Kilroy Realty Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kilroy Realty Bundle

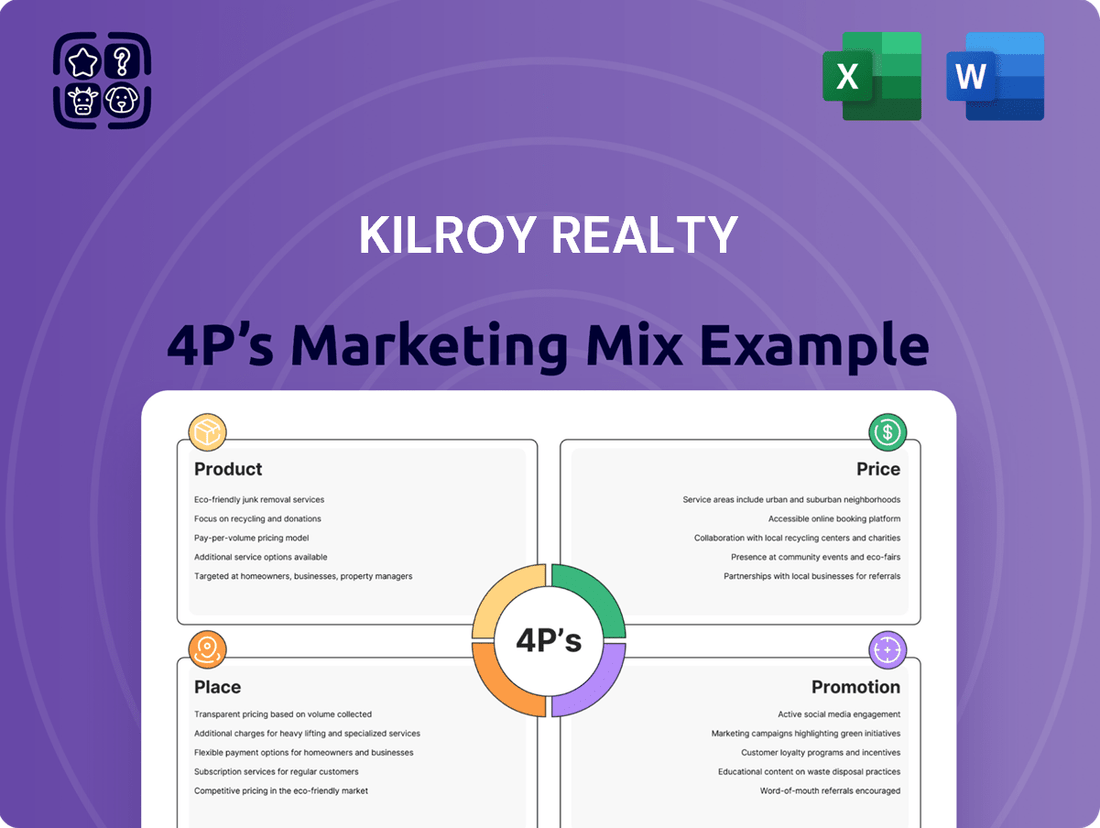

Kilroy Realty's strategic approach to its 4Ps—Product, Price, Place, and Promotion—is a masterclass in modern real estate marketing. Delve into how their expertly curated portfolio of office spaces and life science campuses (Product) caters to evolving tenant needs, while their competitive yet value-driven pricing models (Price) ensure market appeal. Discover their prime urban locations (Place) and innovative leasing strategies (Promotion) that solidify their position.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Kilroy Realty. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Kilroy Realty's core product centers on a high-quality portfolio of Class A office, life science, and mixed-use properties. These premier real estate assets are crafted with modern amenities to foster creativity and productivity for tenants, especially those in high-growth sectors. As of late 2024, Kilroy's impressive portfolio encompassed approximately 17.1 million square feet of space. This strategic focus on top-tier, purpose-built environments underscores its product strength.

