Kilroy Realty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kilroy Realty Bundle

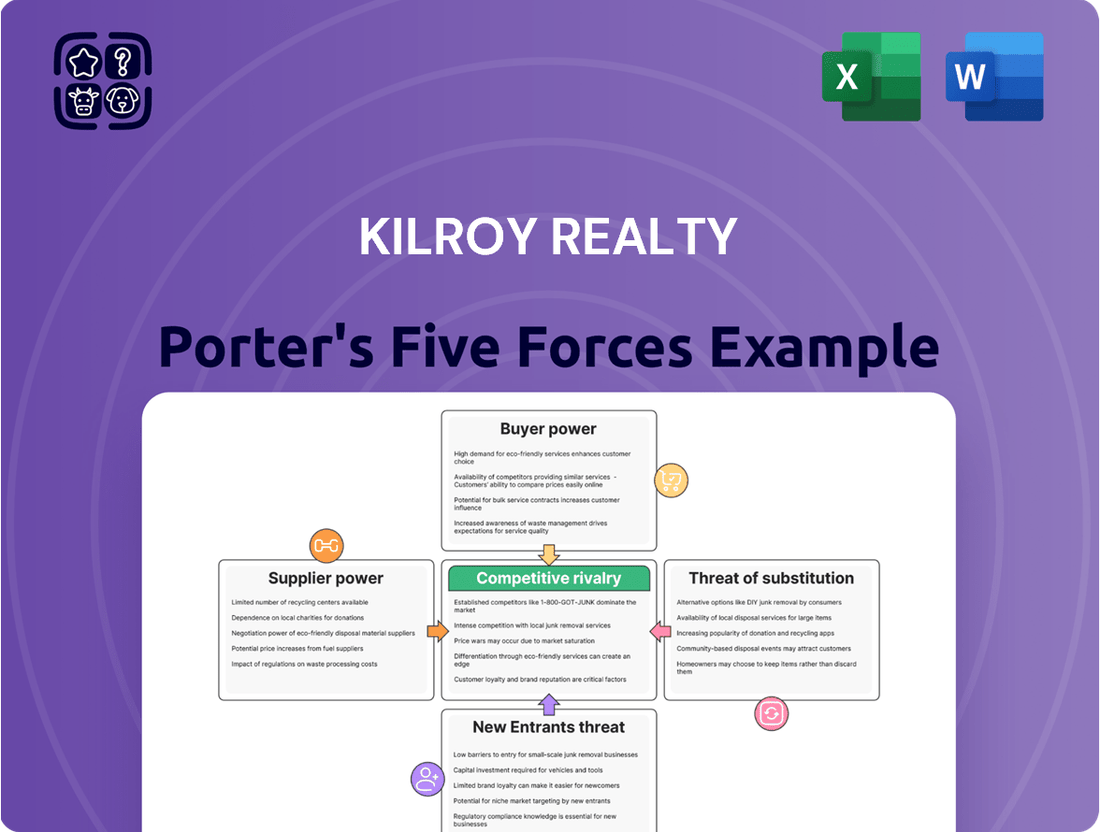

Kilroy Realty operates in a dynamic real estate sector, and understanding the forces at play is crucial for strategic success. Our analysis reveals how the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry shape Kilroy's competitive landscape.

This initial glimpse highlights the significant pressures Kilroy Realty faces, from tenant demands to the availability of alternative office spaces. Each force presents unique challenges and opportunities that directly impact profitability and market share.

The complete report reveals the real forces shaping Kilroy Realty’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The development of high-quality office and life science properties by Kilroy Realty relies heavily on specialized labor and unique materials, which grants significant bargaining power to suppliers. Contractors proficient in building advanced lab spaces or sustainable, tech-enabled offices possess expertise that is not easily replicated. As of 2024, the demand for such specialized construction services, particularly in life sciences, contributes to increased costs. Furthermore, suppliers of specific equipment and materials for these niche properties can command higher prices due to limited alternatives. This reliance means Kilroy Realty often faces elevated input costs.

