KalVista Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KalVista Bundle

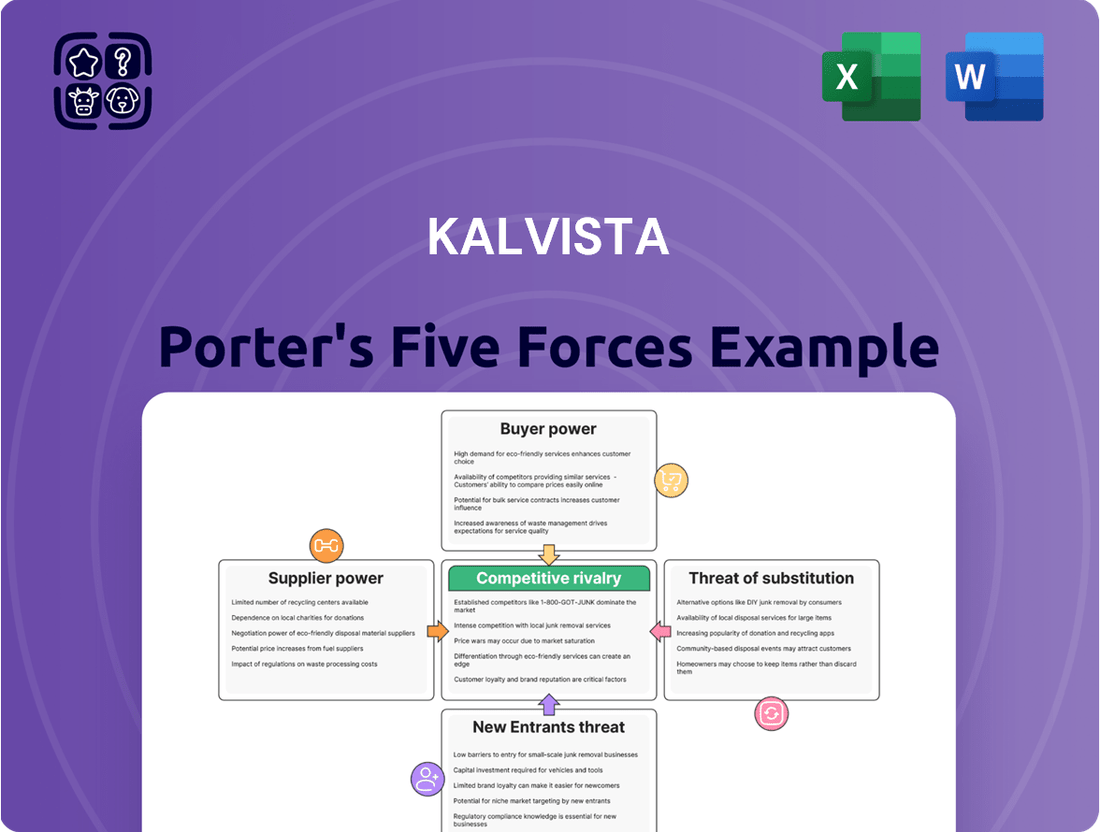

KalVista's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry within the pharmaceutical sector. Understanding these dynamics is crucial for strategic planning.

The threat of new entrants, while potentially significant in a growing market, needs careful consideration alongside the availability of substitute products impacting KalVista's offerings.

Supplier power can also play a role, influencing costs and the availability of essential resources for KalVista's operations and research.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore KalVista’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

KalVista Pharmaceuticals, in its development of small molecule protease inhibitors like sebetralstat, faces a significant bargaining power from its suppliers of specialized raw materials and active pharmaceutical ingredients (APIs). These are not off-the-shelf components; they are often unique and require specialized manufacturing processes, limiting the number of viable sources. This reliance on a select few suppliers for critical, often proprietary, compounds gives those suppliers considerable leverage in negotiations.

The exclusivity of certain APIs and the technical expertise required for their production mean that KalVista, and indeed the broader pharmaceutical industry, often have few alternatives. For instance, the global API market, while growing, is concentrated in certain regions and specialized manufacturers. Any supply chain disruption or even minor quality deviations from these specialized suppliers can directly translate into production delays and impact the availability of KalVista's investigational therapies, directly affecting their ability to bring treatments to market.