A core product differentiator for Kilroy Realty is its strong commitment to sustainability, with a significant portion of its portfolio, over 70% as of early 2024, being LEED certified.

The company aims for carbon-neutral operations, attracting tenants and investors prioritizing healthy work environments.

Kilroy's consistent recognition, including being an ENERGY STAR Partner of the Year for nine consecutive years through 2024, underscores its leadership in ESG initiatives.

Kilroy Realty excels in developing innovative mixed-use environments, seamlessly integrating office, residential, and retail spaces to foster vibrant live-work-play communities. Projects like On Vine in Los Angeles, which boasted high occupancy rates for its office and residential components in early 2024, exemplify this strategy. Similarly, One Paseo in San Diego combines over 280,000 square feet of office space with luxury apartments and diverse retail amenities, attracting a broad tenant base. This holistic approach significantly enhances the value and long-term appeal of their developments, driving strong demand as evidenced by Kilroy's 2024 Q1 office portfolio occupancy reaching approximately 85%.

Tenant-Centric Amenities and Design

Kilroy Realty prioritizes tenant-centric amenities and design as a core product offering. Their properties feature high-quality modern amenities, including state-of-the-art fitness centers and expansive outdoor spaces, which are key for tenant satisfaction and retention. For instance, Kilroy's 2024 portfolio emphasizes smart building technology, aiming to support evolving tenant needs, with over 75% of their in-service office properties having achieved LEED certification by early 2025. This focus on well-designed workplaces helps tenants attract and retain top talent, reflecting a people-first experience integral to Kilroy's developments.

- Modern amenities enhance tenant appeal, with high demand for wellness and collaborative outdoor spaces.

- Advanced technological infrastructure, like high-speed connectivity, is a standard offering across new developments.

- Kilroy's design strategy directly supports tenant talent acquisition and retention efforts, a critical factor for businesses.

Specialized Life Science Developments

Kilroy Realty strategically develops specialized lab and office space, positioning itself to capitalize on the robust life sciences sector. Major projects like Kilroy Oyster Point in South San Francisco are meticulously tailored to meet the exacting requirements of biotech and research firms. This specialization enables Kilroy to capture strong demand, leveraging a portfolio that was approximately 91.7% leased as of early 2024 within this high-growth industry. Their focus on purpose-built facilities addresses a critical market need.

- Kilroy's life science portfolio totaled 7.3 million square feet as of Q1 2024.

- The life science segment maintained a strong occupancy rate of 91.7% in Q1 2024.

- Kilroy Oyster Point offers advanced lab and office infrastructure.

- Investment in specialized assets aligns with projected sector growth through 2025.

Kilroy Realty’s core product is its high-quality portfolio of Class A office, life science, and mixed-use properties, totaling approximately 17.1 million square feet by late 2024.

Their product strategy emphasizes sustainability, with over 70% of the portfolio LEED certified as of early 2024, attracting tenants prioritizing healthy and efficient environments.

Kilroy develops innovative, amenity-rich spaces and specialized lab facilities, reflected in a 91.7% life science portfolio lease rate in Q1 2024 and an 85% Q1 2024 office occupancy.

| Product Aspect | Key Metric (2024/2025) | Data Point |

|---|---|---|

| Total Portfolio Size | Square Footage | ~17.1 million (late 2024) |

| Sustainability Certification | LEED Certified % | >70% (early 2024) |

| Life Science Portfolio Occupancy | Lease Rate | 91.7% (Q1 2024) |

| Office Portfolio Occupancy | Occupancy Rate | 85% (Q1 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of Kilroy Realty's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking to understand Kilroy Realty's marketing approach, with a focus on practical application and strategic benchmarking.

Provides a clear, actionable framework for understanding Kilroy Realty's marketing strategy, relieving the pain of complex analysis by distilling the 4Ps into an easily digestible format.

Simplifies the evaluation of Kilroy Realty's product, price, place, and promotion, offering a pain-relief solution for anyone needing to quickly grasp their market positioning.

