Kakao PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kakao Bundle

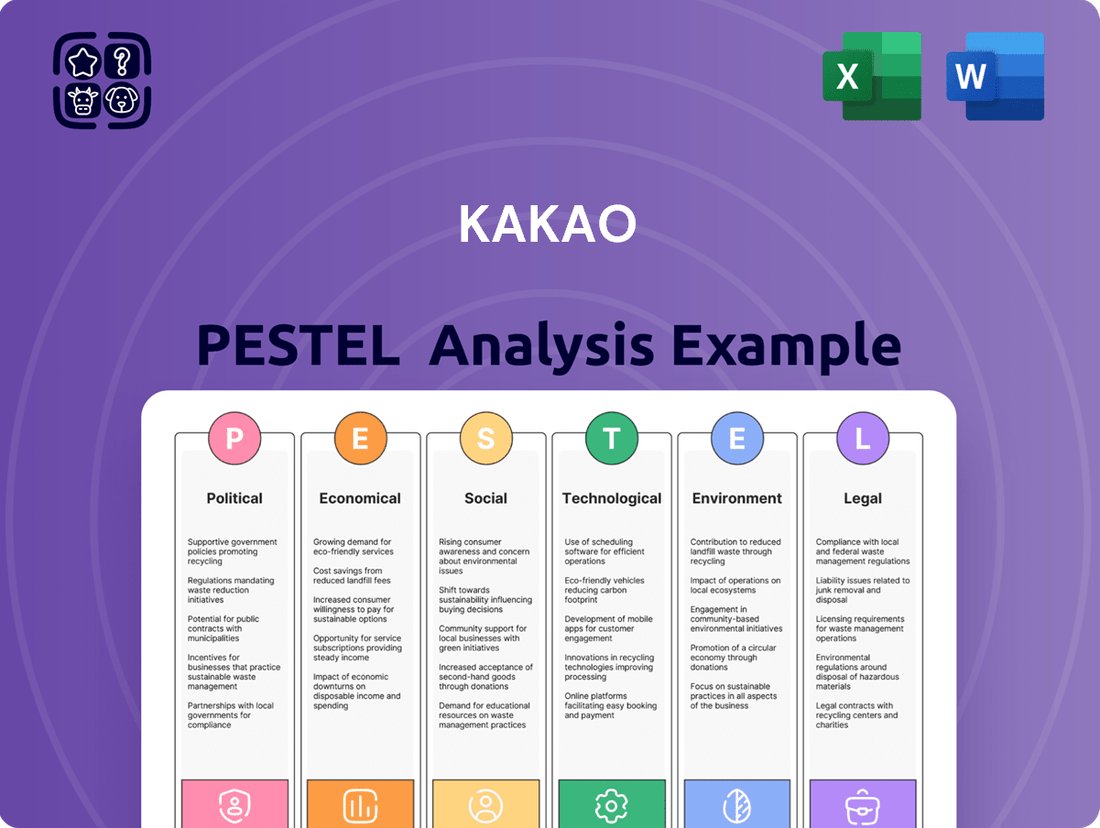

Navigate the dynamic landscape surrounding Kakao with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are pivotal to its success. This expert-crafted report offers a crucial lens through which to view Kakao's strategic positioning and future growth opportunities.

Gain a competitive advantage by leveraging these deep-dive insights. Discover how evolving market conditions and regulatory shifts can be transformed into actionable strategies for your business. Equip yourself with the knowledge to anticipate challenges and capitalize on emerging trends.

Don't let external forces dictate your market approach. Our PESTLE analysis provides the clarity and foresight needed to make informed decisions, whether you're an investor, strategist, or business planner. Download the full, ready-to-use analysis now and unlock Kakao's external environment.

Political factors

The South Korean government is actively scrutinizing major tech platforms, including Kakao, due to growing concerns about monopolistic practices and their impact on fair market competition. This regulatory trend, evident in recent policy discussions and legislative proposals throughout 2024 and into 2025, could significantly influence Kakao's business operations.

These governmental actions, driven by a desire to foster a more equitable digital economy, directly affect Kakao's strategic decisions concerning service diversification, potential mergers, and acquisitions. For instance, the Korea Fair Trade Commission (KFTC) has been particularly vigilant, investigating several platform companies for alleged dominance abuse.

The political landscape in South Korea, with a strong emphasis on consumer protection and small business support, shapes the intensity of this oversight. This political inclination creates an environment where Kakao must navigate stricter compliance requirements, potentially limiting its growth avenues and affecting its overall profitability in the coming years.

Specifically, regulations are being considered and implemented to prevent anti-competitive behaviors, such as prioritizing Kakao's own services within its ecosystem or leveraging user data unfairly against smaller competitors. The goal is to ensure a level playing field for all participants in South Korea's rapidly evolving digital marketplace.

South Korea's Personal Information Protection Commission (PIPC) mandates strict data privacy rules, directly impacting Kakao's data handling practices. This compliance necessitates substantial investment in cybersecurity, estimated to grow as threats evolve.

Adherence to these evolving standards increases operational expenditures for Kakao, as robust data governance becomes paramount. Failure to comply can result in significant fines and damage to Kakao's public image.

The South Korean government continually updates these policies to counter emerging technological threats and address public concerns over data security.

The South Korean government's commitment to digital transformation is a significant tailwind for Kakao. Initiatives like the Digital New Deal, launched in 2020 with a significant budget allocation, aim to foster growth in AI, big data, and smart infrastructure, areas where Kakao has strong existing operations and future ambitions. This governmental push can translate into direct benefits for Kakao through increased R&D funding opportunities and preferential policies designed to accelerate innovation.

Specific government support for sectors like fintech and smart city development directly aligns with Kakao's strategic priorities. For instance, government backing for digital payment infrastructure and the expansion of smart city projects can create fertile ground for Kakao Pay and its urban tech ventures. Such support often includes grants and tax incentives, as seen in the 2024 budget which continued to prioritize technological advancement and digital economy growth.