Fluctuations in construction and development costs, including materials and labor, directly impact Kilroy Realty's profitability. As of 2024, persistent labor shortages and volatile material prices, such as for steel and concrete, continue to empower suppliers. Rising costs compress development spreads, making new projects less financially viable for Kilroy. Their commitment to sustainability often involves higher upfront costs for specialized green building materials and technologies. This further strengthens the bargaining power of suppliers providing these niche, eco-friendly components.

Kilroy Realty, operating as an owner, developer, and manager, relies heavily on a network of contractors and development partners for its projects. A tight market for skilled labor and specialized construction firms, prevalent in 2024 across key West Coast markets, can increase project costs and extend timelines. For instance, construction input prices, while varying, have presented ongoing challenges. However, Kilroy's substantial scale and established long-term relationships with preferred vendors often help mitigate the bargaining power of these suppliers.

Supplier Concentration

Supplier concentration presents a notable challenge for Kilroy Realty, particularly for highly specialized building components like advanced HVAC systems crucial for their life science lab developments. When only a few suppliers dominate these niche markets, they gain significant leverage in pricing and terms. Kilroy's diversified approach, engaging with a broad range of suppliers and leveraging its internal development capabilities, helps mitigate this risk. This strategy aims to reduce reliance on any single vendor, fostering competitive bidding.

- In 2024, specialized construction technology and materials often come from a limited pool of providers, increasing their bargaining power.

- Kilroy's strategic partnerships with multiple vendors, including those for cutting-edge lab infrastructure, enhance its negotiating position.

- The company's in-house development expertise allows for greater control over specifications, potentially reducing supplier dependency.

Economic Conditions and Wildfires

Broader economic conditions significantly impact supplier power for Kilroy Realty. Inflation, which saw the Consumer Price Index (CPI) increase by 3.3% year-over-year in May 2024, directly elevates costs for construction materials and labor. Furthermore, the increasing frequency of events like wildfires, such as the 1,500+ wildfires reported in California by June 2024, disrupts supply chains, making materials scarcer and more expensive. These factors strengthen suppliers' positions, enabling them to demand higher prices from Kilroy for essential goods and services.

- US CPI rose 3.3% year-over-year in May 2024, impacting material costs.

- California recorded over 1,500 wildfires by June 2024, disrupting supply chains.

Kilroy Realty faces strong supplier power from specialized labor and niche materials for its high-quality properties. In 2024, persistent labor shortages and volatile material costs, such as steel and concrete, empower these suppliers. Broader economic factors like inflation, with US CPI rising 3.3% year-over-year in May 2024, further elevate input costs. Kilroy's reliance on unique components for advanced lab spaces strengthens supplier leverage.

| Supplier Factor | Impact on Kilroy | 2024 Data/Context |

|---|---|---|

| Specialized Labor | Increased project costs | Labor shortages on West Coast |

| Niche Materials | Higher input prices | Volatile steel/concrete prices |

| Economic Inflation | Elevated material costs | US CPI +3.3% (May 2024) |

What is included in the product

This analysis specifically examines the competitive forces impacting Kilroy Realty, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the real estate sector.

A dynamic, interactive model that allows for real-time adjustment of Porter's Five Forces based on Kilroy Realty's evolving portfolio and market insights.

Visualize the impact of competitive shifts and new market entrants on Kilroy Realty's strategic positioning with an intuitive, customizable dashboard.

Customers Bargaining Power

Kilroy Realty’s portfolio, heavily weighted with major technology and life science tenants, faces considerable customer bargaining power. This high concentration means a few large companies, like those comprising a significant portion of their 2024 lease revenue, hold substantial leverage during lease negotiations and renewals. Such tenants can demand favorable terms due to the scale of their occupancy. The potential loss of a single major tenant, representing a large percentage of revenue, could significantly impact Kilroy’s occupancy rates and financial performance.