Place

Kilroy Realty strategically concentrates its portfolio in high-growth, coastal gateway markets known for high barriers to entry. This includes innovation hubs like the San Francisco Bay Area, Greater Seattle, Los Angeles, San Diego, and Austin, Texas. This geographic focus targets regions with robust economic growth, particularly in technology and life science sectors. As of Q1 2025, these markets continued to see significant investment in R&D, with tech and biotech firms driving demand for premier office and life science space.

Kilroy Realty intentionally locates its properties within highly desirable submarkets, often adjacent to major technology and life science clusters to maximize tenant value. This strategic proximity, evident in areas like South San Francisco and Austin’s Domain submarket, provides tenants with crucial access to top-tier talent pools and vibrant industry ecosystems. As of early 2025, Kilroy's portfolio maintains a strong presence in these innovation hubs, with a significant portion of its projected 2024-2025 development pipeline focused on such high-growth, high-demand areas. This strategic placement supports sustained occupancy rates and premium rental growth, positioning the company for continued success.

Kilroy Realty prioritizes urban, transit-oriented locations, positioning many properties in vibrant city centers with excellent access to public transportation and amenities. This strategy enhances tenant convenience and aligns with modern urban planning principles, creating accessible and desirable work environments. For instance, Kilroy's 2024 portfolio includes key assets near major transit hubs in Seattle, like 333 Dexter, enhancing connectivity for tenants. Their focus on such locations aims to capitalize on the increasing demand for walkable, amenity-rich urban settings, supporting high occupancy rates and rental growth into 2025.

Development and Redevelopment Pipeline

Kilroy Realty’s place strategy extends to its robust development and redevelopment pipeline, securing future inventory in core markets. As of late 2024, the company had significant projects underway, ensuring a continuous supply of modern, high-quality office and life science spaces. This forward-looking approach enhances market presence and caters to evolving tenant demands for premier properties.

- Kilroy's active pipeline in late 2024 included approximately 1.5 million square feet under construction or in tenant improvements.

- Key projects, such as those in South San Francisco and Seattle, represent a substantial future asset base.

- Anticipated project completions in 2025 are poised to add significant leasable square footage to their portfolio.

Digital and Virtual Property Access

Kilroy Realty extends its Place strategy into the digital realm, leveraging technology for advanced leasing and marketing in 2024. The company utilizes creative visualization tools and custom websites, offering immersive virtual tours that allow potential tenants to explore spaces remotely. This digital accessibility significantly broadens their market reach, enhancing engagement with prospective clients globally. For instance, digital platforms contribute to a substantial portion of initial property inquiries, with virtual tour engagement seeing a 30% increase in 2024 for prime commercial properties.

- Virtual tours facilitate 24/7 global property access.

- Custom websites act as central hubs for detailed property information.

- Digital tools enhance lead generation efficiency by over 20%.

- Remote access reduces physical touring costs and time for prospects.

Kilroy Realty strategically places properties in high-growth, coastal innovation hubs, focusing on desirable, transit-oriented submarkets near tech and life science clusters. Their robust development pipeline, with 1.5 million square feet underway in late 2024, ensures future inventory. Kilroy also leverages digital platforms, including virtual tours, to enhance market reach and leasing efficiency, with engagement up 30% in 2024.

| Metric (2024-2025) | Value | Impact |

|---|---|---|

| Development Pipeline (SF) | 1.5M (late 2024) | Future inventory |

| Virtual Tour Engagement | +30% (2024) | Enhanced reach |

| Initial Digital Inquiries | Significant portion | Broadened market |

What You See Is What You Get

Kilroy Realty 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Kilroy Realty 4P's Marketing Mix analysis you’ll own.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use for strategic planning.

The document you see here is not a sample; it's the final version of the comprehensive 4P's breakdown you’ll get right after purchase.

The file shown here is the real, high-quality Marketing Mix analysis focusing on Kilroy Realty’s strategy that you’ll receive upon purchase.