While government support is beneficial, it often comes with expectations of public good and collaboration. Kakao may find itself navigating requirements for data sharing, contributing to public service platforms, or adhering to specific ethical guidelines in AI development. This dynamic shapes Kakao's strategic direction, encouraging a balance between commercial objectives and societal contributions, a common theme in government-industry partnerships in 2024 and beyond.

Geopolitical Tensions and Regional Stability

Geopolitical tensions in Northeast Asia can indirectly affect Kakao, a major South Korean tech firm. For instance, ongoing trade disputes between South Korea and Japan, or broader regional instability, could disrupt hardware supply chains vital for its services. Investor sentiment toward South Korean companies can also fluctuate based on perceived regional risks, potentially impacting Kakao's valuation or access to capital markets.

While Kakao's core business is domestic, its international ambitions are susceptible to political headwinds. Any expansion into markets with complex political relationships, or partnerships with entities in geopolitically sensitive regions, could face regulatory scrutiny or outright barriers. For example, navigating data localization laws in various countries often involves understanding their political climate.

Stable regional relations are a significant tailwind for the technology sector. In 2023, South Korea's export growth saw fluctuations partly linked to global economic conditions and geopolitical events, impacting the broader tech ecosystem. Kakao, benefiting from a stable domestic environment, has seen its revenue grow, with its platform services contributing significantly.

- Regional Stability: Geopolitical stability in Northeast Asia is crucial for South Korean tech companies like Kakao, influencing investor confidence and operational continuity.

- Supply Chain Risks: Tensions can disrupt the supply of essential hardware components, potentially impacting Kakao's infrastructure and service delivery.

- Market Access: Kakao's international expansion strategies may encounter political hurdles or require careful navigation of cross-border regulations influenced by regional diplomacy.

- Investor Sentiment: Perceived geopolitical risks can lead to volatility in stock markets, indirectly affecting Kakao's market capitalization and investment appeal.

Consumer Protection and Platform Accountability

Governments worldwide are increasingly scrutinizing large tech platforms, including Kakao, to bolster consumer protection and enforce greater accountability for content and transactions. This trend is evident in ongoing discussions and legislative proposals aimed at regulating digital services. For instance, in South Korea, the Korea Communications Commission (KCC) has been actively involved in discussions around platform intermediary responsibility, particularly concerning the handling of illegal content and fair dispute resolution processes. These initiatives reflect a broader political push to ensure user safety and fair market practices within the digital ecosystem.

These evolving political pressures translate into tangible operational requirements for Kakao. New regulations could mandate enhanced dispute resolution mechanisms, stricter protocols for identifying and mitigating fraudulent activities, and more robust content moderation policies across its diverse services, such as KakaoTalk and its e-commerce platforms. Meeting these demands necessitates significant investment in advanced monitoring systems, AI-driven content analysis, and expanded customer support infrastructure. Kakao's proactive engagement with these regulatory trends is crucial for maintaining user trust and operational continuity.

The government's stance on platform responsibility directly shapes Kakao's operational guidelines and strategic direction. For example, the Digital Services Act in the European Union, which came into effect in late 2022 and is being implemented through 2024, sets a precedent for how major platforms must manage risks, including those related to illegal content and systemic risks. While not directly applicable to Kakao's primary markets, the principles and precedents set by such legislation influence global regulatory thinking and could inform future policies in regions where Kakao operates. This regulatory landscape requires Kakao to maintain flexibility and adapt its business practices to comply with diverse and evolving legal frameworks, impacting its user experience and overall efficiency.

- Growing Regulatory Scrutiny: Political bodies are intensifying focus on tech platforms to safeguard consumers.

- Mandated Content Moderation: Platforms face pressure to improve handling of harmful or illegal content.

- Dispute Resolution Emphasis: Governments are pushing for fairer and more efficient ways to resolve user disputes.

- Investment in Compliance: Meeting new regulations requires substantial investment in technology and personnel.

The South Korean government's proactive stance on regulating digital platforms significantly shapes Kakao's operational landscape. Initiatives like the Digital New Deal, with substantial 2024 budget allocations for AI and big data, directly benefit Kakao's innovation. However, increased scrutiny over monopolistic practices and data privacy, driven by bodies like the KFTC and PIPC, necessitates significant compliance investments, impacting strategic growth and operational costs.

What is included in the product

This Kakao PESTLE analysis delves into the external macro-environmental factors impacting the company, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by highlighting key opportunities and potential threats derived from these dynamic external forces.

A clean, summarized Kakao PESTLE analysis provides easy referencing during meetings, quickly highlighting external factors impacting the business and relieving the pain of information overload.

Economic factors

Kakao's business, deeply connected to advertising, e-commerce, and transaction fees, thrives on South Korea's economic vitality and consumer spending habits. When the economy is strong and people have more money to spend, they tend to use Kakao's services more, from online shopping to digital content, which directly benefits Kakao's revenue. In 2023, South Korea's GDP growth was projected around 1.4%, indicating a moderating but still positive economic environment that supports Kakao's core revenue drivers. Conversely, any economic slowdown or recession would likely see companies cutting advertising and consumers reducing their spending, directly hurting Kakao's financial results.

Rising inflation in South Korea, with consumer prices increasing by 3.4% year-on-year in May 2024, directly impacts Kakao's operational expenses. This could mean higher costs for cloud infrastructure, employee salaries in a competitive tech market, and increased advertising spend, all of which can compress profit margins.

Interest rate fluctuations present a dual challenge for Kakao. If the Bank of Korea raises its benchmark rate, as it has done multiple times to combat inflation, Kakao's borrowing costs for new ventures or technology development will rise. For instance, a 0.25% rate hike can add millions to debt servicing.

Furthermore, elevated interest rates can diminish consumer purchasing power. In 2024, as interest rates remained relatively high, individuals might cut back on discretionary spending, potentially affecting Kakao's revenue from services like webtoons, music streaming, and its e-commerce platforms.

