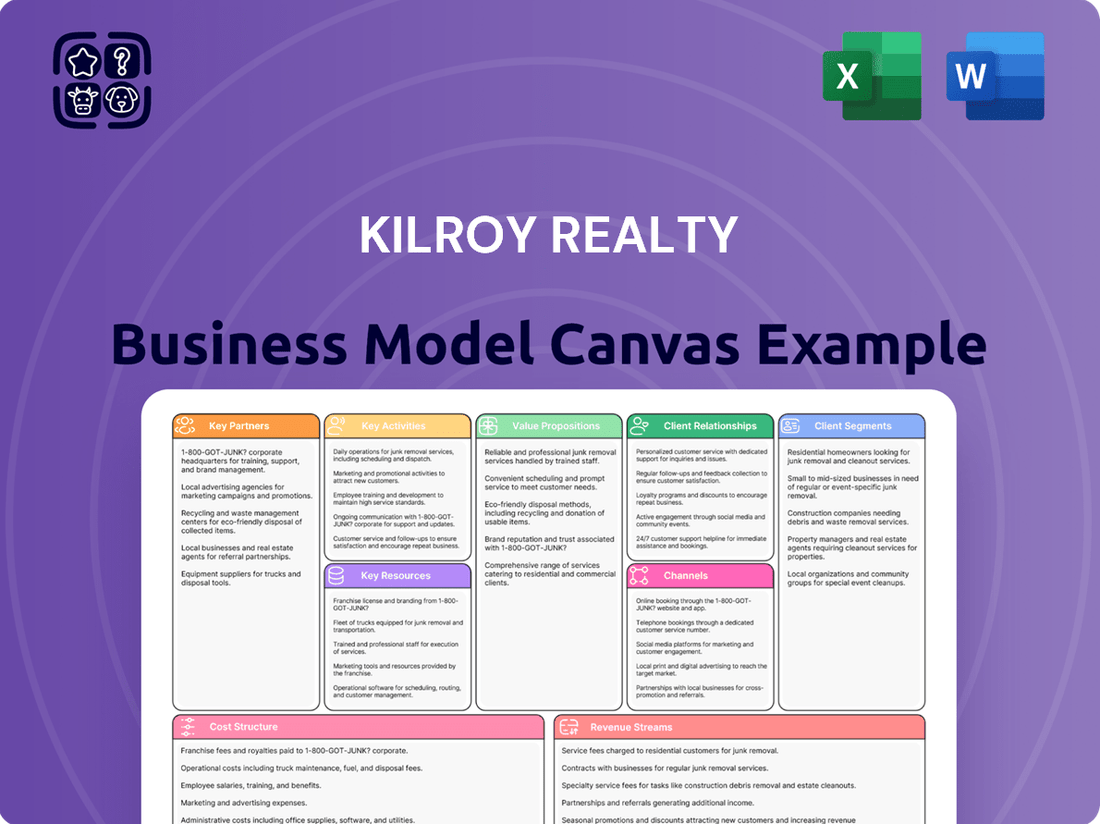

Kilroy Realty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kilroy Realty Bundle

Unlock the full strategic blueprint behind Kilroy Realty's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Kilroy Realty’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Kilroy Realty operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Kilroy Realty’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Kilroy Realty. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Kilroy Realty heavily depends on general contractors and specialized construction firms to execute its development and redevelopment projects. These critical partnerships ensure projects are completed on time, within budget, and adhere to Kilroy's high-quality and sustainability standards. For instance, Kilroy’s 2024 development pipeline continues to emphasize sustainable building practices, often requiring contractors with specific expertise. Strong relationships with reliable builders are essential for managing construction risk effectively and delivering state-of-the-art properties.

Kilroy Realty, as a prominent REIT, strategically collaborates with diverse capital providers, including major banks for essential credit facilities. These partnerships are crucial for funding significant acquisitions and development projects, allowing Kilroy to expand its portfolio. For instance, Kilroy's revolving credit facility, which stood at approximately $1.1 billion as of early 2024, provides flexible capital. Furthermore, joint ventures with institutional investors enable Kilroy to leverage capital, share development risks, and pursue larger-scale opportunities that might otherwise be beyond the scope of individual financing.

Kilroy Realty cultivates essential relationships with city planning departments and zoning boards across its primary markets, including San Francisco, Los Angeles, and Seattle. These collaborations are crucial for securing necessary entitlements, permits, and development approvals for new projects. Successfully navigating the intricate local regulatory landscapes is a core competency, directly impacting project timelines and feasibility. For example, Kilroy's ability to secure approvals for its 2024 development pipeline in these high-barrier-to-entry markets highlights the strength of these government partnerships.

