KalVista SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KalVista Bundle

KalVista's potential is clear, with strong clinical data representing a significant strength. However, understanding the full scope of their competitive landscape and the precise nature of their challenges is crucial for informed decisions. Our comprehensive SWOT analysis dives deep into these areas, providing actionable insights.

Don't miss out on the detailed breakdown of KalVista's opportunities and the nuanced understanding of their threats. Unlock the full strategic picture, including expert commentary and actionable recommendations, to confidently navigate the pharmaceutical market.

Discover the complete KalVista story, revealing the full depth of their innovative pipeline and the strategic advantages they hold. This in-depth report is essential for investors, analysts, and anyone looking to grasp the company's true market position and future trajectory.

Strengths

KalVista's acquisition of FDA approval for EKTERLY (sebetralstat) on July 7, 2025, marks a pivotal strength. This approval positions EKTERLY as the inaugural oral on-demand therapy for hereditary angioedema (HAE) in individuals aged 12 and above, addressing a substantial unmet medical requirement.

The FDA's green light for EKTERLY, a first-in-class oral treatment, underscores KalVista's robust research and development capabilities. It directly targets the demand for accessible, non-injectable HAE management, a significant advantage in the current treatment landscape.

This approval is expected to drive substantial market penetration for KalVista, as it offers a more convenient and patient-friendly option compared to existing injectable therapies. The company's ability to bring such an innovative product to market highlights its strategic execution and scientific expertise.

KalVista's strength lies in its positive Phase 3 clinical trial data for EKTERLY, a treatment for hereditary angioedema (HAE). This data, stemming from the extensive KONFIDENT trial, the largest HAE study to date, forms the bedrock of the FDA's approval.

The KONFIDENT trial showcased EKTERLY's efficacy, demonstrating statistically significant improvements in symptom relief and a reduction in HAE attack severity and duration compared to placebo. This robust clinical evidence is a major advantage.

Furthermore, the trial highlighted EKTERLY's favorable safety profile, a critical factor for patient adoption and physician confidence. This well-tolerated treatment profile is a key differentiator in the HAE market.

The successful completion and positive outcomes of these large-scale trials directly translate to a strong foundation for market penetration and commercial success, reinforcing KalVista's position in the HAE therapeutic area.

KalVista Pharmaceuticals has carved out a distinct niche by concentrating on developing small molecule protease inhibitors for diseases with significant unmet medical needs. This specialized focus, particularly on hereditary angioedema (HAE), allows the company to cultivate deep expertise and pursue targeted therapeutic development, effectively positioning them as a leader in the rare disease space.

Global Regulatory Submissions and Market Expansion

KalVista Pharmaceuticals is strategically pursuing global market access for sebetralstat, demonstrating a robust regulatory submission strategy that extends well beyond the United States. This proactive approach is crucial for maximizing the drug's commercial potential by targeting key international markets.

The company has successfully submitted marketing authorization applications to regulatory bodies in several significant regions, including the UK, Europe, Japan, Switzerland, Australia, and Singapore. This comprehensive filing strategy underscores KalVista's commitment to a broad geographical launch.

- Global Regulatory Reach: Submissions filed in UK, Europe, Japan, Switzerland, Australia, and Singapore.

- Targeted Launch Window: Potential launches in these territories anticipated for 2025 and early 2026.

- Market Expansion Potential: Broad geographic coverage aims to significantly increase sebetralstat's market penetration.

Strong Financial Position for Commercialization

KalVista Pharmaceuticals boasts a robust financial foundation, essential for the upcoming commercialization of EKTERLY. As of April 30, 2025, the company reported a substantial $220.6 million in cash, cash equivalents, and marketable securities. This significant capital infusion provides a projected cash runway extending into the latter half of 2027, a critical advantage for supporting the initial launch and ongoing global distribution of their key product.

This strong financial standing directly translates into a significant competitive advantage.

- Ample Funding: $220.6 million in cash and equivalents as of April 30, 2025, ensures resources for commercialization.

- Extended Runway: Financial stability extends into the second half of 2027, covering initial launch phases.

- Commercialization Support: Capital is available to fund marketing, sales infrastructure, and global supply chain development for EKTERLY.

- Reduced Financial Risk: A strong cash position mitigates the need for immediate, potentially dilutive, financing rounds.