These macroeconomic pressures necessitate careful financial planning for Kakao. Management must balance the need for investment in growth areas against the increased cost of capital and potential shifts in consumer demand influenced by inflation and interest rate policies.

Kakao contends with formidable competition from both South Korean rivals like Naver and international tech titans such as Google, Meta, and Netflix. This intense rivalry spans across Kakao's diverse service offerings, from messaging and search to content streaming and cloud services.

The need to stay ahead in this dynamic market compels Kakao to pour substantial resources into research and development and maintain competitive pricing strategies. For instance, in 2023, Kakao's R&D expenses represented a significant portion of its operating costs, as it sought to bolster its AI capabilities and expand its platform services to counter encroaching competitors.

This constant pressure to innovate and maintain market share requires significant financial investment and a highly adaptable strategic approach. Failing to do so could lead to erosion of its user base and reduced profitability, especially in increasingly saturated market segments where differentiation is paramount.

Digital Advertising Market Trends

Kakao's advertising revenue is closely tied to the health of the digital advertising market. In 2023, global digital ad spending was projected to reach over $600 billion, highlighting the market's significant scale. However, economic uncertainties can lead businesses to cut ad budgets, directly impacting companies like Kakao that rely on this revenue stream. For instance, during economic downturns, advertisers often become more selective, favoring performance-based campaigns, which puts pressure on platforms to demonstrate clear ROI.

The adoption of new advertising technologies and targeting methods is also a key economic factor. As consumers become more privacy-conscious, there's a growing demand for privacy-preserving ad solutions. Kakao must continually innovate its ad platforms to meet these evolving advertiser needs and maintain its competitive edge. The effectiveness of its ad solutions, measured by metrics like click-through rates and conversion rates, is crucial for attracting and retaining advertisers.

Competition for ad dollars remains fierce across the digital landscape. Emerging platforms and evolving consumer attention spans mean Kakao faces constant pressure to optimize its offerings.

- Market Volatility: Global digital ad spending growth is sensitive to economic cycles, potentially impacting Kakao's advertising income. Projections for 2024 suggest continued, albeit potentially moderated, growth in the digital ad market, with a strong emphasis on AI-driven personalization.

- Technological Shifts: The phasing out of third-party cookies and the rise of AI in ad targeting necessitate continuous platform upgrades for Kakao to remain effective and compliant.

- Advertiser Demand: Businesses are increasingly demanding measurable results and efficient ad spend, pushing platforms to demonstrate clear ROI on campaigns.

- Platform Optimization: Kakao's ability to enhance user experience and ad relevance directly influences advertiser satisfaction and revenue generation.

Fintech Adoption and E-commerce Growth Rates

Kakao's significant presence in fintech and e-commerce hinges on South Korea's rapid adoption of digital payments and online shopping. The company's platforms like Kakao Pay and Kakao Bank directly benefit from this trend, as increased transaction volumes translate into higher fee-based revenues. For instance, South Korea's e-commerce market was projected to reach approximately $217 billion in 2024, a substantial portion of which is facilitated by digital payments.

The sustained consumer shift towards mobile transactions and online purchasing is a critical driver for Kakao's revenue streams. As more users embrace these digital channels, Kakao's fintech and e-commerce segments see a direct uplift in transaction volumes and associated fees. This trend is further underscored by the fact that mobile commerce accounted for over 70% of total e-commerce sales in South Korea in recent years.

However, potential market saturation or a deceleration in these adoption rates could pose a challenge to future growth. The economic climate that fosters and supports digital transactions is therefore paramount for Kakao's continued expansion in both its fintech and commerce operations. A robust digital economy ensures a fertile ground for these services to thrive and capture further market share.

- South Korea's e-commerce market value in 2024: ~$217 billion

- Mobile commerce share in South Korea: >70% of total e-commerce sales

- Kakao Pay's transaction volume growth: Consistently high due to increasing digital payment adoption

- Kakao Bank's customer base expansion: Fueled by the convenience of mobile banking services

Kakao's revenue streams, heavily reliant on advertising and e-commerce, are directly influenced by South Korea's economic health and consumer spending. A strong economy with robust consumer confidence benefits Kakao by increasing ad budgets and transaction volumes on its platforms. Conversely, economic downturns can lead to reduced spending and advertising cuts, impacting Kakao's top line.

Inflationary pressures, with South Korea's consumer prices rising 2.7% year-on-year in April 2024, increase Kakao's operating costs for infrastructure and talent, potentially squeezing profit margins. Interest rate hikes, like the Bank of Korea's sustained efforts to control inflation, also raise Kakao's borrowing costs for expansion and development, while simultaneously dampening consumer purchasing power for discretionary services.

The digital advertising market is a key economic driver for Kakao, with global spending projected to exceed $600 billion in 2023. However, economic uncertainties can cause businesses to reduce ad budgets, making performance-based campaigns more critical. Kakao must continuously adapt its advertising technology and targeting methods to meet evolving advertiser demands and privacy concerns, ensuring measurable ROI for its clients.

South Korea's digital economy, particularly its e-commerce market valued at approximately $217 billion in 2024, fuels Kakao's fintech and e-commerce segments. The strong consumer shift towards mobile transactions, where mobile commerce constitutes over 70% of sales, directly boosts Kakao Pay and Kakao Bank's transaction volumes and revenue. Continued growth in these areas is contingent on a supportive economic environment for digital adoption.

What You See Is What You Get

Kakao PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Kakao PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a deep understanding of the external forces shaping Kakao's strategic landscape.

Sociological factors

South Korea's smartphone penetration rate is exceptionally high, reaching an estimated 95% by the end of 2023, according to various market research reports. This near-universal adoption, coupled with strong digital literacy, means Kakao's core services, like KakaoTalk, have an enormous and readily accessible user base. This societal predisposition towards digital engagement directly fuels the rapid adoption of new features and services within Kakao's ecosystem.

The pervasive comfort with technology in South Korea, demonstrated by high engagement across various digital platforms, is a significant sociological advantage for Kakao. This environment allows Kakao to confidently introduce and scale innovative digital offerings, from fintech solutions to content platforms, knowing a substantial portion of the population is digitally adept and receptive to such advancements.