The development of innovative medicines heavily relies on clinical trials, frequently delegated to specialized Contract Research Organizations (CROs). These CROs possess unique expertise and essential infrastructure, particularly for niche areas like rare diseases such as hereditary angioedema (HAE), which can translate into significant bargaining power when setting service contract terms. KalVista's reliance on CROs for critical studies like KONFIDENT and KONFIDENT-KID underscores this dependence.

The global CRO market has seen robust growth, with estimates suggesting it will exceed $70 billion by 2026, highlighting their increasing importance and leverage. For KalVista, a company focusing on HAE treatments, the specialized nature of their clinical trials means fewer CROs possess the necessary experience, further concentrating bargaining power with these providers.

The pharmaceutical sector's reliance on specialized scientific and research talent, especially in drug discovery and development, is substantial. This creates a significant bargaining power for highly skilled labor.

Medicinal chemists, biologists, and clinical development experts are in high demand, leading to intense competition for their expertise. This competition naturally drives up labor costs for pharmaceutical companies.

In 2024, the average salary for a senior research scientist in the pharmaceutical industry in the US could range from $130,000 to $180,000 annually, reflecting the premium placed on such specialized skills.

This scarcity of specialized professionals empowers individual employees and niche recruitment firms, allowing them to negotiate favorable terms, increasing the bargaining power of suppliers in this segment.

Specialized Manufacturing and Packaging Services

As KalVista Pharmaceuticals progresses towards the commercialization of sebetralstat (EKTERLY), its reliance on contract manufacturing organizations (CMOs) for drug production and specialized packaging services becomes a critical factor in the bargaining power of suppliers. CMOs possessing the necessary expertise for rare disease therapeutics and navigating complex global distribution channels are in a strong position. Their specialized equipment and adherence to stringent regulatory requirements, such as Good Manufacturing Practices (GMP), mean they can often command premium pricing. KalVista's own pre-commercial planning activities for EKTERLY highlight this dependence.

The specialized nature of manufacturing and packaging for a drug like sebetralstat, intended for a rare disease, significantly concentrates supplier power. These suppliers are not easily substitutable due to the specific technical capabilities and regulatory accreditations required. For instance, the global pharmaceutical contract manufacturing market was valued at approximately $145 billion in 2023 and is projected to grow, indicating a robust demand for these specialized services. Companies like KalVista must factor in the potential for higher costs from these essential partners.

- Specialized Expertise: CMOs with proven track records in biologics or complex small molecules, particularly those with experience in orphan drugs, hold significant leverage.

- Regulatory Compliance: Suppliers meeting rigorous FDA, EMA, and other international regulatory standards for pharmaceutical manufacturing are highly valuable and can dictate terms.

- Capacity and Scale: As KalVista scales up for commercial launch, securing sufficient manufacturing capacity from qualified CMOs will be paramount, potentially leading to higher negotiation power for suppliers.

- Global Distribution Networks: CMOs with established global logistics and cold chain capabilities, crucial for many therapeutics, can further enhance their bargaining strength.

Intellectual Property and Licensing Partners

KalVista's reliance on intellectual property (IP) and licensing partners introduces a nuanced supplier dynamic. While the company develops its own proprietary molecules, the broader pharmaceutical landscape necessitates collaboration and the use of foundational technologies or specialized research tools. Suppliers holding key patents for these essential components can wield significant bargaining power, potentially influencing KalVista's research and development costs and timelines.

The value of these IP-rich suppliers is underscored by the intricate nature of drug development, where specialized knowledge and patented processes are often critical. For instance, access to advanced gene-editing technologies or novel drug delivery platforms, if patented by a third party, can create a dependency for KalVista.

- High Switching Costs: The integration of specialized IP into KalVista's R&D pipeline can lead to substantial costs and delays if a switch to an alternative supplier is considered, thereby strengthening the supplier's position.

- Proprietary Technology Dependence: If KalVista requires patented technologies for its lead candidates, the supplier of that IP holds considerable leverage.

- Licensing Power: Companies that license foundational research tools or drug delivery systems to KalVista can exert power through their licensing terms and potential future in-licensing opportunities for pipeline expansion.

- Limited Alternatives: The scarcity of providers for highly specialized or patented pharmaceutical technologies can significantly amplify supplier bargaining power.

KalVista's suppliers of specialized raw materials and active pharmaceutical ingredients (APIs) hold significant bargaining power due to the unique and often proprietary nature of these components. The limited number of viable sources for these critical, specialized manufacturing processes means few alternatives exist, directly impacting production and timelines.