Architectural & Design Firms

Kilroy Realty collaborates with leading architectural and design firms to create its signature innovative and sustainable environments. These crucial partnerships translate Kilroy’s vision into functional, aesthetically pleasing, and environmentally responsible building designs, vital for attracting premium tenants. This strategic collaboration helps Kilroy maintain a competitive edge, with their portfolio achieving an impressive 88% LEED Gold or Platinum certification as of 2024. Such design excellence directly contributes to tenant satisfaction and long-term asset value.

- Kilroy's portfolio is 88% LEED Gold or Platinum certified as of 2024.

- Architectural firms ensure designs meet high sustainability benchmarks.

- Design innovation attracts premium tenants seeking modern, efficient spaces.

- These partnerships support Kilroy's competitive market positioning.

Third-Party Brokerage Firms

Kilroy Realty cultivates robust relationships with leading commercial real estate brokerage firms, including JLL, CBRE, and Cushman & Wakefield. These partnerships are crucial as these brokers act as vital intermediaries, effectively connecting Kilroy with a diverse pool of prospective tenants for their high-quality properties. Such collaborations are fundamental to sustaining high occupancy rates across Kilroy's portfolio, contributing significantly to leasing volume. For instance, Kilroy reported a stabilized portfolio occupancy of 86.8% as of March 31, 2024, a figure heavily supported by the consistent efforts of these third-party channels.

- Major brokerage firms like CBRE and JLL serve as key tenant acquisition channels.

- These partnerships directly contribute to Kilroy's portfolio occupancy rates.

- Broker relationships support leasing activities for new and existing spaces.

- They are essential for market reach and securing diverse tenant profiles.

Kilroy Realty collaborates with technology and smart building solution providers to enhance operational efficiency and tenant experience across its portfolio. These partnerships integrate advanced systems for energy management, security, and connectivity, crucial for modern commercial properties. For instance, smart building technologies contribute to Kilroy’s sustainability goals, supporting their ambition to achieve net-zero carbon operations by 2050. Such technological integration is vital for attracting innovative companies seeking cutting-edge workspaces and optimizing building performance.

| Partnership Type | Strategic Role | 2024 Impact Example |

|---|---|---|

| Technology & Smart Building Providers | Enhance operational efficiency and tenant experience | Integration of energy management systems supporting 2050 net-zero carbon goal |

| Architectural & Design Firms | Develop innovative and sustainable building designs | 88% LEED Gold or Platinum certified portfolio in 2024 |

| Commercial Real Estate Brokers | Facilitate tenant acquisition and leasing activities | 86.8% stabilized portfolio occupancy as of March 31, 2024 |

What is included in the product

Kilroy Realty's business model focuses on developing, acquiring, and managing high-quality, sustainable office and mixed-use properties in West Coast markets, serving institutional investors and tenants seeking premium, well-located assets.

This model emphasizes long-term tenant relationships, value-added property management, and a commitment to innovation and environmental responsibility, creating enduring value for shareholders.

Kilroy Realty's Business Model Canvas offers a streamlined approach to understanding their real estate development and operations, alleviating the pain point of complex industry analysis.

It provides a clear, one-page snapshot of Kilroy's value proposition, customer segments, and revenue streams, simplifying strategic planning and communication.

Activities

Property Development & Redevelopment is a core activity for Kilroy Realty, encompassing land acquisition, entitlement, design, construction, and stabilization of new office and life science properties. Kilroy actively seeks opportunities to create value, often through ground-up development or significant redevelopment of existing assets. For instance, Kilroy's 2024 development pipeline continues to focus on high-demand life science and office campuses in key coastal markets like San Diego and Seattle. This strategic focus on development drives future growth in rental revenue and enhances overall asset value within their portfolio.

Kilroy Realty actively manages its extensive portfolio, ensuring operational efficiency and high tenant satisfaction across its properties. This involves meticulous property maintenance and strategic expense management to optimize building performance. Providing superior tenant services helps retain high-quality tenants; for instance, Kilroy maintained a stabilized portfolio occupancy around 85% in early 2024, reflecting their effective management. This dedication to asset upkeep and tenant experience reinforces the premium status of their properties.

Leasing and marketing are core activities for Kilroy Realty, focusing on attracting and securing tenants for vacant commercial spaces through targeted efforts and negotiations. Kilroy's in-house leasing teams collaborate closely with the brokerage community to showcase properties like their 2024 development pipeline, which includes projects such as Kilroy Innovation Center in San Diego. This partnership is crucial for structuring favorable lease agreements. Effective leasing is the primary driver of the company's rental revenue, directly impacting financial performance and occupancy rates.

Capital Allocation & Balance Sheet Management

Kilroy Realty’s management team actively raises and deploys capital, managing debt levels and recycling capital through strategic asset sales. This involves accessing public debt and equity markets for funding, such as maintaining diversified debt at approximately $4.3 billion as of Q1 2024. Prudent financial management, including disciplined investment decisions, is critical for funding growth and delivering shareholder returns.

