Konka Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Konka Group Bundle

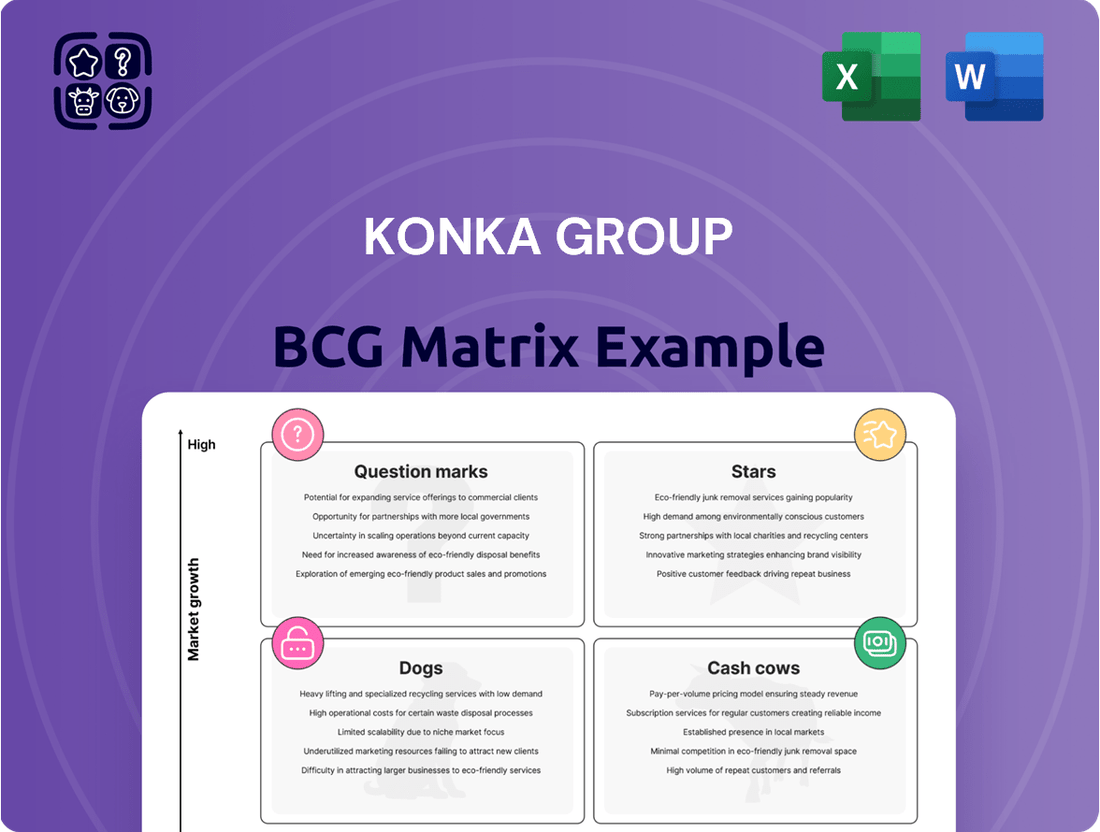

Uncover the strategic positioning of Konka Group's diverse product portfolio with our insightful BCG Matrix preview. Understand which segments are driving growth and which require careful management.

This glimpse into Konka's market standing is just the beginning. To truly leverage this analysis for your own business, dive deeper into the full BCG Matrix report.

Gain clarity on Konka's Stars, Cash Cows, Dogs, and Question Marks, and translate these insights into actionable strategies for your investments and product development.

Purchase the complete BCG Matrix to unlock detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart capital allocation and competitive advantage.

Don't miss out on the complete picture – get the full report and transform your understanding of Konka Group's market dynamics into your own strategic success.

Stars

Konka's substantial investments, including a $365 million R&D center, underscore their commitment to advanced Micro LED display technology. This positions them as a key player in a segment poised for significant expansion.

The company's achievement of a 98% bonding yield in red-light Micro LED chips is a critical technological milestone. This high yield is essential for mass production and cost-effectiveness in the competitive Micro LED market.

