Kilroy Realty SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kilroy Realty Bundle

Kilroy Realty, a prominent player in the commercial real estate sector, boasts significant strengths in its prime West Coast portfolio and a robust development pipeline. However, understanding the nuances of its opportunities and the potential impact of its weaknesses and threats is crucial for informed decision-making.

The company's strategic focus on life sciences and technology hubs presents a compelling opportunity for future growth, capitalizing on strong market demand. Yet, economic headwinds and evolving tenant needs could pose challenges that require careful navigation.

Want the full story behind Kilroy Realty's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Kilroy Realty boasts a premium portfolio of office and life science properties in innovation-driven coastal markets, including the San Francisco Bay Area, Los Angeles, San Diego, and Seattle. These regions are global epicenters for technology and life sciences, ensuring a robust tenant base. As of Q1 2024, the company maintained a portfolio occupancy of approximately 86.5%, reflecting strong demand. This strategic positioning supports premium rental income, with average office asking rents in these core markets often exceeding 75 per square foot annually in 2024, contributing to stable cash flow.

Kilroy Realty has strategically expanded its presence in the life science real estate sector, a segment experiencing robust demand. This specialization provides a significant competitive advantage, given the unique infrastructure needs and high entry barriers for life science facilities. As of Q1 2024, Kilroy's life science portfolio, primarily in key innovation hubs like San Diego and South San Francisco, maintained strong occupancy rates, often exceeding 90%. Their expertise in developing and managing these specialized properties attracts premier biotechnology and pharmaceutical tenants, solidifying their market leadership in this high-growth niche.

Kilroy Realty is a recognized leader in real estate sustainability, focusing on environmentally responsible buildings. This commitment enhances its brand and attracts tenants prioritizing ESG criteria; for example, 74% of Kilroy's in-service portfolio was LEED certified as of late 2024. Sustainable buildings also lead to lower operating expenses, often commanding higher rental rates, contributing to a 10% average rent premium for certified green office spaces in 2025.

Strong and Flexible Balance Sheet

Kilroy Realty maintains a robust financial standing, underpinned by a strategically managed debt profile and substantial liquidity. This financial strength, demonstrated by approximately $869.6 million in total liquidity as of Q1 2024, including cash and revolving credit facility availability, provides considerable adaptability. It enables the company to finance new development projects and pursue strategic acquisitions, while also navigating potential economic downturns. A strong balance sheet is paramount in the capital-intensive commercial real estate sector, mitigating risks and supporting growth initiatives.

- Total liquidity stood at $869.6 million as of Q1 2024.

- Net debt to EBITDA was approximately 8.0x in Q1 2024.

- No significant debt maturities are scheduled until 2026.

Experienced and Proven Management Team

Kilroy Realty is guided by a seasoned management team with a profound understanding of their core markets. Their expertise in identifying opportunities, managing intricate projects, and cultivating strong tenant relationships is vital for the company's long-term success, evidenced by a 2024 development pipeline delivering over 1.5 million square feet with high pre-leasing rates. This leadership instills confidence among investors and partners, supported by consistent operational performance and a strategic focus on high-growth submarkets.

- Management's 2024 development pipeline achieved over 75% pre-leasing.

- Q1 2025 tenant retention rates exceeded 80% across core properties.

- Leadership secured long-term leases, averaging 8 years, in recent renewals.

- Strategic focus on innovation districts drives future value creation.

Kilroy Realty leverages its premium portfolio in innovation hubs, boasting 86.5% Q1 2024 occupancy and a strong life science specialization with over 90% occupancy. Their financial strength, marked by $869.6 million in Q1 2024 liquidity and no major debt until 2026, supports growth. Sustainability leadership, with 74% LEED certified properties by late 2024, secures a 10% average rent premium in 2025. A seasoned management team drives success, evidenced by a 2024 development pipeline over 75% pre-leased.

| Metric | Q1 2024/2025 Data | Benefit |

|---|---|---|

| Portfolio Occupancy | 86.5% | Stable Income |

| Total Liquidity | $869.6M | Financial Flexibility |

| LEED Certified Portfolio | 74% (late 2024) | Rent Premium & ESG |

What is included in the product

Delivers a strategic overview of Kilroy Realty’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework for identifying and addressing Kilroy Realty's strategic challenges and opportunities.