In a post-pandemic market, tenants are increasingly prioritizing newer, amenity-rich office spaces, a trend known as the flight to quality. This shift favors landlords like Kilroy Realty, whose high-quality, sustainable portfolios command stronger demand, allowing for some pricing power. For instance, Kilroy's Class A properties in core markets saw higher occupancy rates compared to older stock in 2024. However, this also means tenants have heightened expectations, demanding premium features and flexible terms, which can increase their bargaining leverage on specific lease negotiations.

The widespread shift to hybrid work models has significantly altered the commercial real estate landscape, empowering tenants. As of early 2024, office vacancy rates in major U.S. markets, including those where Kilroy Realty operates, often exceeded 20%, reflecting reduced demand. Companies are re-evaluating their space needs, frequently seeking shorter lease terms or more flexible arrangements. This dynamic allows tenants greater leverage to negotiate favorable terms, increasing their bargaining power. Landlords like Kilroy Realty face pressure to offer competitive incentives and adaptable solutions to attract and retain occupants.

Vacancy Rates in Key Markets

While Kilroy Realty operates in high-barrier-to-entry markets, vacancy rates directly impact tenant leverage. Higher vacancy rates across the broader market empower tenants with more options, increasing their negotiating power on rental rates and concessions. Conversely, in submarkets with low vacancy for premium life science or office space, Kilroy regains some pricing power, particularly in prime locations.

- San Francisco's office vacancy rate reached approximately 37% by early 2024, providing tenants significant leverage.

- Conversely, life science vacancy in core Boston submarkets remained tighter, often below 10% in 2024.

- Lower vacancy rates in Kilroy's high-quality properties reduce tenant bargaining power.

- Market-wide increases in available space, as seen in some 2024 office markets, favor tenants.

Specialized Needs of Life Science Tenants

Life science tenants, with their highly specific and complex requirements for lab and R&D spaces, often find their options limited. This specialization significantly reduces their ability to easily switch to alternative properties, thereby decreasing their bargaining power against landlords like Kilroy Realty. Kilroy's established expertise in developing and managing these purpose-built environments gives them a strong advantage in attracting and retaining these valuable tenants. As of 2024, Kilroy continued to see strong demand for its specialized life science portfolio, reflecting the high barriers to entry for competitors and the tailored nature of these facilities.

- Kilroy's life science portfolio was approximately 58% of its total portfolio as of Q1 2024, highlighting its strategic focus.

- The high capital expenditure required for lab build-outs locks tenants into long-term leases.

- Specialized infrastructure for ventilation, power, and safety is not easily replicated elsewhere.

- Kilroy's deep industry relationships and proven track record in the sector reduce tenant search costs.

Customer bargaining power for Kilroy Realty is high due to concentrated major tenants, particularly in office markets with elevated vacancy rates like San Francisco's 37% in early 2024. The shift to hybrid work models further empowers tenants, demanding flexible terms. However, Kilroy's specialized life science portfolio, comprising about 58% of its total as of Q1 2024, reduces tenant leverage due to the high capital expenditure and unique infrastructure requirements, with tighter vacancy rates in core life science submarkets often below 10% in 2024.

| Market Segment | 2024 Vacancy Rate | Tenant Bargaining Power |

|---|---|---|

| San Francisco Office | ~37% | High |

| Core Boston Life Science | <10% | Low |

| Kilroy's Life Science Portfolio | N/A (Specialized) | Reduced |

Same Document Delivered

Kilroy Realty Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Kilroy Realty, detailing the competitive landscape and strategic positioning within the real estate sector. The document you see here is exactly what you’ll be able to download after payment, offering a thorough examination of industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You're looking at the actual document, ensuring you receive a complete and professionally formatted analysis of Kilroy Realty's market dynamics.