KalVista's primary strength is the FDA approval of EKTERLY (sebetralstat) on July 7, 2025, marking the first oral on-demand treatment for hereditary angioedema (HAE). This breakthrough, supported by robust Phase 3 KONFIDENT trial data showcasing efficacy and a favorable safety profile, positions the company as a leader in addressing a significant unmet need with a patient-friendly oral option.

The company's focused strategy on small molecule protease inhibitors, particularly for HAE, has cultivated deep expertise, establishing KalVista as a specialized player in rare diseases. This targeted approach is further amplified by a proactive global regulatory strategy, with submissions in key markets like the UK, Europe, Japan, and Australia, aiming for launches in 2025 and early 2026.

Financially, KalVista is robust, holding $220.6 million in cash and equivalents as of April 30, 2025. This substantial capital provides a projected runway into the latter half of 2027, ensuring ample resources to support EKTERLY's commercialization, including marketing, sales infrastructure, and global supply chain development, thereby mitigating financial risk.

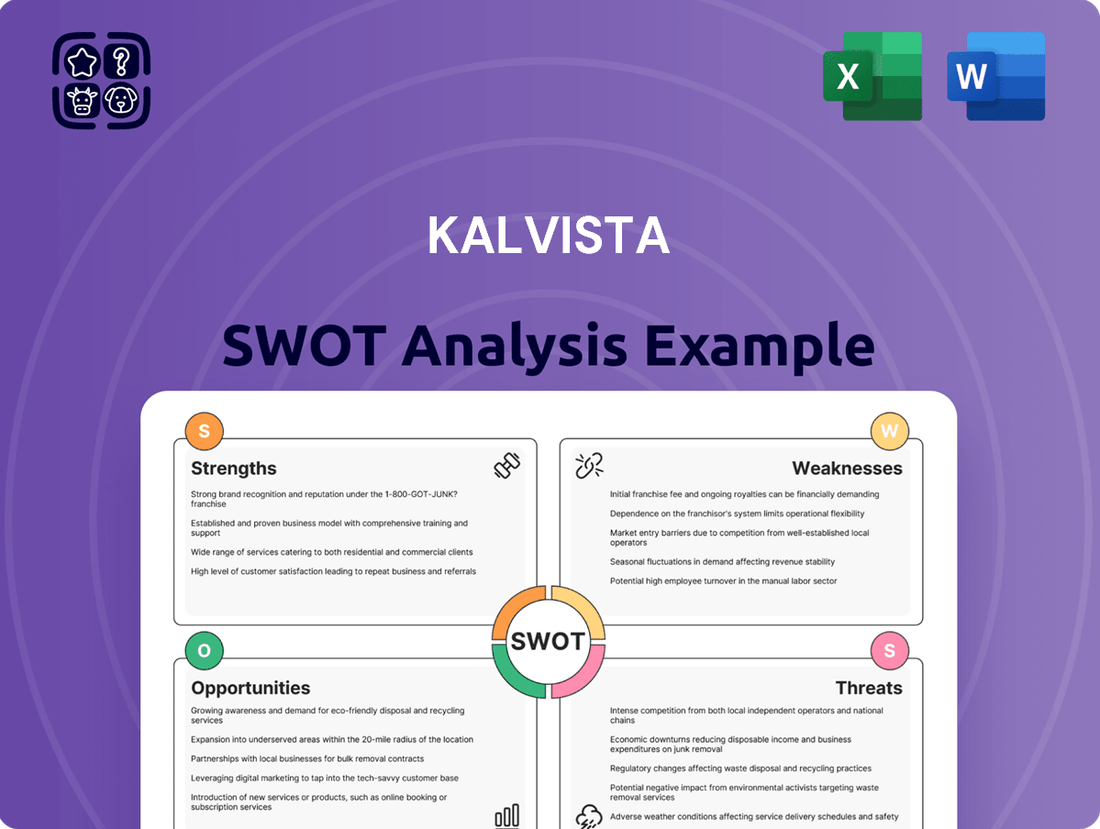

What is included in the product

Delivers a strategic overview of KalVista’s internal and external business factors, highlighting its strong clinical pipeline and market potential while acknowledging development risks and competitive pressures.

KalVista's SWOT analysis offers a clear, structured framework to identify and address key challenges, enabling targeted strategies to alleviate pain points and drive business growth.