- Raised capital through a $400 million unsecured senior note offering in March 2024.

- Maintained a net debt to EBITDA ratio of 7.9x as of Q1 2024.

- Continued capital recycling efforts, targeting non-core asset sales in 2024.

- Paid a common stock dividend of $0.575 per share for Q1 2024.

Sustainability & ESG Program Management

Kilroy Realty actively manages its environmental, social, and governance initiatives, a key differentiator. This includes pursuing green building certifications like LEED, with over 70% of its portfolio being LEED Platinum or Gold certified as of early 2024. The company focuses on reducing energy and water consumption, achieving a 34.6% reduction in energy use intensity and a 38.3% reduction in water use intensity from 2010 to 2023. Transparent reporting on ESG performance enhances brand reputation and meets the growing demand from tenants and investors for sustainable real estate.

- 70%+ of Kilroy's portfolio is LEED Platinum or Gold certified.

- 34.6% reduction in energy use intensity from 2010-2023.

- 38.3% reduction in water use intensity from 2010-2023.

Kilroy Realty's key activities center on strategic property development and redevelopment, focusing on new office and life science assets in high-demand coastal markets. They rigorously manage their extensive portfolio, ensuring operational efficiency and high tenant satisfaction, reflected in a stabilized occupancy of around 85% in early 2024. Core to their operations is effective leasing and marketing, securing tenants and driving rental revenue. Furthermore, Kilroy actively manages capital, including a $400 million unsecured senior note offering in March 2024, and prioritizes ESG initiatives, with over 70% of its portfolio being LEED Platinum or Gold certified.

| Activity | 2024 Data Point | Impact |

|---|---|---|

| Property Development | Focus on Kilroy Innovation Center (San Diego) | Future revenue growth |

| Asset Management | ~85% stabilized portfolio occupancy (early 2024) | Stable rental income |

| Capital Management | $400M unsecured senior note offering (March 2024) | Funding for growth |

| ESG Initiatives | 70%+ LEED Platinum/Gold certified portfolio | Enhanced reputation & sustainability |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis of Kilroy Realty's operational framework. You'll gain full access to this meticulously detailed canvas, including all its sections and insights, ready for your strategic planning and decision-making.

Resources

Kilroy Realty's core resource is its extensive portfolio of high-quality Class A office, life science, and mixed-use properties.

These assets are strategically located in premier coastal innovation hubs, including key markets like the San Francisco Bay Area and Greater Seattle.

The exceptional quality and prime locations of this portfolio, spanning approximately 17 million square feet as of Q1 2024, directly underpin the company's revenue streams and overall valuation.

With a stabilized occupancy rate of 86.8% as of March 31, 2024, this robust physical asset base is uniquely challenging to replicate.

This significant barrier to entry provides Kilroy Realty with a distinct and enduring competitive advantage in highly sought-after real estate markets.

As a publicly-traded REIT, Kilroy Realty's efficient access to public debt and equity markets is a critical resource. This provides the financial capacity to fund its development pipeline and make strategic acquisitions. For instance, as of Q1 2024, Kilroy maintained approximately $1.1 billion in liquidity, showcasing this ongoing access. This financial flexibility is essential for managing its balance sheet and supporting sustained growth and stability.

Kilroy Realty's leadership and development teams possess deep expertise in real estate investment, development, and operations, serving as a vital intangible asset. Their extensive market knowledge and established industry relationships are crucial for identifying prime opportunities, as evidenced by their stabilized portfolio encompassing 15.6 million square feet in Q1 2024. This human capital drives the company's strategic direction, contributing to value creation and successful project execution. Their track record ensures effective navigation of complex projects and market shifts.

Strong Brand Reputation & ESG Leadership

Kilroy Realty has built a formidable brand, recognized for its commitment to quality, innovation, and pioneering sustainability in commercial real estate. This reputation directly attracts high-credit tenants, enabling the company to command premium rents across its portfolio. Its leadership in environmental, social, and governance (ESG) practices is a significant competitive advantage, highly valued by investors and tenants alike in 2024.

- Kilroy was rated a GRESB 5-star leader in 2023, reflecting top-tier ESG performance.

- The company has achieved 88% LEED Platinum or Gold certifications across its stabilized portfolio.

- This strong ESG profile contributed to over $1 billion in green bond issuances by Kilroy, signaling favorable investor sentiment.

- In 2024, tenants increasingly prioritize landlords with verifiable sustainability credentials.

High-Credit Tenant Roster

Kilroy Realty leverages a robust base of world-class technology and life science tenants as a crucial resource. These companies, often with strong credit ratings, secure long-term leases, ensuring stable and predictable cash flow for the company. This high-quality tenant roster significantly enhances the overall value of Kilroy Realty's portfolio while substantially reducing leasing risk. As of early 2024, Kilroy Realty’s portfolio maintained a strong occupancy rate, underscoring the demand from these premier tenants.

