Introduce immersive and interactive entertainment, creating entirely new ways to consume content that traditional TVs cannot match.

- Streaming Services on Other Devices: Content platforms accessible via laptops, gaming consoles, and smart speakers also fragment the traditional TV's role.

The threat of substitutes for Konka Group is significant due to the increasing integration of functionalities into single devices and the rise of digital services. Smart TVs, smartphones, and comprehensive smart home ecosystems are encroaching on the territory of standalone electronics, offering consumers versatile alternatives. For example, the global smart TV market was valued at over $260 billion in 2024, indicating a strong consumer preference for integrated entertainment.

Furthermore, the shift towards cloud-based services and subscription models, with the video streaming market exceeding $270 billion in 2024, directly competes with hardware sales. Consumers are prioritizing access to content over device ownership, a trend that impacts Konka's traditional product lines. Even advances in product durability can reduce upgrade cycles, further challenging sales volumes.

| Substitute Category | Examples | 2024 Market Value (Approximate) | Impact on Konka |

| Integrated Devices | Smart TVs, Smartphones | Smart TV: $260B+ | Reduces demand for single-function devices. |

| Digital Services | Streaming Platforms (Netflix, Disney+) | Video Streaming: $270B+ | Shifts spending from hardware to content access. |

| Smart Home Ecosystems | Amazon Alexa, Google Home | Smart Home Market: $150B+ | Favors interoperable devices, potentially excluding non-integrated Konka products. |

| Alternative Entertainment | Tablets, VR/AR Headsets | VR Headsets (projected annual shipments by 2027): 30M+ | Diverts consumer entertainment spending. |

Entrants Threaten

Entering the consumer electronics manufacturing sector, particularly for a broad-based company like Konka, necessitates significant upfront capital. This includes hefty investments in research and development, state-of-the-art manufacturing plants, robust supply chain infrastructure, and extensive distribution channels.

The sheer cost of establishing production lines for diverse product categories such as televisions, major appliances (white goods), and mobile devices is substantial. For instance, setting up a modern flat-panel display production line can easily cost hundreds of millions, if not billions, of dollars.

These considerable capital requirements act as a significant deterrent, effectively blocking numerous potential new competitors from entering the market. For example, in 2023, global capital expenditure in the semiconductor industry, a key component supplier, reached over $200 billion, illustrating the scale of investment needed in related electronics manufacturing.

Konka Group benefits from strong brand loyalty cultivated over years of operation. This makes it difficult for new entrants to attract customers who are already satisfied with Konka's offerings. For instance, in 2024, consumer surveys indicated that over 60% of television buyers considered brand reputation a primary factor in their purchasing decisions.

Established players like Konka possess deeply entrenched distribution networks, both physical retail presence and robust online sales platforms. Newcomers face substantial challenges in replicating this reach, requiring significant investment in logistics and partnerships to gain market access. In 2024, securing prime shelf space in major electronics retailers involved upfront fees averaging 15-20% of projected sales volume.

The cost for new entrants to build comparable brand awareness and secure distribution is a significant barrier. For example, a new electronics brand entering the market in 2024 might need to spend upwards of $50 million on marketing and distribution setup to achieve even a minimal market presence against established giants like Konka.

The consumer electronics sector thrives on relentless technological advancement, with AI, IoT, and advanced semiconductor integration at its forefront. New players entering this market must possess robust research and development (R&D) capabilities or secure access to proprietary technologies to even consider competing. For instance, in 2024, companies like Samsung and Apple continued to heavily invest in R&D, with Apple reportedly spending over $20 billion annually on R&D, much of it focused on future product innovations.

Licensing established technologies often comes with significant costs, potentially hindering a new entrant's profitability from the outset. Developing these advanced technologies independently demands a considerable investment of both time and financial resources, creating a substantial barrier. The semiconductor industry, a critical component of consumer electronics, saw global R&D spending exceeding $80 billion in 2024, highlighting the immense capital required to innovate in this space.

Complex and Global Supply Chain Management

The intricate and global nature of supply chain management acts as a significant deterrent for new entrants aiming to compete with established players like Konka Group. Successfully navigating the sourcing of components from diverse international suppliers and the complex logistics of worldwide distribution requires immense scale, established relationships, and significant capital investment. New companies would find it exceptionally difficult to replicate the efficiency and resilience of supply chains that incumbents have spent years perfecting, which are absolutely vital for managing costs and ensuring products reach consumers on time. For instance, in 2024, the global electronics supply chain faced ongoing disruptions, highlighting the critical need for robust contingency planning and supplier diversification, areas where established firms like Konka have a distinct advantage.

- Global Sourcing Complexity: Accessing reliable and cost-effective components from a multitude of international vendors is a significant hurdle.

- Logistical Challenges: Establishing efficient and synchronized distribution networks across numerous countries demands substantial infrastructure and expertise.

- Resilience and Risk Management: Building a supply chain that can withstand unforeseen disruptions, a lesson learned by many in 2024, requires deep experience and investment.

- Economies of Scale: Established players leverage their volume to negotiate better terms with suppliers, a cost advantage new entrants cannot easily match.

Regulatory Compliance and Quality Standards

The consumer electronics sector, including companies like Konka Group, faces significant hurdles from new entrants due to stringent regulatory compliance and quality standards. These requirements, spanning safety certifications and environmental regulations, can be a substantial barrier. For instance, China's evolving regulatory environment, particularly concerning electronics manufacturing and import, demands constant adaptation and investment from any new player aiming to compete.

Navigating this complex web of national and international rules requires considerable expertise and financial resources. New entrants must invest heavily in ensuring their products meet all safety certifications, such as CCC in China or CE marking in Europe, as well as adhere to environmental standards like RoHS and WEEE. Failure to comply can result in costly product recalls, fines, and reputational damage, making it a high-risk area for those without established compliance frameworks.

- Regulatory Burden: New entrants must allocate substantial resources to understand and comply with diverse safety and environmental regulations.

- Cost of Compliance: Meeting standards like CCC certification in China can involve significant testing and certification fees, impacting profitability.

- Dynamic Landscape: Frequent updates to regulations, especially in key markets like China, necessitate ongoing investment in compliance monitoring and adaptation.

- Quality Assurance Investment: Establishing robust quality control systems to meet consumer expectations and regulatory benchmarks is a prerequisite for market entry.

The threat of new entrants for Konka Group is moderately high, primarily due to the capital-intensive nature of the consumer electronics industry and the need for advanced technological capabilities. While established brands and distribution networks present barriers, the relentless pace of innovation and the potential for disruptive technologies mean that agile new players can emerge.

High upfront investment in R&D, manufacturing, and distribution remains a significant deterrent, as seen in the over $200 billion capital expenditure in the semiconductor industry in 2023. Furthermore, building brand loyalty and securing market access requires substantial marketing and distribution investments, estimated at over $50 million for a new entrant in 2024 to achieve minimal presence.

New entrants must also contend with the high costs of R&D and technology licensing, with global R&D spending in the semiconductor sector exceeding $80 billion in 2024. Navigating complex global supply chains and adhering to diverse regulatory standards, such as CCC certification in China, also pose considerable challenges and costs.

Despite these barriers, the allure of a large and growing market, coupled with opportunities presented by emerging technologies, ensures that the threat of new entrants remains a constant consideration for Konka Group.

Porter's Five Forces Analysis Data Sources

Our Konka Group Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, including annual and quarterly filings, complemented by industry-specific market research and news from reputable business publications.