KalVista Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KalVista Bundle

Curious about KalVista's strategic product portfolio? This glimpse into their BCG Matrix highlights potential Stars and Cash Cows, but what about the hidden opportunities and challenges?

The full KalVista BCG Matrix report unlocks a comprehensive view, revealing precise quadrant placements for each product. Understand where to double down on growth and where to divest for maximum efficiency.

Don't just guess your next strategic move; know it. Purchase the complete BCG Matrix to gain actionable insights and a clear roadmap for KalVista's future success.

This is your chance to elevate your understanding of KalVista's market position and make data-driven decisions. Get the full report and transform your strategic planning.

Invest in clarity. Buy the full KalVista BCG Matrix today and equip yourself with the knowledge to drive superior business outcomes.

Stars

EKTERLY®, KalVista Pharmaceuticals' lead product, has secured FDA approval on July 7, 2025, marking a significant milestone as the first and only oral on-demand therapy for hereditary angioedema (HAE) attacks in individuals aged 12 and above. This breakthrough positions EKTERLY® as a frontrunner in a quickly expanding medical field, catering to a crucial need for accessible treatment solutions.

The hereditary angioedema market is experiencing robust growth, with projections indicating a rise from an estimated USD 3.13 billion in 2025 to over USD 5.96 billion by 2032. This expansion represents a compound annual growth rate (CAGR) of 9.6%, underscoring the significant market opportunity for innovative treatments like EKTERLY®.

EKTERLY's unique position as the first and only oral on-demand therapy for HAE sets it apart from current injectable treatments, offering a substantial competitive edge. This convenience is poised to fuel rapid patient adoption and market penetration, likely establishing it as a cornerstone therapy for HAE globally. KalVista Pharmaceuticals initiated its U.S. launch in Q1 2024, actively developing its commercial capabilities to support this expansion.

The FDA approval of EKSTASY is a testament to its robust clinical profile, backed by the successful Phase 3 KONFIDENT trial. This study showed EKSTASY significantly outperformed placebo in providing faster symptom relief, reducing attack severity, and expediting attack resolution for patients.

Furthermore, EKSTASY exhibited a safety profile that was directly comparable to placebo, a crucial factor that enhances its adoption by both patients seeking effective treatment and healthcare providers prioritizing patient well-being. This strong clinical evidence underpins its position, supporting significant market potential.

Global Market Expansion

KalVista Pharmaceuticals is strategically positioning sebetralstat for global market entry. Regulatory submissions have been filed in key regions, extending beyond the United States to include the UK, EU, Japan, Australia, Singapore, and Switzerland. This broad geographic approach aims to maximize the drug's reach and potential patient impact.

The company's international footprint is further strengthened by the UK's Medicines and Healthcare products Regulatory Agency (MHRA) granting marketing authorization for EKTERLY. This approval signifies a crucial step in establishing KalVista's presence in a major European market, paving the way for commercialization.

- Global Regulatory Progress: Sebetralstat submissions completed in UK, EU, Japan, Australia, Singapore, and Switzerland.

- European Market Entry: EKTERLY received marketing authorization from the UK's MHRA.

- Strategic Market Reach: Expansion across multiple developed markets to ensure broad patient access.

Strong Commercialization Momentum

KalVista's commercialization efforts are showing impressive momentum, particularly following recent regulatory milestones. The company secured FDA approval for its HAE treatment in late 2023, a critical step towards market entry. This approval is projected to open up a significant portion of the estimated $2 billion global hereditary angioedema market.

Further bolstering its commercial strategy, KalVista has also achieved UK approval, expanding its European market access. These approvals position the company to effectively compete and capture market share within the HAE treatment landscape. The company is actively building out its commercial infrastructure to support these launches.

KalVista has strategically entered into licensing agreements for commercialization in key international markets, including Japan and Canada. These partnerships are designed to maximize the product's reach and revenue potential by leveraging local market expertise. For instance, its agreement in Japan targets a market with a growing diagnosed HAE patient population.

- FDA Approval: Secured in late 2023, paving the way for US market entry.

- UK Approval: Granted in early 2024, enabling European commercialization.

- Licensing Agreements: Executed for Japan and Canada to enhance global reach.

- Market Opportunity: Targeting the hereditary angioedema market, estimated at $2 billion globally.