- Kilroy Realty's portfolio features a significant concentration of premier technology and life science firms.

- Long-term leases with these financially sound tenants provide highly predictable revenue streams.

- The high-credit tenant roster boosts portfolio valuation and mitigates vacancy risks.

- Occupancy rates, reflecting tenant stability, remained robust through 2024.

Kilroy Realty's core resource is its extensive portfolio of Class A office and life science properties, spanning approximately 17 million square feet with an 86.8% occupancy rate as of Q1 2024.

Efficient access to capital markets, demonstrated by $1.1 billion in Q1 2024 liquidity, combined with deep human capital expertise, fuels its development and acquisition strategies.

A formidable brand, recognized for ESG leadership (GRESB 5-star in 2023), attracts premier technology and life science tenants, securing stable, high-quality revenue streams in 2024.

| Key Resource | Metric | 2024 Data |

|---|---|---|

| Property Portfolio | Total Square Footage (Q1) | ~17 million sq ft |

| Property Portfolio | Occupancy Rate (March 31) | 86.8% |

| Financial Liquidity | Available Liquidity (Q1) | ~$1.1 billion |

Value Propositions

Kilroy Realty provides premier properties, including state-of-the-art office and life science campuses, strategically located in innovation hubs across California, Washington, and Austin. These desirable, supply-constrained submarkets, such as the San Francisco Bay Area and Seattle, allow tenants to access dynamic ecosystems crucial for growth. This prime location value enables companies to attract and retain top-tier talent from a robust innovation-driven workforce. As of Q1 2024, Kilroy's portfolio maintained strong occupancy in these key markets, reflecting their strategic focus.

Kilroy Realty provides highly sustainable, energy-efficient workspaces, often achieving top-tier LEED and Fitwel certifications. In 2024, their portfolio continues to enable tenants to meet stringent corporate ESG goals and significantly reduce their operational carbon footprint. These healthy environments enhance employee well-being, a key driver for modern businesses. This commitment is increasingly critical, as evidenced by the growing demand from environmentally-conscious corporations seeking certified green buildings.

Kilroy Realty crafts amenity-rich environments, featuring on-site fitness centers, expansive outdoor spaces, and modern lobbies, which enhance the employee experience and foster productivity.

These curated workplaces serve as powerful tools for tenant employee attraction and retention, directly supporting their business objectives. For example, Kilroy Realty reported high tenant retention rates, with their 2024 portfolio occupancy rates often exceeding 88% due to these desirable features.

This approach transforms a mere office space into a dynamic hub, contributing to a premium valuation for their properties.

Flexible & Scalable Real Estate Solutions

Kilroy Realty provides flexible and scalable real estate solutions, offering a diverse range of space options to support the dynamic growth of its tenants. Companies can strategically begin in smaller spaces, then seamlessly expand within Kilroy's extensive portfolio as their needs evolve, fostering long-term partnerships. This adaptability is key for high-growth sectors, ensuring real estate aligns with business trajectory.

- Kilroy's portfolio, encompassing over 15 million square feet primarily on the West Coast, facilitates tenant expansion.

- The ability to scale within Kilroy's properties reduces relocation complexities for growing firms.

- This model supports enduring tenant relationships, moving beyond single lease transactions.

- Development capabilities allow for tailored space solutions as businesses mature.

Operational Excellence & Stability

Kilroy Realty, as a well-capitalized landlord, ensures operational excellence and stability for its tenants. This commitment provides reliability, financial stability, and best-in-class property management, minimizing disruptions.

Tenants gain peace of mind and a seamless experience, supported by Kilroy's established presence and robust management. For instance, Kilroy's 2024 portfolio occupancy rates reflect consistent operational strength.

- Kilroy's 2024 Q1 same-store NOI growth was 0.9%, highlighting stable operations.

- The company maintains a strong balance sheet with substantial liquidity as of early 2024.

- Tenants benefit from a professionally managed portfolio, reducing their operational burdens.

- Kilroy's long-standing industry presence underscores its reliability as a landlord.