Contract Research Organizations (CROs) also possess considerable leverage, especially those with expertise in niche areas like rare diseases, such as hereditary angioedema (HAE). KalVista’s reliance on CROs for crucial studies, like KONFIDENT and KONFIDENT-KID, highlights this dependence. The global CRO market's projected growth, potentially exceeding $70 billion by 2026, further emphasizes their increasing importance and negotiating strength.

The scarcity of highly skilled scientific and research talent in drug discovery and development empowers employees and niche recruitment firms, driving up labor costs. For example, in 2024, senior research scientists in the US pharmaceutical industry could earn between $130,000 to $180,000 annually, reflecting the premium on specialized skills.

Contract Manufacturing Organizations (CMOs) with expertise in rare disease therapeutics and complex global distribution networks also command strong bargaining power. Their specialized equipment, adherence to stringent Good Manufacturing Practices (GMP), and established global logistics networks, particularly for cold chain capabilities, allow them to negotiate premium pricing. The global pharmaceutical contract manufacturing market was valued at approximately $145 billion in 2023, underscoring the demand and leverage of these essential partners.

| Supplier Type | Factors Contributing to Bargaining Power | Impact on KalVista | 2024 Data/Projections |

|---|---|---|---|

| APIs & Raw Materials | Proprietary nature, specialized manufacturing, limited sources | Potential for higher costs, supply chain risks | Global API market growth |

| Contract Research Organizations (CROs) | Niche expertise (e.g., rare diseases), infrastructure | Higher service contract costs, potential study delays | Global CRO market projected over $70B by 2026 |

| Specialized Labor | High demand for scientific/research talent | Increased labor costs, competition for talent | Senior research scientist salaries: $130K-$180K (US) |

| Contract Manufacturing Organizations (CMOs) | Rare disease expertise, regulatory compliance (GMP), global logistics | Premium pricing, capacity constraints | Global pharma contract manufacturing market: ~$145B (2023) |

What is included in the product

Uncovers the competitive intensity, buyer and supplier power, threat of new entrants, and substitute products impacting KalVista's position in the biopharmaceutical market.

KalVista's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

Customers Bargaining Power

The bargaining power of patients with hereditary angioedema (HAE) for oral, on-demand treatments is currently moderate, but this is a dynamic situation. The significant unmet need for convenient, non-injectable options is a key driver here. For instance, in 2024, the market for HAE treatments is still dominated by injectable therapies, leaving a considerable gap for oral alternatives.

KalVista Pharmaceuticals' sebetralstat (EKTERLY) enters this market as the first and only oral on-demand HAE therapy. This innovation directly addresses patient preferences, shifting some power away from individual patients and towards the collective demand for such a convenient solution. The ability to self-administer a pill rather than relying on injections significantly enhances patient quality of life.

Healthcare providers, particularly allergists and immunologists focusing on Hereditary Angioedema (HAE), wield considerable influence. Their treatment recommendations directly impact the adoption of new therapies. KalVista has noted positive engagement and feedback from these key opinion leaders regarding sebetralstat's potential, underscoring their role as indirect but powerful customers.

The bargaining power of customers in the pharmaceutical sector, particularly for rare disease treatments like those for Hereditary Angioedema (HAE), is significant due to the influence of payers. National healthcare systems, private insurers, and Pharmacy Benefit Managers (PBMs) act as powerful gatekeepers, dictating market access and reimbursement terms. In 2024, these entities continue to wield considerable leverage by negotiating prices and influencing which drugs are covered on formularies, directly impacting a company's revenue potential.

Payers scrutinize the value proposition of high-cost therapies, and for HAE treatments which can cost hundreds of thousands of dollars annually per patient, this scrutiny is intensified. For instance, in 2023, the average annual cost of some HAE treatments in the US was reported to be over $300,000 per patient. This financial pressure compels pharmaceutical companies to demonstrate clear clinical and economic benefits to secure favorable reimbursement and avoid restrictive utilization management.

Patient Advocacy Groups and Disease Awareness

Patient advocacy groups for Hereditary Angioedema (HAE) are a significant force, amplifying patient voices to drive treatment innovation and accessibility. These organizations actively raise awareness about HAE, influencing regulatory bodies and payers to prioritize patient needs. Their collective advocacy directly impacts the demand for and adoption of new therapies, such as KalVista's oral treatments, by highlighting unmet clinical needs and the desire for improved quality of life.