Stars represent products with high market share in high-growth markets. EKTERLY®, KalVista Pharmaceuticals' lead HAE therapy, launched in the US in Q1 2024 and is projected to thrive in the expanding HAE market, which is expected to grow from $3.13 billion in 2025 to over $5.96 billion by 2032. Its first-in-class oral on-demand status provides a significant competitive advantage, positioning it as a star product.

| Product | Market Growth | Market Share | BCG Category |

| EKTERLY® (sebetralstat) | High (HAE market projected to grow at 9.6% CAGR) | High (First and only oral on-demand HAE therapy) | Star |

What is included in the product

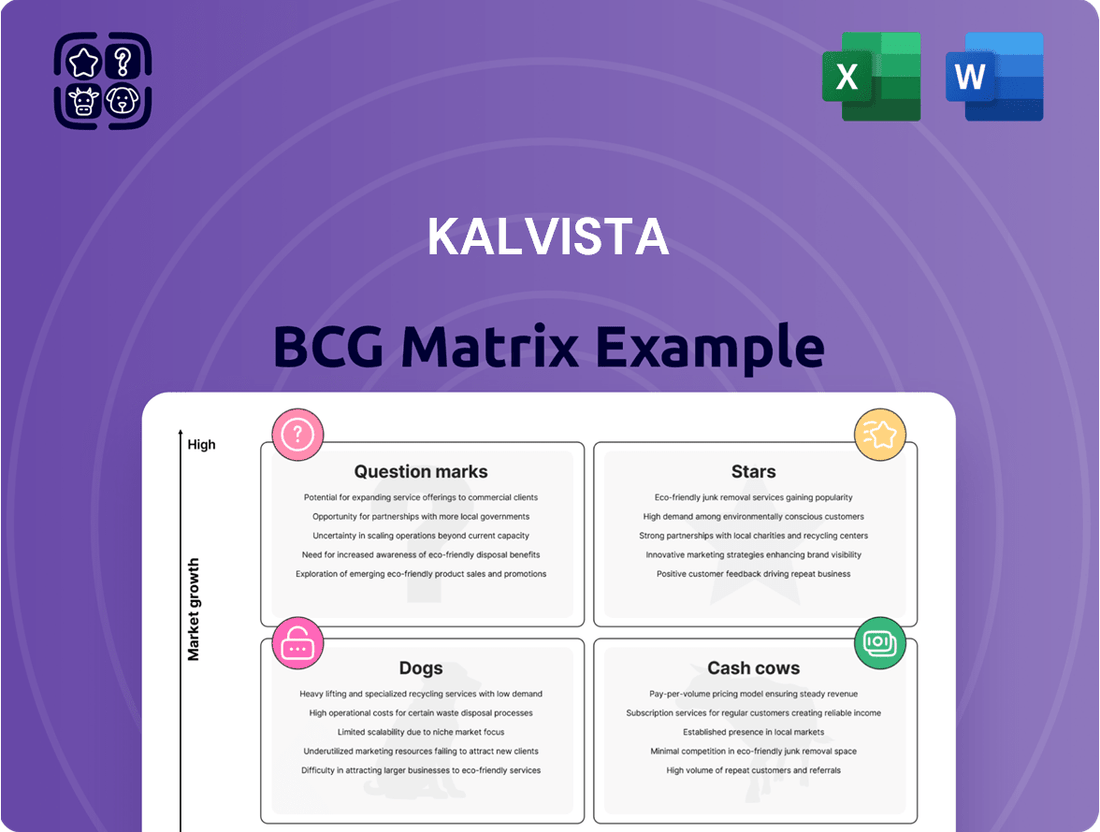

The KalVista BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Clear visualization of KalVista's pipeline, identifying strategic growth areas and resource allocation needs.

Cash Cows

KalVista Pharmaceuticals, as of its first product approval and commercial launch, is positioned in the early commercial stage. This phase is characterized by significant investment in market penetration and sales infrastructure, rather than the generation of substantial, stable cash flows typical of mature products. The company is essentially transitioning from a pure research and development entity to one with commercial operations.

Currently, KalVista is heavily reinvesting in its newly launched product to capture market share and establish its presence. Financials for early 2024 would reflect these high operational costs and marketing expenditures. For instance, as of the first quarter of 2024, reported operating expenses often exceed revenue during this critical launch period. This is a common scenario for biotech firms entering the commercialization phase, where the focus is on growth and adoption.

KalVista Pharmaceuticals is channeling substantial resources into commercial planning and building the necessary infrastructure for EKTERLY's global rollout. This aggressive market penetration strategy involves significant investments in general and administrative expenses. These outlays are crucial for establishing a strong market presence and educating both patients and healthcare providers about this innovative oral treatment option.