With the Micro LED market projected for substantial growth, Konka's strategic focus on this cutting-edge display technology is a clear indicator of their ambition to capture a leading market share.

These demonstrated technological advancements and strategic market positioning firmly place Konka's Micro LED display technology in the star category of the BCG Matrix.

Konka's presence in the high-end Mini LED and OLED TV market is marked by their introduction of flagship models like the 809 and 812 Series at CES 2024. This strategic move into premium displays, boasting advanced technologies and AI sound, targets a segment experiencing increasing demand for superior home entertainment. Their 2023 performance, showing a significant year-on-year increase in brand business revenue and TV sales, underscores their growing strength and competitive footing in this lucrative area.

Konka Group's AIoT and Smart Home Solutions represent a significant investment in future growth, aligning with the company's strategy to leverage AI and 5G. They are actively building advanced laboratories to foster innovation in this space, aiming to deeply integrate artificial intelligence into their smart home product offerings. This focus is crucial as the Chinese smart home appliance market is projected to reach a substantial scale by 2025, presenting a prime opportunity for market expansion.

The company's dedication to developing cutting-edge technologies, such as AI-driven sound perception engines and intelligent appliances, positions Konka to capture a considerable share of this rapidly expanding sector. For instance, by 2024, the global smart home market was already valued in the hundreds of billions of dollars, with China being a major contributor, underscoring the immense potential Konka is targeting.

Overseas Market Expansion (e.g., Sri Lanka, Australia)

Konka's strategic re-entry into markets like Sri Lanka in 2024, alongside its 2023 expansion into Australia, Algeria, and Kazakhstan, highlights a significant push for international growth. These moves suggest a strategy aimed at capturing nascent market share in potentially high-growth regions.

While precise market share figures for these recent ventures are still developing, Konka's broad product portfolio and rapid geographical expansion signal substantial growth potential. For instance, by the end of 2023, Konka had reportedly expanded its presence in over 100 countries, indicating a commitment to global reach.

- Global Reach: Konka's 2023 expansion into Australia, Algeria, and Kazakhstan, coupled with its 2024 re-entry into Sri Lanka, signifies a strategic effort to broaden its international footprint.

- Growth Potential: These new markets, while potentially having low initial market share, represent significant opportunities for Konka to establish a strong presence and increase its global sales volume.

- Product Diversification: The company's strategy involves offering a wide array of products in these new territories, aiming to cater to diverse consumer needs and accelerate market penetration.

- Market Share Ambitions: Konka's aggressive international expansion indicates a clear objective to enhance its overall market share on a global scale, moving beyond its traditional strongholds.

Semiconductor Business (Long-term Potential)

Konka's semiconductor business, currently categorized as a 'Question Mark' within the BCG matrix, represents a significant long-term investment with substantial growth potential. The company is actively developing full-stack capabilities, particularly through its subsidiary Konsemi, focusing on storage controller chips. This strategic move aligns with Konka's broader vision of integrating consumer electronics with semiconductor manufacturing.

The semiconductor industry is experiencing rapid advancements and is crucial for numerous technological sectors. Konka's commitment to this area, despite its current early-stage status, positions it to capture future market share. For instance, the global semiconductor market was valued at approximately $580 billion in 2023 and is projected to grow, driven by demand in AI, automotive, and IoT. By 2024, the market is expected to see continued growth, with projections indicating a strong rebound and expansion in various segments.

- Strategic Focus Konka aims to build comprehensive capabilities in semiconductor design and manufacturing, essential for its consumer electronics ecosystem.

- Market Opportunity The semiconductor sector offers high growth potential, with global market revenues expected to increase significantly in the coming years.

- Investment and Development Significant capital is being allocated to research, development, and industrialization of new semiconductor products.

- Potential for 'Star' Status Successful scaling of production and market penetration could elevate this segment to 'Star' status, a major contributor to Konka's overall business.

Konka's advanced Micro LED display technology, backed by substantial investments like a $365 million R&D center, firmly places it in the 'Star' category of the BCG matrix. The company's high bonding yield of 98% for red-light Micro LED chips is a critical step towards mass production and cost-effectiveness in a market projected for significant expansion.