Weaknesses

KalVista Pharmaceuticals' heavy reliance on sebetralstat, its lead product for hereditary angioedema (HAE), presents a significant weakness. While EKTERLY's approval is a key milestone, the company's near-term financial trajectory is intrinsically tied to sebetralstat's market acceptance and sales performance. This single-product dependency makes KalVista susceptible to unforeseen market shifts or intense competition that could impact sebetralstat’s commercial viability.

KalVista Pharmaceuticals, as a clinical-stage company moving towards commercialization, has consistently operated at a net loss. For the most recent four quarters, the company reported a net loss of $175.87 million. This financial performance is largely attributed to significant investments in pre-commercial activities and general operational expenses.

A substantial portion of these costs includes $116.3 million in general and administrative expenses for the fiscal year ending April 30, 2025. These expenditures are crucial for building the infrastructure needed for future market entry and sales of their lead compound, EKTERLY. The path to sustained profitability hinges directly on the successful launch and market acceptance of EKTERLY.

While EKTERLY represents a significant advancement as the first oral on-demand treatment for HAE, the market remains highly competitive. Several established injectable and subcutaneous therapies, both for on-demand use and prophylaxis, are already entrenched, with significant patient adoption. For instance, Shire's Takhzyro, a prophylactic treatment, generated approximately $1.8 billion in revenue in 2023, indicating a strong existing market presence for established players.

KalVista faces the challenge of effectively differentiating EKTERLY's value proposition to carve out substantial market share. This differentiation will be crucial to attract patients and physicians away from existing, proven treatment regimens. The competitive landscape is further intensified by ongoing research and development from other companies, potentially introducing new therapeutic options that could challenge EKTERLY's market position.

Clinical-Stage Pipeline Beyond HAE is Early

KalVista's pipeline beyond Hereditary Angioedema (HAE) is still in its very early stages. Their oral Factor XIIa inhibitor program, while promising, is currently only at the preclinical development phase.

This means that for indications outside of HAE, KalVista is years away from potential market entry. These early-stage assets carry a substantial amount of development risk, as many compounds fail during clinical trials.

The company's future growth and diversification heavily rely on the successful advancement of these preclinical programs. For instance, as of mid-2024, the company had not yet initiated any human trials for these broader pipeline candidates, highlighting the extended timeline for potential new revenue streams.

- Nascent Pipeline: Beyond HAE, KalVista's drug development is primarily in the preclinical phase.

- Extended Timelines: Significant growth from non-HAE indications is likely years away.

- High Development Risk: Early-stage programs face considerable uncertainty in achieving regulatory approval.

- Limited Diversification: Current reliance on HAE programs means limited diversification in the near to medium term.

Regulatory Delays and Challenges

KalVista faced a setback with its PDUFA goal date for EKTERLY being extended by the FDA, citing a heavy workload and limited resources. This regulatory delay highlights potential challenges in navigating the FDA's review process, which could impact the timeline for future drug approvals or the expansion of existing indications. Such constraints at the regulatory level can create significant uncertainty for development timelines and market entry strategies.

The FDA's resource limitations, as demonstrated by the EKTERLY delay, suggest that other KalVista pipeline candidates could encounter similar obstacles. This implies a need for robust contingency planning to manage potential regulatory slowdowns. For instance, if the FDA continues to face bandwidth issues, the review periods for other promising therapies could extend beyond initial projections, impacting commercialization efforts and investor confidence.

- Extended FDA Review: The PDUFA goal date extension for EKTERLY underscores the FDA's current resource constraints.

- Potential for Future Delays: This precedent suggests that other KalVista drug candidates may also face extended review periods.

- Impact on Market Entry: Regulatory hurdles can significantly delay the commercialization of promising therapies.

- Need for Proactive Risk Management: KalVista must develop strategies to mitigate the impact of potential regulatory bottlenecks.

KalVista's financial health is a significant concern, as the company has consistently reported net losses. For the twelve months ending April 30, 2025, KalVista reported a net loss of $175.87 million. This ongoing deficit reflects substantial investments in research and development, as well as pre-commercialization activities, creating a need for continuous funding to sustain operations.

The company's heavy reliance on sebetralstat, its lead product for hereditary angioedema (HAE), presents a substantial weakness. While EKTERLY's approval is a major step, the company's financial success is predominantly tied to this single product's market performance. This concentration makes KalVista vulnerable to market dynamics, competitive pressures, or any unforeseen issues impacting sebetralstat's commercial viability.

