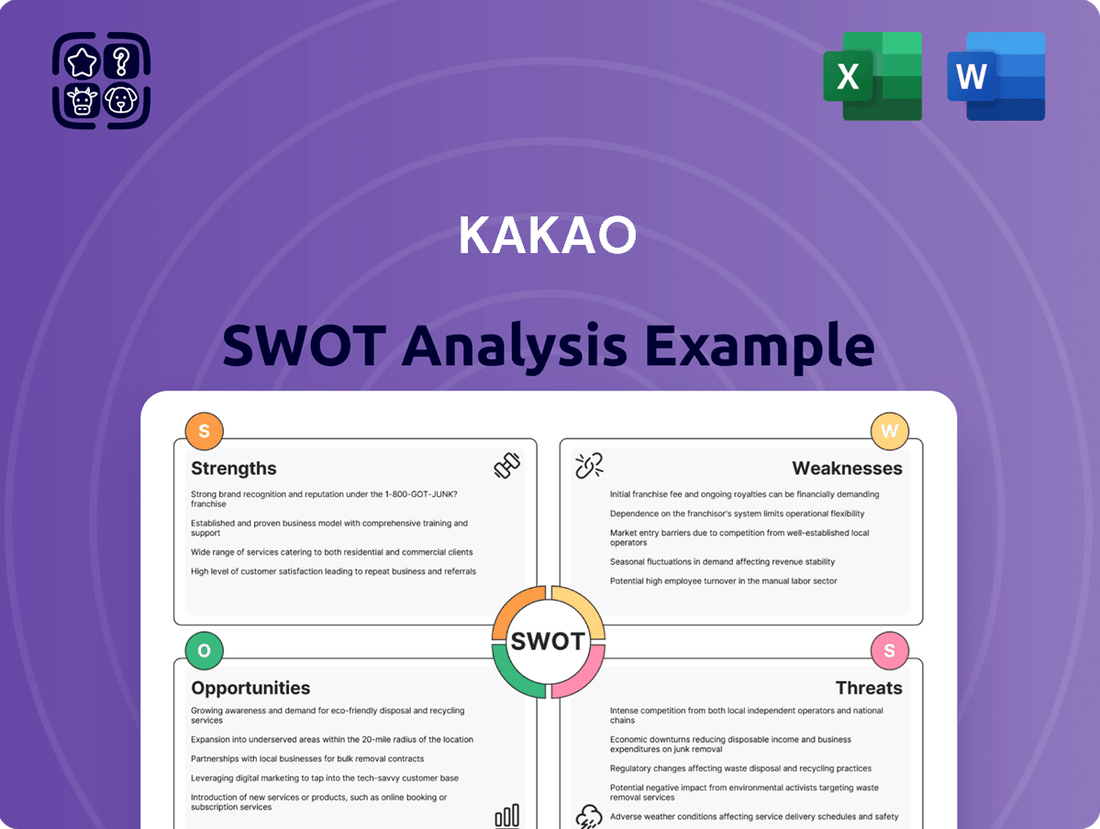

Kakao SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kakao Bundle

Kakao, a South Korean tech giant, boasts powerful brand recognition and a dominant position in its core messaging and social networking services, presenting significant strengths. However, it faces intense competition and evolving regulatory landscapes, highlighting key opportunities and threats. Its diversification into fintech, content, and mobility offers substantial growth potential, but also introduces operational complexities and market-specific challenges.

Want to understand the full strategic picture of Kakao's market position, including detailed insights into its competitive advantages and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Kakao Corp. commands an overwhelming market position within South Korea, largely driven by its ubiquitous messaging application, KakaoTalk. As of early 2024, KakaoTalk's penetration rate continues to hover above 90% of the South Korean population, solidifying its status as the nation's de facto communication platform.

This deep user penetration enables Kakao to seamlessly introduce and integrate a vast array of new services directly to its massive user base. For instance, financial services like Kakao Pay, content platforms, and e-commerce ventures benefit from direct cross-promotion opportunities, leveraging existing user habits and trust.

This entrenched position creates a formidable competitive moat, making it exceptionally difficult for rivals to gain traction in the South Korean market. The high user engagement within Kakao's integrated ecosystem translates into consistent data flow and monetization potential across its diverse service offerings.

Kakao's strength lies in its extensive and deeply integrated ecosystem of services, a significant advantage in the competitive digital landscape. This interconnectedness, covering everything from messaging and fintech to mobility and content, creates a powerful network effect.