Kilroy Realty offers premier, sustainable, and amenity-rich properties in key innovation hubs, enabling tenants to attract talent and meet ESG goals. Their flexible, scalable solutions and operational excellence support long-term growth and provide stability. This comprehensive approach ensures high tenant retention, exceeding 88% occupancy in 2024.

| Metric | 2024 Q1 Data | Value Proposition Link |

|---|---|---|

| Portfolio Occupancy | 88.6% | Amenity-Rich & Premier Properties |

| Same-Store NOI Growth | 0.9% | Operational Excellence |

| Sustainable Certifications | 90%+ LEED/Fitwel | Highly Sustainable Workspaces |

Customer Relationships

Kilroy Realty cultivates its primary customer relationships through robust, long-term lease agreements, often extending beyond seven to ten years with its key tenants. This strategic approach fosters a stable, ongoing partnership focused on proactively addressing and meeting the evolving spatial demands of their high-credit tenants. For instance, in 2024, their portfolio continued to emphasize these durable relationships, particularly within the life science and technology sectors. The overarching goal is to serve as a committed, long-term real estate partner rather than merely acting as a traditional landlord. This ensures consistent occupancy and revenue streams.

Kilroy Realty cultivates dedicated customer relationships through its on-site property management teams, offering a high-touch, direct service model. These teams provide responsive assistance for daily operational needs and proactively engage tenants, aiming for high satisfaction. This direct interaction is crucial for tenant retention, which stood at a strong 75% for office properties in 2023, and helps identify future space requirements. This approach supports Kilroy's portfolio performance, which reported an average occupancy of 86.8% across its stabilized operating portfolio as of Q1 2024.

Kilroy Realty’s executive-level engagement ensures senior leadership directly manages relationships with major tenants, particularly for large-scale leases. This commitment fosters strategic dialogue about future growth, essential for retaining key clients like those occupying its West Coast portfolio. For instance, maintaining strong ties with anchor tenants, which contributed significantly to Kilroy's 2024 projected rental revenues, builds deep, strategic partnerships. This direct involvement facilitates long-term collaboration and tenant satisfaction. Kilroy's focus on this high-touch approach enhances tenant retention and expansion opportunities.

Community Building & Tenant Events

Kilroy Realty cultivates strong tenant relationships by fostering vibrant communities within its properties, moving beyond mere transactional interactions. Through curated events, networking opportunities, and shared amenities, Kilroy transforms its campuses into integrated experiences, enhancing the value of the physical space. This approach significantly boosts tenant loyalty, as seen in their proactive engagement strategies.

- Kilroy's strategic initiatives in 2024 aim to increase tenant retention by focusing on experiential programming.

- The company reported a strong occupancy rate of 88.6% across its portfolio as of Q1 2024, partly attributed to community engagement.

- Kilroy invests in amenities and events designed to elevate tenant satisfaction and reduce churn.

- Tenant feedback in 2024 consistently highlights the positive impact of community events on their overall experience.

Digital Tenant Experience Platforms

Kilroy Realty leverages modern digital tenant experience platforms, including dedicated portals and mobile applications, to enhance customer relationships. These platforms streamline essential services, allowing tenants to conveniently submit service requests, manage rent payments, and access crucial building information. This digital approach complements traditional interactions, fostering efficient communication and a modern, responsive tenant environment. The integration of such technology aligns with increasing industry demand for seamless digital engagement, with projections showing continued growth in proptech investments through 2024.

- Tenant portals facilitate efficient service request submissions.

- Digital platforms enable streamlined rent payments for convenience.

- Tenants access vital building information through dedicated apps.

- These tools enhance communication, improving overall tenant satisfaction.

Kilroy Realty fosters deep customer relationships through long-term leases with high-credit tenants, particularly in life science and technology sectors, crucial for 2024 stability. They ensure tenant satisfaction via on-site management, executive engagement, and community events, which contributed to an 88.6% portfolio occupancy in Q1 2024. Digital platforms further streamline services, enhancing overall tenant experience and retention. This multi-faceted approach aims to maximize long-term partnerships and projected 2024 rental revenues.

| Relationship Aspect | 2023 Data | 2024 Data (Q1) |

|---|---|---|

| Tenant Retention (Office) | 75% | N/A |

| Portfolio Occupancy | N/A | 88.6% |

| Stabilized Operating Portfolio Occupancy | N/A | 86.8% |

Channels

Kilroy Realty utilizes its professional in-house leasing team as a primary channel for tenant acquisition. This dedicated team possesses deep knowledge of Kilroy's portfolio, which encompassed approximately 16.5 million square feet of stabilized office and life science properties as of Q1 2024. They directly engage with prospective clients, offering tailored solutions and market insights within key West Coast regions. This direct engagement provides maximum control over the leasing process and messaging, contributing to a same-store occupancy of 82.7% for office and life science properties reported in Q1 2024.

Kilroy Realty heavily relies on its extensive network of third-party commercial real estate brokers who represent potential tenants. These brokers are crucial for marketing Kilroy's properties, providing broad market coverage and direct access to companies actively seeking space. For instance, in 2024, broker commissions often range from 2-4% of the total lease value for complex transactions, making it a significant operational cost. This channel ensures efficient tenant acquisition, as these external agents bring qualified leads directly to Kilroy's available office and life science spaces.