Societal shifts are dramatically altering how people consume entertainment, with a significant rise in webtoons, streaming video, and online gaming. This directly impacts Kakao's digital content divisions, requiring constant evolution of their offerings to keep users engaged and maintain subscription income. For instance, the global webtoon market was projected to reach $63.1 billion by 2027, indicating a strong consumer appetite for this format.

Kakao's success hinges on its ability to continuously adapt its content portfolio to these changing user demands. By understanding prevailing cultural trends and strategically investing in popular content genres, Kakao can effectively attract and retain its user base. Their 2024 financial reports, for example, will likely show increased revenue from services that align with these evolving tastes, demonstrating the importance of this adaptability.

South Korea's demographic shift towards an older population, with the proportion of those aged 65 and over projected to reach 25.7% by 2025, presents a significant sociological factor for Kakao. This aging trend necessitates a focus on digital inclusion, ensuring that older adults can effectively utilize Kakao's services.

While a smaller youth cohort might temper traditional user acquisition, the expanding senior demographic represents a substantial, yet often underserved, market. Kakao could capitalize on this by innovating user interfaces and developing services specifically designed for the elderly, potentially boosting engagement and revenue streams.

The challenge of bridging the digital divide among age groups is not just a business opportunity but a societal responsibility. By prioritizing accessibility and ease of use for older users, Kakao can enhance its brand image and ensure its continued relevance in a rapidly evolving digital landscape.

Social Perception and Trust in Large Tech Platforms

Public trust in large tech companies like Kakao is a critical factor influencing its brand image and user loyalty. Negative sentiment can arise from concerns about data privacy, market dominance, or the company's social responsibility, impacting user acquisition and retention.

Maintaining a positive public image requires Kakao to actively manage its public relations and showcase its dedication to ethical practices and societal contributions. Societal trust acts as a vital, albeit intangible, asset for platform-based businesses, directly influencing their long-term viability and growth potential.

For instance, in 2023, a significant portion of South Korean internet users expressed concerns regarding the personal data handling practices of major tech platforms, with surveys indicating a growing demand for greater transparency and stronger data protection measures. This sentiment directly impacts user willingness to share information and engage with services.

- Data Privacy Concerns: A 2024 report by the Korea Internet & Security Agency (KISA) highlighted that over 60% of internet users are concerned about how their personal data is collected and used by large online platforms.

- Market Dominance Perception: Public discourse in late 2023 and early 2024 frequently debated Kakao's significant market share in areas like messaging and payments, with some consumers and small businesses raising questions about fair competition.

- Social Responsibility Initiatives: Kakao's investment in areas like AI ethics and digital inclusion programs, announced in its 2024 sustainability reports, aims to build positive public perception and demonstrate commitment beyond core business operations.

- User Loyalty Metrics: While specific figures fluctuate, studies in early 2024 indicated a correlation between perceived trustworthiness and continued engagement with Kakao's services, suggesting that trust is a tangible driver of user retention.

Work-Life Balance Trends and Digital Service Consumption

Societal shifts towards prioritizing work-life balance are profoundly impacting how people consume digital services. As individuals seek to reclaim leisure time, there's a growing appetite for convenient, on-demand solutions that simplify daily tasks and enhance relaxation. This trend is particularly evident in the increased usage of services like mobility and food delivery, which offer immediate gratification and reduce personal effort. For instance, the Korean food delivery market saw significant growth, with transactions reaching an estimated 26 trillion Korean won (approximately $19 billion USD) in 2023, highlighting a strong consumer preference for convenience.

Kakao's integrated platform is strategically positioned to benefit from these evolving lifestyle preferences. By offering a diverse range of services that span essential daily needs, from communication and finance to mobility and entertainment, Kakao can effectively cater to consumers looking to maximize their downtime. The platform's ability to seamlessly connect users with various services that support both productivity and leisure makes it a central hub for modern Korean life. This is reflected in Kakao's continued user engagement across its ecosystem, with its flagship KakaoTalk app remaining a dominant communication tool.

Understanding the nuanced ways Koreans allocate their time outside of traditional work hours is crucial for Kakao's continued innovation and service development. The demand for digital entertainment, such as streaming services and online gaming, often surges during evenings and weekends, presenting opportunities for content expansion and personalized recommendations. As of late 2024, South Korea's digital content market, including webtoons and music streaming, continues its upward trajectory, indicating a strong consumer willingness to spend on leisure-related digital goods and services.

- Increased Demand for Convenience: Evolving work-life balance trends drive higher consumption of on-demand services like mobility and food delivery.

- Kakao's Platform Advantage: The integrated nature of Kakao's services aligns well with consumer desires for convenience and efficiency in daily life.

- Leisure Time Utilization: Digital entertainment services are expected to see continued growth as people dedicate more time to leisure activities.

- Data-Driven Strategy: Analyzing how Koreans spend their free time is vital for Kakao to tailor and develop new offerings.

South Korea's high smartphone penetration, nearing 95% in 2023, combined with strong digital literacy, provides Kakao with a vast and receptive user base for its services. This societal comfort with technology enables Kakao to successfully introduce and scale innovative digital offerings, from fintech to content platforms, as a significant portion of the population is digitally adept and open to advancements.

Societal preferences are shifting towards digital content like webtoons and streaming, with the global webtoon market projected to hit $63.1 billion by 2027, directly impacting Kakao's content divisions. Kakao's ability to adapt its portfolio to these evolving tastes, as reflected in potential revenue growth from aligned services in its 2024 reports, is crucial for user retention.

South Korea's aging population, with those over 65 expected to be 25.7% by 2025, presents a need for Kakao to focus on digital inclusion. This demographic offers an underserved market opportunity for services tailored to seniors, enhancing brand image and relevance.