The growing influence of these groups translates into tangible customer power. For instance, the US HAE Association (HAEA) has been instrumental in advocating for policy changes that improve insurance coverage for HAE medications. By fostering a community that demands better treatment options, these groups can pressure pharmaceutical companies to invest in research and development for more convenient and effective therapies, directly impacting KalVista's market strategy and the perceived value of its pipeline. Their efforts can accelerate market penetration for novel treatments by educating patients and healthcare providers alike.

- Increased patient engagement: Advocacy groups empower patients with information, fostering demand for advanced treatments.

- Policy influence: These groups lobby for favorable reimbursement and regulatory pathways for HAE therapies.

- Market shaping: Advocacy for oral HAE treatments directly benefits companies like KalVista developing such innovations.

- Data-driven advocacy: Patient-reported outcomes collected by advocacy groups provide crucial evidence for treatment value.

Availability of Alternative Treatment Options

The availability of alternative treatment options for hereditary angioedema (HAE) significantly influences customer bargaining power for KalVista Pharmaceuticals. While sebetralstat is positioned as the first oral, on-demand therapy for HAE, existing treatments are primarily injectable. These include various C1-esterase inhibitors, bradykinin B2 receptor antagonists, and other kallikrein inhibitors, which have been the standard of care for years.

The existence of these established, albeit less convenient, injectable alternatives grants patients and payers a degree of choice. This means that even as a novel oral therapy emerges, the market is not entirely devoid of options. For instance, as of late 2024, the HAE treatment landscape includes multiple biosimilar C1-esterase inhibitors, further diversifying the available choices and potentially putting downward pressure on pricing. This competitive environment inherently limits the pricing power of any single provider.

- Existing Injectable Therapies: Established treatments like C1-esterase inhibitors and bradykinin B2 receptor antagonists provide a baseline of care and alternatives.

- Biosimilar Competition: The introduction of biosimilar versions of existing HAE therapies in 2024 and projected into 2025 increases patient and payer options.

- Patient and Payer Choice: The presence of multiple treatment modalities, even with differing convenience factors, empowers customers to negotiate terms.

- Price Sensitivity: The availability of alternatives can lead to greater price sensitivity among customers, impacting KalVista's pricing strategy for sebetralstat.

The bargaining power of patients and payers for Hereditary Angioedema (HAE) treatments remains a critical factor for KalVista. While sebetralstat offers a significant convenience advantage as an oral on-demand therapy, its pricing and market access will be heavily influenced by existing treatment costs and payer negotiations. The market, while evolving, still has established injectable options, some of which have seen biosimilar competition emerge in 2024, creating price pressures.

Payers, including insurers and PBMs, are key customers who wield substantial leverage due to the high annual costs associated with HAE therapies, which can exceed $300,000 per patient as seen in 2023. Their scrutiny of value propositions and negotiation of formulary placement directly impacts a drug's commercial success.

Patient advocacy groups also exert considerable influence by amplifying patient needs and driving demand for innovation. Their efforts in raising awareness and lobbying for better access can accelerate market penetration for novel treatments like sebetralstat by demonstrating unmet needs and improving quality of life.

| Customer Segment | Influence Level | Key Considerations |

|---|---|---|

| Patients | Moderate to High | Demand for convenience (oral vs. injectable), quality of life improvements. |

| Payers (Insurers, PBMs) | High | Price sensitivity, value-based assessments, formulary access, cost-effectiveness. |

| Healthcare Providers (KOLs) | Moderate | Treatment recommendations, clinical trial data, perceived efficacy and safety. |

| Patient Advocacy Groups | Moderate to High | Driving awareness, policy influence, patient-reported outcomes, market access advocacy. |

Preview Before You Purchase

KalVista Porter's Five Forces Analysis

You're previewing the final version—precisely the same KalVista Porter's Five Forces Analysis that will be available to you instantly after buying. This document offers a comprehensive examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You will receive this exact, professionally formatted analysis, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The hereditary angioedema (HAE) treatment market is already a competitive arena, populated by established pharmaceutical giants with a strong foothold. These players, including CSL Behring with its injectable C1-esterase inhibitors like Berinert and subcutaneous Haegarda, and BioCryst Pharmaceuticals, which offers the oral prophylactic treatment berotralstat (Orladeyo), command significant market share and benefit from considerable brand loyalty among patients and physicians. Their approved therapies have set a high standard for efficacy and safety, creating a substantial barrier to entry for new entrants.