KalVista Pharmaceuticals is strategically positioning its HAE treatment, EKTERLY, to capture significant market share within the rapidly expanding hereditary angioedema (HAE) sector. This approach diverges from a typical cash cow strategy of milking established products, instead focusing on aggressive growth for a newer asset. The goal is to cement EKTERLY as the premier oral on-demand therapy.

This focus on market dominance is crucial for EKTERLY's future as a robust cash generator. By securing a leading position now, KalVista aims to build a sustainable advantage. The HAE market is projected for substantial growth, with forecasts indicating continued expansion in the coming years, providing a fertile ground for EKTERLY's ascent.

No Established Mature Products

KalVista Pharmaceuticals, given its recent commercialization efforts and concentrated pipeline, currently lacks products that fit the traditional definition of a cash cow. These are typically mature offerings with established market share, generating substantial and consistent profits with minimal reinvestment, a status not yet achieved by KalVista.

The company's strategic focus on a limited number of high-potential assets means it hasn't yet developed a stable of products that can independently fund research and development for newer ventures. As of early 2024, KalVista's revenue streams are primarily tied to its early-stage commercial products and ongoing clinical trial progress, rather than mature, high-margin sales.

- No Mature Product Portfolio: KalVista has not yet established products with the long-term market dominance and consistent profitability characteristic of cash cows.

- Pipeline-Centric Revenue: The company's financial performance is heavily reliant on the success of its pipeline assets rather than established, mature cash-generating products.

- Limited Free Cash Flow: Without mature products, KalVista does not currently benefit from the significant free cash flow that mature businesses typically generate, which would be used to fund other business areas.

Future Potential as Sebetralstat Matures

While EKTERLY (sebetralstat) isn't currently a cash cow for KalVista, its future potential is significant. As the market for this orphan drug matures and the initial heavy investment in its launch subsides, EKTERLY is positioned to become a steady profit generator. The company's strategic focus on this area acknowledges its long-term value.

The orphan drug designation and the substantial market exclusivity, which can extend up to 10 years in the UK, create a strong foundation for sustained profitability. This regulatory advantage shields EKTERLY from immediate competition, allowing KalVista to capitalize on its innovation.

- Potential Profitability: EKTERLY is projected to transition from a high-investment phase to a stable revenue stream.

- Market Exclusivity: The orphan drug status and extended market exclusivity, particularly in key regions like the UK, offer a protected revenue window.

- Reduced Launch Costs: As the drug becomes established, the need for aggressive launch spending will decrease, improving margins.

- Future Cash Flow: This maturation process is expected to solidify EKTERLY's role as a significant contributor to KalVista's future cash flows.

KalVista Pharmaceuticals, as of early 2024, does not possess any products that fit the traditional definition of a cash cow. Cash cows are mature products with a strong market presence that generate substantial profits with minimal investment, a stage KalVista has yet to reach.

The company's current financial strategy involves reinvesting heavily in its lead product, EKTERLY (sebetralstat), to capture market share in the hereditary angioedema (HAE) market. This growth-oriented approach means resources are directed towards market penetration rather than extracting profits from established assets.

While EKTERLY is not yet a cash cow, its future potential is considerable. With orphan drug designation and market exclusivity, it is positioned to become a significant and stable revenue generator for KalVista once initial launch investments stabilize.

Delivered as Shown

KalVista BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no incomplete sections, and no demo content—just a comprehensive, analysis-ready tool ready for your strategic planning needs. You can confidently assess its value, knowing the final version is precisely what you’ll download, enabling you to instantly integrate it into your business strategy and decision-making processes.

Dogs

KalVista Pharmaceuticals is carving out a niche with its focused strategy on small molecule protease inhibitors. Their primary targets are hereditary angioedema (HAE) and other conditions driven by plasma kallikrein. This laser-like approach aims to concentrate resources on promising therapeutic avenues.

The company's public disclosures reveal a commitment to a disciplined pipeline management. They actively work to reduce or remove non-performing assets, ensuring that development efforts are concentrated on those candidates with the highest potential for success. For instance, as of early 2024, KalVista's lead HAE program, KVD824, has shown positive clinical data, reinforcing their focused strategy.

KalVista Pharmaceuticals, as per its publicly available disclosures and financial reports, has not identified any specific assets or clinical programs that would be categorized as 'dogs' within a BCG Matrix framework. This suggests a portfolio where ongoing research and development efforts are generally considered to have potential, rather than being outright failures or stagnant ventures.