Public trust is paramount for Kakao, with 2023 surveys indicating over 60% of users concerned about data privacy on large platforms, as reported by KISA. Kakao's 2024 sustainability reports, detailing investments in AI ethics and digital inclusion, aim to foster positive public perception and trust.

Technological factors

The rapid evolution of artificial intelligence (AI) and machine learning (ML) is a significant technological factor for Kakao. These advancements enable Kakao to significantly improve its services, from offering highly personalized content recommendations within its messaging and content platforms to powering intelligent chatbots for customer support. For instance, KakaoPay's use of AI for fraud detection in financial transactions is crucial for user trust and security.

Leveraging AI and ML allows Kakao to refine its advertising targeting, leading to more effective campaigns and increased revenue. This technology also drives operational efficiencies across Kakao's diverse business units, from optimizing logistics in e-commerce to enhancing search functionalities. Kakao's commitment to AI research and development is paramount for staying ahead in a competitive market.

Kakao's investment in AI is evident in its ongoing development of proprietary AI models and its partnerships with leading AI research institutions. For example, Kakao Brain, the company's AI research arm, has been instrumental in developing advanced natural language processing and computer vision technologies. In 2023, Kakao continued to invest heavily in AI infrastructure and talent acquisition, recognizing AI as a foundational element for future innovation and service differentiation.

South Korea's 5G network expansion is a significant technological driver for Kakao. By late 2024, over 60% of mobile subscriptions in South Korea were expected to be 5G, a testament to the rapid rollout and consumer adoption. This widespread deployment directly benefits Kakao's mobile-first strategy, allowing for faster data speeds and lower latency, which are crucial for its diverse range of services.

The enhanced capabilities of 5G networks, offering up to 20 times faster speeds than 4G, unlock new possibilities for Kakao. Services like Kakao TV, which relies heavily on video streaming, and potential ventures into cloud gaming or augmented reality experiences, are significantly bolstered by this technological leap. This improved connectivity allows for richer multimedia content and more seamless, immersive user interactions, further integrating Kakao into the daily lives of its users.

Blockchain technology and the surge in digital assets like cryptocurrencies and NFTs present a dual-edged sword for Kakao. This innovation offers potential avenues for enhancing security in transactions and creating verifiable digital ownership, especially within Kakao's fintech and content platforms. For instance, Kakao Pay could leverage blockchain for more secure and transparent payment processing.

Exploring decentralized technologies could unlock new revenue streams and bolster user trust. Imagine Kakao's digital content services offering NFTs, providing creators with new monetization models and fans with provable ownership of digital goods. This move could differentiate Kakao in a competitive digital landscape, potentially attracting a new user base interested in these emerging asset classes.

The global cryptocurrency market capitalization, while volatile, reached approximately $2.5 trillion in early 2024, indicating significant user adoption and investment interest. Similarly, the NFT market, though experiencing fluctuations, saw billions in sales in 2023, demonstrating continued engagement with digital collectibles and ownership. Kakao's strategic engagement with these technologies could tap into these growing markets.

Cloud Computing Infrastructure and Scalability

Kakao's operational backbone relies significantly on cloud computing infrastructure to manage its extensive service portfolio and substantial user base. This allows for seamless scaling to accommodate massive traffic spikes, particularly during peak usage periods. For instance, during major events or popular content releases, efficient cloud solutions are critical for maintaining service stability.

The company's ability to rapidly deploy new features and updates is directly tied to the agility of its cloud environment. This scalability is not just about handling more users, but also about enabling faster innovation across Kakao's diverse business units, from messaging to fintech and content. Investment in secure and flexible cloud infrastructure is therefore a strategic imperative for continued growth and operational resilience.

In 2023, Kakao continued to invest in its cloud capabilities, with a focus on enhancing both performance and security. While specific figures for cloud infrastructure spending are often integrated within broader IT budgets, the company's consistent expansion of services like Kakao Pay and Kakao Entertainment underscores the increasing demand for robust, scalable cloud resources. This ensures high availability and optimal performance across millions of daily active users.

Leveraging advanced cloud technologies is essential for Kakao's operational efficiency and service reliability. This includes adopting solutions that support data analytics, artificial intelligence, and machine learning, which are fundamental to personalizing user experiences and optimizing business operations. The ongoing evolution of cloud computing directly impacts Kakao's capacity to innovate and maintain its competitive edge in the digital landscape.

Emergence of New Computing Platforms and Devices

The evolution of computing platforms, like the metaverse and augmented reality (AR), presents significant future avenues for Kakao. By adapting its extensive service ecosystem to these nascent environments, Kakao can tap into novel user engagement strategies and revenue streams, moving beyond its current mobile-centric model. Global AR/VR market revenue is projected to reach $57.7 billion in 2024, with significant growth anticipated, highlighting the potential for platforms like Kakao to integrate immersive experiences.

Smart home devices are also rapidly expanding, creating opportunities for Kakao's services to become integral to daily life through connected ecosystems. The smart home market is expected to grow substantially, with estimates suggesting continued double-digit growth through 2025. This expansion necessitates Kakao's proactive engagement to ensure its services remain relevant and accessible across a widening array of connected devices.

Kakao’s long-term viability and diversification hinge on its ability to monitor and invest in these next-generation technologies. Strategic integration into emerging platforms is not merely about keeping pace but about capturing future market share and defining new service paradigms.

Key technological factors to consider for Kakao include:

- Metaverse Integration: Exploring opportunities to offer communication, social networking, and commerce within virtual worlds.

- Augmented Reality (AR) Applications: Developing AR features for existing services like mapping, shopping, or interactive content.

- Smart Home Ecosystems: Enabling Kakao services to control and interact with smart home devices, enhancing user convenience.

- Next-Generation Devices: Ensuring compatibility and developing new user experiences for wearable technology and other emerging hardware.

The technological landscape is rapidly evolving, directly impacting Kakao's strategic direction and service offerings. Advancements in artificial intelligence (AI) and machine learning (ML) are fundamental, enhancing personalization and operational efficiency across Kakao's platforms. South Korea's widespread 5G network adoption, projected to exceed 60% of mobile subscriptions by late 2024, significantly boosts Kakao's mobile-first services, enabling faster speeds for streaming and richer user experiences.