KalVista's core competitive edge stems from sebetralstat's status as the inaugural and sole FDA-approved oral on-demand therapy for HAE attacks. This offers a marked convenience advantage over current injectable treatments, potentially enabling KalVista to capture significant market share.

The distinct convenience of sebetralstat could allow KalVista to command a premium price point, further solidifying its market position. For instance, in the first quarter of 2024, KalVista reported $3.4 million in sebetralstat revenue, indicating early market adoption.

However, the threat of competitive rivalry is present as other companies may invest in developing their own oral or similarly convenient HAE therapies. The success of sebetralstat could accelerate such competitive responses, particularly if early sales figures demonstrate strong patient and prescriber preference.

The rare disease sector, particularly for conditions like Hereditary Angioedema (HAE), is a hotbed of innovation. Companies are pouring resources into research and development (R&D) to discover and launch novel treatments. This intense R&D activity is driven by the desire to meet significant unmet medical needs and secure a competitive edge.

Emerging advancements include more effective drug formulations, therapies designed for longer duration of action, and cutting-edge gene therapies. For example, in 2024, several HAE therapies continued to demonstrate promising clinical data, with some companies reporting strong revenue growth from their existing portfolios and pipeline advancements. This constant stream of new therapeutic approaches puts continuous pressure on companies like KalVista to innovate and maintain their market position.

Global Market Expansion and Regulatory Submissions

Competitive rivalry in the global pharmaceutical market, especially for novel therapies like KalVista’s, is intense and extends beyond product development to market penetration. KalVista is strategically pursuing regulatory approvals in key international markets, including Europe, Japan, the United Kingdom, Switzerland, Australia, and Singapore. The company’s success in navigating these diverse regulatory landscapes and securing approvals will be a significant determinant of its ability to compete effectively against established players with existing global footprints and product portfolios.

The pace and outcome of these multi-regional submissions directly impact KalVista’s market expansion capabilities. Companies that can achieve broader market access more rapidly gain a distinct competitive advantage, influencing sales volumes and market share. For instance, in 2024, the pharmaceutical industry saw continued consolidation and strategic partnerships aimed at expanding global reach, highlighting the importance of timely regulatory approvals for new entrants.

- Global Regulatory Hurdles: KalVista's expansion hinges on securing approvals from agencies like the European Medicines Agency (EMA), Japan's Pharmaceuticals and Medical Devices Agency (PMDA), and others across its target markets.

- Competitive Landscape: Rival firms with existing global infrastructure and approved treatments in these regions present a significant challenge, necessitating swift and successful regulatory navigation by KalVista.

- Market Access Speed: The speed at which KalVista can gain market access in these diverse geographies will directly influence its ability to capture market share and establish a competitive presence against established global pharmaceutical companies.

- Resource Allocation: Successfully managing multiple international regulatory submissions requires substantial resource allocation, including financial investment and specialized personnel, which can strain a company's operational capacity.

Pricing and Reimbursement Pressures

Competitive rivalry in the hereditary angioedema (HAE) treatment market is significantly shaped by pricing and reimbursement strategies, particularly due to the substantial cost associated with these therapies. Companies actively compete to secure preferred formulary positions with payers, which directly impacts patient access and market share.

KalVista Pharmaceuticals has received positive feedback regarding its pricing strategy, suggesting a keen understanding of this crucial competitive factor. This focus on pricing is essential for navigating the complex landscape of healthcare economics and payer negotiations, especially as new treatments enter the market.

The high cost of HAE treatments means that reimbursement negotiations are a critical battleground. Companies must demonstrate the value proposition of their therapies to secure favorable reimbursement terms from insurance providers and government health programs. For instance, in 2024, the average annual cost for HAE treatments can range from hundreds of thousands to over a million dollars per patient, making payer access paramount.

- Pricing Strategy: Companies must balance innovation costs with market affordability to gain a competitive edge.

- Reimbursement Negotiations: Securing favorable formulary placement is key to patient access and market penetration.