The platform's ability to seamlessly blend daily activities through services like Kakao Pay, Kakao Bank, and Kakao T fosters remarkable user stickiness. In 2023, Kakao Pay processed over 1.3 billion transactions, demonstrating the sheer volume of user engagement within its financial services alone.

This integrated approach means users are more likely to stay within the Kakao sphere for their diverse needs, from communicating and banking to ordering taxis. This multi-touchpoint strategy provides numerous avenues for monetization and data collection, reinforcing its competitive edge.

Kakao's strength lies in its diverse revenue streams, encompassing advertising, e-commerce, and transaction fees generated across its extensive platform. This multi-faceted approach significantly reduces its dependence on any single revenue source, offering substantial resilience against sector-specific market downturns. For example, in the first quarter of 2024, Kakao reported that its Talk Biz advertising revenue grew by 15.3% year-over-year, reaching 521.9 billion KRW, while its commerce segment also saw robust performance, helping to buffer potential weaknesses in other areas like content.

Strong Brand Recognition and User Loyalty

Kakao's brand recognition in South Korea is exceptionally high, translating into significant user loyalty that underpins its market dominance. This deep connection with its user base, cultivated over years of service provision, acts as a powerful catalyst for the successful introduction of new offerings within its expansive digital ecosystem. The robust brand equity Kakao has amassed is a key driver of its continued leadership in the fiercely competitive digital landscape.

This strong brand identity is not just about familiarity; it fosters a sense of trust that encourages users to engage with and adopt Kakao's diverse range of services, from its ubiquitous messaging app to its financial and content platforms. In 2024, Kakao continued to leverage this strength, with its KakaoTalk app remaining the primary communication tool for a vast majority of South Koreans, solidifying its position as an indispensable part of daily life.

- Dominant Market Share: KakaoTalk consistently holds over 90% of the messaging app market share in South Korea.

- Ecosystem Integration: User loyalty extends across services like Kakao Pay, Kakao T, and Melon, demonstrating broad trust.

- Brand Equity: The Kakao brand is synonymous with convenience and reliability for millions of South Korean consumers.

- Reduced Customer Acquisition Costs: High recognition and loyalty lower the expenses associated with attracting new users to its expanding service portfolio.

Strategic Investments in AI and Future Technologies

Kakao is making substantial investments in artificial intelligence, aiming to become an AI-native company. This includes strategic alliances, such as their collaboration with OpenAI, to embed AI across their diverse service portfolio and pioneer new AI-powered solutions. These efforts are geared towards significantly improving user experiences and unlocking novel avenues for growth.

The company's commitment to AI is underscored by significant capital allocation towards building robust AI infrastructure. A key initiative is the development of a large-scale AI data center, designed to support advanced AI research and deployment. This infrastructure investment is crucial for Kakao to maintain its competitive edge in the rapidly evolving AI landscape.

- AI Integration: Kakao is actively integrating AI into its core services, from communication platforms to content services, to personalize user experiences.

- OpenAI Partnership: The strategic partnership with OpenAI provides Kakao access to cutting-edge AI models and expertise.

- AI Data Center: Plans for a major AI data center highlight Kakao's commitment to building the foundational infrastructure for its AI ambitions.

- New Growth Engines: By focusing on AI, Kakao aims to develop new revenue streams and business opportunities in areas like AI-powered commerce and personalized recommendations.

Kakao's dominant market position in South Korea, driven by its near-universal KakaoTalk adoption, provides a powerful platform for cross-selling services. This deep integration fosters user stickiness, as evidenced by Kakao Pay's processing of over 1.3 billion transactions in 2023. The company also boasts diverse revenue streams, with Q1 2024 advertising revenue reaching 521.9 billion KRW, showcasing resilience and broad monetization capabilities across its ecosystem.

What is included in the product

Analyzes Kakao’s competitive position through key internal and external factors, highlighting its dominant platform strengths alongside potential regulatory threats and diversification opportunities.

Provides a structured framework to identify and address Kakao's competitive challenges and capitalize on emerging market opportunities.

Weaknesses

Despite its global aspirations, Kakao's financial performance remains significantly tethered to its home market. In 2024, a substantial portion, exceeding 70%, of its total revenue was generated within South Korea. This concentration makes the company particularly vulnerable to shifts in the South Korean economy, any new domestic regulations, and the fierce competition it faces locally.

This continued heavy reliance on a single geographic market presents a considerable weakness. While Kakao has made strides in international markets, its revenue streams are not yet sufficiently diversified. Such limited geographic reach could impede its long-term growth trajectory and introduce volatility in revenue streams, especially when contrasted with global technology leaders that benefit from broader market penetration.