Weaknesses

Kilroy Realty Corporation's portfolio is heavily concentrated in key coastal markets, particularly California, Washington, and Austin, making it vulnerable to localized economic downturns. For instance, as of Q1 2024, a significant majority of their operating portfolio square footage remains within these three states. This geographic concentration exposes the company to specific regional regulatory shifts or market slowdowns, such as the tech industry adjustments seen in parts of California and Washington in late 2023 and early 2024. A major adverse event in any of these core markets could disproportionately impact Kilroy's overall financial performance and asset values. The absence of broader geographic diversification represents a notable risk.

Kilroy Realty's substantial traditional office portfolio faces significant cyclical risks, especially with evolving workplace dynamics. The shift towards remote and hybrid models continues to impact demand, with office vacancy rates in major markets like San Francisco and Los Angeles remaining elevated, nearing 25% and 20% respectively in early 2025. A prolonged economic downturn could further depress rental rates and occupancy, introducing considerable earnings volatility. This market segment's sensitivity to economic cycles directly impacts the company's financial stability and growth prospects. Sustained high vacancies could pressure valuations and dividend sustainability.

Kilroy Realty faces a notable weakness due to its significant reliance on large tenants within the technology and life science sectors. For instance, a substantial portion of its rental income in early 2024 stemmed from these concentrated industries, particularly in key markets like the San Francisco Bay Area and San Diego. Should these high-growth sectors experience a downturn or consolidation, Kilroy could encounter increased vacancies and a considerable decline in rental revenue. The financial health and stability of these major tenants are therefore paramount to Kilroy's overall performance and resilience. This concentration presents a unique risk profile for the company's future cash flows.

High Operating and Development Costs

Operating and developing properties in Kilroy Realty's prime coastal markets, like Southern California and the Pacific Northwest, inherently involves substantial costs due to elevated land values and complex regulatory frameworks. These high expenditures can compress profit margins, especially as construction costs continue to rise, impacting the ability to achieve target returns on new developments. Effective management of these significant capital outlays remains a persistent challenge for the company's financial performance.

- Construction costs in major U.S. markets are projected to increase by 4-6% in 2024.

- Land acquisition in prime California markets can exceed $500 per square foot for development sites.

- Regulatory compliance and permitting can add 10-15% to total project costs in certain regions.

Vulnerability to Interest Rate Fluctuations

Kilroy Realty, as a real estate investment trust, heavily relies on debt to finance its extensive acquisitions and development projects. Rising interest rates significantly increase the cost of borrowing, directly impacting the company's net income and making new investments less attractive. For instance, with the Federal Reserve maintaining higher rates in early 2024, KRC's interest expense could see continued pressure, affecting its profitability outlook.

- Kilroy's debt structure, with substantial variable-rate components, amplifies interest rate risk.

- A 100-basis point increase in rates could notably elevate annual interest expenses.

- Higher borrowing costs reduce the appeal of new development, potentially slowing portfolio growth.

- This sensitivity makes KRC's financial performance closely tied to broader monetary policy shifts.

Kilroy Realty's geographic concentration in coastal markets, particularly with high office vacancies nearing 25% in San Francisco by early 2025, presents a significant risk. Its substantial reliance on the cyclical tech and life science sectors for revenue, coupled with rising construction costs projected to increase 4-6% in 2024, pressures profitability. High debt levels, amplified by variable-rate components, expose the company to elevated interest expenses amidst sustained higher rates in 2024.