KalVista's pipeline beyond HAE is still in its nascent stages, with preclinical development for its oral Factor XIIa inhibitor program. This means that revenue generation from these broader indications is likely years away, carrying significant development risk, as many compounds fail during clinical trials. For instance, as of mid-2024, no human trials had been initiated for these non-HAE candidates.

The company experienced a regulatory setback when the PDUFA goal date for EKTERLY was extended by the FDA due to workload and resource limitations. This delay highlights potential challenges in navigating the FDA's review process, which could impact future drug approvals or indication expansions, creating uncertainty in development timelines.

Preview Before You Purchase

KalVista SWOT Analysis

The preview you see is the same document the customer will receive after purchasing—no surprises, just professional quality. This comprehensive SWOT analysis for KalVista Pharmaceuticals offers a detailed examination of its internal strengths and weaknesses, alongside external opportunities and threats. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency about the content and quality. The complete version, containing all insights and strategic recommendations, becomes available immediately after checkout.

Opportunities

KalVista is making a strategic move into the pediatric Hereditary Angioedema (HAE) market, a significant growth opportunity. The company's KONFIDENT-KID trial is specifically designed to evaluate an orally disintegrating tablet (ODT) formulation of sebetralstat for children aged 2 to 11 years.

Successful approval of this ODT formulation would position EKTERLY as the pioneering oral therapy for this young demographic, which currently lacks such treatment options. This would unlock a substantial expansion of EKTERLY's total addressable market.

The pediatric HAE market represents a largely untapped segment, and capturing it could provide KalVista with a first-mover advantage, driving significant revenue growth. This expansion aligns with the company's commitment to addressing unmet needs in HAE treatment.

KalVista is strategically positioned to expand EKTERLY's global footprint, with ongoing regulatory submissions in key international markets presenting a significant opportunity. This geographic market penetration, coupled with the pursuit of commercial partnerships abroad, could unlock substantial new revenue streams beyond the U.S.

By collaborating with local partners, KalVista can effectively navigate diverse regulatory landscapes and market nuances, accelerating EKTERLY's commercialization. For instance, as of early 2025, KalVista has indicated active discussions with potential partners in Europe and Asia, aiming to capitalize on unmet medical needs in hereditary angioedema (HAE) treatment.

This approach allows for localized marketing and sales efforts, tailored to specific regional demands and healthcare systems. The potential for increased market share and diversified revenue streams is substantial, as KalVista aims to replicate its U.S. strategy in markets where HAE is a significant concern, with estimates suggesting a combined addressable market of billions of dollars outside the U.S. for HAE therapies.

There's a clear shift in patient preference towards oral treatments, moving away from less convenient injectable or intravenous methods. This preference stems from the desire for easier administration and a reduced overall treatment burden, making oral therapies increasingly attractive.

KalVista Pharmaceuticals is strategically positioned to benefit from this trend, especially with its oral on-demand therapy for Hereditary Angioedema (HAE). The market is showing a strong appetite for such patient-friendly administration methods.

For instance, the global market for HAE treatments is projected to reach over $3 billion by 2028, with oral therapies expected to capture a significant share due to their inherent advantages in patient compliance and quality of life. EKTERLY's introduction taps directly into this growing demand.

Development of Factor XIIa Inhibitor Program

KalVista's preclinical Factor XIIa inhibitor program represents a significant long-term opportunity, aiming to create advanced treatments for Hereditary Angioedema (HAE) and potentially other conditions linked to the kallikrein-kinin system. This pipeline expansion could lead to a diversified revenue base and entry into new therapeutic markets, a crucial step for sustained growth.

Successful progression of this program could unlock substantial value. For instance, the HAE market is projected to grow, with estimates suggesting it could reach over $3 billion globally by 2028, highlighting the commercial potential of effective new therapies.

- Pipeline Diversification: The Factor XIIa inhibitor program offers a path to expand KalVista's therapeutic focus beyond its current KVD001 program for HAE.

- Addressing Unmet Needs: This program targets a novel pathway, potentially offering improved efficacy or safety profiles compared to existing HAE treatments.

- Broader Market Potential: Beyond HAE, Factor XIIa inhibition may have applications in other thrombo-inflammatory diseases, significantly widening the addressable market.