Emerging technologies like blockchain and the metaverse present both opportunities and challenges. Blockchain could enhance transaction security and create new monetization models through NFTs, tapping into markets that saw billions in sales in 2023. Kakao's investment in cloud computing is crucial for scalability and innovation, supporting millions of daily active users and ensuring service reliability.

The company's future growth is closely tied to its ability to integrate with next-generation computing platforms such as the metaverse and augmented reality (AR), with the global AR/VR market revenue estimated at $57.7 billion for 2024. Furthermore, the expanding smart home market offers opportunities for Kakao services to become integral to connected ecosystems, continuing its double-digit growth trajectory through 2025.

Key technological factors for Kakao include:

| Technology | Impact on Kakao | 2024/2025 Data/Projections |

| AI/ML | Enhanced personalization, fraud detection, advertising efficiency | Kakao Brain actively developing advanced NLP and computer vision models. |

| 5G Networks | Faster data speeds, lower latency for streaming, AR/VR | Over 60% of South Korean mobile subscriptions expected to be 5G by late 2024. |

| Blockchain/NFTs | Secure transactions, new monetization models, digital ownership | NFT market saw billions in sales in 2023; crypto market cap ~ $2.5 trillion in early 2024. |

| Cloud Computing | Scalability, service reliability, data analytics enablement | Continued investment in cloud infrastructure to support millions of daily active users. |

| Metaverse/AR | New user engagement, revenue streams, immersive experiences | Global AR/VR market revenue projected at $57.7 billion for 2024. |

Legal factors

Kakao, as a major platform in South Korea, faces significant scrutiny under antitrust and fair trade laws, overseen by the Korea Fair Trade Commission (KFTC). The KFTC actively monitors Kakao's market dominance, its pricing mechanisms, and how it handles user data, especially in relation to smaller businesses that rely on its services.

In 2023, the KFTC continued to investigate several of Kakao's business practices, including concerns about preferential treatment for its own services and potential abuses of its dominant position in areas like messaging and content distribution. For instance, investigations into Kakao Mobility's practices in 2022 led to a substantial fine, highlighting the commission's assertive stance.

Failure to adhere to these regulations can lead to severe penalties, including hefty fines and mandated adjustments to its operational strategies and business model. For example, the company has faced directives to offer more open access to its platform for third-party services. This means Kakao must remain vigilant and ensure ongoing compliance to avoid disruptions to its growth and strategic initiatives.

The Personal Information Protection Act (PIPA) in South Korea dictates strict rules for handling personal data, impacting Kakao's operations significantly. This includes securing user information, getting clear consent for data usage, and following rules on where data can be stored and moved.

Violations of PIPA can result in substantial penalties for Kakao, such as considerable fines and even criminal repercussions. Beyond financial and legal consequences, non-compliance can also severely damage the company's reputation. For instance, in 2023, South Korea's Personal Information Protection Commission (PIPC) issued fines totaling billions of Korean Won for various data protection breaches across industries, highlighting the seriousness of these regulations.

Given Kakao's reliance on user data for its diverse services, from messaging to finance, PIPA compliance is a non-negotiable legal requirement. Ensuring robust data security and transparent data handling practices is paramount to maintaining user trust and avoiding legal entanglements in its data-intensive business model.

Kakao's fintech arms, Kakao Pay and Kakao Bank, navigate a dense regulatory landscape governed by South Korea's Financial Services Commission (FSC) and Financial Supervisory Service (FSS). These bodies enforce stringent rules on everything from capital adequacy and anti-money laundering protocols to robust consumer protection and cybersecurity measures for all financial dealings.

Compliance isn't a one-time task; it demands constant vigilance and adaptation to the dynamic financial sector's evolving rules. For instance, in 2023, the FSC announced plans to strengthen consumer protection in the digital finance sector, impacting how platforms like Kakao Pay handle user data and transactions.

Securing and maintaining regulatory approvals are paramount for the continued legitimacy and operational capacity of Kakao's financial services. Failure to comply can lead to significant penalties and operational disruptions, impacting user trust and market position.

Content Moderation and Copyright Laws

Kakao's extensive digital content services, like its popular webtoon platform and online gaming ventures, operate under strict content moderation guidelines and copyright laws.

The company bears legal responsibility for actively preventing the distribution of illegal, harmful, or pirated copyrighted material across its platforms.

This necessitates substantial investment in advanced content filtering technologies and robust legal departments to manage intellectual property infringements and user-generated content challenges. For instance, in 2023, global spending on digital content creation tools and services was estimated to be in the hundreds of billions of dollars, highlighting the scale of this operational requirement.

Failure to comply with these regulations can result in costly legal battles, significant fines, and severe damage to Kakao's brand reputation, making adherence to content laws a critical factor for its digital media success.

- Legal Responsibility: Kakao must actively police its platforms for illegal or infringing content.

- Technology Investment: Significant resources are allocated to content filtering and moderation technologies.

- Legal Expertise: Dedicated legal teams are essential to navigate copyright and user-generated content issues.

- Consequences of Non-Compliance: Fines, lawsuits, and reputational damage are potential outcomes of regulatory breaches.

Labor Laws for Platform Workers

South Korea is actively considering new labor laws for platform workers, a significant factor for Kakao Mobility's ride-hailing services and its delivery operations. This evolving legal landscape could impose new requirements on employment status, minimum wages, and benefits for its vast workforce.

The potential for reclassifying platform workers from independent contractors to employees could substantially increase Kakao's operational expenses. For instance, South Korea's minimum wage for 2024 is 9,860 KRW per hour, and any mandates for benefits like health insurance or paid leave would add considerable cost.

- Regulatory Uncertainty: The lack of definitive legal status for platform workers creates ongoing uncertainty for companies like Kakao.

- Increased Labor Costs: Mandated benefits and minimum wage adjustments could raise operating costs for Kakao's mobility and delivery segments.