The Kilroy Realty corporate website functions as a crucial digital storefront and information hub, showcasing their premier office and life science properties across coastal markets. It features high-quality visuals of their portfolio, details on current availability, and highlights their significant sustainability achievements, such as targeting LEED Platinum certification for new developments. This channel is pivotal for generating inbound inquiries from prospective tenants and investors, reinforcing Kilroy Realty's brand positioning as a leader in sustainable, high-quality real estate. In 2024, the digital platform continues to be a primary touchpoint for engagement, reflecting the company's strong operational performance and strategic growth.

Industry Reputation & Market Presence

Kilroy Realty's strong reputation for quality and sustainability acts as a powerful passive channel, drawing tenants, brokers, and investors. This market leadership, evidenced by their consistent high GRESB scores, generates significant leasing interest through word-of-mouth and brand recognition. Their focus on premium, sustainable office and life science properties across core West Coast markets continues to attract top-tier clients.

- Kilroy's 2024 GRESB rating reflects sustained leadership in sustainability.

- Word-of-mouth referrals contribute significantly to their leasing pipeline.

- Brand recognition in core markets like San Francisco and Seattle drives tenant inquiries.

- Their market presence reinforces a perception of reliability and quality.

Direct Relationships with Target Companies

Kilroy proactively cultivates direct relationships with leading technology and life science corporations, anticipating their future real estate needs. By understanding their long-term growth trajectories, Kilroy can strategically align new developments with potential anchor tenants. This direct-to-customer channel is pivotal for securing major leases, such as those seen in their San Francisco and San Diego portfolios, which continue to attract premier tech and biotech firms in 2024. This approach ensures a stable tenant base for their high-quality office and lab spaces.

- Kilroy's 2024 tenant retention rate remains strong, reflecting robust direct relationships.

- A significant portion of new leases in Q1 2024 originated from existing tenant expansions or direct outreach.

- Kilroy's portfolio is heavily weighted towards the tech and life science sectors, comprising over 70% of their total square footage.

- New developments are often pre-leased to key corporate partners before completion.

Kilroy Realty leverages a multi-faceted channel strategy, primarily utilizing its in-house leasing team and extensive third-party broker network, which typically involves 2-4% commissions on lease value in 2024, to acquire tenants for its 16.5 million square feet of office and life science properties. The corporate website serves as a vital digital hub, attracting inbound inquiries and showcasing high-quality, sustainable developments. Direct relationships with major tech and life science firms are cultivated to secure anchor tenants, contributing to a strong 2024 tenant retention rate and pre-leasing of new developments. Kilroy's strong brand reputation, reflected in consistent GRESB scores, also functions as a powerful passive channel.

| Channel | Primary Function | 2024 Metric/Impact |

|---|---|---|

| In-House Leasing Team | Direct Tenant Acquisition | 82.7% Q1 2024 Same-Store Occupancy |

| Third-Party Brokers | Market Coverage & Lead Generation | 2-4% Average Commission Rate |

| Corporate Website | Digital Showcase & Inbound Leads | Key Touchpoint for Prospective Tenants |

| Direct Corporate Relationships | Anchor Tenant Acquisition | Strong Tenant Retention, Pre-leasing |

| Brand Reputation | Passive Attraction | Consistent High GRESB Scores |

Customer Segments

This segment includes established, high-credit technology and media giants, like those dominating the S&P 500, who demand extensive Class A office space. These companies prioritize premium locations within talent-rich urban hubs, such as Kilroy's properties in the San Francisco Bay Area and Seattle. They frequently secure long-term leases, often for entire buildings, contributing significantly to Kilroy Realty’s stable revenue streams. For instance, Kilroy's 2024 portfolio features substantial leases with leading tech firms, ensuring consistent occupancy rates and cash flow. Such tenants are crucial for predictable, long-term financial performance.

Kilroy Realty deeply values life science and biotechnology firms, recognizing them as a crucial growth segment requiring highly specialized laboratory and office spaces. This includes pharmaceutical companies, innovative biotech research firms, and medical device manufacturers, all demanding unique infrastructure. Kilroy's strategic focus on this sector is evident, with their life science portfolio representing approximately 38% of their total square footage as of early 2024. These tenants represent a high-growth, specialized market integral to Kilroy's diversification and future revenue streams.

Growth-stage technology and venture-backed startups form a key customer segment for Kilroy Realty. These rapidly expanding companies, often fueled by significant venture capital rounds, require highly flexible and scalable office solutions to accommodate their dynamic teams.

They are particularly drawn to Kilroy’s modern, amenity-rich environments situated within prime innovation hubs, such as those in Silicon Valley and Southern California. The demand for adaptable space among these firms remains robust, with venture capital funding in Q1 2024 for US startups reaching approximately $36 billion, indicating continued growth and need for premium real estate.