- Value Demonstration: Highlighting clinical efficacy and patient outcomes is crucial for payer acceptance.

- Market Access: Navigating payer landscapes is as important as product development in competitive markets.

The competitive landscape for HAE treatments is robust, with established players like CSL Behring and BioCryst Pharmaceuticals holding significant market share. KalVista's sebetralstat, as the first oral on-demand therapy, offers a distinct convenience advantage, potentially commanding a premium price. Early revenue figures in Q1 2024, with $3.4 million for sebetralstat, underscore its initial market traction, but also signal the intense focus on innovation from competitors developing similar convenient therapies.

SSubstitutes Threaten

The primary substitutes for KalVista's oral on-demand sebetralstat are existing injectable on-demand hereditary angioedema (HAE) treatments. These include well-established therapies like C1-esterase inhibitors, such as Berinert, and bradykinin B2 receptor antagonists.

While these injectable treatments are less convenient due to their administration route, they are proven effective, offering patients a viable alternative. The established nature and efficacy of these injectables present a significant competitive threat, even with the added burden of self-administration.

Long-term prophylaxis (LTP) therapies for HAE, such as oral options like BioCryst's berotralstat, directly substitute for on-demand treatments by aiming to prevent attacks. These preventative measures reduce the reliance on acute therapies, potentially impacting the market for on-demand medications. For instance, in 2024, the market for HAE treatments continued to see growth, with LTPs capturing a significant share as patient preferences shifted towards prevention.

The threat of substitutes in the hereditary angioedema (HAE) market is notably elevated by the rapid advancement of emerging therapies. Research is actively pursuing novel mechanisms of action and potentially curative solutions, with gene therapies and new classes of monoclonal antibodies leading the charge.

These innovative treatments, if proven effective and safe, could significantly disrupt the current treatment paradigm. They represent a fundamental shift away from the on-demand and prophylactic pharmacological approaches currently available, posing a substantial long-term threat to established market players like KalVista.

For instance, the potential for gene therapy to offer a one-time, lasting correction could render lifelong medication unnecessary for many HAE patients. This directly substitutes the continuous revenue streams associated with current treatment modalities, forcing companies to adapt or risk obsolescence.

Off-Label Use of Other Medications

The threat of substitutes for KalVista Pharmaceuticals' HAE treatments is influenced by the off-label use of other medications. Patients may turn to non-specific treatments or drugs used for different conditions if specialized HAE therapies are inaccessible or too expensive. While these are generally less effective, they can still divert demand, especially in underserved markets. For instance, in 2024, reports indicated that some HAE patients in regions with limited access to approved treatments were exploring off-label options, impacting the market penetration of newer therapies.

These substitutes represent a lower-quality alternative but can still exert pressure on pricing and market share for approved HAE medications. The cost factor is particularly significant, as the high price of specialized HAE treatments can drive patients towards more affordable, albeit less targeted, options. This dynamic is a crucial consideration for pharmaceutical companies developing and marketing novel HAE therapies, as demonstrated by market analyses from early 2025 which highlighted the persistent challenge of off-label use in certain emerging markets.

The availability of off-label substitutes can be quantified by observing trends in prescription data and patient surveys. While precise figures for off-label HAE medication use are difficult to ascertain universally, anecdotal evidence and regional studies suggest it remains a factor. For example, a 2024 survey of HAE patient advocacy groups revealed that approximately 15-20% of patients in specific low-income countries reported using non-approved treatments due to accessibility issues.

- Limited Access Drives Off-Label Use: In 2024, regions with restricted access to specific HAE therapies saw patients resorting to off-label medications.

- Cost as a Major Barrier: The high cost of approved HAE treatments makes less expensive, non-specific alternatives attractive to some patients.

- Impact on Demand: Even low-quality substitutes can affect the demand for specialized HAE drugs, influencing market dynamics.

- Data from Patient Groups: A 2024 survey indicated that 15-20% of patients in certain low-income countries used non-approved treatments due to accessibility.

Lifestyle Management and Symptomatic Relief

For individuals managing hereditary angioedema (HAE), lifestyle adjustments and symptomatic relief present a form of indirect substitution for specific HAE medications. These non-pharmaceutical approaches, such as trigger avoidance and managing mild symptoms without on-demand treatment, can influence the demand for targeted therapies. For instance, a patient successfully managing their HAE through diet and stress reduction might opt for less frequent use of acute attack medications, impacting the market penetration of such drugs.