- Contractual Revisions: Kakao may need to revise its agreements with drivers and delivery personnel to comply with new labor regulations.

- Impact on Business Model: Changes in labor laws could necessitate adjustments to Kakao's core business model, potentially affecting pricing and service availability.

Adapting to these developing labor laws is critical for Kakao to maintain the sustainability and competitiveness of its platform-based services in the dynamic South Korean market.

Kakao operates under a robust legal framework in South Korea, primarily influenced by antitrust laws enforced by the Korea Fair Trade Commission (KFTC). The KFTC scrutinizes Kakao's market dominance, particularly concerning fair competition and potential abuses of power. For instance, investigations into Kakao Mobility's practices in 2022 resulted in a significant fine, underscoring the regulatory body's active oversight.

Data privacy is another critical legal domain, governed by South Korea's Personal Information Protection Act (PIPA). Kakao must adhere to strict rules for collecting, storing, and utilizing user data, with violations leading to substantial penalties and reputational damage. In 2023, South Korea's Personal Information Protection Commission (PIPC) issued billions of Korean Won in fines for data breaches, highlighting the severity of PIPA compliance.

Kakao's financial technology services are regulated by the Financial Services Commission (FSC) and Financial Supervisory Service (FSS), demanding strict adherence to capital adequacy, anti-money laundering, and consumer protection standards. The FSC's 2023 focus on strengthening digital finance consumer protection directly impacts how Kakao Pay and Kakao Bank manage transactions and data.

Furthermore, Kakao's digital content platforms must comply with copyright laws and content moderation guidelines, requiring investments in technology to prevent piracy and illegal material distribution. The global digital content market, valued in the hundreds of billions of dollars in 2023, illustrates the scale of these operational and legal responsibilities.

The evolving labor laws concerning platform workers also present a significant legal challenge, potentially increasing operational costs for Kakao Mobility and delivery services. With South Korea's minimum wage at 9,860 KRW per hour in 2024, any reclassification of workers could lead to substantial increases in labor expenses.

Environmental factors

Kakao faces growing demands for robust Corporate Social Responsibility (CSR) and transparent Environmental, Social, and Governance (ESG) reporting from investors, consumers, and regulators. In 2024, for instance, South Korean financial authorities have been emphasizing stricter ESG disclosure requirements for listed companies, pushing entities like Kakao to provide clearer data on their sustainability efforts. This includes detailing progress on reducing their carbon footprint, ensuring ethical practices throughout their supply chains, and quantifying their social impact.

Proactive involvement in CSR and clear ESG disclosures are crucial for Kakao. Such initiatives are vital for bolstering brand reputation, attracting a rising tide of socially conscious investors, and proactively managing potential regulatory risks. For example, many global asset managers, managing trillions of dollars, have publicly stated their intention to prioritize ESG factors in their investment decisions throughout 2024 and into 2025.

ESG performance is increasingly recognized as a critical metric for evaluating a company's overall health and long-term viability by all stakeholders. Companies demonstrating strong ESG credentials, such as those with clear targets for renewable energy adoption or significant investments in community development programs, are often viewed more favorably. By 2025, the expectation is that ESG metrics will be as fundamental to company valuation as traditional financial metrics.

Kakao's vast digital operations, from KakaoTalk to its cloud services, rely on a substantial energy footprint primarily from its data centers. This extensive energy consumption is under increasing scrutiny as environmental consciousness grows. For instance, the global data center industry's energy demand is projected to rise significantly, potentially reaching 6% of total global electricity consumption by 2025, highlighting the scale of this issue.

In response to mounting environmental concerns and stricter regulations, Kakao is compelled to invest in more energy-efficient data center technologies and transition towards renewable energy sources. This strategic shift is not just about compliance; it's about actively reducing their carbon emissions. Many leading tech companies, like Google and Microsoft, have already committed to 100% renewable energy for their data centers, setting a benchmark for the industry.

Effectively managing and reducing energy consumption is crucial for Kakao to achieve its environmental sustainability goals and uphold a positive corporate image. As sustainable data management becomes a more pressing environmental requirement, proactive measures in energy efficiency are paramount for long-term operational viability and public trust.

While Kakao is a digital-first company, its operational footprint still touches upon electronic waste. The devices employees use, from smartphones to laptops, and the infrastructure supporting its vast digital services, all eventually contribute to the growing e-waste problem. In 2024, global e-waste generation reached an estimated 62 million metric tons, a significant increase from previous years, highlighting the urgency of effective management strategies.

There's a discernible global shift towards embracing circular economy principles, which emphasize reducing waste and keeping resources in use for as long as possible. This movement puts pressure on all businesses, including tech giants like Kakao, to consider their role in responsible electronics disposal and recycling. For instance, the European Union's Ecodesign Directive is pushing for products to be more durable, repairable, and recyclable, setting a precedent that could influence global practices.

Kakao may find itself increasingly expected to engage with initiatives focused on responsible e-waste management. This could involve forming partnerships with recycling organizations or actively advocating for policies that promote the circular economy within the tech sector. Such engagement not only addresses environmental concerns but also aligns with growing consumer and investor demand for corporate sustainability, a trend that saw ESG (Environmental, Social, and Governance) investments continue to grow through 2024 and into 2025.

Embracing circular economy principles, even indirectly through supply chain considerations or employee device policies, can bolster Kakao's commitment to environmental sustainability. By supporting repairability, responsible sourcing, and end-of-life management for electronics, Kakao can contribute to a more sustainable digital ecosystem. This proactive approach can enhance brand reputation and potentially mitigate future regulatory risks associated with e-waste, a growing concern for governments worldwide.

Climate Change Impact on Operations and Supply Chains

While Kakao isn't directly involved in heavy manufacturing, climate change still presents indirect operational risks. Extreme weather events, like intensified typhoons or heatwaves, could disrupt South Korea's power grids and internet infrastructure, potentially impacting Kakao's service reliability and uptime. For instance, a prolonged power outage affecting data centers would directly hinder its digital services.