Konka's premium Mini LED and OLED TVs, exemplified by their 2024 CES introductions, also represent a 'Star' segment. Their 2023 performance, showing a notable increase in brand business revenue and TV sales, confirms their growing strength in this lucrative, high-demand sector.

The company's aggressive international expansion, including re-entry into Sri Lanka in 2024 and 2023 ventures into Australia, Algeria, and Kazakhstan, signals a strong push for global market share. This strategic move to broaden its footprint across diverse regions, supported by a wide product portfolio, indicates significant growth potential and positions these emerging markets for future 'Star' status.

Konka's AIoT and Smart Home Solutions are also positioned as 'Stars'. Their investments in advanced laboratories and AI integration for smart home products align with the rapidly growing Chinese smart home market, projected for substantial scale by 2025. Global market valuations in the hundreds of billions of dollars by 2024 highlight the immense opportunity Konka is targeting with its AI-driven innovations.

What is included in the product

Konka Group's BCG Matrix offers tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Konka Group BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

Konka's domestic color TV business, a historical stronghold, remains a significant player, positioning it as a Cash Cow. Despite facing a deficit in the first half of 2024 due to fierce market competition, the segment benefits from robust production capacity and high market penetration within China, a testament to its established brand.

This long-standing presence, coupled with an extensive distribution network, ensures consistent, albeit potentially lower-margin, revenue generation. For instance, in 2023, the color TV market in China saw shipments of over 37 million units, with Konka consistently ranking among the top brands, demonstrating its deep market roots and ability to generate stable cash flow.

Konka's conventional refrigerators and washing machines represent significant cash cows for the group. Their long-standing presence in the white goods market, particularly in mature domestic markets, has likely secured them a substantial market share. This strong positioning allows these product lines to generate consistent and reliable cash flow for Konka.

The company's strategic diversification within these categories, including the adoption of a dual-brand strategy with FRESTEC, further solidifies their hold. These mature product lines generally require less capital for aggressive promotion and groundbreaking innovation compared to emerging product segments. This reduced investment burden means more of the revenue generated can be directly channeled into funding other areas of Konka's business.

Konka's established supply chain and manufacturing operations are a prime example of a cash cow within its business portfolio. The company boasts extensive manufacturing capabilities, notably its large HD color TV production bases. These facilities alone have the capacity to produce over 17 million TVs annually, showcasing a significant operational scale.

This robust production capacity translates into a stable, high-volume output, consistently generating substantial cash flow for Konka. The efficiency derived from well-managed manufacturing processes and a streamlined supply chain is key to this reliable revenue stream.

Further bolstering the profitability of these core operations is Konka's commitment to lean management principles. This focus on efficiency helps to minimize waste and optimize resource utilization, directly contributing to the high cash generation from its manufacturing segment.

PaaS (Platform as a Service) and Internet Services

Konka Group's strategic diversification into PaaS, encompassing internet and supply chain services, represents a move towards establishing robust cash cows. These ventures capitalize on Konka's existing infrastructure and technological expertise, positioning them to generate consistent, recurring revenue with manageable incremental investment. The digital nature of these platforms allows Konka to tap into its substantial consumer electronics user base, offering a variety of value-added services that can translate into stable cash flows.

The PaaS and internet services are designed to leverage Konka's extensive reach. For instance, Konka's smart TV platform, which boasts tens of millions of active users, serves as a prime example of a foundation for internet services. This allows for the monetization of content, advertising, and other digital offerings. In 2023, the company reported significant growth in its internet service segment, driven by increased user engagement and new service introductions, contributing positively to overall profitability.

- Platform Leverage: Konka's PaaS offerings, including its smart home ecosystem and supply chain solutions, benefit from its established hardware presence.

- Recurring Revenue: Internet services, such as content streaming subscriptions and app store revenues, provide predictable income streams.

- User Base Monetization: The massive installed base of Konka consumer electronics devices offers a direct channel to monetize digital services.

- Strategic Investment: While requiring initial investment, the scalability of PaaS and internet services means marginal costs decrease as the user base grows, enhancing cash flow generation.