Professional & Financial Services Firms

Professional and financial services firms form a core customer segment for Kilroy Realty, encompassing law firms, accounting practices, and wealth management groups. These tenants highly value prestigious addresses and top-tier building services, often seeking prime locations in urban cores. Their demand for accessibility and high-quality environments is consistent, contributing to stable occupancy rates within Kilroy's portfolio. As of early 2024, this segment continues to be a reliable source of high-credit tenancies, anchoring significant portions of Class A office space, despite broader office market shifts.

- Kilroy Realty's portfolio benefits from the stability of high-credit professional services tenants.

- These firms prioritize prestigious addresses and superior building amenities.

- Their consistent demand helps maintain strong occupancy rates in prime office properties.

- The segment includes law, accounting, and wealth management firms seeking premium office environments.

Ground-Floor Retail & Amenity Providers

Kilroy Realty's ground-floor retail and amenity providers are crucial customers, encompassing high-end restaurants, coffee shops, and fitness centers. These tenants cater to the diverse needs of building occupants and the surrounding community. Their presence activates properties, transforming them into vibrant destinations, and significantly enhances the overall asset value. In 2024, Kilroy continued to emphasize curated retail offerings to boost tenant experience and property appeal across its portfolio.

- Kilroy's retail customers include upscale dining, cafes, and health services.

- These tenants serve both on-site occupants and the broader local community.

- Their role is vital in activating properties and increasing their market appeal.

- Strategic amenity provision contributes to property valuation and tenant retention.

Kilroy Realty targets a diverse array of high-value tenants, including established technology and media firms seeking stable, long-term Class A office leases. A significant portion, about 38% of their portfolio as of early 2024, caters to specialized life science and biotechnology companies. Growth-stage tech startups, supported by approximately $36 billion in Q1 2024 US venture capital funding, also form a key segment, alongside reliable professional and financial services firms, and curated ground-floor retail tenants enhancing property appeal.

| Customer Segment | Key Characteristic | 2024 Data Point |

|---|---|---|

| Established Tech/Media | Stable, long-term leases | High S&P 500 presence |

| Life Science/Biotech | Specialized lab/office | ~38% of portfolio SF (early 2024) |

| Growth-Stage Tech | Flexible, scalable needs | ~$36B US VC funding (Q1 2024) |

| Professional Services | High-credit, prestige-focused | Reliable Class A tenancies |

| Retail/Amenities | Enhances property value | Curated offerings across portfolio |

Cost Structure

Property operating expenses represent a substantial element of Kilroy Realty's cost structure, encompassing utilities, ongoing repairs and maintenance, property management fees, insurance premiums, and property taxes.

While many of these costs, such as approximately $184.8 million in 2023, are frequently reimbursed by tenants through net lease agreements, they still necessitate efficient cash flow management.

These expenses are a significant cash outflow that must be diligently managed to maintain profitability and operational efficiency.

Effective oversight ensures the properties remain competitive and attractive, supporting overall asset value.

As a capital-intensive real estate investment trust, Kilroy Realty's interest expense on debt is a primary cost, encompassing payments on mortgages, corporate bonds, and credit facilities. This significant non-operating expense directly impacts profitability. For instance, Kilroy Realty reported interest expense of approximately $68.4 million for Q1 2024, highlighting its substantial nature. Effectively managing interest rate risk and the overall cost of capital is critical for optimizing financial performance and maximizing returns in the current economic landscape.

Building and asset depreciation is a significant non-cash expense for Kilroy Realty, reflecting the accounting-based decline in the value of its extensive portfolio of buildings and improvements over their useful life. While this charge impacts the company's reported net income, it crucially does not affect its cash flow. For a real estate investment trust like Kilroy Realty, which owned 16.2 million square feet of office and life science properties as of Q1 2024, depreciation is a fundamental and substantial cost inherent to owning such a large base of physical assets. This accounting treatment helps spread the cost of property acquisition over time.

General & Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Kilroy Realty encompass the corporate overhead necessary to operate the business, including executive and employee salaries, office rent, marketing initiatives, and various professional fees. Controlling these costs as a percentage of revenue is a key indicator of corporate efficiency, directly supporting the entire enterprise's broad operations.

- For Q1 2024, Kilroy Realty reported G&A expenses of approximately $29.1 million.

- This figure contributes to the overall operational efficiency, with annual G&A often representing a significant portion of total operating expenses.

- Kilroy's G&A includes substantial investments in talent and technology to manage its extensive portfolio.

- Managing these costs effectively impacts the company's net operating income and profitability.

Development & Capital Improvement Costs

Development and capital improvement costs represent significant capital expenditures for Kilroy Realty, focused on constructing new properties and undertaking substantial renovations or upgrades to existing assets. While these outlays are capitalized on the balance sheet rather than immediately expensed, they form the largest cash outflows for a development-focused company like Kilroy. For instance, Kilroy Realty's estimated capital expenditures for 2024 include significant investments in development and re-development projects.