- Long-Term Value Creation: Successful development could provide a substantial revenue stream for years to come, enhancing shareholder value.

Strategic Collaborations and M&A Potential

KalVista's successful development of EKSTASY, coupled with its deep knowledge of protease inhibitors, positions it as a prime candidate for strategic alliances. Larger pharmaceutical firms seeking to bolster their rare disease offerings or acquire innovative oral treatment platforms may find KalVista a highly attractive acquisition target. This strategic potential is underscored by the increasing M&A activity in the rare disease space, with valuations often reflecting the unmet medical need and the novelty of the therapeutic approach.

The company’s pipeline, particularly its focus on hereditary angioedema (HAE), presents significant opportunities for licensing deals. Companies with established commercial infrastructure in related therapeutic areas could leverage KalVista's assets to accelerate market entry and revenue generation. For instance, in 2023, the global rare disease drug market was valued at approximately $200 billion, a figure projected to grow substantially, indicating a strong appetite for innovative therapies.

- Strategic Partnerships: KalVista's expertise in protease inhibitors makes it appealing for collaborations aimed at co-development or co-commercialization of its HAE therapies.

- Licensing Agreements: Opportunities exist to license out specific pipeline candidates or platform technologies to larger pharmaceutical companies, generating upfront payments and future royalties.

- Acquisition Potential: The success of EKSTASY and the unmet need in HAE could lead to acquisition interest from major biopharmaceutical players looking to expand their rare disease portfolios.

- Market Trends: The rare disease sector continues to attract significant investment, with M&A activity remaining robust, reflecting the high therapeutic and commercial value of these specialized treatments.

KalVista is poised to enter the pediatric Hereditary Angioedema (HAE) market with its ODT formulation of sebetralstat, a move that could establish EKTERLY as the first oral treatment for children aged 2 to 11 years, addressing a significant unmet need. This strategic expansion targets a substantial portion of the HAE patient population, potentially unlocking billions in additional revenue as the company aims to replicate its U.S. success in international markets through localized partnerships. The company's preclinical Factor XIIa inhibitor program also represents a considerable long-term opportunity, aiming to develop advanced HAE treatments and potentially other thrombo-inflammatory conditions, further diversifying its revenue streams and capitalizing on the projected growth of the HAE market, which could exceed $3 billion by 2028.

The company's expertise in protease inhibitors and the success of EKSTASY position KalVista as an attractive partner or acquisition target for larger pharmaceutical companies, particularly within the burgeoning rare disease sector, which saw global market valuations around $200 billion in 2023.

| Opportunity Area | Description | Key Data/Implication |

| Pediatric HAE Market Entry | Launching an ODT formulation of sebetralstat for children aged 2-11. | Potential first-mover advantage in a segment lacking oral options; significant addressable market expansion. |

| Global Market Expansion | Expanding EKTERLY's footprint through regulatory submissions and commercial partnerships in international markets. | Access to billions in potential revenue outside the U.S.; leveraging local partners for market entry. |

| Factor XIIa Inhibitor Program | Developing novel treatments targeting Factor XIIa for HAE and other conditions. | Pipeline diversification; potential for new therapeutic markets; capitalize on HAE market growth projected over $3 billion by 2028. |

| Strategic Alliances & M&A | Leveraging expertise and pipeline for licensing deals or acquisition by larger biopharma. | Attractive target in a robust rare disease sector (valued at ~$200 billion in 2023); generating upfront payments and royalties. |

Threats

The hereditary angioedema (HAE) treatment market is a crowded space, featuring established prophylactic and on-demand therapies. KalVista Pharmaceuticals faces a significant threat from these existing treatments, as well as from other companies actively developing novel HAE therapies.

Should competitors engage in aggressive marketing campaigns or introduce treatments that are demonstrably superior or more economically viable, KalVista's EKTERLY could see its potential market share significantly diminished. This competitive pressure is a key concern for the company's future growth prospects.

While EKTERLY's approval marks a significant milestone, KalVista's long-term growth hinges on its remaining pipeline. The success of the ODT formulation for pediatrics and the Factor XIIa program are crucial for future revenue streams.

Clinical trial failures for these key candidates pose a substantial threat. Setbacks in late-stage trials, particularly for the promising Factor XIIa program, could severely damage investor sentiment and jeopardize future funding, as seen in historical biotech downturns following failed drug development.