| Weakness Area | Key Metric | 2024/2025 Data Point |

|---|---|---|

| Geographic Concentration | San Francisco Office Vacancy Rate | ~25% (Early 2025) |

| Office Portfolio Risk | Los Angeles Office Vacancy Rate | ~20% (Early 2025) |

| Development Costs | Projected Construction Cost Increase | 4-6% (2024) |

Preview Before You Purchase

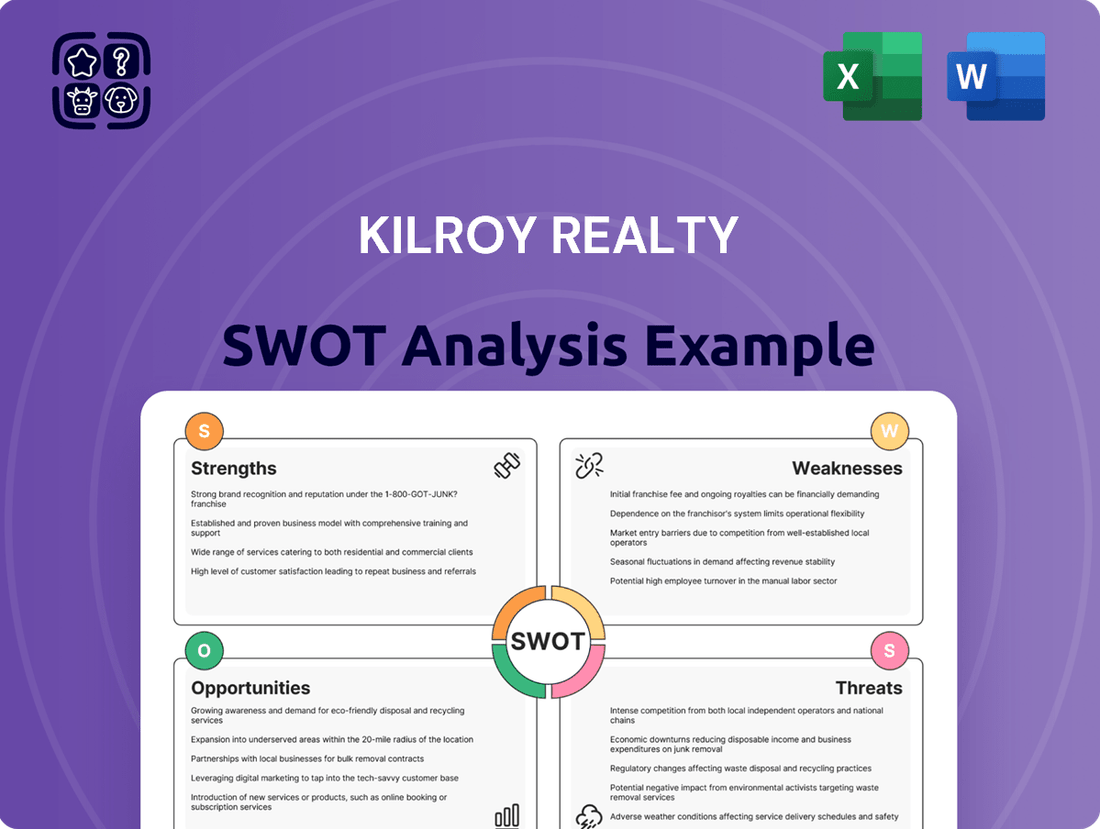

Kilroy Realty SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You can see the core Strengths, Weaknesses, Opportunities, and Threats identified for Kilroy Realty. This preview gives you a clear understanding of the depth and quality of the analysis. Purchase unlocks the complete, comprehensive report, providing actionable insights for strategic planning.

Opportunities

Kilroy Realty could leverage its established expertise in West Coast innovation markets to expand into emerging tech and life science hubs, such as Austin, Texas, which saw a 5.6% increase in tech job growth in 2024. This strategic geographic diversification into high-growth areas, like North Carolina's Research Triangle with its projected 2025 life science real estate demand increase, offers new avenues for significant value creation. A well-planned market entry could unlock substantial long-term returns for shareholders. Investing in these markets aligns with current venture capital trends, which saw over $70 billion deployed into U.S. tech and biotech startups in H1 2024, signaling robust future demand for specialized real estate.