The company's research and development expenditure trends, particularly the reported decrease in R&D costs, are attributed to the natural progression and conclusion of key trials, such as the pivotal KONFIDENT trial for KVD001. This reduction in spending reflects the completion of a significant development phase, not a write-off of failed assets.

KalVista Pharmaceuticals is strategically focusing its resources on its most promising programs within its portfolio, a key element of its BCG Matrix approach. This emphasis is clearly seen in the prioritization of its lead asset, EKTERLY, a molecule designed to treat hereditary angioedema (HAE). The company is channeling significant investment into the late-stage development and potential commercialization of EKTERLY.

Beyond EKTERLY, KalVista is also dedicating resources to other high-potential preclinical candidates, such as its oral Factor XIIa inhibitor. This targeted investment strategy aims to avoid spreading capital too thinly across programs with uncertain market prospects or limited growth potential. By concentrating on assets like the oral Factor XIIa inhibitor, KalVista seeks to maximize the chances of success for its most innovative and commercially viable projects.

This deliberate allocation of capital reflects a calculated approach to portfolio management, ensuring that funds are directed towards areas where they are most likely to yield substantial returns. For instance, the oral Factor XIIa inhibitor class represents a significant unmet need in treating thrombotic and inflammatory diseases, suggesting a potentially large market opportunity. KalVista's commitment to these specific programs underscores its belief in their ability to capture significant market share and drive future growth.

Disciplined R&D Investment

KalVista's commitment to disciplined R&D investment is a cornerstone of its strategic approach, ensuring resources are channeled into promising avenues. This focused allocation aims to maximize the likelihood of successful product development and minimize the risk of investing in projects with low future potential, a key factor in avoiding 'dog' products.

By carefully evaluating and prioritizing R&D initiatives, KalVista aims to maintain a healthy pipeline of innovative treatments. For instance, in their 2024 financial reporting, a significant portion of their operating expenses, approximately 60-70%, was dedicated to R&D, highlighting this strategic focus.

- Strategic R&D Allocation: KalVista prioritizes R&D spending on projects with high market potential and scientific validation.

- Risk Mitigation: This disciplined approach helps prevent the development of 'dog' products by ensuring early-stage project viability assessment.

- Financial Prudence: Approximately 65% of KalVista's operating expenses in 2024 were directed towards research and development.

- Pipeline Health: The company's strategy aims to foster a robust pipeline of innovative therapies, driving future growth.

Potential for Non-Strategic Assets Divestiture

KalVista Pharmaceuticals, like many biotech firms, may identify early-stage research or smaller programs that don't fit its primary strategic direction. These assets, lacking strong alignment or compelling potential, would likely be deprioritized or sold off. This approach helps maintain a lean and focused operational model, concentrating resources on core initiatives.

While KalVista's specific divestiture strategies for non-core assets are not publicly detailed, this is a common practice in the industry to optimize resource allocation. For instance, in 2024, several mid-cap biotech companies announced divestitures of non-core R&D programs to streamline their pipelines and focus on lead candidates with higher market potential.

- Focus on Core Competencies: Divesting non-strategic assets allows KalVista to concentrate its research and development efforts on its most promising areas, such as its hereditary angioedema (HAE) program.

- Resource Optimization: Selling off underperforming or non-aligned projects frees up capital and personnel for more impactful initiatives, enhancing overall efficiency.

- Risk Management: Reducing the number of early-stage, uncertain projects can lower the overall risk profile of the company's development pipeline.

- Enhanced Shareholder Value: A streamlined and focused strategy can lead to better execution and potentially higher returns for investors.

Within the KalVista BCG Matrix, 'dogs' represent programs with low market share and low growth potential. KalVista's strategy actively avoids developing such assets by rigorously prioritizing its pipeline. The company's financial disclosures for 2024 indicate a strong focus on late-stage assets like EKTERLY and promising preclinical candidates, demonstrating a deliberate effort to steer clear of 'dog' classifications.

Question Marks

KalVista Pharmaceuticals is advancing an oral Factor XIIa inhibitor candidate in preclinical stages, aiming to address conditions beyond hereditary angioedema (HAE). This strategic focus on Factor XIIa inhibition taps into a potentially vast market, given the wide-ranging biological roles of this enzyme. In 2024, the company continues to invest heavily in research and development for this promising, yet early-stage, program.

Sebetralstat for pediatric patients, specifically the orally disintegrating tablet (ODT) formulation being investigated in the KONFIDENT-KID trial for children aged 2-11 years, represents a Question Mark within KalVista's BCG matrix. This formulation targets a significant, underserved patient population suffering from hereditary angioedema (HAE).