For example, in 2024, several biotechnology firms experienced significant stock price drops, some exceeding 50%, after announcing clinical trial disappointments for their lead assets, highlighting the market's sensitivity to such news.

Any negative outcomes in ongoing or upcoming trials for KalVista's pipeline could directly impact its valuation and ability to secure necessary capital for continued research and development, potentially limiting its competitive edge.

The significant cost associated with rare disease treatments like KAL VISTA's therapies can attract intense scrutiny from payers and healthcare systems. This pressure could make it difficult for KAL VISTA to secure favorable reimbursement policies and competitive pricing for EKTERLY, especially in international markets. For example, in 2024, many European countries implemented stricter health technology assessments, potentially impacting drug pricing negotiations for novel therapies.

Manufacturing and Supply Chain Risks

As KalVista Pharmaceuticals gears up for the commercial launch of EKTERLY (sebetacogene zolparvovec-xyln), a significant hurdle lies in scaling up manufacturing processes. The company must ensure robust quality control to meet regulatory standards for a gene therapy product. A disruption in the supply chain, which relies on specialized components and viral vectors, could lead to shortages. For instance, the complex nature of gene therapy manufacturing means lead times for critical raw materials can be substantial, potentially impacting production timelines if not managed proactively. This was highlighted by the general challenges faced by biotech firms in 2024, where supply chain vulnerabilities continued to be a concern, leading to increased production costs for some.

Maintaining a stable and reliable supply chain for EKTERLY is paramount to avoid impacting sales projections and, more critically, patient access to this important therapy. KalVista's ability to secure consistent supply of viral vectors and other specialized raw materials will be a key determinant of its commercial success. Reports from late 2024 indicated that the gene therapy sector, in general, was grappling with securing sufficient manufacturing capacity and specialized personnel, which could translate to higher operational expenses for companies like KalVista.

- Manufacturing Scalability: KalVista needs to ensure its manufacturing processes can efficiently scale to meet anticipated commercial demand for EKTERLY.

- Quality Control: Stringent quality control measures are essential for a gene therapy product to meet regulatory approval and ensure patient safety.

- Supply Chain Stability: Reliance on specialized raw materials and viral vectors creates a risk of supply chain disruptions, potentially impacting production and product availability.

- Patient Access: Any manufacturing or supply chain issues could directly affect the availability of EKTERLY, limiting patient access to the treatment.

Intellectual Property Challenges and Patent Expiry

KalVista Pharmaceuticals asserts that its intellectual property for sebetralstat is secured through the 2040s, offering a substantial runway for market exclusivity. However, the broader pharmaceutical landscape is perpetually shaped by the threat of intellectual property challenges and the inevitable expiry of patents, which can significantly impact long-term revenue streams. The emergence of biosimilars or generic alternatives, even for drugs with seemingly robust patent protection, poses a direct risk to market share and pricing power.

For KalVista, potential future challenges to their sebetralstat patents or the successful development and market entry of competing biosimilars could erode the expected long-term exclusivity. For instance, in 2023, the U.S. patent system saw numerous challenges to existing drug patents, highlighting the dynamic nature of IP protection in the sector.

The pharmaceutical industry's reliance on patent protection means that any disruption to this exclusivity can have profound financial consequences. Companies must continually monitor the competitive landscape and anticipate potential patent expirations or challenges to their core assets.

Specifically, the threat of biosimilar competition, while perhaps less immediate for a novel molecule like sebetralstat, remains a critical consideration as the drug progresses through its lifecycle. The cost-effectiveness of biosimilars can force price reductions, impacting profitability even before patent expiry.

KalVista faces intense competition from existing HAE treatments and other companies developing novel therapies. Aggressive marketing or superior, more affordable competitor products could significantly reduce EKTERLY's market share, impacting KalVista's growth. Future revenue hinges on the success of its pipeline, as clinical trial failures for key candidates like the Factor XIIa program could severely damage investor confidence and funding, a risk underscored by multiple biotech firms experiencing over 50% stock drops in 2024 following trial disappointments.

SWOT Analysis Data Sources

This analysis draws from KalVista's official financial filings, comprehensive market research reports, and expert commentary within the pharmaceutical and ophthalmology sectors to provide a robust and accurate assessment.