Rivalry Among Competitors

Kilroy Realty faces significant competitive rivalry from numerous publicly traded REITs and private real estate firms, all targeting prime assets in high-growth coastal markets like those in California and Washington. In 2024, this competition remains fierce for new development sites and existing premium properties, driving up acquisition costs. Rivals also aggressively pursue the same high-quality tenants, potentially impacting Kilroy's ability to maintain or increase rental rates. This intense contest for both assets and tenants can exert downward pressure on property valuations and overall portfolio performance.

Kilroy Realty's strategic concentration on coastal innovation hubs like California, Washington, and Austin, Texas, intensifies competitive rivalry within these high-growth markets. The desirability of these regions for robust technology and life science sectors, which continued significant leasing activity into early 2024, attracts well-capitalized real estate developers. This focus means Kilroy directly competes with established players and new entrants vying for premium office and life science properties. For instance, the San Francisco Bay Area and Seattle markets, key Kilroy locations, saw continued demand for high-quality lab and office spaces in 2024, despite broader market adjustments, underscoring the fierce competition. This dynamic environment necessitates continuous innovation and tenant retention strategies for Kilroy.

Kilroy Realty differentiates itself by developing high-quality, amenity-rich properties and a strong commitment to sustainability. This strategy attracts tenants prioritizing modern work environments and environmental responsibility, evidenced by Kilroy achieving a GRESB 5-star rating in 2024 for its leading ESG performance. Such differentiation helps reduce direct price competition, as tenants value these specific attributes over lower-quality alternatives. For example, their focus on LEED-certified buildings supports premium rents and occupancy rates.

Leasing Activity and Occupancy Rates

Leasing activity and occupancy rates are critical indicators of competitive pressure within the commercial real estate market. While Kilroy Realty has experienced periods of robust leasing, the overall market remains subject to fluctuations driven by broader economic conditions and evolving tenant demand. Competitors maintaining high occupancy levels and strong leasing momentum can intensify the competitive landscape for available tenants. Kilroy Realty’s stabilized portfolio occupancy stood at 84.8% as of Q1 2024, reflecting ongoing market dynamics.

- Kilroy Realty’s stabilized portfolio occupancy was 84.8% in Q1 2024.

- Market conditions and tenant demand directly influence leasing activity.

- Competitors with higher occupancy rates increase rivalry.

- Economic shifts continue to shape the leasing environment in 2024.

Development and Redevelopment Pipeline

The development and redevelopment pipeline of competing real estate firms significantly influences competitive rivalry for Kilroy Realty. A substantial influx of new office or life science space, particularly in key West Coast markets like San Francisco or San Diego, directly increases supply, intensifying the competition for prime tenants. For instance, in early 2024, certain submarkets still showed considerable life science space under construction. Kilroy's own development pipeline, which included projects totaling over 1.7 million square feet as of early 2024, is a critical component of its strategy to maintain its competitive edge and capture market share.

- Competitors adding significant new supply can depress rental rates and increase vacancy.

- Kilroy's strategic focus on high-barrier-to-entry coastal markets helps mitigate some pipeline risks.

- The ability to deliver modern, amenity-rich properties from its own pipeline is a key differentiator.

- Market absorption rates for new developments directly impact the competitive landscape in 2024.

Kilroy Realty faces intense rivalry for premium coastal assets and high-quality tenants, especially in 2024, driving acquisition costs and influencing rental rates. While its focus on amenity-rich, sustainable properties helps differentiate, competitor development pipelines and occupancy rates remain critical factors. Kilroy’s Q1 2024 stabilized portfolio occupancy was 84.8%, navigating a competitive market.

| Metric | Kilroy Realty (2024) | Market Impact (2024) |

|---|---|---|

| Stabilized Occupancy | 84.8% (Q1) | Market competition for tenants |

| Development Pipeline | 1.7M sq ft (early) | Competitor supply dynamics |

| GRESB Rating | 5-star | Differentiation, tenant appeal |

SSubstitutes Threaten

The rise of remote and hybrid work models presents a significant substitute for traditional office space, directly impacting Kilroy Realty. As of early 2024, office utilization rates in major U.S. cities like those Kilroy operates in, such as San Francisco, remained below pre-pandemic levels, often hovering around 50-60%. This sustained shift reduces the overall demand for physical office footprints. Consequently, Kilroy could face pressure on its occupancy rates and rental income. This trend necessitates strategic adjustments to its portfolio and tenant offerings.