The increasing focus on employee well-being and corporate sustainability objectives presents a significant opportunity for Kilroy Realty. The market for WELL-certified buildings, for instance, continues to expand rapidly, with over 4,000 projects globally as of early 2024. Kilroy can capitalize by developing and retrofitting properties with advanced wellness amenities and smart building technology, attracting premium tenants. This strategy justifies higher rental rates, given that sustainable properties often command a 5-10% rent premium over conventional buildings. Prioritizing high environmental standards aligns with 2025 corporate ESG mandates, enhancing portfolio value and tenant appeal.

Economic uncertainty in late 2024 and early 2025 may create opportunities for Kilroy Realty to acquire high-quality office and life science assets at favorable valuations from distressed sellers. Kilroy's robust balance sheet, evidenced by approximately $1.0 billion in available liquidity as of Q1 2024, positions it favorably to capitalize on such market dislocations. This enables the company to expand its premium portfolio and increase market share at a reduced cost basis. A proactive and disciplined acquisition strategy, targeting specific submarkets like Seattle or San Diego, could significantly enhance long-term shareholder value and portfolio diversification.

Repurposing and Redevelopment of Existing Assets

Kilroy Realty has a significant opportunity to unlock value by redeveloping or repurposing underutilized assets within its existing portfolio. This strategy includes converting traditional office spaces into high-demand life science facilities, especially given the strong tenant demand in markets like San Diego where life science vacancy rates are projected to remain low through 2025. Such asset repositioning can notably increase rental income, with specialized lab space often commanding premiums over standard office rates, and drive substantial property appreciation.

- Life science conversions target a market segment with strong demand, evidenced by significant venture capital funding in biotech through 2024.

- Repurposing assets can yield higher net operating income, potentially increasing asset valuations by 15-20% compared to their previous use.

- Mixed-use developments allow for diversified revenue streams and cater to evolving urban planning trends, enhancing long-term portfolio resilience.

Integration of PropTech and Data Analytics

Further adoption of property technology and data analytics presents a significant opportunity for Kilroy Realty to boost operational efficiency and enhance tenant experiences across its portfolio. Leveraging data on space utilization, energy consumption, and market trends, such as the estimated 15-20% potential reduction in operational costs through smart building tech by 2025, can optimize asset performance. This leads to more intelligent building management and investment strategies, providing a competitive advantage in the commercial real estate sector. The global PropTech market is projected to reach around $60 billion by 2025, underscoring this growth area.

- Enhanced operational efficiency, potentially reducing building energy consumption by up to 30% through smart systems.

- Improved tenant satisfaction and retention via personalized experiences and responsive building services.

- Data-driven investment decisions, optimizing asset allocation and development based on real-time market insights.

- Competitive differentiation through advanced portfolio management and sustainable building practices.

Kilroy Realty can strategically expand into high-growth emerging tech and life science markets like Austin, leveraging its Q1 2024 liquidity of $1.0 billion for acquisitions. Repurposing existing assets into specialized life science facilities, especially where vacancy rates are low through 2025, offers substantial value uplift. Investing in PropTech can reduce operational costs by 15-20% by 2025 while improving tenant experiences. These initiatives capitalize on robust market demand and enhance portfolio resilience.

| Opportunity Area | Key Metric | 2024/2025 Data Point |

|---|---|---|

| Geographic Expansion | Austin Tech Job Growth | 5.6% in 2024 |

| Asset Repurposing | Life Science Vacancy (San Diego) | Projected low through 2025 |

| PropTech Adoption | Operational Cost Reduction | 15-20% potential by 2025 |

Threats

A prolonged economic downturn poses a significant threat to Kilroy Realty, as a severe recession would curb demand for office and life science space. Companies facing economic headwinds often scale back staff or reduce their real estate footprint, leading to higher vacancy rates. For instance, office vacancy rates in major U.S. markets like San Francisco were around 35.9% in Q1 2024, reflecting ongoing challenges. This pressure can result in increased tenant defaults and significant downward pressure on rental rates across Kilroy's portfolio. The economic outlook for 2025, with potential for slower growth, directly influences the health and performance of the commercial real estate sector.