Industrial Parks and Real Estate Ventures

Konka Group's Industrial Parks and Real Estate Ventures stand as a prime example of a Cash Cow in their BCG Matrix. These operations focus on developing and managing industrial real estate, which, once established, yields steady rental income and property management fees. This segment is characterized by its maturity and substantial asset base, consistently generating low-growth but reliable cash flow. For instance, by the end of 2024, Konka's real estate segment contributed significantly to the group's financial stability, acting as a dependable source of funds for other business units.

The stability of this business is a key strength.

- Stable Cash Flow: The rental income from developed industrial parks provides a predictable and consistent revenue stream.

- Asset-Heavy Nature: While requiring significant initial investment, these assets generate long-term returns.

- Low Growth, High Share: The business operates in a mature market but holds a strong position, characteristic of a Cash Cow.

- Financial Support: The cash generated by this segment supports investment in other, higher-growth areas of Konka Group.

Konka's established manufacturing and supply chain operations are significant cash cows. With production bases capable of manufacturing over 17 million HD color TVs annually, these facilities ensure high-volume, consistent output. Efficient management and lean principles further enhance profitability, directly contributing to substantial cash generation for the group.

The company's industrial parks and real estate ventures also function as cash cows. These mature operations, characterized by a strong market position, yield steady rental income and property management fees, providing a dependable source of funds. By the close of 2024, this segment bolstered Konka's financial stability.

Konka's domestic color TV business, a historical stronghold, remains a significant player, positioning it as a Cash Cow. Despite facing a deficit in the first half of 2024 due to fierce market competition, the segment benefits from robust production capacity and high market penetration within China, a testament to its established brand.

Konka's conventional refrigerators and washing machines are also key cash cows. Their long-standing presence in mature domestic markets, coupled with strategies like the dual-brand approach with FRESTEC, secures substantial market share and generates reliable cash flow with reduced investment needs.

| Business Segment | BCG Category | Key Characteristic | 2023/2024 Data Point |

| Color TV Business (Domestic) | Cash Cow | High market penetration, robust production capacity | Shipments over 37 million units in China (2023) |

| Conventional Refrigerators & Washing Machines | Cash Cow | Established market presence, consistent revenue generation | Dual-brand strategy (FRESTEC) implemented |

| Manufacturing & Supply Chain | Cash Cow | High production volume, operational efficiency | Annual HD color TV production capacity > 17 million units |

| Industrial Parks & Real Estate | Cash Cow | Steady rental income, mature market position | Contributed significantly to financial stability by end of 2024 |

Full Transparency, Always

Konka Group BCG Matrix

The Konka Group BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, offers actionable insights into Konka's product portfolio, categorizing each business unit as a Star, Cash Cow, Question Mark, or Dog based on market share and growth rate. You can be confident that no watermarks or demo content will obscure the detailed strategic recommendations and visual representations within the final document.

Dogs

Within Konka Group's BCG Matrix, older generation mobile phones are positioned as Dogs. The Chinese smartphone market is incredibly crowded, with giants like Xiaomi and Huawei setting the pace. Konka's legacy mobile products, facing rapid technological advancements and intense competition, likely command a minimal market share in this mature, saturated segment.

These older models may struggle to generate profits, potentially becoming cash drains for the company. Without recent strong performance indicators, their contribution to Konka's overall growth appears limited, fitting the characteristics of a Dog in the BCG framework.

Konka's basic, undifferentiated small home appliances likely reside in the Dogs quadrant of the BCG Matrix. This segment of the market, characterized by intense price competition, often yields thin profit margins. If these product lines lack significant innovation or smart capabilities, they would naturally exhibit both low market share and sluggish growth.

These products could become cash traps for Konka, consuming capital for production and inventory without delivering substantial returns. For instance, in 2024, the global market for basic blenders and toasters, if not differentiated, faces immense pressure from numerous low-cost manufacturers, making it difficult to achieve significant market share or growth. Companies must carefully manage these assets to avoid hindering investment in more promising areas.