The rise of co-working and flexible office spaces offers businesses a compelling alternative to traditional long-term leases, impacting demand for properties held by firms like Kilroy Realty. These solutions, from providers such as Regus and Industrious, provide companies with enhanced agility and reduced upfront costs, which is especially attractive to startups and smaller enterprises. In 2024, the flexible office sector continues to expand, with projections indicating it could account for a growing share of the overall office market, influencing tenant preferences in key urban centers.

While Kilroy Realty primarily invests in premium office spaces within major coastal hubs like San Francisco and Seattle, a growing substitute emerges from companies decentralizing operations. This involves relocating or expanding into more affordable suburban or secondary markets, a trend significantly accelerated by hybrid and remote work models. For example, in 2024, suburban office markets have often shown greater leasing activity resilience compared to some central business districts. This shift directly competes with Kilroy's high-cost urban offerings, as businesses seek lower overheads and flexible workspace solutions outside traditional prime locations.

Technological Advancements

Technological advancements, particularly in virtual and augmented reality, pose a growing threat by reducing the necessity for traditional physical office spaces. As these collaboration technologies mature and become more widely adopted, they offer increasingly sophisticated alternatives to in-person meetings and centralized work environments. This shift could erode demand for premium office locations, directly impacting real estate investment trusts like Kilroy Realty. For instance, in 2024, many companies continue to embrace hybrid models, with office utilization rates often remaining below pre-pandemic levels.

- Global VR/AR market size is projected to exceed $70 billion in 2024, indicating rapid technological progression.

- Office vacancy rates in major U.S. markets, including those where Kilroy operates, reached over 19% in early 2024.

- Studies in 2024 show that over 60% of companies globally offer some form of hybrid or remote work.

- Continued investment in advanced collaboration platforms reduces the perceived value of daily in-office presence.

Re-purposing of Existing Buildings

The potential for converting other building types, like retail or older commercial spaces, into office or life science facilities presents a substitute threat to Kilroy Realty. While this could increase the overall supply, the high cost and intricate nature of such conversions act as significant barriers. For instance, transforming a retail space into a Class A life science lab often requires extensive infrastructure upgrades, including specialized HVAC systems and robust power, which can easily exceed $300 per square foot in 2024. This substantial investment and the technical complexity limit the widespread viability of such projects.

- Retail vacancy rates in major markets like Los Angeles averaged around 5% in Q1 2024, creating potential sites for conversion.

- The average cost for a full Class A office conversion can range from $150 to $250 per square foot.

- Life science conversions demand even higher capital expenditure due to specialized lab infrastructure, often exceeding $400 per square foot for high-containment labs.

- Only a fraction of existing building stock meets the structural and zoning requirements for high-spec office or life science repurposing.

The threat of substitutes for Kilroy Realty is high, primarily driven by the sustained shift to remote and hybrid work models, impacting office utilization. Flexible office solutions and decentralization to more affordable suburban markets also reduce demand for traditional urban spaces. Furthermore, advancements in virtual collaboration technologies and the potential for costly building conversions offer alternatives to conventional office leases.

| Substitute Type | 2024 Data Point | Impact |

|---|---|---|

| Remote/Hybrid Work | Office utilization 50-60% | Reduced demand for physical space |

| Flexible Offices | Sector continues to expand | Offers agile, lower-cost alternatives |

| Decentralization | Suburban resilience vs. CBDs | Shifts demand from prime urban areas |

Entrants Threaten

Kilroy Realty's strategic focus on prime coastal markets in California, Washington, and Austin is protected by significant barriers to entry. These areas are characterized by exceptionally high land and construction costs, with commercial construction in major California metros exceeding $600 per square foot in 2024. The complex entitlement and permitting processes further deter competition, often extending project timelines by years. Such conditions necessitate substantial capital and specialized expertise, effectively limiting the pool of potential new developers. This environment makes it challenging for new competitors to establish a foothold.