Kakao is navigating an increasingly complex regulatory landscape, facing heightened scrutiny over its market dominance and business practices. This has led to significant financial penalties; for instance, in late 2023, Kakao Entertainment was fined 10 million Korean Won for deceptive advertising practices. Investigations into Kakao Mobility's revenue reporting further highlight these persistent challenges.

These regulatory hurdles can cast a shadow over Kakao's public perception and directly impact its bottom line through substantial legal fees and potential operational restrictions. The ongoing investigations and fines underscore the need for robust compliance measures and a proactive approach to regulatory engagement for Kakao's continued growth.

While Kakao's platform business demonstrates resilience, specific content areas are facing headwinds. For instance, Kakao Games recorded an operating loss in the first quarter of 2025. This downturn is attributed to a sparse pipeline of new game launches and a dip in revenue from its existing game catalog, highlighting difficulties in maintaining momentum across its varied content offerings.

Challenges in Global Expansion

Kakao has encountered hurdles in translating its strong domestic performance to international arenas, despite aspirations for greater overseas revenue. For instance, in 2023, while Kakao Games saw revenue growth, a significant portion remained reliant on the Korean market, highlighting the persistent challenge of broader global penetration.

Expanding into new territories, particularly in competitive sectors like gaming and content, demands considerable financial commitment and strategic adaptation to local tastes and regulatory environments. This often means facing off against deeply entrenched global competitors who already have established user bases and distribution networks.

- Global Market Penetration: Difficulty in replicating South Korean success internationally.

- Competitive Landscape: Need for substantial investment to compete with established global players.

- Adaptation Requirements: Challenges in tailoring content and services for diverse overseas markets.

Perception Issues and Corporate Governance Concerns

Kakao has grappled with significant perception issues stemming from corporate governance concerns. The company faced scrutiny over executive stock option practices, which raised questions about fairness and potential conflicts of interest. Furthermore, the founder's arrest on charges of stock price manipulation in late 2023 cast a long shadow over the company's ethical standing. This erosion of trust can directly impact investor confidence and the company's overall market valuation.

These governance lapses have tangible financial implications. For instance, while specific post-arrest stock performance data is still unfolding, such events historically lead to increased volatility and investor hesitancy. For example, during periods of heightened governance concerns, companies often see a dip in their stock price and may struggle to attract new investment. Kakao's ability to address these issues transparently and implement robust governance reforms is paramount to rebuilding credibility. This includes clear communication regarding executive compensation and a demonstrated commitment to ethical business practices.

- Executive stock options: Past controversies have led to public criticism and calls for greater transparency.

- Founder's arrest: Charges of stock price manipulation in late 2023 severely impacted public and investor perception.

- Investor confidence: Governance concerns can directly deter investment and increase the cost of capital.

- Reputational damage: Negative perception can affect customer loyalty and the company's ability to attract top talent.

Kakao's reliance on the South Korean market, which accounted for over 70% of its revenue in 2024, presents a significant vulnerability to domestic economic fluctuations and regulatory changes. This geographic concentration limits its growth potential and exposes it to intense local competition, hindering its ability to diversify revenue streams effectively.

Full Version Awaits

Kakao SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing a genuine excerpt of the Kakao SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll unlock the complete, in-depth report, providing a comprehensive understanding of Kakao's strategic position. This ensures you receive exactly what you see, with no hidden surprises.

Opportunities

Kakao is well-positioned to capitalize on the burgeoning fintech sector, with significant opportunities to expand its Kakao Pay and Kakao Bank offerings both within South Korea and across international borders. KakaoBank, for instance, achieved a record profit in the first quarter of 2025, demonstrating strong domestic traction and setting the stage for ambitious expansion plans into markets such as Thailand and Indonesia.

Furthermore, Kakao Mobility's existing services, including its parking solutions and burgeoning quick delivery operations, represent fertile ground for continued growth and new revenue streams. These areas offer clear avenues for further development and market penetration, building on established user bases and infrastructure.

Kakao is strategically positioning itself to capitalize on AI advancements, evident in its collaborations with leading AI firms like OpenAI. This partnership unlocks the potential to significantly improve current offerings and pioneer entirely new services for its user base.

The introduction of AI-driven features, such as the AI assistant 'Kanana,' and planned expansions like 'AI Mate Shopping' and 'AI Mate Local,' are poised to drive deeper user engagement. These innovations also pave the way for novel revenue streams by offering personalized and intelligent digital experiences.