Legacy display technologies, such as traditional LCDs, within Konka's portfolio likely reside in the Dogs category of the BCG Matrix. As Konka strategically channels significant investment into advanced areas like Mini LED and Micro LED, these older display products are experiencing a decline in market relevance and face intense competition from newer, superior technologies. This results in a low market share and minimal growth prospects, indicating a need for careful resource management.

Underperforming Regional Markets (Divested or Reduced Focus)

Konka Group's interim report for the first half of 2024 highlighted a strategic business restructuring. This involved optimizing specific business lines that lacked synergistic benefits with the core operations and exhibited low gross margins. This suggests that certain regional markets or distribution channels have been underperforming for Konka.

These underperforming areas represent markets where Konka has struggled to establish a significant presence or achieve profitability. Consequently, they likely exhibit both low market share and limited growth potential. Such segments are prime candidates for divestiture or a strategic reduction in investment focus.

- Regional Market Underperformance: Konka's H1 2024 interim report indicated a review of business lines lacking synergy and profitability, directly pointing to underperforming regional markets.

- Low Market Share and Growth: These divested or reduced-focus areas are characterized by Konka's difficulty in gaining traction, resulting in a low market share and stunted growth prospects.

- Strategic Optimization: The company is actively optimizing its portfolio, shedding or deprioritizing operations that do not contribute positively to the overall business synergy and financial health.

- Impact on Margins: The mention of low gross margins in these particular business lines underscores the financial rationale behind Konka's decision to divest or reduce focus in these specific regional markets.

Discontinued or Outdated Product Lines

Discontinued or outdated product lines within Konka Group's portfolio represent the Dogs in the BCG Matrix. These are products that have lost market share and are no longer competitive due to rapid technological shifts or changing consumer demands in the electronics sector. For instance, Konka may have previously offered CRT televisions or older feature phone models that are now largely obsolete, generating negligible revenue and potentially requiring ongoing support costs without significant future growth prospects.

These underperforming assets drain resources that could be better allocated to more promising ventures. Konka's strategic focus would likely involve divesting these lines to cut losses and streamline operations. The company's 2024 financial reports would likely reflect a minimal contribution from such legacy products, potentially showing a decline in sales for these categories if they haven't been fully phased out.

- Obsolescence due to technological advancements

- Minimal revenue generation

- Potential for divestiture

- Resource drain on the company

Konka Group's older generation mobile phones and basic home appliances are categorized as Dogs in the BCG Matrix. These products likely hold minimal market share and experience sluggish growth due to intense competition and rapid technological advancements. For example, in 2024, the market for undifferentiated small appliances faced significant price pressures.

These segments often represent cash traps, consuming resources without substantial returns, and may be candidates for divestiture as Konka optimizes its business lines, as indicated by its H1 2024 interim report which noted the restructuring of underperforming business segments with low gross margins.

| Product Category | BCG Matrix Quadrant | Rationale | 2024 Market Context |

|---|---|---|---|

| Older Generation Mobile Phones | Dogs | Low market share, low growth, intense competition from market leaders. | Highly saturated smartphone market with rapid innovation cycles. |

| Basic Home Appliances | Dogs | Low differentiation, intense price competition, thin profit margins. | Significant pressure from low-cost manufacturers globally. |

| Legacy Display Technologies (e.g., traditional LCDs) | Dogs | Declining market relevance, competition from advanced technologies like Mini LED. | Shift in consumer preference towards higher-resolution and more advanced displays. |

| Underperforming Regional Markets/Distribution Channels | Dogs | Lack of synergy, low profitability, minimal market presence. | Strategic business restructuring in H1 2024 aimed at optimizing such segments. |

Question Marks

Konka's venture into AI-powered smart home ecosystems, while innovative with its AIoT product development, is currently in its early stages. This means the comprehensive integration into a fully realized ecosystem is still a developing market. For instance, while the global smart home market was projected to reach over $138 billion in 2023, with AI integration expected to drive significant growth, Konka's specific share in this nascent AI-driven segment is likely modest.

The company is demonstrating its commitment through AI-driven features in its offerings, showcasing a forward-looking strategy. However, achieving widespread consumer adoption and establishing dominance in this highly competitive landscape will necessitate substantial investment. This is crucial for building a robust ecosystem that can truly rival established players and capture significant market share in the coming years.