Developing high-quality office and life science properties is incredibly capital-intensive, posing a significant barrier for new entrants. New developers require substantial capital for land acquisition and construction, often ranging into hundreds of millions for a single large project. For instance, Kilroy Realty reported total assets of approximately $12.3 billion as of late 2023, showcasing the scale of investment needed to compete. This financial hurdle makes it difficult for new players to rival established firms like Kilroy, which possess strong balance sheets and established access to capital markets for financing large-scale developments in 2024.

The development and management of life science properties demand highly specialized knowledge, encompassing intricate infrastructure, stringent safety protocols, and complex regulatory compliance. Kilroy Realty's deep-rooted expertise in this niche sector, evidenced by their portfolio, which included approximately 6.7 million square feet of life science properties as of early 2024, creates a formidable barrier. New entrants lack this established track record and the specific operational acumen needed to compete effectively. Their proven capability in designing and managing these sophisticated facilities solidifies their market position, deterring potential competitors from easily entering this capital-intensive segment.

Economies of Scale and Reputation

Kilroy Realty, as a large, established player, benefits significantly from economies of scale in its extensive operations, encompassing property management, leasing, and large-scale development projects. The company's robust reputation, built over decades, along with its long-standing relationships with high-profile tenants, brokers, and local communities, provides a formidable competitive advantage. New entrants face substantial capital requirements and difficulty replicating such an entrenched market presence and operational efficiency. For instance, Kilroy's stabilized portfolio maintained an 84.7% occupancy rate as of Q1 2024, reflecting tenant confidence.

- Kilroy's portfolio spanned approximately 17.5 million square feet of stabilized office and life science properties in 2024.

- The average remaining lease term for Kilroy's portfolio was 5.8 years in Q1 2024, indicating strong tenant retention.

- The capital required for new entrants to acquire or develop comparable class-A assets in Kilroy's core markets is exceptionally high.

- Kilroy's 2024 development pipeline continues to demonstrate its capacity for large-scale, high-quality projects.

Limited Availability of Prime Locations

The threat of new entrants for Kilroy Realty is significantly dampened by the scarce availability of prime development sites in its core markets, particularly coastal California and Seattle. In 2024, the competition for the few remaining highly desirable parcels has intensified, driving up land acquisition costs substantially. This scarcity makes it exceedingly challenging for new players to secure locations that can rival Kilroy's established, well-positioned portfolio. New entrants face higher barriers to entry, needing significant capital to compete for these coveted, limited plots.

- Limited developable land in urban coastal markets.

- Increased land acquisition costs for new players in 2024.

- Kilroy's existing prime portfolio creates a competitive moat.

- High capital requirements for new market entry.

The threat of new entrants for Kilroy Realty remains low due to formidable barriers, including exceptionally high land and construction costs, exceeding $600 per square foot in 2024 for commercial projects in key California markets. The complex regulatory environment and the substantial capital required, with Kilroy's assets at approximately $12.3 billion, deter new players. Furthermore, specialized expertise in life science properties and the scarcity of prime development sites in coastal markets, where Kilroy holds an 84.7% occupancy rate as of Q1 2024, create significant hurdles for any potential new competitor.

| Barrier Type | Impact on New Entrants | 2024 Data Point |

|---|---|---|

| Capital Intensity | High financial hurdle | Kilroy's Assets: ~$12.3B |

| Cost & Regulations | Deters new development | CA Commercial Construction: >$600/sq ft |

| Market Scarcity | Limited prime locations | Kilroy Q1 2024 Occupancy: 84.7% |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Kilroy Realty Corporation leverages data from Kilroy Realty's investor relations website, SEC filings, and industry-specific real estate market reports. We also incorporate insights from reputable commercial real estate data providers and economic trend analyses.