By integrating AI across its ecosystem, Kakao can offer more personalized content recommendations, smarter search functionalities, and efficient customer support, directly addressing user needs and enhancing overall satisfaction. This proactive approach to AI integration is a key differentiator in the competitive digital landscape.

Kakao's strategic push into global digital content and gaming presents significant opportunities. Kakao Entertainment is actively expanding its music business, with a particular focus on K-pop's global appeal, and is broadening its webtoon platform, Piccoma, into new international territories. This aligns perfectly with the surging worldwide appetite for Korean cultural exports.

Kakao Games is also strategically positioned for a strong performance in 2025. The company is preparing to launch a diverse range of new game titles specifically designed for global audiences. This proactive approach aims to capitalize on the expanding global gaming market, which saw significant growth, with the global games market revenue projected to reach $200.7 billion in 2024, according to Newzoo.

Strategic Partnerships and Mergers & Acquisitions

Kakao can significantly boost its growth by forming strategic alliances and pursuing targeted mergers and acquisitions. These moves are crucial for faster entry into new international markets and for broadening its range of services. For instance, collaborations like the one with OpenAI are vital for staying ahead in technology and gaining market traction.

These partnerships not only enhance Kakao's technological capabilities but also solidify its market position by expanding its interconnected digital ecosystem. Such strategic actions are key to unlocking new revenue streams and reinforcing its competitive edge in the rapidly evolving digital landscape.

- Accelerated Market Entry: Partnerships can provide immediate access to established customer bases and distribution channels in new regions, reducing the time and cost associated with organic market development.

- Service Diversification: Acquiring companies with complementary technologies or user bases allows Kakao to quickly add new services, such as advanced AI features or specialized content platforms, to its existing offerings.

- Technological Advancement: Collaborations with leading tech firms, like the reported discussions with AI leaders, are essential for integrating cutting-edge technologies, improving existing services, and developing innovative new products.

- Ecosystem Expansion: Strategic alliances strengthen Kakao's overall ecosystem by creating synergies between different services, encouraging user engagement, and increasing the stickiness of its platform.

Diversification Beyond Core Messaging Platform

Kakao has a significant opportunity to move beyond its core messaging platform and diversify its revenue. While KakaoTalk remains a dominant force, exploring new monetization strategies beyond advertising and transaction fees is crucial for sustained growth. The company can leverage its extensive user data to develop innovative digital services and tap into emerging markets, potentially unlocking substantial future revenue streams.

This strategic shift could involve expanding into areas like AI-driven personalized services, advanced content platforms, or even fintech solutions that complement its existing ecosystem. For instance, as of early 2024, Kakao's diverse business portfolio, including areas like webtoons and music streaming, already demonstrates this diversification trend, contributing to its overall financial resilience.

Key areas for diversification include:

- Expansion into AI and Big Data Services: Capitalizing on its vast user data for personalized offerings and B2B solutions.

- Growth in Content and Entertainment: Further developing its webtoon, music, and gaming businesses, which have shown strong growth trajectories.

- Fintech and Digital Payments Innovation: Building on the success of KakaoPay by introducing new financial products and services.

- Exploring New Digital Verticals: Venturing into promising sectors like e-commerce, mobility, and cloud computing, leveraging its established user base.

Kakao's fintech ventures, particularly Kakao Pay and Kakao Bank, present a significant growth avenue. Kakao Bank's record profit in Q1 2025 highlights strong domestic performance and potential for international expansion into markets like Thailand and Indonesia.

The company is strategically leveraging AI advancements through partnerships, aiming to enhance existing services and launch new AI-driven features like 'Kanana' and 'AI Mate Shopping' to boost user engagement and create novel revenue streams.

Kakao's global digital content and gaming expansion, including Kakao Entertainment's focus on K-pop and webtoons via Piccoma, taps into the growing demand for Korean cultural exports. Kakao Games is set to launch new global titles, capitalizing on the projected $200.7 billion global games market in 2024.

Strategic alliances and acquisitions offer accelerated market entry and service diversification. Collaborations, such as with OpenAI, are crucial for technological advancement and ecosystem expansion, strengthening Kakao's competitive edge.

Threats

Kakao contends with formidable competition from domestic powerhouse Naver, particularly in search and content, while global tech titans like Google and Meta exert pressure across messaging, e-commerce, and burgeoning fintech sectors. This multifaceted competitive environment demands substantial and ongoing investment in research and development to preserve its market standing and user loyalty.

For instance, Google's dominance in search and advertising globally, alongside Meta's expansive social media ecosystem and entry into digital payments, directly challenges Kakao's core business areas. Naver’s robust e-commerce platform and emerging AI initiatives also represent significant competitive hurdles within South Korea.