Konka's development of specific semiconductor chips, such as storage controller chips, currently falls into the Question Mark category of the BCG Matrix. As of H1 2024, this segment is characterized by significant investment and is in its early stages of industrialization, aiming for efficient large-scale production.

Despite the high growth potential within the semiconductor market, particularly driven by China's focus on domestic chip manufacturing, Konka's market share remains minimal. This strategic area is consuming substantial capital without immediate large-scale returns, reflecting its high-risk, high-reward profile.

Continued heavy investment is crucial for this segment to potentially transition into a Star performer. The company's commitment to this area signifies a long-term vision, acknowledging the substantial resources needed to build a competitive position in this technologically intensive sector.

Konka is actively investing in the premium 8K television segment, a niche market demonstrating significant growth potential. Their showcase of a 310-inch 8K Micro LED TV highlights this commitment to cutting-edge display technology.

While the 8K TV market is expanding rapidly, Konka's current market share in this ultra-premium category is likely modest. This necessitates considerable investment in marketing and production to translate their technological advancements into substantial sales and a stronger market position against established global competitors.

Aggressive Expansion into New, Highly Competitive Developed Markets (e.g., North America)

Konka's aggressive expansion into North America, a market brimming with established giants like Samsung and LG, positions it as a potential Star in the BCG matrix. While the North American television market is substantial, with sales projected to reach approximately $25 billion in 2024 according to industry reports, Konka's current brand awareness and market share are nascent.

This strategic move requires substantial capital outlay for marketing campaigns, building a robust distribution network, and tailoring products to local consumer preferences. For instance, localization efforts might include adapting smart TV interfaces and ensuring compatibility with regional streaming services. The high competition means Konka must differentiate itself effectively to capture even a modest market share.

- Market Entry Costs: Significant investment is required for advertising, sales infrastructure, and product adaptation.

- Competitive Landscape: North America is dominated by well-entrenched global players with strong brand loyalty.

- Growth Potential: The large market size offers substantial upside if Konka can gain traction.

- Brand Building: Achieving brand recognition will be a primary challenge and necessitate sustained marketing efforts.

Niche Optoelectronic Display Solutions (e.g., commercial Micro LED displays)

Konka's niche optoelectronic display solutions, particularly in commercial Micro LED (MLED) and large-scale Mini LED direct display applications, position them within a growing but specialized market. These solutions are finding traction in demanding environments like airports and cinemas, driven by the need for superior visual performance in professional settings.

The market for these high-end displays is expanding, with projections indicating significant growth in the coming years. For instance, the global Micro LED display market was valued at approximately USD 100 million in 2023 and is expected to reach over USD 3 billion by 2028, demonstrating a robust compound annual growth rate.

- Niche Market Growth: Konka is targeting a segment of the display market that prioritizes specialized professional applications, such as high-brightness and high-contrast visuals for commercial venues.

- Production Capacity: The company has established production lines for MLED direct displays and large-scale Mini LED direct display screens, indicating a commitment to this technology.

- Market Share Considerations: While the market is growing, Konka's current market share in these specific B2B optoelectronic display segments might be nascent when compared to established industrial display manufacturers, suggesting a need for strategic investment to increase penetration.

- Investment Strategy: To capture greater market share, Konka will likely need to make targeted investments in R&D, production scaling, and sales channels to compete effectively against more specialized industrial display players.

Konka's AIoT smart home ecosystem development represents a significant future growth opportunity, currently situated in the Question Mark category. The company is actively investing in AI-driven features and product development, aiming to capture a share of the burgeoning smart home market.

While the global smart home market is projected to continue its strong growth trajectory, with AI integration being a key driver, Konka's specific market share in this evolving AI-centric segment remains to be established. Significant investment is required to build out a comprehensive ecosystem and achieve widespread consumer adoption.

BCG Matrix Data Sources

Our Konka Group BCG Matrix is informed by a comprehensive blend of internal financial statements, market research reports, and expert industry analysis to provide strategic clarity.