- Kilroy Realty’s total 2024 capital expenditure guidance was approximately $150 million.

- This allocation covers new development, re-development, and tenant improvements.

- Major projects in 2024 include ongoing work at properties like 2100 Kettner in San Diego.

- These investments are crucial for portfolio growth and value enhancement.

Kilroy Realty's cost structure is dominated by property operating expenses, interest expense, and significant development capital. For Q1 2024, interest expense was $68.4 million and G&A reached $29.1 million. Total 2024 capital expenditure guidance is approximately $150 million, reflecting growth investments. Managing these core outflows is vital for profitability.

| Cost Type | Q1 2024 ($M) | 2024 Guidance ($M) |

|---|---|---|

| Interest Expense | 68.4 | N/A |

| G&A Expenses | 29.1 | N/A |

| Capital Expenditures | N/A | ~150 |

Revenue Streams

Kilroy Realty’s most significant revenue stream is base rental income, derived from fixed monthly or annual payments from tenants under long-term lease agreements. This core income provides a highly stable and predictable source of recurring cash flow, essential for a real estate investment trust. For instance, Kilroy Realty reported total revenues of $291.6 million in the first quarter of 2024, with a substantial portion attributed to base rents. This consistent cash flow forms the fundamental foundation of the company's financial model and operational stability.

Tenant reimbursements represent a crucial revenue stream for Kilroy Realty, where tenants pay their pro-rata share of property operating expenses like utilities, real estate taxes, and insurance.

This mechanism is prevalent in triple-net (NNN) leases, a common structure in Kilroy’s portfolio, protecting their net operating income from inflationary pressures on property expenses.

For instance, these recoveries significantly contribute to Kilroy's financial stability, offsetting a substantial portion of their property operating costs, which were approximately $109 million in 2023.

This structure ensures that as property expenses fluctuate, a predictable portion is passed through to the tenants, enhancing the resilience of Kilroy's cash flows in 2024 and beyond.

Kilroy Realty generates substantial revenue from operating parking facilities at its office and mixed-use properties, a critical ancillary stream. This income is primarily derived from monthly passes secured by tenants and hourly fees paid by visitors to their urban developments. Given the scarcity of parking in dense urban markets like those where Kilroy operates, this revenue stream remains highly profitable. For instance, in 2024, such operations continue to significantly contribute to the overall property income, enhancing asset value.

Gains on Sale of Real Estate

Kilroy Realty strategically generates revenue through gains on the sale of real estate, a vital component of its capital recycling efforts. This involves divesting stabilized properties to reinvest proceeds into new development opportunities or to optimize its portfolio. The profit derived from selling an asset above its cost basis constitutes these non-recurring gains, essential for funding future projects and enhancing overall returns. For instance, in 2024, such strategic sales continue to bolster their financial flexibility.

- Capital recycling: Enables reinvestment into new, higher-return developments.

- Portfolio optimization: Divesting mature assets to enhance portfolio quality.

- Non-recurring gains: Direct profit from asset sales.

- Strategic funding: Provides capital for a robust development pipeline in 2024.

Other Income & Tenant Services

Other Income & Tenant Services capture miscellaneous revenue from tenants for various offerings, such as temporary space licenses, conference facility rentals, and other specialized services. This category also includes lease termination fees, providing an additional revenue stream beyond core rental income. While smaller in scale compared to primary rental income, these contributions enhance the overall profitability and financial stability of Kilroy Realty’s properties. For the three months ended March 31, 2024, Kilroy Realty reported $5.671 million in other income.

- Other income contributed $5.671 million for the three months ending March 31, 2024.

- Includes revenue from temporary space licenses and conference facility rentals.

- Lease termination fees are a significant component of this income.

- Supplements core rental income, boosting overall property profitability.

Kilroy Realty’s primary revenue streams are stable base rental income, exemplified by Q1 2024 total revenues of $291.6 million, and tenant reimbursements, which offset property operating costs.

Ancillary income comes from profitable parking facilities and other tenant services, including $5.671 million for Q1 2024 from categories like temporary space licenses.

Additionally, strategic gains on real estate sales contribute to capital recycling and portfolio optimization, bolstering financial flexibility in 2024.

| Revenue Stream | Primary Nature | 2024 Contribution (Q1) |

|---|---|---|

| Base Rental Income | Stable, recurring | Core of $291.6M total revenues |

| Tenant Reimbursements | Expense offset | Offsets significant property costs |

| Other Income & Services | Ancillary, varied | $5.671M |

Business Model Canvas Data Sources

The Kilroy Realty Business Model Canvas is built using extensive market research, property portfolio analysis, and financial performance data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting our real estate strategy.