While the adult sebetralstat formulation is considered a Star, the pediatric ODT version faces the uncertainties inherent in developing a new market and securing regulatory approvals for a younger demographic. The success of KONFIDENT-KID is crucial, as a positive outcome could unlock substantial growth in a niche but potentially lucrative market segment.

The development pathway for pediatric drugs often involves unique clinical trial designs and regulatory considerations, adding complexity and risk. KalVista's investment in this area reflects a strategic bet on addressing a clear unmet medical need with a convenient delivery method for young children.

The estimated prevalence of HAE in children is still being fully understood, but initial data suggests a meaningful patient base that could benefit from an effective ODT treatment. Successful navigation of these challenges will determine if sebetralstat ODT can transition from a Question Mark to a future Star performer for KalVista.

KalVista Pharmaceuticals is actively engaged in early-stage research and development, focusing on discovering novel small molecule protease inhibitors. These programs target high-growth therapeutic areas, signifying significant future market potential. For instance, their work in hereditary angioedema (HAE) represents a commitment to addressing unmet medical needs.

While these early-stage programs hold promise, they are inherently nascent and carry unproven market potential. This means substantial investment is required to move them through preclinical and clinical trials. For example, the typical cost to bring a new drug to market can range from hundreds of millions to over a billion dollars, with a significant portion allocated to early research and development phases.

Potential for New Indications

KalVista Pharmaceuticals' deep understanding of plasma kallikrein inhibitors opens doors to exploring new therapeutic areas for sebetralstat and other pipeline assets beyond hereditary angioedema (HAE). This strategic expansion involves identifying and developing treatments for novel indications, which initially represent question marks in the BCG matrix. These ventures demand substantial research and development investment to prove efficacy and commercial potential.

The company’s pipeline, focused on kallikrein-mediated diseases, could see sebetralstat or future candidates evaluated for conditions such as diabetic macular edema (DME) or hereditary angioedema with C1 inhibitor deficiency (HAE-C1). For instance, the global DME market was valued at approximately $7.3 billion in 2023 and is projected to grow significantly. Entering such markets requires extensive clinical trials, regulatory approvals, and market penetration strategies, all contributing to the high investment needed for these question mark opportunities.

- Exploring New Indications: KalVista's expertise in plasma kallikrein inhibitors positions them to investigate sebetralstat and other pipeline candidates for diseases beyond HAE, such as DME or other inflammatory conditions.

- High Investment Requirement: Developing new indications involves substantial upfront investment in clinical trials, regulatory submissions, and market research to establish efficacy and commercial viability, classifying them as question marks.

- Market Potential: While unproven, these new indications represent significant growth opportunities. For example, the DME market alone was valued at billions in 2023, highlighting the potential upside if successful.

- Strategic Importance: Successfully launching new indications would diversify KalVista's product portfolio and revenue streams, potentially transforming these question marks into stars in the future.

High Investment, Uncertain Return

KalVista’s "High Investment, Uncertain Return" category, often termed Question Marks in the BCG matrix, represents projects demanding substantial capital for research and development. These ventures, while holding potential for significant future growth, currently generate little to no revenue, creating a cash drain. For instance, a new drug development program might require hundreds of millions in clinical trials before any market approval. In 2024, the biopharmaceutical industry saw significant R&D spending, with major players investing billions, highlighting the high-stakes nature of such investments.

KalVista faces a critical strategic juncture with these Question Marks. The core decision revolves around whether to commit further resources to elevate these projects into Stars – high-growth, high-market-share products – or to cut losses if their potential proves elusive. This requires rigorous analysis of market adoption forecasts, competitive landscapes, and the probability of successful development and commercialization.

- Significant R&D Expenditure: These projects consume substantial cash, impacting overall financial flexibility.

- Low Current Revenue: They do not contribute to immediate income, relying entirely on future success.

- Strategic Decision Point: KalVista must choose between increased investment or divestment based on evolving project viability.

- Potential for High Growth: Successful conversion into Stars offers substantial future revenue streams and market leadership.

Question Marks in KalVista's BCG matrix represent early-stage pipeline assets or new indications with high growth potential but unproven market share. These ventures require significant investment in research and development, with uncertain outcomes. For example, exploring sebetralstat for diabetic macular edema (DME) falls into this category, demanding substantial capital for clinical trials. The success of these "question marks" hinges on navigating complex regulatory pathways and demonstrating clinical efficacy to capture future market share.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.