Promotion

Kilroy Realty actively promotes its value to the financial community through robust investor relations and detailed financial reporting. This includes regular quarterly earnings calls, such as the Q1 2024 call held in April, and comprehensive annual 10-K reports filed with the SEC, which provide an in-depth view of the company’s performance and strategic direction. Investor presentations, readily available on Kilroy’s dedicated investor relations website, highlight key operational metrics and future outlooks, fostering transparency. These communications, managed by a specialized IR team, are crucial promotional channels, ensuring stakeholders are informed about the company’s financial health and growth trajectory.

Kilroy Realty heavily promotes its sustainability leadership, showcasing ESG achievements and ambitious goals through its annual Sustainability Report. This commitment is underscored by consistent accolades, including its tenth consecutive GRESB 5-star rating in 2023, affirming its global leadership in office and life science property sustainability. The company also earned the ENERGY STAR Partner of the Year – Sustained Excellence Award for the fifth consecutive year in 2024. This robust messaging is integrated across all corporate communications to attract like-minded tenants and investors, enhancing brand reputation and market appeal.

Kilroy Realty maintains a robust corporate brand identity, adhering to precise guidelines for its logo and color palettes to ensure visual consistency across all touchpoints. The company's corporate website functions as a primary promotional hub, showcasing its premier properties, significant sustainability initiatives, and corporate news. For instance, the site features detailed virtual tours of properties like those in its 2024 development pipeline, highlighting top-tier amenities and its unique art programs, fostering an immersive brand experience for potential tenants and investors.

Direct Leasing and Broker Relationships

Kilroy Realty's promotional strategy centers on a direct leasing team and robust relationships with commercial real estate brokers. High-quality marketing collateral, like digital presentations and property-specific websites, supports these efforts. This integrated approach proved highly effective in 2024. The company achieved its highest annual leasing volume since 2019, showcasing the strength of its promotional channels.

- 2024 leasing volume was the highest since 2019.

- Promotional focus on direct leasing and broker networks.

- Marketing collateral includes digital presentations and websites.

Public Relations and Industry Awards

Kilroy Realty effectively leverages public relations through strategic press releases, announcing significant milestones like the 2024 completion of Kilroy Oyster Point Phase 3 or major leases. The company's numerous industry accolades, including consistent recognition in the GRESB assessments for sustainability leadership, serve as powerful promotional tools. This external validation, reflecting their high-quality portfolio and operations, significantly enhances Kilroy's market credibility and strengthens its competitive position. Such widespread recognition supports their 2025 strategic growth initiatives across key West Coast markets.

- Kilroy's 2024 GRESB score placed it among the top performers in sustainability.

- Recent press releases detailed the completion of the 860,000 SF Oyster Point Phase 3 in early 2024.

- Industry awards validate Kilroy's operational excellence and development quality.

- Enhanced credibility supports capital attraction and tenant acquisition through 2025.

Kilroy Realty promotes its offerings through integrated investor relations, public relations, and a strong digital presence. Q1 2024 earnings calls and press releases for milestones like the 2024 Kilroy Oyster Point Phase 3 completion inform stakeholders. Direct leasing efforts, supported by broker networks and digital collateral, drove 2024 leasing volume to its highest since 2019. The company also showcases its sustainability leadership, evidenced by its 2024 ENERGY STAR award and consistent GRESB 5-star ratings, to attract aligned tenants and investors.

| Promotional Channel | Key 2024/2025 Metric | Data Point |

|---|---|---|

| Leasing Volume | 2024 Annual Leasing Volume | Highest since 2019 |

| Sustainability Recognition | ENERGY STAR Partner Award | 5th consecutive year (2024) |

| Development Milestones | Kilroy Oyster Point Phase 3 | 860,000 SF completed Q1 2024 |

Price

Kilroy Realty sets its lease rates based on the premier quality and strategic locations of its assets. These modern, creative office spaces are positioned as a premium product, commanding high-end, market-driven rental rates. Even with prevailing market challenges, the company successfully increased GAAP rents on new and renewal leases by 8.2% in 2024. This reflects their ability to maintain premium pricing for their distinctive offerings.