In 2023, Kakao’s total revenue reached approximately 8 trillion KRW (roughly $6 billion USD), a figure that must be sustained and grown against these well-capitalized rivals. The company's strategy hinges on leveraging its strong domestic user base and expanding into new growth areas to counter these competitive pressures.

The need for continuous innovation is paramount; failing to adapt quickly to evolving user preferences and technological advancements, such as the rapid development in generative AI by competitors, could lead to a gradual erosion of market share and profitability in key segments.

The South Korean government's growing focus on large tech companies presents a significant challenge for Kakao. Increased regulatory oversight, antitrust probes, and the possibility of new laws concerning data privacy, market power, and fair competition could lead to operational limitations, penalties, or necessitate substantial changes to Kakao's business strategies. For instance, South Korea's Fair Trade Commission has been actively investigating platform practices, with potential implications for how Kakao operates its various services.

Macroeconomic uncertainties, including potential global economic downturns, pose a significant threat to Kakao. A slowdown in consumer spending, particularly on discretionary items like digital content and e-commerce, directly impacts Kakao's revenue streams. For instance, if inflation continues to pressure household budgets, consumers might cut back on online shopping and paid digital services, areas where Kakao generates substantial income.

Market volatility and fluctuating investor sentiment can also hinder Kakao's growth prospects. Economic uncertainty often leads to reduced advertising budgets from businesses, a critical revenue source for Kakao's platforms. This could mean lower ad spending on services like KakaoTalk and Daum, impacting profitability. Concerns about a recession in major markets could also make investors wary of tech stocks, potentially affecting Kakao's stock valuation and ability to raise capital.

Cybersecurity Risks and Data Privacy Breaches

Kakao's extensive user base and the sheer volume of personal data it manages across its diverse services, from messaging to financial transactions, expose it to significant cybersecurity risks. A successful breach could erode the hard-won trust of its millions of users, leading to a mass exodus from its platforms.

The financial implications of a data breach are substantial. Beyond direct costs associated with incident response and remediation, Kakao faces potential regulatory fines. For instance, South Korea's Personal Information Protection Act (PIPA) can impose penalties of up to 3% of annual revenue for violations, a figure that would be significant for a company of Kakao's scale. Such an event could also lead to a sharp decline in its stock price, impacting shareholder value.

To mitigate these threats, Kakao must continuously invest in and update its security infrastructure. This includes advanced threat detection systems, regular security audits, and employee training to prevent human error, which is often a weak link in cybersecurity. The company's commitment to data privacy is not just a regulatory obligation but a critical component of its brand reputation and long-term viability.

Key areas of focus for Kakao's cybersecurity strategy in 2024-2025 include:

- Enhancing end-to-end encryption protocols for all communication services.

- Implementing stricter access controls and multi-factor authentication across all platforms.

- Proactively monitoring for and responding to emerging cyber threats, including ransomware and phishing attacks.

- Ensuring compliance with evolving global data privacy regulations, such as GDPR and similar frameworks in Asian markets.

Technological Disruption and Rapid Innovation Cycles

The relentless pace of technological advancement, especially in artificial intelligence, presents a significant challenge for Kakao. Emerging platforms and disruptive innovations can quickly reshape the digital landscape, requiring constant vigilance and adaptation. For instance, advancements in generative AI and its integration into communication and content platforms could create new competitive forces that Kakao must contend with.

Failure to keep pace with these rapid innovation cycles, or a slower adoption rate compared to rivals, risks diminishing Kakao's market position. In 2024, many tech companies are heavily investing in AI research and development; for example, Meta Platforms announced significant AI investments to power its metaverse ambitions, a strategic shift that could impact user engagement across various digital services. This competitive pressure necessitates continuous investment in R&D to maintain relevance and a competitive edge in the fast-evolving digital economy.

Kakao faces intense competition from domestic rival Naver and global tech giants like Google and Meta, particularly in search, content, and burgeoning fintech sectors. This requires significant R&D investment to maintain market share and user loyalty, as evidenced by the need to counter Google's global search dominance and Meta's expansive social media ecosystem. Kakao's 2023 revenue of approximately 8 trillion KRW (around $6 billion USD) must grow against these well-funded competitors.

SWOT Analysis Data Sources

This Kakao SWOT analysis is built upon a foundation of credible data, including their latest financial filings, comprehensive market research reports, and expert industry analysis. These sources provide the necessary insights into Kakao's operational performance, competitive landscape, and future growth prospects.