While not a direct pharmaceutical competitor, these management strategies can reduce the overall need for specialized HAE treatments. This is particularly relevant for individuals experiencing less severe or less frequent attacks. The focus remains on alleviating symptoms rather than addressing the underlying biological cause of HAE, highlighting a key distinction in the threat posed by these alternatives.

- Lifestyle Adjustments: Patients may modify their routines to avoid known HAE triggers, such as certain foods or stressful situations.

- Symptomatic Relief: Over-the-counter or prescription medications for pain, swelling, or gastrointestinal distress can offer temporary relief during mild attacks.

- Reduced Demand for On-Demand Treatments: Effective lifestyle management can lead to fewer acute attacks requiring specific HAE therapies, potentially impacting sales volumes for on-demand HAE medications.

- Focus on Symptom Management: These alternatives primarily address the symptoms of an HAE attack, not the underlying disease pathology.

The threat of substitutes for KalVista's sebetralstat is significant, encompassing both established injectable HAE treatments and emerging therapies like gene therapy. While injectables are proven, their administration route offers a convenience advantage to oral options. The market for HAE treatments saw continued growth in 2024, with preventative therapies gaining traction, further diversifying the competitive landscape.

The market is also influenced by off-label drug use, particularly in regions with limited access to specialized HAE therapies. Cost remains a major driver for this substitution, with an estimated 15-20% of patients in certain low-income countries resorting to non-approved treatments in 2024 due to accessibility issues.

Lifestyle modifications and symptomatic relief also act as indirect substitutes, potentially reducing the demand for on-demand medications. These non-pharmaceutical approaches focus on managing mild symptoms or avoiding triggers, impacting the overall need for acute attack therapies.

| Substitute Type | Examples | Key Differentiator | Impact on KalVista |

| Established Injectables | Berinert, Firazyr | Proven efficacy, but less convenient administration | Direct competition for on-demand treatment market share |

| Long-Term Prophylaxis (LTP) | BioCryst's berotralstat (oral) | Preventative approach, reduces reliance on on-demand | May reduce overall demand for acute therapies |

| Emerging Therapies | Gene therapies, monoclonal antibodies | Potential for novel mechanisms or curative solutions | Significant long-term disruption potential |

| Off-Label Use | Non-specific medications | Lower cost, accessibility issues drive use | Can divert demand, especially in certain markets |

| Lifestyle/Symptomatic | Trigger avoidance, OTC pain relief | Non-pharmaceutical, focus on symptom management | Indirectly reduces demand for on-demand treatments |

Entrants Threaten

The pharmaceutical sector, particularly for rare diseases, demands immense investment in research and development (R&D). The journey from drug discovery through extensive clinical trials to regulatory approval is incredibly expensive, often running into hundreds of millions, if not billions, of dollars. This high capital requirement acts as a substantial barrier, deterring new companies from entering the market. For instance, by 2024, the average cost to develop a new drug was estimated to be around $2.6 billion, with R&D expenses forming a significant portion of this. KalVista's own financial reports consistently highlight its substantial R&D expenditures, underscoring this industry-wide challenge.

The stringent regulatory approval process for new drugs presents a significant threat of new entrants in the pharmaceutical industry, directly impacting companies like KalVista. Bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate extensive, multi-phase clinical trials that can span many years and require substantial investment. For instance, bringing a new drug to market typically costs well over $1 billion and can take 10-15 years from discovery to approval. This arduous journey, involving rigorous data submission and adherence to strict safety and efficacy standards, acts as a formidable barrier, deterring many potential new players from entering the market.

Established pharmaceutical companies, including KalVista, possess robust intellectual property (IP) protection, primarily through patents on their drug molecules and manufacturing methods. These patents act as significant barriers, deterring new entrants from marketing comparable compounds for extended durations. For instance, the global pharmaceutical patent protection typically lasts for 20 years from the filing date, offering a substantial window for recouping R&D investments.

Need for Specialized Sales and Distribution Channels

For companies looking to enter the rare disease market, especially for conditions like Hereditary Angioedema (HAE), establishing specialized sales and distribution channels is a major hurdle. These channels need to effectively reach a small and scattered patient base, as well as the few healthcare professionals who specialize in treating HAE. Building these networks from the ground up represents a substantial barrier for any newcomer. KalVista, for instance, has already taken steps to build its specialized field sales team in preparation for the commercialization of EKLYS. This proactive approach highlights the critical need for such infrastructure before market entry.