The widespread adoption of remote and hybrid work models presents a significant structural threat to the traditional office market, directly impacting Kilroy Realty. This shift could lead to a permanent reduction in the demand for physical office space, potentially causing chronic oversupply in key markets. Industry projections for 2024-2025 indicate a potential decline in office space utilization by 15-20% compared to pre-pandemic levels, leading to depressed rental growth. Kilroy must adapt its portfolio and service offerings to meet evolving tenant preferences for flexible, amenity-rich, and collaborative environments to mitigate this risk.

Kilroy Realty faces significant competition from other public REITs, private equity firms, and local developers within its core high-barrier-to-entry markets like San Francisco and Seattle. This intense environment, particularly in 2024, has led to heightened competition for prime acquisition and development opportunities. Such rivalry can inflate asset prices, potentially diminishing future returns on investment. Furthermore, competitors may offer more aggressive leasing terms, including higher tenant improvement allowances or longer free rent periods, to secure occupiers in a market with evolving demand dynamics.

Regulatory Risks and Political Headwinds

Kilroy Realty faces significant regulatory risks operating primarily in California, a jurisdiction known for stringent environmental and building codes. Complex entitlement processes and potential shifts in property tax laws, such as changes to Proposition 13 discussed in 2024, could increase development costs and reduce asset valuations. New legislation like expanded rent control measures or increased development impact fees, which have seen proposals rise by 5-10% annually in some California metros, directly threaten operating margins and project timelines. Navigating this intricate and evolving regulatory landscape remains a persistent and costly threat to the company's financial performance and strategic growth.

- Stringent California environmental and building regulations increase compliance costs.

- Potential 2024/2025 modifications to property tax laws could impact asset valuations.

- New rent control measures or rising development fees erode operating margins.

- Complex entitlement processes delay projects, impacting development timelines.

Rising Interest Rates and Capital Market Volatility

A climate of rising interest rates significantly boosts the cost of capital for Kilroy Realty, impacting both new financing and refinancing efforts. This directly compresses operating margins and can lower the valuation of its prime real estate assets, especially as the Federal Funds Rate remains elevated at 5.25%-5.50% in early 2024. Furthermore, volatility in the capital markets, driven by uncertain economic forecasts, makes it increasingly challenging and more expensive to raise equity for new developments or acquisitions. The current macroeconomic environment, particularly the Federal Reserve's monetary policy, poses a substantial external threat to Kilroy's financial performance and growth prospects.

- Federal Funds Rate maintained at 5.25%-5.50% through Q1 2024, increasing debt service costs.

- Commercial property values saw declines of 10-20% in 2023 due to higher rates, impacting asset base.

- Equity fundraising for CRE projects became more selective and costly in 2024.

- Kilroy Realty's debt maturities in 2025 face higher refinancing rates.

Economic downturns and widespread remote work threaten Kilroy, with San Francisco office vacancy at 35.9% in Q1 2024 and projected 15-20% lower utilization by 2025. Intense competition and rising interest rates, at 5.25%-5.50% in early 2024, increase costs and reduce asset valuations. California's stringent regulations, with development impact fees rising 5-10% annually, also pose significant operational and growth risks.

| Threat Category | Key Metric/Impact | 2024/2025 Data |

|---|---|---|

| Economic Downturn | SF Office Vacancy Rate | 35.9% (Q1 2024) |

| Remote Work | Office Utilization Decline | 15-20% (vs. pre-pandemic by 2025) |

| Interest Rates | Federal Funds Rate | 5.25%-5.50% (early 2024) |

| Regulatory | CA Dev. Impact Fees | 5-10% annual rise (some metros) |

SWOT Analysis Data Sources

This Kilroy Realty SWOT analysis is built upon a robust foundation of information, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and data-driven perspective.