Kakao's supply chain, even for digital services, isn't entirely immune. If the company relies on physical hardware for its servers or data centers, or outsources certain technical services that involve physical infrastructure, these elements could face disruptions due to climate-related events affecting manufacturing or transportation. For example, semiconductor production, crucial for server hardware, can be sensitive to water availability and extreme temperatures.

Proactive risk assessment and adaptation strategies are therefore crucial for Kakao's business continuity. Building resilience against potential climate impacts, such as investing in backup power solutions or diversifying data center locations, is becoming increasingly important. The global push for climate resilience is a growing concern across all sectors, influencing investor sentiment and regulatory expectations.

Recent data highlights the increasing frequency and intensity of climate-related events. In 2023, South Korea experienced record rainfall and flooding, demonstrating the tangible risks to critical infrastructure. Companies are increasingly evaluated on their climate risk management, with a growing emphasis on sustainability reporting and disaster preparedness.

- Infrastructure Vulnerability: Extreme weather events (typhoons, heatwaves) can disrupt power grids and internet infrastructure, impacting Kakao's service uptime.

- Supply Chain Risks: Reliance on hardware or external services means Kakao's supply chain is susceptible to climate-related disruptions affecting manufacturing and logistics.

- Business Continuity: Proactive risk assessment and adaptation strategies are essential for maintaining Kakao's operational resilience and service reliability.

- Investor and Regulatory Focus: Climate resilience is a growing concern, influencing investor decisions and regulatory requirements for businesses.

Sustainable Business Practices and Green Initiatives

Kakao is increasingly navigating a landscape where consumers and stakeholders prioritize companies with robust sustainable business practices and genuine green initiatives. This shift is not merely about corporate responsibility; it directly impacts brand perception and market competitiveness. For Kakao, this translates into opportunities to bolster its brand appeal by embedding eco-friendly policies throughout its operations, such as reducing energy consumption in data centers or promoting digital solutions that minimize paper usage across its services.

By actively supporting environmental conservation efforts, perhaps through its platform or direct investments, Kakao can further solidify its commitment to sustainability. For instance, initiatives like promoting carbon-neutral services or partnering with environmental organizations can resonate strongly with a growing segment of the market. Demonstrating a tangible commitment to these principles can significantly enhance public perception, making Kakao a more attractive choice for environmentally conscious consumers and talent alike. In 2023, Kakao reported its ESG (Environmental, Social, and Governance) performance, highlighting efforts to reduce greenhouse gas emissions and promote digital inclusion, which are key components of its sustainability strategy.

Furthermore, these green initiatives are crucial for maintaining and strengthening Kakao's overall social license to operate. In South Korea, environmental regulations are becoming more stringent, and public awareness of climate change is high. A proactive approach to sustainability allows Kakao to not only comply with evolving regulations but also to lead by example, fostering goodwill and trust.

- Consumer Preference: A 2024 survey indicated that over 70% of South Korean consumers consider a company's environmental impact when making purchasing decisions.

- Digital Solutions for Sustainability: Kakao's platforms have the potential to reduce paper waste by millions of sheets annually through digital receipts and communications.

- Talent Attraction: Companies with strong ESG commitments, including environmental initiatives, reported a 15% higher employee retention rate in 2023, according to industry reports.

- Social License: Kakao's investment in renewable energy for its data centers, a key green initiative, directly contributes to its social license by demonstrating environmental stewardship.

Kakao's significant digital operations necessitate substantial energy consumption, primarily from its data centers, which are under increasing scrutiny due to growing environmental awareness. The global data center industry's energy demand is projected to reach 6% of total global electricity consumption by 2025, underscoring the scale of this issue for companies like Kakao. Transitioning to renewable energy sources and investing in energy-efficient technologies are crucial steps for Kakao to reduce its carbon footprint and meet evolving sustainability expectations from stakeholders.

The company also faces the environmental challenge of electronic waste (e-waste), a growing global concern with an estimated 62 million metric tons generated in 2024. Embracing circular economy principles, such as responsible disposal and recycling, is becoming a key expectation for tech companies. Kakao's engagement in this area, potentially through partnerships or policy advocacy, can bolster its sustainability credentials and align with consumer and investor demands.

Climate change presents indirect risks to Kakao, including potential disruptions to its infrastructure from extreme weather events, which saw record rainfall and flooding in South Korea in 2023. Proactive risk assessment and adaptation strategies, such as investing in backup power or diversifying data center locations, are essential for Kakao's business continuity and resilience, a factor increasingly considered by investors and regulators.

Consumer preference for sustainable businesses is a significant driver, with over 70% of South Korean consumers in a 2024 survey considering environmental impact in purchasing decisions. Kakao's platforms can contribute to sustainability by reducing paper waste through digital solutions, and companies with strong ESG commitments, including environmental initiatives, reported higher employee retention rates in 2023. Kakao's investment in renewable energy for its data centers further enhances its social license by demonstrating environmental stewardship.

| Environmental Factor | Impact on Kakao | 2024/2025 Data/Trends |

|---|---|---|

| Energy Consumption & Data Centers | High energy usage from data centers contributes to carbon footprint. | Global data center energy demand projected to be 6% of total global electricity by 2025. |

| Electronic Waste (E-waste) | Disposal of employee devices and infrastructure contributes to e-waste. | Global e-waste generation estimated at 62 million metric tons in 2024. |

| Climate Change & Extreme Weather | Disruptions to power grids and internet infrastructure from events like typhoons. | South Korea experienced record rainfall and flooding in 2023, highlighting infrastructure risks. |

| Sustainability & Green Initiatives | Consumer and investor preference for eco-friendly practices. | Over 70% of South Korean consumers consider environmental impact in purchasing (2024 survey). |

PESTLE Analysis Data Sources

Our Kakao PESTLE analysis is informed by a comprehensive blend of data sources, including official reports from South Korean government agencies and financial institutions, as well as global technology and market trend analyses from reputable industry research firms and economic observatories.