The investment required to build a dedicated sales force with the necessary expertise in rare diseases can be considerable. Furthermore, securing access to specialized distribution networks capable of handling potentially temperature-sensitive pharmaceuticals adds another layer of complexity and cost. New entrants often find themselves at a disadvantage compared to established players who already possess these vital relationships and infrastructure.

Consider the following aspects of this barrier:

- Specialized Sales Force: Requires hiring and training individuals with deep knowledge of HAE and the ability to connect with a limited number of key opinion leaders and treatment centers.

- Distribution Network Access: Gaining entry into existing, specialized distribution channels that can ensure efficient and compliant delivery to patients and providers is crucial.

- Geographic Dispersion: The scattered nature of HAE patients necessitates a sales and distribution strategy that can cover wide geographical areas effectively.

- Regulatory Compliance: Navigating the complex regulatory landscape for drug distribution, particularly for rare diseases, adds to the challenge for new entrants.

Brand Recognition and Physician Trust

Existing players in the hereditary angioedema (HAE) market have cultivated significant brand recognition and physician trust over many years. New entrants must overcome this deeply entrenched loyalty, a formidable barrier. For instance, Shire (now Takeda) has a long history in the HAE space with its established therapies. KalVista's strategy involves presenting compelling new clinical data and actively engaging with healthcare providers (HCPs) to build comparable trust and demonstrate the value of its pipeline candidates.

Building physician confidence is paramount. Healthcare professionals often rely on established treatments with proven track records and readily available support. KalVista's efforts to educate physicians about the mechanism of action and clinical benefits of its investigational therapies, such as KVD824, aim to chip away at this barrier. The company’s focus on demonstrating efficacy and safety in its clinical trials, including Phase 2 data, is crucial for gaining traction.

- Established HAE therapies benefit from years of physician experience and patient familiarity.

- New entrants must invest heavily in marketing and education to build trust and encourage adoption.

- KalVista's approach centers on presenting robust clinical trial data to HCPs.

- Physician education and demonstration of superior outcomes are key to overcoming brand loyalty.

The threat of new entrants in the pharmaceutical sector, particularly for rare diseases like HAE, is generally considered low. This is primarily due to the substantial capital investment required for drug development, estimated at around $2.6 billion per new drug by 2024, and the lengthy, rigorous regulatory approval processes that can take over a decade. KalVista's own significant R&D spending reflects these industry-wide financial demands.

Intellectual property protection through patents, typically lasting 20 years, creates another formidable barrier. Furthermore, establishing specialized sales forces and distribution networks to reach scattered rare disease patient populations is complex and costly, a challenge KalVista is proactively addressing for its HAE drug candidate EKLYS. Finally, overcoming established brand loyalty and physician trust, built over years by companies like Takeda in the HAE market, requires extensive education and robust clinical data, which KalVista is prioritizing with its pipeline.

| Barrier Type | Description | Impact on New Entrants | Example (KalVista Context) |

|---|---|---|---|

| Capital Requirements | High R&D costs ($2.6B avg. by 2024) and clinical trial expenses. | Deters new players due to financial risk. | KalVista's substantial R&D investments. |

| Regulatory Hurdles | Lengthy (10-15 years) and strict FDA/EMA approval processes. | Requires significant time, expertise, and resources. | Rigorous data submission for HAE therapies. |

| Intellectual Property | 20-year patent protection on drug molecules. | Limits market entry for competing compounds. | Patents on KalVista's HAE drug candidates. |

| Distribution & Sales Infrastructure | Need for specialized sales teams and networks for rare diseases. | Costly and time-consuming to build from scratch. | KalVista building specialized field sales for EKLYS. |

| Brand Loyalty & Trust | Established players have deep physician and patient relationships. | Difficult to displace incumbents without superior offerings. | Overcoming Shire/Takeda's long-standing HAE presence. |

Porter's Five Forces Analysis Data Sources

Our KalVista Porter's Five Forces analysis is built upon a robust foundation of data, including KalVista's own SEC filings, investor presentations, and published clinical trial results. We also incorporate industry-specific market research reports and analyses of the broader ophthalmic drug market to provide comprehensive competitive insights.