Kilroy Realty prioritizes long-term lease structures, securing contracts with high-credit-quality tenants to ensure stable and predictable cash flow. This strategy significantly minimizes turnover and vacancy risk, providing a robust financial foundation for the company. By the close of 2024, the top 20 tenants, including major tech and life science firms, collectively represented approximately 30% of their total rental revenues. This focus on tenant quality and lease duration is central to their pricing strategy, reflecting a premium for stability.

Kilroy Realty employs dynamic pricing that readily adapts to prevailing market conditions, including real-time supply and demand shifts, broader economic trends, and individual tenant negotiations. In highly competitive submarkets, the company frequently offers strategic concessions or tenant improvement allowances to attract and retain high-value tenants. For the full year 2025, Kilroy Realty has projected its Funds From Operations (FFO) to be between $4.10 and $4.20 per diluted share, reflecting its current pricing strategies and anticipated occupancy rates.

Value-Driven Proposition

The price for leasing space from Kilroy Realty reflects a comprehensive value proposition, extending beyond mere square footage to encompass sustainability features, modern amenities, and operational efficiency. Their high-end tenant experience is a core component, justifying pricing that includes access to state-of-the-art facilities. Kilroy's innovative green leases often incorporate clauses related to energy efficiency and data sharing, aligning costs with a tenant’s environmental, social, and governance (ESG) goals. This positions the lease price as a reflection of total value, particularly as demand for Class A sustainable office space continues to rise in 2024. Kilroy's portfolio boasts over 80% LEED certified properties, further validating their value-driven pricing model.

- Kilroy's portfolio maintains over 80% LEED certified properties as of early 2025, underscoring its commitment to sustainable infrastructure.

- The company reported a 15% reduction in energy consumption across its stabilized portfolio from 2010 to 2023, reflecting operational efficiencies passed to tenants.

- Green leases, common in Kilroy's offerings, can lead to up to 20% lower utility costs for tenants compared to traditional leases.

- Tenant satisfaction scores regarding amenities and building management consistently exceed industry averages, supporting premium valuations.

Capital Recycling and Asset Valuation

Kilroy Realty's pricing strategy extends to capital recycling, involving the strategic sale of assets to fund new development. This proactive approach includes ongoing discussions to sell land sites, such as certain undeveloped parcels in key markets, demonstrating a clear intent to monetize non-core or fully valued assets. Such dispositions allow Kilroy to reinvest capital into higher-yielding opportunities, optimizing their portfolio's overall value and financial performance. This dynamic management ensures assets are valued and divested at opportune market prices, enhancing shareholder returns.

- Kilroy aims to recycle capital from mature assets into new, higher-growth developments.

- Discussions in late 2024/early 2025 focused on divesting non-strategic land sites.

- This strategy supports efficient portfolio management and capital reallocation.

- Asset sales help fund ongoing developments and reduce debt, strengthening financial health.

Kilroy Realty commands premium lease rates, leveraging its high-quality, strategically located assets and an 8.2% GAAP rent increase in 2024. Their focus on long-term leases with high-credit tenants ensures stable revenue, with top 20 tenants representing 30% of 2024 rental income. Pricing adapts dynamically to market shifts, with projected 2025 FFO between $4.10 and $4.20 per diluted share. The price reflects comprehensive value, including over 80% LEED certified properties and capital recycling initiatives.

| Metric | 2024 Data | 2025 Proj. |

|---|---|---|

| GAAP Rent Increase | 8.2% | N/A |

| FFO per Share | N/A | $4.10-$4.20 |

| LEED Cert. Portfolio | >80% | >80% |

4P's Marketing Mix Analysis Data Sources

Our Kilroy Realty 4P's analysis leverages a comprehensive set of data, including official SEC filings, investor relations materials, and property portfolio details. We also incorporate market research reports, real estate industry publications, and competitive leasing information.